0001409970FALSE00014099702024-10-232024-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 | | |

| CURRENT REPORT |

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): October 23, 2024

| | |

LendingClub Corporation |

| (Exact name of registrant as specified in its charter) |

Commission File Number: 001-36771

| | | | | |

| |

| Delaware | 51-0605731 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 595 Market Street, Suite 200, | |

| San Francisco, | CA | 94105 | |

| (Address of principal executive offices and zip code) |

Registrant’s telephone number, including area code: 415 930-7440

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | LC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | | | | |

| Item 2.02 | | Results of Operations and Financial Condition |

On October 23, 2024, LendingClub Corporation (“LendingClub”) issued a press release (the “Earnings Press Release”) regarding its financial results for the third quarter ended September 30, 2024. A copy of the Earnings Press Release is attached as Exhibit 99.1 to this Form 8-K.

The information set forth in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits |

| (d) | | Exhibits |

| | | | | | | | |

Exhibit

Number | | Exhibit Title or Description |

| | |

| 104 | | Cover Page Interactive Data File (Cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE(S)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | LendingClub Corporation |

| Date: | October 23, 2024 | By: | /s/ ANDREW LABENNE |

| | | Andrew LaBenne |

| | | Chief Financial Officer |

| | | (duly authorized officer) |

LendingClub Reports Third Quarter 2024 Results

Originations and Revenue Growth Supported by Return of Bank Buyers

Total Assets Grew 25% Year to Date Driven by $1.3 Billion Purchase of LendingClub Loans

Acquired Tally’s Technology in October to Accelerate Product Roadmap

SAN FRANCISCO – October 23, 2024 – LendingClub Corporation (NYSE: LC), the parent company of LendingClub Bank, America’s leading digital marketplace bank, today announced financial results for the third quarter ended September 30, 2024.

“We had a standout quarter, with credit outperformance and the return of bank buyers driving improved loan sales pricing, our capital strategy delivering a 25% larger balance sheet year to date, and strong financial performance translating to a meaningful improvement in book value per common share over the past 12 months,” said Scott Sanborn, LendingClub CEO. “Looking ahead, our acquisition of Tally’s award-winning credit card debt monitoring and management technology will allow us to accelerate our product roadmap and further seize on the historically large $1.3 trillion credit card refinance opportunity.”

Third Quarter 2024 Results

Balance Sheet:

•Total assets of $11.0 billion compared to $9.6 billion in the prior quarter, primarily due to growth in whole loans held on the balance sheet and securities related to the structured certificates program:

◦Whole loans held on the balance sheet of $6.0 billion, compared to $5.1 billion in the prior quarter, primarily reflecting the purchase of a $1.3 billion LendingClub-issued loan portfolio.

◦Securities available for sale of $3.3 billion, compared to $2.8 billion in the prior quarter, primarily reflecting growth in structured certificate securities.

•Deposits of $9.5 billion compared to $8.1 billion in the prior quarter, primarily due to an increase in consumer deposits and brokered certificates of deposit to fund the loan portfolio purchase.

◦Launched new direct-to-consumer LevelUp Savings product and seeing positive consumer response.

◦88% of total deposits are FDIC-insured.

•Strong liquidity profile with $3.6 billion in readily available liquidity.

•Strong capital position with a consolidated Tier 1 leverage ratio of 11.3% and consolidated Common Equity Tier 1 capital ratio of 15.9%.

•Book value per common share increased to $11.95, compared to $11.52 in the prior quarter.

•Tangible book value per common share increased to $11.19, compared to $10.75 in the prior quarter.

Financial Performance:

•Loan originations grew to $1.9 billion, compared to $1.8 billion in the prior quarter, driven by the successful execution of new consumer loan initiatives, combined with marketplace investor demand for structured certificates and higher whole loan retention.

•Total net revenue increased to $201.9 million, compared to $187.2 million in the prior quarter, driven by higher net interest income from a larger balance sheet and improved marketplace loan sales pricing.

•Provision for credit losses of $47.5 million, compared to $35.6 million in the prior quarter, driven by higher held-for-investment whole loan retention during the quarter.

•Decline in net charge-offs in the held-for-investment at amortized cost loan portfolio to $55.8 million, down from $66.8 million in the prior quarter; net charge-off ratio of 5.4% compared to 6.2% in the prior quarter.

•Net income was $14.5 million, compared to $14.9 million in the prior quarter, with diluted EPS of $0.13 in both periods.

•Pre-Provision Net Revenue (PPNR) increased to $65.5 million, compared to $55.0 million in the prior quarter, driven by a $14.7 million increase in total net revenue partially offset by a $4.0 million increase in non-interest expense.

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| ($ in millions, except per share amounts) | September 30,

2024 | | June 30,

2024 | | September 30,

2023 | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total net revenue | $ | 201.9 | | | $ | 187.2 | | | $ | 200.8 | | | | | |

| Non-interest expense | 136.3 | | | 132.3 | | | 128.0 | | | | | |

Pre-provision net revenue (1) | 65.5 | | | 55.0 | | | 72.8 | | | | | |

| Provision for credit losses | 47.5 | | | 35.6 | | | 64.5 | | | | | |

| Income before income tax expense | 18.0 | | | 19.4 | | | 8.3 | | | | | |

| Income tax expense | (3.6) | | | (4.5) | | | (3.3) | | | | | |

| Net income | $ | 14.5 | | | $ | 14.9 | | | $ | 5.0 | | | | | |

| Diluted EPS | $ | 0.13 | | | $ | 0.13 | | | $ | 0.05 | | | | | |

(1) See page 3 of this release for additional information on our use of non-GAAP financial measures.

For a calculation of Pre-Provision Net Revenue and Tangible Book Value Per Common Share, refer to the “Reconciliation of GAAP to Non-GAAP Financial Measures” tables at the end of this release.

