Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) today

announced financial results for the quarter ended September 30,

2024.

Connor Teskey, President of Brookfield Asset

Management, stated, “We delivered record results in the third

quarter, driven by the substantial increase in fee-bearing capital

due to strong fundraising, deployment and additional strategic

partnerships over the past year. This resulted in 14%

year-over-year growth in fee-related earnings, while fee-bearing

capital increased by 23% to $539 billion.”

He continued, “This past quarter, we continued

to extend our leadership position in our key strategic sectors of

energy transition, AI infrastructure, and private credit. We are

well positioned to continue delivering strong earnings, bolstered

by market tailwinds that should accelerate both our capital raising

and deployment activities for years to come.”

Operating

Results

Brookfield

Asset Management

Ltd.

Net income for Brookfield Asset Management Ltd.

(BAM), the publicly traded entity, totaled $129 million for the

quarter (2023 - $122 million). BAM owns an approximate 27% interest

in our asset management business with the other approximate 73%

owned by Brookfield Corporation. In order to provide meaningful

comparative information, the discussion that follows relates to the

financial results on a 100% basis for our asset management business

(Brookfield Asset Management).

Brookfield Asset

Management1

|

For the periods ended September 30 |

Three Months Ended |

Twelve Months Ended |

|

(US$ millions, except per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Fee-Related

Earnings2 |

$ |

644 |

|

$ |

565 |

|

$ |

2,360 |

|

$ |

2,236 |

|

|

Add back: equity-based compensation costs and other3 |

|

59 |

|

|

49 |

|

|

198 |

|

|

177 |

|

|

Less: cash taxes |

|

(84 |

) |

|

(46 |

) |

|

(258 |

) |

|

(186 |

) |

|

Distributable

Earnings2 |

$ |

619 |

|

$ |

568 |

|

$ |

2,300 |

|

$ |

2,227 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee-related earnings per share |

$ |

0.39 |

|

$ |

0.35 |

|

$ |

1.45 |

|

$ |

1.37 |

|

|

Distributable earnings per share |

$ |

0.38 |

|

$ |

0.35 |

|

$ |

1.41 |

|

$ |

1.36 |

|

|

Net income

attributable to

Brookfield Asset

Management |

$ |

544 |

|

$ |

494 |

|

$ |

1,854 |

|

$ |

1,969 |

|

|

See endnotes |

|

|

|

|

|

|

|

|

|

|

Operating

Highlights

Financial

Results

Fee-bearing capital (FBC) reached $539 billion

at the end of the third quarter, up nearly $100 billion or 23% over

the past year and up over $25 billion or 5% from the prior

quarter.

This growth has come from $101 billion in

fundraising and $25 billion of capital deployment over the last

twelve months. In the quarter, FBC has also benefitted from the

increase in our listed affiliate share prices and execution of a

number of strategic initiatives with leading partner managers, such

as Castlelake and SVB Capital.

On the back of this growth in fee-bearing

capital, fee-related earnings were a record $644

million ($0.39 / share) for the quarter and $2.4 billion

($1.45 / share) over the last twelve months, up 14% and 6% over the

same periods in the prior year, respectively.

Distributable earnings were $619 million ($0.38

/ share) for the quarter and $2.3 billion ($1.41 / share) over the

last twelve months, up 9% and 3% over the same periods in the prior

year, respectively.

Fundraising

We raised $21 billion in the third quarter of 2024. Notable

fundraising updates during the quarter include:

- Within credit, we raised

approximately $14 billion of capital. This included $6.4 billion

raised across Oaktree credit funds and strategies, $4.5 billion

from Brookfield Wealth Solutions and $1.0 billion in a separately

managed account (SMA) from a U.S. life insurance company. We expect

that third-party insurance capital will be a meaningful contributor

to our growth going forward.

- Within renewable

power, we raised $2.2 billion of capital, including $1.4 billion

for our Catalytic Transition Fund.

- Within

infrastructure, we raised a total of $1.4 billion, including over

$500 million within our supercore infrastructure strategy,

surpassing the capital raised for this strategy last quarter and

making it our strongest quarter for fundraising in over two years.

We also raised nearly $800 million within our private wealth

infrastructure fund.

