UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14F-1

Information Statement Pursuant to Section 14(f)

of the

Securities Exchange Act of 1934

and Rule 14f-1 Thereunder

Commission file number 001-40639

RCF ACQUISITION

CORP.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

N/A |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

3109 W. 50th Street, #207

Minneapolis, MN 55410 |

|

(952) 456-5300 |

| (Address of Principal Executive Offices and Zip Code) |

|

(Registrant’s telephone number, including area code) |

(Former Address of Principal Executive Offices

and Zip Code)

Approximate Date of Mailing: November 9, 2023

RCF ACQUISITION CORP.

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 THEREUNDER

NOTICE OF CHANGE IN THE MAJORITY OF THE BOARD

OF DIRECTORS

November 9, 2023

THIS INFORMATION STATEMENT IS BEING

PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE SHAREHOLDERS OF RCF ACQUISITION

CORP. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUIRED TO TAKE ANY ACTION.

Schedule 14f-1

You are urged to read

this Information Statement carefully and in its entirety. However, you are not required to take any action in connection with this Information

Statement. References throughout this Information Statement to “Company,” “we,” “us,” and “our”

refer to RCF Acquisition Corp.

INTRODUCTION

This Information Statement

is being mailed on or about November 9, 2023 of the Class A ordinary shares of RCF Acquisition Corp., a Cayman Islands exempted company

(the “Company”), in accordance with the requirements of Section 14(f) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), and Rule 14f-1 promulgated thereunder, in connection with an anticipated change

in majority control of the Company’s Board of Directors (the “Board of Directors”) other than by a meeting

of shareholders.

You are receiving this Information

Statement in connection with the expected designation of new members to the Board of Directors of the Company pursuant to the terms of

a recent transaction involving the Company’s securities. On November 2, 2023, RCF Sponsor VII LLC (the “Sponsor”)

entered into a Securities Purchase Agreement (the “Agreement”) with Perception Capital Partners IV LLC (the

“Buyer”) pursuant to which, among other things, the Buyer will acquire certain of the Sponsor’s (i) Class

A ordinary shares, par value $0.0001 per share of the Company and (ii) private placement warrants. The transactions contemplated by the

Agreement (the “Transactions”) closed on November 6, 2023 (the “Closing” and such

date, the “Closing Date”). In connection with the Closing, the Company implemented the following change in

management and the board: (i) as of the Closing Date, Rick Gaenzle will replace Sunny S. Shah as Chief Executive Officer, Tao Tan will

join the Company as President and John Stanfield will be appointed as Chief Financial Officer and Corporate Secretary of the Company;

and (ii) each of James McClements, Sunny S. Shah, Thomas M. Boehlert, Hugo Dryland, Elodie Grant Goodey, Timothy Baker, and Daniel Malchuk

have tendered their resignation as directors, with such resignation conditioned on the Closing and to be effective as of the Closing

Date. The Company has designated each of Scott Honour, Rick Gaenzle, R. Rudolph Reinfrank,

Thomas J. Abood and Karrie Willis to fill the vacancies left by the departing directors set forth above, effective as of the Closing

Date (such new directors, collectively, the “14F Directors”).

Please read this information

statement carefully. It contains certain biographical and other information concerning the 14F Directors.

THIS INFORMATION STATEMENT IS REQUIRED BY SECTION

14(F) OF THE EXCHANGE ACT AND RULE 14F-1 PROMULGATED THEREUNDER. NO ACTION IS REQUIRED BY OUR SHAREHOLDERS IN CONNECTION WITH THE RESIGNATION

AND APPOINTMENT OF ANY DIRECTOR.

CHANGE IN MAJORITY OF BOARD OF DIRECTORS

The

current directors of the Company immediately prior to the Closing were James McClements, Sunny S. Shah, Thomas M. Boehlert, Hugo

Dryland, Elodie Grant Goodey, Timothy Baker, and Daniel Malchuk. Each of these directors have tendered their resignation as directors,

with such resignation conditioned on the Closing and to be effective as of the Closing Date.

Pursuant

to the Agreement, five individuals, Scott Honour, Rick Gaenzle, R. Rudolph Reinfrank,

Thomas J. Abood and Karrie Willis will replace Messrs. and Mme. James McClements, Sunny

S. Shah, Thomas M. Boehlert, Hugo Dryland, Elodie Grant Goodey, Timothy Baker, and Daniel Malchuk as

directors of the Company.

To the Company’s knowledge,

none of these appointees has been the subject of any bankruptcy petition filed by or against any business of which an appointee was a

general partner or executive officer either at the time of the bankruptcy or within two years prior to that time, been convicted in a

criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses), been subject

to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently

or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking

activities or been found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission (the “SEC”)

or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not

been reversed, suspended or vacated.

No action is required by

our shareholders in connection with this Information Statement.

VOTING SECURITIES

As of the date hereof, our

authorized capitalization consisted of 200,000,000 Class A ordinary shares, of which 18,764,431 shares were issued and outstanding, 20,000,000

Class B ordinary shares, of which one share was issued and outstanding, and 1,000,000 preference shares, of which none were issued and

outstanding.

Ordinary shareholders of

record are entitled to one vote for each share held on all matters to be voted on by shareholders. Holders of Class A ordinary shares

and holders of Class B ordinary shares will vote together as a single class on all matters submitted to a vote of our shareholders except

as required by law.

Our board of directors is

divided into three classes, each of which will generally serve for a term of three years with only one class of directors being appointed

in each year. There is no cumulative voting with respect to the appointment of directors, with the result that the holders of more than

50% of the shares voted for the appointment of directors can appoint all of the directors. In addition, only holders of Class B ordinary

shares will have the right to vote in a vote to continue the company in a jurisdiction outside the Cayman Islands (which requires the

approval of at least two-thirds of the votes of all ordinary share). Our shareholders are entitled to receive ratable dividends when,

as and if declared by the board of directors out of funds legally available therefor.

Because our amended and restated

memorandum and articles of association authorize the issuance of up to 200,000,000 Class A ordinary shares, if we were to enter into

a business combination, we may (depending on the terms of such a business combination) be required to increase the number of Class A

ordinary shares which we are authorized to issue at the same time as our shareholders vote on the business combination to the extent

we seek shareholder approval in connection with our initial business combination.

