0001835256FALSE00018352562024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

March 7, 2024

Date of Report (Date of earliest event reported)

The Duckhorn Portfolio, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40240 | 81-3866305 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| |

| | |

| |

1201 Dowdell Lane

Saint Helena, CA 94574

(Address of principal executive offices) (Zip Code)

(707) 302-2658

(Registrant's telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | NAPA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2024, The Duckhorn Portfolio, Inc. (the “Company”) issued a press release announcing its financial results for its second quarter ended January 31, 2024. Copies of the press release and presentation are being furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K and are incorporated by reference into this Item 2.02.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | |

| The Duckhorn Portfolio, Inc. |

| | |

Date: March 7, 2024 | By: | /s/ S.B.A. Sullivan |

| | Sean Sullivan |

| | Executive Vice President, Chief Strategy and Legal Officer |

The Duckhorn Portfolio Announces Fiscal

Second Quarter 2024 Financial Results

Net Sales of $103.0 million, approximately flat year over year

Net Income of $15.9 million, up approximately 6% year over year

Adjusted EBITDA of $42.7 million, up approximately 10% year over year

Updates Fiscal Year 2024 Guidance

ST. HELENA, CA, March 7, 2024 – (BUSINESS WIRE) – The Duckhorn Portfolio, Inc. (NYSE: NAPA) (the “Company”) today reported its financial results for the three months ended January 31, 2024.

Second Quarter 2024 Highlights

▪Net sales were $103.0 million, a decrease of $0.4 million, or 0.4%, versus the prior year period.

▪Gross profit was $58.3 million, an increase of $3.1 million, or 5.7%, versus the prior year period. Gross profit margin was 56.6%, up 330 basis points versus the prior year period.

▪Net income was $15.9 million, or $0.14 per diluted share, versus $14.9 million, or $0.13 per diluted share, in the prior year period. Adjusted net income was $20.7 million, or $0.18 per diluted share, versus $21.1 million, or $0.18 per diluted share, in the prior year period.

▪Adjusted EBITDA was $42.7 million, an increase of $3.9 million, or 10.1%, and adjusted EBITDA margin improved 400 basis points versus the prior year period.

▪Cash was $13.1 million as of January 31, 2024. The Company’s leverage ratio was 1.9x net debt (net of debt issuance costs) to trailing twelve months adjusted EBITDA.

Deirdre Mahlan, Interim President, Chief Executive Officer and Chairperson, commented, “We delivered strong profitability in the second quarter and continued to take share amidst broader industry headwinds. Importantly, we grew adjusted EBITDA by approximately 10% to $42.7 million representing a 41.5% adjusted EBITDA margin, a 400-basis point improvement over the prior year period, driven by robust gross margins and strong operating cost management.”

Ms. Mahlan continued, “The Duckhorn Portfolio continues to outpace both total wine and luxury wine markets, as consumers routinely choose our products over the competition.”

Jennifer Fall Jung, Chief Financial Officer, said, “We delivered second quarter profitability well above expectations as we managed through a softer demand environment. We are updating our full-year fiscal 2024 guidance to reflect our second quarter results and more caution with regard to the second half. Our new guidance implies a second half growth rate of low-to-mid single digit net sales growth. As a leading luxury wine company, we remain confident in our ability to continue to take share and deliver sustained, profitable, long-term growth.”

Second Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended January 31, | | Six months ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales (decline) growth | (0.4) | % | | 4.8 | % | | (2.9) | % | | 4.3 | % |

| Volume contribution | (2.7) | % | | (0.4) | % | | (3.1) | % | | 4.5 | % |

| Price / mix contribution | 2.3 | % | | 5.2 | % | | 0.2 | % | | (0.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended January 31, | | Six months ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Wholesale – Distributors | 62.1 | % | | 61.3 | % | | 69.6 | % | | 69.0 | % |

| Wholesale – California direct to trade | 18.9 | | | 19.1 | | | 17.2 | | | 17.4 | |

| DTC | 19.0 | | | 19.6 | | | 13.2 | | | 13.6 | |

| Net sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Net sales were $103.0 million, a decrease of $0.4 million, or 0.4%, versus $103.5 million in the prior year period. The decline in net sales was driven by lower shipment volumes, largely offset by improvements in price / mix of 2.3% driven by lower trade spend.

Gross profit was $58.3 million, an increase of $3.1 million, or 5.7%, versus the prior year period. Gross profit margin was 56.6%, improving 330 basis points versus the prior year period as a result of cost of sales improvement and lower trade spend.

Total selling, general and administrative expenses were $29.2 million, a decrease of $0.3 million, or 1.1%, versus $29.6 million in the prior year period. The decrease was primarily attributed to lower transaction costs related to our pending acquisition of Sonoma-Cutrer Vineyards, Inc., partially offset by higher depreciation expense related to the asset acquisition of the Geyserville winery in Fiscal 2023.

Net income was $15.9 million, or $0.14 per diluted share, versus $14.9 million, or $0.13 per diluted share, in the prior year period. Adjusted net income was $20.7 million, or $0.18 per diluted share, versus $21.1 million, or $0.18 per diluted share, in the prior year period. The decrease in adjusted net income was primarily driven by a modest decrease in sales and increase in interest expense, mostly offset by favorable gross profit.

Adjusted EBITDA was $42.7 million, an increase of $3.9 million, or 10.1%, versus $38.8 million in the prior year period. This increase was driven primarily by an improvement in gross margin and strong operating expense management, partially offset by a slight decrease in net sales. Adjusted EBITDA margin improved 400 basis points versus the prior year period.

Fiscal Year 2024 Guidance

The Company is updating guidance to the ranges below for Fiscal Year 2024 (excluding any impact from the pending acquisition of Sonoma-Cutrer Vineyards):

| | | | | | | | | | | |

| (amounts in millions, except per share data and percentages) | Fiscal year ended July 31, 2024 |

| Net sales | $395 | - | $411 |

| Adjusted EBITDA | $145 | - | $150 |

| Adjusted EPS | $0.63 | - | $0.65 |

| Diluted share count | 115 | - | 116 |

| Effective tax rate | 25% | - | 28% |

Conference Call and Webcast

The Company will host a conference call to discuss these results at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time.) Investors interested in participating in the live call can dial 833-470-1428 from the U.S. and 404-975-4839 internationally, and enter confirmation code 916175. A telephone replay will be available approximately two hours after the call concludes through Thursday, March 21, 2024, by dialing 866-813-9403 or 929-458-6194, and entering confirmation code 518053.

There will also be a simultaneous, live webcast available on the Company’s investor relations website at https://ir.duckhorn.com/events-and-presentations. The webcast will be archived for 30 days.

