Platform+ net revenue increased 19%

year-over-year (YoY) to $169.4 million

Platform+ gross profit increased 15% YoY to

$98.6 million

SmartCast Average Revenue Per User increased

16% YoY to $35.39

VIZIO Holding Corp. (NYSE: VZIO) today announced

the following results for the three months ended June 30, 2024:

Financial and operational highlights include the following,

compared to Q2'23:

- Net revenue of $437.3 million, up 11%

- Platform+ net revenue of $169.4 million, up 19%

- Gross profit of $99.5 million, up 16%

- Platform+ gross profit of $98.6 million, up 15%

- Net income of $0.2 million, compared to $1.9 million

- Adjusted EBITDA1 of $8.6 million, compared to $18.1

million

- Adjusted EBITDA includes acquisition-related costs of $8.4

million and cash incentive awards in lieu of equity awards of $0.5

million in connection with our long-term incentive plan

- SmartCast Average Revenue Per User (ARPU) of $35.39, up

16%

Q2'24 Business highlights include:

- Reached 18.8 million SmartCast Active Accounts, which streamed

5.6 billion hours2

- Grew SmartCast Hours per average SmartCast Active Account to

100 per month, up 6% YoY

- Expanded our direct ad relationships by 13% compared to

Q2'233

- Introduced a new line of award-winning sound bars featuring

select models that start as low as $99 with Dolby Atmos® and DTS:X

capabilities

- Unveiled additional advertising products focusing on new

content hubs and ad formats at the 2024 NewFronts

- Added WatchFree+ channels, including Death Valley Days, Tribeca

Channel, Nature Moments, and World’s Wildest Police Videos bringing

the total number of FAST channels to over 350

- Launched 23 new apps, including NBC Sports, Fox News, Fanmio,

and Binge Korea bringing the total number of built-in apps to over

250

1 A reconciliation of Net Income (Loss) to

Adjusted EBITDA is provided below.

2 Streamed hours represent SmartCast

Hours.

3 Direct ad relationships consists of the

number of advertisers that purchased advertising inventory directly

from VIZIO during the second quarter.

Selected Quarterly Financial

Results

(Unaudited, in millions, except

percentages and SmartCast ARPU)

Three Months Ended June

30,

2024

2023

% Change

Financial

Highlights

Net Revenue

Device

$

267.9

$

252.1

6

%

Platform+

169.4

142.3

19

%

Total Net Revenue

437.3

394.4

11

%

Gross Profit

Device

0.9

0.3

200

%

Platform+

98.6

85.8

15

%

Total Gross Profit

99.5

86.1

16

%

Operating Expenses1

106.5

79.8

33

%

Net Income

$

0.2

$

1.9

(89

)%

Adjusted EBITDA2,3

$

8.6

$

18.1

(52

)%

Operational

Metrics

Smart TV Shipments

1.2

1.0

15

%

SmartCast Active Accounts (as of)

18.8

17.6

7

%

Total VIZIO Hours

9,314

8,852

5

%

SmartCast Hours

5,612

4,952

13

%

SmartCast ARPU

$

35.39

$

30.55

16

%

_________________________

1 Operating expenses for the three months

ended June 30, 2024 include share-based compensation of $11.7

million. Operating expenses for the three months ended June 30,

2023 include share-based compensation of $9.3 million.

2 A reconciliation of Net Income (Loss) to

Adjusted EBITDA is provided below.

3 2024 Adjusted EBITDA includes

acquisition-related costs of $8.4 million and cash incentive awards

in lieu of equity awards of $0.5 million in connection with our

long-term incentive plan.

About VIZIO

Founded and headquartered in Orange County, California, our

mission at VIZIO Holding Corp. (NYSE: VZIO) is to deliver immersive

entertainment and compelling lifestyle enhancements that make our

products the center of the connected home. We are driving the

future of televisions through our integrated platform of

cutting-edge Smart TVs and powerful operating system. We also offer

a portfolio of innovative sound bars that deliver consumers an

elevated audio experience. Our platform gives content providers

more ways to distribute their content and advertisers more tools to

connect with the right audience.

Supplemental Financial and Other Information

Supplemental financial and other information can be accessed

through our Investor Relations website at investors.vizio.com. We

announce material information to the public about our company,

products and services, and other matters through a variety of

means, including filings with the Securities and Exchange

Commission, press releases, public conference calls, webcasts, our

Investor Relations website (investors.vizio.com), our blog

(accessible via vizio.com/en/newsroom) and our X account (@VIZIO)

in order to achieve broad, non-exclusionary distribution of

information to the public and for complying with our disclosure

obligations under Regulation FD.

Key Operational and Financial Metrics

We review certain key operational and financial metrics to

evaluate our business, measure our performance, identify trends

affecting our business, formulate business plans and make strategic

decisions. We regularly review and may adjust our processes for

calculating our internal metrics to improve their accuracy.

