Medifast (NYSE: MED), the health and wellness company known for

its habit-based and Coach-guided lifestyle solution,

OPTAVIA®, today reported results for the first quarter ended

March 31, 2024.

First Quarter 2024

- Revenue of $174.7 million, with revenue per active earning

coach of $4,623

- Independent active earning OPTAVIA Coaches of

37,800

- Net income of $8.3 million (non-GAAP adjusted net income of

$7.2 million)

- Earnings per diluted share ("EPS") of $0.76 (non-GAAP adjusted

EPS of $0.66)

- Cash, Cash Equivalents, and Investment Securities of $156.4

million with zero debt

“Fast paced medical innovation is providing greater access to

medical weight loss solutions than ever before. We are transforming

our OPTAVIA offer to include comprehensive support for

consumers who wish to use GLP-1 medical weight loss solutions on

their individual journeys to sustainable healthy lifestyles. It’s a

market that is estimated by a recent BCG market study to have the

potential to grow to $50B or more by 2030, and it’s one that we are

uniquely positioned to capitalize on,” said Dan Chard, Chairman

& Chief Executive Officer.

“Our new model is highly differentiated from competitors, with a

holistic approach including our habit-based and Coach guided

solution along with nutrition products and community support. It

will be supported by a reimagined framework for customer

acquisition, with a new company-led national marketing campaign,

enhancing both awareness of the benefits of our approach, and the

visibility of our brand. While 2024 will be a year of investment

for future growth, we believe the initiatives we are undertaking

will be foundational in creating a platform for sustained company

growth in the years ahead.”

First Quarter 2024 Results

First quarter 2024 revenue decreased 49.9% to $174.7 million

from $349.0 million for the first quarter of 2023, primarily driven

by a decrease in the number of active earning OPTAVIA

Coaches, lower Coach productivity, and a $9.1 million impact from a

timing difference related to changes in the company’s sales order

terms and conditions with its customers realized in the first

quarter of 2023. The total number of active earning OPTAVIA

Coaches decreased 35.6% to 37,800 compared to 58,700 for the first

quarter of 2023. The average revenue per active earning

OPTAVIA Coach was $4,623, compared to $5,945 for the first

quarter last year, primarily driven by continued pressure on

customer acquisition.

Gross profit decreased 48.3% to $127.3 million from $246.4

million for the first quarter of 2023. The decrease in gross profit

was due to lower revenue, partially offset by efficiencies in

inventory management and cost savings from Fuel for the Future

initiatives. Gross profit margin was 72.8% compared to 70.6% in the

first quarter of 2023, primarily due to efficiencies in inventory

management and cost savings from Fuel for the Future initiatives,

partially offset by increased shipping costs.

Selling, general, and administrative expenses (“SG&A”)

decreased 38.1% to $119.4 million compared to $192.9 million for

the first quarter of 2023. The decrease in SG&A was primarily

due to lower OPTAVIA Coach compensation expense due to lower

volumes and fewer active earning Coaches, partially offset by

market research and investment costs related to medically supported

weight loss activities and costs for company-led acquisition

initiatives. As a percentage of revenue, SG&A increased 1,300

basis points year-over-year to 68.3% of revenue, as compared to

55.3% for the first quarter of 2023. The increase in SG&A as a

percentage of revenue was primarily due to market research and

investment costs related to medically supported weight loss

activities, loss of leverage on fixed costs due to lower sales

volumes, and costs for company-led acquisition initiatives.

Non-GAAP adjusted SG&A, which excludes expenses to initiate and

operationalize the LifeMD, Inc. (“LifeMD”) collaboration, decreased

38.8% to $118.0 million and non-GAAP adjusted SG&A as a

percentage of revenue increased 1,220 basis points year-over-year

to 67.5%.

Income from operations decreased 85.2% to $7.9 million from

$53.5 million in the prior year period. As a percentage of revenue,

income from operations was 4.5% for the first quarter of 2024

compared to 15.3% in the prior-year period. Non-GAAP adjusted

income from operations decreased 82.7% to $9.3 million. Non-GAAP

adjusted income from operations as a percentage of revenue was

5.3%, a decrease of 1,000 basis points from the year-ago

period.

The effective tax rate was 28.2% for the first quarter of 2024

compared to 25.1% in the prior-year period. The increase in the

effective tax rate from the three months ended March 31, 2023 was

primarily driven by an increase in the tax shortfall for stock

compensation and the rate impact of research and development tax

credits, partially offset by the decrease in the limitation for

executive compensation and various other miscellaneous items. The

non-GAAP effective tax rate was 28.7% as compared to 25.1% in the

prior year period.

In the first quarter of 2024, net income was $8.3 million, or

$0.76 per diluted share, based on approximately 11.0 million shares

of common stock outstanding. In the first quarter of 2023, net

income was $40.0 million, or $3.67 per diluted share, based on

approximately 10.9 million shares of common stock outstanding. In

the first quarter 2024, non-GAAP adjusted net income was $7.2

million, or $0.66 per diluted share.

