Thermo Fisher Scientific Inc. (NYSE: TMO), the world leader in

serving science, today reported its financial results for the

second quarter ended June 29, 2024.

Second Quarter 2024 Highlights

- Second quarter revenue was $10.54 billion.

- Second quarter GAAP diluted earnings per share (EPS) increased

15% to $4.04.

- Second quarter adjusted EPS increased 4% to $5.37.

- Advanced our proven growth strategy, launching a range of

high-impact, innovative new products during the quarter. This

included a number of analytical instruments introduced at the

American Society for Mass Spectrometry conference, including the

Thermo Scientific™ Stellar™ mass spectrometer, which validates

proteins of clinical interest discovered through our groundbreaking

Thermo Scientific Orbitrap™ Astral™ mass spectrometer; and three

new built-for-purpose editions of the Thermo Scientific Orbitrap

Ascend Tribrid™ mass spectrometer tailored to MultiOmics,

Structural Biology and BioPharma applications. To help our

customers meet their sustainability goals, we also launched: a

first-of-its-kind biobased film for our bioprocessing containers,

which uses plant-based materials to deliver lower-carbon solutions

in the manufacturing of therapies; and a new line of ENERGY

STAR-certified Thermo Scientific™ TSX™ Universal Series ULT

Freezers, which deliver industry-leading performance and energy

efficiency.

- Continued to strengthen our industry-leading commercial engine

and deepen our trusted partner status with customers to accelerate

their innovation and enhance their productivity. In the quarter, we

expanded our leading clinical trial supply services with a new

ultra-cold facility in Bleiswijk, the Netherlands and a new

state-of-the-art innovation lab at our site in Center Valley,

Pennsylvania, to enable our pharmaceutical and biotech customers to

accelerate the development of therapies and medicines. Also in the

quarter, to support Indonesia’s growing investments in healthcare,

scientific research, and renewable energy, we expanded our presence

and capabilities in the country, further demonstrating our

relevance to customers around the world.

- Shortly after the quarter ended, we completed our acquisition

of Olink, a provider of differentiated next-generation proteomic

solutions. The addition of Olink’s technology extends our

capabilities and further advances our leadership position in

protein research, enabling our customers to meaningfully accelerate

discovery and scientific breakthroughs while delivering on the

promise of precision medicine.

“Our excellent execution enabled us to deliver another quarter

of strong financial performance and share gain,” said Marc N.

Casper, chairman, president, and chief executive officer of Thermo

Fisher Scientific. “We continue to see the benefit of our proven

growth strategy and the impact of our PPI Business System in our

performance. Shortly after the quarter ended, we were also pleased

to welcome our Olink colleagues to Thermo Fisher and are excited

about the power of this new combination to better serve our

customers and advance science.”

Casper added, “We have made very good progress through the

halfway point of the year and are in a great position to deliver

differentiated performance in 2024. We’ve further extended our

industry leadership and positioned our company for an even brighter

future.”

Second Quarter 2024

Revenue for the quarter declined 1% to $10.54 billion in 2024,

versus $10.69 billion in 2023. Organic revenue was 1% lower and

Core organic revenue growth was flat.

GAAP Earnings Results

GAAP diluted EPS in the second quarter of 2024 increased 15% to

$4.04, versus $3.51 in the same quarter last year. GAAP operating

income for the second quarter of 2024 grew to $1.82 billion,

compared with $1.58 billion in the year-ago quarter. GAAP operating

margin increased to 17.3%, compared with 14.8% in the second

quarter of 2023.

Non-GAAP Earnings Results

Adjusted EPS in the second quarter of 2024 increased 4% to

$5.37, versus $5.15 in the second quarter of 2023. Adjusted

operating income for the second quarter of 2024 was $2.35 billion,

compared with $2.37 billion in the year-ago quarter. Adjusted

operating margin increased to 22.3%, compared with 22.2% in the

second quarter of 2023.

Annual Guidance for 2024

Thermo Fisher is raising its full-year revenue and adjusted EPS

guidance. The company is raising its revenue guidance to a new

range of $42.4 to $43.3 billion versus its previous guidance of

$42.3 to $43.3 billion. The company is raising its adjusted EPS

guidance to a new range of $21.29 to $22.07 versus its previous

guidance of $21.14 to $22.02.

