UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-CSR

CERTIFIED SHAREHOLDER

REPORT OF REGISTERED

MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-23248

Ecofin Sustainable and Social Impact Term

Fund

(Exact name of registrant as specified in charter)

6363 College Boulevard, Suite 100A, Overland

Park, KS 66211

(Address of principal executive offices) (Zip code)

P. Bradley Adams

Diane Bono

6363 College Boulevard, Suite 100A, Overland

Park, KS 66211

(Name and address of agent for service)

913-981-1020

Registrant’s telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: May 31, 2023

Item 1. Report to Stockholders.

(a) The report to Shareholders is attached herewith.

Semi-Annual Report | May 31, 2023

2023 Semi-Annual Report

Closed-End Funds

Tortoise

2023 Semi-Annual Report to Stockholders

This combined report provides you with a comprehensive

review of our funds that span essential assets.

TTP and TPZ distribution policies

Tortoise Pipeline & Energy Fund, Inc. (“TTP”)

and Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ”) are relying on exemptive relief permitting them to make long-term

capital gain distributions throughout the year. Each of TTP and TPZ, with approval of its Board of Directors (the “Board”),

has adopted a managed distribution policy (the “Policy”). Annual distribution amounts are expected to fall in the range of

7% to 10% of the average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. In accordance

with its Policy, TTP distributes a fixed amount per common share, currently $.59, each quarter to its common shareholders. TPZ distributes

a fixed amount per common share, currently $.105, each month to its common shareholders. Prior to February 2022, the monthly distribution

rate was $.06. These amounts are subject to change from time to time at the discretion of the Board. Although the level of distributions

is independent of TTP’s and TPZ’s performance, TTP and TPZ expect such distributions to correlate with its performance over

time. Each quarterly and monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for

extraordinary distributions in light of TTP’s and TPZ’s performance for the entire calendar year and to enable TTP and TPZ

to comply with the distribution requirements imposed by the Internal Revenue Code. The Board may amend, suspend or terminate the Policy

without prior notice to shareholders if it deems such action to be in the best interests of TTP, TPZ and their respective shareholders.

For example, the Board might take such action if the Policy had the effect of shrinking TTP’s or TPZ’s assets to a level that

was determined to be detrimental to TTP or TPZ shareholders. The suspension or termination of the Policy could have the effect of creating

a trading discount (if TTP’s or TPZ’s stock is trading at or above net asset value), widening an existing trading discount,

or decreasing an existing premium. You should not draw any conclusions about TTP’s or TPZ’s investment performance from the

amount of the distribution or from the terms of TTP’s or TPZ’s distribution policy. Each of TTP and TPZ estimates that it

has distributed more than its income and net realized capital gains; therefore, a portion of your distribution may be a return of capital.

A return of capital may occur, for example, when some or all of the money that you invested in TTP or TPZ is paid back to you. A return

of capital distribution does not necessarily reflect TTP’s or TPZ’s investment performance and should not be confused with

“yield” or “income.” The amounts and sources of distributions reported are only estimates and are not being provided

for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon TTP’s and

TPZ’s investment experience during their fiscal year and may be subject to changes based on tax regulations. TTP and TPZ will send

you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

2023 Semi-Annual Report | May

31, 2023

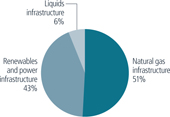

| Closed-end Fund Comparison |

| |

Name/Ticker |

Primary

focus |

Structure |

Total

investments

($ millions)(1) |

Portfolio mix

by asset type(1) |

Portfolio mix

by structure(1) |

|

Tortoise Energy Infrastructure Corp.

NYSE: TYG

Inception: 2/2004 |

Energy Infrastructure |

C-Corp(2) |

$502.2 |

|

|

|

Tortoise Midstream Energy Fund, Inc.

NYSE: NTG

Inception: 7/2010 |

Natural Gas Infrastructure |

C-Corp(2) |

$260.6 |

|

|

|

Tortoise Pipeline

& Energy Fund, Inc.

NYSE: TTP

Inception: 10/2011 |

North

American

pipeline

companies |

Regulated investment company |

$81.3 |

|

|

|

Tortoise Energy Independence

Fund, Inc.

NYSE: NDP

Inception: 7/2012 |

North

American

oil & gas

producers |

Regulated investment company |

$64.0 |

|

|

|

Tortoise Power

and Energy Infrastructure

Fund, Inc.

NYSE: TPZ

Inception: 7/2009 |

Power

& energy infrastructure companies

(Fixed income

& equity) |

Regulated investment company |

$117.4 |

|

|

|

Ecofin Sustainable and Social Impact Term Fund

NYSE: TEAF

Inception: 3/2019 |

Essential

assets |

Regulated investment company |

$238.7 |

|

|

(1) As of 5/31/2023

(2) TYG and NTG intend to qualify as regulated investment

companies. See Note 2.E. to the financial statements for further disclosure.

(unaudited)

Tortoise

2023 Semi-Annual Report to closed-end fund stockholders

Dear stockholder

The first half of the 2023 fiscal year proved to

be a volatile environment for energy infrastructure and the renewable and power infrastructure sectors, yet different attributes drove

performance. Energy infrastructure displayed strong earnings fundamentals while navigating recessionary concerns, declining commodity

prices, and a macro environment favoring growth stocks over value stocks. Renewable and power infrastructure sector messaged additional

growth backlogs driven by the Inflation Reduction Act (IRA) while simultaneously navigating headwinds around higher interest rate concerns

and rising costs. Social impact investments continued to make progress with demand increasing for educational solutions and improvements

along with an increased aging population and slower pace of new senior living inventory supply.

Energy and power infrastructure

The

broad energy sector, as represented by the S&P Energy Select Sector® Index returned -14.2% for the first half of 2023

fiscal year. The first half of 2023 saw the energy sector pressured by lower prices in both crude oil (-14.3%) and natural gas (-57.5%)

on recession concerns and warmer-than-expected winter weather. On the contrary, long-term supply concerns remained as 2022 was the eighth

consecutive year of underinvestment in oil and gas. The opportunity for North American energy infrastructure remains as the U.S. energy

industry focuses on maximizing shareholder returns. Global underinvestment resulting from environmental, social and governance (ESG)

commitments and energy transition is likely to keep global stock balances extremely tight for the foreseeable future.

The global energy markets

remained dynamic to start 2023. Most notable was OPEC+ twice cutting crude oil production. The production cuts (April 2023 for 1.6mm

b/d and June 2023 for 1mm b/d) are intended to tighten the market as short-term demand concerns remain. These followed a production

cut from OPEC+ of 2mm b/d in October 2022. We believe OPEC+ is sending a clear message to the market it is focusing on profits over

market share. This is a marked change from past messaging and is aligned with U.S. shale prioritizing profits over market share.

