Third Quarter 2023 Summary Results and Highlights

- Net income of $7.6 million, or $0.16 per diluted Class A share;

Adjusted pro forma net income of $8.5 million, or $0.19 per fully

diluted share, for the quarter ended September 30, 2023

- Adjusted EBITDA of $23.4 million

- Increased deployments of Solaris’ new top fill technology

across multiple basins

- Generated $6 million in free cash flow after asset sales and

reduced borrowings outstanding on the credit facility by $6

million

- Announced a quarterly dividend of $0.12 per share to be paid on

December 11, 2023, which represents a 9% per-share increase over

the third quarter 2023 and Solaris’ third raise since initiating

the dividend in 2018. Once paid, the fourth quarter 2023 dividend

will be Solaris’ 21st consecutive quarterly dividend

- Approximately $158 million cumulatively returned to

shareholders through dividends and share buybacks since 2018, pro

forma for the announced dividend to be paid in December

Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) (“Solaris” or

the “Company”), today announced third quarter 2023 financial and

operational results.

“The Solaris team executed strongly and safely as industry

activity bottomed during the third quarter. Despite this, we

continued to see adoption of our new technology offerings. As a

result, nearly 55% of industry frac crews we followed in the

quarter deployed either a top fill or AutoBlend™ system, up from

over 40% in the prior quarter,” Solaris’ Chairman and Chief

Executive Officer Bill Zartler commented.

“We generated another quarter of positive free cash flow and

used excess cash to reduce our revolver borrowings. We expect free

cash flow to grow in the fourth quarter and into 2024 as we

generate returns from the growth capital we have invested in the

business over the last couple of years. We will use this additional

cash flow to continue to return capital to shareholders and

strengthen the balance sheet.”

“We are pleased to announce today that the Board has approved a

$0.12 per share dividend, the second increase to our ordinary

dividend in 2023. Our current per share dividend is a 9% increase

over the third quarter dividend and a 14% increase over the fourth

quarter 2022 dividend. Since we began returning cash to

shareholders in 2018, we will have cumulatively returned

approximately $158 million through dividends and share

repurchases.”

Third Quarter 2023 Financial Review

Solaris reported net income of $7.6 million, or $0.16 per

diluted Class A share, for third quarter 2023, compared to second

quarter 2023 net income of $12.2 million, or $0.24 per diluted

Class A share, and third quarter 2022 net income of $11.5 million,

or $0.22 per diluted Class A share. Adjusted pro forma net income

for third quarter 2023 was $8.5 million, or $0.19 per fully diluted

share, compared to second quarter 2023 adjusted pro forma net

income of $11.3 million, or $0.25 per fully diluted share, and

third quarter 2022 adjusted pro forma net income of $11.1 million,

or $0.24 per fully diluted share.

Revenues were $69.7 million for third quarter 2023, which were

down 10% sequentially and down 25% year over year. Adjusted EBITDA

for third quarter 2023 was $23.4 million, which was down 13% from

second quarter 2023 and down 2% from third quarter 2022. The

sequential decrease in revenue was primarily driven by decreases in

ancillary trucking services activity. Total system revenue was

approximately flat sequentially, as the decline in industry frac

activity was offset by revenue growth from the addition of top fill

systems. The sequential decrease in Adjusted EBITDA was impacted by

the decline in ancillary services as well as higher maintenance

costs that were incurred to improve system reliability as operators

continue to drive frac efficiency through increased service

intensity. These system improvements are also expected to enhance

Solaris’ ability to respond more quickly to anticipated future

activity improvements.

During the third quarter of 2023, Solaris earned revenue on 108

fully utilized systems, which includes sand systems, top fill

systems and AutoBlend™ systems. Total fully utilized systems were

flat sequentially and up 2% year over year. The Company followed an

average of 67 industry frac crews on a fully utilized basis in the

third quarter of 2023, which was down 8% from 73 frac crews

followed in the second quarter of 2023.

Capital Expenditures, Free Cash Flow and Liquidity

Capital expenditures after the sale of assets in the third

quarter 2023 were approximately $15 million, which is primarily

related to manufacturing of top fill systems. The Company expects

capital expenditures in the fourth quarter of 2023 to be

approximately $10 million, including maintenance capital

expenditures. Based on this estimate, full year 2023 capital

expenditures are expected to be at the low end of the previously

guided range of $65 million to $75 million.