Use of Non-GAAP Financial Measures

Adjusted EPS, adjusted net income, adjusted operating income,

adjusted operating margin, free cash flow, organic revenue growth

and Core organic revenue growth are non-GAAP measures that exclude

certain items detailed after the tables that accompany this press

release, under the heading “Supplemental Information Regarding

Non-GAAP Financial Measures.” The reconciliations of GAAP to

non-GAAP financial measures are provided in the tables that

accompany this press release.

Note on Presentation

Certain amounts and percentages reported within this press

release are presented and calculated based on underlying unrounded

amounts. As a result, the sum of components may not equal

corresponding totals due to rounding.

Conference Call

Thermo Fisher Scientific will hold its earnings conference call

today, July 24, at 8:30 a.m. Eastern Daylight Time. During the

call, the company will discuss its financial performance, as well

as future expectations. To listen, call (833) 470-1428 within the

U.S. or (404) 975-4839 outside the U.S. The access code is 023107.

You may also listen to the call live on the “Investors” section of

our website, www.thermofisher.com. The earnings press release and

related information can also be found in that section of our

website under the heading “Financials”. A replay of the call will

be available under “News, Events & Presentations” through

Wednesday, August 7, 2024.

About Thermo Fisher Scientific

Thermo Fisher Scientific Inc. is the world leader in serving

science, with annual revenue over $40 billion. Our Mission is to

enable our customers to make the world healthier, cleaner and

safer. Whether our customers are accelerating life sciences

research, solving complex analytical challenges, increasing

productivity in their laboratories, improving patient health

through diagnostics or the development and manufacture of

life-changing therapies, we are here to support them. Our global

team delivers an unrivaled combination of innovative technologies,

purchasing convenience and pharmaceutical services through our

industry-leading brands, including Thermo Scientific, Applied

Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services,

Patheon and PPD. For more information, please visit

www.thermofisher.com.

Safe Harbor Statement

The following constitutes a “Safe Harbor” statement under the

Private Securities Litigation Reform Act of 1995: This press

release contains forward-looking statements that involve a number

of risks and uncertainties. Important factors that could cause

actual results to differ materially from those indicated by

forward-looking statements include risks and uncertainties relating

to: the COVID-19 pandemic; the need to develop new products and

adapt to significant technological change; implementation of

strategies for improving growth; general economic conditions and

related uncertainties; dependence on customers' capital spending

policies and government funding policies; the effect of economic

and political conditions and exchange rate fluctuations on

international operations; use and protection of intellectual

property; the effect of changes in governmental regulations; any

natural disaster, public health crisis or other catastrophic event;

and the effect of laws and regulations governing government

contracts, as well as the possibility that expected benefits

related to recent or pending acquisitions, may not materialize as

expected. Additional important factors that could cause actual

results to differ materially from those indicated by such

forward-looking statements are set forth in our most recent annual

report on Form 10-K, and subsequent quarterly report on Form 10-Q,

which are on file with the SEC and available in the “Investors”

section of our website under the heading “SEC Filings.” While we

may elect to update forward-looking statements at some point in the

future, we specifically disclaim any obligation to do so, even if

estimates change and, therefore, you should not rely on these

forward-looking statements as representing our views as of any date

subsequent to today.

Condensed Consolidated Statements of

Income (unaudited)

Three months ended

June 29,

% of

July 1,

% of

(Dollars in millions except per share

amounts)

2024

Revenues

2023

Revenues

Revenues

$

10,541

$

10,687

Costs and operating expenses:

Cost of revenues (a)

6,106

57.9

%

6,323

59.2

%

Selling, general and administrative

expenses (b)

1,687

16.0

%

1,673

15.7

%

Amortization of acquisition-related

intangible assets

513

4.9

%

585

5.4

%

Research and development expenses

339

3.2

%

345

3.2

%

Restructuring and other costs (c)

77

0.7

%

183

1.7

%

Total costs and operating expenses

8,722

82.7

%

9,109

85.2

%

Operating income

1,820

17.3

%

1,578

14.8

%

Interest income

295

178

Interest expense

(354

)

(326

)

Other income/(expense) (d)

5

—

Income before income taxes

1,765

1,430

Provision for income taxes (e)

(128

)

(52

)

Equity in earnings/(losses) of

unconsolidated entities

(84

)

(16

)

Net income

1,553

1,362

Less: net income/(losses) attributable to

noncontrolling interests and redeemable noncontrolling interest

6

1

Net income attributable to Thermo Fisher

Scientific Inc.