Russian crude, despite Western sanctions, remained more resilient than expected, yet volumes are projected to decline and/or face

longer transit times to their end market. In the physical markets, U.S. production remained steady. For 2023, the Energy Information

Agency (EIA) forecasts that U.S. crude production will increase 0.7 mm b/d to 12.6 mm b/d, up from 11.9 mm b/d average in 2022. On

the demand side, the International Energy Agency (IEA) projects world crude consumption will increase by 2.2 million b/d in 2023 to

a record 102 million b/d. Global demand is being driven by China after the country lifted its Covid restrictions. Finally, U.S.

& global inventories are projected to decline as we head into the summer driving months.

With lower commodity prices during the period, the

midstream sector proved to be defensive, outperforming exploration and production companies (E&Ps) and other energy subsectors. Midstream’s

strong fundamentals, attractive valuations, defensive characteristics in a higher rate and inflationary environment supported outperformance

on a relative basis. The first half of 2023 underscored several 2022 themes in resilient quarterly earnings and return of capital to shareholders.

The banking crisis in March provided another opportunity to highlight the resiliency of the asset class. Energy infrastructure credit

facilities were and remain largely undrawn with an average utilization of 10%. With significant free cash flow today and expectations

for growing free cash flow in future years we believe there is limited need for credit facilities.

Recession concerns weighed on investor psyche highlighted

by the banking crisis in March. While there were several recessions in the last 40 years, energy demand increased in 38 out of the last

40 years (2008 and 2020 decreased). Due to actions taken during the 2020 recession, we believe the energy sector, and specifically midstream,

is well prepared to deal with another potential recession. The world remains undersupplied in energy, and we believe sector balance sheets

are in much better shape than in past recessions including 2001, 2008 and 2020.

The balanced return of capital story continued for

investors via debt reduction, share buybacks and increased distributions. Debt paydown across the sector continued to be paramount led

by Enterprise Product Partners which lowered its targeted leverage to 3.0x. In March, S&P upgraded EPD’s credit rating to A-

by S&P. This is the first time we recall a midstream company with A rated debt! Western Midstream and Cheniere Energy are other midstream

companies which saw improvement in their debt ratings during the first half of the fiscal year. Distribution growth continued in Q1 2023

as companies targeted a return to pre-COVID levels and midstream companies ended 2022 with a total of $4.8 billion in stock repurchased.

The significant free cash flow is increasingly making

midstream assets and companies’ attractive merger & acquisition (M&A) targets. In May, ONEOK announced plans to acquire

Magellan Midstream Partners (MMP) at a 22% premium. The deal is contingent upon shareholder vote and could close in the second half of

2023. DCP Midstream was also acquired by Phillips 66 at a significant premium during the first

(unaudited)

2023 Semi-Annual Report

| May 31, 2023

half of 2023. In both instances, we believe the companies

being acquired operate critical energy infrastructure assets and are undervalued due to their high free cash flow generation potential

over the next decade and beyond. Dealmaking is also happening in the private markets. In March, Energy Transfer announced the acquisition

of privately owned Lotus Midstream. Management expects this transaction to deliver immediate accretion to free cash flow per unit driven

by significant overlap of existing assets. Importantly, companies are controlling energy volumes throughout their value chain. Increasing

volumes helps incumbent midstream companies maintain a competitive advantage.

Another continuing theme for energy infrastructure

companies is the focus on export related infrastructure. With energy security a higher priority and concern around natural gas inventories,

Europe is increasingly importing U.S. liquefied natural gas (LNG). Throughout 2022, LNG exporters contracted almost 6 billion cubic feet

per day (Bcf/d) of new contracts, signing 15-25-year contracts with European and Asian counterparties. The first half of the 2023 fiscal

year saw two Final Investment Decisions (FIDs) proceed to construction at Sempra’s Port Arthur LNG project and Venture Global’s

Plaquemines LNG project. Additionally, Cheniere made progress with counterparties for the company’s Sabine Pass Liquefaction Expansion

Project. The U.S. remains on track to roughly double LNG export capacity by the end of the decade.

Despite all the positives, risks to our outlook remain.

In 2023, we expect a more mixed setup for natural gas, as supply outpaces demand. Unseasonably warm winter lessened the gas demand for

Europe and North America. Further, the delayed restart of Freeport LNG, offline since the second half of 2022 through February 2023, kept

more gas inventories from being exported globally. While supply remains abundant in the short-term, we expect more demand pull for natural

gas in the back half of the decade. This demand will come from LNG facilities coming online and increased demand for natural gas through

power generation. Gas and its reliability and affordability is a key resource for utilities. An example of this is the recent Texas law

passed with anti-renewables provisions in ERCOT coupled with low-cost loans for new conventional generation.

On the regulatory front there

continues to be hurdles for energy infrastructure mega-projects. During the period, projects faced mixed results around legislative

and cost hurdles. On the positive side, the long-disputed Mountain Valley Pipeline received its required construction permits via

the debt ceiling bill. The pipeline now expects to go into service in late 2023 or early 2024. On the negative side,

TransCanada’s (TRP) Costal Gas Link, located on the west coast of Canada, is facing delays due to cost overruns, which TRP

announced would increase 30%. These examples highlight the importance of cash flowing infrastructure already in the ground. Lastly,

the Environmental Protection Agency (EPA) officially unveiled its latest proposal to stunt emissions from coal and gas power plants

with most of the limitations appearing to take effect starting in 2035. The EPA projects that less than 20% of existing gas plants

would be impacted, but for coal plants looking to run through 2040, the plants would need to switch to running on natural gas 40% of

the time. This decision is likely to be litigated but is noteworthy in that the push towards natural gas is one we advocated for

historically.

Sustainable infrastructure

Renewable energy

From a macro perspective the semi-annual period ending

May 31, 2023, was generally characterized by influences stemming from stubborn inflation, elevated interest rates, and declining energy

prices, in particular natural gas. In China, the magnitude of economic recovery following the post-COVID reopening ultimately did not

come to fruition. From a policy perspective, we did see some further developments, albeit less potent, in a European response to the U.S.’s

IRA.

2022’s clean energy ‘winners’,

propelled by higher power prices and the growth catalysts inherent in the energy transition and the IRA, suffered profit taking in early

2023. Elevated borrowing costs were concerning for businesses which ‘borrow to grow,’ as were higher equipment costs, trade

issues, permitting and transmission constraints. The period also saw banking turmoil triggered primarily by Silicon Valley Bank in early

March, which presented both opportunities and challenges to the energy transition space. As such, some companies in our investment universe

could not escape these varying impulses even if their secular growth remains intact.

