UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05078

MFS GOVERNMENT MARKETS INCOME TRUST

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant's telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: November 30, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

Annual Report

November 30, 2023

MFS® Government Markets Income Trust

MANAGED DISTRIBUTION POLICY

DISCLOSURE

The MFS Government Markets Income

Trust’s (the fund) Board of Trustees adopted a managed distribution policy. The fund seeks to pay monthly distributions based on an annual rate of 7.25% of the fund’s average monthly net asset value. The

primary purpose of the managed distribution policy is to provide shareholders with a constant, but not guaranteed, fixed rate of distribution each month. You should not draw any conclusions about the fund’s

investment performance from the amount of the current distribution or from the terms of the fund’s managed distribution policy. The Board may amend or terminate the managed distribution policy at any time

without prior notice to fund shareholders. The amendment or termination of the managed distribution policy could have an adverse effect on the market price of the fund’s shares.

With each distribution, the fund

will issue a notice to shareholders and an accompanying press release which will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and

sources of distributions reported in the notice to shareholders are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will

depend upon the fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. The fund will send you a Form 1099-DIV for the calendar year that will tell you how to

report these distributions for federal income tax purposes. Please refer to “Tax Matters and Distributions” under Note 2 of the Notes to Financial Statements for information regarding the tax character of

the fund’s distributions.

Under a managed distribution policy

the fund may at times distribute more than its net investment income and net realized capital gains; therefore, a portion of your distribution may result in a return of capital. A return of capital may occur, for

example, when some or all of the money that you invested in the fund is paid back to you. Any such returns of capital will decrease the fund’s total assets and, therefore, could have the effect of increasing the

fund’s expense ratio. In addition, in order to make the level of distributions called for under its managed distribution policy, the fund may have to sell portfolio securities at a less than opportune time. A

return of capital does not necessarily reflect the fund’s investment performance and should not be confused with ‘yield’ or ‘income’. The fund’s total return in relation to changes

in net asset value is presented in the Financial Highlights.

MFS® Government Markets Income Trust

New York Stock Exchange Symbol: MGF

| 1

|

| 3

|

| 5

|

| 7

|

| 18

|

| 19

|

| 20

|

| 31

|

| 32

|

| 33

|

| 34

|

| 36

|

| 47

|

| 49

|

| 50

|

| 54

|

| 58

|

| 58

|

| 58

|

| 58

|

| 58

|

| 59

|

NOT FDIC INSURED

• MAY LOSE VALUE • NO BANK GUARANTEE

Portfolio structure at value (v)

Portfolio structure reflecting equivalent exposure of

derivative positions (i)

Fixed income sectors (i)

| U.S. Treasury Securities

| 47.0%

|

| Mortgage-Backed Securities

| 41.0%

|

| Investment Grade Corporates

| 11.3%

|

| Emerging Markets Bonds

| 4.0%

|

| Commercial Mortgage-Backed Securities

| 3.4%

|

| Municipal Bonds

| 2.6%

|

| Collateralized Debt Obligations

| 1.5%

|

| Asset-Backed Securities

| 1.2%

|

| High Yield Corporates

| 0.6%

|

| Non-U.S. Government Bonds

| 0.3%

|

| U.S. Government Agencies

| 0.3%

|

Composition including fixed income credit quality

(a)(i)

| AAA

| 5.3%

|

| AA

| 1.8%

|

| A

| 6.7%

|

| BBB

| 9.3%

|

| BB

| 0.9%

|

| C

| 0.9%

|

| U.S. Government

| 35.9%

|

| Federal Agencies

| 41.3%

|

| Not Rated

| 11.1%

|

| Cash & Cash Equivalents

| (2.1)%

|

| Other

| (11.1)%

|

Portfolio facts

| Average Duration (d)

| 6.5

|

| Average Effective Maturity (m)

| 8.0 yrs.

|

Portfolio Composition - continued

| (a)

| For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard &

Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies

rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4

rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA).

Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and

unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities.

|

Not Rated includes fixed income

securities and fixed income derivatives that have not been rated by any rating agency. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies.

| (d)

| Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is

likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any.

|

| (i)

| For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may

be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to

hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more

representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts.

|

| (m)

| In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s

stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an

earlier date can be substantially shorter than the instrument’s stated maturity.

|

| (q)

| For purposes of this presentation, Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

|

| (v)

| For purposes of this presentation, market value of fixed income and/or equity derivatives, if any, is included in Cash & Cash Equivalents.

|

Where the fund holds convertible

bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes

any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash

position and other assets and liabilities.

From time to time Cash & Cash

Equivalents may be negative due to the timing of cash receipts and disbursements.

Percentages are based on net assets

as of November 30, 2023.

The portfolio is actively managed

and current holdings may be different.

Management Review

Summary of Results

For the twelve months ended November

30, 2023, the MFS Government Markets Income Trust (fund) provided a total return of 0.71%, at net asset value, and a total return of -1.85%, at market value. This compares with a return of 0.23% for the fund’s

benchmark, the Bloomberg U.S. Government/Mortgage Index. Over the same period, the fund’s other benchmark, the MFS Government Markets Income Trust Blended Index (Blended Index), generated a return of 0.86%. The

Blended Index reflects the blended returns of various fixed income market indices, with percentage allocations to each index designed to resemble the fixed income allocations of the fund. The market indices and

related percentage allocations used to compile the Blended Index are set forth in the Performance Summary.

The performance commentary below is

based on the net asset value performance of the fund, which reflects the performance of the underlying pool of assets held by the fund. The total return at market value represents the return earned by owners of the

shares of the fund, which are traded publicly on the exchange.

Market Environment

During the reporting period, central

banks around the world had to combat the strongest inflationary pressures in four decades, fueled by the global fiscal response to the pandemic, disrupted supply chains and the dislocations to energy markets stemming

from the war in Ukraine. Interest rates rose substantially, but the effects of a tighter monetary policy may not have been fully experienced yet, given that monetary policy works with long and variable lags. Strains

resulting from the abrupt tightening of monetary policy began to affect some parts of the economy, most acutely among small and regional US banks, which suffered from deposit flight as depositors sought higher yields

on their savings. Additionally, activity in the US housing sector has slowed as a result of higher mortgage rates. China’s abandonment of its Zero-COVID policy ushered in a brief uptick in economic activity in

the world’s second-largest economy in early 2023, although its momentum soon stalled as the focus turned to the country’s highly indebted property development sector. In developed markets, consumer demand

for services remained stronger than the demand for goods.

Policymakers found themselves in the

difficult position of trying to restrain inflation without tipping economies into recession. Despite the challenging macroeconomic and geopolitical environment, central banks remained focused on controlling price

pressures while also confronting increasing financial stability concerns. Central banks had to juggle achieving their inflation mandates while using macroprudential tools to keep banking systems liquid, a potentially

difficult balancing act, and one that suggested that we may be nearing a peak in policy rates.

Against an environment of relatively

tight labor markets, tighter global financial conditions and volatile materials prices, investor anxiety appeared to have increased over the potential that corporate profit margins may be past peak for this cycle.

That said, signs that supply chains have generally normalized, coupled with low levels of unemployment across developed markets and hopes that inflation levels have peaked, were supportive factors for the

macroeconomic backdrop.

Management Review - continued

Factors Affecting Performance

Relative to the Blended Index, the

fund’s longer duration(d) stance detracted from relative returns as interest rates rose throughout the reporting period. Bond selection within the mortgage-backed securities (MBS) agency fixed rate sector and an

underweight exposure to the industrials sector further weighed on relative results.