$

1,548

14.7

%

$

1,361

12.7

%

Earnings per share attributable to Thermo

Fisher Scientific Inc.:

Basic

$

4.05

$

3.53

Diluted

$

4.04

$

3.51

Weighted average shares:

Basic

382

386

Diluted

383

388

Reconciliation of adjusted operating

income and adjusted operating margin

GAAP operating income

$

1,820

17.3

%

$

1,578

14.8

%

Cost of revenues adjustments (a)

1

0.0

%

18

0.2

%

Selling, general and administrative

expenses adjustments (b)

(64

)

-0.6

%

6

0.1

%

Restructuring and other costs (c)

77

0.7

%

183

1.7

%

Amortization of acquisition-related

intangible assets

513

4.9

%

585

5.4

%

Adjusted operating income (non-GAAP

measure)

$

2,347

22.3

%

$

2,370

22.2

%

Reconciliation of adjusted net

income

GAAP net income attributable to Thermo

Fisher Scientific Inc.

$

1,548

$

1,361

Cost of revenues adjustments (a)

1

18

Selling, general and administrative

expenses adjustments (b)

(64

)

6

Restructuring and other costs (c)

77

183

Amortization of acquisition-related

intangible assets

513

585

Other income/expense adjustments (d)

—

(1

)

Provision for income taxes adjustments

(e)

(102

)

(171

)

Equity in earnings/losses of

unconsolidated entities

84

16

Noncontrolling interests adjustments

(f)

(1

)

—

Adjusted net income (non-GAAP measure)

$

2,057

$

1,997

Reconciliation of adjusted earnings per

share

GAAP diluted EPS attributable to Thermo

Fisher Scientific Inc.

$

4.04

$

3.51

Cost of revenues adjustments (a)

0.00

0.05

Selling, general and administrative

expenses adjustments (b)

(0.17

)

0.01

Restructuring and other costs (c)

0.20

0.47

Amortization of acquisition-related

intangible assets

1.34

1.51

Other income/expense adjustments (d)

0.00

0.00

Provision for income taxes adjustments

(e)

(0.26

)

(0.44

)

Equity in earnings/losses of

unconsolidated entities

0.22

0.04

Noncontrolling interests adjustments

(f)

0.00

0.00

Adjusted EPS (non-GAAP measure)

$

5.37

$

5.15

Reconciliation of free cash

flow

GAAP net cash provided by operating

activities

$

1,960

$

1,540

Purchases of property, plant and

equipment

(301

)

(284

)

Proceeds from sale of property, plant and

equipment

15

4

Free cash flow (non-GAAP measure)

$

1,674

$

1,260

Business Segment Information

Three months ended

June 29,

% of

July 1,

% of

(Dollars in millions)

2024

Revenues

2023

Revenues

Revenues

Life Sciences Solutions

$

2,355

22.3

%

$

2,463

23.0

%

Analytical Instruments

1,782

16.9

%

1,749

16.4

%

Specialty Diagnostics

1,117

10.6

%

1,109

10.4

%

Laboratory Products and Biopharma

Services

5,758

54.6

%

5,831

54.6

%

Eliminations

(470

)

-4.5

%

(465

)

-4.4

%

Consolidated revenues

$

10,541

100.0

%

$

10,687

100.0

%

Segment income and segment income

margin

Life Sciences Solutions

$

865

36.7

%

$

817

33.2

%

Analytical Instruments

439

24.6

%

432

24.7

%

Specialty Diagnostics

299

26.7

%

297

26.7

%

Laboratory Products and Biopharma

Services

745

12.9

%

824

14.1

%

Subtotal reportable segments

2,347

22.3

%

2,370

22.2

%

Cost of revenues adjustments (a)

(1

)

0.0

%

(18

)

-0.2

%

Selling, general and administrative

expenses adjustments (b)

64

0.6

%

(6

)

-0.1

%

Restructuring and other costs (c)

(77

)

-0.7

%

(183

)

-1.7

%

Amortization of acquisition-related

intangible assets

(513

)

-4.9

%

(585

)

-5.4

%

Consolidated GAAP operating income

$

1,820

17.3

%

$

1,578

14.8

%

(a) Adjusted results in 2024 and 2023

exclude charges for inventory write-downs associated with

large-scale abandonment of product lines. Adjusted results in 2023

exclude $11 of charges for the sale of inventory revalued at the

date of acquisition and $5 of accelerated depreciation on

manufacturing assets to be abandoned due to facility

consolidations.