Generally, companies participating in the energy

transition tend to benefit at the margin from higher power prices in the short-term. Even if electricity prices are well above pre-2022

levels, as they have peaked and come down from very high levels, companies with some exposure to merchant prices face lower results in

2023 versus 2022, which reduces their appeal.

Looking ahead: Over the course of the next months

we anticipate either a slowdown in inflation or in some cases deflation in certain areas of the energy transition space such as solar

and car prices (internal combustion engines and electric vehicles). Wind turbine prices may, however, see more resistance to deflation.

(unaudited)

With respect to renewables, a key component to solar

panel manufacturing, polysilicon, has come down massively year-to-date in China. Declining equipment costs provides a tailwind to the

deployment of renewables that should fuel faster and more profitable growth.

Policy will have an important role to play in the

coming months as certain protectionist policies have material implications for pricing power, market share and profitability in wind,

solar, battery storage and electric vehicles industries. We expect the EU and countries within the EU to unveil a variety of measures

and subsidies to counteract the IRA and encourage more domestic production and installation of key clean technologies such as manufacturing

along the solar value chain and key industries serving the electric vehicle sector — potentially favorable for local champions.

While decelerating global inflation and the potential

impact this may have on the rate cycle might start to provide an improved backdrop for duration businesses such as utilities and renewable

developers, declining power prices are a headwind to those asset owners with elevated merchant power exposure –additionally, we

are also closely monitoring the risks in certain regions globally to grid congestion and the knock on effects this may have on large utility

scale renewables installations. As such, we are cautiously optimistic as we head further into 2023.

Waste transition

One of the recent highlights was the release of the

final “SET-Rule” by the United States Environmental Protection Agency. The EPA’s SET-Rule establishes the Renewable

Volume Obligations, known as RVO’s, that oil and gas producers must meet annually under the Renewable Fuel Standard program. In

delineating these obligations, the SET-Rule is a critical component in establishing market demand, and therefore price support, for renewable

fuel credits in the U.S. The new SET-Rule contains several positive features regarding waste transition, including:

| ● | A longer 3-year RVO term through 2025, providing market participants with better demand visibility; |

| ● | The final RVO’s include an annual growth rate of 27-33% for renewable natural gas production, which is far higher than the 13-14%

growth rate included in the Environmental Protection Agency’s (EPA’s) initially-proposed SET-Rule; |

| ● | The SET-Rule does not contain cellulosic waiver credit availability for obligated parties, which historically has acted as a cap on

Renewable Identification Number (RIN) pricing; |

| ● | The SET-Rule contains a new methodology for apportioning RINs when utilizing food waste as a blended feedstock, enabling project owners

to receive a higher percentage of more-valuable D3 RINs as opposed to less-valuable D5 RINs; and |

| ● | The SET-Rule allows greater flexibility for biogas to be utilized as an intermediate fuel to produce or decarbonize non-transportation

fuels, such as hydrogen. |

Market reaction has been swift and positive, with

D3 RIN prices rising nearly 30% within 1 week of the EPA’s announcement. D3 RINs may represent 25% or more of an RNG project’s

revenue base, so a 30% increase in RIN pricing may be economically meaningful.

One of the few negative aspects of the SET-Rule is

that it did not include provisions for e-RINs, as had been expected. e-RINs would have provided additional revenue to biogas projects

that generate electricity. The EPA indicated that it paused the initiation of e-RINs due to implementation complexities. Market expectations

are that the EPA will re-consider e-RINs when the next SET-Rule is proposed.

In the waste-to-value sector, recent news suggests

that recycling rates have been going down, landfill tipping fees have been rising, and pollution settlement costs are becoming dramatically

expensive.

The Circularity Gap Report 2023, published by Circle

Economy in collaboration with Deloitte, determined that the global circularity rate was 9.1% in 2018, before declining to 8.6% in 2020,

and 7.2% in 2022. So, even as recycling efforts have increased, the usage of virgin materials has risen at a faster rate. This fact underscores

the need for enhanced recycling efforts to promote better overall sustainability.

In June, the Environmental Research and Education

Foundation published its annual analysis, finding that U.S. landfill tipping fees increased 11% from 2021 to 2022, up substantially from

annual increases in the 1-5% range during the 3 prior years. Industry experts believe such fees will continue to rise, thereby encouraging

the diversion of waste away from landfill introduction and toward recycling facilities.

Finally, in June, 3M and DuPont separately agreed

to pay over $11 billion to settle pollution claims involving per-and polyfluoroalkyl substances (PFAS), also known as “Forever Chemicals,”

that are present in community water systems. This outcome, in conjunction with extended producer responsibility laws introduced in several

states, is expected to encourage producers to take circularity and recycling efforts more seriously going forward.

(unaudited)

2023 Semi-Annual Report | May

31, 2023

Social impact

Education

The public bond market for new issuance of K-12 charter

school and private school revenue bonds in Q2 2023 continued to decline, with only 29 new issues for a par value of $664,315,000, a 54.8%

decrease from the same period in 2022. Year to date, there have been 46 new issues with par value totaling $1,044,778,000 as compared

to 94 new issues at par value of $2,334,820,000 for the first 6 months of 2022.1

While

the cost of borrowing for charter and K-12 private schools has increased significantly over the past 12 months, it is Ecofin’s

assessment that cumulative outflows of nearly $7 billion from municipal bond funds in the first half of 2023 are the primary driver of

the slowdown.2 The specialty investor segment of the charter and K-12 bond market, which includes Ecofin, remains strong.

Specialty investor transactions have made up nearly a quarter of market (par value) for both Q2 and the first 6 months of 2023 as opposed

to 15.7% for the same quarter and less than 14% for the first half of 2022.

