Net revenues increased 7% Comparable-store

sales increased 2.9% Unlimited Wash Club® (“UWC”) memberships

increased 2% year-over-year Opened 10 new greenfield locations

surpassing 500 locations Raising 2024 adjusted net income and

adjusted EBITDA guidance

Mister Car Wash, Inc. (the “Company”) (NYSE: MCW), the nation’s

largest car wash brand, today announced its financial results for

the quarter ended September 30, 2024.

“We are pleased with our strong third quarter performance and

momentum in the business. Our subscription business remained

incredibly resilient, our new premium Titanium offering ramped

ahead of expectations, retail sales trends moved in the right

direction, and we managed expenses. All of this drove strong sales

and profit growth in the third quarter,” commented John Lai,

Chairperson and CEO of Mister Car Wash. “In the third quarter, we

also opened our 500th store – marking another incredible milestone

in Mister Car Wash’s 28-year history. With so much growth still

ahead of us, we remain committed to expanding our footprint and

investing in our team members while providing top-notch car wash

services to customers as we scale the nation’s premier car wash

brand.”

Third Quarter 2024 Highlights:

- Net revenues increased 7% to $249.3 million, up from $234.1

million in the third quarter of 2023.

- Comparable-store sales increased 2.9% during the quarter.

- UWC sales represented 74% of total wash sales compared to 71%

in the third quarter of 2023.

- The Company added approximately 39 thousand or 2% net new UWC

members year-over-year, with approximately 2.1 million members as

of September 30, 2024.

- The Company opened 10 new greenfield locations, bringing the

total number of car wash locations operated to 501 as of September

30, 2024, compared to 462 car wash locations as of September 30,

2023, an increase of 8%.

- Net income and net income per diluted share were $22.3 million

and $0.07, respectively.

- Adjusted net income(1) and adjusted net income per diluted

share(1) were $28.8 million and $0.09, respectively.

- Adjusted EBITDA(1) increased 10% to $78.8 million from $71.6

million in the third quarter of 2023.

Nine Month 2024 Highlights:

- Net revenues increased 7% to $743.6 million, up from $696.9

million in 2023.

- Comparable-store sales increased 2.1%.

- The Company opened 25 new greenfield locations.

- Net income and net income per diluted share were $61.1 million

and $0.19, respectively.

- Adjusted net income(1) and adjusted net income per diluted

share(1) were $92.2 million and $0.28, respectively.

- Adjusted EBITDA(1) increased 12% to $242.7 million from $216.4

million in 2023.

(1) Adjusted net income, adjusted EBITDA and adjusted net income

per diluted share are non-GAAP financial measures. See Use of

Non-GAAP Financial Measures and GAAP to Non-GAAP Reconciliations

disclosures included below in this press release.

Store Count

Three Months Ended September

30,

Nine Months Ended September

30, 2024

2024

2023

Beginning location count

491

449

476

Locations acquired

-

5

-

Greenfield locations opened

10

8

25

Ending location count

501

462

501

Balance Sheet and Cash Flow Highlights

- As of September 30, 2024, cash and cash equivalents totaled

$16.5 million, and there were $22.0 million of borrowings under the

Company's Revolving Commitment, compared to cash and cash

equivalents of $19.0 million and no borrowings under the Company’s

Revolving Commitment as of December 31, 2023.

- Net cash provided by operating activities totaled $198.8

million during the first nine months of 2024, compared to $165.5

million in the first nine months of 2023.

Sale-Leasebacks and Rent Expense

- In the third quarter of 2024, the Company completed four

sale-leaseback transactions involving four car wash locations for

aggregate consideration of $18.6 million.

- With 447 car wash leases at the end of the third quarter versus

422 leases at the end of the third quarter 2023, rent expense, net

increased 7% to $27.4 million, compared to the third quarter of

2023.

Fiscal 2024 Outlook

The Company revises the guidance previously provided for the

full fiscal year ending December 31, 2024:

Current

Previous

Net revenues

$988 to $995 million

$988 to $1,016 million

Comparable-store sales growth %

2.0% to 2.5%

0.5% to 2.5%

Adjusted net income

$114 to $117 million

$99 to $111 million

Adjusted EBITDA

$313 to $318 million

$291.5 to $308 million

Adjusted earnings per diluted share

$0.35 to $0.36

$0.30 to $0.34

Interest expense, net

Approx. $81 million

$81 million

Rent expense, net

Approx. $110 million

Approx. $111 million

Weighted average common shares

outstanding, diluted, full year

Approx. 330 million

330 million

New greenfield locations

Approx. 40

Approx. 40

Capital expenditures(1)

$330 to $350 million

$364 to $405 million

Sale leasebacks

$120 to $135 million

$135 to $150 million

(1)

Total capital expenditures for the fiscal

year ending December 31, 2024 are expected to consist of

approximately $280 million to $295 million of new store growth

capital expenditures and $50 million to $55 million of other

capital expenditures related to store-level maintenance,

productivity improvements and the integration of acquired

locations.