BENEFICIAL OWNERSHIP OF SECURITIES

The following table sets

forth information regarding the beneficial ownership of the ordinary shares as of immediately prior to the Closing, based on information

obtained from the persons named below, with respect to the beneficial ownership of ordinary shares, by:

| · | each

person known by us to be the beneficial owner of more than 5% of our issued and outstanding

ordinary shares; |

| · | each

of our current executive officers and directors that beneficially owns ordinary shares; |

| · | all

of our current executive officers and directors as a group; |

| · | each

of the new executive officers and 14F Directors; and |

| · | all

of our new executive officers and 14F Directors as a group. ‘ |

As of the Closing Date, there

were a total of 18,764,432 ordinary shares outstanding, of which 18,764,431 are Class A ordinary shares and one is Class B ordinary shares.

Unless otherwise indicated, it is believed that all persons named in the table below have sole voting and investment power with respect

to all ordinary shares beneficially owned by them. The table below does not include any Ordinary Shares underlying our outstanding warrants

because these securities are not exercisable within 60 days of the date hereof.

| | |

Class A ordinary

shares | | |

Class B ordinary

shares | | |

| |

| Name

of Beneficial Owners(1) | |

Number of

Shares

Beneficially

Owned | | |

Approximate

Percentage of

Class | | |

Number of

Shares

Beneficially

Owned | | |

Approximate

Percentage of

Class | | |

Approximate

Percentage of

Voting

Control | |

| Current Directors and Executive Officers | |

| | |

| | |

| | |

| | |

| |

| James McClements(2) | |

| 5,347,499 | | |

| 28.5 | | |

| 1 | | |

| 100 | % | |

| 28.5 | % |

| Sunny S. Shah | |

| 162,500 | | |

| * | | |

| - | | |

| - | | |

| * | |

| Hugo Dryland | |

| 30,000 | | |

| * | | |

| - | | |

| - | | |

| * | |

| Thomas M. Boehlert | |

| 80,000 | | |

| * | | |

| - | | |

| - | | |

| * | |

| Elodie Grant Goodey | |

| 30,000 | | |

| * | | |

| - | | |

| - | | |

| * | |

| Timothy Baker | |

| 30,000 | | |

| * | | |

| - | | |

| - | | |

| * | |

| Daniel Malchuk | |

| | | |

| * | | |

| - | | |

| - | | |

| * | |

| All current officers and directors

as a group (eight individuals) | |

| | | |

| | | |

| | | |

| | | |

| | |

| New

Executive Officers and 14F Directors(1) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Rick Gaenzle | |

| - | | |

| - | | |

| | | |

| | | |

| | |

| John Stanfield | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Tao Tan | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Scott Honour | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| R. Rudolph Reinfrank | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Thomas J. Abood | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Karrie Willis | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| All new executive officers and 14F

Directors as a group (eight individuals) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Five Percent Holders | |

| | | |

| - | | |

| - | | |

| - | | |

| - | |

| RCF VII Sponsor LLC(2) | |

| 5,347,499 | | |

| 28.5 | | |

| 1 | | |

| 100 | % | |

| 28.5 | % |

| Saba Capital Management,

L.P. (3) | |

| 1,623,814 | | |

| 8.7 | | |

| - | | |

| - | | |

| 8.7 | % |

| Adage Capital Partners,

L.P. (4) | |

| 1,800,000 | | |

| 9.6 | | |

| - | | |

| - | | |

| 9.6 | % |

| Calamos Market Neutral Income

Fund, a series of Calamos Investment Trust(5) | |

| 1,500,000 | | |

| 8 | | |

| - | | |

| - | | |

| 8 | % |

| Millennium Management LLC(6) | |

| 1,464,970 | | |

| 7.8 | | |

| - | | |

| - | | |

| 7.8 | % |

| (1) |

Unless otherwise noted, the business address of each of our shareholders

listed is 1400 Wewatta Street, Suite 850, Denver, Colorado 80202. The business address of each of our new executive officers and 14F Directors

is 3109 W 50th St, #207 Minneapolis, MN 55410. |

| (2) |

RCF VII Sponsor LLC, our Sponsor, is the record holder

of such shares. Resource Capital Fund VII L.P. (“RCF VII LP”) is the sole managing member of our Sponsor. Resource Capital

Associates VII L.P. is the General Partner of RCF VII LP, and RCFM GP L.L.C. is the General Partner of Resource Capital Associates

VII L.P. James McClements is the managing member of RCFM GP L.L.C. |

| (3) |

According to a Schedule 13G/A filed on February 13,

2023, interests shown are held by Saba Capital Management, L.P. (“Saba L.P.”), Saba Capital Management GP, LLC (“Saba

GP”) and Boaz R. Weinstein (“Mr. Weinstein”). Mr. Weinstein is the founder and chief investment officer of Saba

Capital Management, L.P. Saba L.P., Saba GP and Mr. Weinstein entered into a joint filing statement, dated November 19, 2021. The

address of this shareholder is 405 Lexington Avenue, 58th Floor, New York, New York 10174. |

| (4) |

According to a Schedule 13G filed on November 25,

2021, interests shown are held by Adage Capital Partners, L.P. (“ACP”), Adage Capital Partners GP, L.L.C. (“ACPGP”),

Adage Capital Advisors, L.L.C. (“ACA”), Mr. Robert Atchinson (“Mr. Atchinson”) and Mr. Philip Gross (“Mr.