About The Duckhorn Portfolio, Inc.

The Duckhorn Portfolio is North America’s premier luxury wine company, with ten winery brands, nine state-of-the-art winemaking facilities, seven tasting rooms and over 1,100 coveted acres of vineyards spanning 32 Estate properties. Established in 1976, when vintners Dan and Margaret Duckhorn founded Napa Valley’s Duckhorn Vineyards, today, our portfolio features some of North America’s most revered wineries, including Duckhorn Vineyards, Decoy, Paraduxx, Goldeneye, Migration, Canvasback, Calera, Kosta Browne, Greenwing and Postmark. Sourcing grapes from our own Estate properties and fine growers in Napa Valley, Sonoma County, Anderson Valley, California’s North and Central Coasts, Oregon, Washington State and Burgundy, we offer a curated and comprehensive portfolio of acclaimed luxury wines with price points ranging from $20 to $230 across more than 15 varieties and 39 appellations. Our wines are available throughout the United States, on five continents, and in more than 50 countries around the world. To learn more, visit us at: https://www.duckhornportfolio.com/. Investors can access information on our investor relations website at: https://ir.duckhorn.com.

Use of Non-GAAP Financial Information

In addition to the Company’s results, which are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company believes the following non-GAAP measures presented in this press release and discussed on the related teleconference call are useful in evaluating its operating performance: adjusted gross profit, adjusted EBITDA, adjusted net income and adjusted EPS. Certain of these non-GAAP measures exclude depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses, inventory write-downs, changes in the fair value of derivatives, and certain other items, net of the tax effects of all such adjustments, which are not related to the Company’s core operating performance. The Company believes that these non-GAAP financial measures are provided to enhance the reader’s understanding of our past financial performance and our prospects for the future. The Company’s management team uses these non-GAAP financial measures to evaluate business performance in comparison to budgets, forecasts and prior period financial results. The non-GAAP financial information is presented for supplemental informational purposes only and should not be

considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP measures used by other companies. A reconciliation is provided herein for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Readers are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

Forward-Looking Statements

This press release includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. These forward-looking statements address various matters including statements regarding the timing or nature of future operating or financial performance or other events. For example, all statements The Duckhorn Portfolio makes relating to its estimated and projected financial results or its plans and objectives for future operations, growth initiatives or strategies are forward-looking statements. Each forward-looking statement contained in this press release is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the Company’s ability to manage the growth of its business; the Company’s reliance on its brand name, reputation and product quality; the effectiveness of the Company’s marketing and advertising programs, including the consumer reception of the launch and expansion of our product offerings; general competitive conditions, including actions the Company’s competitors may take to grow their businesses; overall decline in the health of the economy and the impact of inflation on consumer discretionary spending and consumer demand for wine; the occurrence of severe weather events (including fires, floods and earthquakes), catastrophic health events, natural or man-made disasters, social and political conditions, war or civil unrest; risks associated with disruptions in the Company’s supply chain for grapes and raw and processed materials, including corks, glass bottles, barrels, winemaking additives and agents, water and other supplies; risks associated with the disruption of the delivery of the Company’s wine to customers; disrupted or delayed service by the distributors and government agencies the Company relies on for the distribution of its wines outside of California; the Company’s ability to successfully execute its growth strategy; risks associated with our acquisition of Sonoma-Cutrer Vineyards, Inc.; decreases in the Company’s wine score ratings by wine rating organizations; quarterly and seasonal fluctuations in the Company’s operating results; the Company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; the Company’s ability to protect its trademarks and other intellectual property rights, including its brand and reputation; the Company’s ability to comply with laws and regulations affecting its business, including those relating to the manufacture, sale and distribution of wine; the risks associated with the legislative, judicial, accounting, regulatory, political and economic risks and conditions specific to both domestic and to international markets; claims, demands and lawsuits to which the Company is, and may in the future, be subject and the risk that its insurance or indemnities coverage may not be sufficient; the Company’s ability to operate, update or implement its IT systems; the Company’s ability to successfully pursue strategic acquisitions and integrate acquired businesses; the Company’s potential ability to obtain additional financing when and if needed; the Company’s substantial indebtedness and its ability to maintain compliance with restrictive covenants in the documents governing such indebtedness; the Company’s sponsor’s significant influence over the Company, and the Company’s status as a “controlled company” under the rules of the New York Stock Exchange; the potential liquidity and trading of the Company’s securities; the future trading prices of the Company’s common stock and the impact of securities analysts’ reports on these prices; and the risks identified in the Company’s other filings with the SEC. The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this press release. You are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of

this document, and the Company undertakes no obligation to update or revise any of these statements. The Company’s business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Contacts

Investor Contact

Ben Avenia-Tapper

ir@duckhorn.com

707-339-9232

Media Contact

Jessica Liddell, ICR

DuckhornPR@icrinc.com

203-682-8200

THE DUCKHORN PORTFOLIO, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands, except shares and per share data)

| | | | | | | | | | | |

| January 31, 2024 | | July 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash | $ | 13,139 | | | $ | 6,353 | |

| Accounts receivable trade, net | 51,822 | | | 48,706 | |

| Inventories | 392,634 | | | 322,227 | |

| | | |

| Prepaid expenses and other current assets | 12,254 | | | 10,244 | |

| Total current assets | 469,849 | | | 387,530 | |

| Property and equipment, net | 324,461 | | | 323,530 | |

| Operating lease right-of-use assets | 17,937 | | | 20,376 | |

| Intangible assets, net | 180,447 | | | 184,227 | |

| Goodwill | 425,209 | | | 425,209 | |

| Other assets | 6,047 | | | 6,810 | |

| Total assets | $ | 1,423,950 | | | $ | 1,347,682 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Accounts payable | $ | 14,252 | | | $ | 4,829 | |

| Accrued expenses | 25,060 | | | 38,246 | |

| Accrued compensation | 9,382 | | | 16,460 | |

| Deferred revenue | 5,211 | | | 66 | |

| | | |

| | | |

| | | |

| Current maturities of long-term debt | 9,721 | | | 9,721 | |

| Other current liabilities | 4,965 | | | 5,138 | |

| Total current liabilities | 68,591 | | | 74,460 | |

| Revolving line of credit | 68,000 | | | 13,000 | |

| Long-term debt, net of current maturities and debt issuance costs | 205,677 | | | 210,619 | |

| | | |

| Operating lease liabilities | 14,145 | | | 16,534 | |

| | | |

| Deferred income taxes | 90,216 | | | 90,216 | |

| Other liabilities | 517 | | | 445 | |

| Total liabilities | 447,146 | | | 405,274 | |

| Stockholders’ equity: | | | |

| Common stock, $0.01 par value; 500,000,000 shares authorized; 115,409,107 and 115,316,308 issued and outstanding at January 31, 2024 and July 31, 2023, respectively | 1,154 | | | 1,153 | |

| Additional paid-in capital | 740,548 | | | 737,557 | |

| Retained earnings | 234,516 | | | 203,122 | |

| Total The Duckhorn Portfolio, Inc. stockholders’ equity | 976,218 | | | 941,832 | |

| Non-controlling interest | 586 | | | 576 | |

| Total stockholders’ equity | 976,804 | | | 942,408 | |

| Total liabilities and stockholders’ equity | $ | 1,423,950 | | | $ | 1,347,682 | |