Capital Allocation and Balance Sheet

The company’s balance sheet remains strong with $156.4 million

in cash, cash equivalents and investment securities and no

interest-bearing debt as of March 31, 2024 compared to $150.0

million in cash, cash equivalents and investment securities and no

debt at December 31, 2023.

Outlook

The company expects second quarter 2024 revenue to be in the

range of $150 million to $170 million and second quarter 2024

diluted EPS to be in the range of $0.05 to $0.40. The EPS range

excludes the costs related to the initiation of the LifeMD

collaboration and any gains or losses from changes in the market

price of the company’s LifeMD common stock investment.

Conference Call Information

The conference call is scheduled for today, Monday, April 29,

2024 at 4:30 p.m. ET. The call will be broadcast live over the

Internet, hosted on the Investor Relations section of Medifast’s

website at www.MedifastInc.com or directly at

https://viavid.webcasts.com/starthere.jsp?ei=1663236&tp_key=1b6e0e1efe

and will be archived online and available through July 29, 2024. In

addition, listeners may dial (877) 451-6152 to join via telephone.

A telephonic playback will be available from 8:30 p.m. ET, April 29

2024, through May 6, 2024. Participants can dial (844) 512-2921 and

enter passcode 13745406 to hear the playback.

About Medifast®:

Medifast (NYSE: MED) is the health and wellness company known

for its habit-based and coach-guided lifestyle solution

OPTAVIA®, which provides people with a simple, yet

comprehensive approach to help them achieve lasting optimal health

and wellbeing. OPTAVIA's lifestyle plans deliver clinically

proven health benefits as well as evidence-based tools, including

scientifically developed products and a framework for habit

creation reinforced by independent Coaches and Community support.

As a physician-founded company with a 40+ year history, Medifast is

a leader in the U.S. weight management industry. Through a

collaboration with the national virtual primary care provider

LifeMD, OPTAVIA customers have access to board-certified

affiliated clinicians and medications, such as GLP-1s, that support

treatment plans for obesity and other health conditions. The

company continues to innovate and build upon its scientific and

clinical heritage to fulfill its mission of offering the world

Lifelong Transformation, One Healthy Habit at a Time®. Medifast was

recognized in 2023 by Financial Times as one of The Americas'

Fastest Growing Companies and in 2022 as one of America’s Best

Mid-Sized Companies by Forbes. For more information, visit

MedifastInc.com and OPTAVIA.com and follow @Medifast on

X.

MED-F

Forward Looking Statements

Please Note: This release contains "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements generally can be identified by use

of phrases or terminology such as "intend," "anticipate," "expect"

or other similar words or the negative of such terminology.

Similarly, descriptions of Medifast's objectives, strategies,

plans, goals, outlook or targets contained herein are also

considered forward-looking statements. These statements are based

on the current expectations of the management of Medifast and are

subject to certain events, risks, uncertainties and other factors.

Some of these factors include, among others, Medifast's inability

to maintain and grow the network of independent OPTAVIA

Coaches; Industry competition and new weight loss products,

including weight loss medications, or services; Medifast’s health

or advertising related claims by our OPTAVIA customers;

Medifast's inability to continue to develop new products;

effectiveness of Medifast's advertising and marketing programs,

including use of social media by OPTAVIA Coaches; the

departure of one or more key personnel; Medifast's inability to

protect against online security risks and cyberattacks; risks

associated with Medifast's direct-to-consumer business model;

disruptions in Medifast's supply chain; product liability claims;

Medifast's planned growth into domestic markets including through

its collaboration with LifeMD, Inc.; adverse publicity associated

with Medifast's products; the impact of existing and future laws

and regulations on Medifast’s business; fluctuations of Medifast's

common stock market price; increases in litigation; actions of

activist investors; the consequences of other geopolitical events,

overall economic and market conditions and the resulting impact on

consumer sentiment and spending patterns; and Medifast's ability to

prevent or detect a failure of internal control over financial

reporting. Although Medifast believes that the expectations,

statements and assumptions reflected in these forward-looking

statements are reasonable, it cautions readers to always consider

all of the risk factors and any other cautionary statements

carefully in evaluating each forward-looking statement in this

release, as well as those set forth in its Annual Report on Form

10-K for the fiscal year ended December 31, 2023, and other filings

filed with the United States Securities and Exchange Commission,

including its quarterly reports on Form 10-Q and current reports on

Form 8-K. All of the forward-looking statements contained herein

speak only as of the date of this release.

