0000076334false00000763342024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 31, 2024

PARKER-HANNIFIN CORPORATION

(Exact Name of Registrant as Specified in Charter) | | | | | | | | |

Ohio | 1-4982 | 34-0451060 |

(State or other jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

6035 Parkland Boulevard, Cleveland, Ohio | | 44124-4141 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (216) 896-3000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on which Registered |

| Common Shares, $.50 par value | | PH | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On October 31, 2024, Parker-Hannifin Corporation issued a press release and presented a Webcast announcing results of operations for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report. A copy of the Webcast presentation is furnished as Exhibit 99.2 to this report.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | |

| | | PARKER-HANNIFIN CORPORATION |

| | | By: /s/ Todd M. Leombruno |

| | | Todd M. Leombruno |

| | | Executive Vice President and Chief Financial Officer |

| | | |

| | | |

| | | |

| Date: | October 31, 2024 | | |

| | | |

| | | |

Exhibit 99.1

Parker Reports Fiscal 2025 First Quarter Results

Record sales, segment operating margin and earnings per share; EPS outlook increased

CLEVELAND, October 31, 2024 -- Parker Hannifin Corporation (NYSE: PH), the global leader in motion and control technologies, today reported results for the quarter ended September 30, 2024, that included the following highlights (compared with the prior year quarter):

Fiscal 2025 First Quarter Highlights:

•Sales increased 1.2% to $4.9 billion; Organic sales growth was 1.4%

•Net income was $698 million, an increase of 7%, or $810 million adjusted, an increase of 4%

•EPS were $5.34, an increase of 7%, or $6.20 adjusted, an increase of 4%

•Segment operating margin was 22.6%, an increase of 130 bps, or a record 25.7% adjusted, an increase of 80 bps

•Cash flow from operations was 15.2% of sales, an increase of 14% to $744 million

“Through continued execution of The Win Strategy™, our global team produced outstanding results in the first quarter,” said Chairman and Chief Executive Officer, Jenny Parmentier. “We delivered records for sales, adjusted segment operating margin, adjusted earnings per share and year-to-date cash flow from operations. Our performance also reflects the strength of our transformed portfolio with our Aerospace Systems segment achieving exceptional results. Looking ahead to the full year, we anticipate near-term pressure in select industrial markets and accelerating growth in aerospace. Reflecting these conditions and our strong first quarter performance, we have raised our outlook for segment operating margin and earnings per share. We remain committed to our fiscal 2029 targets and continue to see a very promising future for Parker.”

This news release contains non-GAAP financial measures. Reconciliations of adjusted numbers and certain non-GAAP financial measures are included in the financial tables of this press release.

Outlook

Guidance for the fiscal year ending June 30, 2025 has been updated. Guidance now reflects divestiture activity in the Diversified Industrial Segment, North America Businesses expected to be completed during the second quarter of fiscal 2025. The company now expects:

•Total sales growth in fiscal 2025 of 0.5% to 3.5%, with organic sales growth of 1.5% to 4.5%; divestitures of (1.5%) and favorable currency of 0.5%

•Total segment operating margin to increase to approximately 22.6%, or approximately 25.7% on an adjusted basis

•EPS to increase to $22.78 to $23.48, or $26.35 to $27.05 on an adjusted basis

Segment Results

Diversified Industrial Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

North America Businesses | | | | | | | | | | | |

| $ in mm | FY25 Q1 | | FY24 Q1 | | Change | | Organic Growth | | | | |

Sales | $ | 2,100 | | | $ | 2,230 | | | -5.8 | % | | -5.0 | % | | | | |

| | | | | | | | | | | |

Segment Operating Income | $ | 485 | | | $ | 506 | | | -4.2 | % | | | | | | |

Segment Operating Margin | 23.1 | % | | 22.7 | % | | 40 | bps | | | | | | |

| Adjusted Segment Operating Income | $ | 532 | | | $ | 554 | | | -4.1 | % | | | | | | |

Adjusted Segment Operating Margin | 25.3 | % | | 24.9 | % | | 40 | bps | | | | | | |

•Achieved record adjusted segment operating margin

•HVAC returns to growth, while delays impact in-plant and energy markets

•Softness continues in transportation and off-highway markets

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| International Businesses | | | | | |

$ in mm | FY25 Q1 | | FY24 Q1 | | Change | | Organic Growth | | | | |

Sales | $ | 1,356 | | | $ | 1,389 | | | -2.4 | % | | -2.4 | % | | | | |

| | | | | | | | | | | |

Segment Operating Income | $ | 299 | | | $ | 301 | | | -0.6 | % | | | | | | |

Segment Operating Margin | 22.1 | % | | 21.7 | % | | 40 | bps | | | | | | |

| Adjusted Segment Operating Income | $ | 327 | | | $ | 334 | | | -2.2 | % | | | | | | |

Adjusted Segment Operating Margin | 24.1 | % | | 24.1 | % | | — | bps | | | | | | |

•Achieved record adjusted segment operating margin

•Positive sales growth in Asia, offset by continued softness in Europe

Aerospace Systems Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

$ in mm | FY25 Q1 | | FY24 Q1 | | Change | | Organic Growth | | | | |

Sales | $ | 1,448 | | | $ | 1,229 | | | 17.8 | % | | 17.2 | % | | | | |

| | | | | | | | | | | |

Segment Operating Income | $ | 323 | | | $ | 226 | | | 42.7 | % | | | | | | |

Segment Operating Margin | 22.3 | % | | 18.4 | % | | 390 | bps | | | | | | |

| Adjusted Segment Operating Income | $ | 403 | | | $ | 320 | | | 26.3 | % | | | | | | |

Adjusted Segment Operating Margin | 27.9 | % | | 26.0 | % | | 190 | bps | | | | | | |

•Achieved record sales and adjusted segment operating margin

•Outstanding aftermarket sales growth in both commercial and defense markets

Order Rates

| | | | | |

| FY25 Q1 |

Parker | +1% |

Diversified Industrial Segment - North America Businesses | -3% |

Diversified Industrial Segment - International Businesses | +1% |

Aerospace Systems Segment | +7% |

•Company order rates continue to be positive

•International orders turned positive on Asia improvement

•Aerospace orders remained strong against a tough prior year comparison

About Parker Hannifin

Parker Hannifin is a Fortune 250 global leader in motion and control technologies. For more than a century the company has been enabling engineering breakthroughs that lead to a better tomorrow. Learn more at www.parker.com or @parkerhannifin.

| | | | | |

Contacts: | |

Media: | Financial Analysts: |

Aidan Gormley | Jeff Miller |

216-896-3258 | 216-896-2708 |

aidan.gormley@parker.com | jeffrey.miller@parker.com |

Notice of Webcast

Parker Hannifin's conference call and slide presentation to discuss its fiscal 2025 first quarter results are available to all interested parties via live webcast today at 11:00 a.m. ET, at investors.parker.com. A replay of the webcast will be available on the site approximately one hour after the completion of the call and will remain available for one year. To register for e-mail notification of future events please visit investors.parker.com.

