Annaly Capital Management, Inc. (NYSE: NLY) (“Annaly” or the

“Company”) announced today an update on its portfolio and risk

position, including preliminary financial information as of

September 30, 2022, in light of sustained market volatility.

Below are preliminary updates on the Company’s business and

financial performance, demonstrating Annaly’s continued ability to

navigate challenging market environments:

- Book value per common share. We estimate that on a preliminary

basis our book value per common share at September 30, 2022 was

between $19.85 and $20.05 compared to $23.59 per common share at

June 30, 2022.

- GAAP leverage and economic leverage. We estimate that on a

preliminary basis our GAAP leverage ratio increased to

approximately 5.8:1 at September 30, 2022, compared to 5.4:1 at

June 30, 2022 and our economic leverage ratio increased to

approximately 7.1:1 at September 30, 2022, compared to 6.6:1 at

June 30, 2022.1

- Liquidity position. We have maintained a strong liquidity

position. We estimate that on a preliminary basis we had cash and

unencumbered Agency MBS of approximately $4.1 billion and total

unencumbered assets of $6.0 billion, as of September 30, 2022.

- Cash dividend. As previously announced on September 8, 2022, we

declared the third quarter 2022 common stock cash dividend of $0.88

per common share. This dividend is payable October 31, 2022, to

common shareholders of record on September 30, 2022. We estimate

that on a preliminary basis we generated earnings available for

distribution in excess of our dividend for the third quarter

2022.

Per share amounts at September 30, 2022 are based on 468 million

common shares issued and outstanding as of such date. Comparative

per share amounts at June 30, 2022 are adjusted to give retroactive

effect to the Company’s recently completed 1-for-4 reverse stock

split.

As previously announced on October 5, 2022, Annaly will release

its financial results for the quarter ended September 30, 2022

after the market close on Wednesday, October 26, 2022. The Company

will conduct a conference call and audio webcast to discuss the

results on Thursday, October 27, 2022 at 9:00 a.m. Eastern Time.

Participants are encouraged to pre-register for the conference call

to receive a unique PIN to gain immediate access to the call and

bypass the live operator. Pre-registration may be completed by

accessing the Pre-Registration link found on the homepage or

“Investors” section of the Company’s website at www.annaly.com, or

by using the following link:

https://dpregister.com/sreg/10171506/f491665b6c.

Pre-registration may be completed at any time, including up to

and after the call start time. Participants who would like to join

the call but have not pre-registered can do so on the day of the

event by dialing the numbers provided below and requesting the

“Annaly Earnings Call.”

Call-in Number:

U.S. Toll Free 844 735 3317

International 412 317 5703

Webcast http://www.annaly.com/

About Annaly

Annaly is a leading diversified capital manager with investment

strategies across mortgage finance. Annaly’s principal business

objective is to generate net income for distribution to its

stockholders and optimize its returns through prudent management of

its diversified investment strategies. Annaly is internally managed

and has elected to be taxed as a real estate investment trust, or

REIT, for federal income tax purposes. Additional information on

the Company can be found at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond the Company’s control) and may be identified by

reference to a future period or periods or by the use of

forward-looking terminology, such as “may,” “will,” “should,”

“could,” “estimate,” “project,” “believe,” “expect,” “anticipate,”

“continue,” or similar terms or variations on those terms or the

negative of those terms. Statements regarding our ability to

accurately estimate the financial and other information discussed

above may be forward-looking. These forward-looking statements are

based on assumptions that management of the Company has made in

light of experience in the business in which the Company operates,

as well as other factors management believes to be appropriate

under the circumstances. Actual events, results and performance of

the Company could differ materially from those set forth in

forward-looking statements due to a variety of factors, including,

but not limited to, risks and uncertainties related to the COVID-19

pandemic, including as related to adverse economic conditions on

real estate-related assets and financing conditions (and the

Company’s outlook for its business in light of these conditions,

which is uncertain); changes in interest rates; changes in the

yield curve; changes in prepayment rates; the availability of

mortgage-backed securities and other securities for purchase; the

availability of financing and, if available, the terms of any

financing; changes in the market value of the Company’s assets;

changes in business conditions and the general economy; operational

risks or risk management failures by the Company or critical third

parties, including cybersecurity incidents; the Company’s ability

to grow the Company’s residential credit business; credit risks

related to the Company’s investments in credit risk transfer

securities, residential mortgage-backed securities, and related

residential mortgage credit assets; risks related to investments in

mortgage servicing rights; the Company’s ability to consummate any

contemplated investment opportunities; changes in government

regulations or policy affecting the Company’s business; the

Company’s ability to maintain its qualification as a REIT for U.S.

federal income tax purposes; and the Company’s ability to maintain

its exemption from registration under the Investment Company Act.

