INVESTOR PRESENTATION November 2023 Destination at Arista Broomfield, CO

1 Table of Contents Overview 2 Recent Operating Metrics 3 Driving Earnings Accretion and Deleveraging 4 – 10 Well-Positioned Portfolio 11 – 14 ESG Initiatives 15 Path to Long-Term Growth 16 Appendix Our Performance 18 – 19 2023 Guidance 20 Market Statistics 21 Value Add Summary 22 Market Profiles 23 – 37 Demographic Profile 38 End Notes 39 – 40 Definitions and Non-GAAP Financial Measure Reconciliations 41 – 43 Forward-Looking Statement 44

2 IRT Overview OWN AND OPERATE Sunbelt Exposure 72% of NOI 120 Communities 35,427 Units 4.4% 3Q23 Portfolio Average Rental Rate Growth PORTFOLIO SUMMARY (1) SAME STORE HIGHLIGHTS Q3 2023 (2) • Revenue growth: +5.4% Y-o-Y • Avg occupancy: +40bps to 94.6% • NOI growth: 4.8% Y-o-Y UPSIDE FROM VALUE ADD • Projects to date have generated a 17.9% unlevered return on interior costs and an avg rental increase of 19.7% (3) • ~17,000 units available for value add renovation $6.2B In gross assets FL GAALTX CO OK IL IN OH KY TN SC NC VA 2023 GUIDANCE • Same Store NOI growth of 5.5% and Core FFO per share growth of 6.0% at the midpoint of our guided range(4) All notations throughout this presentation appear as “End Notes” on pages 39-40. IRT’s Operating Communities Communities to be sold as part of Portfolio Optimization Strategy

3 Strong Performance Across Key Operating Metrics Same Store Excluding Value Add Note: As of October 28, 2023, same-store portfolio occupancy was 94.6%, same-store portfolio excluding ongoing value add occupancy was 95.0%, and value add occupancy was 93.1%. All notations throughout this presentation appear as “End Notes” on pages 39-40. Same Store Total (1)Same Store Value Add O cc u p an cy Sa m e St o re T o ta l Le as e o ve r Le as e R en t G ro w th ( 2 ) New Leases Renewals Blended 93.9% 93.1% 94.2% 94.6% 94.3% Q4 22 Q1 23 Q2 23 Q3 23 Q4 QTD 23 (3) (4) 5.0% 2.3% 4.8% 5.0% 0% 1% 2% 3% 4% 5% 1Q 2023 2Q 2023 3Q 2023 Q4 QTD 23 2.9% 2.8% 0.8% -2.3% -3% -2% -1% 0% 1% 2% 3% 4% 5% 1Q 2023 2Q 2023 3Q 2023 Q4 QTD 23 3.9% 2.5% 3.0% 2.3% 1Q 2023 2Q 2023 3Q 2023 Q4 QTD 23 90.8% 90.3% 92.2% 92.8% 92.8% Q4 22 Q1 23 Q2 23 Q3 23 Q4 QTD 23 94.7% 93.8% 94.7% 95.0% 94.7% 85% 90% 95% 100% Q4 22 Q1 23 Q2 23 Q3 23 Q4 QTD 23 (3)

4 Continue value add renovations at ~2,500 annually Focused on Driving Earnings Accretion and Deleveraging 1 Complete existing ground up developments 2 Optimize portfolio by exiting lower growth, single asset markets 3 Use proceeds from asset sales to delever the balance sheet 4 Drive on-site efficiencies through the use of technology 5 Villas of Kingwood Kingwood, TX The Enclave at Tranquility Lake Riverview, FL

5 In-Place Program Identified 2024 Starts Future Pipeline Total Units to Renovate 11,382 474 12,727 24,583 Units Renovated-to-Date (7,285) - - (7,285) Remaining Units to Renovate 4,097 474 12,727 17,298 Remaining Renovation Costs (3) $59 - $64 $7 - $7 $185 - $197 $251 - $268 Incremental NOI (4) $11- $11 $1 - $1 $33 - $35 $45 - $48 Incremental Value Creation (5) $134 - $143 $15 - $17 $416 - $445 $565 - $604 Value Add Program: Improving Our Growth Profile Sizeable ~17,000 unit value add pipeline providing ~$600 million of incremental shareholder value Value Add Pipeline (2) ($ in millions) All notations throughout this presentation appear as “End Notes” on pages 39-40. IRT’s historical projects have generated an 17.9% return on investment across approximately 7,285 units, resulting in over $227 million of incremental value creation (1)

6 Real Estate Under Development: Expected to Generate Strong NOI Total Projected Development Spend ~$103M Q1 2025 Construction Starts Q3 2021 Delivery period Q4 2023 Est. Stabilization 38% Occupied(1) Oct 2023 Flatirons Apartment Denver, CO Costs NOI In Place NOI – Q3 2023 $0 / In lease-up # of Units 325 At Stabilization $7.2m/yr Destination at Arista Denver, CO Total Projected Development Spend ~$120M Q1 2026 Construction Starts Projected delivery Q4 2024 Est. Stabilization In Place – Q3 2023 $0 / In Development Q4 2022 # of Units 296 At Stabilization $7.3m/yr Costs NOI Q2 2023

7 Portfolio Optimization: Reducing Our Presence in Non-Core Markets • Target sales of 10 properties (~2,750 units) in 7 markets; 9 acquired as part of the STAR merger • Asset sales to generate gross sales proceeds of ~$521 to $533 million • Weighted average economic cap rate of approximately 5.9% • Proceeds used to immediately delever our balance sheet Asset Sale Overview Impact on Portfolio Impact on Financial Profile • Exiting 5 markets where we have a single-asset exposure • Reduces exposure in 2 other markets • Reduce average age of the properties in our portfolio by ~1 year • Reduce near-term debt maturities (2024-2026) by ~$270 million • Reduce net debt to adjusted EBITDA ratio by 0.8x to 0.9x • Dilutive to Core FFO per share by $0.02-$0.03 • After the effect of annual capex, expect to be breakeven on a free cash flow basis • Increases our unencumbered asset pool and reduces near-term debt maturities • Better positions IRT for an investment grade rating

8 Deleveraging: Where We Are and Where We Are Going • Organic NOI growth from stabilized portfolio consistent with long-term historical growth rates • Higher NOI from ongoing value add renovations consistent with historical track record • Incremental NOI from delivery of two Denver, CO development projects • Completion of our Portfolio Optimization and Deleveraging Strategy to exit single-asset markets and pay down debt Net Debt to Adjusted EBITDA 8.2x 7.7x 6.9x ~6.7x Mid-5’s Q4 2020 Q4 2021 Q4 2022 Q4 2023e Q4 2024e Progressing Towards Our Accelerated Target of Mid-5’s by Year-End 2024 through the Following Drivers:

9 $3 $68 $218 $597 $27 $1,763 $3 $24 $164 $427 $27 $1,510 2023 2024 2025 2026 2027 Thereafter Actual Debt Proforma Debt 54.4% 45.6% Maintain a Simple Capital Structure $6.0bn Common Equity Debt • Simple capital structure consisting of secured and unsecured debt • Maintain conservative financial and credit policies and expect to further deliver the balance sheet through organic NOI & EBITDA growth and excess cash flows. • Transitioning to a predominantly unsecured capital structure • 95% of debt is fixed rate (or hedged), further de-risking the balance sheet • Minimal near-term maturities with a focus on improving our leverage profile and achieving an investment grade rating Total Capitalization (1) Balance Sheet Highlights Debt Maturity Schedule % of total 0% 0% 3% 1% 8% 8% 22% 20% 1% 1% 66% 70% ($ in millions) All notations throughout this presentation appear as “End Notes” on pages 39-40. Less than 11% of IRT’s debt matures through end-2025, lowest among public peers

10 Continuing Our Efforts in Technology Significant Accomplishments Last 12-18 Months Modern Property Management System & CRM ‘Single Domain’ Website Strategy Value Add ERP Platform 24 Hour Leasing Call Center Digital Property Management Workflow Solutions Centralized Resident Account Services Team Mobile-Enabled Maintenance Teams IRT Data Hub & Business Intelligence Back-Office Automation and Restructuring Standardized Network Infrastructure & VOIP Our Goals Offer a Superior Prospect & Resident Experience Automate Processes to Lower Operating Expenses Improve Sustainability & Social Responsibility Create Empowered, Efficient, Engaged On-Site Teams Current Priorities Leverage Data for Learning & Prediction AI Messaging Solutions for Resident Relations & Collections Specialized Leasing & Property Management Support Teams Property Support Task Routing & Automation Platform Machine Learning, Artificial Intelligence, & Predictive Analytics Streamlined Procure to Pay Processes Next-Gen Identity & Income Screening

11 TOP 10 MARKETS Our Portfolio is Focused On the High Growth Sunbelt & Midwest Regions PORTFOLIO SUMMARY IRT owns 120 communities and has 2 communities under development across resilient, high growth markets Geographic Distribution Operating Communities • Strong presence in high growth metros including Atlanta, Charlotte, Tampa, Dallas, Denver and Nashville; exited markets with slower growth and higher costs • Sunbelt and Midwest regions have exhibited strong fundamentals with favorable population migration trends due to a lower cost of living, better tax policy and growing economic opportunity (2) Average community age (2) 22 years 130 Communities 37,828Units $6.2B In gross assets TBU Desktop FL GAALTX CO OK IL IN OH KY TN SC NC VA Sunbelt Exposure Communities | 82 Units | 25,289 % of NOI | 72% (1) Market Units % Unit % NOI Atlanta 5,180 15% 15% Dallas 4,007 11% 13% Denver 2,292 6% 8% Columbus 2,510 7% 6% 1,979Indianapolis 6% 5% Raleigh-Durham 1,690 6% 5%Oklahoma City 2,147 5% 5% Houston 1,932 5% 5% Tampa 1,452 4% 5% Total 24,697 70% 70% Note: Sunbelt markets defined as AL, FL, GA, NC, OK, SC, TN and TX. Nashville 1,508 5%4% Communities to be sold as part of Portfolio Optimization Strategy (1)

12 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 Atlanta - GA Columbus - OH Dallas-Fort Worth - TX Denver - CO Houston - TX Indianapolis - IN Memphis - TN Nashville - TN Oklahoma City - OK Tampa - FL IRT Top 10 Markets WAV IRT In-Place Monthly Rent Homeownership Cost Rent vs. Buy Differential Will Support Rental Demand in 2024 • Median home price is approximately $434,000(1) across IRT’s top 10 markets(2) weighted by NOI at the zip code level • With interest rates expect to remain higher for longer, mortgage rates will remain high and support rental demand • Monthly Cost Premium to buy and own a home today ranges from 34% - 157% higher than IRT’s top 10 markets’ rents • Monthly Ownership Costs3 assume a 20% down payment and monthly estimates for insurance and real estate taxes Home Ownership Monthly Cost(3) vs IRT In-Place Rents On Average, Ownership Costs are 34% - 157% higher than IRT’s Rent 79% more to own a home

13 IRT’s Resident Demographic Trends Are Favorable Recent residents in IRT’s top 10 markets are in their mid-30s and make an average annual income of ~$86,000, resulting in a ~22% rent to income(1) Market Resident Average Age(1) 1 Atlanta, GA 37 2 Dallas, TX 38 3 Denver, CO 36 4 Columbus, OH 37 5 Raleigh-Durham, NC 37 6 Indianapolis, IN 37 7 Oklahoma City, OK 34 8 Tampa-St. Petersburg, FL 37 9 Nashville, TN 36 10 Houston, TX 40 PORTFOLIO AVERAGE 37 Market Rent/ Income(1) 1 Atlanta, GA 22.2% 2 Dallas, TX 23.5% 3 Denver, CO 25.0% 4 Columbus, OH 20.3% 5 Raleigh-Durham, NC 22.2% 6 Indianapolis, IN 21.1% 7 Oklahoma City, OK 17.6% 8 Tampa-St. Petersburg, FL 25.2% 9 Nashville, TN 22.8% 10 Houston, TX 19.0% PORTFOLIO AVERAGE 21.9% Top 10 IRT Markets by NOI 130 Communities 37,828Units $6.2B In gross assets TBU Desktop GA TX CO OK IN OH FL TN NC Market Average Income 1 2 3 4 5 1 Atlanta, GA $86,704 2 Dallas, TX $94,451 3 Denver, CO $81,746 4 Columbus, OH $86,669 5 Indianapolis, IN $82,639 6 Raleigh-Durham, NC $86,181 7 Oklahoma City, OK $84,668 8 Tampa-St. Petersburg, FL $84,798 9 Nashville, TN $87,584 10 Houston, TX $89,172 PORTFOLIO AVERAGE $86,461 Top 5 Employment Sectors(1) Services/Retail Professional Healthcare Technology Sales Engineering Self Employed Construction Student/Education Hospitality Key

14 Defensive Middle Market Communities, Positioned to Perform Even in Tough Economic Times A B C • Higher income residents move down in a recession • Renters move down to Class B as rent increases outstrip income growth • Capture households moving down in a recession • Capture seniors who sell homes to fund retirement • Capture individuals/families moving up with career progression • Lower income residents move up as income grows Sample Resident Demographic: • Value driven • Middle income category • Renters by necessity Residents Require Accommodations That Are: • Affordable • Well maintained, spacious, comfortable, clean and modern • Equipped with state-of-the-art amenities • Conveniently located Class B Positioning: • Most opportunity to consistently increase rents • Less exposure to homeownership • Less likely to be impacted from new construction Multifamily exposure is a natural inflation hedge due to our ability to reset rents annually. Our portfolio of 75% Class B communities is highly defensive during recessionary periods.

