0001846975

false

--12-31

0001846975

2023-10-27

2023-10-27

0001846975

SEDAU:UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember

2023-10-27

2023-10-27

0001846975

SEDAU:ClassOrdinarySharesParValue0.0001PerShareMember

2023-10-27

2023-10-27

0001846975

SEDAU:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2023-10-27

2023-10-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 31, 2023 (October 27, 2023)

SDCL EDGE Acquisition Corp

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40980 |

|

98-1583135 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

60 East 42nd Street, Suite 1100,

New York, NY |

|

10165 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(212) 488-5509

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

SEDA.U |

|

New York Stock Exchange LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

SEDA |

|

New York Stock Exchange LLC |

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

SEDA.WS |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On October 27, 2023, SDCL EDGE Acquisition Corp (the “Company”) and Continental Stock Transfer & Trust Company (“CST”) entered into an amendment (the “Trust Agreement Amendment”) to the Investment Management Trust Agreement, dated as of October 28, 2021, relating to the Company’s Trust Account to permit CST, as trustee, to effectuate the Company’s instructions to liquidate the U.S. government securities or money market funds previously held in the Trust Account and to subsequently hold such funds in an interest-bearing demand deposit bank account.

The foregoing summary of the Trust Agreement Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Trust Agreement Amendment filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 3.03 Material Modification to Rights of Security Holders.

The information disclosed in Item 5.07 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03 to the extent required herein.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information disclosed in Item 5.07 of this Current Report on Form 8-K under the heading “Proposal 1” is incorporated by reference into this Item 5.03 to the extent required herein.

Item 5.07 Submission of Matters to a Vote of Security Holders.

Extraordinary General Meeting

On October 30, 2023, the Company held an extraordinary general meeting (the “Extraordinary General Meeting”), at which holders of 17,164,852 ordinary shares, comprised of 14,345,520 Class A ordinary shares, par value $0.0001 per share of the Company (“Class A ordinary shares”), and 2,819,332 Class B ordinary shares, par value $0.0001 per share of the Company (“Class B ordinary shares,” and together with the Class A ordinary shares, the “ordinary shares”), were present in person or by proxy, representing approximately 68.7% of the voting power of the 24,994,057 issued and outstanding ordinary shares of the Company, comprised of 19,995,246 Class A ordinary shares and 4,998,811 Class B ordinary shares, entitled to vote at the Extraordinary General Meeting at the close of business on September 27, 2023, which was the record date (the “record date”) for the Extraordinary General Meeting. Shareholders of record as of the close of business on the record date are referred to herein as “shareholders.”

In connection with the Extension, a total of 44

shareholders have elected to redeem an aggregate of 6,817,313 Class A ordinary shares, representing approximately 34.1% of the

issued and outstanding Class A ordinary shares. As a result, $72,546,419.86 will be paid out of the Company’s Trust Account in

connection with the redemptions, representing a redemption price per Class A ordinary share of approximately $10.64. A

summary of the voting results at the Extraordinary General Meeting for each of the proposals is set forth below.

Proposal 1

The shareholders approved, by special resolution, the proposal to amend the Company’s Amended and Restated Memorandum and Articles of Association (the “Charter”) to extend the date by which the Company must (1) consummate a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses or entities (an “initial business combination”) or (2) (i) cease its operations except for the purpose of winding up if it fails to complete such initial business combination and (ii) redeem all of the Class A ordinary shares included as part of the units sold in the Company’s initial public offering that was consummated on November 2, 2021 (the “IPO”), from November 2, 2023 to March 2, 2024 (the “Extended Date”) and to allow the board of directors of the Company, without another shareholder vote, to elect to further extend the date to consummate an initial business combination after the Extended Date up to four times, by an additional month each time, upon two days’ advance notice prior to the applicable deadline, up to July 2, 2024 (the “Extension Proposal”). The voting results for such proposal were as follows:

| For |

|

Against |

|

Abstain |

|

Broker Non-Votes |

| 16,619,547 |

|

545,300 |

|

5 |

|

N/A |

On October 30, 2023, to effectuate the Extension, the Company filed with the Cayman Islands Registrar of Companies the amendment to the amended and restated memorandum and articles of association of the company (the “Charter amendment”). The foregoing description of the Charter amendment does not purport to be complete and is qualified in its entirety by the terms of the Charter amendment, a copy of which is attached hereto as Exhibit 3.1 and incorporated herein by reference.

