0000887905

false

0000887905

2023-07-25

2023-07-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20459

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13

OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report: July

25, 2023

(Date of earliest event reported)

LTC PROPERTIES, INC.

(Exact name of Registrant as specified in

its charter)

| Maryland |

|

1-11314 |

|

71-0720518 |

| (State or other jurisdiction of |

|

(Commission file number) |

|

(I.R.S. Employer |

| incorporation or organization) |

|

|

|

Identification No) |

2829 Townsgate Road, Suite 350

Westlake

Village, CA 91361

(Address of principal executive offices)

(805)

981-8655

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common stock, $.01 par value |

LTC |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. — Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On July 25, 2023, the Board of Directors of LTC

Properties, Inc. elected Mr. David Gruber to the Board effective July 25, 2023. Mr. Gruber has been appointed to serve on the ESG Committee, Compensation

Committee and Investment Committee.

In conjunction with his appointment to the Board,

Mr. Gruber will be granted 3,000 restricted shares to vest over one year. Mr. Gruber will receive compensation for his service on the

Board consistent with that received by LTC’s other non-employee directors as described in LTC’s definitive proxy statement

filed with the Securities and Exchange Commission on April 18, 2023. In addition, LTC will enter into an indemnity agreement with Mr.

Gruber in the form of which LTC has entered into with each of its directors as incorporated by reference to Exhibit 10.1 to LTC's Quarterly

Report on Form 10-Q for the quarter ended June 30, 2009.

Mr. Gruber has (i) no arrangements or understandings with any other

person pursuant to which he was elected for the position described above and (ii) no family relationship with any director or other executive

officer of LTC or any person nominated or chosen by LTC to become a director or executive officer. Mr. Gruber has had a 20-year career

with KeyBanc Capital Markets (“KeyBanc”), and retired in December 2022, as a Managing Director, Head of Equity Capital Markets.

Mr. Gruber’s primary responsibility at KeyCorp was managing the equity capital markets group. As such, KeyBanc Capital Markets received

customary fees and commissions from LTC over a period of several years. Mr. Gruber has had no direct or indirect material interest

in any transaction or series of similar transactions contemplated by Item 404(a) of Regulation S-K other than through his former employment

by KeyBanc.

A copy of the press release announcing Mr. Gruber’s

election to the Board is filed as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01. — Financial Statements and

Exhibits

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of Section 13 or

15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned,

hereunto duly authorized.

| |

LTC PROPERTIES, INC. |

| |

|

| Dated: July 26, 2023 |

By: |

/s/ WENDY L. SIMPSON |

| |

|

Wendy L. Simpson |

| |

|

Chairman & CEO |

Exhibit 99.1

|

FOR IMMEDIATE RELEASE

For more information contact:

Mandi Hogan

(805) 981-8655 |

LTC Names David

Gruber to Board of Directors

WESTLAKE VILLAGE, CALIFORNIA, July 26, 2023 – LTC Properties

Inc. (NYSE: LTC), a real estate investment trust that invests in seniors housing and health care properties, today announced that

David Gruber has been elected to its Board of Directors effective July 25, 2023, increasing the total number of directors from six to

seven, six of whom are independent.

Gruber, 53, is a qualified financial expert with significant corporate

finance, governance and compliance expertise, having served as Managing Director, Head of Equity Capital Markets for KeyBanc Capital Markets

for more than 20 years, where he chaired and was a member of the bank’s Equity Commitment and Capital Commitment Committees. Under

his leadership, Gruber’s team helped execute more than 1,100 equity transactions, raising in excess of $500 billion in equity

capital.

“We are thrilled to welcome David to our Board. He brings significant

experience in equity capital markets, REIT and other industry financings and talent management, which should serve us well as we continue

to implement our growth strategy,” said Wendy Simpson, LTC’s Chairman and Chief Executive Officer. “We began our relationship

with David nearly 20 years ago when he worked with us as an investment banker, and have been impressed with his financial acumen and knowledge

of our industry since then. Additionally, his ability to bring an astute investor and capital markets lens to public companies, while

developing and implementing business strategy, will create added perspective for us.”

Gruber holds a B.S. in Finance from Kent State University, and is currently

a member of the advisory board for Cleveland Central Catholic High School in Cleveland, Ohio. He also has served on numerous nonprofit

organization boards in recent years.

About LTC

LTC is a real estate investment trust (REIT) investing in seniors

housing and health care properties primarily through sale-leasebacks, mortgage financing, joint-ventures and structured finance solutions

including preferred equity and mezzanine lending. LTC’s investment portfolio includes 212 properties in 29 states with 30 operating

partners. Based on its gross real estate investments, LTC’s investment portfolio is comprised of approximately 50% seniors housing

and 50% skilled nursing properties. Learn more at www.LTCreit.com.

Forward-Looking Statements

This press release includes statements that are not purely

historical and are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the Company’s

expectations, beliefs, intentions or strategies regarding the future. All statements other than historical facts contained in this

press release are forward-looking statements. These forward-looking statements involve a number of risks and uncertainties. Please

see LTC’s most recent Annual Report on Form 10-K, its subsequent Quarterly Reports on Form 10-Q, and its other publicly

available filings with the Securities and Exchange Commission for a discussion of these and other risks and uncertainties. All

forward-looking statements included in this press release are based on information available to the Company on the date hereof, and

LTC assumes no obligation to update such forward-looking statements. Although the Company’s management believes that the

assumptions and expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such

expectations will prove to have been correct. The actual results achieved by the Company may differ materially from any

forward-looking statements due to the risks and uncertainties of such statements.

# # #

v3.23.2

Cover

|

Jul. 25, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 25, 2023

|

| Entity File Number |

1-11314

|

| Entity Registrant Name |

LTC PROPERTIES, INC.

|

| Entity Central Index Key |

0000887905

|

| Entity Tax Identification Number |

71-0720518

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

2829 Townsgate Road

|

| Entity Address, Address Line Two |

Suite 350

|

| Entity Address, City or Town |

Westlake

Village

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91361

|

| City Area Code |

805

|

| Local Phone Number |

981-8655

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $.01 par value

|

| Trading Symbol |

LTC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

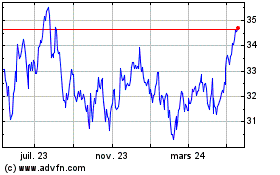

LTC Properties (NYSE:LTC)

Graphique Historique de l'Action

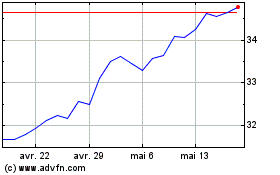

De Avr 2024 à Mai 2024

LTC Properties (NYSE:LTC)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024