Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the

“Company”), a leading global lithium-ion battery resource recovery

company, today announced that its previously announced

consolidation (the “Share Consolidation”) of all of its issued and

outstanding common shares (“Shares”) at a ratio of eight (8)

pre-consolidation Shares for one (1) post-consolidation Share

became effective today.

The Company expects the Shares to begin trading on a

post-consolidation basis on the New York Stock Exchange (“NYSE”)

when the market opens on June 4, 2024, under the existing symbol

“LICY.” The new CUSIP identifier for the Shares will be

50202P204.

Shareholders will not receive any fractional Shares as a result

of the Share Consolidation. Any fractional Shares resulting from

the Share Consolidation are deemed to have been tendered

immediately by the holder thereof to the Company for cancellation

for no consideration. The Share Consolidation does not modify any

voting rights or other terms of the Shares.

As a result of the Share Consolidation, the exercise or

conversion price and the number of Shares issuable under any of the

Company’s outstanding securities that are exercisable or

convertible into Shares, including under equity awards, warrants,

rights, convertible notes and other similar securities, will be

proportionally adjusted in accordance with the terms of such

securities.

The Share Consolidation has been implemented to potentially

increase the trading price of Shares and regain compliance with the

NYSE minimum share price criteria set forth in Section 802.01C of

the NYSE Listed Company Manual.

Continental Stock Transfer and Trust Company (“Continental”),

the Company's transfer agent, has acted as the exchange agent for

the Share Consolidation. Shares held by shareholders in ‘street

name’ will have their accounts automatically credited by their

brokerage firm, bank or other nominee, as will any shareholders who

held their Shares in book-entry form at Continental.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery

resource recovery company. Established in 2016, and with major

customers and partners around the world, Li-Cycle’s mission is to

recover critical battery-grade materials to create a domestic

closed-loop battery supply chain for a clean energy future. The

Company leverages its innovative, sustainable and patent-protected

Spoke & Hub Technologies™ to recycle all different types of

lithium-ion batteries. At our Spokes, or pre-processing facilities,

we recycle battery manufacturing scrap and end-of-life batteries to

produce black mass, a powder-like substance which contains a number

of valuable metals, including lithium, nickel and cobalt. At our

future Hubs, or post-processing facilities, we plan to process

black mass to produce critical battery-grade materials, including

lithium carbonate, for the lithium-ion battery supply chain. For

more information, visit https://li-cycle.com/.

Forward-Looking Statements

Certain statements contained in this press release may be

considered “forward-looking statements” within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995, Section 27A

of the U.S. Securities Act of 1933, as amended, Section 21 of the

U.S. Securities Exchange Act of 1934, as amended, and applicable

Canadian securities laws. Forward-looking statements may generally

be identified by the use of words such as “will”, “expect”, or

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters, although

not all forward-looking statements contain such identifying words.

Forward-looking statements in this press release include but are

not limited to statements about: the expected commencement of

trading of the Shares on a post-consolidation basis on the NYSE and

the intended effects of the Share Consolidation, including

potentially an increase in the trading price of the Shares and

regained compliance with the NYSE’s continued listing standards.

These statements are based on various assumptions, whether or not

identified in this communication, including but not limited to

assumptions regarding the timing, scope and cost of Li-Cycle’s

projects; Li-Cycle’s ability to execute on its growth and other

strategic plans; the processing capacity and production of

Li-Cycle’s facilities; Li-Cycle’s ability to source feedstock and

manage supply chain risk; Li-Cycle’s ability to increase recycling

capacity and efficiency; Li-Cycle’s ability to obtain financing on

acceptable terms; Li-Cycle’s ability to retain and hire key

personnel and maintain relationships with customers, suppliers and

other business partners; general economic conditions; currency

exchange and interest rates; compensation costs; and inflation.

There can be no assurance that such estimates or assumptions will

prove to be correct and, as a result, actual results or events may

differ materially from expectations expressed in or implied by the

forward-looking statements.

These forward-looking statements are provided for the purpose of

assisting readers in understanding certain key elements of

Li-Cycle’s current objectives, goals, targets, strategic

priorities, expectations and plans, and in obtaining a better

understanding of Li-Cycle’s business and anticipated operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes and is not intended to serve as, and

must not be relied on, by any investor as a guarantee, an

assurance, a prediction or a definitive statement of fact or

probability.

Forward-looking statements involve inherent risks and

uncertainties, most of which are difficult to predict and many of

which are beyond the control of Li-Cycle, and are not guarantees of

future performance. Li-Cycle believes that these risks and

uncertainties include, but are not limited to, the following:

Li-Cycle’s inability to economically and efficiently source,

recover and recycle lithium-ion batteries and lithium-ion battery

manufacturing scrap, as well as third party black mass, and to meet

the market demand for an environmentally sound, closed-loop

solution for manufacturing waste and end-of-life lithium-ion

batteries; Li-Cycle’s inability to successfully implement its

global growth strategy, on a timely basis or at all; Li-Cycle’s

inability to manage future global growth effectively; Li-Cycle’s

inability to develop the Rochester Hub as anticipated or at all,

and other future projects including its Spoke network expansion

projects in a timely manner or on budget or that those projects

will not meet expectations with respect to their productivity or

the specifications of their end products; Li-Cycle’s history of

losses and expected significant expenses for the foreseeable future

as well as additional funds required to meet Li-Cycle’s liquidity

needs and capital requirements in the future not being available to

Li-Cycle on acceptable terms or at all when it needs them; risk and

uncertainties related to Li-Cycle’s ability to continue as a going

concern; uncertainty related to the success of Li-Cycle’s cash

preservation plan and related past and further workforce

reductions; Li-Cycle’s inability to attract, train and retain top

talent who possess specialized knowledge and technical skills;