15 Focusing on Our ESG Initiatives Find out more on the Sustainability page of IRT’s Investor Relations website at http://investors.irtliving.com. Diversity, Equity and Inclusion Committee formed to ensure a culture of understanding and respect as representation across gender, race, age and sexual orientation are all important factors to our success Sustainability Committee’s efforts protect and create a positive impact on the environment, specifically water conservation, energy management, reduced consumption, waste management, electric vehicle chargers Charitable and Philanthropic Initiatives with participation in organizations fighting against poverty and homelessness Our Board’s Guidelines reflect a strong commitment to the strength and success of the Company; Promote Shareholder Engagement Provide a Residence Proud to Call Home, with enhanced amenities, a robust maintenance program and resident & community events We believe that operating multifamily real estate can be conducted with a conscious regard for the environment and wider society

16 Compelling Investment Opportunity With a Path to Long-Term Growth Leading Multifamily REIT, Well-Positioned in Class B Communities, Focused on the High-Growth U.S. Sunbelt Region Los Robles San Antonio, TX Eleven10 at Farmers Market Dallas, TX The Residences on McGinnis Ferry Suwanee, GA Investing in Technology to Create Operational Efficiencies and Focusing on Our ESG Initiatives in Support of Our People & Communities Strong Long-Term Growth Profile Supported by a Value Add Pipeline, New Development Initiatives and Joint Ventures Continuing to Improve Leverage Through Organic Growth and Reinvestment of Excess Cash Flow IRT Has Built a Company that is Well-Positioned at All Points of Market Cycles and Able to Capture Future Growth Opportunities

Appendix & Definitions Talison Row at Daniel Island Charleston, SC

18 Source: Company reports; coastal peer group includes AVB, EQR, ESS, and UDR; non-gateway peer group includes CPT, CSR, MAA, and NXRT. Same store NOI growth and CFFO per share metrics are based on the definitions used by the peer group companies and may not be comparable. IRT is Delivering Industry Leading Operating Performance Relative to peers in non-gateway and coastal markets, IRT outpaced industry growth over the past few years and momentum is expected to continue due to our attractive location in sunbelt markets, as well as our investments in Value Add renovations and new development initiatives Same Store NOI Growth CFFO per Share Growth IRT Non-Gateway Coastal Peer Group 90 95 100 105 110 115 120 125 130 135 140 2019 2020 2021 2022 2023 Guidance (Mid-Point) IRT Non-Gateway Coastal Peer Group IRT Non-Gateway Coastal Peer Group 90 95 100 105 110 115 120 125 130 135 140 145 150 155 2019 2020 2021 2022 2023 Guidance (Mid-Point) IRT Non-Gateway Coastal Peer Group

19 Source: S&P Global, FactSet. Market data as of November 3, 2023. Note: Represents compound total return, with dividends reinvested. Track Record of Value Creation IRT has a proven track record of outperforming its peers 1-Year 3-Year 5-Year Since IPO (1) 3% 17% 21% 78% -2% 15% 26% 128% -13% 16% 74% 202% -50% 0% 50% 100% 150% 200% 250% RMS Multifamily Index IRT

20 Low High Earnings per share $(0.07) $(0.02) Adjustments: Depreciation and amortization 0.94 0.94 (Gains on sale) loss on impairment of real estate assets (3) 0.32 0.28 Loan (premium accretion) discount amortization, net (0.05) (0.05) CORE FFO per share $1.14 $1.15 CORE FFO ($s in millions) Same Store Communities 2023 Outlook (4) Number of communities/units 106 communities/31,829 units Property revenue growth 5.5% to 5.7% Controllable operating expense growth 6.0% to 7.0% Real estate tax and insurance expense growth 4.2% to 4.8% Total operating expense growth 5.5% to 5.9% Property NOI growth 5.3% to 5.7% Key Operating Assumptions Corporate Expenses General & administrative expenses and Property management expenses $50.0 to $51.0 million Capital Expenditures Recurring $20 to $21 million Value add & non-recurring $83 to $85 million Development $75 to $80 million Transaction/Investment Volume (6) Acquisition volume None Disposition volume $122 to $127 million Interest expense (5) $101.0 to $102.0 million Full Year 2023 Guidance All notations throughout this presentation appear as “End Notes” on pages 39-40. 65.1 68.5 75.9 92.0 247.4 263.9 2018 2019 2020 2021 2022 2023E 2023 Full Year EPS and CFFO Guidance (1)(2)

21 Assets Demonstrate Attractive Apartment Industry Dynamics Low Homeownership More Insulated from New Supply ◼ The national Class B vacancy rate remains resilient to supply and demand shocks with 2023 projected spreads in vacancy rates between Class A & B, with Class B at 7.0% and Class A at 10.2% o The majority of new supply remains concentrated in gateway markets, and competes with existing Class A communities for renters by choice compared to renters by necessity in Class B communities Homeownership Data Source: U.S Census Bureau as of Q3 2023. New Completions (Supply) Data Source: CoStar Q3 2023 Data Release. ◼ Growth in households increases the pool of renters, even more so during periods of reduced homeownership o The homeownership rate was 66.0% in Q3 2023 down from an uptick in Q3 2020 to 67.7% and the 69.2% in Q4 2004 (the peak) ◼ Homeownership affordability remains challenging for many households, especially first-time buyers. Lack of for-sale housing inventory, and rising mortgage rates continue to make homeownership unattainable or unattractive to many households. The Favorable Fundamentals of Our Markets Drive Demand for Our Assets 60.0% 61.0% 62.0% 63.0% 64.0% 65.0% 66.0% 67.0% 68.0% 69.0% 70.0% 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 1 9 81 1 9 83 1 9 85 1 9 87 1 9 89 1 9 91 1 9 93 1 9 95 1 9 97 1 9 99 2 0 01 2 0 03 2 0 05 2 0 07 2 0 09 2 0 11 2 0 13 2 0 15 2 0 17 2 0 19 2 0 21 H o m e o w n e rs h ip R at e U n it s C o m p le te d Single Family Multifamily Homeownership Rate 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 0 25,000 50,000 75,000 100,000 125,000 150,000 175,000 200,000 225,000 250,000 275,000 300,000 325,000 350,000 375,000 400,000 425,000 450,000 475,000 500,000 525,000 550,000 575,000 600,000 2 0 05 2 0 06 2 0 07 2 0 08 2 0 09 2 0 10 2 0 11 2 0 12 2 0 13 2 0 14 2 0 15 2 0 16 2 0 17 2 0 18 2 0 19 2 0 20 2 0 21 2 0 22 2 0 23 2 0 24 V ac an cy R at e ( % ) C o m p le ti o n s (U n it s) Completions Projected Completions Class A Vacancy Class BC Vacancy