The metrics included in this press release, including the key

operational and financial metrics defined below, as well as

SmartCast Hours per SmartCast Active Account and direct advertising

client relationships, are not based on any standardized industry

methodology and are not necessarily calculated in the same manner

or comparable to similarly titled measures presented by other

companies. Similarly, these metrics may differ from estimates

published by third parties or from similarly titled metrics of our

competitors due to differences in methodology. The numbers that we

use to calculate these metrics are based on internal data. While

these numbers are based on what we believe to be reasonable

judgments and estimates for the applicable period of measurement,

there are inherent challenges in measuring usage and engagement. We

regularly review and may adjust our processes for calculating our

internal metrics to improve their accuracy.

Smart TV Shipments. We define Smart TV Shipments as the

number of Smart TV units shipped to retailers or direct to

consumers in a given period. Smart TV Shipments currently drive the

majority of our revenue and provide the foundation for increased

adoption of our SmartCast operating system and the growth of our

Platform+ revenue. The growth rate between Smart TV Shipments and

Device net revenue is not directly correlated because VIZIO’s

Device net revenue can be impacted by other variables, such as the

series and sizes of Smart TVs sold during the period, the

introduction of new products as well as the number of sound bars

shipped.

SmartCast Active Accounts. We define SmartCast Active

Accounts as the number of VIZIO Smart TVs where a user has

activated the SmartCast operating system through an internet

connection at least once in the past 30 days. We believe that the

number of SmartCast Active Accounts is an important metric to

measure the size of our engaged user base, the attractiveness and

usability of our operating system, and subsequent monetization

opportunities to increase our Platform+ net revenue.

Total VIZIO Hours. We define Total VIZIO Hours as the

aggregate amount of time users spend utilizing our Smart TVs in any

capacity. We believe this usage metric is useful to understanding

our total potential monetization opportunities.

SmartCast Hours. We define SmartCast Hours as the

aggregate amount of time viewers engage with our SmartCast platform

to stream content or access other applications. This metric

reflects the size of the audience engaged with our operating system

as well as indicates the growth and awareness of our platform. It

is also a measure of the success of our offerings in addressing

increased user demand for OTT streaming. Greater user engagement

translates into increased revenue opportunities as we earn a

significant portion of our Platform+ net revenue through

advertising, which is influenced by the amount of time users spend

on our platform.

SmartCast ARPU. We define SmartCast ARPU as total

Platform+ net revenue, less revenue attributable to legacy VIZIO

V.I.A. Plus units, during the preceding four quarters divided by

the average of (i) the number of SmartCast Active Accounts at the

end of the current period; and (ii) the number of SmartCast Active

Accounts at the end of the corresponding prior year period.

SmartCast ARPU indicates the level at which we are monetizing our

SmartCast Active Account user base. Growth in SmartCast ARPU is

driven significantly by our ability to add users to our platform

and our ability to monetize those users.

Device gross profit. We define Device gross profit as

Device net revenue less Device cost of goods sold in a given

period. Device gross profit is directly influenced by consumer

demand, device offerings, and our ability to maintain a

cost-efficient supply chain.

Platform+ gross profit. We define Platform+ gross profit

as Platform+ net revenue less Platform+ cost of goods sold in a

given period. As we continue to grow and scale our business, we

expect Platform+ gross profit to increase over the long term.

Non-GAAP Financial Measures

To supplement our financial information presented in accordance

with generally accepted accounting principles in the United States

of America, or GAAP, VIZIO considers certain financial measures

that are not prepared in accordance with GAAP, including Adjusted

EBITDA. We define Adjusted EBITDA as total net income (loss) before

interest income, net, other income, net, (benefit from) provision

for income taxes, depreciation and amortization and share-based

compensation. We consider Adjusted EBITDA to be an important metric

to assess our operating performance and help us to manage our

working capital needs. Utilizing Adjusted EBITDA, we can identify

and evaluate trends in our business as well as provide investors

with consistency and comparability to facilitate period-to-period

comparisons of our business. We believe that providing users with

non-GAAP measures such as Adjusted EBITDA may assist investors in

seeing VIZIO’s operating results through the eyes of management and

in comparing VIZIO’s operating results over multiple periods with

other companies in our industry.

We use Adjusted EBITDA in conjunction with net income (loss) as

part of our overall assessment of our operating performance and the

management of our working capital needs. Our definition of Adjusted

EBITDA may differ from the definition used by other companies and

therefore comparability may be limited. In addition, other

companies may not publish Adjusted EBITDA or similar metrics.

Furthermore, Adjusted EBITDA has certain limitations in that it

does not include the impact of certain expenses that are reflected

in our condensed consolidated statement of operations that are

necessary to run our business. Thus, Adjusted EBITDA should be

considered in addition to, not as a substitute for, or in isolation

from, measures prepared in accordance with GAAP, including net

income (loss).