On the positive side, the

fund’s out-of-benchmark exposure to both the municipal sector and collateralized loan obligations (CLOs) contributed to relative performance. Additionally, bond selection within both the industrials and

government-related agencies sectors supported relative results.

The fund has a managed distribution

policy, the primary purpose of which is to provide shareholders with a constant, but not guaranteed, fixed rate of distribution each month. This policy had no material impact on the fund's investment strategies during

its most recent fiscal year. The level of distributions paid by the fund pursuant to its managed distribution policy may cause the fund's net asset value (NAV) per share to decline more so than if the policy were not

in place, including if distributions are in excess of fund returns. However, the adviser believes the policy may benefit the fund’s market price and premium/discount to the fund’s NAV. For the twelve

months ended November 30, 2023, the tax character of dividends paid pursuant to the managed distribution policy includes an ordinary income distribution of $3,465,689 and a tax return of capital distribution of

$4,684,173. See “Managed Distribution Policy Disclosure” in the inside cover page of this Annual Report for additional details regarding the policy and related implications for the fund and

shareholders.

Respectfully,

Portfolio Manager(s)

Geoffrey Schechter, Neeraj Arora,

Alexander Mackey, and Jake Stone

Note to Shareholders: Effective May

31, 2023, Jake Stone was added as a Portfolio Manager of the fund.

| (d)

| Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is

likely to lose about 5.00% of its value.

|

The views expressed in this report

are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views

are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading

intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

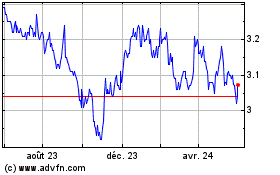

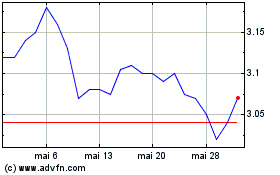

Performance Summary THROUGH 11/30/23

The following chart illustrates the

fund’s historical performance in comparison to its benchmark(s). Performance results reflect the percentage change in net asset value and market value, including reinvestment of fund distributions. Benchmarks

are unmanaged and may not be invested in directly. Benchmark returns do not reflect commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past

performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or

higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the sale of fund shares.

Growth of a Hypothetical $10,000

Investment

Average Annual Total Returns

through 11/30/23

|

| Inception Date

| 1-yr

| 5-yr

| 10-yr

|

| Market Value (r)

| 5/28/1987

| (1.85)%

| 0.63%

| 1.64%

|

| Net Asset Value (r)

| 5/28/1987

| 0.71%

| 0.73%

| 1.27%

|

Comparative benchmark(s)

|

|

|

|

|

| Bloomberg U.S. Government/Mortgage Index (f)

| 0.23%

| 0.12%

| 0.89%

|

| MFS Government Markets Income Trust Blended Index (f)(w)

| 0.86%

| 0.48%

| 1.19%

|

| Bloomberg U.S. Credit Index (f)

| 3.38%

| 1.91%

| 2.38%

|

| (f)

| Source: FactSet Research Systems Inc.

|

| (r)

| Includes reinvestment of all distributions. Market value references New York Stock Exchange Price.

|

Performance Summary - continued

| (w)

| The MFS Government Markets Income Trust Blended Index (a custom index) was comprised of the following at the beginning and at the end of the reporting period:

|

|

| 11/30/23

|

| Bloomberg U.S. Government/Mortgage Index

| 80%

|

| Bloomberg U.S. Credit Index

| 20%

|

Benchmark Definition(s)

Bloomberg U.S. Credit Index(a) – a market capitalization-weighted index that measures the performance of publicly issued, SEC-registered, U.S. corporate and specified

foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements.

Bloomberg U.S. Government/Mortgage

Index(a) – measures the performance of debt issued by the U.S. Government, and its agencies, as well as mortgage-backed pass-through securities of

Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

It is not possible to invest

directly in an index.

| (a)

| Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg's

licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express

or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

|

Notes to Performance Summary

The fund’s shares may trade at

a discount or premium to net asset value. When fund shares trade at a premium, buyers pay more than the net asset value of the underlying fund shares, and shares purchased at a premium would receive less than the

amount paid for them in the event of the fund’s concurrent liquidation.

The fund's target annual

distribution rate is calculated based on an annual rate of 7.25% of the fund's average monthly net asset value, not a fixed share price, and the fund's dividend amount will fluctuate with changes in the fund's average

monthly net assets.

Performance results based on net

asset value per share do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Financial

Highlights.

From time to time the fund may

receive proceeds from litigation settlements, without which performance would be lower.

In accordance with Section 23(c) of

the Investment Company Act of 1940, the fund hereby gives notice that it may from time to time repurchase shares of the fund in the open market at the option of the Board of Trustees and on such terms as the Trustees

shall determine.

Investment Objective, Principal Investment

Strategies and Principal Risks

Investment Objective

The fund’s investment

objective is to seek high current income, but may also consider capital appreciation. The fund’s objective may be changed without shareholder approval.

Principal Investment Strategies

MFS normally invests at least 80% of

the fund’s net assets, including borrowings for investment purposes, in U.S. and foreign government securities.

MFS may invest the fund’s

assets in other types of debt instruments.

MFS generally invests substantially

all of the fund’s assets in investment grade quality debt instruments.

MFS may purchase or sell securities

for the fund on a when-issued, delayed delivery, or forward commitment basis where payment and delivery take place at a future settlement date, including mortgage-backed securities purchased or sold in the to be

announced (TBA) market. When MFS sells securities for the fund on a when-issued, delayed delivery, or forward commitment basis, the fund typically owns or has the right to acquire securities equivalent in kind

and amount to the deliverable securities.

MFS invests the fund’s assets

in U.S. and foreign securities, including emerging market securities.

MFS normally invests the fund's

assets across different countries and regions, but MFS may invest a significant percentage of the fund's assets in issuers in a single country or region.

MFS may invest a significant

percentage of the fund’s assets in a single issuer or a small number of issuers.

The fund seeks to make a monthly

distribution at an annual fixed rate of 7.25% of the fund’s average monthly net asset value.

While MFS may use derivatives for

any investment purpose, to the extent MFS uses derivatives, MFS expects to use derivatives primarily to increase or decrease exposure to a particular market, segment of the market, or security, to increase or decrease

interest rate or currency exposure, or as alternatives to direct investments.

MFS uses an active bottom-up

investment approach to buying and selling investments for the fund. Investments are selected primarily based on fundamental analysis of individual instruments and their issuers in light of the issuers’ financial

condition and market, economic, political, and regulatory conditions. Factors considered may include the instrument’s credit quality and terms, any underlying assets and their credit quality, and the

issuer’s management ability, capital structure, leverage, and ability to meet its current obligations. MFS may also consider environmental, social, and governance (ESG) factors in its fundamental investment

analysis where MFS believes such factors could materially impact the economic value of an issuer or instrument. Quantitative

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

screening tools that systematically evaluate the

structure of a debt instrument and its features may also be considered. In structuring the fund, MFS also considers top-down factors, including sector allocations, yield curve positioning, duration, macroeconomic

factors, and risk management factors.

If approved by the fund’s

Board of Trustees, the fund may use leverage through the issuance of preferred shares, borrowing from banks, and/or other methods of creating leverage, and investing the proceeds pursuant to its investment

strategies.

