Conference Call and Webcast on Tuesday,

March 19 at 8:15 a.m. Eastern Time to discuss business update and

2023 financial results

Highlights

- Announced $75 million strategic investment from Glencore and

amended existing convertible note, with expected closing on or

about March 25th, 2024;

- Continuing to work closely with the U.S. Department of Energy

(DOE) on the conditional commitment for a loan of up to $375

million;

- Executing on Cash Preservation Plan, including further

organization right-sizing and right-shaping, as well as

streamlining of operations;

- Delivered 6,825 tonnes of black mass & black mass

equivalents, exceeding the top end of the revised annual production

guidance; and

- Conducting an internal technical review to examine scope and

cost for the Rochester Hub project and confirmed technical

viability to produce lithium carbonate and mixed hydroxide

precipitate.

Li-Cycle Holdings Corp. (NYSE: LICY) ("Li-Cycle" or the

“Company"), a leading global lithium-ion battery resource recovery

company, today provided a business update.

“Since embarking on our comprehensive review, we are pleased to

report significant progress, including improving our current

liquidity position and conducting an internal technical review of

the Rochester Hub. We recently announced $75 million of strategic

financing from Glencore to enhance our liquidity position and

further build on our long-term strategic partnership,” said Ajay

Kochhar, Li-Cycle’s President and Chief Executive Officer.

“Additionally, as part of our internal technical review of the

Rochester Hub project, we confirmed the technical viability of

producing lithium carbonate and mixed hydroxide precipitate

(“MHP”). We also continue to work closely with the DOE on the

conditional commitment for a loan of up to $375 million. We believe

the strategic value of the Rochester Hub is underpinned by strong

industry fundamentals driving robust demand for domestic sources of

critical battery materials.”

Financing

Following the announcement by the Company in October 2023 of the

construction pause for the Rochester Hub project, the Company

formed a Special Committee solely composed of independent Board

directors (and which excluded Glencore’s Board representative) (the

“Special Committee”) and the Special Committee engaged Moelis &

Company LLC (“Moelis”) as its financial advisor to explore

financing options and to evaluate strategic alternatives. After a

robust process conducted by the Special Committee to review and

evaluate potential financial and strategic alternatives available

to the Company, Li-Cycle entered into an agreement on March 12,

2024 to issue a senior secured convertible note in an aggregate

principal amount of $75 million to an affiliate of Glencore plc

(LON: GLEN) (“Glencore”), with expected closing on or around March

25, 2024. This demonstrates Glencore’s continued endorsement of

Li-Cycle’s Spoke & Hub model, patented recycling technology,

and development plans for the Rochester Hub.

Glencore’s $75 million investment represents an interim step in

Li-Cycle’s funding strategy to support the Company’s future plans.

Li-Cycle continues to assess additional financing opportunities,

including continuing to work closely with the DOE Loan Programs

Office on the conditional commitment for a loan of up to $375

million under the DOE’s Advanced Technology Vehicles Manufacturing

program.

Cash Preservation Plan

As part of the pause in construction of the Rochester Hub

project, on November 1, 2023, Li-Cycle implemented a Cash

Preservation Plan (“CPP”) to reduce expenses and slow cash

outflows, while exploring both financing options and strategic

alternatives to increase liquidity. As a result of the CPP, the

Company has taken steps to significantly reduce its workforce and

curtail other non-operational spending.

Additionally, the Company has slowed operations at its Spoke

network, including pausing operations at its Ontario Spoke, slowing

operations at its New York, Arizona and Alabama Spokes on an

ongoing basis, and is currently re-evaluating the Company’s

strategy for its North American Spokes, which may include further

pauses or slowdowns. In 2023, Li-Cycle’s Spokes produced 6,825

tonnes of black mass, which exceeded the top end of its revised

annual guidance.

Based on the go-forward strategic objectives and the CPP,

Li-Cycle expects to further right-size and right-shape its

organization. The Company will continue to evaluate other measures

to reduce costs and expects the results from the CPP to deliver

lower cash outflows. As of December 31, 2023 and March 15, 2024,

Li-Cycle had cash and cash equivalents on hand of approximately $71

million and approximately $35 million respectively, excluding

restricted cash of approximately $10 million. This excludes

expected gross proceeds from the Glencore financing of $75 million

which is expected to close on or about March 25, 2024. Based on

cash on hand as of March 15, 2024 and the expected gross proceeds

from the Glencore financing, pro forma cash is estimated to be

approximately $110 million, excluding restricted cash of

approximately $10 million.