We compensate for these limitations by providing a

reconciliation of Adjusted EBITDA to net income (loss). We

encourage investors and others to review our financial information

in its entirety, not to rely on any single financial measure and to

view Adjusted EBITDA in conjunction with net income (loss).

Forward-looking information

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements generally relate to future events or VIZIO’s future

financial or operating performance. In some cases, you can identify

forward looking statements because they contain words such as

“may,” “will,” “should,” “expects,” “plans,” “anticipates,” “going

to,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential,” or “continue,” or

the negative of these words or other similar terms or expressions

that concern our expectations, strategy, priorities, plans, or

intentions.

There are a number of risks and uncertainties that could cause

actual results to differ materially from statements made in this

press release. If any of these risks or uncertainties materialize,

our actual results could differ materially from the results

expressed or implied by these forward-looking statements.

The forward-looking statements contained in this press release

are also subject to other risks and uncertainties, including those

more fully described in our filings with the Securities and

Exchange Commission, including our Annual Report on Form 10-K for

the year ended December 31, 2023, as filed on February 28, 2024,

and our Quarterly Report on Form 10-Q for the quarter ended March

31, 2024, as filed on May 8, 2024. Additional information will also

be set forth in our Quarterly Report on Form 10-Q for the three and

six months ended June 30, 2024. The forward-looking statements in

this press release are based on information available to VIZIO as

of the date hereof, and VIZIO disclaims any obligation to update

any forward-looking statements, except as required by law.

VIZIO HOLDING CORP.

Consolidated Statements of

Operations

(Unaudited, in millions except

per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenue:

Device

$

267.9

$

252.1

$

462.2

$

483.4

Platform+

169.4

142.3

328.9

267.8

Total net revenue

437.3

394.4

791.1

751.2

Cost of goods sold:

Device

267.0

251.8

468.5

481.4

Platform+

70.8

56.5

142.0

108.1

Total cost of goods sold

337.8

308.3

610.5

589.5

Gross profit:

Device

0.9

0.3

(6.3

)

2.0

Platform+

98.6

85.8

186.9

159.7

Total gross profit

99.5

86.1

180.6

161.7

Operating expenses:

Selling, general and administrative

79.8

58.6

155.9

116.8

Marketing

9.8

10.0

18.3

17.7

Research and development

15.7

10.0

30.7

21.9

Depreciation and amortization

1.2

1.2

2.4

2.2

Total operating expenses

106.5

79.8

207.3

158.6

(Loss) income from operations

(7.0

)

6.3

(26.7

)

3.1

Interest income, net

3.2

3.1

7.1

5.4

Other income, net

2.6

0.3

3.2

0.3

Total non-operating income, net

5.8

3.4

10.3

5.7

(Loss) income before income taxes

(1.2

)

9.7

(16.4

)

8.8

(Benefit from) provision for income

taxes

(1.4

)

7.8

(4.5

)

7.6

Net income (loss)

$

0.2

$

1.9

$

(11.9

)

$

1.2

Net income (loss) per share attributable

to Class A and Class B stockholders:

Basic

$

0.00

$

0.01

$

(0.06

)

$

0.01

Diluted

$

0.00

$

0.01

$

(0.06

)

$

0.01

Weighted-average Class A and Class B

common shares outstanding:

Basic

199.3

195.9

198.6

195.6

Diluted

210.0

200.7

198.6

201.0

VIZIO HOLDING CORP.

Consolidated Balance

Sheets

(Unaudited, in millions except

par values)

June 30, 2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

202.1

$

221.6

Short-term investments

132.0

129.9

Accounts receivable, net

321.6

381.2

Inventories

27.6

6.8

Income tax receivable

21.4

9.0

Prepaid and other current assets

53.8

45.9

Total current assets

758.5

794.4

Property, equipment and software, net

18.5

19.7

Goodwill

44.8

44.8

Deferred income taxes

49.6

49.6

Other assets

71.8

52.2

Total assets

$

943.2

$

960.7

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable due to related

parties

$

65.9

$

109.1

Accounts payable

189.6

157.8

Accrued expenses

153.0

178.6

Accrued royalties

43.4

40.7

Other current liabilities

5.3

5.8

Total current liabilities

457.2

492.0

Other long-term liabilities

19.1

19.4

Total liabilities

476.3

511.4

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value; 100.0

shares authorized and no shares issued and outstanding as of June

30, 2024 and December 31, 2023

—

—

Common stock, $0.0001 par value; 1,350.0

shares authorized as of June 30, 2024 and December 31, 2023

- Class A, 125.7 and 125.3 shares issued and 125.7 and 121.5

shares outstanding as of June 30, 2024 and December 31, 2023,

respectively,

- Class B, 75.3 and 76.2 shares issued and 75.3 and 76.2 shares

outstanding as of June 30, 2024 and December 31, 2023,

respectively

- Class C, no shares issued and outstanding as of June 30, 2024

and December 31, 2023

—

—

Additional paid-in capital

443.9

414.3

Accumulated other comprehensive loss

(0.4

)

(0.3

)

Retained earnings

23.4

35.3

Total stockholders’ equity

466.9

449.3

Total liabilities and stockholders’

equity

$

943.2

$

960.7

VIZIO HOLDING CORP.