THE DUCKHORN PORTFOLIO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands, except shares and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended January 31, | | Six months ended January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales (net of excise taxes of $1,407, $1,469, $2,801 and $3,052, respectively) | $ | 103,045 | | | $ | 103,488 | | | $ | 205,554 | | | $ | 211,659 | |

| Cost of sales | 44,727 | | | 48,302 | | | 93,383 | | | 101,763 | |

| Gross profit | 58,318 | | | 55,186 | | | 112,171 | | | 109,896 | |

| | | | | | | |

| Selling, general and administrative expenses | 29,247 | | | 29,579 | | | 59,730 | | | 55,318 | |

| Income from operations | 29,071 | | | 25,607 | | | 52,441 | | | 54,578 | |

| | | | | | | |

| Interest expense | 4,500 | | | 2,684 | | | 8,504 | | | 4,846 | |

| Other expense, net | 2,696 | | | 2,743 | | | 883 | | | 2,656 | |

| Total other expenses, net | 7,196 | | | 5,427 | | | 9,387 | | | 7,502 | |

| Income before income taxes | 21,875 | | | 20,180 | | | 43,054 | | | 47,076 | |

| Income tax expense | 6,021 | | | 5,265 | | | 11,650 | | | 12,352 | |

| Net income | 15,854 | | | 14,915 | | | 31,404 | | | 34,724 | |

| Net loss (income) attributable to non-controlling interest | 3 | | | 2 | | | (10) | | | 8 | |

| Net income attributable to The Duckhorn Portfolio, Inc. | $ | 15,857 | | | $ | 14,917 | | | $ | 31,394 | | | $ | 34,732 | |

| | | | | | | |

| Earnings per share of common stock: | | | | | | | |

| Basic | $ | 0.14 | | | $ | 0.13 | | | $ | 0.27 | | | $ | 0.30 | |

| Diluted | $ | 0.14 | | | $ | 0.13 | | | $ | 0.27 | | | $ | 0.30 | |

| | | | | | | |

| Weighted average shares of common stock outstanding: | | | | | | | |

| Basic | 115,376,711 | | | 115,191,575 | | | 115,358,242 | | | 115,187,868 | |

| Diluted | 115,415,348 | | | 115,327,660 | | | 115,593,594 | | | 115,424,809 | |

THE DUCKHORN PORTFOLIO, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands) | | | | | | | | | | | | | |

| Six months ended January 31, | | |

| 2024 | | 2023 | | |

| Cash flows from operating activities | | | | | |

| Net income | $ | 31,404 | | | $ | 34,724 | | | |

| Adjustments to reconcile net income to net cash from operating activities: | | | | | |

| | | | | |

| Depreciation and amortization | 17,037 | | | 13,290 | | | |

| (Gain) loss on disposal of assets | (11) | | | 93 | | | |

| Change in fair value of derivatives | 1,258 | | | 2,061 | | | |

| Amortization of debt issuance costs | 388 | | | 593 | | | |

| | | | | |

| | | | | |

| Equity-based compensation | 3,214 | | | 2,985 | | | |

| | | | | |

| Change in operating assets and liabilities: | | | | | |

| Accounts receivable trade, net | (3,115) | | | (11,298) | | | |

| Inventories | (68,687) | | | (39,881) | | | |

| Prepaid expenses and other current assets | (2,080) | | | 26 | | | |

| Other assets | (684) | | | (555) | | | |

| Accounts payable | 9,390 | | | 15,020 | | | |

| Accrued expenses | (10,200) | | | 830 | | | |

| Accrued compensation | (7,078) | | | (3,669) | | | |

| Deferred revenue | 5,144 | | | 3,013 | | | |

| Other current and non-current liabilities | (1,841) | | | 865 | | | |

| Net cash (used in) provided by operating activities | (25,861) | | | 18,097 | | | |

| Cash flows from investing activities | | | | | |

| Purchases of property and equipment, net of sales proceeds | (17,130) | | | (12,388) | | | |

| | | | | |

| Net cash used in investing activities | (17,130) | | | (12,388) | | | |

| Cash flows from financing activities | | | | | |

| Payments under line of credit | (13,000) | | | (119,000) | | | |

| Borrowings under line of credit | 68,000 | | | 9,000 | | | |

| | | | | |

| Issuance of long-term debt | — | | | 225,833 | | | |

| Payments of long-term debt | (5,000) | | | (115,166) | | | |

| Taxes paid related to net share settlement of equity awards | (342) | | — | | | |

| Proceeds from employee stock purchase plan | 119 | | | 181 | | | |

| Payments for debt issuance costs | — | | | (2,432) | | | |

| | | | | |

| Net cash provided by (used in) financing activities | 49,777 | | | (1,584) | | | |

| Net increase in cash | 6,786 | | | 4,125 | | | |

| Cash - Beginning of period | 6,353 | | | 3,167 | | | |

| Cash - End of period | $ | 13,139 | | | $ | 7,292 | | | |

| Supplemental cash flow information | | | | | |

| Interest paid, net of amount capitalized | $ | 8,304 | | | $ | 1,649 | | | |

| Income taxes paid | $ | 23,484 | | | $ | 10,621 | | | |

| Non-cash investing activities | | | | | |

| Property and equipment additions in accounts payable and accrued expenses | $ | 407 | | | $ | 467 | | | |

THE DUCKHORN PORTFOLIO, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted gross profit, adjusted net income, adjusted EBITDA and adjusted EPS, collectively referred to as “Non-GAAP Financial Measures,” are commonly used in the Company’s industry and should not be construed as an alternative to net income or earnings per share as indicators of operating performance (as determined in accordance with GAAP). These Non-GAAP Financial Measures may not be comparable to similarly titled measures reported by other companies. The Company has included these Non-GAAP Financial Measures because it believes the measures provide management and investors with additional information to evaluate business performance in comparison to budgets, forecasts and prior year financial results.