Proposal 2

The proposal to adjourn the Extraordinary General Meeting to a later date or dates, if necessary or convenient, to permit further solicitation and vote of proxies in the event that there were insufficient votes for, or otherwise in connection with, the approval of the Extension Proposal, was not presented at the Extraordinary General Meeting, as the Extension Proposal received a sufficient number of votes required for approval.

Item 7.01 Regulation FD Disclosure.

On

October 31, 2023, the Company issued a press release regarding the matters discussed in Item 5.07, a copy of which is attached hereto

as Exhibit 99.1.

The

information in this Item 7.01 and in Exhibit 99.1 attached hereto is furnished pursuant to the rules and regulations of the SEC and shall

not be deemed “filed” for purposes of Section 18 of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the U.S.

Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SDCL EDGE Acquisition Corp |

| |

|

|

| Date: October 31, 2023 |

|

|

| |

|

|

| |

By: |

/s/ Ned Davis |

| |

Name: |

Ned Davis |

| |

Title: |

Chief Financial Officer |

Exhibit 3.1

Registrar of Companies

Government Administration Building

133 Elgin Avenue

George Town

Grand Cayman

SDCL EDGE Acquisition Corporation (ROC # 371727) (the “Company”)

TAKE NOTICE that by the minutes of the extraordinary general

meeting of the Company dated 30 October 2023, the following special resolution was passed:

Proposal No. 1

RESOLVED, as a special resolution, that the Memorandum

and Articles be amended by amending Article 50.7, by deleting the words:

“In the event that the Company does not

consummate a Business Combination within 24 months from the consummation of the IPO, or such later time as the Members may approve in

accordance with the Articles, the Company shall:”; and replacing them with the words:

“In the event that the Company does not consummate a Business

Combination by (i) March 2, 2024 or (ii) July 2, 2024, in the event that the Directors resolve by resolutions of the board of Directors,

to extend the amount of time to complete a Business Combination for up to four (4)times for an additional one (1) month each time after

March 2, 2024, or such later time as the Members may approve in accordance with the Articles, the Company shall:”.

| /s/ Simeon Dandie |

|

| Simeon Dandie |

|

| Corporate Administrator |

|

| for and on behalf of |

|

| Maples Corporate Services Limited |

|

Dated this 30th day of October 2023

Exhibit

10.1

AMENDMENT

NO. 1 TO INVESTMENT MANAGEMENT TRUST AGREEMENT

THIS

AMENDMENT NO. 1 TO THE INVESTMENT MANAGEMENT TRUST AGREEMENT (this “Amendment”) is made as of October 27,

2023, by and between SDCL EDGE Acquisition Corporation, a Cayman Islands exempted company (the “Company”),

and Continental Stock Transfer & Trust Company, a New York corporation (the “Trustee”). Capitalized

terms contained in this Amendment, but not specifically defined in this Amendment, shall have the meanings ascribed to such terms

in the Original Agreement (as defined below).

WHEREAS,

on November 2, 2021, the Company consummated its initial public offering of units of the Company (the “Units”),

each of which is composed of one of the Company’s Class A ordinary shares, par value $0.0001 per share (the “Ordinary

Shares”), and one-half of one redeemable warrant, each whole warrant entitling the holder thereof to purchase one

Ordinary Share of the Company (such initial public offering hereinafter referred to as the “Offering”);

WHEREAS,

$201,951,985 of the gross proceeds of the Offering and sale of the private placement warrants, over-allotment Units and over-allotment

warrants were delivered to the Trustee to be deposited and held in the segregated Trust Account located at all times in the United

States for the benefit of the Company and the holders of the Ordinary Shares included in the Units issued in the Offering pursuant

to the Investment Management Trust Agreement made effective as of October 28, 2021, by and between the Company and the Trustee

(the “Original Agreement”); and

WHEREAS,

the parties desire to amend the Original Agreement to, among other things, reflect the amendment to the Original Agreement contemplated

by the Trust Amendment.