Rochester Hub Project

On October 23, 2023, the Company announced that it was pausing

construction on the Rochester Hub project, pending completion of a

comprehensive review of the project’s go-forward strategy. As of

December 31, 2023, the Company incurred total costs of

approximately $567 million on the project, comprised of total cash

spend of approximately $452 million, including $97 million of spend

for the construction of process buildings and warehouse and costs

incurred but not yet paid of approximately $115 million.

The Company has been conducting an internal technical and

economic review of the Rochester Hub project in order to assess a

possible change in the project development strategy. The internal

technical review has focused on constructing, commissioning and

operating only those process areas needed to produce two key

products: lithium carbonate and MHP, containing nickel, cobalt and

manganese. The construction, commissioning and operating costs for

process areas associated with production of nickel sulphate and

cobalt sulphate, as originally planned for the Rochester Hub, have

not been included in the internal technical review and there are no

current plans that include production of nickel sulphate and cobalt

sulphate. The internal technical review confirmed the technical

viability of the MHP process and allows the project to proceed on a

schedule aligned with the Company's current expectations regarding

the timing and evolution of the battery recycling and EV markets,

subject to obtaining any required permits, regulatory approvals, if

needed, and additional financing.

As part of the internal technical review, the Company has

conducted an engineering study internally and estimates the cost to

complete (“CTC”) the Rochester Hub project under the MHP scope at

approximately $508 million, including approximately $115 million of

costs incurred but not yet paid as of December 31, 2023. Taking

into account total cash spend of approximately $452 million as of

December 31, 2023, the revised estimated project cost of the

Rochester Hub Project is approximately $960 million for the MHP

scope. The increase in estimated project cost as compared to the

prior range from November 2023 of approximately $850 million to

approximately $1 billion, that included the expected production of

nickel sulphate and cobalt sulphate, is primarily due to further

refinement of the methodology used for estimating the project cost

based on an MHP scope and the cost required to complete the MHP

project.

The CTC estimate for the MHP scope is based solely upon the

internal technical review, is subject to a number of assumptions,

including refining detailed engineering, procurement, construction

activities, including the cost of labor and is likely to change.

The Company continues to complete its comprehensive review work,

including re-engaging and re-bidding construction subcontracts. In

addition to the CTC, the Company will incur costs during the

construction pause between October 23, 2023 to the potential

project re-start date, which the Company expects to fund with

current cash and required additional interim funding. The Company

will also incur other costs such as working capital, commissioning

and ramp-up costs and financing costs which will be included in the

full funding solution.

Key Glencore Investment Terms

The Glencore $75 million investment is expected to close on or

about March 25, 2024, subject to customary closing conditions.

Glencore will purchase from the Company a senior secured

convertible note that will mature on the fifth anniversary of

closing and will be convertible into common shares of the Company

at an initial conversion price of $0.53 per Li-Cycle common share.

Li-Cycle will have the option to pay interest on the Note in cash

or in-kind (“PIK”). Cash interest payments will be based on the

Secured Overnight Financing Rate (“SOFR”) plus 5.0% per year, and

PIK payments will be based on SOFR plus 6.0% per year.

In addition, Li-Cycle and Glencore have agreed to amend and

restate the terms of the existing Glencore convertible note, which

was issued on May 31, 2022 and has a current aggregate principal

amount outstanding of approximately $225 million in two tranches,

each of which will include new terms that come into effect upon the

occurrence of future events. For more information, refer to our

press release and Form 8-K dated March 12, 2024.

The issuance and sale of the senior secured convertible note to

Glencore is subject to customary closing conditions and the

expiration of the ten-day period for required notice to

shareholders informing them of the Company’s reliance on the New

York Stock Exchange (“NYSE”) financial viability exception to the

NYSE’s shareholder approval policy and is expected to close on or

about March 25, 2024.

Webcast and Conference Call Information

On Tuesday, March 19, 2024, at 8:15 a.m. Eastern Time, the

Company management will host a webcast and conference call to

provide a business update and a review of financial results for

full year 2023 as filed and reported on Friday March 15, 2024. The

related presentation materials for the webcast and conference call

will be made available on the investor section of the Li-Cycle

website: https://investors.li-cycle.com/overview/default.aspx

Investors may listen to the conference call live via audio-only

webcast or through the following dial-in numbers:

Domestic: (800) 579-2543 International: (203)

518-9814 Participant Code: LICYQ423 Webcast:

https://investors.li-cycle.com

A replay of the conference call/webcast will also be made

available on the Investor Relations section of the Company’s

website at https://investors.li-cycle.com.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery

resource recovery company. Established in 2016, and with major

customers and partners around the world, Li-Cycle’s mission is to

recover critical battery-grade materials to create a domestic

closed-loop battery supply chain for a clean energy future. The

Company leverages its innovative, sustainable and patent-protected

Spoke & Hub Technologies™ to recycle all different types of

lithium-ion batteries. At our Spokes, or pre-processing facilities,

we recycle battery manufacturing scrap and end-of-life batteries to

produce black mass, a powder-like substance which contains a number

of valuable metals, including lithium, nickel and cobalt. At our

future Hubs, or post-processing facilities, we plan to process

black mass to produce critical battery-grade materials, including

lithium carbonate, for the lithium-ion battery supply chain. For

more information, visit https://li-cycle.com/.