Non-GAAP Financial Measures are adjusted to exclude certain items that affect comparability. The adjustments are itemized in the tables below. You are encouraged to evaluate these adjustments and the reason the Company considers them appropriate for supplemental analysis. In evaluating adjustments, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments set forth below. The presentation of Non-GAAP Financial Measures should not be construed as an inference that future results will be unaffected by unusual or recurring items.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that the Company calculates as net income before interest, taxes, depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, changes in the fair value of derivatives and certain other items which are not related to our core operating performance. Adjusted EBITDA is a key performance measure the Company uses in evaluating its operational results. The Company believes adjusted EBITDA is a helpful measure to provide investors an understanding of how management regularly monitors the Company’s core operating performance, as well as how management makes operational and strategic decisions in allocating resources. The Company believes adjusted EBITDA also provides management and investors consistency and comparability with the Company’s past financial performance and facilitates period to period comparisons of operations, as it eliminates the effects of certain variations unrelated to its overall performance.

Adjusted EBITDA has certain limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Some of these limitations include:

•although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•adjusted EBITDA does not reflect changes in, or cash requirements for, the Company’s working capital needs;

•adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s debt;

•adjusted EBITDA does not reflect income tax payments that may represent a reduction in cash available to the Company; and

•other companies, including companies in the Company’s industry, may calculate adjusted EBITDA differently, which reduce their usefulness as comparative measures.

Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including net income and the Company’s other GAAP results. In evaluating adjusted EBITDA, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in this presentation. The Company’s presentation of adjusted EBITDA should not be construed as an inference that the Company’s future results will be unaffected by the types of items excluded from the calculation of adjusted EBITDA.

Adjusted Gross Profit

Adjusted gross profit is a non-GAAP financial measure that the Company calculates as gross profit excluding the impact of purchase accounting adjustments (including depreciation and amortization related to purchase accounting), non-cash equity-based compensation expense, and certain inventory charges. We believe adjusted gross profit is a useful measure to us and our investors to assist in evaluating our operating performance because it provides consistency and direct comparability with our past financial performance between fiscal periods, as the metric eliminates the effects of non-cash or other expenses unrelated to our core operating performance that would result in fluctuations in a given metric for reasons unrelated to overall continuing operating performance. Adjusted gross profit should not be considered a substitute for gross profit or any other measure of financial performance reported in accordance with GAAP.

Adjusted Net Income

Adjusted net income is a non-GAAP financial measure that the Company calculates as net income excluding the impact of non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses (including certain inventory charges), changes in the fair value of derivatives and certain other items unrelated to core operating performance, as well as the estimated income tax impacts of all such adjustments included in this non-GAAP performance measure. We believe adjusted net income assists us and our investors in evaluating our performance period-over-period. In calculating adjusted net income, we also calculate the following non-GAAP financial measures which adjust each GAAP-based financial measure for the relevant portion of each adjustment to reach adjusted net income:

•Adjusted SG&A – calculated as selling, general, and administrative expenses excluding the impacts of purchase accounting, transaction expenses, equity-based compensation; and

•Adjusted income tax – calculated as the tax effect of all adjustments to reach adjusted net income based on the applicable blended statutory tax rate for the period.

Adjusted net income should not be considered a substitute for net income or any other measure of financial performance reported in accordance with GAAP.

Adjusted EPS

Adjusted EPS is a non-GAAP financial measure that the Company calculates as adjusted net income divided by diluted share count for the applicable period. We believe adjusted EPS is useful to us and our investors because it improves the comparability of results of operations from period to period. Adjusted EPS should not be considered a substitute for net income per share or any other measure of financial performance reported in accordance with GAAP.

THE DUCKHORN PORTFOLIO, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Three months ended January 31, 2024 and 2023

(Unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended January 31, 2024 |

| Net

sales | | Gross

profit | | SG&A | | Adjusted EBITDA | | Income

tax | | Net

income | | Diluted

EPS |

| GAAP results | $ | 103,045 | | | $ | 58,318 | | | $ | 29,247 | | | $ | 15,857 | | | $ | 6,021 | | | $ | 15,857 | | | $ | 0.14 | |

Percentage of net sales | | | 56.6 | % | | 28.4 | % | | 15.4 | % | | | | | | |

Interest expense | |

| | | |

| 4,500 | | | | | | | |

Income tax expense | |

| | | |

| 6,021 | | | | | | | |

Depreciation and amortization expense | |

| 107 | | | (3,102) | |

| 9,708 | | | | | | | |

| EBITDA | | | | | | | $ | 36,086 | | | | | | | |

| Purchase accounting adjustments | |

| 23 | | | |

| 23 | | | 6 | | | 17 | | | — | |

| Transaction expenses | |

| | | (1,759) | |

| 1,759 | | | 484 | | | 1,275 | | | 0.01 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Change in fair value of derivatives | |

| | | |

| 3,147 | | | 865 | | | 2,282 | | | 0.02 | |

| Equity-based compensation | |

| 189 | | | (1,592) | |

| 1,781 | | | 479 | | | 1,302 | | | 0.01 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Lease income, net | (927) | | | (927) | | | (866) | | | (61) | | | (17) | | | (44) | | | — | |

| Non-GAAP results | $ | 102,118 | | | $ | 57,710 | | | $ | 21,928 | | | $ | 42,735 | | | $ | 7,838 | | | $ | 20,689 | | | $ | 0.18 | |

Percentage of net sales | | | 56.0 | % | | 21.3 | % | | 41.5 | % | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Three months ended January 31, 2023 |

| Net

sales | | Gross

profit | | SG&A | | Adjusted EBITDA | | Income

tax | | Net

income | | Diluted

EPS |

| GAAP results | $ | 103,488 | | | $ | 55,186 | | | $ | 29,579 | | | $ | 14,917 | | $ | 5,265 | | | $ | 14,917 | | | $ | 0.13 | |

Percentage of net sales | | | 53.3 | % | | 28.6 | % | | 14.4% | | | | | | |

Interest expense | |

| | | |

| 2,684 | | | | | | |

Income tax expense | |

| | | |

| 5,265 | | | | | | |

Depreciation and amortization expense | |

| 116 | | | (1,904) | |

| 7,533 | | | | | | |

| EBITDA | | | | | | | $ | 30,399 | | | | | | |

| Purchase accounting adjustments | |

| 65 | | | |

| 65 | | 17 | | | 48 | | | — | |

| Transaction expenses | | | | | (3,596) | | | 3,596 | | 939 | | | 2,657 | | | 0.02 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Change in fair value of derivatives | |

| | | |

| 2,429 | | 634 | | | 1,795 | | | 0.02 | |

| Equity-based compensation | |

| 96 | | | (1,468) | |

| 1,564 | | 400 | | | 1,164 | | | 0.01 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Debt refinancing costs | | | | | | | 760 | | 198 | | | 562 | | | — | |

| | | | | | | | | | | | | |

| Non-GAAP results | $ | 103,488 | | | $ | 55,463 | | | $ | 22,611 | | | $ | 38,813 | | $ | 7,453 | | | $ | 21,143 | | | $ | 0.18 | |

Percentage of net sales | | | 53.6 | % | | 21.8 | % | | 37.5 | % | | | | | | |

Note: Sum of individual amounts may not recalculate due to rounding.