(b) Adjusted results in 2024 and 2023

exclude certain third-party expenses, principally

transaction/integration costs related to recent acquisitions, and

charges/credits for changes in estimates of contingent acquisition

consideration.

(c) Adjusted results in 2024 and 2023

exclude restructuring and other costs consisting principally of

severance, impairments of long-lived assets, net charges for

pre-acquisition litigation and other matters, and abandoned

facility and other expenses of headcount reductions and real estate

consolidations. Adjusted results in 2023 also exclude $26 of

contract termination costs associated with facility closures.

(d) Adjusted results in 2024 and 2023

exclude net gains/losses on investments.

(e) Adjusted results in 2024 and 2023

exclude incremental tax impacts for the reconciling items between

GAAP and adjusted net income, incremental tax impacts as a result

of tax rate/law changes, and the tax impacts from audit

settlements.

(f) Adjusted results exclude the

incremental impacts for the reconciling items between GAAP and

adjusted net income attributable to noncontrolling interests.

Note:

Consolidated depreciation expense is $276

and $270 in 2024 and 2023, respectively.

Organic and Core organic revenue growth

Three months ended

June 29, 2024

Revenue growth

-1 %

Acquisitions

0 %

Currency translation

-1 %

Organic revenue growth (non-GAAP

measure)

-1 %

COVID-19 testing revenue

-1 %

Core organic revenue growth (non-GAAP

measure)

0 %

Note:

For more information related to non-GAAP

financial measures, refer to the section titled “Supplemental

Information Regarding Non-GAAP Financial Measures” of this

release.

Condensed Consolidated Statements of

Income (unaudited)

Six months ended

June 29,

% of

July 1,

% of

(Dollars in millions except per share

amounts)

2024

Revenues

2023

Revenues

Revenues

$

20,886

$

21,397

Costs and operating expenses:

Cost of revenues (a)

12,146

58.2

%

12,760

59.6

%

Selling, general and administrative

expenses (b)

3,417

16.4

%

3,319

15.5

%

Amortization of acquisition-related

intangible assets

1,065

5.1

%

1,191

5.5

%

Research and development expenses

670

3.2

%

691

3.2

%

Restructuring and other costs (c)

106

0.5

%

295

1.4

%

Total costs and operating expenses

17,404

83.3

%

18,256

85.3

%

Operating income

3,483

16.7

%

3,141

14.7

%

Interest income

574

324

Interest expense

(717

)

(626

)

Other income/(expense) (d)

14

(46

)

Income before income taxes

3,354

2,793

Provision for income taxes (e)

(408

)

(98

)

Equity in earnings/(losses) of

unconsolidated entities

(61

)

(41

)

Net income

2,885

2,654

Less: net income/(losses) attributable to

noncontrolling interests and redeemable noncontrolling interest

9

4

Net income attributable to Thermo Fisher

Scientific Inc.

$

2,875

13.8

%

$

2,650

12.4

%

Earnings per share attributable to Thermo

Fisher Scientific Inc.:

Basic

$

7.53

$

6.86

Diluted

$

7.50

$

6.83

Weighted average shares:

Basic

382

386

Diluted

383

388

Reconciliation of adjusted operating

income and adjusted operating margin

GAAP operating income

$

3,483

16.7

%

$

3,141

14.7

%

Cost of revenues adjustments (a)

17

0.1

%

59

0.3

%

Selling, general and administrative

expenses adjustments (b)

(45

)

-0.2

%

14

0.1

%

Restructuring and other costs (c)

106

0.5

%

295

1.4

%

Amortization of acquisition-related

intangible assets

1,065

5.1

%

1,191

5.5

%

Adjusted operating income (non-GAAP

measure)

$

4,625

22.1

%

$

4,700

22.0

%

Reconciliation of adjusted net

income

GAAP net income attributable to Thermo

Fisher Scientific Inc.