Financial Outlook

| | | | | | |

| Fourth Quarter 2024 | |

| Loan originations | $1.8B to $1.9B | |

| Pre-provision net revenue (PPNR) | $60M to $70M | |

About LendingClub

LendingClub Corporation (NYSE: LC) is the parent company of LendingClub Bank, National Association, Member FDIC. LendingClub Bank is the leading digital marketplace bank in the U.S., where members can access a broad range of financial products and services designed to help them pay less when borrowing and earn more when saving. Based on hundreds of billions of cells of data and over $90 billion in loans, our advanced credit decisioning and machine-learning models are used across the customer lifecycle to expand seamless access to credit for our members, while generating compelling risk-adjusted returns for our loan investors. Since 2007, more than 5 million members have joined the Club to help reach their financial goals. For more information about LendingClub, visit https://www.lendingclub.com.

Conference Call and Webcast Information

The LendingClub third quarter 2024 webcast and teleconference is scheduled to begin at 2:00 p.m. Pacific Time (or 5:00 p.m. Eastern Time) on Wednesday, October 23, 2024. A live webcast of the call will be available at http://ir.lendingclub.com under the Filings & Financials menu in Quarterly Results. To access the call, please dial +1 (404) 975-4839, or outside the U.S. +1 (833) 470-1428, with Access Code 834946, ten minutes prior to 2:00 p.m. Pacific Time (or 5:00 p.m. Eastern Time). An audio archive of the call will be available at http://ir.lendingclub.com. An audio replay will also be available 1 hour after the end of the call until October 30, 2024, by calling +1 (929) 458-6194 or outside the U.S. +1 (866) 813-9403, with Access Code 106763. LendingClub has used, and intends to use, its investor relations website, blog (http://blog.lendingclub.com), X (formerly Twitter) handles (@LendingClub and @LendingClubIR) and Facebook page (https://www.facebook.com/LendingClubTeam) as a means of disclosing material non-public information and to comply with its disclosure obligations under Regulation FD.

Contacts

For Investors:

IR@lendingclub.com

Media Contact:

Press@lendingclub.com

Non-GAAP Financial Measures

To supplement our financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: Pre-Provision Net Revenue and Tangible Book Value Per Common Share. Our non-GAAP financial measures do have limitations as analytical tools and you should not consider them in isolation or as a substitute for an analysis of our results under GAAP.

We believe these non-GAAP financial measures provide management and investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and enable comparison of our financial results with other public companies.

We believe Pre-Provision Net Revenue is an important measure because it reflects the financial performance of our business operations. Pre-Provision Net Revenue is a non-GAAP financial measure calculated by subtracting the provision for credit losses and income tax benefit/expense from net income.

We believe Tangible Book Value (TBV) Per Common Share is an important measure used to evaluate the company’s use of equity. TBV Per Common Share is a non-GAAP financial measure representing common equity reduced by goodwill and intangible assets, divided by ending common shares issued and outstanding.

For a reconciliation of such measures to the nearest GAAP measures, please refer to the tables on page 13 of this release.

We do not provide a reconciliation of forward-looking Pre-Provision Net Revenue to the most directly comparable GAAP reported financial measures on a forward-looking basis because we are unable to predict future provision expense with reasonable certainty without unreasonable effort.

Safe Harbor Statement

Some of the statements above, including statements regarding our competitive advantages, macroeconomic outlook, anticipated future performance and financial results, are “forward-looking statements.” The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “will,” “would” and similar expressions may identify forward-looking statements, although not all forward-looking statements contain these identifying words. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include: our ability to continue to attract and retain new and existing borrowers and platform investors; competition; overall economic conditions; the interest rate environment; the regulatory environment; default rates and those factors set forth in the section titled “Risk Factors” in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, as well as in our subsequent filings with the Securities and Exchange Commission. We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

*****

LENDINGCLUB CORPORATION

OPERATING HIGHLIGHTS

(In thousands, except percentages or as noted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the three months ended | | % Change |

| September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | Q/Q | | Y/Y |

| Operating Highlights: |

| Non-interest income | $ | 61,640 | | | $ | 58,713 | | | $ | 57,800 | | | $ | 54,129 | | | $ | 63,844 | | | 5 | % | | (3) | % |

| Net interest income | 140,241 | | | 128,528 | | | 122,888 | | | 131,477 | | | 137,005 | | | 9 | % | | 2 | % |

| Total net revenue | 201,881 | | | 187,241 | | | 180,688 | | | 185,606 | | | 200,849 | | | 8 | % | | 1 | % |

| Non-interest expense | 136,332 | | | 132,258 | | | 132,233 | | | 130,015 | | | 128,035 | | | 3 | % | | 6 | % |

Pre-provision net revenue(1) | 65,549 | | | 54,983 | | | 48,455 | | | 55,591 | | | 72,814 | | | 19 | % | | (10) | % |

| Provision for credit losses | 47,541 | | | 35,561 | | | 31,927 | | | 41,907 | | | 64,479 | | | 34 | % | | (26) | % |

Income before income tax expense | 18,008 | | | 19,422 | | | 16,528 | | | 13,684 | | | 8,335 | | | (7) | % | | 116 | % |

Income tax expense | (3,551) | | | (4,519) | | | (4,278) | | | (3,529) | | | (3,327) | | | (21) | % | | 7 | % |

| Net income | $ | 14,457 | | | $ | 14,903 | | | $ | 12,250 | | | $ | 10,155 | | | $ | 5,008 | | | (3) | % | | 189 | % |

| | | | | | | | | | | | | |

| Basic EPS | $ | 0.13 | | | $ | 0.13 | | | $ | 0.11 | | | $ | 0.09 | | | $ | 0.05 | | | — | % | | 160 | % |

| Diluted EPS | $ | 0.13 | | | $ | 0.13 | | | $ | 0.11 | | | $ | 0.09 | | | $ | 0.05 | | | — | % | | 160 | % |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| LendingClub Corporation Performance Metrics: |

| Net interest margin | 5.63 | % | | 5.75 | % | | 5.75 | % | | 6.40 | % | | 6.91 | % | | | | |