Conference Call Details

A conference call to discuss the Company’s financial results for

the third quarter of fiscal 2024 and to provide a business update

is scheduled for today, October 30, 2024, at 4:30 p.m. Eastern

Time. Investors and analysts interested in participating in the

call are invited to dial 855-209-8213 (international callers please

dial 1-412-542-4146) approximately 10 minutes prior to the start of

the call. A live audio webcast of the conference call will be

available online at https://ir.mistercarwash.com/.

A recorded replay of the conference call will be available

within approximately three hours of the conclusion of the call and

can be accessed online at https://ir.mistercarwash.com/ for 90

days.

About Mister Car Wash® | Inspiring People to Shine®

Headquartered in Tucson, Arizona, Mister Car Wash, Inc. (NYSE:

MCW) operates over 500 locations and has North America's largest

car wash subscription program. With a passionate team of

professionals, advanced technology, and a commitment to exceptional

customer experiences, Mister Car Wash is dedicated to providing a

clean, shiny, and dry vehicle every time. The Mister brand is

deeply rooted in delivering quality service, fostering

friendliness, and demonstrating a genuine commitment to the

communities it serves while prioritizing responsible environmental

practices and resource management. To learn more visit

www.mistercarwash.com.

Use of Non-GAAP Financial Measures

This press release includes references to non-GAAP financial

measures, including adjusted EBITDA, adjusted net income, and

adjusted net income per diluted share (the “Company’s Non-GAAP

Financial Measures”). These non-GAAP financial measures are not

based on any comprehensive set of accounting rules or principles

and should not be considered a substitute for, or superior to,

financial measures calculated in accordance with GAAP, and may be

different from similarly titled non-GAAP financial measures used by

other companies. In addition, the Company’s Non-GAAP Financial

Measures should be read in conjunction with the Company’s financial

statements prepared in accordance with GAAP. The reconciliations of

the Company’s Non-GAAP Financial Measures to the corresponding GAAP

measures should be carefully evaluated.

The Company’s Non-GAAP Financial Measures are non-GAAP measures

of the Company’s operating performance and should not be considered

as an alternative to net income as a measure of financial

performance or any other performance measure derived in accordance

with U.S. GAAP and should not be construed as an inference that the

Company’s future results will be unaffected by unusual or

nonrecurring items. Adjusted EBITDA is defined as net income before

interest expense, net, income tax provision, depreciation and

amortization expense, (gain) loss on sale of assets, net,

stock-based compensation expense and related taxes, acquisition

expenses, non-cash rent expense, loss on extinguishment of debt,

and other nonrecurring charges. Adjusted net income is defined as

net income before (gain) loss on sale of assets, net, stock-based

compensation expense, acquisition expenses, non-cash rent expense,

loss on extinguishment of debt, other nonrecurring charges, income

tax impact of stock award exercises and the tax impact of

adjustments to net income. Adjusted net income per share is defined

as basic net income per share before (gain) loss on sale of assets,

net, stock-based compensation expense and related taxes,

acquisition expenses, non-cash rent expense, loss on extinguishment

of debt, other nonrecurring charges, income tax impact of stock

award exercises and the tax impact of adjustments to basic net

income per share. Adjusted net income per diluted share is defined

as diluted net income per share before (gain) loss on sale of

assets, net, stock-based compensation expense, acquisition

expenses, non-cash rent expense, loss on extinguishment of debt,

other nonrecurring charges, income tax impact of stock award

exercises and the tax impact of adjustments to basic net income per

share.

Management believes the Company’s Non-GAAP Financial Measures

assist investors and analysts in comparing the Company’s operating

performance across reporting periods on a consistent basis by

excluding items that management does not believe are indicative of

the Company’s ongoing operating performance. Investors are

encouraged to evaluate these adjustments and the reasons the

Company considers them appropriate for supplemental analysis. In

evaluating the Company’s Non-GAAP Financial Measures, investors

should be aware that in the future the Company may incur expenses

that are the same as or similar to some of the adjustments in the

Company’s presentation of the Company’s Non-GAAP Financial

Measures. There can be no assurance that the Company will not

modify the presentation of the Company’s Non-GAAP Financial

Measures in future periods, and any such modification may be

material.