For a discussion of the risks and uncertainties which could cause

actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in the Company’s

most recent Annual Report on Form 10-K and any subsequent Quarterly

Reports on Form 10-Q. The Company does not undertake, and

specifically disclaims any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

Non-GAAP Financial Measures

This news release includes certain non-GAAP financial measures,

including earnings available for distribution. The Company believes

the non-GAAP financial measures are useful for management,

investors, analysts, and other interested parties in evaluating the

Company’s performance but should not be viewed in isolation and are

not a substitute for financial measures computed in accordance with

U.S. generally accepted accounting principles (“GAAP”). In

addition, the Company may calculate its non-GAAP metrics, such as

earnings available for distribution, or the premium amortization

adjustment, differently than the Company’s peers making comparative

analysis difficult.

The following table presents a summary reconciliation of the

Company’s preliminary estimate range of its GAAP financial results

to its preliminary estimate range of non-GAAP economic leverage

ratio for the quarter ended September 30, 2022. Amounts for the

quarter ended June 30, 2022 are based on actual results, as

previously reported:

For the Quarters Ended

September 30, 2022

June 30, 2022

(dollars in millions)

GAAP debt

$

63,155

$

59,564

Less:

Non-recourse debt

(8,745)

(8,199)

Plus:

Cost basis of TBA and CMBX derivatives

16,150

19,723

Net forward purchases (sales) of

investments

7,215

1,562

Economic debt

$

77,775

$

72,649

Total equity

$

10,910 – 11,005

$

11,090

Economic leverage ratio

7.1x – 7.2x

6.6x

The Company’s closing procedures for the three months ended

September 30, 2022 are not yet complete and, as a result, the

Company’s preliminary estimates of the financial information above

reflect its preliminary estimate ranges with respect to such

results based on information currently available to management, and

may vary from the Company’s actual financial results as of and for

the quarter ended September 30, 2022. Further, these estimates are

not a comprehensive statement of the Company’s financial results as

of and for the quarter ended September 30, 2022. Accordingly,

investors should not place undue reliance on this preliminary

information. These estimates, which are the responsibility of the

Company’s management, were prepared in connection with the

preparation of the Company’s financial statements and are based

upon a number of assumptions. Additional items that may require

adjustments to the preliminary operating results may be identified

and could result in material changes to the Company’s estimated

preliminary operating results. Estimates of operating results are

inherently uncertain and the Company undertakes no obligation to

update this information. Factors that could cause actual results of

operations to differ from those expressed in forward-looking

statements include, without limitation, the risks and uncertainties

described under the headings “Special Note Regarding

Forward-Looking Statements,” “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in the Annual Report on Form 10-K for the year ended

December 31, 2021, filed by us with the Securities and Exchange

Commission (“SEC”) and described in the other filings we make from

time to time with the SEC. Neither Ernst & Young LLP, the

Company’s independent registered public accounting firm, nor any

other independent accountants, have audited, reviewed, compiled or

performed any procedures with respect to this preliminary financial

information. Accordingly, Ernst & Young LLP does not express an

opinion or provide any form of assurance with respect thereto.

1 Economic leverage is computed as the sum of recourse debt,

cost basis of TBA and CMBX derivatives outstanding, and net forward

purchases (sales) of investments divided by total equity. Recourse

debt consists of repurchase agreements and other secured financing

(excluding certain non-recourse credit facilities). Certain credit

facilities (included within other secured financing), debt issued

by securitization vehicles, participations issued, and mortgages

payable are non-recourse to the Company and are excluded from

economic leverage. Economic leverage is a non-GAAP financial

measure. Refer to the “Non-GAAP Financial Measures” section for

additional information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221011005501/en/

Investors:

Annaly Capital Management, Inc. Investor Relations 1-888-8Annaly

investor@annaly.com

Media:

Brunswick Group Alex Yankus 1-212-333-3810

ANNALY@brunswickgroup.com

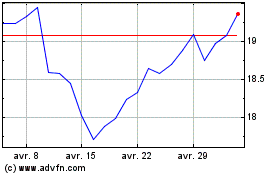

Annaly Capital Management (NYSE:NLY)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Annaly Capital Management (NYSE:NLY)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024