- Within private

equity, we raised $2.0 billion of capital in the quarter. We also

announced strategic commitments from two of our Saudi Arabian

clients for our Middle East Partners fund in October.

- Within real estate,

we raised $1.6 billion of capital during the quarter.

Notable

Transactions

Investment activity has continued to increase.

In the third quarter, we deployed or committed to approximately $20

billion of capital into investments across a number of high-quality

businesses and assets. We also monetized or agreed to sell over $17

billion of investments in recent months.

Recent notable deployments and commitments include:

- We completed the

acquisition of Network International for $2.0 billion of equity

capital, a deal announced previously last year. Post-acquisition,

we intend to combine Network with Magnati, our UAE payment

processing business, to create a leading payments platform in the

Middle East that will benefit from secular tailwinds and

significantly expand our presence in the region.

- We acquired a

portfolio of 76,000 telecom sites in India from American Tower Corp

for $800 million of equity capital ($2.2 billion of enterprise

value).

- Subsequent to

the end of the quarter, we announced a new partnership agreement

with Ørsted to acquire a $2.3 billion stake in a premium portfolio

of 3.5 GW of contracted operating offshore wind assets in the

United Kingdom with strong operating history.

- Subsequent to

the end of the quarter, we made an offer to acquire Tritax EuroBox,

a publicly-traded European logistics REIT, for approximately $730

million.

Recent notable monetizations and sales agreements include:

- Within real

estate, we sold a total of $5.4 billion of assets in the past few

months, including the sale of our UK Retail Parks Portfolio, a US

Manufactured Home portfolio and the sale of the Conrad hotel in

Seoul, Korea.

- Within renewable

power, we announced a total of $3.2 billion of asset sales in

recent months. The largest of these transactions include Saeta

Yield, a leading independent developer, owner and operator of

renewable power assets in Spain and Portugal; our stake in First

Hydro, a critical electricity generation and storage facility in

the United Kingdom; and a 50% stake in our Shepherds Flat onshore

wind portfolio in Oregon.

- Within

infrastructure, we announced a total of $2.6 billion of asset sales

in recent months. This includes separate agreements to sell two

Mexican regulated natural gas transmission pipelines.

Uncalled Fund

Commitments and

Liquidity

As of September 30, 2024, we had a total of $106

billion of uncalled fund commitments.

- Uncalled fund

commitments include $50 billion which is not currently earning

fees, but will earn approximately $500 million of fees annually

once deployed.

We had corporate liquidity of $2.1 billion on

our balance sheet as of September 30, 2024, comprised of cash,

short term financial assets, and the undrawn capacity on our

revolving credit facility.

- This includes a

five-year, unsecured, $750 million revolving facility, raised in

August, further enhancing our liquidity.

Recent

Strategic Transactions

We announced or completed several strategic

transactions during the quarter:

- We closed on a

51% interest in and strategic partnership with Castlelake, a global

alternative investment manager specializing in asset-based private

credit including aviation and specialty finance.

- We completed the

acquisition of SVB Capital through Pinegrove Venture Partners, our

venture investment platform formed with Sequoia Heritage.

Regular

Dividend Declaration

The board of directors of Brookfield Asset

Management Ltd. declared a quarterly dividend of $0.38 per share,

payable on December 31, 2024, to shareholders of record as of the

close of business on November 29, 2024.

End Notes

- Reflects full period results unless

otherwise noted on a 100% basis for Brookfield Asset Management,

being Brookfield Asset Management ULC and its subsidiaries,

including its share of the asset management activities of partly

owned subsidiaries.

- See

Reconciliation of Net Income to Fee-Related Earnings and

Distributable Earnings on page 6 and Non-GAAP and Performance

Measures section on page 8.