Free cash flow (defined as net cash provided by operating

activities less investment in property, plant and equipment) after

asset sales was positive $6 million in the third quarter of 2023,

including a working capital use of $1 million and capital

expenditures of $17 million, which was offset by the sale of $2

million of assets no longer used. Distributable cash flow (defined

as Adjusted EBITDA less maintenance capital expenditures) was

approximately $20 million for the third quarter 2023 and covered

quarterly dividend distributions of $5 million by approximately

four times.

As of September 30, 2023, the Company had approximately $3

million of cash on the balance sheet. The Company reduced net

borrowings on the credit facility by $6 million and ended the third

quarter of 2023 with $37 million in borrowings outstanding and $41

million of liquidity.

Shareholder Returns

On August 15, 2023, the Company’s Board of Directors approved a

cash dividend of $0.11 per share of Class A common stock, which was

paid on September 15, 2023 to holders of record as of September 5,

2023. A distribution of $0.11 per unit was also approved for

holders of units in Solaris Oilfield Infrastructure, LLC (“Solaris

LLC”).

On October 25, 2023, the Company’s Board of Directors approved a

cash dividend of $0.12 per share of Class A common stock, to be

paid on December 11, 2023 to holders of record as of December 1,

2023. A distribution of $0.12 per unit has also been approved for

holders of units in Solaris LLC, which is subject to the same

payment and record dates.

The Company did not repurchase shares during the third quarter

of 2023 and approximately $24 million remains in the Company’s

stock repurchase authorization. Since initiating the repurchase

authorization in the first quarter of 2023, Solaris has repurchased

a total of 3.1 million Class A common shares, or 6.5% of the

Company’s total outstanding shares.

Pro forma for the announced dividend to be paid in December

2023, the Company has paid 21 consecutive quarterly dividends and

repurchased approximately 12% of total outstanding shares.

Conference Call

The Company will host a conference call to discuss its third

quarter 2023 results on Friday, October 27, 2023 at 8:00 a.m.

Central Time (9:00 a.m. Eastern Time). To join the conference call

from within the United States, participants may dial (844)

413-3978. To join the conference call from outside of the United

States, participants may dial (412) 317-6594. When instructed,

please ask the operator to be joined to the Solaris Oilfield

Infrastructure, Inc. call. Participants are encouraged to log in to

the webcast or dial in to the conference call approximately ten

minutes prior to the start time. To listen via live webcast, please

visit the Investor Relations section of the Company’s website at

http://www.solarisoilfield.com.

An audio replay of the conference call will be available shortly

after the conclusion of the call and will remain available for

approximately seven days. It can be accessed by dialing (877)

344-7529 within the United States or (412) 317-0088 outside of the

United States. The conference call replay access code is 2373251.

The replay will also be available in the Investor Relations section

of the Company’s website shortly after the conclusion of the call

and will remain available for approximately seven days.

About Non-GAAP Measures

In addition to financial results determined in accordance with

generally accepted accounting principles in the United States

(“GAAP”), this news release presents non-GAAP financial measures.

Management believes that adjusted net income, adjusted diluted

earnings per share and Adjusted EBITDA, provide useful information

to investors regarding the Company’s financial condition and

results of operations because they reflect the core operating

results of our businesses and help facilitate comparisons of

operating performance across periods. Although management believes

the aforementioned non-GAAP financial measures are good tools for

internal use and the investment community in evaluating Solaris’

overall financial performance, the foregoing non-GAAP financial

measures should be considered in addition to, not as a substitute

for or superior to, other measures of financial performance

prepared in accordance with GAAP. A reconciliation of these

non-GAAP measures to the most directly comparable GAAP measures is

included in the accompanying financial tables.

About Solaris Oilfield Infrastructure, Inc.

Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) provides mobile

equipment that drives supply chain and execution efficiencies in

the completion of oil and natural gas wells. Solaris’ patented

equipment and systems are deployed across oil and natural gas

basins in the United States. Additional information is available on

our website, www.solarisoilfield.com.

Website Disclosure

We use our website (www.solarisoilfield.com) as a routine

channel of distribution of company information, including news

releases, analyst presentations, and supplemental financial

information, as a means of disclosing material non-public

information and for complying with our disclosure obligations under

the U.S. Securities and Exchange Commission’s (the “SEC”)

Regulation FD. Accordingly, investors should monitor our website in

addition to following press releases, SEC filings and public

conference calls and webcasts. Additionally, we provide

notifications of news or announcements on our investor relations

website. Investors and others can receive notifications of new

information posted on our investor relations website in real time

by signing up for email alerts.