Efficiency ratio(2) | 67.5 | % | | 70.6 | % | | 73.2 | % | | 70.0 | % | | 63.7 | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Return on average equity (ROE)(3) | 4.4 | % | | 4.7 | % | | 3.9 | % | | 3.3 | % | | 1.7 | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Return on average total assets (ROA)(4) | 0.6 | % | | 0.6 | % | | 0.5 | % | | 0.5 | % | | 0.2 | % | | | | |

| | | | | | | | | | | | | |

| Marketing expense as a % of loan originations | 1.37 | % | | 1.47 | % | | 1.47 | % | | 1.44 | % | | 1.30 | % | | | | |

| | | | | | | | | | | | | |

| LendingClub Corporation Capital Metrics: |

| Common equity Tier 1 capital ratio | 15.9 | % | | 17.9 | % | | 17.6 | % | | 17.9 | % | | 16.9 | % | | | | |

| Tier 1 leverage ratio | 11.3 | % | | 12.1 | % | | 12.5 | % | | 12.9 | % | | 13.2 | % | | | | |

| Book value per common share | $ | 11.95 | | | $ | 11.52 | | | $ | 11.40 | | | $ | 11.34 | | | $ | 11.02 | | | 4 | % | | 8 | % |

Tangible book value per common share(1) | $ | 11.19 | | | $ | 10.75 | | | $ | 10.61 | | | $ | 10.54 | | | $ | 10.21 | | | 4 | % | | 10 | % |

| | | | | | | | | | | | | |

Loan Originations (in millions)(5): | | | | | | | | | | | | | |

| Total loan originations | $ | 1,913 | | | $ | 1,813 | | | $ | 1,646 | | | $ | 1,630 | | | $ | 1,508 | | | 6 | % | | 27 | % |

| Marketplace loans | $ | 1,403 | | | $ | 1,477 | | | $ | 1,361 | | | $ | 1,432 | | | $ | 1,182 | | | (5) | % | | 19 | % |

| Loan originations held for investment | $ | 510 | | | $ | 336 | | | $ | 285 | | | $ | 198 | | | $ | 326 | | | 52 | % | | 56 | % |

| Loan originations held for investment as a % of total loan originations | 27 | % | | 19 | % | | 17 | % | | 12 | % | | 22 | % | | | | |

| | | | | | | | | | | | | |

Servicing Portfolio AUM (in millions)(6): |

| Total servicing portfolio | $ | 12,674 | | $ | 12,999 | | $ | 13,437 | | $ | 14,122 | | $ | 14,818 | | (3) | % | | (14) | % |

| Loans serviced for others | $ | 7,028 | | $ | 8,337 | | $ | 8,671 | | $ | 9,336 | | $ | 9,601 | | (16) | % | | (27) | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

(1) Represents a non-GAAP financial measure. See “Reconciliation of GAAP to Non-GAAP Financial Measures.”

(2) Calculated as the ratio of non-interest expense to total net revenue.

(3) Calculated as annualized net income divided by average equity for the period presented.

(4) Calculated as annualized net income divided by average total assets for the period presented.

(5) Includes unsecured personal loans and auto loans only.

(6) Loans serviced on our platform, which includes unsecured personal loans, auto loans and education and patient finance loans serviced for others and held for investment by the company.

LENDINGCLUB CORPORATION

OPERATING HIGHLIGHTS (Continued)

(In thousands, except percentages or as noted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the three months ended | | % Change |

| September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | Q/Q | | Y/Y |

| Balance Sheet Data: |

| Securities available for sale | $ | 3,311,418 | | | $ | 2,814,383 | | | $ | 2,228,500 | | | $ | 1,620,262 | | | $ | 795,669 | | | 18 | % | | 316 | % |

| Loans held for sale at fair value | $ | 849,967 | | | $ | 791,059 | | | $ | 550,415 | | | $ | 407,773 | | | $ | 362,789 | | | 7 | % | | 134 | % |

| Loans and leases held for investment at amortized cost | $ | 4,108,329 | | | $ | 4,228,391 | | | $ | 4,505,816 | | | $ | 4,850,302 | | | $ | 5,237,277 | | | (3) | % | | (22) | % |

Gross allowance for loan and lease losses (1) | $ | (274,538) | | | $ | (285,368) | | | $ | (311,794) | | | $ | (355,773) | | | $ | (388,156) | | | (4) | % | | (29) | % |

Recovery asset value (2) | $ | 53,974 | | | $ | 56,459 | | | $ | 52,644 | | | $ | 45,386 | | | $ | 37,661 | | | (4) | % | | 43 | % |

| Allowance for loan and lease losses | $ | (220,564) | | | $ | (228,909) | | | $ | (259,150) | | | $ | (310,387) | | | $ | (350,495) | | | (4) | % | | (37) | % |

| Loans and leases held for investment at amortized cost, net | $ | 3,887,765 | | | $ | 3,999,482 | | | $ | 4,246,666 | | | $ | 4,539,915 | | | $ | 4,886,782 | | | (3) | % | | (20) | % |

Loans held for investment at fair value (3)(4) | $ | 1,287,495 | | | $ | 339,222 | | | $ | 427,396 | | | $ | 272,678 | | | $ | 344,417 | | | 280 | % | | 274 | % |