Principal Investment Types

The principal investment types in

which the fund may invest are:

Debt Instruments: Debt instruments represent obligations of corporations, governments, and other entities to repay money borrowed, or other instruments believed to have debt-like characteristics. The issuer

or borrower usually pays a fixed, variable, or floating rate of interest, and must repay the amount borrowed, usually at the maturity of the instrument. Debt instruments generally trade in the over-the-counter market

and can be less liquid than other types of investments, particularly during adverse market and economic conditions. During certain market conditions, debt instruments in some or many segments of the debt market

can trade at a negative interest rate (i.e., the price to purchase the debt instrument is more than the present value of expected interest payments and principal due at the maturity of the instrument). Some debt

instruments, such as zero coupon bonds or payment-in-kind bonds, do not pay current interest. Other debt instruments, such as certain mortgage-backed securities and other securitized instruments, make periodic

payments of interest and/or principal. Some debt instruments are partially or fully secured by collateral supporting the payment of interest and principal.

U.S. Government Securities: U.S. Government securities are securities issued or guaranteed as to the payment of principal and interest by the U.S. Treasury, by an agency or instrumentality of the U.S. Government, or

by a U.S. Government-sponsored entity. Certain U.S. Government securities are not supported as to the payment of principal and interest by the full faith and credit of the U.S. Treasury or the ability to borrow from

the U.S. Treasury. Some U.S. Government securities are supported as to the payment of principal and interest only by the credit of the entity issuing or guaranteeing the security. U.S. Government securities include

mortgage-backed securities and other types of securitized instruments guaranteed by the U.S. Treasury, by an agency or instrumentality of the U.S. Government, or by a U.S. Government-sponsored entity.

Foreign Government Securities: Foreign government securities are debt instruments issued, guaranteed, or supported, as to the payment of principal and interest, by foreign governments, foreign government agencies,

foreign semi-governmental entities or supranational entities, or debt instruments issued by entities organized and operated for the purpose of restructuring outstanding foreign government securities. Foreign

government securities may not be supported as to the payment of principal and interest by the full faith and credit of the foreign government.

Securitized Instruments: Securitized instruments are debt instruments that generally provide payments of principal and interest based on the terms of the instrument and cash flows generated by the underlying

assets. Underlying assets include residential and commercial mortgages, debt instruments, loans, leases, and receivables.

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

Securitized instruments are issued by trusts or

other special purpose entities that hold the underlying assets. Certain securitized instruments offer multiple classes that differ in terms of their priority to receive principal and/or interest payments under the

terms of the instrument. Securitized instruments include mortgage-backed securities, collateralized debt obligations, and other asset-backed securities. Certain mortgage-backed securities are issued on a delayed

delivery or forward commitment basis where payment and delivery take place at a future date.

When-Issued, Delayed Delivery, and

Forward Commitment Transactions: When-issued, delayed delivery, and forward commitment transactions, including securities purchased or sold in the to be announced (TBA) market, involve a commitment to purchase or sell a

security at a predetermined price or yield at which payment and delivery take place after the customary settlement period for that type of security. Typically, no interest accrues to the purchaser until the security

is delivered. When purchasing or selling securities pursuant to one of these transactions, payment for the securities is not required until the delivery date. In the TBA market, mortgage-backed securities are

purchased and sold at predetermined prices on a delayed delivery or forward commitment basis with the underlying securities to be announced at a future date.

Corporate Bonds: Corporate bonds are debt instruments issued by corporations or similar entities.

Inflation-Adjusted Debt

Instruments: Inflation-adjusted debt instruments are debt instruments whose principal and/or interest are adjusted for inflation. Inflation-adjusted debt instruments issued by the U.S. Treasury pay a

fixed rate of interest that is applied to an inflation-adjusted principal amount. The principal amount is adjusted based on changes in the Consumer Price Index. The principal due at maturity is typically equal to the

inflation-adjusted principal amount, or to the instrument’s original par value, whichever is greater. Other types of inflation-adjusted debt instruments may use other methods of adjusting for inflation, and

other measures of inflation. Other issuers of inflation-adjusted debt instruments include U.S. Government agencies, instrumentalities and sponsored entities, U.S. and foreign corporations, and foreign

governments.

Derivatives: Derivatives are financial contracts whose value is based on the value of one or more underlying indicators or the difference between underlying indicators. Underlying indicators may include

a security or other financial instrument, asset, currency, interest rate, credit rating, commodity, volatility measure, or index. Derivatives often involve a counterparty to the transaction. Derivatives include

futures, forward contracts, options, swaps, and certain complex structured securities.

Principal Risks

The share price of the fund will

change daily based on changes in market, economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions. As with any mutual fund, the fund may not achieve its objective

and/or you could lose money on your investment in the fund. An investment in the fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental

agency. The significance of any specific risk to

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

an investment in the fund will vary over time

depending on the composition of the fund's portfolio, market conditions, and other factors. You should read all of the risk information below carefully, because any one or more of these risks may result in losses to

the fund.

The principal risks of investing in

the fund are:

Investment Selection Risk: MFS' investment analysis and its selection of investments may not produce the intended results and/or can lead to an investment focus that results in the fund underperforming other funds

with similar investment strategies and/or underperforming the markets in which the fund invests. In addition, to the extent MFS considers quantitative tools in managing the fund, such tools may not work as expected or

produce the intended results. In addition, MFS or the fund's other service providers may experience disruptions or operating errors that could negatively impact the fund.

Debt Market Risk: Debt markets can be volatile and can decline significantly in response to changes in, or investor perceptions of, issuer, market, economic, industry, political, regulatory, geopolitical,

environmental, public health, and other conditions. These conditions can affect a single instrument, issuer, or borrower, a particular type of instrument, issuer, or borrower, a segment of the debt markets, or

debt markets generally. Certain changes or events, such as political, social, or economic developments, including increasing and negative interest rates or the U.S. government's inability at times to agree on a

long-term budget and deficit reduction plan (which has in the past resulted and may in the future result in a government shutdown); market closures and/or trading halts; government or regulatory actions, including the

imposition of tariffs or other protectionist actions and changes in fiscal, monetary, or tax policies; natural disasters; outbreaks of pandemic and epidemic diseases; terrorist attacks; war; and other geopolitical

changes or events can have a dramatic adverse effect on debt markets and may lead to periods of high volatility and reduced liquidity in a debt market or a segment of a debt market.

Interest Rate Risk: The price of a debt instrument typically changes in response to interest rate changes. Interest rates can change in response to the supply and demand for credit, government and/or central

bank monetary policy and action, inflation rates, general economic and market conditions, and other factors. In general, the price of a debt instrument falls when interest rates rise and rises when interest rates

fall. Inflationary price movements may cause fixed income securities markets to experience heightened levels of interest rate volatility and liquidity risk. The risks associated with rising interest rates may be

particularly acute in the current market environment because the Federal Reserve Board recently raised interest rates and may continue to do so. Interest rate risk is generally greater for fixed-rate instruments than

floating-rate instruments and for instruments with longer maturities or durations, or that do not pay current interest. In addition, short-term and long-term interest rates do not necessarily move in the same

direction or by the same amount. An instrument’s reaction to interest rate changes depends on the timing of its interest and principal payments and the current interest rate for each of those time periods. The

price of an instrument trading at a negative interest rate responds to interest rate changes like other debt instruments; however, an instrument purchased at a negative interest rate is expected to produce a negative

return if held to maturity. Fluctuations in the market price of fixed-rate

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

instruments held by the fund may not affect

interest income derived from those instruments, but may nonetheless affect the fund's share price, especially if an instrument has a longer maturity or duration and is therefore more sensitive to changes in interest

rates.