None of the information provided on our website, in our press

releases, public conference calls and webcasts, or through social

media channels is incorporated by reference into, or deemed to be a

part of, this press release or will be incorporated by reference

into any report or document we file with the SEC unless we

expressly incorporate any such information by reference, and any

references to our website are intended to be inactive textual

references only.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Examples of forward-looking statements include, but are

not limited to, our business strategy, our industry, our future

profitability, the various risks and uncertainties associated with

the extraordinary market environment and impacts resulting from the

volatility in global oil markets and the COVID-19 pandemic,

expected capital expenditures and the impact of such expenditures

on performance, management changes, current and potential future

long-term contracts and our future business and financial

performance. Forward-looking statements are based on our current

expectations and assumptions regarding our business, the economy

and other future conditions. Because forward-looking statements

relate to the future, by their nature, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, our actual results may differ

materially from those contemplated by the forward-looking

statements. Factors that could cause our actual results to differ

materially from the results contemplated by such forward-looking

statements include, but are not limited to the factors discussed or

referenced in our filings made from time to time with the SEC.

Readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

Factors or events that could cause our actual results to differ may

emerge from time to time, and it is not possible for us to predict

all of them. We undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future developments or otherwise, except as may be

required by law.

SOLARIS OILFIELD

INFRASTRUCTURE, INC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

2023

2022

2023

2023

2022

Revenue

64,427

89,376

69,925

212,180

222,342

Revenue - related parties

5,249

2,949

7,277

17,420

13,609

Total revenue

69,676

92,325

77,202

229,600

235,951

Operating costs and expenses:

Cost of services (excluding depreciation

and amortization)

42,102

64,171

45,652

140,977

163,079

Depreciation and amortization

9,179

7,716

9,071

26,667

21,777

Property tax contingency (1)

—

—

—

—

3,072

Selling, general and administrative

6,359

5,929

6,825

19,722

17,202

Impairment of fixed assets

1,423

—

—

1,423

—

Other operating (income)/expense (2)

613

524

(125

)

150

(899

)

Total operating costs and expenses

59,676

78,340

61,423

188,939

204,231

Operating income

10,000

13,985

15,779

40,661

31,720

Interest expense, net

(1,057

)

(141

)

(879

)

(2,395

)

(308

)

Total other expense

(1,057

)

(141

)

(879

)

(2,395

)

(308

)

Income before income tax expense

8,943

13,844

14,900

38,266

31,412

Provision for income taxes

1,305

2,332

2,659

6,450

5,889

Net income

7,638

11,512

12,241

31,816

25,523

Less: net income related to

non-controlling interests

(2,704

)

(4,106

)

(4,709

)

(11,781

)

(9,162

)

Net income attributable to Solaris

$

4,934

$

7,406

$

7,532

$

20,035

$

16,361

Earnings per share of Class A common stock

- basic

$

0.16

$

0.22

$

0.24

$

0.64

$

0.49

Earnings per share of Class A common stock

- diluted

$

0.16

$

0.22

$

0.24

$

0.64

$

0.49

Basic weighted average shares of Class A

common stock outstanding

29,025

31,599

29,542

29,919

31,425

Diluted weighted average shares of Class A

common stock outstanding

29,025

31,599

29,542

29,919

31,425

1)

Property tax contingency represents a

reserve related to an unfavorable Texas District Court ruling

related to prior period property taxes. The ruling is currently

under appeal and we anticipate a ruling to be delivered sometime in

the fourth quarter of 2023.

2)

Other income includes accrued excise tax

on share repurchases, the sale or disposal of assets, insurance

gains, credit losses or recoveries, severance costs, and other

settlements.