Total loans and leases held for investment (3)(4) | $ | 5,175,260 | | | $ | 4,338,704 | | | $ | 4,674,062 | | | $ | 4,812,593 | | | $ | 5,231,199 | | | 19 | % | | (1) | % |

Whole loans held on balance sheet (4)(5) | $ | 6,025,227 | | | $ | 5,129,763 | | | $ | 5,224,477 | | | $ | 5,220,366 | | | $ | 5,593,988 | | | 17 | % | | 8 | % |

| Total assets | $ | 11,037,507 | | | $ | 9,586,050 | | | $ | 9,244,828 | | | $ | 8,827,463 | | | $ | 8,472,351 | | | 15 | % | | 30 | % |

| Total deposits | $ | 9,459,608 | | | $ | 8,095,328 | | | $ | 7,521,655 | | | $ | 7,333,486 | | | $ | 7,000,263 | | | 17 | % | | 35 | % |

| Total liabilities | $ | 9,694,612 | | | $ | 8,298,105 | | | $ | 7,978,542 | | | $ | 7,575,641 | | | $ | 7,264,132 | | | 17 | % | | 33 | % |

| Total equity | $ | 1,342,895 | | | $ | 1,287,945 | | | $ | 1,266,286 | | | $ | 1,251,822 | | | $ | 1,208,219 | | | 4 | % | | 11 | % |

(1) Represents the allowance for future estimated net charge-offs on existing portfolio balances.

(2) Represents the negative allowance for expected recoveries of amounts previously charged-off.

(3) Beginning in the first quarter of 2024, “Retail and certificate loans held for investment at fair value” were combined within “Loans held for investment at fair value.” Prior period amounts have been reclassified to conform to the current period presentation.

(4) The balance at September 30, 2024 includes a $1.3 billion loan outstanding principal portfolio that was acquired during the third quarter of 2024.

(5) Includes loans held for sale at fair value, loans and leases held for investment at amortized cost, net of allowance for loan and lease losses, and loans held for investment at fair value.

The asset quality metrics presented in the following table are for loans and leases held for investment at amortized cost and do not reflect loans held for investment at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the three months ended |

| September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 |

Asset Quality Metrics (1): |

Allowance for loan and lease losses to total loans and leases held for investment at amortized cost | 5.4 | % | | 5.4 | % | | 5.8 | % | | 6.4 | % | | 6.7 | % |

| | | | | | | | | |

| Allowance for loan and lease losses to commercial loans and leases held for investment at amortized cost | 3.1 | % | | 2.7 | % | | 1.9 | % | | 1.8 | % | | 2.0 | % |

Allowance for loan and lease losses to consumer loans and leases held for investment at amortized cost | 5.8 | % | | 5.9 | % | | 6.4 | % | | 7.2 | % | | 7.4 | % |

Gross allowance for loan and lease losses to consumer loans and leases held for investment at amortized cost | 7.3 | % | | 7.5 | % | | 7.8 | % | | 8.3 | % | | 8.2 | % |

| Net charge-offs | $ | 55,805 | | | $ | 66,818 | | | $ | 80,483 | | | $ | 82,511 | | | $ | 68,795 | |

Net charge-off ratio (2) | 5.4 | % | | 6.2 | % | | 6.9 | % | | 6.6 | % | | 5.1 | % |

(1) Calculated as ALLL or gross ALLL, where applicable, to the corresponding portfolio segment balance of loans and leases held for investment at amortized cost.

(2) Net charge-off ratio is calculated as annualized net charge-offs divided by average outstanding loans and leases held for investment during the period.

LENDINGCLUB CORPORATION

LOANS AND LEASES HELD FOR INVESTMENT

(In thousands)

(Unaudited)

The following table presents loans and leases held for investment at amortized cost and loans held for investment at fair value:

| | | | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 | | |

| Unsecured personal | $ | 3,068,078 | | | $ | 3,726,830 | | | |

| Residential mortgages | 175,345 | | | 183,050 | | | |

| Secured consumer | 239,206 | | | 250,039 | | | |

| | | | | |

| Total consumer loans held for investment | 3,482,629 | | | 4,159,919 | | | |

Equipment finance (1) | 74,674 | | | 110,992 | | | |

| Commercial real estate | 371,796 | | | 380,322 | | | |

Commercial and industrial | 179,230 | | | 199,069 | | | |

| Total commercial loans and leases held for investment | 625,700 | | | 690,383 | | | |

| Total loans and leases held for investment at amortized cost | 4,108,329 | | | 4,850,302 | | | |

| Allowance for loan and lease losses | (220,564) | | | (310,387) | | | |

| Loans and leases held for investment at amortized cost, net | $ | 3,887,765 | | | $ | 4,539,915 | | | |

Loans held for investment at fair value (2)(3) | 1,287,495 | | | 272,678 | | | |

Total loans and leases held for investment (3) | $ | 5,175,260 | | | $ | 4,812,593 | | | |

(1) Comprised of sales-type leases for equipment.

(2) Beginning in the first quarter of 2024, “Retail and certificate loans held for investment at fair value” were combined within “Loans held for investment at fair value.” Prior period amount has been reclassified to conform to the current period presentation.

(3) The balance at September 30, 2024 includes a $1.3 billion loan outstanding principal portfolio that was acquired during the third quarter of 2024.

LENDINGCLUB CORPORATION

ALLOWANCE FOR LOAN AND LEASE LOSSES

(In thousands)

(Unaudited)

The following table presents the components of the allowance for loan and lease losses on loans and leases held for investment at amortized cost:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

Gross allowance for loan and lease losses (1) | $ | 274,538 | | | $ | 355,773 | |

Recovery asset value (2) | (53,974) | | | (45,386) | |

| Allowance for loan and lease losses | $ | 220,564 | | | $ | 310,387 | |

(1) Represents the allowance for future estimated net charge-offs on existing portfolio balances.