$

2,875

$

2,650

Cost of revenues adjustments (a)

17

59

Selling, general and administrative

expenses adjustments (b)

(45

)

14

Restructuring and other costs (c)

106

295

Amortization of acquisition-related

intangible assets

1,065

1,191

Other income/expense adjustments (d)

(11

)

45

Provision for income taxes adjustments

(e)

(51

)

(342

)

Equity in earnings/losses of

unconsolidated entities

61

41

Noncontrolling interests adjustments

(f)

(1

)

—

Adjusted net income (non-GAAP measure)

$

4,016

$

3,953

Reconciliation of adjusted earnings per

share

GAAP diluted EPS attributable to Thermo

Fisher Scientific Inc.

$

7.50

$

6.83

Cost of revenues adjustments (a)

0.04

0.15

Selling, general and administrative

expenses adjustments (b)

(0.12

)

0.03

Restructuring and other costs (c)

0.28

0.76

Amortization of acquisition-related

intangible assets

2.78

3.07

Other income/expense adjustments (d)

(0.03

)

0.11

Provision for income taxes adjustments

(e)

(0.13

)

(0.88

)

Equity in earnings/losses of

unconsolidated entities

0.16

0.11

Noncontrolling interests adjustments

(f)

0.00

0.00

Adjusted EPS (non-GAAP measure)

$

10.47

$

10.18

Reconciliation of adjusted free cash

flow

GAAP net cash provided by operating

activities

$

3,211

$

2,269

Purchases of property, plant and

equipment

(648

)

(742

)

Proceeds from sale of property, plant and

equipment

20

10

Free cash flow (non-GAAP measure)

$

2,583

$

1,537

Business Segment Information

Six months ended

June 29,

% of

July 1,

% of

(Dollars in millions)

2024

Revenues

2023

Revenues

Revenues

Life Sciences Solutions

$

4,640

22.2

%

$

5,075

23.7

%

Analytical Instruments

3,469

16.6

%

3,472

16.2

%

Specialty Diagnostics

2,227

10.7

%

2,217

10.4

%

Laboratory Products and Biopharma

Services

11,480

55.0

%

11,594

54.2

%

Eliminations

(930

)

-4.5

%

(961

)

-4.5

%

Consolidated revenues

$

20,886

100.0

%

$

21,397

100.0

%

Segment income and segment income

margin

Life Sciences Solutions

$

1,705

36.7

%

$

1,653

32.6

%

Analytical Instruments

838

24.2

%

853

24.6

%

Specialty Diagnostics

593

26.6

%

577

26.0

%

Laboratory Products and Biopharma

Services

1,489

13.0

%

1,617

14.0

%

Subtotal reportable segments

4,625

22.1

%

4,700

22.0

%

Cost of revenues adjustments (a)

(17

)

-0.1

%

(59

)

-0.3

%

Selling, general and administrative

expenses adjustments (b)

45

0.2

%

(14

)

-0.1

%

Restructuring and other costs (c)

(106

)

-0.5

%

(295

)

-1.4

%

Amortization of acquisition-related

intangible assets

(1,065

)

-5.1

%

(1,191

)

-5.5

%

Consolidated GAAP operating income

$

3,483

16.7

%

$

3,141

14.7

%

(a) Adjusted results in 2024 and 2023

exclude charges for inventory write-downs associated with

large-scale abandonment of product lines and accelerated

depreciation on manufacturing assets to be abandoned due to

facility consolidations. Adjusted results in 2023 exclude $21 of

charges for the sale of inventory revalued at the date of

acquisition.

(b) Adjusted results in 2024 and 2023

exclude certain third-party expenses, principally

transaction/integration costs related to recent acquisitions, and

charges/credits for changes in estimates of contingent acquisition

consideration.

(c) Adjusted results in 2024 and 2023

exclude restructuring and other costs consisting principally of

severance, impairments of long-lived assets, net charges for

pre-acquisition litigation and other matters, and abandoned

facility and other expenses of headcount reductions and real estate

consolidations. Adjusted results in 2023 also exclude $26 of

contract termination costs associated with facility closures.