NOW,

THEREFORE, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree as follows:

1. Amendments

to Trust Agreement

(a) Sections 1(c)

of the Original Agreement are hereby amended and restated to read in their entirety as follows:

1. Agreements

and Covenants of Trustee. The Trustee hereby agrees and covenants to:

(c)

In a timely manner, upon the written instruction of the Company, i) hold funds uninvested, ii) hold funds in an interest-bearing

bank demand deposit account, or iii) invest and reinvest the Property in solely United States government securities within the

meaning of Section 2(a)(16) of the Investment Company Act of 1940, as amended, having a maturity of 185 days or less, or in

money market funds meeting the conditions of paragraphs (d)(1), (d)(2), (d)(3) and (d)(4) of Rule 2a-7 promulgated under the

Investment Company Act of 1940, as amended (or any successor rule), which invest only in direct U.S. government treasury obligations,

as determined by the Company; the Trustee may not invest in any other securities or assets, it being understood that the Trust

Account will earn no interest while account funds are uninvested awaiting the Company’s instructions hereunder and while

invested or uninvested, the Trustee may earn bank credits or other consideration.

2. Miscellaneous

Provisions.

(a) Entire

Agreement. The Original Agreement, as modified by this Amendment, constitutes the entire understanding of the parties and supersedes

all prior agreements, understandings, arrangements, promises and commitments, whether written or oral, express or implied, relating

to the subject matter hereof, and all such prior agreements, understandings, arrangements, promises and commitments are hereby

canceled and terminated.

Signatures

on following page.

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first above written.

| |

CONTINENTAL

STOCK TRANSFER AND TRUST COMPANY, as Trustee |

| |

| |

| |

By: | /s/

Francis Wolf |

| |

Name: | Francis

Wolf |

| |

Title: | Vice

President |

| |

SDCL

EDGE Acquisition Corporation |

| |

| |

| |

By: | /s/

Ned Davis |

| |

Name: | Ned

Davis |

| |

Title: | Chief

Financial Officer |

Exhibit 99.1

SDCL EDGE Acquisition

Corporation Announces Shareholder Approval of Extension of Deadline

to Complete Business Combination

NEW YORK, NY, October 31, 2023 – SDCL EDGE Acquisition Corporation (the “Company”) announced today that at a special meeting of the shareholders of the Company held on October 30, 2023, the shareholders have approved the proposal to extend the date by which the Company must (1) consummate an initial business combination or (2) (i) cease its operations except for the purpose of winding up if it fails

to complete such initial business combination and (ii) redeem all of the Class A ordinary

shares, par value $0.0001 per share, of the Company (the “Class A Ordinary Shares”)

included as part of the units sold in the Company’s initial public offering that was consummated on November 2, 2021 (the “IPO”), from November 2, 2023 to March 2, 2024 (the “Extended Date”) and to allow the board of directors of the Company, without

another shareholder vote, to elect to further extend the date to consummate an initial

business combination after the Extended Date up to four times, by an additional month

each time, upon two days’ advance notice prior to the applicable deadline, up to July 2, 2024 (together with the Extended Date the “Extension”, and such proposal the “Extension Proposal”).

Approximately 96.8% of the votes cast on the Extension Proposal by holders of the Company’s ordinary shares, total votes cast representing approximately 68.7% of the Company’s ordinary shares issued and outstanding, voted to approve the Extension Proposal.

The Company is also pleased to announce that following the Extension, the Company has maintained 65.9% of the capital in its trust account, with 13,177,933 Class A Ordinary Shares remaining in float. Market averages for redemptions post extension are around 75%, and the Company’s lower redemptions represent a standout case in the market.

The purpose of the Extension is to allow the Company more time to complete an initial

business combination. The Company, as previously announced, has entered into a non-binding letter of intent

with Magnet Joint Venture GmbH (“JV GmbH”), KME SE (“KME”) and The Paragon Fund III

GmbH & Co. geschlossene Investment KG (“Paragon”), for a proposed business combination

(the “Business Combination”) relating to Cunova GmbH, a wholly-owned subsidiary of JV GmbH (“Cunova”), and certain assets of KME comprising KME’s Aerospace Business (“KME Aerospace” and, together with Cunova, the “Target”). Under the terms of the LOI, KME is expected to hold a majority stake in the post-Business Combination entity whose

share capital is expected to be listed on the New York Stock Exchange. The Company anticipates announcing additional details at the time of execution of the definitive agreements (“Definitive Agreements”) for the Business Combination.