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (UNAUDITED)

(U.S. dollars in thousands,

except per share amounts & dividend data)

Three Months Ended March

31,

2024

2023

Revenue

$

174,739

$

348,983

Cost of sales

47,447

102,593

Gross profit

127,292

246,390

Selling, general, and administrative

119,352

192,879

Income from operations

7,940

53,511

Other income (expense)

Interest income (expense)

1,223

(181

)

Other income (expense)

2,422

(1

)

3,645

(182

)

Income from operations before income

taxes

11,585

53,329

Provision for income taxes

3,269

13,361

Net income

$

8,316

$

39,968

Earnings per share - basic

$

0.76

$

3.68

Earnings per share - diluted

$

0.76

$

3.67

Weighted average shares

outstanding

Basic

10,909

10,864

Diluted

10,958

10,899

Cash dividends declared per share

$

—

$

1.65

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(U.S. dollars in thousands,

except par value)

March 31, 2024

December 31,

2023

ASSETS

Current Assets

Cash and cash equivalents

$

97,471

$

94,440

Inventories

46,273

54,591

Investments

58,957

55,601

Income taxes, prepaid

5,471

8,727

Prepaid expenses and other current

assets

11,412

10,670

Total current assets

219,584

224,029

Property, plant and equipment - net of

accumulated depreciation

50,986

51,467

Right-of-use assets

14,536

15,645

Other assets

13,648

14,650

Deferred tax assets

4,005

4,117

TOTAL ASSETS

$

302,759

$

309,908

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current Liabilities

Accounts payable and accrued expenses

$

71,229

$

86,415

Current lease obligations

5,958

5,885

Total current liabilities

77,187

92,300

Lease obligations, net of current lease

obligations

14,611

16,127

Total liabilities

91,798

108,427

Stockholders' Equity

Common stock, par value $0.001 per share:

20,000 shares authorized;

10,937 and 10,896 issued and

outstanding

at March 31, 2024 and December 31, 2023,

respectively

11

11

Additional paid-in capital

27,963

26,573

Accumulated other comprehensive income

22

248

Retained earnings

182,965

174,649

Total stockholders' equity

210,961

201,481

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

302,759

$

309,908

Non-GAAP Financial Measures

In an effort to provide investors with additional information

regarding the company's results, the company discloses various

non-GAAP financial measures in its quarterly earnings press release

and other public disclosures. The following GAAP financial measures

have been presented on an as adjusted basis: SG&A expenses,

income from operations, other income (expense), provision for

income taxes, net income and diluted EPS. Each of these non-GAAP

financial measures excludes the impact of certain amounts to

initiate and operationalize the LifeMD collaboration and unrealized

gains on investment in LifeMD common stock as further identified

below and have not been calculated in accordance with GAAP. A

reconciliation of each of these non-GAAP financial measures to its

most comparable GAAP financial measure is included below. These

non-GAAP financial measures are not intended to replace GAAP

financial measures.

The company uses these non-GAAP financial measures internally to

evaluate and manage the company's operations because it believes

they provide useful supplemental information regarding the

company's on-going economic performance. The company has chosen to

provide this information to investors to enable them to perform

more meaningful comparisons of operating results and as a means to

emphasize the results of on-going operations.

The following tables reconcile the non-GAAP financial measures

included in this release:

MEDIFAST, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

NON-GAAP (UNAUDITED)

(U.S. dollars in thousands,

except per share amounts)

Three months ended March 31,

2024

GAAP

Unrealized Gain on Investment

in LifeMD Common Stock

LifeMD Prepaid Services

Amortization

Non-GAAP

Selling, general, and administrative

$

119,352

$

—

$

(1,327

)

$

118,025

Income from operations

7,940

—

1,327

9,267

Other income (expense)

3,645

(2,841

)

—

804

Provision for income taxes

3,269

(710

)

332

2,891

Net income

8,316

(2,130

)

995

7,181

Diluted earnings per share (1)

0.76

(0.19

)

0.09

0.66

Three Months Ended March 31,

2023

GAAP

Unrealized Gain on Investment

in LifeMD Common Stock

LifeMD Prepaid Services

Amortization

Non-GAAP

Selling, general, and administrative

$

192,879

$

—

$

—

$

192,879

Income from operations

53,511

—

—

53,511

Other income (expense)

(182

)

—

—

(182

)

Provision for income taxes

13,361

—

—

13,361

Net income

39,968

—

—

39,968

Diluted earnings per share (1)

3.67

—

—

3.67

(1)

The weighted-average diluted shares

outstanding used in the calculation of these non-GAAP financial

measures are the same as the weighted-average shares outstanding

used in the calculation of the reported per share amounts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429772740/en/

Investor Contact: Medifast, Inc. Steven Zenker

InvestorRelations@medifastinc.com (443) 379-5256

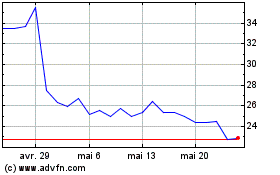

Medifast (NYSE:MED)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Medifast (NYSE:MED)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025