Gross”). ACP is a Delaware limited partnership; ACPGP is a limited liability company organized under the laws of the State

of Delaware and general partner of ACP with respect to the Class A ordinary shares directly owned by ACP; ACA is a limited liability

company organized under the laws of the State of Delaware, and managing member of ACPGP, general partner of ACP, with respect to

the Class A ordinary shares directly owned by ACP; and Mr. Atchinson and Mr. Gross are United States citizens who serve as managing

members of ACA, managing members of ACPGP, and general partners of ACP with respect to the Class A ordinary shares directly owned

by ACP. The address of this shareholder is 200 Clarendon Street, 52nd Floor, Boston, Massachusetts 02116. |

| (5) |

According to a Schedule 13G filed on February 8, 2022,

interests shown are held by Calamos Market Neutral Income Fund, a series of Calamos Investment Trust. The address of this shareholder

is 2020 Calamos Court, Naperville, IL 60563. |

| (6) |

According to a Schedule 13G filed on January 19, 2023,

interests shown are held by (i) Millennium Management LLC, a Delaware limited liability company (“Millennium Management”),

Millennium Group Management LLC, a Delaware limited liability company (“Millennium Group Management”), Millennium International

Management LP, a Delaware limited partnership (“Millennium International Management”) and Israel A. Englander, a United

States citizen. Millennium Group Management is the managing member of Millennium Management. The managing member of Millennium Group

Management is a trust of which Mr. Englander, currently serves as the sole voting trustee. The address of this shareholder is 399

Park Avenue, New York, New York 10022. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE

GOVERNANCE

The Company’s Board

of Directors has appointed Scott Honour, Rick Gaenzle, R. Rudolph Reinfrank, Thomas J. Abood

and Karrie Willis as new members of the Board of Directors, conditioned on the Closing.

Under the terms of the Agreement,

the Board of Directors of the Company will consist of five directors, until their successors shall have been duly elected or appointed

and qualified or until their earlier death, resignation or removal in accordance with the Company’s amended and restated articles

of Association.

The following sets forth

information regarding (i) the Company’s officers and directors as of immediately prior to the Closing and (ii) the 14F Directors

and incoming officers. Except with respect to the Agreement, there is no agreement or understanding between the Company and each current

or proposed officer or director pursuant to which he or she was selected as an officer or director.

| Name |

|

Age |

|

Position |

| James McClements |

|

59 |

|

Outgoing Chairman and Director |

| Sunny S. Shah |

|

40 |

|

Outgoing Chief Executive Officer and Director |

| Thomas M. Boehlert |

|

63 |

|

Outgoing Chief Financial Officer and Director |

| Hugo Dryland |

|

67 |

|

Outgoing Director |

| Elodie Grant Goodey |

|

50 |

|

Outgoing Director |

| Timothy Baker |

|

70 |

|

Outgoing Director |

| Daniel Malchuk |

|

57 |

|

Outgoing Director |

| |

|

|

|

|

| Scott Honour |

|

57 |

|

14F Director and Incoming Chairman |

| Rick Gaenzle |

|

58 |

|

14F Director and Incoming Chief

Executive Officer |

| R. Rudolph Reinfrank |

|

68 |

|

14F Director |

| Thomas J. Abood |

|

59 |

|

14F Director |

| Karrie Willis |

|

51 |

|

14F Director |

| |

|

|

|

|

| Tao Tan |

|

38 |

|

Incoming President |

| John Stanfield |

|

41 |

|

Incoming Chief Financial Officer

and Secretary |

The experience of our directors and executive

officers as of immediately prior to the Closing is as follows:

James McClements,

59, has been our Chairman since July 2021. Mr. McClements co-founded RCF in 1998 and has helped to oversee its strategic direction since

its founding. He has over 35 years of experience in the mining industry and, prior to launching RCF, was a natural resources sector banker

at both N.M. Rothschild & Sons and Standard Chartered PLC. Mr. McClements has extensive experience in project identification and

development, valuation, M&A and sourcing capital across both private and public capital markets. He has served on the boards of directors

of eight public mining companies and numerous private portfolio companies. Mr. McClements currently serves on the boards of directors

of three mining companies: (i) Mineral Resources Ltd. (OTCMKTS: MALRF), a mining company with an A$10 billion market capitalization and

a substantial mining services division as well as iron ore and lithium operations; (ii) Ausenco, a global, market-leading engineering

services business and a RCF portfolio company with 26 offices across 14 countries currently executing several new copper mine developments;

and (iii) Global Advance Markets, another RCF portfolio company, which is a leading producer and manufacturer of downstream tantalum

products, with an active additive manufacturing business that Mr. McClements was instrumental in establishing. He began his professional

career with BHP Limited after completing an honors degree in Economics from the University of Western Australia.

Sunny S. Shah,

40, has served as our Chief Executive Officer and as a director on our board of directors since July 2021. Mr. Shah is an experienced

investment banker with over 18 years of global metals and mining advisory experience. From May 2011 to June 2021, he was an investment

banker at Goldman Sachs (NYSE: GS), where most recently he was managing director and head of EMEA Metals and Mining investment banking

division for Goldman Sachs International, as well as manager for all analysts within the EMEA Natural Resources team. Prior to working

at Goldman Sachs, Mr. Shah spent eight years at Citigroup Inc. (NYSE: C) in both London and New York in a similar role. Over his career,

Mr. Shah has executed and advised on over $225 billion in M&A and financing transactions. Selected notable transactions on which

he has advised include: (i) Acerinox, S.A. (OTCMKTS: ANIOY) on its acquisition of VDM, a special metal alloy manufacturer; (ii) Anglo

American PLC (OTCMKTS: NGLOY) (“Anglo American”), on its sale of an equity stake in the Quellaveco Copper Project to Mitsubishi

Corporation (OTCMKTS: MSBHF); (iii) Anglo American, on the sale of its Niobium and Phosphates business for $1.5 billion to China Molybdenum

Co. Ltd (OTCMKTS: CMCLF); (iv) Anglo American, on the sale of its Anglo Norte business, Mantos Copper; (v) BHP Group Ltd. (NYSE: BHP),

on its proposal to combine with Rio Tinto Group (OTCMKTS: RTNTF); and (vi) Arcelor on numerous M&A and financing transactions, including

its recent $2 billion capital raise, its acquisition of Essar Steel India Private Limited as well as the merger between Mittal Steel

and Arcelor. Through his experience, Mr. Shah has developed an extensive global network within the metals and mining industry across

base, battery and ferrous metals as well as downstream steel. He holds a Bachelor of Science (Honors) in Business Mathematics and Statistics

from the London School of Economics.