The completion of the Business Combination is subject to, among other things, the

completion of due diligence, the negotiation of the Definitive Agreements, satisfaction of the conditions negotiated therein, approval of the transaction by the board and shareholders of both the Company and

Target, as well as regulatory approvals and other customary conditions. There can be no assurance that Definitive Agreements will be entered into or that

the Business Combination will be consummated on the terms or timeframe currently contemplated,

or at all.

About SDCL EDGE Acquisition Corporation

SDCL EDGE Acquisition Corporation is a blank check company formed for the purpose

of effecting a merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more businesses. The Company

intends to focus on opportunities created by the rapid shift towards energy efficient and decentralized energy solutions for a lower

carbon economy and, in particular, for the built environment and transport sectors.

About Cunova and KME Aerospace

Cunova and KME Aerospace are two specialty metals businesses, producing critical components

for the processes of offtakers in the industrials and maritime, and aerospace sectors,

respectively. Cunova is a wholly-owned subsidiary of JV GmbH and KME Aerospace is entirely owned by KME. For KME Aerospace, the LOI contemplates that

the same will be transferred to Cunova or an affiliate of the post-Business Combination entity prior to the consummation of the Business Combination.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent, or authorization

with respect to any securities or in respect of the proposed transaction. This press

release shall also not constitute an offer to sell or the solicitation of an offer

to buy any securities, nor shall there be any sale of securities in any states or

jurisdictions in which such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the

requirements of the U.S. Securities Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements

of historical fact included in this press release are forward-looking statements.

When used in this press release, words such as “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “will,” and similar expressions, as they relate to us or our management team, identify forward-looking

statements. Such forward-looking statements are based on the beliefs of management,

as well as assumptions made by, and information currently available to, the Company’s management. Actual results could differ materially from those contemplated by the forward-looking

statements as a result of certain factors detailed in the Company’s filings with the Securities and Exchange Commission (the “SEC”). All subsequent written or oral forward-looking statements attributable to us or persons

acting on our behalf are qualified in their entirety by this paragraph. Forward-looking

statements are subject to numerous conditions, many of which are beyond the control

of the Company, including those set forth in the Risk Factors section of the Company’s filings with the SEC. Copies of such filings are available on the SEC’s website, www.sec.gov. The Company undertakes no obligation to update these statements

for revisions or changes after the date of this release, except as required by law.

Contacts

Ned Davis

Chief Financial Officer, SDCL EDGE Acquisition

Corporation

Telephone: (212) 488-5509

Email: ned.davis@sdclgroup.com

Francesca Lorenzini

Investor Relations Director, SDCL EDGE Acquisition

Corporation

(512) 632-0292

Francesca.lorenzini@sdclgroup.com

Kelly McAndrew

Financial Profiles, Inc.

310-622-8239

kmcandrew@finprofiles.com

v3.23.3

Cover

|

Oct. 27, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 27, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-40980

|

| Entity Registrant Name |

SDCL EDGE Acquisition Corp

|

| Entity Central Index Key |

0001846975

|

| Entity Tax Identification Number |

98-1583135

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

60 East

|

| Entity Address, Address Line Two |

42nd Street

|

| Entity Address, Address Line Three |

Suite 1100

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10165

|

| City Area Code |

212

|

| Local Phone Number |

488-5509

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant

|

| Trading Symbol |

SEDA.U

|

| Security Exchange Name |

NYSE

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

SEDA

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

SEDA.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SEDAU_UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SEDAU_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SEDAU_RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

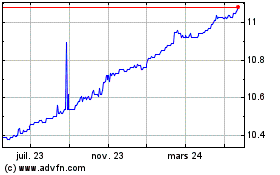

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

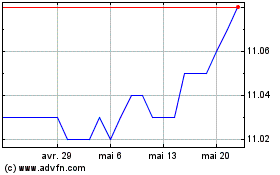

SDCL EDGE Acquisition (NYSE:SEDA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024