Consolidated Statements of

Cash Flows

(Unaudited, in millions)

Six Months Ended June

30,

2024

2023

Cash flows from operating activities:

Net (loss) income

$

(11.9

)

$

1.2

Adjustments to reconcile net (loss) income

to net cash used in operating activities:

Depreciation and amortization

5.7

3.7

Realized gain on investments

(0.4

)

—

Amortization of premium and discount on

investments

(3.2

)

(1.8

)

Change in fair value of investment

securities

—

(0.2

)

Unrealized gain on conversion of

convertible equity investments

(3.8

)

—

Share-based compensation expense

26.1

18.1

Change in allowance for doubtful

accounts

(0.5

)

0.7

Changes in operating assets and

liabilities:

Accounts receivable

60.1

50.9

Other receivables due from related

parties

—

2.2

Inventories

(20.8

)

7.9

Income taxes receivable

(12.4

)

1.7

Prepaid and other current assets

(7.9

)

(6.2

)

Other assets

(18.2

)

(5.7

)

Accounts payable due to related

parties

(43.2

)

(59.5

)

Accounts payable

31.8

5.9

Accrued expenses

(25.6

)

(45.4

)

Accrued royalties

2.7

(0.1

)

Income taxes payable

—

1.9

Other current liabilities

(0.5

)

(0.3

)

Other long-term liabilities

(0.3

)

(2.6

)

Net cash used in operating activities

(22.3

)

(27.6

)

Cash flows from investing activities:

Purchase of property and equipment

(2.3

)

(1.5

)

Purchase of investments

(67.4

)

(114.6

)

Sale of investments

0.6

—

Maturity of investments

68.6

45.1

Net cash used in investing activities

(0.5

)

(71.0

)

Cash flows from financing activities:

Proceeds from the exercise of stock

options

2.2

1.9

Withholding taxes paid on behalf of

employees on net settled share-based awards

—

(0.6

)

Proceeds from sale of stock under employee

stock purchase plan

1.2

1.2

Net cash provided by financing

activities

3.4

2.5

Effects of exchange rate changes on cash

and cash equivalents

(0.1

)

—

Net decrease in cash and cash

equivalents

(19.5

)

(96.1

)

Cash and cash equivalents at beginning of

period

221.6

288.7

Cash and cash equivalents at end of

period

$

202.1

$

192.6

Supplemental disclosure of cash flow

information:

Cash paid for income taxes

$

7.4

$

4.6

Cash paid for interest

$

0.1

$

0.1

Cash paid for amounts included in the

measurement of operating lease liabilities

$

2.3

$

2.1

Supplemental disclosure of non-cash

investing and financing activities:

Right-of-use assets obtained in exchange

for new operating lease liabilities

$

1.8

$

0.5

Additions to property and equipment

financed by accounts payable

$

—

$

0.7

VIZIO HOLDING CORP.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(Unaudited, in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss)

$

0.2

$

1.9

$

(11.9

)

$

1.2

Adjusted to exclude the following:

Interest income, net

(3.2

)

(3.1

)

(7.1

)

(5.4

)

Other income, net

(2.6

)

(0.3

)

(3.2

)

(0.3

)

(Benefit from) provision for income

taxes

(1.4

)

7.8

(4.5

)

7.6

Depreciation and amortization

2.8

1.9

5.7

3.7

Share-based compensation

12.7

9.9

26.1

18.1

Adjusted EBITDA1,2

$

8.6

$

18.1

$

5.1

$

24.9

_________________________

1 For the three months ended June 30,

2024, Adjusted EBITDA includes acquisition-related costs of $8.4

million and cash incentive awards in lieu of equity awards of $0.5

million in connection with our long-term incentive plan. For the

six months ended June 30, 2024, Adjusted EBITDA includes

acquisition-related costs of $14.1 million and cash incentive

awards in lieu of equity awards of $0.5 million in connection with

our long-term incentive plan.

2 Totals may not sum due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240804108969/en/

Investors and Analysts: Michael Marks IR@vizio.com

Media: PR@vizio.com

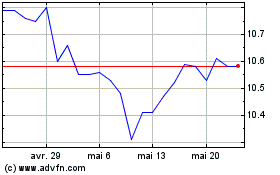

VIZIO (NYSE:VZIO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

VIZIO (NYSE:VZIO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024