Education research and assessments featured prominently

in the news during the quarter. Results for the National Assessment of Education Progress (NAEP), often referred to as the nation’s

report card, were made public and confirmed the disastrous effects of the COVID pandemic on student learning. The education news organization,

Chalkbeat, reported, “Scores were substantially lower in the fall of 2022 compared to the last time the test was administered three

years earlier. Making matters worse, even before the pandemic hit, 13-year-olds had lost ground on the National Assessment of Educational

Progress or NAEP. That adds up to a striking collapse in achievement scores since 2012, after decades of progress in math and modest gains

in reading. In reading, 13-year-olds scored about the same as those who took the test in 1971, when it was first administered. Math scores

were now comparable to those in 1992.”3

The second quarter also saw the

release of “The National Charter School Study III, 2023” by Stanford University’s Center for Research on Education

Outcomes (CREDO). The report is the third of its kind and offers the most rigorous assessment of the effect of charter schools on

student learning. It offers a direct comparison of the results for students in district and charter public schools, including

results by race, income, English language learner and special education status, while controlling for other factors that could skew

results. The study found that, on average, brick and mortar (non-virtual) charter schools provided the equivalent of 22 additional

days of learning in reading and 15 additional days in math based on a typical 180 day school year. For low-income, minority students

the effect was even more dramatic: African-American students achieved the equivalent of 37 additional days of academic growth in

reading and 36 additional days growth in math, while Hispanic students showed 30 additional days of academic growth in both reading

and math.4

In other “school choice” news, Florida,

Arkansas, Iowa and Utah passed new laws to provide funding for families choosing to send their children to accredited K-12 private schools.

Additionally, expansion of the Indiana Choice Scholarship program makes 97% of all families in the state eligible to participate. Finally,

North Carolina expanded its existing Opportunity Scholarship program to apply to all families, which based on their financial means, will

provide $3,000 to $7,000 for use at private schools of their choice.5 All of these new and expanded programs are expected to

dramatically increase the demand for private school facilities over the next decade.

Senior Living

In the first quarter of 2023, the for-profit senior

living sector recorded its seventh quarter in a row of occupancy gains. Statistically, nationwide occupancy for independent living and

assisted living is 85.2% and 81.2%, respectively. Recovery has been slightly stronger in the higher acuity and needs based assisted living

setting; however, independent living is not far behind. As of the fourth quarter, senior living occupancy including independent and assisted

living occupancy had recovered 5.4% from the pandemic lows in 2021, but still has 4.0% to reach the pre-pandemic occupancy of 87.2%.6

Non-profit senior living has fared better than their

for-profit brethren since the pandemic hit. As of Q1 2023, non-profit continuing care retirement communities (“CCRC’s”)

were 89.3% occupied.6

Occupancy recovery has been fueled by almost three

years of slowing construction starts which as of the first quarter 2023 recorded the lowest primary market inventory growth since 2005,

when NIC started recording the data. Rising interest rates, elevated construction costs and tight lending conditions will continue to

propel occupancy in the months to come. Given the incredibly low number of units under construction, the market is setting up for a severe

supply and demand imbalance just as the baby boomer population is knocking on the doorstep.

(unaudited)

From

now until 2030, an average of 10,000 baby boomers will turn 65 every day.7 With the combination of increased population and

a slower pace of new senior living inventory supply, we remain confident in the senior living industry’s ability to rebound and

prepare for the upcoming “Silver Tsunami” as our population continues to age.

Concluding thoughts

We continue to stand by our positive long-term outlook

for the energy and power and sustainable infrastructure sectors. Opportunities for investing in education and senior living continue to

expand for many reasons positioning the sectors well for continued growth.

The S&P Energy Select Sector®

Index is a capitalization-weighted index of S&P 500® Index companies in the energy sector involved in the development

or production of energy products. The Tortoise North American Pipeline IndexSM is a float adjusted, capitalization-weighted index of

energy pipeline companies domiciled in the United States and Canada. The Tortoise MLP Index® is a float-adjusted, capitalization-weighted

index of energy master limited partnerships.

The Tortoise indices are the exclusive

property of Tortoise Index Solutions, LLC, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC)

to calculate and maintain the Tortoise MLP Index® and Tortoise North American Pipeline IndexSM (the “Indices”).

The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P

Dow Jones Indices LLC”). S&P Dow Jones Indices will not be liable for any errors or omission in calculating the Indices. “Calculated

by S&P Dow Jones Indices” and its related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed

for use by Tortoise Index Solutions, LLC and its affiliates. S&P® is a registered trademark of Standard & Poor’s

Financial Services LLC (“SPFS”), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings

LLC (“Dow Jones”).

It is not possible to invest directly in an index.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost.

| 1 | Electronic Municipal Market Access ( https://emma.msrb.org/ ) & MuniOS ( https://www.munios.com/

) |

| 2 | Refinitiv Lipper US Fund Flows ( https://www.lipperusfundflows.com/ ) |

| 3 | Latest National Test Results Show Striking Drop in 13-year-olds’ Math and Reading Scores, Matt Barnum, “Chalkbeat”,

June 20, 2023 |

| 4 | The National Charter School Study III 2023, Center for Research on Education Outcomes (CREDO), June 19, 2023. |

2023 Semi-Annual Report | May

31, 2023

Tortoise

Energy Infrastructure Corp. (TYG)

Fund description

TYG seeks a high level of total return

with an emphasis on current distributions paid to stockholders. TYG invests primarily in equity securities in energy infrastructure companies.

The fund is positioned to benefit from growing energy demand and accelerated efforts to reduce global CO2 emissions in energy

production. Energy infrastructure companies generate, transport and distribute electricity, as well as process, store, distribute and

market natural gas, natural gas liquids, refined products and crude oil.

Fund performance

With

lower commodity prices during the period, the midstream sector proved to be defensive, outperforming E&Ps and other energy subsectors.

Midstream’s strong fundamentals, attractive valuations, defensive characteristics in a higher rate and inflationary environment

supported outperformance on a relative basis. The first half of 2023 underscored several 2022 themes in resilient quarterly earnings

and return of capital to shareholders. Renewable and power infrastructure sector messaged additional growth backlogs driven by the Inflation

Reduction Act (IRA) while simultaneously navigating headwinds around higher interest rate concerns and rising costs. The fund’s

market-based and NAV-based returns for the fiscal period ending May 31, 2023 were -15.7% and -10.7%, respectively (including the reinvestment

of distributions). The Tortoise MLP Index® returned -1.8% during the same period.

| 2023 mid-fiscal year summary |

|

| Distributions paid per share |

$0.7100 |

| Distribution rate (as of 5/31/2023) |

10.5% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in February 2004 |

$42.4275 |

| Market-based total return |

(15.7)% |

| NAV-based total return |

(10.7)% |

| Premium (discount) to NAV (as of 5/31/2023) |

(19.7)% |

Key asset performance drivers

| Top five contributors |

Company type |

| Magellan Midstream Partners, L.P. |

Refined products pipeline company |

| Enterprise Products Partners L.P. |

Natural gas pipeline company |

| DCP Midstream LP |

Natural gas pipeline company |

| Energy Transfer LP |

Natural gas pipeline company |

| MPLX LP |

Refined products pipeline company |

| Bottom five contributors |

Company type |

| Williams Companies Inc. |

Natural gas pipeline company |

| AES Corp. |

Power company |

| NextEra Energy Partners LP |

Diversified infrastructure company |

| Clearway Energy, Inc. |

Diversified infrastructure company |

| ONEOK, Inc. |

Natural gas pipeline company |

Unlike the fund return, index return is pre-expenses

and taxes.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

Tortoise

Energy Infrastructure Corp. (TYG) (continued)

Value

of $10,000 vs. Tortoise Energy Infrastructure Fund – Market (unaudited)

From May 31, 2013 through May 31, 2023

The chart assumes an initial investment

of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would

be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal

value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end

may be lower or higher than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment

of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund

distributions or the redemption of Fund shares.