SOLARIS OILFIELD

INFRASTRUCTURE, INC AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share amounts)

(Unaudited)

September 30,

December 31,

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

3,451

$

8,835

Accounts receivable, net of allowances for

credit losses of $316 and $385, respectively

48,295

64,543

Accounts receivable - related party

7,065

4,925

Prepaid expenses and other current

assets

5,633

5,151

Inventories

7,447

5,289

Assets held for sale

3,000

—

Total current assets

74,891

88,743

Property, plant and equipment, net

327,427

298,160

Non-current inventories

1,856

1,569

Operating lease right-of-use assets

12,773

4,033

Goodwill

13,004

13,004

Intangible assets, net

884

1,429

Deferred tax assets

49,398

55,370

Other assets

275

268

Total assets

$

480,508

$

462,576

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

20,053

$

25,934

Accrued liabilities

18,002

25,252

Current portion of payables related to Tax

Receivable Agreement

—

1,092

Current portion of operating lease

liabilities

1,599

917

Current portion of finance lease

liabilities

2,429

1,924

Other current liabilities

822

790

Total current liabilities

42,905

55,909

Operating lease liabilities, net of

current

13,197

6,212

Borrowings under the credit agreement

37,000

8,000

Finance lease liabilities, net of

current

3,029

3,429

Payables related to Tax Receivable

Agreement

71,530

71,530

Other long-term liabilities

120

367

Total liabilities

167,781

145,447

Stockholders' equity:

Preferred stock, $0.01 par value, 50,000

shares authorized, none issued and outstanding

—

—

Class A common stock, $0.01 par value,

600,000 shares authorized, 29,052 shares issued and outstanding as

of September 30, 2023 and 31,641 shares issued and outstanding as

of December 31, 2022

291

317

Class B common stock, $0.00 par value,

180,000 shares authorized, 13,674 shares issued and outstanding as

of September 30, 2023 and December 31, 2022

—

—

Additional paid-in capital

187,700

202,551

Retained earnings

16,811

12,847

Total stockholders' equity attributable to

Solaris and members' equity

204,802

215,715

Non-controlling interest

107,925

101,414

Total stockholders' equity

312,727

317,129

Total liabilities and stockholders'

equity

$

480,508

$

462,576

SOLARIS OILFIELD

INFRASTRUCTURE, INC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

(Unaudited)

Nine Months Ended September

30,

Three Months Ended September

30,

2023

2022

2023

Cash flows from operating activities:

Net income

$

31,816

$

25,523

$

7,638

Adjustment to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

26,667

21,777

9,179

Impairment of fixed assets

1,423

—

1,423

Loss on disposal of asset

604

1,307

622

Stock-based compensation

5,830

4,665

1,926

Amortization of debt issuance costs

114

127

43

Allowance for credit losses

160

(420

)

162

Change in payables related to Tax

Receivable Agreement

—

(654

)

—

Deferred income tax expense

6,019

5,143

1,166

Other

(178

)

(178

)

(16

)

Changes in assets and liabilities:

Accounts receivable

16,088

(38,563

)

7,646

Accounts receivable - related party

(2,140

)

1,011

(277

)

Prepaid expenses and other assets

263

2,972

(880

)

Inventories

(5,020

)

(4,744

)

781

Accounts payable

(6,469

)

12,569

(9,516

)

Accrued liabilities

(7,744

)

10,305

984

Payments pursuant to tax receivable

agreement

(1,092

)

—

—

Property tax contingency (1)

—

3,072

—

Net cash provided by operating

activities

66,341

43,912

20,881

Cash flows from investing activities:

Investment in property, plant and

equipment

(57,117

)

(59,527

)

(16,987

)

Cash received from insurance proceeds

122

1,308

53

Proceeds from disposal of assets

2,165

422

2,000

Net cash used in investing activities

(54,830

)

(57,797

)

(14,934

)

Cash flows from financing activities:

Share repurchases

(25,757

)

—

—

Distribution to unitholders (includes

distribution of $4.5 million at $0.11/unit, $4.3 million at

$0.105/unit, and $1.5 million at $0.11/unit, respectively)

(4,993

)

(4,327

)

(1,504

)

Dividend paid to Class A common stock

shareholders

(10,402

)

(10,348

)

(3,358

)

Borrowings under the credit agreement

35,000

9,000

—

Repayment of the credit agreement

(6,000

)

(3,000

)

(6,000

)

Payments under finance leases

(1,908

)

(1,100

)

(582

)

Payments under insurance premium

financing

(1,380

)

(946

)

(414

)

Payments related to debt issuance

costs

(91

)

(358

)

—

Payments for shares withheld for taxes

from RSU vesting and cancelled

(1,364

)

(1,100

)

(9

)

Net cash used in financing activities

(16,895

)

(12,179

)

(11,867

)

Net decrease in cash and cash

equivalents

(5,384

)

(26,064

)

(5,920

)

Cash and cash equivalents at beginning of

period

8,835

36,497

9,371

Cash and cash equivalents at end of

period

$

3,451

$

10,433

$

3,451

Non-cash activities

Investing:

Capitalized depreciation in property,

plant and equipment

202

424

95

Capitalized stock based compensation

410

296

114

Property and equipment additions incurred

but not paid at period-end

588

3,436

360

Property, plant and equipment additions

transferred from inventory

2,575

1,210

533

Additions to fixed assets through finance

leases

2,012

4,554

86

Financing:

Insurance premium financing

283

806

414

Cash paid for:

Interest

2,079

102

1,051

Income taxes

198

370

—

(1)

Property tax contingency represents a

reserve related to an unfavorable Texas District Court ruling

related to prior period property taxes. The ruling is currently

under appeal.

SOLARIS OILFIELD INFRASTRUCTURE, INC AND

SUBSIDIARIES

RECONCILIATION AND CALCULATION OF NON-GAAP

FINANCIAL AND OPERATIONAL MEASURES

(In thousands)

(Unaudited)

EBITDA AND ADJUSTED EBITDA

We view EBITDA and Adjusted EBITDA as important indicators of

performance. We define EBITDA as net income, plus (i) depreciation

and amortization expense, (ii) interest expense and (iii) income

tax expense, including franchise taxes. We define Adjusted EBITDA

as EBITDA plus (i) stock-based compensation expense and (ii)

certain non-cash items and extraordinary, unusual or non-recurring

gains, losses or expenses.

We believe that our presentation of EBITDA and Adjusted EBITDA

provides useful information to investors in assessing our financial

condition and results of operations. Net income is the GAAP measure

most directly comparable to EBITDA and Adjusted EBITDA. EBITDA and

Adjusted EBITDA should not be considered alternatives to net income

presented in accordance with GAAP. Because EBITDA and Adjusted

EBITDA may be defined differently by other companies in our

industry, our definitions of EBITDA and Adjusted EBITDA may not be

comparable to similarly titled measures of other companies, thereby

diminishing their utility. The following table presents a

reconciliation of net income to EBITDA and Adjusted EBITDA for each

of the periods indicated.

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

2023

2022

2023

2023

2022

Net income

$

7,638

$

11,512

$

12,241

$

31,816

$

25,523

Depreciation and amortization

9,179

7,716

9,071

26,667

21,777

Interest expense, net

1,057

141

879

2,395

308

Income taxes (1)

1,305

2,332

2,659

6,450

5,889

EBITDA

$

19,179

$

21,701

$

24,850

$

67,328

$

53,497

Property tax contingency (2)

—

—

—

—

3,072

Stock-based compensation expense (3)

1,917

1,553

1,924

5,821

4,665

Loss on disposal of assets

746

989

4

390

1,025

Impairment on fixed assets (4)

1,423

—

—

1,423

—

Change in payables related to Tax

Receivable Agreement (5)

—

—

—

—

(654

)

Other (6)

163

(309

)

47

409

(867

)

Adjusted EBITDA

$

23,428

$

23,934

$

26,825

$

75,371

$

60,738

_______________________

1)

Federal and state income taxes.

2)

Property tax contingency represents a

reserve related to an unfavorable Texas District Court ruling

related to prior period property taxes. The ruling is currently

under appeal and we anticipate a ruling to be delivered sometime in

the fourth quarter of 2023.

3)

Represents stock-based compensation

expense related to restricted stock awards, including

performance-based restricted stock.

4)

Impairment recorded on certain fixed

assets classified as assets held for sale during the three months

ended September 30, 2023.

5)

Reduction in liability due to state tax

rate change.

6)

Other includes accrued excise tax on share

repurchases, gains on insurance claims, credit losses or recoveries

and other settlements.

ADJUSTED PRO FORMA NET INCOME AND ADJUSTED PRO FORMA EARNINGS

PER FULLY DILUTED SHARE

Adjusted pro forma net income represents net income attributable

to Solaris assuming the full exchange of all outstanding membership

interests in Solaris LLC not held by Solaris Oilfield

Infrastructure, Inc. for shares of Class A common stock, adjusted

for certain non-recurring items that the Company doesn't believe

directly reflect its core operations and may not be indicative of

ongoing business operations. Adjusted pro forma earnings per fully

diluted share is calculated by dividing adjusted pro forma net

income by the weighted-average shares of Class A common stock

outstanding, assuming the full exchange of all outstanding units of

Solaris LLC (“Solaris LLC Units”), after giving effect to the

dilutive effect of outstanding equity-based awards.