(2) Represents the negative allowance for expected recoveries of amounts previously charged-off.

The following tables present the allowance for loan and lease losses on loans and leases held for investment at amortized cost and do not reflect loans held for investment at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2024 | | June 30, 2024 |

| Consumer | | Commercial | | Total | | Consumer | | Commercial | | Total |

| Allowance for loan and lease losses, beginning of period | $ | 210,729 | | | $ | 18,180 | | | $ | 228,909 | | | $ | 246,280 | | | $ | 12,870 | | | $ | 259,150 | |

| Credit loss expense for loans and leases held for investment | 45,813 | | | 1,647 | | | 47,460 | | | 30,760 | | | 5,817 | | | 36,577 | |

| | | | | | | | | | | |

| Charge-offs | (68,388) | | | (721) | | | (69,109) | | | (77,494) | | | (594) | | | (78,088) | |

| Recoveries | 12,745 | | | 559 | | | 13,304 | | | 11,183 | | | 87 | | | 11,270 | |

| Allowance for loan and lease losses, end of period | $ | 200,899 | | | $ | 19,665 | | | $ | 220,564 | | | $ | 210,729 | | | $ | 18,180 | | | $ | 228,909 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2023 |

| Consumer | | Commercial | | Total |

| Allowance for loan and lease losses, beginning of period | $ | 341,161 | | | $ | 14,002 | | | $ | 355,163 | |

Credit loss expense for loans and leases held for investment | 63,733 | | | 394 | | | 64,127 | |

| | | | | |

| Charge-offs | (73,644) | | | (534) | | | (74,178) | |

| Recoveries | 5,038 | | | 345 | | | 5,383 | |

| Allowance for loan and lease losses, end of period | $ | 336,288 | | | $ | 14,207 | | | $ | 350,495 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

LENDINGCLUB CORPORATION

PAST DUE LOANS AND LEASES HELD FOR INVESTMENT

(In thousands)

(Unaudited)

The following tables present past due loans and leases held for investment at amortized cost and do not reflect loans held for investment at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | 30-59

Days | | 60-89

Days | | 90 or More

Days | | Total Days Past Due | | Guaranteed Amount (1) | | | | |

| Unsecured personal | $ | 25,749 | | | $ | 20,156 | | | $ | 22,352 | | | $ | 68,257 | | | $ | — | | | | | |

| Residential mortgages | — | | | 145 | | | 167 | | | 312 | | | — | | | | | |

| Secured consumer | 2,283 | | | 675 | | | 242 | | | 3,200 | | | — | | | | | |

| Total consumer loans held for investment | $ | 28,032 | | | $ | 20,976 | | | $ | 22,761 | | | $ | 71,769 | | | $ | — | | | | | |

| | | | | | | | | | | | | |

| Equipment finance | $ | — | | | $ | — | | | $ | 4,850 | | | $ | 4,850 | | | $ | — | | | | | |

| Commercial real estate | 3,882 | | | 678 | | | 6,106 | | | 10,666 | | | 8,681 | | | | | |

Commercial and industrial | 417 | | | 8,207 | | | 7,232 | | | 15,856 | | | 12,347 | | | | | |

Total commercial loans and leases held for investment | $ | 4,299 | | | $ | 8,885 | | | $ | 18,188 | | | $ | 31,372 | | | $ | 21,028 | | | | | |

Total loans and leases held for investment at amortized cost | $ | 32,331 | | | $ | 29,861 | | | $ | 40,949 | | | $ | 103,141 | | | $ | 21,028 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | 30-59

Days | | 60-89

Days | | 90 or More

Days | | Total Days Past Due | | Guaranteed Amount (1) | | | | |

| Unsecured personal | $ | 32,716 | | | $ | 29,556 | | | $ | 30,132 | | | $ | 92,404 | | | $ | — | | | | | |

| Residential mortgages | 1,751 | | | — | | | — | | | 1,751 | | | — | | | | | |

| Secured consumer | 2,076 | | | 635 | | | 217 | | | 2,928 | | | — | | | | | |

| Total consumer loans held for investment | $ | 36,543 | | | $ | 30,191 | | | $ | 30,349 | | | $ | 97,083 | | | $ | — | | | | | |

| | | | | | | | | | | | | |

| Equipment finance | $ | 1,265 | | | $ | — | | | $ | — | | | $ | 1,265 | | | $ | — | | | | | |

| Commercial real estate | — | | | 3,566 | | | 1,618 | | | 5,184 | | | 4,047 | | | | | |

Commercial and industrial | 12,261 | | | 1,632 | | | 1,515 | | | 15,408 | | | 11,260 | | | | | |

Total commercial loans and leases held for investment | $ | 13,526 | | | $ | 5,198 | | | $ | 3,133 | | | $ | 21,857 | | | $ | 15,307 | | | | | |

Total loans and leases held for investment at amortized cost | $ | 50,069 | | | $ | 35,389 | | | $ | 33,482 | | | $ | 118,940 | | | $ | 15,307 | | | | | |

(1) Represents loan balances guaranteed by the Small Business Association.