Note on Orders The company reported orders for the quarter ending September 30, 2024, compared with the same quarter a year ago. All comparisons are at constant currency exchange rates, with the prior year quarter restated to the current-year rates. Diversified Industrial comparisons are on 3-month average computations and Aerospace Systems comparisons are on rolling 12-month average computations.

Note on Non-GAAP Financial Measures

This press release contains references to non-GAAP financial information including (a) adjusted net income; (b) adjusted earnings per share; (c) adjusted operating margin and segment operating margins; (d) adjusted operating income and segment operating income and (e) organic sales growth. The adjusted net income, adjusted earnings per share, adjusted operating margin, adjusted segment operating margin, adjusted operating income, adjusted segment operating income and organic sales measures are presented to allow investors and the company to meaningfully evaluate changes in net income, earnings per share and segment operating margins on a comparable basis from period to period. Although adjusted net income, adjusted earnings per share, adjusted operating margin and segment operating margins, adjusted operating income and segment operating income, and organic sales growth are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the results of this quarter versus the prior period. Comparable descriptions of record adjusted results in this release refer only to the period from the first quarter of FY2011 to the periods presented in this release. This period coincides with recast historical financial results provided in association with our FY2014 change in segment reporting. A reconciliation of non-GAAP measures is included in the financial tables of this press release.

Forward-Looking Statements

Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. Often but not always, these statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and may also include statements regarding future performance, orders, earnings projections, events or developments. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance may differ materially from expectations, including those based on past performance.

Among other factors that may affect future performance are: changes in business relationships with and orders by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms, changes in contract costs and revenue estimates for new development programs; changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions; ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination and ability to successfully undertake business realignment activities and the expected costs, including cost savings, thereof; ability to implement successfully business and operating initiatives, including the timing, price and execution of share repurchases and other capital initiatives; availability, cost increases of or other limitations on our access to raw materials, component products and/or commodities if associated costs cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; legal and regulatory developments and other government actions, including related to environmental protection, and associated compliance costs; supply chain and labor disruptions, including as a result of labor shortages; threats associated with international conflicts and cybersecurity risks and risks associated with protecting our intellectual property; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; effects on market conditions, including sales and pricing, resulting from global reactions to U.S. trade policies; manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and economic conditions such as inflation, deflation, interest rates and credit availability; inability to obtain, or meet conditions imposed for, required governmental and regulatory approvals; changes in the tax laws in the United States and foreign jurisdictions and judicial or regulatory interpretations thereof; and large scale disasters, such as floods, earthquakes, hurricanes, industrial accidents and pandemics. Readers should also consider forward-looking statements in light of risk factors discussed in Parker’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024 and other periodic filings made with the SEC.

###

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

| | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENT OF INCOME | | | | | | | |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands, except per share amounts) | 2024 | | 2023 | | | | |

| Net sales | | $ | 4,903,984 | | | $ | 4,847,488 | | | | | |

| Cost of sales | | 3,097,719 | | | 3,097,349 | | | | | |

| Selling, general and administrative expenses | 848,789 | | | 873,691 | | | | | |

| Interest expense | | 113,091 | | | 134,468 | | | | | |

| Other income, net | | (30,801) | | | (78,455) | | | | | |

| Income before income taxes | | 875,186 | | | 820,435 | | | | | |

| Income taxes | | 176,658 | | | 169,363 | | | | | |

| Net income | | 698,528 | | | 651,072 | | | | | |

| Less: Noncontrolling interests | | 108 | | | 245 | | | | | |

| Net income attributable to common shareholders | $ | 698,420 | | | $ | 650,827 | | | | | |

| | | | | | | | |

| Earnings per share attributable to common shareholders: | | | | | | | |

| Basic earnings per share | | $ | 5.43 | | | $ | 5.07 | | | | | |

| Diluted earnings per share | | $ | 5.34 | | | $ | 4.99 | | | | | |

| | | | | | | | |

| Average shares outstanding during period - Basic | 128,663,088 | | 128,472,550 | | | | |

| Average shares outstanding during period - Diluted | 130,680,242 | | 130,363,441 | | | | |

| | | | | | | | |

| | | | | | | | |

| CASH DIVIDENDS PER COMMON SHARE | | | | | | | |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Amounts in dollars) | | 2024 | | 2023 | | | | |

| Cash dividends per common share | $ | 1.63 | | | $ | 1.48 | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF ORGANIC GROWTH | | | | | | | | |

| (Unaudited) | Three Months Ended |

| As Reported | | | | | | | | Adjusted |

| September 30, 2024 | | Currency | | Divestitures | | | | September 30, 2024 |

| Diversified Industrial Segment | (4.5) | % | | (0.3) | % | | (0.2) | % | | | | (4.0) | % |

| Aerospace Systems Segment | 17.8 | % | | 0.6 | % | | — | % | | | | 17.2 | % |

| Total | 1.2 | % | | — | % | | (0.2) | % | | | | 1.4 | % |

| | | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS TO ADJUSTED NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Net income attributable to common shareholders | $ | 698,420 | | | $ | 650,827 | | | | | |

| Adjustments: | | | | | | | |

| Acquired intangible asset amortization expense | 140,121 | | | 155,520 | | | | | |

| Business realignment charges | 9,506 | | | 13,092 | | | | | |

| Integration costs to achieve | | 6,411 | | | 6,406 | | | | | |

| Gain on sale of building | (10,461) | | | — | | | | | |

| Gain on divestiture | — | | | (13,260) | | | | | |

Tax effect of adjustments1 | | (34,211) | | | (36,148) | | | | | |

| | | | | | | | |

| Adjusted net income attributable to common shareholders | $ | 809,786 | | | $ | 776,437 | | | | | |

| | | | | | | | |

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

| | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF EARNINGS PER DILUTED SHARE TO ADJUSTED EARNINGS PER DILUTED SHARE |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Amounts in dollars) | | 2024 | | 2023 | | | | |

| Earnings per diluted share | $ | 5.34 | | | $ | 4.99 | | | | | |

| Adjustments: | | | | | | | |

| Acquired intangible asset amortization expense | 1.07 | | | 1.19 | | | | | |

| Business realignment charges | 0.07 | | | 0.10 | | | | | |

| Integration costs to achieve | 0.05 | | | 0.05 | | | | | |

| Gain on sale of building | (0.08) | | | — | | | | | |

| Gain on divestiture | — | | | (0.10) | | | | | |

Tax effect of adjustments1 | | (0.25) | | | (0.27) | | | | | |

| | | | | | | | |

| Adjusted earnings per diluted share | $ | 6.20 | | | $ | 5.96 | | | | | |

| | | | | | | | |

1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. |

|

| | | | | | | | | | | | | | | | | | |

| BUSINESS SEGMENT INFORMATION | | | | | | | |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Net sales | | | | | | | | |