22 IRT Value Add Summary Project Life to Date as of September 30, 2023 Renovation Costs per Unit (2) Market Total Properties Total Units To Be Renovated Units Complete Units Leased Rent Premium (1) % Rent Increase Interior Exterior Total ROI - Interior Costs (3) ROI - Total Costs (4) Ongoing Memphis, TN 1 362 265 271 373 34.1% 15,281 807 16,088 29.3% 27.8% Indianapolis, IN 1 236 167 168 254 23.4% 15,451 805 16,256 19.7% 18.7% Raleigh-Durham, NC 1 318 213 214 192 15.2% 15,648 1,046 16,694 14.7% 13.8% Tampa-St. Petersburg, FL 2 612 315 325 362 24.7% 15,922 943 16,865 27.2% 25.7% Atlanta, GA (5) 5 2,180 1,220 1,238 238 19.2% 14,839 1,235 16,074 19.3% 17.8% Austin, TX 1 256 139 135 219 14.7% 17,466 1,104 18,570 15.0% 14.1% Oklahoma City, OK 3 793 386 386 137 15.9% 17,180 1,025 18,205 9.6% 9.0% Columbus, OH 3 786 300 300 270 21.8% 14,045 880 14,925 23.1% 21.7% Dallas, TX 4 1,199 400 400 279 19.4% 18,905 1,879 20,784 17.7% 16.1% Nashville, TN 1 724 213 213 151 10.7% 16,199 1,664 17,863 11.2% 10.1% Total/Weighted Average 22 7,466 3,618 3,629 $248 20.0% $15,856 $1,250 $17,106 20.0% 18.7% Future (6) Atlanta, GA 1 180 - - - - - - - - - Oklahoma City, OK 1 294 Total/Weighted Average 2 474 - - - - - - - - - Completed (7) Wilmington, NC 1 288 288 287 72 7.2% 8,076 56 8,132 10.8% 10.7% Raleigh-Durham, NC 1 328 325 323 184 18.0% 14,648 2,108 16,756 15.1% 13.2% Louisville, KY 2 728 717 771 212 23.8% 15,445 2,173 17,618 16.5% 14.5% Memphis, TN 2 691 638 639 189 18.7% 11,659 974 12,633 19.5% 18.0% Atlanta, GA 1 494 455 454 176 17.5% 9,122 1,773 10,895 23.1% 19.3% Columbus, OH 3 763 690 685 204 22.5% 10,142 666 10,808 24.1% 22.7% Tampa-St. Petersburg, FL 2 624 554 553 226 19.2% 13,220 1,482 14,702 20.5% 18.4% Total/Weighted Average 12 3,916 3,667 3,712 $191 19.5% $12,018 $1,346 $13,364 19.2% 17.2% Grand Total/Weighted Average 36 11,856 7,285 7,341 $213 19.7% $13,927 $1,262 $15,189 19.5% 17.9% All notations throughout this presentation appear as “End Notes” on pages 39-40.

23 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators Communities located within 5 min. of major highways Communities located in top school districts Benefiting from suburban sprawl, well-positioned in MSA with growing ancillary job markets Major company presence in Atlanta include: Our Markets | Atlanta(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 Atlanta represents 14.8% of IRT’s NOI, portfolio-wide (3) Pointe at Canyon Ridge Sandy Springs, GA Waterstone at Big Creek Alpharetta, GA 0.93% 3.83% 1.20% 2021 2022 2023 0.80% 2.11% 1.22% 2021 2022 2023 3.40% 2.89% 4.50% 2021 2022 2023

24 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators 9th largest city in the U.S. by population 4 The Dallas MSA has had the largest population growth within the past 10 years 5 Dallas accounts for nearly 8% of all financial service jobs in the Southwest region6 Major employers include: Our Markets | Dallas(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) 2020 Census Data (5) Freddie Mac Report as of January 2021 (6) Fannie Mae Multifamily Metro Outlook 2021 Q3 Dallas represents 12.7% of IRT’s NOI, portfolio-wide (3) Avenues at Craig Ranch Dallas, TX Vue at Knoll Trail Dallas, TX 2.88% 6.07% 2.38% 2021 2022 2023 1.61% 3.67% 1.06% 2021 2022 2023 5.29% 2.76% 4.44% 2021 2022 2023

25 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators -0.02% 2.99% 0.22% Population growth in the metro area is expected to exceed 5.5% over the next five years4 The MSA had the 10th largest population increases from 2010-20195 Major employers include: Our Markets | Denver(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) Fannie Mae Multifamily Metro Outlook 2021 Q3 (5) Freddie Mac Report as of January 2021 Denver represents 7.9% of IRT’s NOI, portfolio-wide (3) Belmar Villas Lakewood, CO Bristol Village Aurora, CO 202320222021 0.26% 0.67% 1.12% 2021 2022 2023 2.76% 2.59% 1.59% 2021 2022 2023

26 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators 14th largest city in the U.S. by population4 Strong accessibility to major highway I-270 Near thriving employment hubs such as Rickenbacker International airport Class B communities insulated from new Class A construction Major employers, and companies with headquarter-presence include: Our Markets | Columbus (1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) 2020 Census Data Columbus represents 6.3% of IRT’s NOI, portfolio-wide (3) Bennington Pond Apartments Groveport, OH Schirm Farms Canal Winchester, OH 202320222021 -0.03% 1.66% 1.32% 0.34% 1.10% 1.08% 2021 2022 2023 1.88% 1.44% 4.08% 2021 2022 2023

27 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators -0.09% 0.04% 0.32% -1.21% 2.45% 0.76% Located within 5 min. of major highways Benefiting from the proximity to growing industrial footprint Each community is in a top school district in the market Burgeoning tourism hub Major employers include: 5.08% 0.00% 0.00% 2021 2022 2023 Our Markets | Louisville(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 Louisville represents 5.1% of IRT’s NOI, portfolio-wide (3) Prospect Park Apartment Homes Louisville, KY Meadows Apartment Homes Louisville, KY 202320222021 202320222021