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . Second Quarter Fiscal Year 2024 Financial Results March 7, 2024 Exhibit 99.2

LEGAL DISCLAIMER This presentation of The Duckhorn Portfolio, Inc. (the “Company”) and the accompanying conference call contain forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. These forward-looking statements address various matters including statements regarding the timing or nature of future operating or financial performance or other events. Each forward-looking statement contained in this presentation is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the Company’s ability to manage the growth of its business; the Company’s reliance on its brand name, reputation and product quality; the effectiveness of the Company’s marketing and advertising programs; general competitive conditions, including actions the Company’s competitors may take to grow their businesses; overall decline in the health of the economy and the impact of inflation on consumer discretionary spending; the occurrence of severe weather events (including fires, floods and earthquakes), catastrophic health events, natural or man-made disasters, social and political conditions, war or civil unrest; risks associated with disruptions in the Company’s supply chain for grapes and raw and processed materials, including corks, glass bottles, barrels, winemaking additives and agents, water and other supplies; disrupted or delayed service by the distributors and government agencies the Company relies on for the distribution of its wines outside of California; the Company’s ability to successfully execute its growth strategy; risks associated with the Company’s acquisition of Sonoma-Cutrer Vineyards, Inc.; decreases in the Company’s wine score ratings by wine rating organizations; quarterly and seasonal fluctuations in the Company’s operating results; the Company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; the Company’s ability to protect its trademarks and other intellectual property rights, including its brand and reputation; the Company’s ability to comply with laws and regulations affecting its business, including those relating to the manufacture, sale and distribution of wine; the risks associated with the legislative, judicial, accounting, regulatory, political and economic risks and conditions specific to both domestic and to international markets; claims, demands and lawsuits to which the Company is, and may in the future, be subject and the risk that its insurance or indemnities coverage may not be sufficient; the Company’s ability to operate, update or implement its IT systems; the Company’s ability to successfully pursue strategic acquisitions and integrate acquired businesses; the Company’s potential ability to obtain additional financing when and if needed; the Company’s substantial indebtedness and its ability to maintain compliance with restrictive covenants in the documents governing such indebtedness; the Company’s majority shareholder’s significant influence over the Company, and the Company’s status as a “controlled company” under the rules of the New York Stock Exchange; the potential liquidity and trading of the Company’s securities; the future trading prices of the Company’s common stock and the impact of securities analysts’ reports on these prices; and the risks identified in the Company’s other filings with the Securities and Exchange Commission (“SEC”). The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this presentation. You are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, including its most recent Annual Report on Form 10-K, as amended, for a discussion of these and other risks and uncertainties. The forward-looking statements in this presentation speak only as of the date of this document, and the Company undertakes no obligation to update or revise any of these statements. The Company’s business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties. This presentation also includes certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not as a substitute for or superior to, measures of financial performance prepared in accordance with generally accepted accounting principles (“GAAP”). Certain of these non-GAAP measures exclude depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses, inventory write-downs, changes in the fair value of derivatives, and certain other items, net of the tax effects of all such adjustments, which are not related to the Company’s core operating performance. The Company believes that these non-GAAP financial measures enhance the reader’s understanding of our past financial performance and our prospects for the future. The Company’s management team uses these non-GAAP financial measures to evaluate business performance in comparison to budgets, forecasts and prior period financial results. The non-GAAP financial information is presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP and may be different from similarly titled non-GAAP measures used by other companies. A reconciliation is provided herein for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Readers are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. For further information with respect to the Company, we refer you to our most recent Annual Report on Form 10-K, as amended, filed with the SEC. In addition, we are subject to the information and reporting requirements of the Securities Exchange Act of 1934 and, accordingly, we file periodic reports, current reports, proxy statements and other information with the SEC. These periodic reports, current reports, proxy statements and other information are available for review at the SEC’s website at http://www.sec.gov. 2

The Duckhorn Portfolio sets the standard for American fine wine Over nearly half a century of producing iconic luxury wines, we’ve curated a cohesive portfolio of critically acclaimed winery brands that are beloved by wine consumers and trusted by our trade partners. Our ability to leverage the brand strength of our entire portfolio makes us a category leader, poised to continue to scale and take market share.

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . Leverage portfolio brand strength Use portfolio strength to increase individual winery brand equity and engagement, cultivate purchase intent and drive conversion. Targeted portfolio evolution Launch winery brand extensions to proactively address changes in customer and market dynamics and penetrate white space. Expand and accelerate wholesale distribution Leverage our scale and strength in trade relationships to capture distribution growth opportunities. Continue to enhance our DTC experience Drive consumer engagement across our luxury portfolio through our elevated tasting rooms, wine clubs and eCommerce website. Disciplined strategic acquisitions Strategically evaluate and acquire winery brands, production wineries and acclaimed vineyards to drive stockholder value. O R G AN IC AD D IT IV E STRATEGIES FOR GROWTH

F Y24 Q2 F INANCIAL PERFORMANCE $103.0m NET SALES a decrease 0.4% YoY $58.3m GROSS PROFIT an increase of 5.7% YoY 56.6% GROSS PROFIT MARGIN an increase of 330 bps YoY $15.9m NET INCOME or $0.14 per diluted share$20.7m ADJUSTED NET INCOME1 or $0.18 per diluted share $42.7m ADJUSTED EBITDA1 an increase 10.1% YoY 41.5% ADJUSTED EBITDA MARGIN1 an increase of 400 bps YoY OTHER KEY METRICS • Cash was $13.1 million as of January 31, 2024 • The Company’s leverage ratio was 1.9x net debt (net of debt issuance costs), to trailing twelve months adjusted EBITDA See Appendix II for other formats 1. Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Net Income are non-GAAP measures. Reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the appendix section of this presentation. 4