| Diversified Industrial | | $ | 3,456,158 | | | $ | 3,618,528 | | | | | |

| Aerospace Systems | | 1,447,826 | | | 1,228,960 | | | | | |

| Total net sales | | $ | 4,903,984 | | | $ | 4,847,488 | | | | | |

| Segment operating income | | | | | | | | |

| Diversified Industrial | | $ | 783,546 | | | $ | 806,754 | | | | | |

| Aerospace Systems | | 322,986 | | | 226,260 | | | | | |

| Total segment operating income | 1,106,532 | | | 1,033,014 | | | | | |

| Corporate general and administrative expenses | 48,794 | | | 55,656 | | | | | |

| Income before interest expense and other expense, net | 1,057,738 | | | 977,358 | | | | | |

| Interest expense | | 113,091 | | | 134,468 | | | | | |

| Other expense, net | | 69,461 | | | 22,455 | | | | | |

| Income before income taxes | | $ | 875,186 | | | $ | 820,435 | | | | | |

| | | | | | | | |

|

| | | | | | | | |

| | | | | | | | |

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

| | | | | | | | | | | | | | | | | | |

| | | | | |

| RECONCILIATION OF SEGMENT OPERATING MARGINS TO ADJUSTED SEGMENT OPERATING MARGINS |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Diversified Industrial Segment sales | | $ | 3,456,158 | | | $ | 3,618,528 | | | | | |

| | | | | | | | |

| Diversified Industrial Segment operating income | | $ | 783,546 | | | $ | 806,754 | | | | | |

| Adjustments: | | | | | | | | |

| Acquired intangible asset amortization | | 65,264 | | | 67,951 | | | | | |

| Business realignment charges | | 8,900 | | | 12,639 | | | | | |

| Integration costs to achieve | | 778 | | | 1,139 | | | | | |

| Adjusted Diversified Industrial Segment operating income | | $ | 858,488 | | | $ | 888,483 | | | | | |

| | | | | | | | |

| Diversified Industrial Segment operating margin | | 22.7 | % | | 22.3 | % | | | | |

| Adjusted Diversified Industrial Segment operating margin | | 24.8 | % | | 24.6 | % | | | | |

| | | | | | | | |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Aerospace Systems Segment sales | | $ | 1,447,826 | | | $ | 1,228,960 | | | | | |

| | | | | | | | |

| Aerospace Systems Segment operating income | | $ | 322,986 | | | $ | 226,260 | | | | | |

| Adjustments: | | | | | | | | |

| Acquired intangible asset amortization | | 74,857 | | | 87,569 | | | | | |

| Business realignment charges | | 8 | | | 453 | | | | | |

| Integration costs to achieve | | 5,633 | | | 5,267 | | | | | |

| Adjusted Aerospace Systems Segment operating income | | $ | 403,484 | | | $ | 319,549 | | | | | |

| | | | | | | | |

| Aerospace Systems Segment operating margin | | 22.3 | % | | 18.4 | % | | | | |

| Adjusted Aerospace Systems Segment operating margin | | 27.9 | % | | 26.0 | % | | | | |

| | | | | | | | |

| RECONCILIATION OF SEGMENT OPERATING MARGINS TO ADJUSTED SEGMENT OPERATING MARGINS |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Total net sales | | $ | 4,903,984 | | | $ | 4,847,488 | | | | | |

| | | | | | | | |

| Total segment operating income | | $ | 1,106,532 | | | $ | 1,033,014 | | | | | |

| Adjustments: | | | | | | | | |

| Acquired intangible asset amortization | | 140,121 | | | 155,520 | | | | | |

| Business realignment charges | | 8,908 | | | 13,092 | | | | | |

| Integration costs to achieve | | 6,411 | | | 6,406 | | | | | |

| Adjusted total segment operating income | | $ | 1,261,972 | | | $ | 1,208,032 | | | | | |

| | | | | | | | |

| Total segment operating margin | | 22.6 | % | | 21.3 | % | | | | |

| Adjusted total segment operating margin | | 25.7 | % | | 24.9 | % | | | | |

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

| | | | | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEET | | | |

| (Unaudited) | | September 30, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 371,068 | | | $ | 422,027 | |

| Trade accounts receivable, net | | 2,712,656 | | | 2,865,546 | |

| Non-trade and notes receivable | | 317,381 | | | 331,429 | |

| Inventories | | 2,872,250 | | | 2,786,800 | |

| Prepaid expenses | | 249,148 | | | 252,618 | |

| Other current assets | | 511,198 | | | 140,204 | |

| Total current assets | | 7,033,701 | | | 6,798,624 | |

| Property, plant and equipment, net | | 2,839,542 | | | 2,875,668 | |

| Deferred income taxes | | 91,882 | | | 92,704 | |

| Investments and other assets | | 1,263,190 | | | 1,207,232 | |

| Intangible assets, net | | 7,747,233 | | | 7,816,181 | |

| Goodwill | | 10,625,287 | | | 10,507,433 | |

| Total assets | | $ | 29,600,835 | | | $ | 29,297,842 | |

| | | | |

| Liabilities and equity | | | | |

| Current liabilities: | | | | |

| Notes payable and long-term debt payable within one year | | $ | 3,515,613 | | | $ | 3,403,065 | |

| Accounts payable, trade | | 1,953,477 | | | 1,991,639 | |

| Accrued payrolls and other compensation | | 407,106 | | | 581,251 | |

| Accrued domestic and foreign taxes | | 457,761 | | | 354,659 | |

| Other accrued liabilities | | 1,004,073 | | | 982,695 | |

| Total current liabilities | | 7,338,030 | | | 7,313,309 | |

| Long-term debt | | 6,673,303 | | | 7,157,034 | |

| Pensions and other postretirement benefits | | 427,702 | | | 437,490 | |

| Deferred income taxes | | 1,544,503 | | | 1,583,923 | |

| Other liabilities | | 715,948 | | | 725,193 | |

| Shareholders' equity | | 12,891,900 | | | 12,071,972 | |

| Noncontrolling interests | | 9,449 | | | 8,921 | |

| Total liabilities and equity | | $ | 29,600,835 | | | $ | 29,297,842 | |

| | | | |

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

| | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENT OF CASH FLOWS | | | | | | |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | |

| Cash flows from operating activities: | | | | | | |

| Net income | | $ | 698,528 | | | $ | 651,072 | | | |

| Depreciation and amortization | | 229,046 | | | 240,387 | | | |

| Stock incentive plan compensation | | 75,842 | | | 77,894 | | | |

| Gain on sale of businesses | | (313) | | | (13,260) | | | |

| (Gain) loss on property, plant and equipment and intangible assets | | (8,422) | | | 1,333 | | | |

| Net change in receivables, inventories and trade payables | | (40,430) | | | (69,280) | | | |

| Net change in other assets and liabilities | | (223,585) | | | (185,691) | | | |