- Equity-based

compensation costs and other income includes Brookfield Asset

Management's portion of partly owned subsidiaries investment

income, realized carried interest, and other items.

|

Brookfield Asset Management Ltd.Statement

of Financial Position |

|

UnauditedAs at(US$ millions) |

September 30,2024 |

|

December 31,2023 |

|

|

Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

16 |

|

$ |

9 |

|

|

Investment in Brookfield Asset Management |

|

3,309 |

|

|

2,270 |

|

|

Due from affiliates |

|

923 |

|

|

886 |

|

|

Other assets |

|

76 |

|

|

40 |

|

|

Total Assets |

$ |

4,324 |

|

$ |

3,205 |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

Accounts payable and other |

$ |

858 |

|

$ |

859 |

|

|

Due to affiliates |

|

218 |

|

|

261 |

|

|

Total Liabilities |

|

1,076 |

|

|

1,120 |

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

Total Equity |

|

3,248 |

|

|

2,085 |

|

|

Total Liabilities

and Equity |

$ |

4,324 |

|

$ |

3,205 |

|

|

Brookfield Asset Management Ltd.Statement of Operating

Results |

|

Unaudited |

|

|

|

|

|

|

|

For the periods ended September 30 |

Three Months Ended |

|

(US$ millions, except per share amounts) |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