Li-Cycle’s failure to oversee and supervise strategic review of all

or any of the Li-Cycle’s operations and capital project and obtain

financing and other strategic alternatives; Li-Cycle’s inability to

service its debt and the restrictive nature of the terms of its

debt; Li-Cycle’s potential engagement in strategic transactions,

including acquisitions, that could disrupt its business, cause

dilution to its shareholders, reduce its financial resources,

result in incurrence of debt, or prove not to be successful; one or

more of Li-Cycle’s current or future facilities becoming

inoperative, capacity constrained or disrupted, or lacking

sufficient feed streams to remain in operation; the potential

impact of the pause in construction of the Rochester Hub on the

authorizations and permits granted to Li-Cycle for the operation of

the Rochester Hub and the Spokes on pause; the risk that the New

York state and municipal authorities determine that the permits

granted to Li-Cycle for the production of metal sulphates at the

Rochester Hub will be impacted by the change to MHP and the

reduction in scope for the project; Li-Cycle’s failure to

materially increase recycling capacity and efficiency; Li-Cycle

expects to continue to incur significant expenses and may not

achieve or sustain profitability; problems with the handling of

lithium-ion battery cells that result in less usage of lithium-ion

batteries or affect Li-Cycle’s operations; Li-Cycle’s inability to

maintain and increase feedstock supply commitments as well as

secure new customers and off-take agreements; a decline in the

adoption rate of EVs, or a decline in the support by governments

for “green” energy technologies; decreases in benchmark prices for

the metals contained in Li-Cycle’s products; changes in the volume

or composition of feedstock materials processed at Li-Cycle’s

facilities; the development of an alternative chemical make-up of

lithium-ion batteries or battery alternatives; Li-Cycle’s expected

revenues for the Rochester Hub are expected to be derived

significantly from a limited number of customers; uncertainty

regarding the sublease agreement with Pike Conductor Dev 1, LLC

related to the construction, financing and leasing of a warehouse

and administrative building for the Rochester Hub; Li-Cycle’s

insurance may not cover all liabilities and damages; Li-Cycle’s

heavy reliance on the experience and expertise of its management;

Li-Cycle’s reliance on third-party consultants for its regulatory

compliance; Li-Cycle’s inability to complete its recycling

processes as quickly as customers may require; Li-Cycle’s inability

to compete successfully; increases in income tax rates, changes in

income tax laws or disagreements with tax authorities; significant

variance in Li-Cycle’s operating and financial results from period

to period due to fluctuations in its operating costs and other

factors; fluctuations in foreign currency exchange rates which

could result in declines in reported sales and net earnings;

unfavorable economic conditions, such as consequences of the global

COVID-19 pandemic; natural disasters, unusually adverse weather,

epidemic or pandemic outbreaks, cyber incidents, boycotts and

geo-political events; failure to protect or enforce Li-Cycle’s

intellectual property; Li-Cycle may be subject to intellectual

property rights claims by third parties; Li-Cycle may be subject to

cybersecurity attacks, including, but not limited to, ransomware;

Li-Cycle’s failure to effectively remediate the material weaknesses

in its internal control over financial reporting that it has

identified or its failure to develop and maintain a proper and

effective internal control over financial reporting; the potential

for Li-Cycle’s directors and officers who hold Company common

shares to have interests that may differ from, or be in conflict

with, the interests of other shareholders; and risks related to

adoption of Li-Cycle’s shareholder rights plan and amendment to the

shareholder rights plan; the Shares may not begin trading on a

post-consolidation basis on the NYSE as expected and the volatility

of the price of Li-Cycle’s common shares. These and other risks and

uncertainties related to Li-Cycle’s business are described in

greater detail in the sections titled “Item 1A. Risk Factors” and

“Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operation—Key Factors Affecting Li-Cycle’s

Performance” in its Annual Report on Form 10-K and the sections

titled “Part II. Other Information—Item 1A. Risk Factors” and “Part

I. Financial Information—Item 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operation—Key

Factors Affecting Li-Cycle’s Performance” in its Quarterly Reports

on Form 10-Q, in each case filed with the U.S. Securities and

Exchange Commission and the Ontario Securities Commission in

Canada. Because of these risks, uncertainties and assumptions,

readers should not place undue reliance on these forward-looking

statements. Actual results could differ materially from those

contained in any forward-looking statement.

Li-Cycle assumes no obligation to update or revise any

forward-looking statements, except as required by applicable laws.

These forward-looking statements should not be relied upon as

representing Li-Cycle’s assessments as of any date subsequent to

the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240603750175/en/

Investor Relations & Media Louie Diaz Sheldon D'souza

Investor Relations: investors@li-cycle.com Media:

media@li-cycle.com

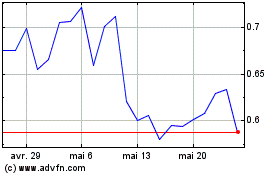

Li Cycle (NYSE:LICY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Li Cycle (NYSE:LICY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024