Management believes that the Company’s Non-GAAP Financial

Measures are helpful in highlighting trends in the Company’s core

operating performance compared to other measures, which can differ

significantly depending on long-term strategic decisions regarding

capital structure, the tax jurisdictions in which the Company

operates, and capital investments. Management also uses adjusted

EBITDA in connection with establishing discretionary annual

incentive compensation; to supplement U.S. GAAP measures of

performance in the evaluation of the effectiveness of the Company’s

business strategies; to make budgeting decisions, and because the

Company’s credit facilities use measures similar to adjusted EBITDA

to measure the Company’s compliance with certain covenants.

The Company’s Non-GAAP Financial Measures have limitations as

analytical tools, and investors should not consider these measures

in isolation or as substitutes for analysis of the Company’s

results as reported under U.S. GAAP. Some of these limitations

include, for example, adjusted EBITDA does not reflect: the

Company’s cash expenditure or future requirements for capital

expenditures or contractual commitments; the Company’s cash

requirements for the Company’s working capital needs; the interest

expense and the cash requirements necessary to service interest or

principal payments on the Company’s debt, cash requirements for

replacement of assets that are being depreciated and amortized, and

the impact of certain cash charges or cash receipts resulting from

matters management does not find indicative of the Company’s

ongoing operations.

The Company is not providing a reconciliation of the fiscal 2024

outlook for adjusted EBITDA, adjusted net income, and adjusted net

income per diluted share because we are unable to predict with

reasonable certainty the reconciling items that may affect the most

directly comparable GAAP financial measures without unreasonable

efforts. The amounts that are necessary for such reconciliations,

including acquisition expenses, other expenses, and the other

adjustments reflected, are uncertain, depend on various factors,

and could significantly impact, either individually or in the

aggregate, the GAAP measures.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements contained in this press release other than statements of

historical fact, including, without limitation, statements

regarding Mister Car Wash’s expansion efforts and expected growth

and financial and operational results for fiscal 2024 are

forward-looking statements. Words including “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “plan,” “potential,” “predict,” “seek,” or

“should,” or the negative thereof or other variations thereon or

comparable terminology are intended to identify forward-looking

statements, though not all forward-looking statements use these

words or expressions. In addition, any statements or information

that refer to expectations, beliefs, plans, projections,

objectives, performance or other characterizations of future events

or circumstances, including any underlying assumptions, are

forward-looking.

These forward-looking statements are based on management’s

current expectations and beliefs. These statements are neither

promises nor guarantees, but involve known and unknown risks,

uncertainties and other important factors that may cause the

Company’s actual results, performance or achievements to be

materially different from those expressed or implied by the

forward-looking statements, including, but not limited to: our

inability to attract new customers, retain existing customers and

maintain or grow the number of UWC members, which could adversely

affect our business, financial condition and results of operations

and rate of growth; our failure to acquire, or open and operate new

locations in a timely and cost-effective manner, and enter into new

markets or leverage new technologies, may materially and adversely

affect our competitive advantage or financial performance; our

inability to successfully implement our growth strategies on a

timely basis or at all; we are subject to a number of risks and

regulations related to credit card and debit card payments we

accept; an overall decline in the health of the economy and other

factors impacting consumer spending, such as natural disasters and

fluctuations in inflation, may affect consumer purchases, reduce

demand for our services and materially and adversely affect our

business, results of operations and financial condition; inflation,

supply chain disruption and other increased operating costs could

materially and adversely affect our results of operations; our

locations may experience difficulty hiring and retaining qualified

personnel, resulting in higher labor costs; we lease or sublease

the land and buildings where a number of our locations are

situated, which could expose us to possible liabilities and losses;

our indebtedness could adversely affect our financial health and

competitive position; our business is subject to various laws and

regulations and changes in such laws and regulations, or failure to

comply with existing or future laws and regulations, may result in

litigation, investigation or claims by third parties or employees

that could adversely affect our business; our locations are subject

to certain environmental laws and regulations; we are subject to

data security and privacy risks that could negatively impact our

results of operations or reputation; we may be unable to adequately

protect, and we may incur significant costs in enforcing or

defending, our intellectual property and other proprietary rights;

stockholders’ ability to influence corporate matters may be limited

because a small number of stockholders beneficially own a

substantial amount of our common stock and continue to have

substantial control over us; our stock price may be volatile or may

decline regardless of our operating performance, resulting in

substantial losses for investors purchasing shares of our common

stock; and the other important factors discussed under the caption

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, as such factors may be updated

from time to time in its other filings with the SEC accessible on

the SEC’s website at www.sec.gov and the Investors Relations

section of the Company’s website at www.mistercarwash.com.