Thomas M. Boehlert,

63, our Chief Financial Officer, has served on our board of directors since November 2021. Mr. Boehlert is a senior natural resources

and commodity executive with over 20 years of experience across a range of public and private companies. Most recently, from 2017 to

2019, he served as chief financial officer and executive vice president of Bunge, a global agricultural and food company where he designed,

managed and implemented the Global Competitiveness Program to improve business effectiveness and reduce costs and played a key role in

guiding the company through M&A, leadership transitions, financings, and activist investor settlements to drive value creation. Prior

to working at Bunge, Mr. Boehlert served as chief executive officer, president and director at First Nickel Inc. (TSX: FNI), a private

equity-backed base metal mining company, from 2011 to 2015, where he was instrumental in recruiting an experienced leadership team, advancing

a mine from development into production and setting a clear operating strategy. Mr. Boehlert also served as chief financial officer and

executive vice president of Kinross from 2006 to 2011, during which time the market value of Kinross grew from approximately $6 billion

to $20 billion. He has also held chief financial officer roles with Texas Genco, Direct Energy LP and Sithe Energies, Inc. Earlier in

his career, Mr. Boehlert created and led Credit Suisse Group’s EMEA infrastructure and project finance business. He has served

as chair of each of the Audit Committee and the Compensation Committee of the board of directors of Arizona Sonoran Copper Company, Inc.

since 2020. From September 2019 to February 2021, Mr. Boehlert served on the board of directors of TMAC Resources Inc. (TMX: TMR) where

he was chair of the Audit Committee and a member of the Special Committee. He was also previously a member of the board of directors

of Harry Winston Diamond Corp. Mr. Boehlert holds a Master’s of Business Administration degree from New York University and a Bachelor

of Arts degree from Indiana University and is a certified public accountant (inactive).

Hugo Dryland,

67, is a global partner and Chairman of Rothschild & Co’s investment banking activities in the mining and metals sector. Over

a 35-year career at Rothschild & Co, he has worked on a wide range of M&A and financing transactions in the mining and metals,

oil and gas, energy, utilities, and infrastructure sectors across the globe. In particular, he has advised on numerous acquisitions,

divestments, joint ventures, and mine development financings in base metals involving many of the world’s largest copper producers

and mines (including Andina, Los Bronces, Escondida, Collahuasi, Cerro Colorado, Los Pelambres, El Tesoro, Esperanza, Antucoya, Antamina,

Centinela, Quebrada Blanca, Oyu Tolgoi and others). He has also worked on similar transactions involving other battery metals during

his career. Mr. Dryland played an active role in the formation and operation of the Emerging Markets Gold Fund, one of the first mining

industry focused private equity funds, and was later involved in the establishment and early years of operation of RCF. He also served

as a Non-Executive Director on the board of directors of Antofagasta plc (LON: ANTO), the FTSE 100 copper mining company, from 2011 to

2016. Prior to joining Rothschild & Co, he practiced law focusing on M&A, debt and equity financing transactions with a focus

on the natural resources sector. Before that, he worked at the World Bank advising emerging market governments on the promotion of private

sector investment in the extractive industries. Mr. Dryland holds Master’s degrees in Business Administration and Comparative Law

from the University of Warwick and George Washington University, respectively. He was born in the United Kingdom and presently lives

in the United States.

Elodie Grant Goodey,

50, has served on our board of directors since November 2021. Ms. Grant Goodey is a leading ESG professional with over 25 years of senior

leadership and board level experience in social performance, governance, risk assessment, stakeholder engagement and external issues

management across the oil and gas and mining industries. She is currently a managing director with Saltus Consulting Limited, where she

leads ESG consulting projects for the extractive industry in Africa and Latin America, and is also practice lead at International Conflict

and Security (INCAS) Consulting Ltd., where she focuses on human rights compliance and responsible sourcing for the extractive industry.

Prior to these roles, Ms. Grant Goodey worked for over 17 years at BP PLC (NYSE: BP) in a variety of roles including as head of societal

issues and relationships from 2010 to 2015. In this position, she was responsible for leading the identification and management of social

policy issues and stakeholder engagement. Ms. Grant Goodey has served as the senior independent director, chair of the Audit and Risk

Committee, a member of the Remuneration Committee, and chair of the Health, Safety, Environment and Community Committee on the board

of directors of SolGold PLC (OTCMKTS: SLGGF) from 2020-2022 and also serves as a member of the Advisory Board for Celicourt Communications,

a leading communications consultancy based in London. Previously, she was a member of the board of directors of Amerisur Resources (LON:

AMER) and the Extractive Industries Transparency Initiative as well as a member of the FTSE’s ESG Advisory Group. Earlier in her

career, Ms. Grant Goodey held roles with Monitor Deloitte and BBC World Service and has volunteered for a number of human rights nonprofit

organizations. She holds a Bachelor of Arts degree from the University of London and a Diplôme d’études universitaires

générales in History from the Sorbonne.

Timothy Baker,

70, has served on our board of directors since November 2021. Mr. Baker is an experienced corporate director and mining executive with

over 40 years of experience in the mining industry. Mr. Baker served as chief operating officer of Kinross Gold Corporation (NYSE: KGC),

a senior gold mining company with operations in the USA, Chile, Brazil, Russia and West Africa, from 2006 to his retirement in 2010.

Prior to that he worked for nearly 20 years for Placer Dome Inc. (“Placer Dome”) in Canada, Chile, Venezuela, the USA and

Tanzania, culminating as Country Manager for Chile up to the time of Barrick Gold Corporation (NYSE: GOLD)’s acquisition of Placer

Dome. He has subsequently acted as a corporate director for various mining companies. He has been the chairman of the board of Golden

Star Resources Ltd. (NYSE A: GSS) since January 2013 and has been a director of Triple Flag Precious Metals Corp. (TSE: TFPM) since May

2021 and director of Mag Silver Corp. (NYSE A/TSX: MAG) since March 2021, for which he is a member of the Remuneration Committee. He

served as a director of Sherritt International (OTCMKTS: SHERF) from May 2014 to May 2021, where he chaired the EHSS Committee, a director

of Alio Gold Inc. (NYSE A/TSX: ALO) (previously Rye Patch Gold Corp.) from December 2016 to May 2019, where he was a member of the Remuneration

Committee, and a director of Antofagasta PLC (OTCMKTS: ANFGF) from March 2011 to May 2020, where he served as chair of the Remuneration

Committee. Mr. Baker has a Bachelor of Science degree with Honors in Geology from Edinburgh University.