Equity accounted income |

$ |

138 |

|

$ |

123 |

|

|

Compensation and other expenses |

|

(9 |

) |

|

(1 |

) |

|

Net Income |

$ |

129 |

|

$ |

122 |

|

|

Net income per

share of common

stock |

|

|

|

|

|

|

|

Diluted |

$ |

0.30 |

|

$ |

0.31 |

|

|

Basic |

$ |

0.31 |

|

$ |

0.31 |

|

|

Brookfield Asset Management Statement of Financial

Position |

|

UnauditedAs at(US$ millions) |

September 30,2024 |

|

December 31,2023 |

|

|

Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

903 |

|

$ |

2,667 |

|

|

Accounts receivable and other |

|

614 |

|

|

588 |

|

|

Investments |

|

9,354 |

|

|

7,522 |

|

|

Due from affiliates |

|

2,378 |

|

|

2,504 |

|

|

Deferred income tax assets and other assets |

|

1,005 |

|

|

1,009 |

|

|

Total Assets |

$ |

14,254 |

|

$ |

14,290 |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

Accounts payable and other |

$ |

1,667 |

|

$ |

1,799 |

|

|

Due to affiliates |

|

1,386 |

|

|

986 |

|

|

Deferred income tax liabilities and other |

|

2,200 |

|

|

2,206 |

|

|

|

|

5,253 |

|

|

4,991 |

|

|

|

|

|

|

|

|

|

|

Equity |

|

9,001 |

|

|

9,299 |

|

|

|

|

|

|

|

|

|

|

Total Liabilities

and Equity |

$ |

14,254 |

|

$ |

14,290 |

|

|

Brookfield Asset Management Statement of Operating

Results |

|

Unaudited |

|

|

For the periods ended September 30 |

Three Months Ended |

|

(US$ millions, except per share amounts) |

|

2024 |

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

Management fee and incentive distribution revenues |

$ |

873 |

|

$ |

778 |

|

|

Carried interest income, net of amounts attributable to

Corporation |

|

104 |

|

|

25 |

|

|

Other revenues, net |

|

140 |

|

|

90 |

|

|

Total Revenues |

|

1,117 |

|

|

893 |

|

|

Expenses |

|

|

|

Compensation, operating, and general and administrative

expenses |

|

(430 |

) |

|

(307 |

) |

|

Interest expense |

|

(8 |

) |

|

(3 |

) |

|

Total Expenses |

|

(438 |

) |

|

(310 |

) |

|

Other expenses |

|

(107 |

) |

|

(43 |

) |

|

Share of income from equity accounted investments |

|

61 |

|

|

22 |

|

|

Income Before

Taxes |

|

633 |

|

|

562 |

|

|

Income tax expense |

|

(96 |

) |

|

(52 |

) |

|

Net Income |

|

537 |

|

|

510 |

|

|

Net (loss) income attributable to Brookfield Corporation |

|

(7 |

) |

|

16 |

|

|

Net income

attributable to

Brookfield Asset

Management |

$ |

544 |

|

$ |

494 |

|

|

Net income per

share |

|

|

|

|

|

|

|

Diluted |

$ |

0.33 |

|

$ |

0.30 |

|

|

Basic |

$ |

0.33 |

|

$ |

0.30 |

|

SELECT FINANCIAL

INFORMATION

RECONCILIATION OF

NET INCOME TO

FEE-RELATED EARNINGS

AND DISTRIBUTABLE

EARNINGS

Brookfield Asset

Management

|

Unaudited |

|

|

For the periods ended September 30 |

Three Months Ended |

|

(US$ millions) |

|

2024 |

|

|

2023 |

|

|

Net income |

$ |

537 |

|

$ |

510 |

|

|

Add or subtract the following: |

|

|

|

|

|

|

|

Provision for taxes1 |

|

96 |

|

|

52 |

|

|

Depreciation and amortization2 |

|

4 |

|

|

3 |

|

|

Carried interest allocations3 |

|

(55 |

) |

|

(89 |

) |

|

Carried interest allocation compensation3 |

|

38 |

|

|

3 |

|

|

Other expenses4 |

|

69 |

|

|

40 |

|

|

Interest expense paid to related parties5 |

|

8 |

|

|

3 |

|

|

Interest and dividend revenue5 |

|

(34 |

) |

|

(44 |

) |

|

Other revenues6 |

|

(141 |

) |

|

(10 |

) |

|

Share of income from equity method investments7 |

|

(61 |

) |

|

(22 |

) |

|

Fee-related earnings of partly owned subsidiaries at our

share7 |

|

87 |

|

|

71 |

|

|

Compensation costs recovered from affiliates8 |

|

95 |

|

|

15 |

|

|

Fee Revenues from BSREP III & other9 |

|

1 |

|

|

33 |

|

|

Fee-Related Earnings |

|

644 |

|

|

565 |

|

|

Cash taxes10 |

|

(84 |

) |

|

(46 |

) |

|

Add back: equity-based compensation costs and other11 |

|

59 |

|

|

49 |

|

|

Distributable Earnings |

$ |

619 |

|

$ |

568 |

|

- This adjustment removes the impact

of income tax provisions on the basis that we do not believe this

item reflects the present value of the actual tax obligations that

we expect to incur over the long-term due to the substantial

deferred tax assets of Brookfield Asset Management.

- This adjustment removes the

depreciation and amortization on property, plant and equipment and

intangible assets, which are non-cash in nature and therefore

excluded from Fee-Related Earnings.

- These adjustments remove the impact

of both unrealized and realized carried interest allocations and

the associated compensation expense. Unrealized carried interest

allocations and associated compensation expense are non-cash in

nature. Carried interest allocations and associated compensation

costs are included in Distributable Earnings once realized.

- This adjustment removes other

income and expenses associated with non-cash fair value

changes.

- This adjustment removes interest

and charges paid or received from related party loans.

- This adjustment adds back other

revenues earned that are non-cash in nature.

- These adjustments remove our share

of partly owned subsidiaries’ earnings, including items 1) to 6)

above and include its share of partly owned subsidiaries’

Fee-Related Earnings.

- This item adds back compensation

costs that will be borne by affiliates and are non-cash in

nature.

- This adjustment adds base

management fees earned from funds that are eliminated upon

consolidation and other items.

- Represents the impact of cash taxes

paid by the business.

- This adjustment adds back

equity-based compensation and other income associated with

Brookfield Asset Management’s portion of partly owned subsidiaries’

investment income, realized carried interest, interest income

received and charges paid on related party loans, and other

income.

Additional Information

The Letter to Shareholders and the Supplemental

Information for the three months and twelve months ended September

30, 2024 contain further information on the company’s strategy,

operations and financial results. Shareholders are encouraged to

read these documents, which are available on BAM’s website.

The statements contained herein are based

primarily on information that has been extracted from our financial

statements for the quarter ended September 30, 2024, which have

been prepared using U.S. GAAP. The amounts have not been audited by

BAM’s external auditor.

BAM’s board of directors has reviewed and

approved this document, including the summarized unaudited

consolidated financial statements, prior to its release.

Information on our dividends can be found on our

website under Stock & Distributions - Distribution History

section at bam.brookfield.com.

Quarterly Earnings

Call Details

Investors, analysts and other interested parties

can access BAM’s Third Quarter 2024 Results, as well as the Letter

to Shareholders and Supplemental Information, on its website under

the Reports & Filings section at bam.brookfield.com.

To participate in the Conference Call today at

10:00 a.m. ET, please preregister at

https://register.vevent.com/register/BI40fc91cc173d4008997926152f847ba6.

Upon registering, you will be emailed a dial-in number, and unique

PIN.