28 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators 15th largest city in the U.S. by population Communities located in top school districts Experienced outsized job growth in health care and retail trade industries Major employers include: Our Markets | Indianapolis(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 Indianapolis represents 4.9% of IRT’s NOI, portfolio-wide (3) Bayview Club Apartments Indianapolis, IN Reveal on Cumberland Indianapolis, IN 0.54% 4.39% 1.13% 2021 2022 2023 0.66% 1.25% 0.48% 2021 2022 2023 2.14% 2.98% 1.12% 2021 2022 2023

29 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators Communities located within 5 min. of major throughways Easy access to local retail centers Concentration around Research Triangle Park Many companies have a strong presence in the area, including: Our Markets | Raleigh–Durham(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 Raleigh-Durham represents 5.1% of IRT’s NOI, portfolio-wide (3) Creekstone at RTP Durham, NC Waterstone at Brier Creek Raleigh, NC 3.27% 4.11% 2.75% 2021 2022 2023 2.14% 3.97% 1.08% 2021 2022 2023 1.24% 3.75% 7.30% 2021 2022 2023

30 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators -1.62% 3.61% 1.01% The metro’s population grew 0.5% this year, which was above the 0.2% national average4 Actively executing the redevelopment of its downtown area5 Located within 5 min. of major highways and retail Major employers include: Our Markets | Oklahoma City(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) Fannie Mae Multifamily Metro Outlook 2021 Q3 Oklahoma City represents 4.9% of IRT’s NOI, portfolio-wide (3) Windrush Oklahoma City, OK Augusta Oklahoma City, OK 202320222021 0.98% 1.99% 0.42% 2021 2022 2023 0.90% 1.69% 2.93% 2021 2022 2023

31 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators -1.01% 5.05% 1.54% Job growth is expected to be 2.7% annually through 2025, compared to 1.7% nationally4 Houston sits at #2 for the Top ten MSAs by population growth (2010-2019)5 Major employers include: Our Markets | Houston(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) Fannie Mae Multifamily Metro Outlook 2021 Q3 (5) Freddie Mac Report as of January 2021 Houston represents 4.5% of IRT’s NOI, portfolio-wide (3) Villas at Huffmeister Houston, TX Carrington Place Houston, TX 202320222021 1.21% 2.95% 1.25% 2021 2022 2023 5.59% 3.78% 5.31% 2021 2022 2023

32 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators $3 billion Water Street mixed-use investment backed by Jeff Vinik and Bill Gates is underway downtown Major companies have committed to a major presence in the market such as: Our Markets | Tampa(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 Tampa represents 4.8% of IRT’s NOI, portfolio-wide (3) Lucerne Tampa, FL Vantage on Hillsborough Tampa, FL 2.78% 5.08% 1.80% 2021 2022 2023 1.45% 3.22% 0.86% 2021 2022 2023 2.17% 3.16% 3.44% 2021 2022 2023

33 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators Metro area job growth expected to outpace the national rate through 20254 Oracle plans to expand in the market. Adding 8,500 jobs and will invest $1.2 billion in the new project Major employers include: Our Markets | Nashville(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) Fannie Mae Multifamily Metro Outlook 2021 Q3 Nashville represents 4.6% of IRT’s NOI, portfolio-wide (3) Landings of Brentwood Brentwood, TN Stoneridge Farms Smyrna, TN 2.33% 6.04% 2.10% 2021 2022 2023 0.98% 2.67% 1.12% 2021 2022 2023 3.77% 6.17% 5.06% 2021 2022 2023

34 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators -0.24% -0.36% 0.18% -1.15% 2.93% -0.18% Memphis has all the amenities of a large city with a cost of living more than 20% below the national average4 Tennessee is one of the lowest-taxed states per capita in the nation4 Major employers include: Our Markets | Memphis(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) Greater Memphis Chamber of Commerce Memphis represents 4.0% of IRT’s NOI, portfolio-wide (3) Walnut Hill Memphis, TN Stonebridge Crossing Memphis, TN 202320222021 202320222021 0.89% 1.16% 0.71% 2021 2022 2023