Inflation-adjusted debt instruments

tend to react to changes in “real” interest rates. “Real” interest rates represent nominal interest rates reduced by the inflation rate.

Credit Risk: The price of a debt instrument depends, in part, on the issuer's or borrower's credit quality or ability to pay principal and interest when due. The price of a debt instrument is likely to

fall if an issuer or borrower defaults on its obligation to pay principal or interest, if the instrument's credit rating is downgraded by a credit rating agency, or based on other changes in, or perceptions of, the

financial condition of the issuer or borrower. For certain types of instruments, including derivatives, the price of the instrument depends in part on the credit quality of the counterparty to the transaction.

For other types of debt instruments, including securitized instruments, the price of the debt instrument also depends on the credit quality and adequacy of the underlying assets or collateral as well as whether there

is a security interest in the underlying assets or collateral. Enforcing rights, if any, against the underlying assets or collateral may be difficult.

Government securities not supported

as to the payment of principal or interest by the full faith and credit of the government are subject to greater credit risk than are government securities supported by the full faith and credit of the government.

Foreign Risk: Investments in securities of foreign issuers, securities of companies with significant foreign exposure, and foreign currencies can involve additional risks relating to market, economic,

industry, political, regulatory, geopolitical, environmental, public health, and other conditions. Political, social, diplomatic, and economic developments, U.S. and foreign government action, or the threat thereof,

such as the imposition of currency or capital blockages, controls, or tariffs, economic and trade sanctions or embargoes, security trading suspensions, entering or exiting trade or other intergovernmental agreements,

or the expropriation or nationalization of assets in a particular country, can cause dramatic declines in certain or all securities with exposure to that country and other countries. Sanctions, or the threat of

sanctions, may cause volatility in regional and global markets and may negatively impact the performance of various sectors and industries, as well as companies in other countries, which could have a negative effect

on the performance of the fund. In the event of nationalization, expropriation, confiscation or other government action, intervention, or restriction, the fund could lose its entire investment in a particular foreign

issuer or country. Civil unrest, geopolitical tensions, wars, and acts of terrorism are other potential risks that could adversely affect an investment in a foreign security or in foreign markets or issuers generally.

Economies and financial markets are interconnected, which increases the likelihood that conditions in one country or region can adversely impact issuers in different countries and regions. Less stringent regulatory,

accounting, auditing, and disclosure requirements for issuers and markets are more common in certain foreign countries. Enforcing legal rights can be difficult, costly, and slow in certain foreign countries and with

respect to certain types of investments, and can be particularly difficult against foreign governments. Changes in currency exchange rates can significantly impact the financial condition of a company or other issuer

with exposure to multiple countries as well as affect the U.S. dollar value of foreign currency

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

investments and investments denominated in foreign

currencies. Additional risks of foreign investments include trading, settlement, custodial, and other operational risks, and withholding and other taxes. These factors can make foreign investments, especially those

tied economically to emerging markets, more volatile and less liquid than U.S. investments. In addition, foreign markets can react differently to market, economic, industry, political, regulatory, geopolitical,

environmental, public health, and other conditions than the U.S. market.

Emerging Markets Risk: Investments tied economically to emerging markets, especially frontier markets (emerging markets that are early in their development), can involve additional and greater risks than the

risks associated with investments in developed markets. Emerging markets typically have less developed economies and markets, greater custody and operational risk, less developed legal, regulatory, and accounting

systems, less trading volume, less stringent investor protection and disclosure standards, less reliable settlement practices, greater government involvement in the economy, and greater risk of new or inconsistent

government treatment of or restrictions on issuers and instruments than developed countries. Financial and other disclosures by emerging market issuers may be considerably less reliable than disclosures made by

issuers in developed markets. In addition, the Public Company Accounting Oversight Board, which regulates auditors of U.S. public companies, may not be able to inspect audit work papers in certain emerging market

countries. Emerging markets can also be subject to greater political, social, geopolitical, and economic instability and more susceptible to environmental problems. In addition, many emerging market countries with

less established health care systems have experienced outbreaks of pandemics or contagious diseases from time to time. These factors can make emerging market investments more volatile and less liquid than investments

in developed markets.

Currency Risk: Changes in currency exchange rates can significantly impact the financial condition of a company or other issuer with exposure to multiple countries. In addition, a decline in the value of

a foreign currency relative to the U.S. dollar reduces the value of the foreign currency and investments denominated in that currency. In addition, the use of foreign exchange contracts to reduce foreign currency

exposure can eliminate some or all of the benefit of an increase in the value of a foreign currency versus the U.S. dollar. The value of foreign currencies relative to the U.S. dollar fluctuates in response to, among

other factors, interest rate changes, intervention (or failure to intervene) by the U.S. or foreign governments, central banks, or supranational entities such as the International Monetary Fund, the imposition of

currency controls, and other political or regulatory conditions in the United States or abroad. Foreign currency values can decrease significantly both in the short term and over the long term in response to these and

other conditions.

Focus Risk: Issuers in a single country or region can react similarly to market, currency, political, economic, regulatory, geopolitical, environmental, public health, and other conditions. These

conditions include business environment changes; economic factors such as fiscal, monetary, and tax policies; inflation and unemployment rates; and government and regulatory changes. The fund's performance will

be affected by the conditions in the countries and regions to which the fund is exposed. If MFS invests a significant percentage of the fund’s assets in a single issuer or small number of issuers, the

fund’s performance will be affected by economic, industry, political, regulatory,

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

geopolitical, environmental, public health, and

other conditions that impact that one issuer or issuers, could be closely tied to the value of that issuer or issuers, and could be more volatile than the performance of more diversified funds.

Prepayment/Extension Risk: Many types of debt instruments, including mortgage-backed securities, securitized instruments, certain corporate bonds, and municipal housing bonds, and certain derivatives, are subject to

the risk of prepayment and/or extension. Prepayment occurs when unscheduled payments of principal are made or the instrument is called or redeemed prior to an instrument’s maturity. When interest rates decline,

the instrument is called, or for other reasons, these debt instruments may be repaid more quickly than expected. As a result, the holder of the debt instrument may not be able to reinvest the proceeds at the same

interest rate or on the same terms, reducing the potential for gain. When interest rates increase or for other reasons, these debt instruments may be repaid more slowly than expected, increasing the potential for

loss. In addition, prepayment rates are difficult to predict and the potential impact of prepayment on the price of a debt instrument depends on the terms of the instrument.

Inflation-Adjusted Debt Instruments

Risk: Interest payments on inflation-adjusted debt instruments can be unpredictable and vary based on the level of inflation. If inflation is negative, principal and income both can decline. In

addition, the measure of inflation used may not correspond to the actual rate of inflation experienced by a particular individual.