| Other, net | | 13,309 | | | (52,496) | | | |

| Net cash provided by operating activities | | 743,975 | | | 649,959 | | | |

| Cash flows from investing activities: | | | | | | |

| | | | | | |

| Capital expenditures | | (95,302) | | | (97,746) | | | |

| Proceeds from sale of property, plant and equipment | | 13,271 | | | 710 | | | |

| Proceeds from sale of businesses | | 884 | | | 36,691 | | | |

| | | | | | |

| Other, net | | (5,461) | | | 4,351 | | | |

| Net cash used in investing activities | | (86,608) | | | (55,994) | | | |

| Cash flows from financing activities: | | | | | | |

| Net payments for common stock activity | | (92,089) | | | (78,148) | | | |

| Acquisition of noncontrolling interests | | — | | | (2,883) | | | |

| Net payments for debt | | (408,929) | | | (346,411) | | | |

| | | | | | |

| Dividends paid | | (209,937) | | | (190,420) | | | |

| Net cash used in financing activities | | (710,955) | | | (617,862) | | | |

| Effect of exchange rate changes on cash | | 2,629 | | | (2,359) | | | |

| Net decrease in cash and cash equivalents | | (50,959) | | | (26,256) | | | |

| Cash and cash equivalents at beginning of year | | 422,027 | | | 475,182 | | | |

| Cash and cash equivalents at end of period | | $ | 371,068 | | | $ | 448,926 | | | |

| | | | | | |

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

| | | | | | | | |

| RECONCILIATION OF FORECASTED ORGANIC GROWTH | |

| (Unaudited) | | |

| (Amounts in percentages) | | Fiscal Year 2025 |

| Forecasted net sales | | 0.5% to 3.5% |

| Adjustments: | | |

| Currency | | (0.5)% |

| Divestitures | | 1.5% |

| Adjusted forecasted net sales | | 1.5% to 4.5% |

| | |

| RECONCILIATION OF FORECASTED SEGMENT OPERATING MARGIN TO ADJUSTED FORECASTED SEGMENT OPERATING MARGIN |

| | |

| (Unaudited) | | |

| (Amounts in percentages) | | Fiscal Year 2025 |

| Forecasted segment operating margin | ~22.6% |

| Adjustments: | |

| Business realignment charges | 0.2% |

| Costs to achieve | | 0.1% |

| Acquisition-related intangible asset amortization expense | | 2.7% |

| | |

| | |

| | |

| | |

| Adjusted forecasted segment operating margin | ~25.7% |

| | |

|

| | | | | | | | |

| | |

| |

| RECONCILIATION OF FORECASTED EARNINGS PER DILUTED SHARE TO ADJUSTED FORECASTED EARNINGS PER DILUTED SHARE |

| | |

| (Unaudited) | | |

| (Amounts in dollars) | | Fiscal Year 2025 |

| Forecasted earnings per diluted share | $22.78 to $23.48 |

| Adjustments: | |

| Business realignment charges | 0.39 |

| Costs to achieve | | 0.11 |

| Acquisition-related intangible asset amortization expense | | 4.21 |

| | |

| | |

| Gain on sale of building | | (0.08) |

Tax effect of adjustments1 | | (1.07) |

| Adjusted forecasted earnings per diluted share | $26.35 to $27.05 |

| | |

| | |

1This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. |

| | |

Note: Totals may not foot due to rounding |

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

SUPPLEMENTAL INFORMATION

| | | | | | | | | | | | | | | | | | |

| BUSINESS SEGMENT INFORMATION | | | | | | | |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Net sales | | | | | | | | |

| Diversified Industrial: | | | | | | | | |

| North America businesses | | $ | 2,100,324 | | | $ | 2,229,906 | | | | | |

| International businesses | | 1,355,834 | | | 1,388,622 | | | | | |

| | | | | | | | |

| Segment operating income | | | | | | | |

| Diversified Industrial: | | | | | | | | |

| North America businesses | | $ | 484,563 | | | $ | 506,053 | | | | | |

| International businesses | | 298,983 | | | 300,701 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF ORGANIC GROWTH | | | | | | |

| (Unaudited) | Three Months Ended |

| As Reported | | | | | | | | Adjusted |

| September 30, 2024 | | Currency | | Divestitures | | | | September 30, 2024 |

| Diversified Industrial Segment: | | | | | | | | | |

| North America businesses | (5.8) | % | | (0.5) | % | | (0.3) | % | | | | (5.0) | % |

| International businesses | (2.4) | % | | — | % | | — | % | | | | (2.4) | % |

| | | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Exhibit 99.1

PARKER HANNIFIN CORPORATION - SEPTEMBER 30, 2024

SUPPLEMENTAL INFORMATION

| | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF SEGMENT OPERATING MARGINS TO ADJUSTED SEGMENT OPERATING MARGINS |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Diversified Industrial Segment: | | | | | | | | |

| North America businesses sales | | $ | 2,100,324 | | | $ | 2,229,906 | | | | | |

| | | | | | | | |

| North America businesses operating income | | $ | 484,563 | | | $ | 506,053 | | | | | |

| Adjustments: | | | | | | | | |

| Acquired intangible asset amortization | | 42,975 | | | 44,683 | | | | | |

| Business realignment charges | | 3,444 | | | 2,584 | | | | | |

| Integration costs to achieve | | 605 | | | 945 | | | | | |

| Adjusted North America businesses operating income | | $ | 531,587 | | | $ | 554,265 | | | | | |

| | | | | | | | |

| North America businesses operating margin | | 23.1 | % | | 22.7 | % | | | | |

| Adjusted North America businesses operating margin | | 25.3 | % | | 24.9 | % | | | | |

| | | | | | | | |

| (Unaudited) | | Three Months Ended September 30, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Diversified Industrial Segment: | | | | | | | | |

| International businesses sales | | $ | 1,355,834 | | | $ | 1,388,622 | | | | | |

| | | | | | | | |

| International businesses operating income | | $ | 298,983 | | | $ | 300,701 | | | | | |

| Adjustments: | | | | | | | | |

| Acquired intangible asset amortization | | 22,289 | | | 23,268 | | | | | |

| Business realignment charges | | 5,456 | | | 10,055 | | | | | |

| Integration costs to achieve | | 173 | | | 194 | | | | | |

| Adjusted International businesses operating income | | $ | 326,901 | | | $ | 334,218 | | | | | |

| | | | | | | | |

| International businesses operating margin | | 22.1 | % | | 21.7 | % | | | | |

| Adjusted International businesses operating margin | | 24.1 | % | | 24.1 | % | | | | |