LENDINGCLUB CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Change (%) | | |

| | September 30,

2024 | | June 30,

2024 | | September 30,

2023 | | Q3 2024

vs

Q2 2024 | | Q3 2024

vs

Q3 2023 | | | | |

| Non-interest income: | | | | | | | | | | | | | |

| Origination fees | $ | 71,465 | | | $ | 77,131 | | | $ | 60,912 | | | (7) | % | | 17 | % | | | | |

| Servicing fees | 8,081 | | | 19,869 | | | 32,768 | | | (59) | % | | (75) | % | | | | |

| Gain on sales of loans | 12,433 | | | 10,748 | | | 8,572 | | | 16 | % | | 45 | % | | | | |

| Net fair value adjustments | (33,595) | | | (51,395) | | | (41,366) | | | (35) | % | | (19) | % | | | | |

| Marketplace revenue | 58,384 | | | 56,353 | | | 60,886 | | | 4 | % | | (4) | % | | | | |

| Other non-interest income | 3,256 | | | 2,360 | | | 2,958 | | | 38 | % | | 10 | % | | | | |

| Total non-interest income | 61,640 | | | 58,713 | | | 63,844 | | | 5 | % | | (3) | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total interest income | 240,377 | | | 219,634 | | | 207,412 | | | 9 | % | | 16 | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total interest expense | 100,136 | | | 91,106 | | | 70,407 | | | 10 | % | | 42 | % | | | | |

| Net interest income | 140,241 | | | 128,528 | | | 137,005 | | | 9 | % | | 2 | % | | | | |

| | | | | | | | | | | | | |

| Total net revenue | 201,881 | | | 187,241 | | | 200,849 | | | 8 | % | | 1 | % | | | | |

| | | | | | | | | | | | | |

| Provision for credit losses | 47,541 | | | 35,561 | | | 64,479 | | | 34 | % | | (26) | % | | | | |

| | | | | | | | | | | | | |

| Non-interest expense: | | | | | | | | | | | | | |

| Compensation and benefits | 57,408 | | | 56,540 | | | 58,497 | | | 2 | % | | (2) | % | | | | |

| Marketing | 26,186 | | | 26,665 | | | 19,555 | | | (2) | % | | 34 | % | | | | |

| Equipment and software | 12,789 | | | 12,360 | | | 12,631 | | | 3 | % | | 1 | % | | | | |

| Depreciation and amortization | 13,341 | | | 13,072 | | | 11,250 | | | 2 | % | | 19 | % | | | | |

| Professional services | 8,014 | | | 7,804 | | | 8,414 | | | 3 | % | | (5) | % | | | | |

| Occupancy | 4,005 | | | 3,941 | | | 4,612 | | | 2 | % | | (13) | % | | | | |

| Other non-interest expense | 14,589 | | | 11,876 | | | 13,076 | | | 23 | % | | 12 | % | | | | |

| Total non-interest expense | 136,332 | | | 132,258 | | | 128,035 | | | 3 | % | | 6 | % | | | | |

| | | | | | | | | | | | | |

Income before income tax expense | 18,008 | | | 19,422 | | | 8,335 | | | (7) | % | | 116 | % | | | | |

Income tax expense | (3,551) | | | (4,519) | | | (3,327) | | | (21) | % | | 7 | % | | | | |

| Net income | $ | 14,457 | | | $ | 14,903 | | | $ | 5,008 | | | (3) | % | | 189 | % | | | | |

| | | | | | | | | | | | | |

Net income per share: | | | | | | | | | | | | | |

| Basic EPS | $ | 0.13 | | | $ | 0.13 | | | $ | 0.05 | | | — | % | | 160 | % | | | | |

| Diluted EPS | $ | 0.13 | | | $ | 0.13 | | | $ | 0.05 | | | — | % | | 160 | % | | | | |

| Weighted-average common shares – Basic | 112,042,202 | | | 111,395,025 | | | 109,071,180 | | | 1 | % | | 3 | % | | | | |

| Weighted-average common shares – Diluted | 113,922,256 | | | 111,466,497 | | | 109,073,194 | | | 2 | % | | 4 | % | | | | |

LENDINGCLUB CORPORATION

NET INTEREST INCOME

(In thousands, except percentages or as noted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated LendingClub Corporation (1) |

| Three Months Ended September 30, 2024 | | Three Months Ended June 30, 2024 | | Three Months Ended September 30, 2023 |

| Average

Balance | | Interest Income/

Expense | | Average Yield/

Rate | | Average

Balance | | Interest Income/

Expense | | Average Yield/

Rate | | Average

Balance | | Interest Income/

Expense | | Average Yield/

Rate |

Interest-earning assets (2) | | | | | | | | | | | | | | | | | |

| Cash, cash equivalents, restricted cash and other | $ | 939,611 | | | $ | 12,442 | | | 5.30 | % | | $ | 976,330 | | | $ | 13,168 | | | 5.40 | % | | $ | 1,249,087 | | | $ | 16,798 | | | 5.38 | % |

| Securities available for sale at fair value | 3,047,305 | | | 52,476 | | | 6.89 | % | | 2,406,767 | | | 42,879 | | | 7.13 | % | | 601,512 | | | 9,467 | | | 6.30 | % |

| Loans held for sale at fair value | 899,434 | | | 30,326 | | | 13.49 | % | | 838,143 | | | 26,721 | | | 12.75 | % | | 286,111 | | | 9,582 | | | 13.40 | % |

| Loans and leases held for investment: | | | | | | | | | | | | | | | | | |

| Unsecured personal loans | 3,045,150 | | | 103,291 | | | 13.57 | % | | 3,243,161 | | | 108,425 | | | 13.37 | % | | 4,257,360 | | | 142,118 | | | 13.35 | % |

| Commercial and other consumer loans | 1,057,688 | | | 15,497 | | | 5.86 | % | | 1,097,846 | | | 16,394 | | | 5.97 | % | | 1,147,130 | | | 16,842 | | | 5.87 | % |

| Loans and leases held for investment at amortized cost | 4,102,838 | | | 118,788 | | | 11.58 | % | | 4,341,007 | | | 124,819 | | | 11.50 | % | | 5,404,490 | | | 158,960 | | | 11.76 | % |

Loans held for investment at fair value (3)(4) | 972,698 | | | 26,345 | | | 10.83 | % | | 383,872 | | | 12,047 | | | 12.55 | % | | 385,148 | | | 12,605 | | | 13.09 | % |