Managed Distribution Plan Risk: The fund may not be able to maintain a monthly distribution at an annual fixed rate of up to 7.25% of the fund’s average monthly net asset value due to many factors, including but not

limited to, changes in market returns, fluctuations in market interest rates, and other factors. If income from the fund’s investments is less than the amount needed to make a monthly distribution, the fund may

distribute a return of capital to pay the distribution. In certain cases, the fund may sell portfolio investments at less opportune times in order to pay such distribution. Distributions that are treated

as tax return of capital will have the effect of reducing the fund’s assets and could increase the fund’s expense ratio. If a portion of the fund’s distributions represents returns of capital

over extended periods, the fund’s assets may be reduced over time to levels where the fund is no longer viable and might be liquidated. Please see “Managed Distribution Policy Disclosure” in

this report for additional information regarding the plan.

Market Discount/Premium Risk: The market price of shares of the fund will be based on factors such as the supply and demand for shares in the market and general market, economic, industry, political or regulatory

conditions. Whether shareholders will realize gains or losses upon the sale of shares of the fund will depend on the market price of shares at the time of the sale, not on the fund’s net asset value.

The market price may be lower or higher than the fund’s net asset value. Shares of closed-end funds frequently trade at a discount to their net asset value.

Leveraging Risk: If the fund utilizes investment leverage, there can be no assurance that such a leveraging strategy will be successful during any period in which it is employed. The use of leverage is a

speculative investment technique that results in greater volatility in the fund’s net asset value. To the extent that investments are purchased with the proceeds from the borrowings from a bank, the issuance of

preferred shares, or the creation of tender option bonds, the fund’s net asset value will

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

increase or decrease at a greater rate than a

comparable unleveraged fund. If the investment income or gains earned from the investments purchased with the proceeds from the borrowings from a bank, the issuance of preferred shares, or the creation of tender

option bonds, fails to cover the expenses of leveraging, the fund’s net asset value is likely to decrease more quickly than if the fund was not leveraged. In addition, the fund’s distributions could be

reduced. The fund is currently required under the Investment Company Act of 1940 (“1940 Act”) to maintain asset coverage of at least 200% on outstanding preferred shares and at least 300% on

outstanding indebtedness; however, the fund may be required to abide by asset coverage or other requirements that are more stringent than those imposed by the 1940 Act. The fund may be required to sell a portion of

its investments at a time when it may be disadvantageous to do so in order to redeem preferred shares or to reduce outstanding indebtedness to comply with asset coverage or other restrictions including those imposed

by the 1940 Act, any applicable loan agreement, any applicable offering documents for preferred shares issued by the fund, and the rating agencies that rate the preferred shares. The fund may be prohibited from

declaring and paying common share dividends and distributions if the fund fails to satisfy the 1940 Act’s asset coverage requirements or other agreed upon asset coverage requirements. In these situations, the

fund may choose to repurchase or redeem any outstanding leverage to the extent necessary in order to maintain compliance with such asset coverage requirements. The expenses of leveraging are paid by the holders of

common shares. Borrowings from a bank or preferred shares may have a stated maturity. If this leverage is not extended prior to maturity or replaced with the same or a different form of leverage, distributions to

common shareholders may be decreased.

Certain transactions and investment

strategies can result in leverage. Because movements in a fund’s share price generally correlate over time with the fund’s net asset value, the market price of a leveraged fund will also tend to be more

volatile than that of a comparable unleveraged fund. The costs of an offering of preferred shares and/or borrowing program would be borne by shareholders.

Under the terms of any loan

agreement or of a purchase agreement between the fund and the investor in the preferred shares, as the case may be, the fund may be required to, among other things, limit its ability to pay dividends and distributions

on common shares in certain circumstances, incur additional debts, engage in certain transactions, and pledge some or all of its assets at an inopportune time. Such agreements could limit the fund’s ability to

pursue its investment strategies. The terms of any loan agreement or purchase agreement could be more or less restrictive than those described.

Under guidelines generally required

by a rating agency providing a rating for any preferred shares, the fund may be required to, among other things, maintain certain asset coverage requirements, restrict certain investments and practices, and adopt

certain redemption requirements relating to preferred shares. Such guidelines or the terms of a purchase agreement between a fund and the investor in the preferred shares could limit the fund’s ability to

pursue its investment strategies. The guidelines imposed with respect to preferred shares by a rating agency or an investor in the preferred shares could be more or less restrictive than those described.

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

When-Issued, Delayed Delivery, and

Forward Commitment Transaction Risk: The purchaser in a when-issued, delayed delivery or forward commitment transaction assumes the rights and risks of ownership, including the risks of price and yield fluctuations and the

risk that the security will not be issued or delivered as anticipated, and the seller loses the opportunity to benefit if the price of the security rises. When-issued, delayed delivery, and forward commitment

transactions can involve leverage.

Derivatives Risk: Derivatives can be highly volatile and involve risks in addition to, and potentially greater than, the risks of the underlying indicator(s). Gains or losses from derivatives can be

substantially greater than the derivatives’ original cost and can sometimes be unlimited. Derivatives can involve leverage. Derivatives can be complex instruments and can involve analysis and processing

that differs from that required for other investment types used by the fund. If the value of a derivative does not change as expected relative to the value of the market or other indicator to which the derivative is

intended to provide exposure, the derivative may not have the effect intended. Derivatives can also reduce the opportunity for gains or result in losses by offsetting positive returns in other investments. Derivatives

can be less liquid than other types of investments.

Counterparty and Third Party Risk:

Transactions involving a counterparty other than the issuer of the instrument, including clearing organizations, or a third party responsible for servicing the instrument or effecting the

transaction, are subject to the credit risk of the counterparty or third party, and to the counterparty’s or third party’s ability or willingness to perform in accordance with the terms of the

transaction. If a counterparty or third party fails to meet its contractual obligations, goes bankrupt, or otherwise experiences a business interruption, the fund could miss investment opportunities, lose value

on its investments, or otherwise hold investments it would prefer to sell, resulting in losses for the fund.

Liquidity Risk: Certain investments and types of investments are subject to restrictions on resale, may trade in the over-the-counter market, or may not have an active trading market due to adverse market,

economic, industry, political, regulatory, geopolitical, environmental, public health, and other conditions, including trading halts, sanctions, or wars. Investors trying to sell large quantities of a particular

investment or type of investment, or lack of market makers or other buyers for a particular investment or type of investment may also adversely affect liquidity. At times, all or a significant portion of a

market may not have an active trading market. Without an active trading market, it may be difficult to value, and it may not be possible to sell, these investments and the fund could miss other investment

opportunities and hold investments it would prefer to sell, resulting in losses for the fund. In addition, the fund may have to sell certain of these investments at prices or times that are not advantageous in

order to meet redemptions or other cash needs, which could result in dilution of remaining investors' interests in the fund. The prices of illiquid securities may be more volatile than more liquid

investments.

Anti-Takeover Provisions Risk: The fund’s declaration of trust includes provisions that could limit the ability of other persons or entities to acquire control of the fund, to convert the fund to an open-end fund,

or to change the composition of the fund’s Board of Trustees. These provisions could reduce the opportunities for shareholders to sell their shares at a premium over the then-current market

price.

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

Other Investment Strategies and

Risks

Active and Frequent Trading: MFS may engage in active and frequent trading in pursuing the fund's principal investment strategies. Frequent trading may increase transaction costs, which can reduce the fund's return.

Frequent trading can also increase the possibility of capital gain and ordinary distributions. Frequent trading can also result in the realization of a higher percentage of short-term capital gains and a lower

percentage of long-term capital gains as compared to a fund that trades less frequently. Because short-term capital gains are distributed as ordinary income, this would generally increase your tax liability

unless you hold your shares through a tax-advantaged or tax-exempt vehicle.