Parker Hannifin Corporation Fiscal 2025 First Quarter Earnings Presentation October 31, 2024 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. Often but not always, these statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and may also include statements regarding future performance, orders, earnings projections, events or developments. Parker cautions readers not to place undue reliance on these statements. It is possible that the future performance may differ materially from expectations, including those based on past performance. Among other factors that may affect future performance are: changes in business relationships with and orders by or from major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms, changes in contract costs and revenue estimates for new development programs; changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions; ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination and ability to successfully undertake business realignment activities and the expected costs, including cost savings, thereof; ability to implement successfully business and operating initiatives, including the timing, price and execution of share repurchases and other capital initiatives; availability, cost increases of or other limitations on our access to raw materials, component products and/or commodities if associated costs cannot be recovered in product pricing; ability to manage costs related to insurance and employee retirement and health care benefits; legal and regulatory developments and other government actions, including related to environmental protection, and associated compliance costs; supply chain and labor disruptions, including as a result of labor shortages; threats associated with international conflicts and cybersecurity risks and risks associated with protecting our intellectual property; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; effects on market conditions, including sales and pricing, resulting from global reactions to U.S. trade policies; manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and economic conditions such as inflation, deflation, interest rates and credit availability; inability to obtain, or meet conditions imposed for, required governmental and regulatory approvals; changes in the tax laws in the United States and foreign jurisdictions and judicial or regulatory interpretations thereof; and large scale disasters, such as floods, earthquakes, hurricanes, industrial accidents and pandemics. Readers should also consider forward-looking statements in light of risk factors discussed in Parker’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024 and other periodic filings made with the SEC. This presentation contains references to non-GAAP financial information including adjusted net income, organic sales, adjusted earnings per share, adjusted segment operating margin for Parker and by segment, EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, Net Debt to Adjusted EBITDA, free cash flow, and free cash flow margin. As used in this presentation, EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before business realignment, integration costs to achieve, acquisition related expenses, and other one-time items. Free cash flow is defined as cash flow from operations less capital expenditures. Although adjusted net income, organic sales, adjusted earnings per share, adjusted segment operating margin for Parker and by segment, EBITDA, EBITDA margin, adjusted EBITDA, adjusted EBITDA margin, Net Debt to Adjusted EBITDA, free cash flow, and free cash flow margin are not measures of performance calculated in accordance with GAAP, we believe that they are useful to an investor in evaluating the company performance for the periods presented. Detailed reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures have been included in the appendix to this presentation. Please visit investors.parker.com for more information. 2

3 FY25 Q1 Highlights $4.9B Sales +1.2% Reported +1.4% Organic1 25.7% Adjusted Segment Operating Margin1 +80 bps 24.9% Adjusted EBITDA Margin1 +10 bps $744M CFOA +14% Growth Top quartile safety performance Exceptional Aerospace performance Consistent execution and margin expansion Record Adjusted Segment Operating Margin of 25.7% Record Cash Flow from Operations, 14% growth Transformed Portfolio Drives Record Performance 10% Reduction in Recordable Incidents 1. Includes certain non-GAAP adjustments and financial measures. See Appendix for additional details and reconciliations. Note: FY25 Q1 As Reported: Segment Operating Margin of 22.6%, EBITDA Margin of 24.8%, Net Income of $699M, EPS of $5.34. 4% Adjusted EPS Growth1

Why We Win Strong Competitive Advantages 4 Interconnected Technologies Enables comprehensive solutions for customers Application Engineering Technical expertise creates competitive advantage Innovative Products Deep customer partnership to uncover unmet needs Distribution Network Serving global aftermarket & small to mid-sized OEMs Decentralized structure, strategic positioning & operational excellence Parker’s Business System

~$20B Sales #1 Position in Motion & Control Industry >90% of Sales Comes from 6 Market Verticals 5 Interconnected technologies and solutions across market verticals 2/3’s of our revenue comes from customers who buy 4 or more technologies Growth focused on faster growing, longer cycle markets and secular trends In-plant & Industrial Equipment 20% Other 5% HVAC/R 4% Energy 8% Aerospace & Defense 33% Off Highway 15% Transportation 15% ~$145B Market Size Note: Sales and market sizes as of FY24. Aerospace & Defense market includes sales reported both in the Aerospace Systems segment and Diversified Industrial segment.

Balanced & Diverse Aerospace Portfolio Drives Growth Commercial Transport 38% Military Fixed Wing 29% Business Jets 15% Regional Transport 8% Helicopters 5% Energy & Other 5% FY24 Sales by Platform 6 Competitive Advantages Diversified customer base Comprehensive offering with proprietary designs Balanced narrowbody / widebody sales mix Meggitt significantly expanded aftermarket sales ~50% aftermarket sales mix ~7% Air Traffic Growth CY23 – CY27E CAGR1 F-35 F/A-18 F-16 F-15 ERJ-175/195 E1 Global 7500/8000Black Hawk Apache A220 A320 777 G650/700/800 G400/500/600787A350 737 1: Source: IATA

• Hydraulic Power • Air & Water Management • HVAC In-Plant & Industrial Equipment A comprehensive suite of motion & control technologies Solutions for Factory InfrastructureSolutions for Factory Equipment Assembly & Testing Machine Tools & Presses Product Transfer & Automation 7

In-Plant & Industrial Equipment Market Vertical Positioned for Growth 8 Mega Projects Announced1 1. Source: Dodge Data & Analytics, company estimate. Projects announced since 2021. Macro Growth Drivers Mega projects continue to drive long-term growth Industrial CapEx investment Digitalization and AI are driving the need for semiconductor fabs and data centers Aftermarket OEM Parker’s Differentiators A powerhouse of interconnected technologies Independent distribution network Parker benefits throughout a project’s lifecycle Parker’s In-Plant Equipment Sales Mix Power Generation Chemicals Semiconductor Energy Data Center Commercial Infrastructure Facilities Battery &EV ~$1T

Summary of Fiscal 2025 1st Quarter Highlights

FY25 Q1 Financial Summary 1. Sales figures As Reported. Includes certain non-GAAP adjustments and financial measures. See Appendix for additional details and reconciliations. Note: FY24 Q1 As Reported: Segment Operating Margin of 21.3%, EBITDA Margin of 24.7%, Net Income to common shareholders of $651M, EPS of $4.99. 10 $ Millions, except per share amounts FY25 Q1 FY25 Q1 FY24 Q1 YoY Change As Reported Adjusted¹ Adjusted¹ Adjusted Sales $4,904 $4,904 $4,847 +1.2% Segment Operating Margin 22.6% 25.7% 24.9% +80 bps EBITDA Margin 24.8% 24.9% 24.8% +10 bps Net Income $698 $810 $776 +4.3% EPS $5.34 $6.20 $5.96 +4.0%

FY25 Q1 Adjusted Earnings per Share Bridge 1. FY24 Q1 As Reported EPS of $4.99. FY25 Q1 As Reported EPS of $5.34. Includes certain non-GAAP adjustments and financial measures. See Appendix for additional details and reconciliations. 11 $5.16 $6.13 $4.74 $5.96 $5.96 $6.20