Daniel Malchuk,

57, has served on our board of directors since November 2021. Mr. Malchuk is a seasoned global executive in the metals and mining sector

with over 25 years of experience leading operations, business development and exploration activities as well as commercial transactions

in more than 20 countries. Until December 2020 he served as president of Operations at BHP Group Ltd. (ASX: BHP) with P&L accountability

for all mineral businesses in the Americas region. This portfolio of assets and projects comprises more than 20,000 people, has revenues

of more than $12 billion per year and annual capital expenditures in the order of $2.5 billion with operated and non-operated activities

in Chile, Peru, Ecuador, Brazil, Colombia, the United States and Canada. Prior to that, Mr. Malchuk had a long career with BHP holding

a variety of strategic, commercial, and operational roles in Chile, Singapore, Australia, and the United States including his last eight

years of experience as C-suite executive. Some of his prior roles were president of Aluminium, Manganese and Nickel, president of Global

Mineral Explorations, and vice president of Strategy and Development Base Metals. Mr. Malchuk has had significant exposure to board dynamics,

having served as a member and chair of boards in various JV companies in Australia, Africa, and the Americas, as well as of private entities

and industry associations. Mr. Malchuk is currently a senior advisor to Appian Capital Advisory and serves of the board of directors

of Jetti Resources. Mr. Malchuk has also worked as an investment banker for Dresdner Kleinwort Benson covering the metals and mining

sector. Mr. Malchuk holds an Industrial Engineering degree from University of Chile and a Master’s in Business Administration from

the Anderson School at UCLA.

The experience of our 14F Directors is

as follows:

Scott Honour will serve as the

Chairman of our Board of Directors. Mr. Honour has over 30 years of private equity investment experience and has been involved in over

100 transactions totaling over $20 billion in transaction value. Mr. Honour is the Managing Partner of NPG, a private equity firm, which

he co-founded in 2012. He also serves as Chairman of EVO, the Chairman of Perception Capital Corp. III, and previously served as Chairman

of Perception Capital Corp. II and Sustainable Opportunities Acquisition Corp., the first ESG focused SPAC. Prior to that, Mr. Honour

was at The Gores Group, a Los Angeles-based private equity firm, for 10 years, serving as Senior Managing Director and as one of the

firm’s top executives. Mr. Honour also served on the investment committee for The Gores Group. During his time at The Gores Group,

the firm raised four funds, totaling $4 billion in aggregate, and made over 35 investments. Prior to joining The Gores Group, Mr. Honour

was a Managing Director at UBS Investment Bank from 2000 to 2002 and was an investment banker at Donaldson, Lufkin & Jenrette from

1991 to 2000. Mr. Honour began his career at Trammell Crow Company in 1988. Mr. Honour has served on the board of directors of numerous

public and private companies, including Anthem Sports & Entertainment Inc., 1st Choice Delivery, United Language Group, Renters Warehouse,

Real Dolmen (REM:BB) and Westwood One, Inc. (formerly Nasdaq: WWON), and is a co-founder of Titan CNG LLC and YapStone Inc. Mr. Honour

earned a B.S. and B.A., cum laude, in Business Administration and Economics from Pepperdine University and an M.B.A. in Finance and Marketing

from the Wharton School of the University of Pennsylvania.

Rick Gaenzle will serve as our

Chief Executive Officer and director. Mr. Gaenzle has over 30 years of private equity investment and corporate finance experience; he

is a co-founder and currently serves as a Managing Director of Gilbert Global Equity Capital, L.L.C., the principal investment advisor

to Gilbert Global Equity Partners, L.P. and related entities, a $1.2 billion leveraged buyout and private equity fund. Mr. Gaenzle has

spent the last 28 years at Gilbert Global and its predecessor entity, completing over 110 direct equity investments, co-investments and

add-on acquisitions for portfolio companies. He also serves as the Chief Executive Officer and a member of the board of directors of

Perception Capital Corp. III, and previously served in that same role on Perception Capital Corp. II. Previously, Mr. Gaenzle was a Principal

of Soros Capital L.P., the principal venture capital and leveraged equity entity of the Quantum Group of Funds and a principal advisor

to Quantum Industrial Holdings Ltd. Prior to joining Soros Capital, Mr. Gaenzle held various positions at PaineWebber Inc. Mr. Gaenzle

currently serves as an Operating Partner of NPGand Chairman of Lake Street Homes, a single-family rental investment vehicle. Mr. Gaenzle

previously served on the boards of CPM Holdings, Inc., True Temper Corp, Optical Capital Group, Inc., Birch Telecommunications, Inc.,

E-via S.p.A., Tinka-ServiCos de Consultoria, S.A., the LaserSharp Corporation and Sustainable Opportunities Acquisition Corp. (“SOAC”),

where he also served as Chairman of the Audit Committee. Mr. Gaenzle holds a B.A. from Hartwick College and an M.B.A. from Fordham University.

R. Rudolph Reinfrank will serve

on our Board of Directors. Mr. Reinfrank is the Managing General Partner of Riverford Partners, LLC, a strategic advisory and investment

firm which acts as an investor, board member and strategic advisor to growth companies and companies in transition. Prior to founding

Riverford, Mr. Reinfrank was a co-founder and a Managing General Partner of Clarity Partners L.P., an $800 million private equity firm

focused on media and communications, and a co-founder of Clarity China, L.P., a $220 million private equity partnership with investments

in Greater China. Prior to joining Clarity, he was a co-founder and a Managing General Partner of Rader Reinfrank & Co., a private

equity fund. His prior experience includes roles as an executive, investor, and advisor across a wide range of industries for the Roy

E. Disney and Marvin Davis families. Mr. Reinfrank is a member of the board of directors of MidCap Financial Investment Corp. (formerly

Apollo Investment Corporation), a registered investment company and publicly-traded financial services company. Mr. Reinfrank is also

a member of the board of directors of Perception Capital Corp. II, Mount Logan Capital, a publicly traded Canadian based asset manager.