Operational and Cybersecurity Risk:

The fund and its service providers, and your ability to transact in fund shares, may be negatively impacted due to operational matters arising from, among other issues, human errors,

systems and technology disruptions or failures, fraudulent activities, or cybersecurity incidents. Operational issues and cybersecurity incidents may cause the fund or its service providers, as well as

securities trading venues and other market participants, to suffer data corruption and/or lose operational functionality, and could, among other things, impair the ability to calculate the fund's net asset value per

share, impede trading of portfolio securities, and result in the theft, misuse, and/or improper release of confidential information relating to the fund or its shareholders. Such operational issues and

cybersecurity incidents may result in losses to the fund and its shareholders. Because technology is frequently changing, new ways to carry out cyberattacks continue to develop. Therefore, there is a chance that

certain risks have not been identified or prepared for, or that an attack may not be detected, which puts limitations on the ability of the fund and its service providers to plan for or respond to a cyberattack.

Furthermore, geopolitical tensions could increase the scale and sophistication of deliberate cybersecurity attacks, particularly those from nation-states or from entities with nation-state backing.

Temporary Defensive Strategy: In response to adverse market, economic, industry, political, or other conditions, MFS may depart from the fund’s principal investment strategies by temporarily investing for

defensive purposes. When MFS invests defensively, different factors could affect the fund’s performance and the fund may not achieve its investment objective. In addition, the defensive strategy may not work as

intended.

Investment Restrictions

The Fund has adopted the following

policies which cannot be changed without the approval of a “majority of its outstanding voting securities” as such term is defined by the 1940 Act. Under the 1940 Act, the vote of a “majority

of its outstanding voting securities” means the vote of the lesser of (i) 67% or more of the voting securities present at a meeting at which holders of voting securities representing more than 50% of the

outstanding voting securities are present or represented by proxy, or (ii) more than 50% of the outstanding voting securities. Except for fundamental investment restriction (1), these investment restrictions are

adhered to at the time of purchase or utilization of assets; a subsequent change in circumstances will not be considered to result in a violation of policy.

Investment Objective, Principal Investment

Strategies and Principal Risks - continued

The Fund may not:

| (1)

| borrow money or issue any senior security except to the extent permitted by the 1940 Act or exemptive orders granted under such Act, or otherwise permitted from time to time by regulatory authority

having jurisdiction.

|

| (2)

| underwrite securities issued by other persons, except that all or any portion of the assets of the Fund may be invested in one or more investment companies, to the extent not prohibited by the 1940 Act

and exemptive orders granted under such Act, and except insofar as the Fund may technically be deemed an underwriter under the Securities Act of 1933, as amended, in selling a portfolio security.

|

| (3)

| issue any senior securities except to the extent not prohibited by the 1940 Act and exemptive orders granted under such Act. For purposes of this restriction, collateral arrangements with respect to any

type of swap, option, Forward Contracts and Futures Contracts and collateral arrangements with respect to initial and variation margin are not deemed to be the issuance of a senior security.

|

| (4)

| make loans except to the extent not prohibited by the 1940 Act and exemptive orders granted under such Act.

|

| (5)

| purchase or sell real estate (excluding securities secured by real estate or interests therein and securities of companies, such as real estate investment trusts, which deal in real estate or interests

therein), interests in oil, gas or mineral leases, commodities or commodity contracts (excluding currencies and any type of option, Futures Contracts and Forward Contracts) in the ordinary course of its business. The

Fund reserves the freedom of action to hold and to sell real estate, mineral leases, commodities or commodity contracts (including currencies and any type of option, Futures Contracts and Forward Contracts) acquired

as a result of the ownership of securities.

|

| (6)

| purchase any securities of an issuer in a particular industry if as a result 25% or more of its total assets (taken at market value at the time of purchase) would be invested in securities of issuers

whose principal business activities are in the same industry.

|

For purposes of investment

restriction (5), investments in certain types of derivative instruments whose value is related to commodities or commodity contracts, including swaps and structured notes, are not considered commodities or commodity

contracts.

For purposes of fundamental

investment restriction (6), investments in securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities and tax-exempt obligations issued or guaranteed by a U.S. territory or possession,

a state or local government, or a political subdivision of any of the foregoing, are not considered an investment in any particular industry.

For purposes of fundamental

investment restriction (6), investments in other investment companies are not considered an investment in any particular industry and portfolio securities held by an underlying fund in which the Fund may invest are

not considered to be securities purchased by the Fund.

For purposes of fundamental

investment restriction (6), MFS uses a customized set of industry groups for classifying securities based on classifications developed by third party providers.

Portfolio Managers' Profiles

| Portfolio Manager

| Primary Role

| Since

| Title and Five Year History

|

| Geoffrey Schechter

| Lead and U.S. Government Securities Portfolio Manager

| 2006

| Investment Officer of MFS; employed in the investment management area of MFS since 1993.

|

| Neeraj Arora

| Emerging Markets Debt Instruments Portfolio Manager

| 2021

| Investment Officer of MFS; employed in the investment management area of MFS since 2011.

|

| Alexander Mackey

| Investment Grade Debt Instruments Portfolio Manager

| 2021

| Investment Officer of MFS; employed in the investment management area of MFS since 2001.

|

| Jake Stone

| U.S. Government Securities Portfolio Manager

| May 2023

| Investment Officer of MFS; employed in the investment management area of MFS since July 2018; Vice President, Wellington Management Company, LLP prior to 2018.

|

The following information in this

annual report is a summary of certain changes since November 30, 2022. This information may not reflect all of the changes that have occurred since you purchased this fund.

On May 31, 2023, Jake Stone was

added as a Portfolio Manager of the fund.

Dividend Reinvestment And Cash Purchase Plan

The fund offers a Dividend

Reinvestment and Cash Purchase Plan (the “Plan”) that allows common shareholders to reinvest either all of the distributions paid by the fund or only the long-term capital gains. Generally, purchases are

made at the market price unless that price exceeds the net asset value (the shares are trading at a premium). If the shares are trading at a premium, the fund will issue shares at a price of either the net asset value

or 95% of the market price, whichever is greater. You can also buy shares on a quarterly basis in any amount $100 and over. Computershare Trust Company, N.A. (the Transfer Agent for the fund) (the “Plan

Agent”) will purchase shares under the Plan on the 15th of January, April, July, and October or shortly thereafter. You may obtain a copy of the Plan by contacting the Plan Agent at 1-800-637-2304 any business

day from 9 a.m. to 5 p.m. Eastern time or by visiting the Plan Agent's Web site at www.computershare.com/investor.

If shares are registered in your own

name, new shareholders will automatically participate in the Plan, unless you have indicated that you do not wish to participate. If your shares are in the name of a brokerage firm, bank, or other nominee, you can ask

the firm or nominee to participate in the Plan on your behalf. If the nominee does not offer the Plan, you may wish to request that your shares be re-registered in your own name so that you can participate. There is

no service charge to reinvest distributions, nor are there brokerage charges for shares issued directly by the fund. However, when shares are bought on the New York Stock Exchange or otherwise on the open market, each

participant pays a pro rata share of the transaction expenses, including commissions. The tax status of dividends and capital gain distributions does not change whether received in cash or reinvested in additional

shares – the automatic reinvestment of distributions does not relieve you of any income tax that may be payable (or required to be withheld) on the distributions.