FY25 Q1 Segment Performance Sales As Reported $ Organic %1 Segment Operating Margin As Reported Segment Operating Margin Adjusted1 Order Rates2 Commentary D iv er si fie d In du st ria l North America Businesses $2,100M (5.0%) Organic 23.1% 25.3% +40 bps YoY (3%) Record adjusted segment operating margins HVAC returns to growth, while delays impact in-plant and energy markets Softness continues in transportation and off-highway International Businesses $1,356M (2.4%) Organic 22.1% 24.1% Flat YoY +1% Record adjusted segment operating margins Positive sales growth in Asia, offset by continued softness in Europe Orders turned positive on Asia improvement Aerospace Systems $1,448M +17.2% Organic 22.3% 27.9% +190 bps YoY +7% Record sales and adjusted segment operating margin Outstanding aftermarket sales growth in both commercial and defense markets Parker $4,904M +1.4% Organic 22.6% 25.7% +80 bps YoY +1% Performance reflects transformed portfolio Record adjusted segment operating margins Order rates remain positive due to longer cycle businesses 1. Includes certain non-GAAP adjustments and financial measures. See Appendix for additional details and reconciliations. 2. Diversified Industrial orders are on a 3-month average computation and Aerospace Systems are rolling 12-month average computations. 12

$552M $649M CFOA $650M $744M CFOA FY25 Q1 Cash Flow Performance 1. Includes certain non-GAAP adjustments and financial measures. See Appendix for additional details and reconciliations. 13 Free Cash Flow1 11.4% 13.2% Cash Flow from Operations 13.4% 15.2% FY24 FY25 % to sales $744M Cash Flow from Operations +14% growth 15.2% Cash Flow from Operations Margin 13.2% Free Cash Flow Margin1 $649M Free Cash Flow1 +17% growth 1.9x Net Debt to Adjusted TTM EBITDA1 Cash Flow Highlights FY25FY24

Outlook

Key Market Verticals % of Sales Previous FY25 Guidance Commentary Current FY25 Guidance Current vs. Previous Guidance Aerospace & Defense 33% HSD Raising guidance on aftermarket strength Diversified customer base ~10% In-Plant & Industrial 20% LSD Near term delays in projects & CapEx Positive channel sentiment LSD Transportation 15% LSD Lower automotive production forecast Heavy duty & work truck demand remains positive LSD Off-Highway 15% (MSD) OEM destocking continues Higher interest rates continue to impact Ag (HSD) Energy 8% LSD Near term delays in projects & CapEx Lower oil prices continue to impact outlook Neutral HVAC/R 4% LSD Regulatory changes driving growth LSD 15 FY25 Sales Growth Forecast by Key Market Verticals Current FY25 Organic: 1.5% - 4.5%

FY25 Guidance Update Reflects Expected Divestiture Activity 1. Includes certain non-GAAP adjustments and financial measures. See Appendix for additional details and reconciliations. 16 Guidance Metric FY25 Full Year Full Year Assumptions FY25 Q2 Midpoint Reported Sales 0.5% - 3.5% Currency favorable 0.5% Divestiture activity impact (~1.5%) Divestiture activity impact on Diversified Industrial, North America Businesses (3.5%) $4.8B Organic Sales Growth1 1.5% - 4.5% Raised Aerospace organic growth to 10% Assumes near term industrial pressure 1% Adj. Operating Margin1 ~25.7% All segments expected to expand margins 80 bps margin expansion ~70% incremental margin ~25.2% Adj. EPS1 $26.35 - $27.05 Full year tax rate ~22.5% Split: 1H: 46% | 2H: 54% $6.15 Free Cash Flow1 $3.0B - $3.3B CapEx: ~2% of sales FCF Conversion >100% - -

FY25 Adjusted Earnings per Share Guidance Bridge 1. Previous FY25 As Reported EPS Guidance midpoint of $23.00. Current FY25 As Reported EPS Guidance midpoint of $23.13. Adjusted numbers include certain non-GAAP financial measures. See Appendix for additional details and reconciliations. 17 $26.65 $26.70 Reflects expected divestiture activity

What Drives Parker Safety, Engagement, Ownership Living up to Our Purpose Top Quartile Performance Great Generators & Deployers of Cash 18

Upcoming Event Calendar FY25 Q2 Earnings Release January 30, 2025 FY25 Q3 Earnings Release May 1, 2025 FY25 Q4 Earnings Release August 7, 2025

Appendix FY25 Guidance Details Reconciliation of Organic Growth Adjusted Amounts Reconciliation – Consolidated Adjusted Amounts Reconciliation – Segment Operating Income Reconciliation of EBITDA to Adjusted EBITDA Reconciliation of Net Debt to Adjusted EBITDA Reconciliation of Free Cash Flow Margin Supplemental Sales Information – Global Technology Platforms Reconciliation of FY25 Guidance 20

FY25 Guidance Details Sales Growth vs. Prior Year As Reported Organic1 Diversified Industrial Segment North America Businesses (6%) – (3%) (1.5%) - 1.5% International Businesses 2% - 5% 0% - 3% Aerospace Systems Segment 9% - 12% 8.5% - 11.5% Parker 0.5% - 3.5% 1.5% - 4.5% Segment Operating Margins As Reported Adjusted1 Diversified Industrial Segment North America Businesses ~23.1% ~25.3% International Businesses ~21.8% ~23.9% Aerospace Systems Segment ~22.7% ~27.9% Parker ~22.6% ~25.7% Earnings Per Share As Reported Adjusted1 Midpoint $23.13 $26.70 Range $22.78 - $23.48 $26.35 - $27.05 1. Includes certain non-GAAP adjustments and financial measures. Detail of Pre-Tax Adjustments to: Segment Margins Below Segment Acquired Intangible Asset Amortization ~$550M — Business Realignment Charges ~$50M ~$0.6M Integration Costs to Achieve ~$15M — Gain on Sale of Building __ (~$10.5M) 21 Additional Items As Reported Corporate G&A ~$215M Interest Expense ~$415M Other (Income) Expense ~$70M Reported Tax Rate ~22.5% Diluted Shares Outstanding ~130.7M Reflects Expected Divestiture Activity in the Diversified Industrial Segment, North America Businesses