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . WINE INDUSTRY TRENDS Source: Circana (IRI) US Food data for the 12-week period ended January 28, 2024. The luxury segment continues to outpace broader wine industry growth. Dollar sales change by segment Last 12 weeks as of 01.28.24 (0.6%) 1.1% 3.0% Total Wine $15+ Luxury The Duckhorn Portfolio The Duckhorn Portfolio is outpacing our peers in the luxury segment on a 12-week basis 6

61.3% 62.1% 19.1% 18.9% 19.6% 19.0% $103.5 $103.0 Q2 FY23 Q2 FY24 Q2 Net Sales ($M) The Duckhorn Portfolio 66.3% 67.9% 17.9% 17.1% 15.8% 15.0%$372.5 $403.0 FY22 FY23 FY24 Guidance FY Net Sales ($M) The Duckhorn Portfolio Wholesale – Distributors Wholesale – CA Direct-to-trade Direct-to-consumer REVENUE MIX 7 The Duckhorn Portfolio’s growth was led by our Decoy winery brand, which continues to be one of the best performing and most recognized brands in the $15 to $25 range. $395.0 - $411.0

Duckhorn continues to drive margin expansion year-over-year. $55.2 $58.3 Q2 FY23 Q2 FY24 Q2 Gross Profit ($M) OPERATING METRICS 8 53.3% $38.8 $42.7 Q2 FY23 Q2 FY24 Q2 Adj. EBITDA1 ($M) $0.18 $0.18 Q2 FY23 Q2 FY24 Q2 Adjusted EPS1 56.6% 41.5%37.5% 1. Adjusted EBITDA and Adjusted EPS are non-GAAP measures. Reconciliation to the most directly comparable financial measures presented in accordance with GAAP are set forth in the appendix section of this presentation.

MARGIN EXPANSION 1. Adjusted EBITDA margin is a non-GAAP measure. Reconciliation to the most directly comparable financial measure presented in accordance with GAAP is set forth in the appendix section of this presentation. We are committed to sustained gross and operating margin expansion through thoughtful management of our business. • We delivered 330 bps of gross profit margin expansion year-over-year in FY24 Q2. • We delivered 400 bps of Adjusted EBITDA1 margin expansion year-over-year in FY24 Q2. • We are an industry leader in scaled luxury wine production, leveraging an optimal mix of estate fruit and grower fruit in our grape sourcing and in-house and custom crush capabilities in our production model.

FY24 SECOND HALF GROWTH DRIVERS 10 Implied growth rate of the steady state business. (trailing 12-week luxury wine growth rate of flat to 1%, as measured by Circana, plus Duckhorn’s ability to consistently outperform the market) Low Single Digit Growth = Innovation Decoy Featherweight Sauvignon Blanc (lower-in- calorie and lower-in- alcohol); Decoy Limited Paso Robles Cabernet Sauvignon and continued Decoy Limited growth. Forecast Low- to Mid- Single Digit Growth FY24 second half implied growth rate (implied from FY24 full-year guidance) 200 to 300 bps targeted incremental growth (ordered from most to least impactful) + Our FY24 full-year guidance implies a low- to mid-single digit growth rate in the second half of FY24. The building blocks below bridge the implied rate of growth of the steady state business to the implied second half growth rate. + Product Availability Greater availability of key releases, including Duckhorn Chardonnay and Decoy Limited Merlot. + Programming Incremental programming with distributor and retailer partners.

FY23 FY24 Note: Reflective of shipment timing. Note: Circle sizes correspond to the approximate size of each offering relative to the others. Size is not meant to correspond directly with size of specific offerings across fiscal years. Kosta Browne Appellation Offering (the largest offering of the year) shifts from Q4 (in FY23) to Q3 (in FY24). • The shift of this offering to Q3 is responsive to the preferences of our Kosta Browne members and better aligns the offering to when our customers would like to receive this shipment. • FY24 second half net sales are expected to be distributed ~53% in Q3 and ~47% in Q4. Q1 Single Vineyard Offering Single Vineyard Offering Burgundy Offering Burgundy Offering Estate Offering Estate Offering Appellation Offering Appellation Offering SEASONALITY OF THE KOSTA BROWNE SHIPMENT SCHEDULE Q2 Q3 Q4 11

Net Sales: $395M - $411M Adjusted EBITDA*: $145M - $150M Represents (2%)-2% growth over FY23 Represents 0%-4% growth over FY23 and a margin of 36.6% at the midpoint FY24 FULL-YEAR GUIDANCE * Note: The Duckhorn Portfolio is not able to forecast net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income including, but not limited to, income tax expense, stock-based compensation expense and interest expense. Adjusted EBITDA should not be used to predict net income as the difference between the two measures is variable. Adjusted EPS: $0.63 - $0.65

K E Y T R AN S A C T I O N T E R M S 1. Transaction value of approximately $400 million, which will be paid with approximately $350 million in common stock issued at signing to Brown-Forman and approximately $50 million in cash 2. Brown-Forman will take an ownership interest of approximately 21.5% in the Company post-closing and will be entitled to nominate two directors to the Board of Directors 3. Transaction is expected to be accretive to Adjusted EPS starting in Fiscal Year 2025 with $5 million of expected cost-saving synergies, primarily in operating expenses 4. Net leverage is expected to remain unchanged at closing 5. Transaction is anticipated to be completed in spring of 2024, subject to customary closing conditions ANNOUNCED ACQUISITION OF SONOMA-CUTRER

Strategic Fit Within Luxury Portfolio Architecture Demonstrated Brand Strength Immediately Accretive Transaction Opportunity for The Duckhorn Portfolio to Accelerate Growth Positioning in Luxury Chardonnay Optimization of Grape Supply and Production Adds a Well-Respected Long-Term-Focused Stockholder The acquisition of Sonoma-Cutrer Vineyards enhances The Duckhorn Portfolio’s status as a leader among luxury ($15+ per Bottle) wineries in the United States1 Vine Hill Vineyard, Sonoma-Cutrer Vineyards Source: (1) Circana (IRI) Total US Food data for the 52-week period ended October 29, 2023. Luxury wine defined as $15.00 per bottle or above. Only includes domestically produced wine. Net Leverage is Expected to Remain Unchanged ACQUISITION STRATEGIC RATIONALE