Annualized Rates of Return as of May 31, 2023

| |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception(1) |

| Tortoise Energy Infrastructure Fund - NAV |

-6.68% |

18.41% |

-13.48% |

-7.49% |

2.02% |

| Tortoise Energy Infrastructure Fund - Market |

-12.93% |

21.46% |

-18.46% |

-10.21% |

0.63% |

| Tortoise

MLP Index® |

5.15% |

25.94% |

5.78% |

2.16% |

8.32% |

| Tortoise Decarbonization Infrastructure IndexSM (2) |

-12.46% |

N/A |

N/A |

N/A |

N/A |

| (1) | Inception date of the Fund was Feburary 25, 2004. |

| (2) | The Tortoise Decarbonization Infrastructure Index was added to reflect the inclusion of a broader scope of energy infrastructure equities

including midstream, utilities, and renewables in TYG effective November 30, 2021. |

Fund structure and distribution policy

The fund intends to qualify as a Regulated Investment Company

(RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as a RIC,

the fund must meet specific income, diversification and distribution requirements. See Note 2E to financial statements for further disclosure.

The fund has adopted a managed distribution policy (“MDP”).

Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value (“NAV”)

per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return

on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts

in May and November.

Leverage

The fund’s leverage utilization decreased $33.3 million

during the six months ended May 31, 2023, compared to the six months ended November 30, 2022, and represented 22.8% of total assets at

May 31, 2023. During the period, the fund was in compliance with its applicable coverage ratios, 93.8% of the leverage cost was fixed,

the weighted-average maturity was 2.4 years and the weighted-average annual rate on leverage was 3.79%. These rates will vary in the future

as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed. During

the six month period ended May 31, 2023, $9.7 million of Senior Notes were paid in full upon maturity.

Please see the Financial Statements and Notes to Financial

Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund

information.

For further information regarding the calculation of distributable

cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

(unaudited)

2023 Semi-Annual Report | May

31, 2023

TYG Key Financial Data

(supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The

information presented below is supplemental non-GAAP financial information, is not inclusive of required financial disclosures (e.g.

Total Expense Ratio), and should be read in conjunction with the full financial statements.

| |

|

2022 |

|

|

2023 |

|

| |

|

Q1(1) |

|

|

Q2(1) |

|

|

Q3(1) |

|

|

Q4(1) |

|

|

Q1(1) |

|

|

Q2(1) |

|

| Selected Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions paid on common stock |

|

$ |

8,469 |

|

|

$ |

8,469 |

|

|

$ |

8,469 |

|

|

$ |

8,045 |

|

|

$ |

8,045 |

|

|

$ |

8,046 |

|

| Distributions paid on common stock per share(2) |

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

| Total assets, end of period(3) |

|

|

612,536 |

|

|

|

640,253 |

|

|

|

638,068 |

|

|

|

623,319 |

|

|

|

577,524 |

|

|

|

504,066 |

|

| Average total assets during period(3)(4) |

|

|

589,709 |

|

|

|

626,150 |

|

|

|

621,364 |

|

|

|

607,430 |

|

|

|

595,508 |

|

|

|

547,380 |

|

| Leverage(5) |

|

|

146,087 |

|

|

|

144,987 |

|

|

|

144,587 |

|

|

|

147,993 |

|

|

|

146,213 |

|

|

|

114,713 |

|

| Leverage as a percent of total assets |

|

|

23.8 |

% |

|

|

22.6 |

% |

|

|

22.7 |

% |

|

|

23.7 |

% |

|

|

25.3 |

% |

|

|

22.8 |

% |

| Operating expenses before leverage costs and current taxes(6) |

|

|

1.11 |

% |

|

|

1.07 |

% |

|

|

1.05 |

% |

|

|

1.16 |

% |

|

|

1.11 |

% |

|

|

1.22 |

% |

| Net

unrealized appreciation (depreciation), end of period |

|

|

(311,995 |

) |

|

|

(268,736 |

) |

|

|

(270,982 |

) |

|

|

9,330 |

|

|

|

(34,286 |

) |

|

|

(65,512 |

) |

| Net assets, end of period |

|

|

436,770 |

|

|

|

469,005 |

|

|

|

467,109 |

|

|

|

446,618 |

|

|

|

416,799 |

|

|

|

380,323 |

|

| Average net assets during period(7) |

|

|

413,334 |

|

|

|

459,626 |

|

|

|

442,939 |

|

|

|

435,678 |

|

|

|

429,315 |

|

|

|

409,946 |

|

| Net asset value per common share(2) |

|

|

36.62 |

|

|

|

39.32 |

|

|

|

39.16 |

|

|

|

39.41 |

|

|

|

36.78 |

|

|

|

33.56 |

|

| Market value per share(2) |

|

|

30.25 |

|

|

|

33.84 |

|

|

|

34.14 |

|

|

|

33.54 |

|

|

|

30.89 |

|

|

|

26.95 |

|

| Shares outstanding (000’s) |

|

|

11,928 |

|

|

|

11,928 |

|

|

|

11,928 |

|

|

|

11,332 |

|

|

|

11,332 |

|

|

|

11,332 |

|

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August.

Q4 is the period from September through November. |

| (2) | Adjusted to reflect 1 for 4 reverse stock split effective May 1, 2020. |

| (3) | Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (4) | Computed by averaging month-end values within each period. |

| (5) | Leverage consists of senior notes, preferred stock and outstanding borrowings under credit facilities. |

| (6) | As a percent of total assets. |

| (7) | Computed by averaging daily net assets within each period. |

Tortoise

Midstream Energy Fund, Inc. (NTG)

Fund description

NTG seeks to provide stockholders with a high level of total

return with an emphasis on current distributions. NTG invests primarily in midstream energy equities that own and operate a network of

pipeline and energy related logistical infrastructure assets with an emphasis on those that transport, gather, process and store natural

gas and natural gas liquids (NGLs). NTG targets midstream energy equities, including MLPs benefiting from U.S. natural gas production

and consumption expansion, with minimal direct commodity exposure.