Reconciliation of Organic Growth 22 (Dollars in thousands) (Unaudited) Quarter-to-Date As Reported Adjusted As Reported Net Sales September 30, 2024 September 30, 2024 September 30, 2023 Diversified Industrial 3,456,158$ 9,457$ 7,352$ 3,472,967$ 3,618,528$ Aerospace Systems 1,447,826 (6,954) - 1,440,872 1,228,960 Total Parker Hannifin 4,903,984$ 2,503$ 7,352$ 4,913,839$ 4,847,488$ As reported Currency Divestitures Organic Diversified Industrial (4.5)% (0.3)% (0.2)% (4.0)% Aerospace Systems 17.8 % 0.6 % 0.0 % 17.2 % Total Parker Hannifin 1.2 % 0.0 % (0.2)% 1.4 % Supplemental Information: As Reported Adjusted As Reported Net Sales September 30, 2024 September 30, 2024 September 30, 2023 Diversified Industrial: North America businesses 2,100,324$ 10,376$ 7,352$ 2,118,052$ 2,229,906$ International businesses Europe 737,158 (14,325) - 722,833 784,198 Asia Pacific 542,016 (433) - 541,583 524,954 Latin America 76,660 13,839 - 90,499 79,470 International businesses 1,355,834$ (919)$ -$ 1,354,915$ 1,388,622$ As reported Currency Divestitures Organic Diversified Industrial: North America businesses (5.8)% (0.5)% (0.3)% (5.0)% International businesses Europe (6.0)% 1.8 % 0.0 % (7.8)% Asia Pacific 3.3 % 0.1 % 0.0 % 3.2 % Latin America (3.5)% (17.4)% 0.0 % 13.9 % International businesses (2.4)% (0.0)% 0.0 % (2.4)% Currency Divestitures Currency Divestitures

Adjusted Amounts Reconciliation Consolidated Statement of Income 23 (Dollars in thousands, except per share data) (Unaudited) Quarter-to-Date FY 2025 Acquired Business Meggitt As Reported Intangible Asset Realignment Costs to Gain on Adjusted September 30, 2024 % of Sales Amortization Charges Achieve Sale of Building September 30, 2024 % of Sales Net sales 4,903,984$ 100.0 % -$ -$ -$ -$ 4,903,984$ 100.0 % Cost of sales 3,097,719 63.2 % 23,199 5,440 108 - 3,068,972 62.6 % Selling, general and admin. expenses 848,789 17.3 % 116,922 3,468 6,303 - 722,096 14.7 % Interest expense 113,091 2.3 % - - - - 113,091 2.3 % Other (income) expense, net (30,801) (0.6)% - 598 - (10,461) (20,938) (0.4)% Income before income taxes 875,186 17.8 % (140,121) (9,506) (6,411) 10,461 1,020,763 20.8 % Income taxes 176,658 3.6 % 32,928 2,234 1,507 (2,458) 210,869 4.3 % Net income 698,528 14.2 % (107,193) (7,272) (4,904) 8,003 809,894 16.5 % Less: Noncontrolling interests 108 0.0 % - - - - 108 0.0 % Net income - common shareholders 698,420$ 14.2 % (107,193)$ (7,272)$ (4,904)$ 8,003$ 809,786$ 16.5 % Diluted earnings per share 5.34$ (0.82)$ (0.06)$ (0.04)$ 0.06$ 6.20$ Quarter-to-Date FY 2024 Acquired Business Meggitt As Reported Intangible Asset Realignment Costs to Gain on Adjusted September 30, 2023 % of Sales Amortization Charges Achieve Divestiture September 30, 2023 % of Sales Net sales 4,847,488$ 100.0 % -$ -$ -$ -$ 4,847,488$ 100.0 % Cost of sales 3,097,349 63.9 % 27,199 6,984 1,274 - 3,061,892 63.2 % Selling, general and admin. Expenses 873,691 18.0 % 128,321 6,108 5,132 - 734,130 15.1 % Interest expense 134,468 2.8 % - - - - 134,468 2.8 % Other (income) expense, net (78,455) (1.6)% - - - (13,260) (65,195) (1.3)% Income before income taxes 820,435 16.9 % (155,520) (13,092) (6,406) 13,260 982,193 20.3 % Income taxes 169,363 3.5 % 37,169 3,129 1,531 (5,681) 205,511 4.2 % Net income 651,072 13.4 % (118,351) (9,963) (4,875) 7,579 776,682 16.0 % Less: Noncontrolling interests 245 0.0 % - - - - 245 0.0 % Net income - common shareholders 650,827$ 13.4 % (118,351)$ (9,963)$ (4,875)$ 7,579$ 776,437$ 16.0 % Diluted earnings per share 4.99$ (0.91)$ (0.08)$ (0.04)$ 0.06$ 5.96$

Adjusted Amounts Reconciliation Segment Operating Income 1. Segment operating income as a percent of sales is calculated on segment sales. 2. Adjusted amounts as a percent of sales are calculated on as reported sales. 24 (Dollars in thousands) (Unaudited) Quarter-to-Date FY 2025 Acquired Business Meggitt As Reported Intangible Asset Realignment Costs to Gain on Adjusted September 30, 2024 % of Sales Amortization Charges Achieve Sale of Building September 30, 2024 % of Sales2 Diversified Industrial1 783,546$ 22.7% 65,264$ 8,900$ 778$ -$ 858,488$ 24.8% Aerospace Systems1 322,986 22.3% 74,857 8 5,633 - 403,484 27.9% Total segment operating income 1,106,532 22.6% (140,121) (8,908) (6,411) - 1,261,972 25.7% Corporate administration 48,794 1.0% - - - - 48,794 1.0% Income before interest and other 1,057,738 21.6% (140,121) (8,908) (6,411) - 1,213,178 24.7% Interest expense 113,091 2.3% - - - - 113,091 2.3% Other (income) expense 69,461 1.4% - 598 - (10,461) 79,324 1.6% Income before income taxes 875,186$ 17.8% (140,121)$ (9,506)$ (6,411)$ 10,461$ 1,020,763$ 20.8% Supplemental Information: Diversified Industrial: North America businesses1 484,563$ 23.1% 42,975$ 3,444$ 605$ -$ 531,587$ 25.3% International businesses1 298,983 22.1% 22,289 5,456 173 - 326,901 24.1% Quarter-to-Date FY 2024 Acquired Business Meggitt As Reported Intangible Asset Realignment Cost to Gain on Adjusted September 30, 2023 % of Sales Amortization Charges Achieve Divestiture September 30, 2023 % of Sales2 Diversified Industrial1 806,754$ 22.3% 67,951$ 12,639$ 1,139$ 888,483$ 24.6% Aerospace Systems1 226,260 18.4% 87,569 453 5,267 319,549 26.0% Total segment operating income 1,033,014 21.3% (155,520) (13,092) (6,406) 1,208,032 24.9% Corporate administration 55,656 1.1% - - - 55,656 1.1% Income before interest and other 977,358 20.2% (155,520) (13,092) (6,406) 1,152,376 23.8% Interest expense 134,468 2.8% - - - 134,468 2.8% Other (income) expense 22,455 0.5% - - - (13,260) 35,715 0.7% Income before income taxes 820,435$ 16.9% (155,520)$ (13,092)$ (6,406)$ 13,260$ 982,193$ 20.3% Supplemental Information: Diversified Industrial: North America businesses1 506,053$ 22.7% 44,683$ 2,584$ 945$ -$ 554,265$ 24.9% International businesses1 300,701 21.7% 23,268 10,055 194 - 334,218 24.1%