Cautionary Notes - Forward-Looking Statements and Unaudited

Results

Certain statements contained in this press release may be

considered “forward-looking statements” within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995, Section 27A

of the U.S. Securities Act of 1933, as amended, Section 21 of the

U.S. Securities Exchange Act of 1934, as amended, and applicable

Canadian securities laws. Forward-looking statements may generally

be identified by the use of words such as “believe”, “may”, “will”,

“continue”, “anticipate”, “intend”, “expect”, “should”, “would”,

“could”, “plan”, “potential”, “future”, “target” or other similar

expressions that predict or indicate future events or trends or

that are not statements of historical matters, although not all

forward-looking statements contain such identifying words.

Forward-looking statements in this press release include but are

not limited to statements about: the expected closing of the

Glencore investment and the Company’s expected pro forma cash

following the closing; the Company’s plans regarding the Cash

Preservation Plan including future cost reductions and workforce

reductions; the Company’s plans regarding the Rochester Hub,

including the project scope, the estimated project costs and

funding; the Company’s future funding strategy; the Company’s

financial and liquidity position; statements regarding the up to

$375 million conditional commitment for a loan by the U.S.

Department of Energy; statements regarding the development of

Li-Cycle’s Hub facilities, including the Rochester Hub; statements

regarding the growth of global demand for critical battery

materials and Li-Cycle’s position as a leading provider of critical

battery materials; and statements regarding the operations and

development of the North American Spokes. These statements are

based on various assumptions, whether or not identified in this

communication, including but not limited to assumptions regarding

the timing, scope and cost of Li-Cycle’s projects, including paused

projects; the processing capacity and production of Li-Cycle’s

facilities; Li-Cycle’s expectations regarding near-term significant

workforce reductions and the ability to right-size and right-shape

the organization; Li-Cycle's ability to source feedstock and manage

supply chain risk; Li-Cycle’s ability to increase recycling

capacity and efficiency; Li-Cycle’s ability to obtain financing on

acceptable terms or execute any strategic transactions; the

expected closing of the Glencore investment; Li-Cycle’s ability to

retain and hire key personnel and maintain relationships with

customers, suppliers and other business partners; the success of

the Cash Preservation Plan, the outcome of the review of the

go-forward strategy of the Rochester Hub, Li-Cycle’s ability to

attract new suppliers or expand its supply pipeline from existing

suppliers; general economic conditions; currency exchange and

interest rates; compensation costs; and inflation. There can be no

assurance that such estimates or assumptions will prove to be

correct and, as a result, actual results or events may differ

materially from expectations expressed in or implied by the

forward-looking statements.

These forward-looking statements are provided for the purpose of

assisting readers in understanding certain key elements of

Li-Cycle’s current objectives, goals, targets, strategic

priorities, expectations and plans, and in obtaining a better

understanding of Li-Cycle’s business and anticipated operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes and is not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability.

Forward-looking statements involve inherent risks and

uncertainties, most of which are difficult to predict and many of

which are beyond the control of Li-Cycle, and are not guarantees of

future performance. Li-Cycle believes that these risks and

uncertainties include, but are not limited to, the following:

Li-Cycle’s inability to economically and efficiently source,

recover and recycle lithium-ion batteries and lithium-ion battery

manufacturing scrap, as well as third party black mass, and to meet

the market demand for an environmentally sound, closed-loop

solution for manufacturing waste and end-of-life lithium-ion

batteries; Li-Cycle’s inability to successfully implement its

global growth strategy, on a timely basis or at all; Li-Cycle’s

inability to manage future global growth effectively; Li-Cycle’s

inability to develop the Rochester Hub as anticipated or at all,

and other future projects including its Spoke network expansion

projects in a timely manner or on budget or that those projects

will not meet expectations with respect to their productivity or

the specifications of their end products; Li-Cycle's history of

losses and expected significant expenses for the foreseeable future

as well as additional funds required to meet Li-Cycle’s liquidity

needs and capital requirements in the future not being available to

Li-Cycle on acceptable terms or at all when it needs them; risk and

uncertainties related to Li-Cycle’s ability to continue as a going

concern; uncertainty related to the success of Li-Cycle’s Cash

Preservation Plan and related past and expected near-term further

significant workforce reductions; Li-Cycle's inability to attract,

train and retain top talent who possess specialized knowledge and

technical skills; Li-Cycle’s failure to oversee and supervise

strategic review of all or any of Li-Cycle’s operations and capital

project and obtain financing and other strategic alternatives;