Total loans and leases held for investment (3)(4) | 5,075,536 | | | 145,133 | | | 11.44 | % | | 4,724,879 | | | 136,866 | | | 11.59 | % | | 5,789,638 | | | 171,565 | | | 11.85 | % |

| Total interest-earning assets | 9,961,886 | | | 240,377 | | | 9.65 | % | | 8,946,119 | | | 219,634 | | | 9.82 | % | | 7,926,348 | | | 207,412 | | | 10.47 | % |

| Cash and due from banks and restricted cash | 41,147 | | | | | | | 55,906 | | | | | | | 69,442 | | | | | |

| Allowance for loan and lease losses | (225,968) | | | | | | | (245,478) | | | | | | | (354,263) | | | | | |

| Other non-interest earning assets | 624,198 | | | | | | | 632,253 | | | | | | | 691,641 | | | | | |

| Total assets | $ | 10,401,263 | | | | | | | $ | 9,388,800 | | | | | | | $ | 8,333,168 | | | | | |

| Interest-bearing liabilities | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | |

| Checking and money market accounts | $ | 1,092,376 | | | $ | 10,146 | | | 3.70 | % | | $ | 1,097,696 | | | $ | 10,084 | | | 3.69 | % | | $ | 1,271,720 | | | $ | 9,541 | | | 2.98 | % |

| Savings accounts and certificates of deposit | 6,944,586 | | | 86,717 | | | 4.97 | % | | 6,449,061 | | | 80,109 | | | 5.00 | % | | 5,357,717 | | | 59,968 | | | 4.44 | % |

| Interest-bearing deposits | 8,036,962 | | | 96,863 | | | 4.79 | % | | 7,546,757 | | | 90,193 | | | 4.81 | % | | 6,629,437 | | | 69,509 | | | 4.16 | % |

Other interest-bearing liabilities (3) | 486,736 | | | 3,273 | | | 2.69 | % | | 56,628 | | | 913 | | | 6.45 | % | | 35,878 | | | 898 | | | 10.03 | % |

| Total interest-bearing liabilities | 8,523,698 | | | 100,136 | | | 4.67 | % | | 7,603,385 | | | 91,106 | | | 4.82 | % | | 6,665,315 | | | 70,407 | | | 4.19 | % |

| Non-interest bearing deposits | 344,577 | | | | | | | 303,199 | | | | | | | 183,728 | | | | | |

| Other liabilities | 225,467 | | | | | | | 215,608 | | | | | | | 271,118 | | | | | |

| Total liabilities | $ | 9,093,742 | | | | | | | $ | 8,122,192 | | | | | | | $ | 7,120,161 | | | | | |

| Total equity | $ | 1,307,521 | | | | | | | $ | 1,266,608 | | | | | | | $ | 1,213,007 | | | | | |

| Total liabilities and equity | $ | 10,401,263 | | | | | | | $ | 9,388,800 | | | | | | | $ | 8,333,168 | | | | | |

| | | | | | | | | | | | | | | | | |

| Interest rate spread | | | | | 4.98 | % | | | | | | 5.00 | % | | | | | | 6.28 | % |

| | | | | | | | | | | | | | | | | |

| Net interest income and net interest margin | | | $ | 140,241 | | | 5.63 | % | | | | $ | 128,528 | | | 5.75 | % | | | | $ | 137,005 | | | 6.91 | % |

(1) Consolidated presentation reflects intercompany eliminations.

(2) Nonaccrual loans and any related income are included in their respective loan categories.

(3) Beginning in the first quarter of 2024, “Retail and certificate loans held for investment at fair value” were combined within “Loans held for investment at fair value” and “Retail notes and certificates at fair value” were combined within “Other interest-bearing liabilities.” Prior period amounts have been reclassified to conform to the current period presentation.

(4) The average balance for the third quarter of 2024 includes a $1.3 billion loan outstanding principal portfolio that was acquired during the quarter.

LENDINGCLUB CORPORATION

CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Share and Per Share Amounts)

(Unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Cash and due from banks | $ | 25,558 | | | $ | 14,993 | |

| Interest-bearing deposits in banks | 991,372 | | | 1,237,511 | |

| Total cash and cash equivalents | 1,016,930 | | | 1,252,504 | |

| Restricted cash | 33,347 | | | 41,644 | |

Securities available for sale at fair value ($3,319,988 and $1,663,990 at amortized cost, respectively) | 3,311,418 | | | 1,620,262 | |

| Loans held for sale at fair value | 849,967 | | | 407,773 | |

| Loans and leases held for investment | 4,108,329 | | | 4,850,302 | |

| Allowance for loan and lease losses | (220,564) | | | (310,387) | |

| Loans and leases held for investment, net | 3,887,765 | | | 4,539,915 | |

Loans held for investment at fair value (1)(2) | 1,287,495 | | | 272,678 | |

| Property, equipment and software, net | 167,809 | | | 161,517 | |

| Goodwill | 75,717 | | | 75,717 | |

| Other assets | 407,059 | | | 455,453 | |

| Total assets | $ | 11,037,507 | | | $ | 8,827,463 | |

| Liabilities and Equity | | | |

| Deposits: | | | |

| Interest-bearing | $ | 9,099,092 | | | $ | 7,001,680 | |

| Noninterest-bearing | 360,516 | | | 331,806 | |

| Total deposits | 9,459,608 | | | 7,333,486 | |

Borrowings (1) | 2,683 | | | 19,354 | |

| | | |

| Other liabilities | 232,321 | | | 222,801 | |

| Total liabilities | 9,694,612 | | | 7,575,641 | |

| Equity | | | |

| | | |

Common stock, $0.01 par value; 180,000,000 shares authorized; 112,401,990 and 110,410,602 shares issued and outstanding, respectively | 1,124 | | | 1,104 | |

| Additional paid-in capital | 1,692,538 | | | 1,669,828 | |

| Accumulated deficit | (347,196) | | | (388,806) | |

| | | |

| Accumulated other comprehensive loss | (3,571) | | | (30,304) | |

| | | |

| | | |

| Total equity | 1,342,895 | | | 1,251,822 | |

| Total liabilities and equity | $ | 11,037,507 | | | $ | 8,827,463 | |

(1) Beginning in the first quarter of 2024, “Retail and certificate loans held for investment at fair value” were combined within “Loans held for investment at fair value” and “Retail notes and certificates at fair value” were combined within “Borrowings.” Prior period amounts have been reclassified to conform to the current period presentation.