Reconciliation of EBITDA to Adjusted EBITDA 25 (Dollars in thousands) Three Months Ended (Unaudited) September 30, 2024 % of Sales 2023 % of Sales Net sales $ 4,903,984 100.0% $ 4,847,488 100.0% Net income $ 698,528 14.2% $ 651,072 13.4% Income taxes 176,658 3.6% 169,363 3.5% Depreciation 88,925 1.8% 84,867 1.8% Amortization 140,121 2.9% 155,520 3.2% Interest expense 113,091 2.3% 134,468 2.8% EBITDA 1,217,323 24.8% 1,195,290 24.7% Adjustments: Business realignment charges 9,506 0.2% 13,092 0.3% Meggitt costs to achieve 6,411 0.1% 6,406 0.1% Gain on divestiture - 0.0% (13,260) -0.3% Gain on sale of building (10,461) -0.2% - 0.0% EBITDA - Adjusted $ 1,222,779 24.9% $ 1,201,528 24.8% EBITDA margin 24.8 % 24.7 % EBITDA margin - Adjusted 24.9 % 24.8 %

Reconciliation of Net Debt / Adjusted EBITDA 26 (Unaudited) (Dollars in thousands) September 30, 2024 Notes payable and long-term debt payable within one year 3,515,613$ Long-term debt 6,673,303 Add: Deferred debt issuance costs 55,024 Total gross debt 10,243,940$ Cash and cash equivalents 371,068$ Marketable securities and other investments 4,805 Total cash 375,873$ Net debt (Gross debt less total cash) 9,868,067$ TTM Net Sales 19,986,102$ Net income 2,892,392$ Income tax 756,962 Depreciation 353,194 Amortization 562,596 Interest Expense 485,118 TTM EBITDA 5,050,262$ Adjustments: Business realignment charges 49,870 Costs to achieve 38,278 Acquisition-related costs 0 Gain on divestitures (12,391) Gain on sale of building (10,461) Amortization of inventory step-up to FV 0 Net loss on divestitures 0 TTM Adjusted EBITDA 5,115,558$ Net Debt/TTM Adjusted EBITDA 1.9

Reconciliation of Free Cash Flow Margin 27 (Unaudited) (Dollars in thousands) 2024 2023 Net Sales 4,903,984$ 4,847,488$ Cash Flow from Operations 743,975$ 649,959$ Capital Expenditures (95,302) (97,746) Free Cash Flow 648,673$ 552,213$ Cash Flow from Operations Margin 15.2% 13.4% Free Cash Flow Margin 13.2% 11.4% Three Months Ended September 30,

Supplemental Sales Information Global Technology Platforms 28 (Unaudited) (Dollars in thousands) 2024 2023 Net sales Diversified Industrial: Motion Systems $ 848,549 $ 942,314 Flow and Process Control 1,125,634 1,181,461 Filtration and Engineered Materials 1,481,975 1,494,753 Aerospace Systems 1,447,826 1,228,960 Total $ 4,903,984 $ 4,847,488 Three Months Ended September 30,

RECONCILIATION OF FORECASTED EARNINGS PER SHARE (Unaudited) (Amounts in dollars) Q2 Fiscal Year 2025 Forecasted earnings per diluted share ~$5.27 Adjustments: Business realignment charges 0.08 Costs to achieve 0.02 Acquisition-related intangible asset amortization expense 1.05 Tax effect of adjustments1 (0.26) Adjusted forecasted earnings per diluted share ~$6.15RECONCILIATION OF OPERATING INCOME TO ADJUSTED OPERATING INCOME (Unaudited) (Amounts in percentages) Q2 Fiscal Year 2025 Forecasted segment operating margin ~22.1% Adjustments: Business realignment charges 0.2% Costs to achieve 0.1% Acquisition-related intangible asset amortization expense 2.8% Adjusted forecasted segment operating margin ~25.2% RECONCILIATION OF ORGANIC GROWTH (Unaudited) (Amounts in percentages) Q2 Fiscal Year 2025 Forecasted net sales (~0.3%) Adjustments: Currency (0.3%) Divestitures 1.6% Adjusted forecasted net sales ~1.0% Reconciliation of Q2 FY25 Guidance 1. This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. *Totals may not foot due to rounding 29

RECONCILIATION OF CASH FLOW FROM OPERATIONS TO FREE CASH FLOW (Unaudited) (Dollars in millions) Fiscal Year 2025 Cash flow from operations $3,400 to $3,700 Less: Capital Expenditures ~(400) Free cash flow $3,000 to $3,300 RECONCILIATION OF FORECASTED EARNINGS PER SHARE (Unaudited) (Amounts in dollars) Fiscal Year 2025 Forecasted earnings per diluted share $22.78 to $23.48 Adjustments: Business realignment charges 0.39 Costs to achieve 0.11 Acquisition-related intangible asset amortization expense 4.21 Gain on sale of building (0.08) Tax effect of adjustments1 (1.07) Adjusted forecasted earnings per diluted share $26.35 to $27.05 RECONCILIATION OF OPERATING INCOME TO ADJUSTED OPERATING INCOME (Unaudited) Fiscal Year 2025 (Amounts in percentages) Forecasted Segment Operating Margin Business Realignment Charges Costs to Achieve Acquisition-Related Intangible Asset Amortization Expense Adjusted Forecasted Segment Operating Margin Diversified Industrial North America Businesses ~23.1% ~0.2% - ~2.0% ~25.3% International Businesses ~21.8% ~0.5% - ~1.5% ~23.9% Aerospace Systems ~22.7% - ~0.2% ~4.9% ~27.9% Parker ~22.6% ~0.2% ~0.1% ~2.7% ~25.7% RECONCILIATION OF ORGANIC GROWTH (Unaudited) Fiscal Year 2025 (Amounts in percentages) Forecasted Net Sales Currency Divestitures Adjusted Forecasted Net Sales Diversified Industrial North America Businesses (6.0%) to (3.0%) ~1.0% ~3.5% (1.5%) to 1.5% International Businesses 2.0% to 5.0% (~2.0%) - 0.0% to 3.0% Aerospace Systems 9.0% to 12.0% (~0.5%) - 8.5% to 11.5% Parker 0.5% to 3.5% (~0.5%) ~1.5% 1.5% to 4.5% Reconciliation of FY25 Guidance 1. This line item reflects the aggregate tax effect of all non-tax adjustments reflected in the preceding line items of the table. We estimate the tax effect of each adjustment item by applying our overall effective tax rate for continuing operations to the pre-tax amount, unless the nature of the item and/or the tax jurisdiction in which the item has been recorded requires application of a specific tax rate or tax treatment, in which case the tax effect of such item is estimated by applying such specific tax rate or tax treatment. *Totals may not foot due to rounding 30

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

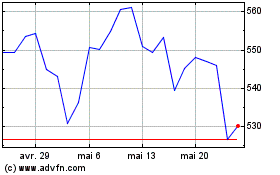

Parker Hannifin (NYSE:PH)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Parker Hannifin (NYSE:PH)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025