(d) Adjusted results in 2024 and 2023

exclude net gains/losses on investments.

(e) Adjusted results in 2024 and 2023

exclude incremental tax impacts for the reconciling items between

GAAP and adjusted net income, incremental tax impacts as a result

of tax rate/law changes and the tax impacts from audit

settlements.

(f) Adjusted results exclude the

incremental impacts for the reconciling items between GAAP and

adjusted net income attributable to noncontrolling interests.

Notes:

Consolidated depreciation expense is $562

and $523 in 2024 and 2023, respectively.

For more information related to non-GAAP

financial measures, refer to the section titled “Supplemental

Information Regarding Non-GAAP Financial Measures” of this

release.

Condensed Consolidated Balance Sheets (unaudited)

June 29,

December 31,

(In millions)

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

7,073

$

8,077

Short-term investments

1,750

3

Accounts receivable, net

7,943

8,221

Inventories

5,198

5,088

Other current assets

3,512

3,200

Total current assets

25,476

24,589

Property, plant and equipment, net

9,282

9,448

Acquisition-related intangible assets,

net

15,519

16,670

Other assets

4,377

3,999

Goodwill

43,843

44,020

Total assets

$

98,496

$

98,726

Liabilities, redeemable noncontrolling

interest and equity

Current liabilities:

Short-term obligations and current

maturities of long-term obligations

$

5,121

$

3,609

Other current liabilities

9,651

10,403

Total current liabilities

14,772

14,012

Other long-term liabilities

5,907

6,564

Long-term obligations

30,284

31,308

Redeemable noncontrolling interest

115

118

Total equity

47,419

46,724

Total liabilities, redeemable

noncontrolling interest and equity

$

98,496

$

98,726

Condensed Consolidated Statements of

Cash Flows (unaudited)

Six months ended

June 29,

July 1,

(In millions)

2024

2023

Operating activities

Net income

$

2,885

$

2,654

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

1,626

1,714

Change in deferred income taxes

(607

)

(328

)

Other non-cash expenses, net

311

480

Changes in assets and liabilities,

excluding the effects of acquisitions

(1,003

)

(2,251

)

Net cash provided by operating

activities

3,211

2,269

Investing activities

Purchases of property, plant and

equipment

(648

)

(742

)

Proceeds from sale of property, plant and

equipment

20

10

Proceeds from cross-currency interest rate

swap interest settlements

111

35

Acquisitions, net of cash acquired

—

(2,751

)

Purchases of investments

(1,778

)

(188

)

Other investing activities, net

12

51

Net cash used in investing activities

(2,283

)

(3,585

)

Financing activities

Net proceeds from issuance of debt

1,204

—

Repayment of debt

—

(1,000

)

Net proceeds from issuance of commercial

paper

—

1,620

Repayment of commercial paper

—

(1,441

)

Purchases of company common stock

(3,000

)

(3,000

)

Dividends paid

(284

)

(252

)

Other financing activities, net

145

24

Net cash used in financing activities

(1,936

)

(4,049

)

Exchange rate effect on cash

7

(19

)

Decrease in cash, cash equivalents and

restricted cash

(1,000

)

(5,384

)

Cash, cash equivalents and restricted cash

at beginning of period

8,097

8,537

Cash, cash equivalents and restricted cash

at end of period

$

7,097

$

3,153

Free cash flow (non-GAAP measure)

$

2,583

$

1,537

Note:

For more information related to non-GAAP

financial measures, refer to the section titled “Supplemental

Information Regarding Non-GAAP Financial Measures” of this

release.

Supplemental Information Regarding Non-GAAP Financial

Measures

In addition to the financial measures prepared in accordance

with generally accepted accounting principles (GAAP), we use

certain non-GAAP financial measures such as organic revenue growth,

which is reported revenue growth, excluding the impacts of

acquisitions/divestitures and the effects of currency translation.

We also report Core organic revenue growth, which is reported

revenue growth, excluding the impacts of COVID-19 testing revenue,

and excluding the impacts of acquisitions/divestitures and the

effects of currency translation. We report these measures because

Thermo Fisher management believes that in order to understand the

company’s short-term and long-term financial trends, investors may

wish to consider the impact of acquisitions/divestitures, foreign

currency translation and/or COVID-19 testing on revenues. Thermo

Fisher management uses these measures to forecast and evaluate the

operational performance of the company as well as to compare

revenues of current periods to prior periods.