Fund performance

With lower commodity prices during the period, the midstream

sector proved to be defensive, outperforming E&Ps and other energy subsectors. Midstream’s strong fundamentals, attractive valuations,

defensive characteristics in a higher rate and inflationary environment supported outperformance on a relative basis. The first half of

2023 underscored several 2022 themes in resilient quarterly earnings and return of capital to shareholders. The fund’s market-based

and NAV-based returns for the fiscal period ending May 31, 2023 were -12.5% and -11.7%, respectively (including the reinvestment of distributions).

The Tortoise MLP Index® returned -1.8% during the same period.

| 2023 mid-fiscal year summary |

|

| Distributions paid per share |

$0.7700 |

| Distribution rate (as of 5/31/2023) |

9.8% |

| Quarter-over-quarter distribution increase (decrease) |

0.0% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in July 2010 |

$22.5800 |

| Market-based total return |

(12.5)% |

| NAV-based total return |

(11.7)% |

| Premium (discount) to NAV (as of 5/31/2023) |

(15.5)% |

Key asset performance drivers

| Top five contributors |

Company type |

| Enterprise Products Partners L.P. |

Natural gas pipelines company |

| Plains GP Holdings, L.P. |

Crude oil pipeline company |

| DCP Midstream LP |

Natural gas pipeline company |

| Energy Transfer LP |

Natural gas pipeline company |

| Magellan Midstream Partners, L.P. |

Refined products pipeline company |

| Bottom five contributors |

Company type |

| Williams Companies Inc. |

Natural gas pipeline company |

| Kinder Morgan Inc. |

Natural gas pipeline company |

| Cheniere Energy Inc. |

Natural gas pipeline company |

| ONEOK, Inc. |

Natural gas pipeline company |

| DT Midstream Inc. |

Natural gas pipeline company |

Unlike the fund return, index return is pre-expenses

and taxes.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

2023 Semi-Annual Report | May

31, 2023

Tortoise

Midstream Energy Fund, Inc. (NTG) (continued)

Value of $10,000 vs. Tortoise

Midstream Energy Fund – Market (unaudited)

From May 31, 2013 through May 31, 2023

The chart assumes an initial investment of $10,000. Performance

reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data

quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when

sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than

the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income distributions.

The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of May 31, 2023

| |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception(1) |

| Tortoise Midstream Energy Fund – NAV |

-8.53% |

21.66% |

-19.15% |

-10.64% |

-6.19% |

| Tortoise Midstream Energy Fund – Market |

-9.56% |

23.10% |

-23.12% |

-12.53% |

-7.75% |

| Tortoise

MLP Index® |

5.15% |

25.94% |

5.78% |

2.16% |

5.73% |

(1) Inception date of the

Fund was July 27, 2010.

Fund structure and distribution policy

The fund intends to qualify as a Regulated Investment Company

(RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as a RIC,

the fund must meet specific income, diversification and distribution requirements. See Note 2E to the financial statements for further

disclosure.

The fund has adopted a managed distribution policy (“MDP”).

Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value (“NAV”)

per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return

on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts

in May and November.

Leverage

The fund’s leverage utilization decreased approximately

$5.4 million during the six months ended May 31, 2023 compared to the six months ended November 30, 2022, and represented 21.7% of total

assets at May 31, 2023. During the period, the fund was in compliance with its applicable coverage ratios, 84.4% of the leverage cost

was fixed, the weighted-average maturity was 3.6 years and the weighted-average annual rate on leverage was 3.86%. These rates will vary

in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed.

During the six month period ended May 31, 2023, $3.8 million of preferred stock was paid in full upon maturity.

Please see the Financial Statements and Notes to Financial

Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund

information.

For further information regarding the calculation of distributable

cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

(unaudited)

NTG Key Financial Data

(supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental non-GAAP

financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| |

|

2022 |

|

|

2023 |

| |

|

Q1(1) |

|

|

Q2(1) |

|

|

Q3(1) |

|

|

Q4(1) |

|

|

Q1(1) |

|

|

Q2(1) |

|

| Selected Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions

paid on common stock |

|

$ |

4,345 |

|

|

$ |

4,345 |

|

|

$ |

4,345 |

|

|

$ |

4,128 |

|

|

$ |

4,128 |

|

|

$ |

4,128 |

|

| Distributions paid on common stock per share(2) |

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

| Total assets, end of period(3) |

|

|

307,035 |

|

|

|

328,526 |

|

|

|

316,411 |

|

|

|

323,122 |

|

|

|

296,682 |

|

|

|

261,858 |

|

| Average total assets during period(3)(4) |

|

|

289,590 |

|

|

|

317,967 |

|

|

|

312,932 |

|

|

|

308,008 |

|

|

|

304,884 |

|

|

|

281,520 |

|

| Leverage(5) |

|

|

63,069 |

|

|

|

66,369 |

|

|

|

64,169 |

|

|

|

62,369 |

|

|

|

66,120 |

|

|

|

56,920 |

|

| Leverage as a percent of total assets |

|

|

20.5 |

% |

|

|

20.2 |

% |

|

|

20.3 |

% |

|

|

19.3 |

% |

|

|

22.3 |

% |

|

|

21.7 |

% |

| Operating expenses before leverage costs and current taxes(6) |

|

|

1.22 |

% |

|

|

1.07 |

% |

|

|

1.11 |

% |

|

|

1.29 |

% |

|

|

1.16 |

% |

|

|

1.36 |

% |

| Net unrealized appreciation (depreciation), end of period |

|

|

129,068 |

|

|

|

154,849 |

|

|

|

145,148 |

|

|

|

27,611 |

|

|

|

6,856 |

|

|

|

(11,572 |

) |

| Net assets, end of period |

|

|

231,856 |

|

|

|

250,913 |

|

|

|

240,864 |

|

|

|

237,022 |

|

|

|

221,555 |

|

|

|

200,046 |

|

| Average net assets during period(7) |

|

|

212,000 |

|

|

|

244,906 |

|

|

|

231,908 |

|

|

|

230,297 |

|

|

|

226,098 |

|

|

|

215,743 |

|

| Net asset value per common share(2) |

|

|

41.09 |

|

|

|

44.46 |

|

|

|

42.68 |

|

|

|

44.21 |

|

|

|

41.33 |

|

|

|

37.32 |

|

| Market value per common share(2) |

|

|

34.81 |

|

|

|

37.99 |

|

|

|

36.79 |

|

|

|

37.69 |

|

|

|

35.28 |

|

|

|

31.53 |

|

| Shares outstanding (000’s) |

|

|

5,643 |

|

|

|

5,643 |

|

|

|

5,643 |

|

|

|

5,361 |

|

|

|

5,361 |

|

|

|

5,361 |

|

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August.