If your shares are held directly

with the Plan Agent, you may withdraw from the Plan at any time by contacting the Plan Agent. Please have available the name of the fund and your account number. For certain types of registrations, such as corporate

accounts, instructions must be submitted in writing. Please call for additional details. When you withdraw from the Plan, you can receive the value of the reinvested shares in one of three ways: your full shares will

be held in your account, the Plan Agent will sell your shares and send the proceeds to you, or you may transfer your full shares to your investment professional who can hold or sell them. Additionally, the Plan Agent

will sell your fractional shares and send the proceeds to you.

If you have any questions, contact

the Plan Agent by calling 1-800-637-2304, visit the Plan Agent’s Web site at www.computershare.com/investor, or by writing to the Plan Agent at P.O. Box 43078, Providence, RI 02940-3078.

Portfolio of Investments

11/30/23

The Portfolio of Investments is a

complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer

|

|

| Shares/Par

| Value ($)

|

| Bonds – 101.5%

|

| U.S. Bonds – 96.2%

|

| Asset-Backed & Securitized – 6.1%

|

| 3650R Commercial Mortgage Trust, 2021-PF1, “XA”, 1.131%, 11/15/2054 (i)

|

| $

| 1,167,272

| $57,322

|

| ACREC 2021-FL1 Ltd., “AS”, FLR, 6.944% ((SOFR - 1mo. + 0.11448%) + 1.5%), 10/16/2036 (n)

|

|

| 323,500

| 313,902

|

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “B”, FLR, 6.937% ((SOFR - 1mo. + 0.11448%) + 1.5%), 12/15/2035 (n)

|

|

| 175,500

| 170,422

|

| Arbor Realty Trust, Inc., CLO, 2021-FL3, “AS”, FLR, 6.837% ((SOFR - 1mo. + 0.11448%) + 1.4%), 8/15/2034 (n)

|

|

| 374,500

| 363,405

|

| AREIT 2022-CRE6 Trust, “AS”, FLR, 6.975% (SOFR - 30 day + 1.65%), 1/20/2037 (n)

|

|

| 512,000

| 498,969

|

| ARI Fleet Lease Trust, 2023-B, “A2”, 6.05%, 7/15/2032 (n)

|

|

| 100,000

| 100,400

|

| BBCMS Mortgage Trust, 2021-C10, “XA”, 1.41%, 7/15/2054 (i)

|

|

| 1,171,161

| 72,618

|

| BBCMS Mortgage Trust, 2021-C9, “XA”, 1.734%, 2/15/2054 (i)

|

|

| 979,564

| 79,654

|

| BBCMS Mortgage Trust, 2022-C18, “XA”, 0.638%, 12/15/2055 (i)

|

|

| 1,231,363

| 44,493

|

| Benchmark 2021-B23 Mortgage Trust, “XA”, 1.374%, 2/15/2054 (i)

|

|

| 1,970,679

| 119,321

|

| Benchmark 2021-B24 Mortgage Trust, “XA”, 1.264%, 3/15/2054 (i)

|

|

| 1,168,691

| 62,264

|

| Benchmark 2021-B26 Mortgage Trust, “XA”, 0.996%, 6/15/2054 (i)

|

|

| 1,595,664

| 70,204

|

| Benchmark 2021-B27 Mortgage Trust, “XA”, 1.377%, 7/15/2054 (i)

|

|

| 1,451,114

| 89,375

|

| Benchmark 2021-B28 Mortgage Trust, “XA”, 1.386%, 8/15/2054 (i)

|

|

| 2,195,361

| 144,072

|

| Benchmark 2021-B29 Mortgage Trust, “XA”, 1.144%, 9/15/2054 (i)

|

|

| 1,882,951

| 94,566

|

| BSPDF 2021-FL1 Issuer Ltd., “A”, FLR, 6.637% ((SOFR - 1mo. + 0.11448%) + 1.2%), 10/15/2036 (n)

|

|

| 200,494

| 197,684

|

| BSPDF 2021-FL1 Issuer Ltd., “AS”, FLR, 6.917% ((SOFR - 1mo. + 0.11448%) + 1.48%), 10/15/2036 (n)

|

|

| 253,500

| 242,612

|

| BXMT 2021-FL4 Ltd., “AS”, FLR, 6.744% ((SOFR - 1mo. + 0.11448%) + 1.3%), 5/15/2038 (n)

|

|

| 345,000

| 318,065

|

| Capital Automotive, 2020-1A, “A4”, REIT, 3.19%, 2/15/2050 (n)

|

|

| 98,771

| 93,962

|

| Chesapeake Funding II LLC, 2023-2A, “A2”, FLR, 6.424% (SOFR - 1mo. + 1.1%), 10/15/2035 (n)

|

|

| 350,299

| 350,040

|

| Citigroup Commercial Mortgage Trust, 2019-XA, “C7”, 0.987%, 12/15/2072 (i)(n)

|

|

| 1,415,823

| 54,730

|

| Commercial Mortgage Pass-Through Certificates, 2021-BN31, “XA”, 1.423%, 2/15/2054 (i)

|

|

| 1,510,168

| 101,957

|

| Commercial Mortgage Pass-Through Certificates, 2021-BN32, “XA”, 0.883%, 4/15/2054 (i)

|

|

| 994,283

| 38,256

|

| Commercial Mortgage Pass-Through Certificates, 2021-BN35, “XA”, 1.146%, 6/15/2064 (i)

|

|

| 989,603

| 53,374

|

| Dell Equipment Finance Trust, 2023-1, “A2”, 5.65%, 9/22/2028 (n)

|

|

| 271,000

| 270,407

|

| Dell Equipment Finance Trust, 2023-3, “A2”, 6.1%, 4/23/2029 (n)

|

|

| 100,000

| 100,252

|

Portfolio of Investments –

continued

| Issuer

|

|

| Shares/Par

| Value ($)

|

| Bonds – continued

|

| U.S. Bonds – continued

|

| Asset-Backed & Securitized – continued

|

| GLS Auto Select Receivables Trust, 2023-2A, 6.37%, 6/15/2028 (n)

|

| $

| 115,000

| $115,399

|

| LAD Auto Receivables Trust, 2022-1A, “A”, 5.21%, 6/15/2027 (n)

|

|

| 67,115

| 66,724

|

| LoanCore 2021-CRE5 Ltd., “AS”, FLR, 7.187% ((SOFR - 1mo. + 0.11448%) + 1.75%), 7/15/2036 (n)

|

|

| 283,500

| 277,428

|

| LoanCore 2021-CRE6 Ltd., “AS”, FLR, 7.087% ((SOFR - 1mo. + 0.11448%) + 1.65%), 11/15/2038 (n)

|

|

| 500,000

| 486,784

|

| MF1 2021-FL5 Ltd., “AS”, FLR, 6.644% ((SOFR - 1mo. + 0.11448%) + 1.2%), 7/15/2036 (n)

|

|

| 173,500

| 169,649

|

| MF1 2021-FL5 Ltd., “B”, FLR, 6.894% ((SOFR - 1mo. + 0.11448%) + 1.45%), 7/15/2036 (n)

|

|

| 279,500

| 272,141

|

| Morgan Stanley Capital I Trust, 2018-H4, “XA”, 0.981%, 12/15/2051 (i)

|

|

| 1,517,401

| 49,737

|

| Morgan Stanley Capital I Trust, 2021-L5, “XA”, 1.414%, 5/15/2054 (i)