(2) The balance at September 30, 2024 includes a $1.3 billion loan outstanding principal portfolio that was acquired during the third quarter of 2024.

LENDINGCLUB CORPORATION

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except share and per share data)

(Unaudited)

Pre-Provision Net Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | |

| September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | | | |

| GAAP Net income | $ | 14,457 | | | $ | 14,903 | | | $ | 12,250 | | | $ | 10,155 | | | $ | 5,008 | | | | | |

| Less: Provision for credit losses | (47,541) | | | (35,561) | | | (31,927) | | | (41,907) | | | (64,479) | | | | | |

Less: Income tax expense | (3,551) | | | (4,519) | | | (4,278) | | | (3,529) | | | (3,327) | | | | | |

| Pre-provision net revenue | $ | 65,549 | | | $ | 54,983 | | | $ | 48,455 | | | $ | 55,591 | | | $ | 72,814 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | |

| September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | | | |

| Non-interest income | $ | 61,640 | | | $ | 58,713 | | | $ | 57,800 | | | $ | 54,129 | | | $ | 63,844 | | | | | |

| Net interest income | 140,241 | | | 128,528 | | | 122,888 | | | 131,477 | | | 137,005 | | | | | |

| Total net revenue | 201,881 | | | 187,241 | | | 180,688 | | | 185,606 | | | 200,849 | | | | | |

| Non-interest expense | (136,332) | | | (132,258) | | | (132,233) | | | (130,015) | | | (128,035) | | | | | |

| Pre-provision net revenue | 65,549 | | | 54,983 | | | 48,455 | | | 55,591 | | | 72,814 | | | | | |

| Provision for credit losses | (47,541) | | | (35,561) | | | (31,927) | | | (41,907) | | | (64,479) | | | | | |

Income before income tax expense | 18,008 | | | 19,422 | | | 16,528 | | | 13,684 | | | 8,335 | | | | | |

Income tax expense | (3,551) | | | (4,519) | | | (4,278) | | | (3,529) | | | (3,327) | | | | | |

| GAAP Net income | $ | 14,457 | | | $ | 14,903 | | | $ | 12,250 | | | $ | 10,155 | | | $ | 5,008 | | | | | |

Tangible Book Value Per Common Share

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 |

| GAAP common equity | $ | 1,342,895 | | | $ | 1,287,945 | | | $ | 1,266,286 | | | $ | 1,251,822 | | | $ | 1,208,219 | |

| Less: Goodwill | (75,717) | | | (75,717) | | | (75,717) | | | (75,717) | | | (75,717) | |

| Less: Intangible assets | (9,439) | | | (10,293) | | | (11,165) | | | (12,135) | | | (13,151) | |

| Tangible common equity | $ | 1,257,739 | | | $ | 1,201,935 | | | $ | 1,179,404 | | | $ | 1,163,970 | | | $ | 1,119,351 | |

| | | | | | | | | |

| Book value per common share |

| GAAP common equity | $ | 1,342,895 | | | $ | 1,287,945 | | | $ | 1,266,286 | | | $ | 1,251,822 | | | $ | 1,208,219 | |

| Common shares issued and outstanding | 112,401,990 | | | 111,812,215 | | | 111,120,415 | | | 110,410,602 | | | 109,648,769 | |

| Book value per common share | $ | 11.95 | | | $ | 11.52 | | | $ | 11.40 | | | $ | 11.34 | | | $ | 11.02 | |

| | | | | | | | | |

| Tangible book value per common share |

| Tangible common equity | $ | 1,257,739 | | | $ | 1,201,935 | | | $ | 1,179,404 | | | $ | 1,163,970 | | | $ | 1,119,351 | |

| Common shares issued and outstanding | 112,401,990 | | | 111,812,215 | | | 111,120,415 | | | 110,410,602 | | | 109,648,769 | |

| Tangible book value per common share | $ | 11.19 | | | $ | 10.75 | | | $ | 10.61 | | | $ | 10.54 | | | $ | 10.21 | |

v3.24.3

Cover Page Statement

|

Oct. 23, 2024 |

| Cover Page [Abstract] |

|

| Entity Central Index Key |

0001409970

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Document Period End Date |

Oct. 23, 2024

|

| Entity Address, Address Line One |

595 Market Street, Suite 200,

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36771

|

| Entity Registrant Name |

LendingClub Corporation

|

| Document Type |

8-K

|

| Entity Tax Identification Number |

51-0605731

|

| Entity Address, City or Town |

San Francisco,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94105

|

| City Area Code |

415

|

| Local Phone Number |

930-7440

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

LC

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

lc_CoverPageAbstract |

| Namespace Prefix: |

lc_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

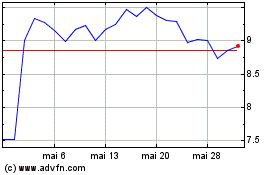

LendingClub (NYSE:LC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

LendingClub (NYSE:LC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024