Q4 is the period from September through November. |

| (2) | Adjusted to reflect 1 for 10 reverse stock split effective May 1, 2020. |

| (3) | Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (4) | Computed by averaging month-end values within each period. |

| (5) | Leverage consists of senior notes, preferred stock and outstanding borrowings under the credit facility. |

| (6) | Computed as a percent of total assets. |

| (7) | Computed by averaging daily net assets within each period. |

2023 Semi-Annual Report | May

31, 2023

Tortoise

Pipeline & Energy Fund, Inc. (TTP)

Fund description

TTP seeks a high level of total return with an emphasis

on current distributions paid to stockholders. TTP invests primarily in equity securities of North American pipeline companies that transport

natural gas, natural gas liquids (NGLs), crude oil and refined products and, to a lesser extent, in other energy infrastructure companies.

Fund performance

With

lower commodity prices during the period, the midstream sector proved to be defensive, outperforming E&Ps and other energy subsectors.

Midstream’s strong fundamentals, attractive valuations, defensive characteristics in a higher rate and inflationary environment

supported outperformance on a relative basis. The first half of 2023 underscored several 2022 themes in resilient quarterly earnings

and return of capital to shareholders. The fund’s market-based and NAV-based returns for the fiscal period ending May 31, 2023

were -9.3% and -9.5%, respectively (including the reinvestment of distributions). The Tortoise North American Pipeline IndexSM

returned -8.2% for the same period.

| 2023 mid-fiscal year summary |

|

| Distributions paid per share |

$0.5900 |

| Distribution rate (as of 5/31/2023) |

9.5% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in October 2011 |

$18.4775 |

| Market-based total return |

(9.3)% |

| NAV-based total return |

(9.5)% |

| Premium (discount) to NAV (as of 5/31/2023) |

(17.6)% |

Please refer to the inside front cover of the report

for important information about the fund’s distribution policy.

Key asset performance drivers

| Top five contributors |

Company type |

| Magellan Midstream Partners, L.P. |

Refined products pipeline company |

| Plains GP Holdings, L.P. |

Crude oil pipeline company |

| Enterprise Products Partners L.P. |

Natural gas pipeline company |

| Equitrans Midstream Corporation |

Gathering & processing company |

| Energy Transfer LP |

Natural gas pipeline company |

| Bottom five contributors |

Company type |

| Williams Companies Inc. |

Natural gas pipeline company |

| Cheniere Energy Inc. |

Natural gas pipeline company |

| Kinder Morgan Inc. |

Natural gas pipeline company |

| ONEOK, Inc. |

Natural gas pipeline company |

| Enbridge Inc. |

Crude oil pipeline company |

Unlike the fund return, index return is pre-expenses.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

Tortoise

Pipeline & Energy Fund, Inc. (TTP) (continued)

Value of $10,000 vs. Tortoise

Pipeline and Energy Fund – Market (unaudited)

From May 31, 2013 through May 31, 2023

The chart assumes an initial investment of $10,000. Performance

reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data

quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when

sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than

the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income distributions.

The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of May 31, 2023

| |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception(1) |

| Tortoise Pipeline and Energy Fund – NAV |

-8.15% |

21.68% |

-9.80% |

-5.34% |

-2.33% |

| Tortoise Pipeline and Energy Fund – Market |

-9.31% |

20.97% |

-11.92% |

-7.31% |

-4.33% |

| Tortoise North American Pipeline Index |

-9.52% |

17.28% |

6.20% |

5.36% |

6.97% |

| | | |

| (1) | Inception date of the Fund was October 26, 2011. |

Fund structure and distribution policy

The fund is structured to qualify as a Regulated Investment

Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as

a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the

fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements

including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer

of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer

other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income.

RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net

capital gains to avoid a 4 percent excise tax.

The fund has adopted a

distribution policy which is included on the inside front cover of this report. To summarize, the fund has adopted a managed

distribution policy (“MDP”). Annual distribution amounts are expected to fall in the range of 7% to 10% of the average

week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will be

reset both up and down to provide a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset in

February and August, with no changes in distribution amounts in May and November. The fund may designate a portion of its

distributions as capital gains and may also distribute additional capital gains in the last quarter of the year to meet annual

excise distribution requirements. Distribution amounts are subject to change from time to time at the discretion of the

Board.

Leverage

The fund’s leverage

utilization decreased approximately $2.4 million during the six months ended May 31, 2023, compared to the six months ended November

30, 2022, and represented 21.3% of total assets at May 31, 2023. During the period, the fund maintained compliance with its

applicable coverage ratios, 57.6% of the leverage cost was fixed, the weighted-average maturity was 1.1 years and the

weighted-average annual rate on leverage was 5.31%. These rates will vary in the future as a result of changing floating rates,

utilization of the fund’s credit facility and as leverage matures or is redeemed.

Please see the Financial Statements and Notes to Financial

Statements for additional detail regarding critical accounting policies, results of operations, leverage and other important fund information.

For further information regarding the calculation of distributable

cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

(unaudited)

2023 Semi-Annual Report | May

31, 2023

TTP Key Financial Data

(supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental non-GAAP

financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| |

|

2022 |

|

|

2023 |

| |

|

Q1(1) |

|

|

Q2(1) |

|

|

Q3(1) |

|

|

Q4(1) |

|

|

Q1(1) |

|

|

Q2(1) |

|

| Selected Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions paid on common stock |