Mr. Reinfrank is a Senior Advisor to Grafine Partners and an Operating Partner of Nile Capital Group, both private asset management firms.

Until 2021, Mr. Reinfrank was a Senior Advisor to BC Partners, a private equity and credit firm. Until November 2018, Mr. Reinfrank was

a member of the board of directors of Kayne Anderson Acquisition Corp., and chairman of its audit committee and a member of its compensation

committee. Mr. Reinfrank earned a B.A. from Stanford University and an M.B.A from the UCLA Graduate School of Management.

Thomas J. Abood will serve on our

Board of Directors. From September 2019 to September 2022, Mr. Abood was CEO and a director of EVO, a national trucking firm serving

the USPS and other freight customers. Currently, he sits on the board of directors of Nelson Worldwide Holdings, a national architecture,

engineering and interior design firm, Perception Capital Corp. II, and SBH Funds, a mutual fund complex sponsored by Segall Bryant and

Hamill. From 1994 to 2014, Mr. Abood was an owner and Executive Vice President, General Counsel and Secretary of Dougherty Financial

Group LLC. From 1988 to 1994, Mr. Abood was an associate with the law firm of Skadden Arps. Mr. Abood is past Chair of the Archdiocesan

Finance Council and Corporate Board of the Archdiocese of St. Paul and Minneapolis, past Chair of the board of directors and executive

committee member of Citation Jet Pilots, Inc. owner pilot association, past Chair of the Board and director of MacPhail Center for Music,

past Chair of the Board and governor of the University of St. Thomas School of Law, past Chair of the Board and director of the Minnesota

Children’s Museum and past President and Governor of The Minikahda Club. Mr. Abood received his J.D. from Georgetown University

Law Center, cum laude and his B.B.A. from the University of Notre Dame, magna cum laude.

Karrie Willis will serve on our

Board of Directors. Ms. Willis is the CFO of SMITH, a full-service digital agency with expertise in commerce, technology, custom architecture

and software development. Prior to joining SMITH in 2020, Ms. Willis was the CFO of United Language Group, where she worked for four

years. Currently, she is an independent board member and chair of the audit committee of Perception Capital Corp. II, as well as MSA

Engineering, a board member and treasurer of The Heroes Journey and executive chair of the Diversity & Inclusion Committee of SMITH,

where she also attends all board meetings and presents content as a non-board member. During Ms. Willis’ tenure at United Language

Group, she attended all board meetings and presented content as a non-board member. Ms. Willis has over 25 years of experience in financial

and board leadership in private, private-equity and family fund sponsored structures. She earned a B.S. in Accounting from the University

of Wisconsin LaCrosse and is licensed as a Certified Public Accountant in Minnesota.

Tao Tan will serve as our President.

Mr. Tan has nearly 15 years of experience across finance, strategy and business transformation. He serves as Co-President of Perception

Capital Corp. III, and previously served as Co-President of Perception Capital Corp. II. Prior to joining Perception, Mr. Tan was an

officer and a senior advisor to multiple investing and operating entities. Until 2020, Mr. Tan was an Associate Partner at McKinsey &

Company’s New York office. At McKinsey, Mr. Tan led teams across the firm’s transformation and private equity & principal

investor practices, where he drove comprehensive performance transformation and turnaround programs for companies with revenues ranging

from $200 million to $25 billion across multiple industries and continents. Most recently, Mr. Tan helped found, launch and lead McKinsey’s

SPAC service line, and served in a leadership role in McKinsey’s COVID-19 client response team. Prior to McKinsey, Mr. Tan was

a Senior Associate at Rose Tech Ventures, where he led the firm’s first-round investment in JUMP Bikes, which was subsequently

sold to Uber in 2018. Prior to Rose Tech Ventures, Mr. Tan served in investment banking and capital markets roles at Bank of America

Merrill Lynch and Lehman Brothers. Mr. Tan is a member of the Council on Foreign Relations and of the Economic Club of New York. Mr.

Tan received his B.A. and his M.B.A, both with honors, from Columbia University in the City of New York, where he was an Erwin Wolfson

Scholar and a Toigo Foundation Fellow.

John Stanfield will serve as our

Chief Financial Officer. Mr. Stanfield, age 42, has significant experience with U.S. GAAP, finance,

operations, and taxation demonstrated over several years and several billion dollars of enterprise value in the private equity and alternative

asset industry. He has been a Certified Public Accountant since 2006, and has served as senior principal with Stanfield & Associates,

a public accounting firm specializing in the private equity industry and international taxation, since 2011. Mr. Stanfield has also served

as Chief Executive Officer at Aequum Capital, LLC, a tech-enabled commercial lender, since August 2023 and Chief Financial Officer at

Welsbach Technology Metals Acquisition Corp. (Nasdaq:WTMAU) since December 2021. He held the role of Co-President at Aequum from September

2021 to August 2023. Previously, he served as Chief Executive Officer of Lorem LLC, a provider of accounting services for special purpose

acquisition companies, from May 2021 to September 2022, and as Chief Financial Officer at LQD Business Finance, a national fintech startup,

from 2018 to September 2020. Mr. Stanfield holds a B.A. and an M.S.T. from the University of Illinois Urbana-Champaign and an M.S.A from

DePaul University.

Involvement in Certain Legal Proceedings

To

the knowledge of our management, there was no material proceeding to which any 14F Director or new executive officer, or any associate

thereof, is a party adverse to us or has a material interest adverse to us.

Number and Terms

of Office of Officers and Directors

Our

board of directors is divided into three classes, with only one class of directors being elected in each year, and with each class (except

for those directors appointed prior to our first annual meeting of shareholders) serving a three-year term. In accordance with NYSE corporate

governance requirements, we are not required to hold an annual general meeting until one year after our first fiscal year end following

our listing on the NYSE. There is no requirement under the Companies Act for us to hold annual or extraordinary general meetings or appoint

directors. We may not hold an annual general meeting to appoint new directors prior to the consummation of our initial business combination.