E S G E S G VA LU E S Enterprise Risk Management Board Diversity and Accountability Diversity, Equity & Inclusion Human Capital Management Community Involvement Sustainable Product Employee Health and Safety Climate and Emissions Sustainable Agriculture Supply Chain Circularity Data Stewardship • Examined prior ESG disclosure to determine pathway for future ESG initiatives. • Created internal working group to develop water efficiency projects at production facilities. • Continued evaluation and development of our DEI programming with the People Team. • Implemented Workiva ESG module to support consistent, transparent ESG data disclosures. • Completed second annual Scope 1 and Scope 2 emissions calculations • Published FY23 ESG Report with Workiva to ensure confidence in externally-reported metrics. Completed Projects and Programs Certifications and Frameworks In-Progress Projects and Programs • We look forward to ESG-focused investor outreach. • Development and tracking of new company ESG goals to measure progress. • Refinement of future ESG Report to reflect new and current material, to ensure streamlined and concise disclosure. We continue to advance our commitment to ESG across our organization. 15

S T R I C T L Y C O N F I D E N T I A L . N O U N A U T H O R I Z E D D I S T R I B U T I O N O R D U P L I C A T I O N . APPENDIX

CONDENSED CONSOLIDATED BALANCE SHEETS ( U N A U D I T E D , I N T H O U S A N D S , E X C E P T S H A R E S A N D P E R S H A R E D A T A ) 17 January 31, 2024 July 31, 2023 ASSETS Current assets: Cash $ 13,139 $ 6,353 Accounts receivable trade, net 51,822 48,706 Inventories 392,634 322,227 Prepaid expenses and other current assets 12,254 10,244 Total current assets 469,849 387,530 Property and equipment, net 324,461 323,530 Operating lease right-of-use assets 17,937 20,376 Intangible assets, net 180,447 184,227 Goodwill 425,209 425,209 Other assets 6,047 6,810 Total assets $ 1,423,950 $ 1,347,682 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 14,252 $ 4,829 Accrued expenses 25,060 38,246 Accrued compensation 9,382 16,460 Deferred revenue 5,211 66 Current maturities of long-term debt 9,721 9,721 Other current liabilities 4,965 5,138 Total current liabilities 68,591 74,460 Revolving line of credit 68,000 13,000 Long-term debt, net of current maturities and debt issuance costs 205,677 210,619 Operating lease liabilities 14,145 16,534 Deferred income taxes 90,216 90,216 Other liabilities 517 445 Total liabilities 447,146 405,274 Stockholders’ equity: Common stock, $0.01 par value; 500,000,000 shares authorized; 115,409,107 and 115,316,308 issued and outstanding at January 31, 2024 and July 31, 2023, respectively 1,154 1,153 Additional paid-in capital 740,548 737,557 Retained earnings 234,516 203,122 Total The Duckhorn Portfolio, Inc. stockholders’ equity 976,218 941,832 Non-controlling interest 586 576 Total stockholders’ equity 976,804 942,408 Total liabilities and stockholders’ equity $ 1,423,950 $ 1,347,682

CONDENSED CONSOLIDATED STATEMENTS OF OPER ATIONS ( U N A U D I T E D , I N T H O U S A N D S , E X C E P T S H A R E S A N D P E R S H A R E D A T A ) 18 Three months ended January 31, Six months ended January 31, 2024 2023 2024 2023 Net sales (net of excise taxes of $1,407, $1,469, $2,801 and $3,052, respectively) $ 103,045 $ 103,488 $ 205,554 $ 211,659 Cost of sales 44,727 48,302 93,383 101,763 Gross profit 58,318 55,186 112,171 109,896 Selling, general and administrative expenses 29,247 29,579 59,730 55,318 Income from operations 29,071 25,607 52,441 54,578 Interest expense 4,500 2,684 8,504 4,846 Other expense, net 2,696 2,743 883 2,656 Total other expenses, net 7,196 5,427 9,387 7,502 Income before income taxes 21,875 20,180 43,054 47,076 Income tax expense 6,021 5,265 11,650 12,352 Net income 15,854 14,915 31,404 34,724 Net loss (income) attributable to non-controlling interest 3 2 (10) 8 Net income attributable to The Duckhorn Portfolio, Inc. $ 15,857 $ 14,917 $ 31,394 $ 34,732 Earnings per share of common stock: Basic $ 0.14 $ 0.13 $ 0.27 $ 0.30 Diluted $ 0.14 $ 0.13 $ 0.27 $ 0.30 Weighted average shares of common stock outstanding: Basic 115,376,711 115,191,575 115,358,242 115,187,868 Diluted 115,415,348 115,327,660 115,593,594 115,424,809

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS ( U N A U D I T E D , I N T H O U S A N D S ) 19 Six months ended January 31, 2024 2023 Cash flows from operating activities Net income $ 31,404 $ 34,724 Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization 17,037 13,290 (Gain) loss on disposal of assets (11) 93 Change in fair value of derivatives 1,258 2,061 Amortization of debt issuance costs 388 593 Equity-based compensation 3,214 2,985 Change in operating assets and liabilities: Accounts receivable trade, net (3,115) (11,298) Inventories (68,687) (39,881) Prepaid expenses and other current assets (2,080) 26 Other assets (684) (555) Accounts payable 9,390 15,020 Accrued expenses (10,200) 830 Accrued compensation (7,078) (3,669) Deferred revenue 5,144 3,013 Other current and non-current liabilities (1,841) 865 Net cash (used in) provided by operating activities (25,861) 18,097 Cash flows from investing activities Purchases of property and equipment, net of sales proceeds (17,130) (12,388) Net cash used in investing activities (17,130) (12,388) Cash flows from financing activities Payments under line of credit (13,000) (119,000) Borrowings under line of credit 68,000 9,000 Issuance of long-term debt — 225,833 Payments of long-term debt (5,000) (115,166) Taxes paid related to net share settlement of equity awards (342) — Proceeds from employee stock purchase plan 119 181 Payments for debt issuance costs — (2,432) Net cash provided by (used in) financing activities 49,777 (1,584) Net increase in cash 6,786 4,125 Cash - Beginning of period 6,353 3,167 Cash - End of period $ 13,139 $ 7,292 Supplemental cash flow information Interest paid, net of amount capitalized $ 8,304 $ 1,649 Income taxes paid $ 23,484 $ 10,621 Non-cash investing activities Property and equipment additions in accounts payable and accrued expenses $ 407 $ 467