Li-Cycle’s ability to service its debt and the restrictive nature

of the terms of its debt; Li-Cycle's potential engagement in

strategic transactions, including acquisitions, that could disrupt

its business, cause dilution to its shareholders, reduce its

financial resources, result in incurrence of debt, or prove not to

be successful; one or more of Li-Cycle's current or future

facilities becoming inoperative, capacity constrained or disrupted,

or lacking sufficient feed streams to remain in operation; the

potential impact of the pause in construction of the Rochester Hub

on the authorizations and permits granted to Li-Cycle for the

operation of the Rochester Hub and the Spokes on pause; the risk

that the New York state and municipal authorities determine that

the permits granted to Li-Cycle for the production of metal

sulphates at the Rochester Hub will be impacted by the change to

MHP and the reduction in scope for the project; Li-Cycle's failure

to materially increase recycling capacity and efficiency; Li-Cycle

expects to continue to incur significant expenses and may not

achieve or sustain profitability; problems with the handling of

lithium-ion battery cells that result in less usage of lithium-ion

batteries or affect Li-Cycle’s operations; Li-Cycle’s inability to

maintain and increase feedstock supply commitments as well as

secure new customers and off-take agreements; a decline in the

adoption rate of EVs, or a decline in the support by governments

for “green” energy technologies; decreases in benchmark prices for

the metals contained in Li-Cycle’s products; changes in the volume

or composition of feedstock materials processed at Li-Cycle’s

facilities; the development of an alternative chemical make-up of

lithium-ion batteries or battery alternatives; Li-Cycle’s expected

revenues for the Rochester Hub are expected to be derived

significantly from a limited number of customers; uncertainty

regarding the sublease agreement with Pike Conductor Dev 1, LLC

related to the construction, financing and leasing of a warehouse

and administrative building for the Rochester Hub; Li-Cycle’s

insurance may not cover all liabilities and damages; Li-Cycle’s

heavy reliance on the experience and expertise of its management;

Li-Cycle’s reliance on third-party consultants for its regulatory

compliance; Li-Cycle’s inability to complete its recycling

processes as quickly as customers may require; Li-Cycle’s inability

to compete successfully; increases in income tax rates, changes in

income tax laws or disagreements with tax authorities; significant

variance in Li-Cycle’s operating and financial results from period

to period due to fluctuations in its operating costs and other

factors; fluctuations in foreign currency exchange rates which

could result in declines in reported sales and net earnings;

unfavorable economic conditions, such as consequences of the global

COVID-19 pandemic; natural disasters, unusually adverse weather,

epidemic or pandemic outbreaks, cyber incidents, boycotts and

geo-political events; failure to protect or enforce Li-Cycle’s

intellectual property; Li-Cycle may be subject to intellectual

property rights claims by third parties; Li-Cycle may be subject to

cybersecurity attacks, including, but not limited to, ransomware;

Li-Cycle’s failure to effectively remediate the material weaknesses

in its internal control over financial reporting that it has

identified or its failure to develop and maintain a proper and

effective internal control over financial reporting; the potential

for Li-Cycle’s directors and officers who hold Company common

shares to have interests that may differ from, or be in conflict

with, the interests of other shareholders; and risks related to

adoption of Li-Cycle’s shareholder rights plan and amendment to the

shareholder rights plan and the volatility of the price of

Li-Cycle’s common shares. These and other risks and uncertainties

related to Li-Cycle’s business are described in greater detail in

the section entitled "Item 1A. Risk Factors" and “Item 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operation—Key Factors Affecting Li-Cycle’s Performance”

in its Annual Report on Form 10-K filed with the U.S. Securities

and Exchange Commission and the Ontario Securities Commission in

Canada. Because of these risks, uncertainties and assumptions,

readers should not place undue reliance on these forward-looking

statements. Actual results could differ materially from those

contained in any forward-looking statement.

Li-Cycle assumes no obligation to update or revise any

forward-looking statements, except as required by applicable laws.

These forward-looking statements should not be relied upon as

representing Li-Cycle’s assessments as of any date subsequent to

the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240318851351/en/

Investor Relations Nahla Azmy Sheldon D'souza Email:

investors@li-cycle.com Media Louie Diaz Email:

media@li-cycle.com

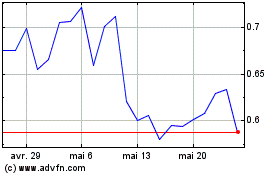

Li Cycle (NYSE:LICY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Li Cycle (NYSE:LICY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024