We report adjusted operating income, adjusted operating margin,

adjusted net income, and adjusted EPS. We believe that the use of

these non-GAAP financial measures, in addition to GAAP financial

measures, helps investors to gain a better understanding of our

core operating results and future prospects, consistent with how

management measures and forecasts the company’s core operating

performance, especially when comparing such results to previous

periods, forecasts, and to the performance of our competitors. Such

measures are also used by management in their financial and

operating decision-making and for compensation purposes. To

calculate these measures we exclude, as applicable:

- Certain acquisition-related costs, including charges for the

sale of inventories revalued at the date of acquisition,

significant transaction/acquisition-related costs, including

changes in estimates of contingent acquisition-related

consideration, and other costs associated with obtaining short-term

financing commitments for pending/recent acquisitions. We exclude

these costs because we do not believe they are indicative of our

normal operating costs.

- Costs/income associated with restructuring activities and

large-scale abandonments of product lines, such as reducing

overhead and consolidating facilities. We exclude these costs

because we believe that the costs related to restructuring

activities are not indicative of our normal operating costs.

- Equity in earnings/losses of unconsolidated entities;

impairments of long-lived assets; and certain other gains and

losses that are either isolated or cannot be expected to occur

again with any predictability, including gains/losses on

investments, the sale of businesses, product lines, and real

estate, significant litigation-related matters,

curtailments/settlements of pension plans, and the early retirement

of debt. We exclude these items because they are outside of our

normal operations and/or, in certain cases, are difficult to

forecast accurately for future periods.

- The expense associated with the amortization of

acquisition-related intangible assets because a significant portion

of the purchase price for acquisitions may be allocated to

intangible assets that have lives of up to 20 years. Exclusion of

the amortization expense allows comparisons of operating results

that are consistent over time for both our newly acquired and

long-held businesses and with both acquisitive and non-acquisitive

peer companies.

- The noncontrolling interest and tax impacts of the above items

and the impact of significant tax audits or events (such as changes

in deferred taxes from enacted tax rate/law changes), the latter of

which we exclude because they are outside of our normal operations

and difficult to forecast accurately for future periods.

We report free cash flow, which is operating cash flow excluding

net capital expenditures, to provide a view of the continuing

operations’ ability to generate cash for use in acquisitions and

other investing and financing activities. The company also uses

this measure as an indication of the strength of the company. Free

cash flow is not a measure of cash available for discretionary

expenditures since we have certain non-discretionary obligations

such as debt service that are not deducted from the measure.

Thermo Fisher Scientific does not provide GAAP financial

measures on a forward-looking basis because we are unable to

predict with reasonable certainty and without unreasonable effort

items such as the timing and amount of future restructuring actions

and acquisition-related charges as well as gains or losses from

sales of real estate and businesses, the early retirement of debt

and the outcome of legal proceedings. The timing and amount of

these items are uncertain and could be material to Thermo Fisher

Scientific’s results computed in accordance with GAAP.

The non-GAAP financial measures of Thermo Fisher Scientific’s

results of operations and cash flows included in this press release

are not meant to be considered superior to or a substitute for

Thermo Fisher Scientific’s results of operations prepared in

accordance with GAAP. Reconciliations of such non-GAAP financial

measures to the most directly comparable GAAP financial measures

are set forth in the tables above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723465896/en/

Media Contact Information: Sandy Pound Thermo Fisher Scientific

Phone: 781-622-1223 E-mail: sandy.pound@thermofisher.com

Investor Contact Information: Rafael Tejada Thermo Fisher

Scientific Phone: 781-622-1356 E-mail:

rafael.tejada@thermofisher.com

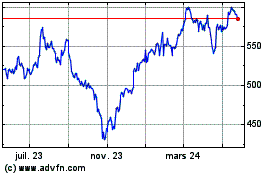

Thermo Fisher Scientific (NYSE:TMO)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

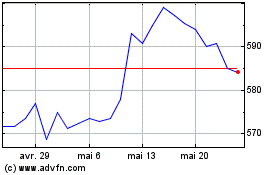

Thermo Fisher Scientific (NYSE:TMO)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025