When used in conjunction with GAAP financial measures, adjusted

pro forma net income and adjusted pro forma earnings per fully

diluted share are supplemental measures of operating performance

that the Company believes are useful measures to evaluate

performance period over period and relative to its competitors. By

assuming the full exchange of all outstanding Solaris LLC Units,

the Company believes these measures facilitate comparisons with

other companies that have different organizational and tax

structures, as well as comparisons period over period because it

eliminates the effect of any changes in net income attributable to

Solaris as a result of increases in its ownership of Solaris LLC,

which are unrelated to the Company's operating performance, and

excludes items that are non-recurring or may not be indicative of

ongoing operating performance.

Adjusted pro forma net income and adjusted pro forma earnings

per fully diluted share are not necessarily comparable to similarly

titled measures used by other companies due to different methods of

calculation. Presentation of adjusted pro forma net income and

adjusted pro forma earnings per fully diluted share should not be

considered alternatives to net income and earnings per share, as

determined under GAAP. While these measures are useful in

evaluating the Company's performance, it does not account for the

earnings attributable to the non-controlling interest holders and

therefore does not provide a complete understanding of the net

income attributable to Solaris. Adjusted pro forma net income and

adjusted pro forma earnings per fully diluted share should be

evaluated in conjunction with GAAP financial results. A

reconciliation of adjusted pro forma net income to net income

attributable to Solaris, the most directly comparable GAAP measure,

and the computation of adjusted pro forma earnings per fully

diluted share are set forth below.

Three Months Ended

Nine Months Ended

September 30,

June 30,

September 30,

2023

2022

2023

2023

2022

Numerator:

Net income attributable to Solaris

$

4,934

$

7,406

$

7,532

$

20,035

$

16,361

Adjustments:

Reallocation of net income attributable to

non-controlling interests from the assumed exchange of LLC

Interests (1)

2,704

4,106

4,709

11,781

9,162

Loss on disposal of assets

746

989

4

390

1,025

Impairment on fixed assets (2)

1,423

—

—

1,423

—

Property tax contingency (3)

—

—

—

—

3,072

Change in payables related to Tax

Receivable Agreement (4)

—

—

—

—

(654

)

Other (5)

163

(309

)

47

409

(867

)

Incremental income tax expense

(1,453

)

(1,071

)

(983

)

(2,688

)

(2,780

)

Adjusted pro forma net income

$

8,517

$

11,121

$

11,309

$

31,350

$

25,319

Denominator:

Weighted average shares of Class A common

stock outstanding

29,025

31,599

29,542

29,919

31,425

Adjustments:

Potentially dilutive shares (6)

15,448

15,021

15,365

15,273

14,983

Adjusted pro forma fully weighted average

shares of Class A common stock outstanding - diluted

44,473

46,620

44,907

45,192

46,408

Adjusted pro forma earnings per share -

diluted

$

0.19

$

0.24

$

0.25

$

0.69

$

0.55

(1)

Assumes the exchange of all outstanding

Solaris LLC Units for shares of Class A common stock at the

beginning of the relevant reporting period, resulting in the

elimination of the non-controlling interest and recognition of the

net income attributable to non-controlling interests.

(2)

Impairment recorded on certain fixed

assets classified as assets held for sale during the three months

ended September 30, 2023.

(3)

Property tax contingency represents a

reserve related to an unfavorable Texas District Court ruling

related to prior period property taxes. The ruling is currently

under appeal and we anticipate a ruling to be delivered sometime in

the fourth quarter of 2023.

(4)

Reduction in liability due to state tax

rate change.

(5)

Other includes accrued excise tax on share

repurchases, gains on insurance claims, credit losses or recoveries

and other settlements.

(6)

Assumes the exchange of all outstanding

Solaris LLC Units for shares of Class A common stock and vesting of

Restricted stock awards and Performance-based restricted stock

awards at the beginning of the relevant reporting periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231026107862/en/

Yvonne Fletcher Senior Vice President, Finance and Investor

Relations (281) 501-3070 IR@solarisoilfield.com

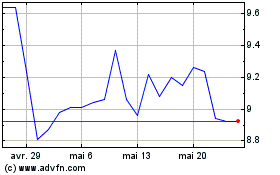

Solaris Oilfield Infrast... (NYSE:SOI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Solaris Oilfield Infrast... (NYSE:SOI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025