Any forward-looking statement that the Company makes in this

press release speaks only as of the date hereof. Except as required

by law, the Company does not undertake any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Consolidated Statements of

Operations

(Amounts in thousands, except

share and per share data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net revenues

$

249,329

$

234,076

$

743,555

$

696,930

Cost of labor and chemicals

73,617

72,760

217,966

210,376

Other store operating expenses

102,607

90,514

298,953

270,317

General and administrative

25,436

26,426

80,058

78,438

(Gain) loss on sale of assets, net

(1,916

)

1,321

(552

)

(3,470

)

Total costs and expenses

199,744

191,021

596,425

555,661

Operating income

49,585

43,055

147,130

141,269

Other (income) expense:

Interest expense, net

20,653

19,100

60,931

55,143

Loss on extinguishment of debt

-

-

1,882

-

Other income

-

-

(5,189

)

-

Total other expense, net

20,653

19,100

57,624

55,143

Income before taxes

28,932

23,955

89,506

86,126

Income tax provision

6,590

4,470

28,436

18,373

Net income

$

22,342

$

19,485

$

61,070

$

67,753

Earnings per share:

Basic

$

0.07

$

0.06

$

0.19

$

0.22

Diluted

$

0.07

$

0.06

$

0.19

$

0.21

Weighted-average common shares

outstanding:

Basic

321,917,525

312,883,586

319,067,596

309,850,600

Diluted

329,299,326

328,844,569

329,222,641

328,265,878

Consolidated Balance

Sheets

(Amounts in thousands, except

share and per share data)

(Unaudited)

As of

(Amounts in thousands, except share and

per share data)

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

16,478

$

19,047

Accounts receivable, net

2,835

6,304

Other receivables

15,422

14,714

Inventory, net

5,491

8,952

Prepaid expenses and other current

assets

12,559

11,877

Total current assets

52,785

60,894

Property and equipment, net

870,903

725,121

Operating lease right of use assets,

net

857,861

833,547

Other intangible assets, net

113,139

117,667

Goodwill

1,134,734

1,134,734

Other assets

16,450

9,573

Total assets

$

3,045,872

$

2,881,536

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

44,715

$

33,641

Accrued payroll and related expenses

30,265

19,771

Other accrued expenses

26,793

38,738

Current maturities of long-term debt

9,250

–

Current maturities of operating lease

liability

47,195

43,979

Current maturities of finance lease

liability

811

746

Deferred revenue

34,639

32,686

Total current liabilities

193,668

169,561

Long-term portion of debt, net

931,046

897,424

Operating lease liability

826,213

809,409

Financing lease liability

13,473

14,033

Deferred tax liability

97,499

71,657

Other long-term liabilities

4,570

4,417

Total liabilities

2,066,469

1,966,501

Stockholders’ equity:

Common stock, $0.01 par value,

1,000,000,000 shares authorized, 322,239,140 and 315,192,401 shares

outstanding as of September 30, 2024 and December 31, 2023,

respectively

3,228

3,157

Additional paid-in capital

820,498

817,271

Retained earnings

155,677

94,607

Total stockholders’ equity

979,403

915,035

Total liabilities and stockholders’

equity

$

3,045,872

$

2,881,536

Consolidated Statements of

Cash Flows

(Amounts in thousands)

(Unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net income

$

61,070

$

67,753

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

61,038

51,418

Stock-based compensation expense

18,843

17,643

Gain on sale of assets, net

(552

)

(3,470

)

Loss on extinguishment of debt

1,882

-

Amortization of debt issuance costs

961

1,270

Non-cash lease expense

36,557

33,337

Deferred income tax

25,842

14,748

Changes in assets and liabilities:

Accounts receivable, net

3,469

(1,874

)

Other receivables

(7,012

)

212

Inventory, net

3,461

88

Prepaid expenses and other current

assets

(605

)

(408

)

