LEO Impact Capital Closes on Tax Exempt Bond Issuance in Montgomery County

11 Décembre 2024 - 3:00PM

Business Wire

LEO Impact Capital, JBG SMITH’s workforce housing investment

management platform, announced today the placement of a $13 million

bond on Franklin Apartments and Earle Manor from the Montgomery

County Revenue Authority. The tax-exempt bond replaces the taxable

mezzanine loans provided by the Washington Housing Initiative

Impact Pool in a single issuance with the same terms. LEO Impact

Capital manages the Washington Housing Initiative Impact Pool.

Located in Takoma Park, Md., Franklin Apartments is a mid-rise

apartment community with 185 senior-living units reserved for

residents 62 or older. The property has been owned by the

Montgomery Housing Partnership (MHP) since 2022 and in 2024, the

Impact Pool provided a $6 million mezzanine loan to MHP for its

refinancing of the property.

Earle Manor, located in Wheaton, Md., consists of 140 units

across two low-rise apartment buildings. Owned by a joint venture

between the Washington Housing Conservancy (WHC) and MHP, the

property was acquired in 2022 through the Montgomery County Right

of First Refusal (ROFR) process and was supported by a $5.6 million

mezzanine loan from the Impact Pool, a soft loan from Montgomery

County and a Payment in Lieu of Taxes (PILOT) to reduce property

taxes.

“This bond will not only secure long-term affordability and

prevent displacement for residents in Montgomery County, Maryland

but also allows LEO Impact Capital to organize competitively priced

capital at scale to expand housing affordability and economic

mobility in great communities,” said AJ Jackson, President of LEO

Impact Capital. “This is an excellent example of our ability to

leverage our platform to broaden access to and supply of workforce

housing. We thank the Montgomery County Revenue Authority for its

partnership.”

About LEO Impact Capital

LEO Impact Capital unlocks access to opportunity by acquiring,

operating, and investing in multifamily housing in high impact

neighborhoods to preserve affordability for middle-income residents

– such as teachers, healthcare workers, first-responders,

administrative professionals and other workers whose services are

vital to thriving communities. Leveraging our double-bottom line

approach and the resources of JBG SMITH, our NYSE-listed parent

company, we deliver long-term value for investors and measurable

impact for residents.

For more information on LEO Impact Capital please visit

www.LEOIC.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211674225/en/

Mittie Rooney Rubenstein Executive Vice President (301) 602-8709

mrooney@rubenstein.com

Samantha Schmieder JBG SMITH Corporate Communications Manager

(240) 333-7706 sschmieder@jbgsmith.com

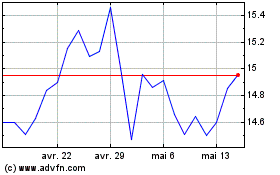

JBG SMITH Properties (NYSE:JBGS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

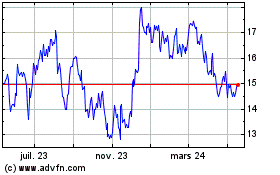

JBG SMITH Properties (NYSE:JBGS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025