Adjusted gross profit, adjusted net income, adjusted EBITDA and adjusted EPS, collectively referred to as “Non-GAAP Financial Measures,” are commonly used in the Company’s industry and should not be construed as an alternative to net income or earnings per share as indicators of operating performance (as determined in accordance with GAAP). These Non-GAAP Financial Measures may not be comparable to similarly titled measures reported by other companies. The Company has included these Non-GAAP Financial Measures because it believes the measures provide management and investors with additional information to evaluate business performance in comparison to budgets, forecasts and prior year financial results. Non-GAAP Financial Measures are adjusted to exclude certain items that affect comparability. The adjustments are itemized in the tables below. You are encouraged to evaluate these adjustments and the reason the Company considers them appropriate for supplemental analysis. In evaluating adjustments, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments set forth below. The presentation of Non-GAAP Financial Measures should not be construed as an inference that future results will be unaffected by unusual or recurring items. Adjusted EBITDA Adjusted EBITDA is a non-GAAP financial measure that the Company calculates as net income before interest, taxes, depreciation and amortization, non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, changes in the fair value of derivatives and certain other items which are not related to our core operating performance. Adjusted EBITDA is a key performance measure the Company uses in evaluating its operational results. The Company believes adjusted EBITDA is a helpful measure to provide investors an understanding of how management regularly monitors the Company’s core operating performance, as well as how management makes operational and strategic decisions in allocating resources. The Company believes adjusted EBITDA also provides management and investors consistency and comparability with the Company’s past financial performance and facilitates period to period comparisons of operations, as it eliminates the effects of certain variations unrelated to its overall performance. Adjusted EBITDA has certain limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Some of these limitations include: • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; • adjusted EBITDA does not reflect changes in, or cash requirements for, the Company’s working capital needs; • adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on the Company’s debt; • adjusted EBITDA does not reflect income tax payments that may represent a reduction in cash available to the Company; and • other companies, including companies in the Company’s industry, may calculate adjusted EBITDA differently, which reduce their usefulness as comparative measures. Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including net income and the Company’s other GAAP results. In evaluating adjusted EBITDA, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in this presentation. The Company’s presentation of adjusted EBITDA should not be construed as an inference that the Company’s future results will be unaffected by the types of items excluded from the calculation of adjusted EBITDA. Adjusted Gross Profit Adjusted gross profit is a non-GAAP financial measure that the Company calculates as gross profit excluding the impact of purchase accounting adjustments (including depreciation and amortization related to purchase accounting), non- cash equity-based compensation expense, and certain inventory charges. We believe adjusted gross profit is a useful measure to us and our investors to assist in evaluating our operating performance because it provides consistency and direct comparability with our past financial performance between fiscal periods, as the metric eliminates the effects of non-cash or other expenses unrelated to our core operating performance that would result in fluctuations in a given metric for reasons unrelated to overall continuing operating performance. Adjusted gross profit should not be considered a substitute for gross profit or any other measure of financial performance reported in accordance with GAAP. Adjusted Net Income Adjusted net income is a non-GAAP financial measure that the Company calculates as net income excluding the impact of non-cash equity-based compensation expense, purchase accounting adjustments, casualty losses or gains, impairment losses (including certain inventory charges), changes in the fair value of derivatives and certain other items unrelated to core operating performance, as well as the estimated income tax impacts of all such adjustments included in this non-GAAP performance measure. We believe adjusted net income assists us and our investors in evaluating our performance period-over-period. In calculating adjusted net income, we also calculate the following non-GAAP financial measures which adjust each GAAP-based financial measure for the relevant portion of each adjustment to reach adjusted net income: • Adjusted SG&A – calculated as selling, general, and administrative expenses excluding the impacts of purchase accounting, transaction expenses, equity-based compensation; and • Adjusted income tax – calculated as the tax effect of all adjustments to reach adjusted net income based on the applicable blended statutory tax rate for the period. Adjusted net income should not be considered a substitute for net income or any other measure of financial performance reported in accordance with GAAP. Adjusted EPS Adjusted EPS is a non-GAAP financial measure that the Company calculates as adjusted net income divided by diluted share count for the applicable period. We believe adjusted EPS is useful to us and our investors because it improves the comparability of results of operations from period to period. Adjusted EPS should not be considered a substitute for net income per share or any other measure of financial performance reported in accordance with GAAP. 20 RECONCIL IAT ION OF NON-GAAP F INANCIAL MEASURES

RECONCIL IAT ION OF NON-GAAP F INANCIAL MEASURES T H R E E M O N T H S E N D E D J A N U A R Y 3 1 , 2 0 2 4 A N D 2 0 2 3 ( U N A U D I T E D , I N T H O U S A N D S , E X C E P T P E R S H A R E D A T A ) 21 Three months ended January 31, 2024 Net sales Gross profit SG&A Adjusted EBITDA Income tax Net income Diluted EPS GAAP results $ 103,045 $ 58,318 $ 29,247 $ 15,857 $ 6,021 $ 15,857 $ 0.14 Percentage of net sales 56.6 % 28.4 % 15.4 % Interest expense 4,500 Income tax expense 6,021 Depreciation and amortization expense 107 (3,102) 9,708 EBITDA $ 36,086 Purchase accounting adjustments 23 23 6 17 — Transaction expenses (1,759) 1,759 484 1,275 0.01 Change in fair value of derivatives 3,147 865 2,282 0.02 Equity-based compensation 189 (1,592) 1,781 479 1,302 0.01 Lease income, net (927) (927) (866) (61) (17) (44) — Non-GAAP results $ 102,118 $ 57,710 $ 21,928 $ 42,735 $ 7,838 $ 20,689 $ 0.18 Percentage of net sales 56.0 % 21.3 % 41.5 % Three months ended January 31, 2023 Net sales Gross profit SG&A Adjusted EBITDA Income tax Net income Diluted EPS GAAP results $ 103,488 $ 55,186 $ 29,579 $ 14,917 $ 5,265 $ 14,917 $ 0.13 Percentage of net sales 53.3 % 28.6 % 14.4 % Interest expense 2,684 Income tax expense 5,265 Depreciation and amortization expense 116 (1,904) 7,533 EBITDA $ 30,399 Purchase accounting adjustments 65 65 17 48 — Transaction expenses (3,596) 3,596 939 2,657 0.02 Change in fair value of derivatives 2,429 634 1,795 0.02 Equity-based compensation 96 (1,468) 1,564 400 1,164 0.01 Debt refinancing costs 760 198 562 — Non-GAAP results $ 103,488 $ 55,463 $ 22,611 $ 38,813 $ 7,453 $ 21,143 $ 0.18 Percentage of net sales 53.6 % 21.8 % 37.5 %

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

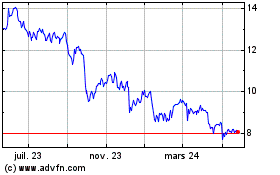

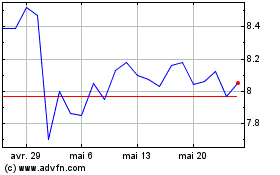

Duckhorn Portfolio (NYSE:NAPA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Duckhorn Portfolio (NYSE:NAPA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024