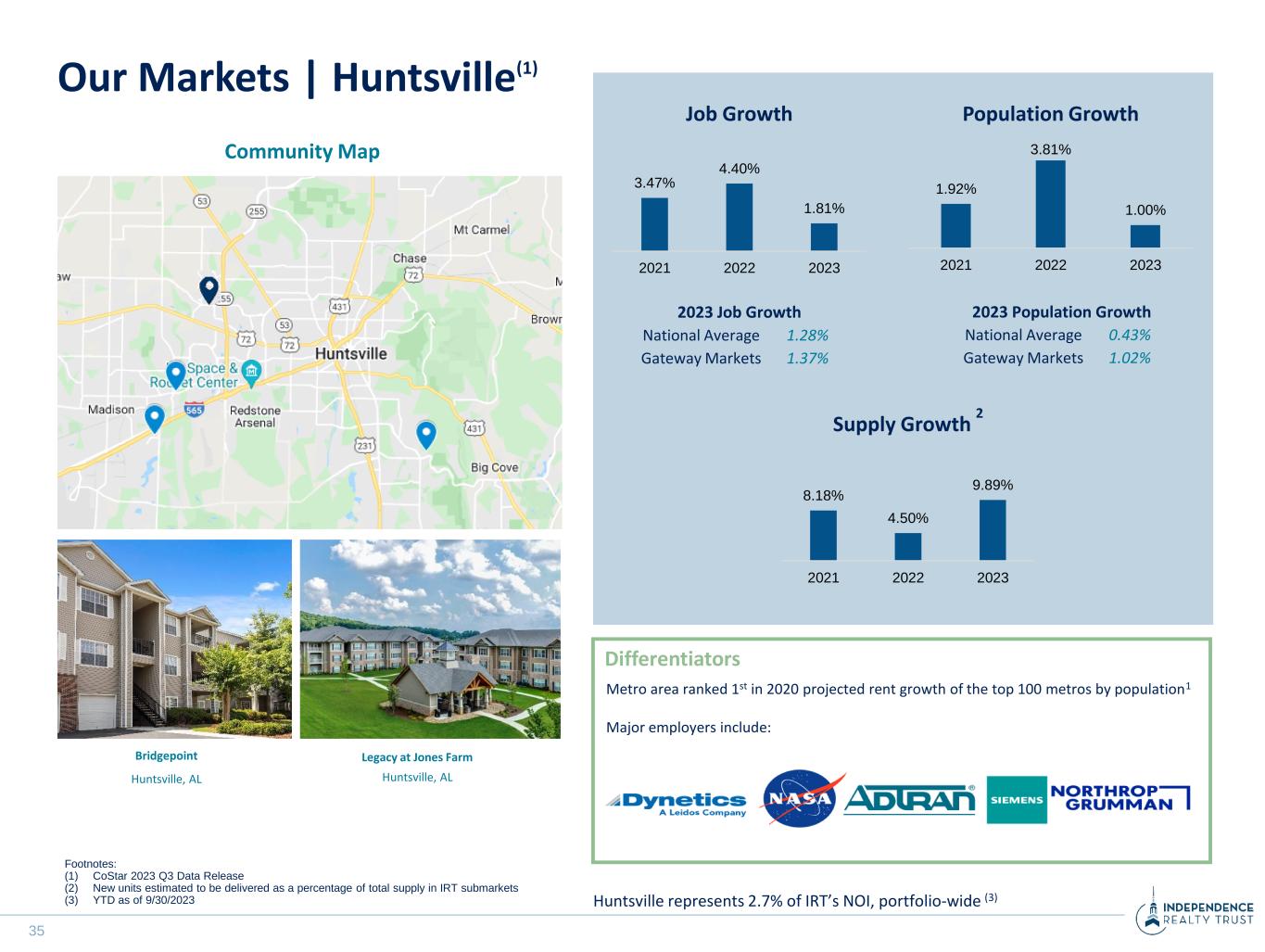

35 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators Metro area ranked 1st in 2020 projected rent growth of the top 100 metros by population1 Major employers include: Our Markets | Huntsville(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 Huntsville represents 2.7% of IRT’s NOI, portfolio-wide (3) Bridgepoint Huntsville, AL Legacy at Jones Farm Huntsville, AL 3.47% 4.40% 1.81% 2021 2022 2023 1.92% 3.81% 1.00% 2021 2022 2023 8.18% 4.50% 9.89% 2021 2022 2023

36 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators 16th largest city in the U.S. by population4 Long-term demand fundamentals are favorable with outsized population growth projected in the key age group of 20-34 5 Job growth driven by an economic shift away from a manufacturing economy toward a service economy Major employers include: Our Markets | Charlotte(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) 2020 Census Data (5) Fannie Mae Multifamily Metro Outlook 2021 Q3 Charlotte represents 2.6% of IRT’s NOI, portfolio-wide (3) Fountains Southend Charlotte, NC Vesta City Park Charlotte, NC 1.64% 3.51% 3.22% 2021 2022 2023 1.53% 3.34% 1.42% 2021 2022 2023 5.95% 4.14% 7.57% 2021 2022 2023

37 Community Map Job Growth Population Growth Supply Growth 2 2023 Job Growth National Average 1.28% Gateway Markets 1.37% 2023 Population Growth National Average 0.43% Gateway Markets 1.02% Differentiators -0.02% 6.01% 2.22% Established tourism hub Centrally located in FL, easily accessible to drive to and from close markets Job growth is expected to be at 3.4% annually through 2025, compared to 1.7% nationally4 Major employers include: Our Markets | Orlando(1) Footnotes: (1) CoStar 2023 Q3 Data Release (2) New units estimated to be delivered as a percentage of total supply in IRT submarkets (3) YTD as of 9/30/2023 (4) Fannie Mae Multifamily Metro Outlook 2021 Q3 Orlando represents 0.9% of IRT’s NOI, portfolio-wide (3) 202320222021 Millenia 700 Orlando, FL 1.12% 3.44% 1.59% 2021 2022 2023 1.71% 2.66% 0.89% 2021 2022 2023

38 IRT Resident Demographics at a Glance(1) All notations throughout this presentation appear as “End Notes” on pages 39-40. 47% 53% Gender Breakdown 79% 21% Marital Status Average Resident Age: 37 Residents make up a diverse job pool Top Industries of Residents: 1. Medical Services 2. Services 3. Professional 4. Technology 5. Sales Male Female Single Married Residents moving to our communities: 19% are from out-of-state 25% of those from out-of-state are from either the West Coast, IL or the Northeast Young, growing resident population benefiting from amenity-rich communities without overextending on rent Average Rent to Income of Our Newest Residents(2) 22%

39 Slide 2 (1) For the total portfolio as of 3Q 2023, as applicable; including portfolio average rental rate growth for the IRT same store portfolio for the three months ended September 30, 2023. (2) Highlights are for the IRT same store portfolio for the three months ended September 30, 2023 vs. the three months ended September 30, 2022. NOI is a non-GAAP financial measure. See slides 52-54 for definitions and reconciliations. (3) Return on investment or ROI throughout this presentation is calculated as rent premium per unit per month, multiplied by 12 months, dividend by interior renovation costs or total renovation costs, as applicable. Rent premium reflects the per unit per month difference between the rental rate on the renovated unit and the market rent for an unrenovated unit. Project results are through September 30, 2023. (4) This guidance, including the underlying assumptions, constitutes forward-looking information. Actual full year 2023 CFFO could vary significantly from the projections presented. See “Forward- Looking Statement” at the end of this presentation. Slide 3 (1) Same-store portfolio includes 115 properties, which represent 34,197 units. (2) Lease-over-lease effective rent growth represents the change in effective monthly rent, as adjusted for concessions, for each unit that had a prior lease and current lease that are for a term of 9- 13 months. (3) 4Q 2023 QTD average occupancy is through October 28, 2023. 4Q 2023 QTD new lease and renewal rates are for leases commencing during 4Q 2023 that were signed as of October 28, 2023. (4) As of October 28, 2023, same-store portfolio occupancy was 94.6%, same-store portfolio excluding ongoing value add occupancy was 95.0%, and value add occupancy was 93.1%. Slide 5 (1) Calculated as incremental NOI, divided by a 5.5% cap rate, net of capital investment. Incremental NOI of $18.6 million equates to total units completed to date of 7,285 multiplied by $213 rent premium annualized. Total costs-to-date of $110.6 million equates to total units completed to date multiplied cost per unit of $15,189. (2) Value add pipeline data is as of September 30, 2023. These projections constitute forward-looking information. See “Forward-Looking Statement” at the end of this presentation. (3) Illustrative estimated cost / unit ranging from $14,500 to $15,500. (4) Illustrative 17.9% annual ROI based on IRT’s historical returns. (5) Calculated as incremental NOI, divided by 5.5% cap rate net of capital invested. Slide 6 (1) Occupancy % is calculated using the leased or occupied units, as applicable, divided by the number of delivered units. Slide 9 (1) Market data as of September 30, 2023. Slide 11 (1) Portfolio Summary as of September 30 2023, NOI for 3Q 2023 and total communities as of September 30, 2023. (2) Includes communities located in Denver, Fort Collins, Colorado Springs and Loveland, CO. Slide 12 (1) Median home prices from Redfin for the month of September 2023 for actual sale prices for All Home types (Single family, Townhomes and Condos). (2) Top 10 IRT Markets weighted based on NOI Exposure for IRT Actuals-Budget. (3) Home ownership Monthly Costs are calculated using Median Home Values by market are based on the zip code in which IRT’s communities are located within, Insurance premiums from Bankrate as of November 9, 2023, and real estate taxes based on estimates from nearby sales from Trulia (weighted by property NOI’s across each IRT community and market). End Notes