Accounts payable

11,629

3,777

Accrued expenses

11,850

8,170

Deferred revenue

1,954

3,288

Operating lease liability

(31,811

)

(29,689

)

Other noncurrent assets and

liabilities

264

(777

)

Net cash provided by operating

activities

198,840

165,486

Cash flows from investing

activities:

Purchases of property and equipment

(259,896

)

(218,692

)

Acquisition of car wash operations, net of

cash acquired

-

(51,890

)

Proceeds from sale of property and

equipment

36,431

96,930

Net cash used in investing activities

(223,465

)

(173,652

)

Cash flows from financing

activities:

Proceeds from issuance of common stock

under employee plans

3,742

6,176

Payments of tax withholding on option

exercises

(19,290

)

-

Proceeds from debt borrowings

925,000

-

Proceeds from revolving line of credit

186,000

-

Payments on debt borrowings

(903,513

)

-

Payments on revolving line of credit

(164,000

)

-

Payments of deferred financing costs

(5,257

)

-

Principal payments on finance lease

obligations

(552

)

(492

)

Other financing activities

-

(500

)

Net cash provided by financing

activities

22,130

5,184

Net change in cash and cash equivalents

and restricted cash during period

(2,495

)

(2,982

)

Cash and cash equivalents and restricted

cash at beginning of period

19,119

65,222

Cash and cash equivalents and restricted

cash at end of period

$

16,624

$

62,240

Reconciliation of cash, cash

equivalents, and restricted cash to the consolidated balance

sheets

Cash and cash equivalents

16,478

62,133

Restricted cash, included in prepaid

expenses and other current assets

146

107

Total cash, cash equivalents, and

restricted cash

$

16,624

$

62,240

Supplemental disclosure of cash flow

information:

Cash paid for interest

$

60,436

$

56,164

Cash paid for income taxes

$

2,267

$

2,409

Supplemental disclosure of non-cash

investing and financing activities:

Property and equipment in accounts

payable

$

17,352

$

15,167

Property and equipment in other accrued

expenses

$

-

$

16,439

Stock option exercise proceeds in other

receivables

$

1

$

17

GAAP to Non-GAAP

Reconciliations

(Amounts in thousands, except

share and per share data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Reconciliation of net income to adjusted

EBITDA:

Net income

$

22,342

$

19,485

$

61,070

$

67,753

Interest expense, net

20,653

19,100

60,931

55,143

Income tax provision

6,590

4,470

28,436

18,373

Depreciation and amortization expense

21,182

17,599

61,038

51,418

(Gain) loss on sale of assets, net

(1,916

)

1,321

(552

)

(3,470

)

Stock-based compensation expense

6,774

6,522

20,367

17,876

Acquisition expenses

863

912

1,976

2,651

Non-cash rent expense

1,560

1,409

4,542

3,623

Loss on extinguishment of debt

-

-

1,882

-

Employee retention credit

-

-

(5,189

)

-

Other

756

780

8,167

3,067

Adjusted EBITDA

$

78,804

$

71,598

$

242,668

$

216,434

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Reconciliation of net income to adjusted

net income:

Net income

$

22,342

$

19,485

$

61,070

$

67,753

(Gain) loss on sale of assets, net

(1,916

)

1,321

(552

)

(3,470

)

Stock-based compensation expense

6,774

6,522

20,367

17,876

Acquisition expenses

863

912

1,976

2,651

Non-cash rent expense

1,560

1,409

4,542

3,623

Loss on extinguishment of debt

-

-

1,882

-

Employee retention credit

-

-

(5,189

)

-

Other

756

780

8,167

3,067

Income tax impact of stock award

exercises

4

(2,159

)

6,006

(4,332

)

Tax impact of adjustments to net

income

(1,567

)

(2,736

)

(6,083

)

(5,937

)

Adjusted net income

$

28,816

$

25,534

$

92,186

$

81,231

Adjusted earnings per diluted share

$

0.09

$

0.08

$

0.28

$

0.25

Adjusted weighted-average common shares

outstanding - diluted

329,299,326

328,844,569

329,222,641

328,265,878

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030778673/en/

Investors John Rouleau ICR IR@mistercarwash.com

Media media@mistercarwash.com

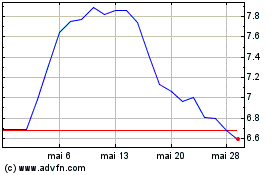

Mister Car Wash (NYSE:MCW)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Mister Car Wash (NYSE:MCW)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024