|

$ |

1,314 |

|

|

$ |

1,314 |

|

|

$ |

1,314 |

|

|

$ |

1,249 |

|

|

$ |

1,248 |

|

|

$ |

1,249 |

|

| Distributions paid on common stock per share(2) |

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

| Total assets, end of period(3) |

|

|

92,230 |

|

|

|

100,901 |

|

|

|

97,010 |

|

|

|

93,907 |

|

|

|

87,895 |

|

|

|

81,736 |

|

| Average total assets during period(3)(4) |

|

|

86,730 |

|

|

|

96,706 |

|

|

|

96,086 |

|

|

|

93,079 |

|

|

|

90,503 |

|

|

|

86,135 |

|

| Leverage(5) |

|

|

20,143 |

|

|

|

20,943 |

|

|

|

21,343 |

|

|

|

19,843 |

|

|

|

20,143 |

|

|

|

17,443 |

|

| Leverage as a percent of total assets |

|

|

21.8 |

% |

|

|

20.8 |

% |

|

|

22.0 |

% |

|

|

21.1 |

% |

|

|

22.9 |

% |

|

|

21.3 |

% |

| Operating expenses before leverage costs(6) |

|

|

1.00 |

% |

|

|

1.90 |

% |

|

|

1.05 |

% |

|

|

1.32 |

% |

|

|

1.28 |

% |

|

|

1.37 |

% |

| Net unrealized appreciation, end of period |

|

|

11,927 |

|

|

|

20,208 |

|

|

|

17,286 |

|

|

|

19,117 |

|

|

|

13,950 |

|

|

|

9,483 |

|

| Net assets, end of period |

|

|

71,653 |

|

|

|

79,443 |

|

|

|

75,181 |

|

|

|

73,509 |

|

|

|

67,264 |

|

|

|

63,730 |

|

| Average net assets during period(7) |

|

|

66,721 |

|

|

|

76,749 |

|

|

|

73,287 |

|

|

|

71,609 |

|

|

|

69,939 |

|

|

|

66,399 |

|

| Net asset value per common share(2) |

|

|

32.16 |

|

|

|

35.66 |

|

|

|

33.75 |

|

|

|

34.73 |

|

|

|

31.78 |

|

|

|

30.11 |

|

| Market value per common share(2) |

|

|

26.44 |

|

|

|

29.76 |

|

|

|

29.18 |

|

|

|

28.58 |

|

|

|

27.09 |

|

|

|

24.81 |

|

| Shares outstanding (000’s) |

|

|

2,228 |

|

|

|

2,228 |

|

|

|

2,228 |

|

|

|

2,116 |

|

|

|

2,116 |

|

|

|

2,116 |

|

| (1) | Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through August.

Q4 is the period from September through November. |

| (2) | Adjusted to reflect 1 for 4 reverse stock split effective May 1, 2020. |

| (3) | Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (4) | Computed by averaging month-end values within each period. |

| (5) | Leverage consists of senior notes, preferred stock and outstanding borrowings under the revolving credit facility. |

| (6) | Computed as a percent of total assets. |

| (7) | Computed by averaging daily net assets within each period. |

Tortoise

Energy Independence Fund, Inc. (NDP)

Fund description

NDP seeks a high level of total

return with an emphasis on current distributions paid to stockholders. NDP invests primarily in equity securities of upstream North

American energy companies that engage in the exploration and production of crude oil, condensate, natural gas and natural gas

liquids that generally have a significant presence in North American oil and gas fields, including shale reservoirs.

Fund performance

The first half of 2023 saw the energy sector pressured by

lower prices in both crude oil and natural gas on recession concerns and warmer-than-expected winter weather. On the contrary, long-term

supply concerns remain as 2022 was the eighth consecutive year of underinvestment in oil and gas. The opportunity for North American energy

infrastructure remains as the U.S. energy industry focuses on maximizing shareholder returns. Global underinvestment resulting from environmental,

social and governance (ESG) commitments and energy transition is likely to keep global stock balances extremely tight for the foreseeable

future. The fund’s market-based and NAV-based returns for the fiscal period ending May 31, 2023 were -12.7% and -13.9%, respectively

(including the reinvestment of distributions).

| 2023 mid-fiscal year summary |

|

| Distributions paid per share |

$0.6300 |

| Distribution rate (as of 5/31/2023) |

9.3% |

| Year-over-year distribution increase (decrease) |

31.3% |

| Cumulative

distributions paid per share to stockholders since inception in July 2012 |

$16.0725 |

| Market-based total return |

(12.7)% |

| NAV-based total return |

(13.9)% |

| Premium (discount) to NAV (as of 5/31/2023) |

(14.1)% |

The fund utilizes a covered call strategy when appropriate,

which seeks to generate income while reducing overall volatility. No covered calls were written during the period.

Key asset performance drivers

| Top five contributors |

Company type |

| Plains All American Pipeline, L.P. |

Crude oil pipeline company |

| DCP Midstream LP |

Natural gas pipeline company |

| Magellan Midstream Partners, L.P. |

Refined products pipeline company |

| Energy Transfer LP |

Natural gas pipeline company |

| TXO Partners LP |

Oil & gas production company |

| |

|

| Bottom five contributors |

Company type |

| Devon Energy Corporation |

Oil & gas production company |

| Cheniere Energy Inc. |

Natural gas pipeline company |

| EQT Corp. |

Oil & gas production company |

| EOG Resources Inc. |

Oil & gas production company |

| Marathon Oil Corp. |

Oil & gas production company |

Unlike the fund return, index return is pre-expenses.

Performance data quoted represent past performance:

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

2023 Semi-Annual Report | May

31, 2023

Tortoise

Energy Independence Fund, Inc. (NDP) (continued)

Value of $10,000 vs. Tortoise

Energy Independence Fund – Market (unaudited)

From May 31, 2013 through May 31, 2023

The chart assumes an initial investment of $10,000. Performance

reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data

quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when

sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than

the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income distributions.

The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of May 31, 2023

| |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception(1) |

| Tortoise Energy Independence Fund − NAV |

-11.84% |

31.27% |

-13.11% |

-8.30% |

-6.93% |

| Tortoise Energy Independence Fund − Market |

-9.80% |

37.35% |

-16.11% |

-9.74% |

-8.62% |

| S&P 500 Energy Select Sector Index |

-8.23% |

31.60% |

5.34% |

3.43% |

4.78% |

(1) Inception date of the

Fund was July 26, 2012.

Fund structure and distribution policy

The fund is structured to qualify as a Regulated Investment

Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as

a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the

fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements

including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer

of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer

other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income.

RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net

capital gains to avoid a 4 percent excise tax.

The fund has adopted a managed distribution policy (“MDP”).

Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value (“NAV”)

per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return

on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts

in May and November.

Leverage

The fund’s leverage utilization increased $5.1 million

during the six months ended May 31, 2023 as compared to the six months ended November 30, 2022. The fund utilizes all floating rate leverage

that had an interest rate of 6.44% and represented 13.7% of total assets at May 31, 2023. During the period, the fund maintained compliance

with its applicable coverage ratios. The interest rate on the fund’s leverage will vary in the future along with changing floating

rates.

Please see the Financial Statements and Notes to Financial

Statements for additional detail regarding critical accounting policies, results of operations, leverage and other important fund information.

For further information regarding the calculation of distributable

cash flow and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

(unaudited)

NDP

Key Financial Data (supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental non-GAAP

financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| |

|

2022 |

|

|