40 End Notes (continued) Slide 13 (1) All resident demographic data is self-reported by residents. Average age, average income, and rent-to-income ratio are for residents that have moved in during the three months ending September 30, 2023. Employment sector data is for all residents as of September 30, 2023. Slide 19 (1) IPO date of August 13, 2013. Slide 20 (1) This guidance, including the underlying assumptions presented in the table below, constitutes forward-looking information. Actual full year 2023 EPS, FFO, and CFFO could vary significantly from the projections presented. See “Forward-Looking Statements” . Our guidance is based on the key guidance assumptions. (2) Per share guidance is based on 230.4 million weighted average shares and units outstanding. (3) Gain on sale (loss on impairment) of real estate assets includes gains (impairments) on one asset sale that occurred during the first quarter of 2023, one property identified as held for sale as of September 30, 2023, and nine other assets targeted for sale as part of our Portfolio Optimization and Deleveraging Strategy. (4) This guidance, including the underlying assumptions, constitutes forward-looking information. Actual results could vary significantly from the projections presented. See “Forward-Looking Statements” . (5) Interest expense includes amortization of deferred financing costs but excludes loan premium accretion, net. As a result of purchase accounting, we recorded a $72.1 million loan premium, net, related to STAR debt. This loan premium will be accreted into and reduce GAAP interest expense over the remaining term of the associated debt. However, loan premium accretion will be excluded from CFFO. (6) Includes one asset sale that occurred in the first quarter 2023 and one property identified as held for sale as of September 30, 2023. We expect sales of the other nine properties included in the Portfolio Optimization and Deleveraging Strategy to close in 2024. Actual acquisitions and dispositions could vary significantly from our projections. We undertake no duty to update these assumptions except as required by law. See “Forward-Looking Statements”. Slide 22 (1) The rent premium reflects the per unit per month difference between the rental rate on the renovated unit and the market rent for an unrenovated unit as of the date presented, as determined by management consistent with its customary rent-setting and evaluation procedures. (2) Includes all costs to renovate the interior units and make certain exterior renovations, including clubhouses and amenities. Interior costs per unit are based on units leased. Exterior costs per unit are based on total units at the community. Excludes overhead costs to support and manage the value add program as those costs relate to the entire program and cannot be allocated to individual projects. (3) Calculated using the rent premium per unit per month, multiplied by 12, divided by the interior renovation costs per unit. (4) Calculated using the rent premium per unit per month, multiplied by 12, divided by the total renovation costs per unit. (5) During the three months ended September 30, 2023, we paused renovations at one property comprised of 496 units in Atlanta, Georgia given current market conditions. (6) Renovation projects expected to commence during the first half of 2024. (7) We consider value add projects completed when over 85% of the property’s units to be renovated have been completed. We continue to renovate remaining unrenovated units as leases expire until we complete 100% of the property’s units. Slide 38 (1) All resident demographic data is self-reported by residents. Data as of September 30, 2023. (2) Data as of the last 90 days ending September 30, 2023.

41 Definitions and Non-GAAP Financial Measure Reconciliations This presentation may contain non-U.S. generally accepted accounting principals (“GAAP”) financial measures. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures is included in this document and/or IRT’s reports filed or furnished with the SEC available at IRT’s website www.IRTLIVING.com under Investor Relations. IRT’s other SEC filings are also available through this website. Average Effective Monthly Rent per Unit Average effective rent per unit represents the average of gross rent amounts, divided by the average occupancy (in units) for the period presented. IRT believes average effective rent per unit is a helpful measurement in evaluating average pricing. This metric, when presented, reflects the average effective rent per month. Same-Store Average Occupancy Same-store average occupancy represents the average occupied units for the reporting period divided by the average of total units available for rent for the reporting period. EBITDA and Adjusted EBITDA EBITDA is defined as net income before interest expense including amortization of deferred financing costs, income tax expense, and depreciation and amortization expenses. Adjusted EBITDA is EBITDA before certain other non-cash or non-operating gains or losses related to items such as asset sales, debt extinguishments and acquisition related debt extinguishment expenses, casualty losses, and abandoned deal costs. EBITDA and Adjusted EBITDA are each non-GAAP measures. IRT considers each of EBITDA and Adjusted EBITDA to be an appropriate supplemental measure of performance because it eliminates interest, income taxes, depreciation and amortization, and other non-cash or nonoperating gains and losses, which permits investors to view income from operations without these non-cash or non-operating items. IRT’s calculation of Adjusted EBITDA differs from the methodology used for calculating Adjusted EBITDA by certain other REITs and, accordingly, IRT’s Adjusted EBITDA may not be comparable to Adjusted EBITDA reported by other REITs. Funds From Operations (“FFO”) and Core Funds From Operations (“CFFO”) We believe that FFO and Core FFO (“CFFO”), each of which is a non-GAAP financial measure, are additional appropriate measures of the operating performance of a REIT and us in particular. We compute FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), as net income or loss allocated to common shares (computed in accordance with GAAP), excluding real estate-related depreciation and amortization expense, gains or losses on sales of real estate and the cumulative effect of changes in accounting principles. While our calculation of FFO is in accordance with NAREIT’s definition, it may differ from the methodology for calculating FFO utilized by other REITs and, accordingly, may not be comparable to FFO computations of such other REITs. CFFO is a computation made by analysts and investors to measure a real estate company’s operating performance by removing the effect of items that do not reflect ongoing property operations, including depreciation and amortization of other items not included in FFO, and other non-cash or non-operating gains or losses related to items such as casualty (gains) losses, abandoned deal costs, loan premium accretion and discount amortization, debt extinguishment costs, and merger and integration costs from the determination of FFO. Our calculation of CFFO may differ from the methodology used for calculating CFFO by other REITs and, accordingly, our CFFO may not be comparable to CFFO reported by other REITs. Our management utilizes FFO and CFFO as measures of our operating performance, and believe they are also useful to investors, because they facilitate an understanding of our operating performance after adjustment for certain non-cash or non-recurring items that are required by GAAP to be expensed but may not necessarily be indicative of current operating performance and our operating performance between periods. Furthermore, although FFO, CFFO and other supplemental performance measures are defined in various ways throughout the REIT industry, we believe that FFO and CFFO may provide us and our investors with an additional useful measure to compare our financial performance to certain other REITs. Neither FFO nor CFFO is equivalent to net income or cash generated from operating activities determined in accordance with GAAP. Furthermore, FFO and CFFO do not represent amounts available for management’s discretionary use because of needed capital replacement or expansion, debt service obligations or other commitments or uncertainties. Accordingly, FFO and CFFO do not measure whether cash flow is sufficient to fund all of our cash needs, including principal amortization and capital improvements. Neither FFO nor CFFO should be considered as an alternative to net income or any other GAAP measurement as an indicator of our operating performance or as an alternative to cash flow from operating, investing, and financing activities as a measure of our liquidity.