Following the Closing Date, the term of office of the first class of directors, consisting of R. Rudolph Reinfrank and Thomas J. Abood,

will expire at our first annual meeting of shareholders. The term of office of the second class of directors, consisting of Scott Honour

and Karrie Willis, will expire at our second annual meeting of shareholders. The term of office of the third class of directors, consisting

of Rick Gaenzle, will expire at our third annual meeting of shareholders.

Our

officers are appointed by the Board of Directors and serve at the discretion of the Board of Directors, rather than for specific terms

of office. Our Board of Directors is authorized to appoint persons to the offices set forth in our amended and restated memorandum and

articles of association as it deems appropriate. Our amended and restated memorandum and articles of association provides that the Board

of Directors may, at any time prior to the time appointed for the meeting to commence, appoint any person to act as chairman of a general

meeting of the Company or, if the Directors do not make any such appointment, the chairman, if any, of the board of Directors shall preside

as chairman at such general meeting.

Director Independence

NYSE

listing standards require that a majority of our board of directors be independent. In connection with the Closing, we expect that our

Board of Directors will determine that R. Rudolph Reinfrank, Thomas Abood and Karrie Willis will be “independent directors”

as defined in the NYSE listing standards. Our independent directors have regularly scheduled meetings at which only independent directors

are present.

Board Committees

Audit Committee

We

have established an audit committee of our Board of Directors. R. Rudolph Reinfrank, Thomas Abood, and Karrie Willis will serve as members

of our audit committee and Mr. Reinfrank will serve as the chair of the audit committee. Following the Closing, we expect that each member

of the audit committee will be independent under the NYSE listing standards and applicable SEC rules. Additionally, we expect each member

of the audit committee will be financially literate and that our Board of Directors will determine that R. Rudolph Reinfrank will qualify

as an “audit committee financial expert” as defined in applicable SEC rules.

We

have adopted an audit committee charter, which details the principal functions of the audit committee, including:

| ● | assisting board

oversight of (1) the integrity of our financial statements, (2) our compliance

with legal and regulatory requirements, (3) our independent registered public accounting

firm’s qualifications and independence, and (4) the performance of our internal

audit function and independent auditors; the appointment, compensation, retention, replacement,

and oversight of the work of the independent auditors and any other independent registered

public accounting firm engaged by us; |

| ● | pre-approving all

audit and non-audit services to be provided by the independent auditors or any other

registered public accounting firm engaged by us, and establishing pre-approval policies

and procedures; reviewing and discussing with the independent auditors all relationships

the auditors have with us in order to evaluate their continued independence; |

| ● | setting clear

policies for audit partner rotation in compliance with applicable laws and regulations; obtaining

and reviewing a report, at least annually, from the independent registered public accounting

firm describing (1) the independent auditor’s internal quality-control procedures

and (2) any material issues raised by the most recent internal quality-control review,

or peer review, of the audit firm, or by any inquiry or investigation by governmental or

professional authorities, within the preceding five years respecting one or more independent

audits carried out by the firm and any steps taken to deal with such issues; |

| ● | meeting to review

and discuss our annual audited financial statements and quarterly financial statements with

management and the independent auditor, including reviewing our specific disclosures under

“Management’s Discussion and Analysis of Financial Condition and Results of Operations”;

reviewing and approving any related party transaction required to be disclosed pursuant to

Item 404 of Regulation S-K promulgated by the SEC prior to us entering into

such transaction; and |

| ● | reviewing with

management, the independent auditors, and our legal advisors, as appropriate, any legal,

regulatory or compliance matters, including any correspondence with regulators or government

agencies and any employee complaints or published reports that raise material issues regarding

our financial statements or accounting policies and any significant changes in accounting

standards or rules promulgated by the Financial Accounting Standards Board, the SEC or other

regulatory authorities |

Nominating and

Corporate Governance Committee

We

have adopted a nominating and corporate governance committee of the Board of Directors. Upon their appointments R. Rudolph Reinfrank,

Thomas Abood and Karrie Willis will serve as members of our nominating and corporate governance committee and Mr. Reinfrank will serve

as the chair of the nominating and corporate governance committee. We expect that our board of directors will determine that each member

of the nominating committee is independent.

We have adopted a nominating and corporate governance

committee charter, which details the purpose and responsibilities of the nominating and corporate governance committee, including:

| ● | identifying, screening

and reviewing individuals qualified to serve as directors, consistent with criteria approved

by the board, and recommending to the board of directors candidates for nomination for election

at the annual meeting of shareholders or to fill vacancies on the board of directors; |

| ● | developing and

recommending to the board of directors and overseeing implementation of our corporate governance

guidelines; |

| ● | coordinating and

overseeing the annual self-evaluation of the board of directors, its committees, individual

directors and management in the governance of the company; and |

| ● | reviewing on a

regular basis our overall corporate governance and recommending improvements as and when

necessary. |

The charter also provides that the nominating and corporate governance

committee may, in its sole discretion, retain or obtain the advice of, and terminate, any search firm to be used to identify director

candidates, and will be directly responsible for approving the search firm’s fees and other retention terms.

Guidelines for Selecting

Director Nominees

We have not formally

established any specific, minimum qualifications that must be met or skills that are necessary for directors to possess. In general,

in identifying and evaluating nominees for director, the board of directors considers educational background, diversity of professional

experience, knowledge of our business, integrity, professional reputation, independence, wisdom, and the ability to represent the best

interests of our shareholders. Prior to our initial business combination, holders of our public shares will not have the right to recommend

director candidates for nomination to our board of directors.

Compensation Committee

We

have established a compensation committee of the Board of Directors. Thomas Abood, R. Rudolph Reinfrank and Karrie Willis will serve

as members of our compensation committee and Mr. Abood will serve as the chair of the compensation committee. Under the NYSE listing

standards, we are required to have a compensation committee composed entirely of independent directors. We expect that our Board of Directors

will determine that each member of the compensation committee is independent.