|

|

| 735,102

| 44,964

|

| Morgan Stanley Capital I Trust, 2021-L6, “XA”, 1.325%, 6/15/2054 (i)

|

|

| 1,130,845

| 62,697

|

| Morgan Stanley Capital I Trust, 2021-L7, “XA”, 1.208%, 10/15/2054 (i)

|

|

| 3,352,630

| 177,550

|

| Navistar Financial Dealer Note Master Owner Trust, 2023-1, “A”, 6.18%, 8/25/2028 (n)

|

|

| 121,000

| 121,297

|

| Navistar Financial Dealer Note Master Owner Trust, 2023-1, “B”, 6.48%, 8/25/2028 (n)

|

|

| 50,000

| 50,133

|

| PFP III 2021-7 Ltd., “AS”, FLR, 6.594% ((SOFR - 1mo. + 0.114%) + 1.15%), 4/14/2038 (n)

|

|

| 253,183

| 250,034

|

| PFS Financing Corp., 2023-C, “B”, 5.91%, 10/15/2028 (n)

|

|

| 63,000

| 62,507

|

| ReadyCap Commercial Mortgage Trust, 2021-FL7, “A”, FLR, 6.657% ((SOFR - 1mo. + 0.11448%) + 1.2%), 11/25/2036 (z)

|

|

| 158,254

| 156,253

|

| Wells Fargo Commercial Mortgage Trust, 2018-C48, “XA”, 1.105%, 1/15/2052 (i)(n)

|

|

| 856,839

| 30,992

|

|

|

|

|

| $6,496,615

|

| Broadcasting – 0.9%

|

| Discovery Communications LLC, 4.65%, 5/15/2050

|

| $

| 229,000

| $172,928

|

| Walt Disney Co., 3.5%, 5/13/2040

|

|

| 612,000

| 492,889

|

| WarnerMedia Holdings, Inc., 4.279%, 3/15/2032

|

|

| 379,000

| 334,340

|

|

|

|

|

| $1,000,157

|

| Cable TV – 0.3%

|

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 4.908%, 7/23/2025

|

| $

| 242,000

| $238,029

|

| Time Warner Cable, Inc., 4.5%, 9/15/2042

|

|

| 100,000

| 74,002

|

|

|

|

|

| $312,031

|

Portfolio of Investments –

continued

| Issuer

|

|

| Shares/Par

| Value ($)

|

| Bonds – continued

|

| U.S. Bonds – continued

|

| Consumer Products – 0.2%

|

| Haleon US Capital LLC, 3.625%, 3/24/2032

|

| $

| 250,000

| $220,279

|

| Consumer Services – 0.1%

|

| Conservation Fund, 3.474%, 12/15/2029

|

| $

| 159,000

| $136,809

|

| Electrical Equipment – 0.2%

|

| Arrow Electronics, Inc., 6.125%, 3/01/2026

|

| $

| 171,000

| $170,763

|

| Electronics – 0.5%

|

| Broadcom, Inc., 3.187%, 11/15/2036 (n)

|

| $

| 750,000

| $573,056

|

| Food & Beverages – 2.2%

|

| Constellation Brands, Inc., 4.65%, 11/15/2028

|

| $

| 1,500,000

| $1,466,348

|

| JBS USA Lux S.A./JBS USA Food Co./JBS USA Finance, Inc., 3%, 2/02/2029

|

|

| 488,000

| 417,164

|

| Keurig Dr Pepper, Inc., 3.8%, 5/01/2050

|

|

| 650,000

| 482,719

|

| Tyson Foods, Inc., 5.15%, 8/15/2044

|

|

| 38,000

| 32,675

|

|

|

|

|

| $2,398,906

|

| Industrial – 0.1%

|

| Howard University, Washington D.C., AGM, 2.516%, 10/01/2025

|

| $

| 42,000

| $39,598

|

| Insurance – 0.4%

|

| Corebridge Financial, Inc., 3.85%, 4/05/2029

|

| $

| 500,000

| $457,793

|

| Insurance - Health – 0.8%

|

| Humana, Inc., 3.7%, 3/23/2029

|

| $

| 167,000

| $156,157

|

| UnitedHealth Group, Inc., 4.625%, 7/15/2035

|

|

| 672,000

| 645,660

|

|

|

|

|

| $801,817

|

| Insurance - Property & Casualty – 0.1%

|

| Liberty Mutual Group, Inc., 3.951%, 10/15/2050 (n)

|

| $

| 99,000

| $69,350

|

| Major Banks – 2.0%

|

| Bank of America Corp., 2.687% to 4/22/2031, FLR (SOFR - 1 day + 1.32%) to 4/22/2032

|

| $

| 750,000

| $609,315

|

| JPMorgan Chase & Co., 2.58% to 4/22/2031, FLR (SOFR - 1 day + 1.25%) to 4/22/2032

|

|

| 750,000

| 612,988

|

| JPMorgan Chase & Co., 3.109% to 4/22/2050, FLR (SOFR - 1 day + 2.44%) to 4/22/2051

|

|

| 485,000

| 325,406

|

| Morgan Stanley, 3.622% to 4/01/2030, FLR (SOFR - 1 day + 3.12%) to 4/01/2031

|

|

| 588,000

| 521,831

|

Portfolio of Investments –

continued

| Issuer

|

|

| Shares/Par

| Value ($)

|

| Bonds – continued

|

| U.S. Bonds – continued

|

| Major Banks – continued

|

| State Street Corp., 3.152% to 3/30/2030, FLR (SOFR + 2.65%) to 3/30/2031

|

| $

| 138,000

| $120,563

|

|

|

|

|

| $2,190,103

|

| Medical & Health Technology & Services – 1.0%

|

| Becton, Dickinson and Co., 4.685%, 12/15/2044

|

| $

| 123,000

| $107,296

|

| Laboratory Corp. of America Holdings, 4.7%, 2/01/2045

|

|

| 106,000

| 90,964

|

| Montefiore Obligated Group, AGM, 5.246%, 11/01/2048

|

|

| 614,000

| 543,426

|

| ProMedica Toledo Hospital, “B”, AGM, 5.325%, 11/15/2028

|

|

| 170,000

| 166,096

|

| ProMedica Toledo Hospital, “B”, AGM, 5.75%, 11/15/2038

|

|

| 175,000

| 170,930

|

|

|

|

|

| $1,078,712

|

| Midstream – 0.1%

|

| Targa Resources Corp., 4.95%, 4/15/2052

|

| $

| 109,000

| $89,417

|

| Mortgage-Backed – 40.9%

|

| Fannie Mae, 3%, 11/01/2028 - 5/25/2053

|

| $

| 1,960,420

| $1,770,789

|

| Fannie Mae, 6.5%, 5/01/2031 - 1/01/2037

|

|

| 154,033

| 158,831

|

| Fannie Mae, 2.5%, 11/01/2031 - 10/01/2046

|

|

| 208,957

| 184,823

|

| Fannie Mae, 3.5%, 12/25/2031 - 2/25/2036 (i)

|

|

| 62,955

| 5,537

|

| Fannie Mae, 2%, 1/25/2033 - 4/25/2046

|

|

| 136,961

| 124,033

|

| Fannie Mae, 3%, 2/25/2033 (i)

|

|

| 96,372

| 8,134

|

| Fannie Mae, 3.5%, 8/15/2033 - 6/25/2048

|

|

| 1,443,006

| 1,308,567

|