42 Net Operating Income We believe that Net Operating Income (“NOI”), a non-GAAP financial measure, is a useful supplemental measure of its operating performance. We define NOI as total property revenues less total property operating expenses, excluding depreciation and amortization, casualty related costs and gains, property management expenses, and general and administrative expenses, interest expenses, and net gains on sale of assets. Other REITs may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REITs. We believe that this measure provides an operating perspective not immediately apparent from GAAP operating income or net income insofar as the measure reflects only operating income and expense at the property level. We use NOI to evaluate performance on a same store and non-same store basis because NOI measures the core operations of property performance by excluding corporate level expenses, financing expenses, and other items not related to property operating performance and captures trends in rental housing and property operating expenses. However, NOI should only be used as an alternative measure of our financial performance. Same Store Properties and Same Store Portfolio We review our same store portfolio at the beginning of each calendar year. Properties are added into the same store portfolio if they were owned at the beginning of the previous year. Properties that are held-for-sale or have been sold are excluded from the same store portfolio. We may also refer to the Same Store Portfolio as the IRT Same Store Portfolio. Total Gross Assets Total Gross Assets equals total assets plus accumulated depreciation and accumulated amortization, including fully depreciated or amortized real estate and real estate related assets. The following table provides a reconciliation of total assets to total gross assets (dollars in thousands). Interest Coverage is a ratio computed by dividing Adjusted EBITDA by interest expense Net Debt, a non-GAAP financial measure, equals total consolidated debt less cash and cash equivalents and loan premiums and discounts. The following table provides a reconciliation of total consolidated debt to net debt (Dollars in thousands). We present net debt and net debt to Adjusted EBITDA because management believes it is a useful measure of our credit position and progress toward reducing leverage. The calculation is limited because we may not always be able to use cash to repay debt on a dollar for dollar basis. Definitions and Non-GAAP Financial Measure Reconciliations

43 Definitions and Non-GAAP Financial Measure Reconciliations Independence Realty Trust Inc. Reconciliation of Same-Store Net Operating Income to Net Income (loss) (Dollars in thousands) For the Three-Months Ended (a) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 Reconciliation of same-store net operating income to net income (loss) Same-store net operating income $ 101,012 $ 98,130 $ 99,303 $ 97,774 $ 94,566 Non same-store net operating income 4,063 3,400 2,577 7,269 5,767 Pre-Merger STAR Portfolio NOI - - - - - Other revenue 232 354 239 306 300 Other income (expense), net (1,547) (1,277) (683) 299 (712) Property management expenses (7,232) (6,818) (6,371) (6,593) (5,744) General and administrative expenses (3,660) (5,910) (8,154) (5,739) (5,625) Depreciation and amortization expense (55,546) (53,984) (53,536) (52,161) (49,722) Casualty gains (losses), net (35) (680) (151) 1,690 191 Interest expense (22,033) (22,227) (22,124) (23,337) (22,093) Gain on sale (loss on impairment) of real estate assets, net (11,268) — 985 17,044 — Gain (loss) on extinguishment of debt — — — — — Restructuring costs — — (3,213) — — Merger and integration costs — — — (2,028) (275) Net income (loss) $ 3,986 $ 10,988 $ 8,872 $ 34,524 $ 16,653 (a) Same store portfolio includes 115 properties, which represents 34,197 units.

44 Forward-Looking Statement This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward looking statements include, but are not limited to, our earnings guidance and certain actions that we expect or seek to take in connection with our portfolio optimization and deleveraging strategy and anticipated enhancements to our financial results and future growth from this strategy. All statements in this release that address financial and operating performance, events or developments that we expect or anticipate will occur or be achieved in the future are forward-looking statements. Our forward-looking statements are not guarantees of future performance and involve estimates, projections, forecasts and assumptions, including as to matters that are not within our control, and are subject to risks and uncertainties including, without limitation, risks and uncertainties related to changes in market demand for rental apartment homes and pricing pressures, including from competitors, that could lead to declines in occupancy and rent levels, uncertainty and volatility in capital and credit markets, including changes that reduce availability, and increase costs, of capital, unexpected changes in our intention or ability to repay certain debt prior to maturity, increased costs on account of inflation, increased competition in the labor market, failure to realize cost savings, efficiencies and other benefits that we expect to result from our portfolio optimization and deleveraging strategy, inability to sell certain assets, including those assets designated as held for sale, within the time frames or at the pricing levels expected, failure to achieve expected benefits from the redeployment of proceeds from asset sales, delays in completing, and cost overruns incurred in connection with, our value add initiatives and failure to achieve rent increases and occupancy levels on account of the value add initiatives, unexpected impairments or impairments in excess of our estimates, increased regulations generally and specifically on the rental housing market, including legislation that may regulate rents or delay or limit our ability to evict non-paying residents, risks endemic to real estate and the real estate industry generally, the impact of potential outbreaks of infectious diseases and measures intended to prevent the spread or address the effects thereof, the effects of natural and other disasters, unknown or unexpected liabilities, including the cost of legal proceedings, costs and disruptions as the result of a cybersecurity incident or other technology disruption, unexpected capital needs, inability to obtain appropriate insurance coverages at reasonable rates, or at all, or losses from catastrophes in excess of our insurance coverages, and share price fluctuations. Please refer to the documents filed by us with the SEC, including specifically the “Risk Factors” sections of our Annual Report on Form 10-K for the year ended December 31, 2022, and our other filings with the SEC, which identify additional factors that could cause actual results to differ from those contained in forward-looking statements. These forward-looking statements are based upon the beliefs and expectations of our management at the time of this release and our actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. We undertake no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.