We have adopted a compensation committee charter,

which details the principal functions of the compensation committee, including:

| ● | reviewing and

approving on an annual basis the corporate goals and objectives relevant to our chief executive

officer’s compensation, evaluating our chief executive officer’s performance

in light of such goals and objectives and determining and approving the remuneration (if

any) of our chief executive officer based on such evaluation; |

| ● | reviewing and

making recommendations to our board of directors with respect to the compensation, and any

incentive compensation and equity based plans that are subject to board approval of all of

our other officers; |

| ● | reviewing our

executive compensation policies and plans; |

| ● | implementing and

administering our incentive compensation equity-based remuneration plans; |

| ● | assisting management

in complying with our proxy statement and annual report disclosure requirements; |

| ● | approving all

special perquisites, special cash payments and other special compensation and benefit arrangements

for our officers and employees; |

| ● | producing a report

on executive compensation to be included in our annual proxy statement; and |

| ● | reviewing, evaluating

and recommending changes, if appropriate, to the remuneration for directors. |

The

charter also provides that the compensation committee may, in its sole discretion, retain or obtain the advice of a compensation consultant,

independent legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work

of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other

adviser, the compensation committee will consider the independence of each such adviser, including the factors required by NYSE and the

SEC.

Compensation Committee Interlocks and Insider

Participation

To

the Company’s knowledge, none of the new officers currently serves, and in the past year has not served, as a member of the Board

of Directors or compensation committee of any entity that has one or more officers serving on our Board of Directors.

Code of Ethics and

Committee Charters

We

have adopted a Code of Business Conduct and Ethics applicable to our directors, officers and employees. We have filed a copy of our Code

of Business Conduct and Ethics as an exhibit to our registration statement in connection with the Public Offering. You are able to review

this document by accessing our public filings at the SEC’s web site at www.sec.gov. In addition, a copy of the Code

of Business Conduct and Ethics and the charters of the committees of our board of directors will be provided without charge upon request

from us. If we make any amendments to our Code of Business Conduct and Ethics other than technical, administrative or other non-substantive amendments,

or grant any waiver, including any implicit waiver, from a provision of the Code of Business Conduct and Ethics applicable to our principal

executive officer, principal financial officer principal accounting officer or controller or persons performing similar functions requiring

disclosure under applicable SEC or NYSE rules, we will disclose the nature of such amendment or waiver on our website.

Delinquent Beneficial Ownership Reports

Section

16(a) of the Exchange Act requires our officers, directors and persons who beneficially own more than 10% of our ordinary shares to file

reports of ownership and changes in ownership with the SEC. These reporting persons are also required to furnish us with copies of all

Section 16(a) forms they file. To the Company’s knowledge, during the year ended December 31, 2022, there were no delinquent filers.

EXECUTIVE COMPENSATION

Executive Officer and Director Compensation

After

the completion of our initial business combination, directors or members of our management team who remain with us may be paid consulting

or management fees from the combined company. All of these fees will be fully disclosed to shareholders, to the extent then known, in

the proxy solicitation materials or tender offer materials furnished to our shareholders in connection with a proposed business combination.

We have not established any limit on the amount of such fees that may be paid by the combined company to our directors or members of

management. It is unlikely the amount of such compensation will be known at the time of the proposed business combination, because the

directors of the post-combination business will be responsible for determining officer and director compensation. Any compensation to

be paid to our officers will be determined, or recommended to the board of directors for determination, either by a compensation committee

constituted solely by independent directors or by a majority of the independent directors on our board of directors.

We

do not intend to take any action to ensure that members of our management team maintain their positions with us after the consummation

of our initial business combination, although it is possible that some or all of our officers and directors may negotiate employment

or consulting arrangements to remain with us after our initial business combination. The existence or terms of any such employment or

consulting arrangements to retain their positions with us may influence our management’s motivation in identifying or selecting

a target business but we do not believe that the ability of our management to remain with us after the consummation of our initial business

combination will be a determining factor in our decision to proceed with any potential business combination. We are not party to any

agreements with our officers and directors that provide for benefits upon termination of employment.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Related Party Transactions

None

of the 14F Directors have had or will have a direct or indirect material interest in any transaction required to be disclosed by the

Company under Item 404(a) of Regulation S-K.

Policy for Approval

of Related Party Transactions

The

audit committee of our Board of Directors has adopted a charter, providing for the review, approval and/or ratification of “related

party transactions,” which are those transactions required to be disclosed pursuant to Item 404 of Regulation S-K as promulgated

by the SEC, by the audit committee. At its meetings, the audit committee shall be provided with the details of each new, existing, or

proposed related party transaction, including the terms of the transaction, any contractual restrictions that the Company has already

committed to, the business purpose of the transaction, and the benefits of the transaction to the Company and to the relevant related

party. Any member of the committee who has an interest in the related party transaction under review by the committee shall abstain from

voting on the approval of the related party transaction, but may, if so requested by the chairman of the committee, participate in some

or all of the committee’s discussions of the related party transaction. Upon completion of its review of the related party transaction,

the committee may determine to permit or to prohibit the related party transaction.

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

The Company is subject to

the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements and other information

including annual and quarterly reports on Forms 10-K and 10-Q, respectively, with the SEC. Copies of such material can be obtained on

the SEC’s website (http://www.sec.gov) that contains the filings of issuers with the SEC through the EDGAR system.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Company has duly caused this information statement on Schedule 14f-1 to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

RCF ACQUISITION CORP. |

| |

|

| |

Dated: |

November 9, 2023 |

| |

|

|

| |

By: |

/s/ Rick Gaenzle |

| |

|

Rick Gaenzle |

| |

|

Chief Executive Officer |

15

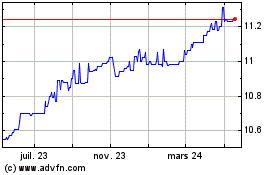

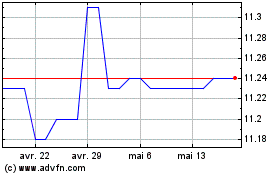

Perception Capital Corp IV (NYSE:RCFA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Perception Capital Corp IV (NYSE:RCFA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024