The Conference Call will also be webcast live at

https://edge.media-server.com/mmc/p/2q5sxe62. For those unable to

participate in the Conference Call, the telephone replay will be

archived and available for 90 days, or on our website at

bam.brookfield.com.

About Brookfield

Asset Management

Brookfield Asset Management Ltd. (NYSE: BAM,

TSX: BAM) is a leading global alternative asset manager with over

$1 trillion of assets under management across renewable power and

transition, infrastructure, private equity, real estate, and

credit. We invest client capital for the long-term with a focus on

real assets and essential service businesses that form the backbone

of the global economy. We offer a range of alternative investment

products to investors around the world — including public and

private pension plans, endowments and foundations, sovereign wealth

funds, financial institutions, insurance companies and private

wealth investors. We draw on Brookfield’s heritage as an owner and

operator to invest for value and generate strong returns for our

clients, across economic cycles.

Please note that Brookfield Asset Management

Ltd.’s previous audited annual and unaudited quarterly reports have

been filed on EDGAR and SEDAR+ and can also be found in the

investor section of its website at bam.brookfield.com. Hard copies

of the annual and quarterly reports can be obtained free of charge

upon request. For more information, please visit our website at

bam.brookfield.com or contact:

|

Media:Simon MaineTel: (44) 739 890 9278Email:

simon.maine@brookfield.com |

Investor Relations:Jason

FooksTel: (866) 989-0311Email: jason.fooks@brookfield.com |

|

|

|

Non-GAAP and

Performance Measures

This news release and accompanying financial

information are based on generally accepted accounting principles

in the United States of America (“U.S. GAAP”).

We make reference to Distributable Earnings

(“DE”), which is referring to the sum of its fee-related earnings,

realized carried interest, realized principal investments, interest

expense, and general and administrative expenses; excluding

equity-based compensation costs and depreciation and amortization.

The most directly comparable measure disclosed in the primary

financial statements of Brookfield Asset Management for DE is net

income. This provides insight into earnings received by the company

that are available for distribution to common shareholders or to be

reinvested into the business.

We use Fee-Related Earnings (“FRE”) and DE to

assess our operating results and the value of Brookfield’s business

and believe that many shareholders and analysts also find these

measures of value to them.

We disclose a number of financial measures in

this news release that are calculated and presented using

methodologies other than in accordance with U.S. GAAP. These

financial measures, which include FRE and DE, should not be

considered as the sole measure of our performance and should not be

considered in isolation from, or as a substitute for, similar

financial measures calculated in accordance with U.S. GAAP. We

caution readers that these non-GAAP financial measures or other

financial metrics are not standardized under U.S. GAAP and may

differ from the financial measures or other financial metrics

disclosed by other businesses and, as a result, may not be

comparable to similar measures presented by other issuers and

entities.

We provide additional information on key terms

and non-GAAP measures in our filings available at

bam.brookfield.com.

Notice to

Readers

BAM is not making any offer or invitation of any

kind by communication of this news release and under no

circumstance is it to be construed as a prospectus or an

advertisement.

This news release contains “forward-looking

information” within the meaning of Canadian provincial securities

laws and “forward-looking statements” within the meaning of the

U.S. Securities Act of 1933, the U.S. Securities Exchange Act of

1934, “safe harbor” provisions of the United States Private

Securities Litigation Reform Act of 1995 and in any applicable

Canadian securities regulations (collectively, “forward-looking

statements”). Forward- looking statements include statements that

are predictive in nature, depend upon or refer to future results,

events or conditions, and include, but are not limited to,

statements which reflect management’s current estimates, beliefs

and assumptions regarding the operations, business, financial

condition, expected financial results, performance, prospects,

opportunities, priorities, targets, goals, ongoing objectives,

strategies, capital management and outlook of BAM, Brookfield Asset

Management and its subsidiaries, as well as the outlook for North

American and international economies for the current fiscal year

and subsequent periods, and which are in turn based on our

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors

management believes are appropriate in the circumstances. The

estimates, beliefs and assumptions of BAM are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and as such, are subject

to change. Forward-looking statements are typically identified by

words such as “target”, “project”, “forecast”, “expect”,

“anticipate”, “believe”, “foresee”, “could”, “estimate”, “goal”,

“intend”, “plan”, “seek”, “strive”, “will”, “may” and “should” and

similar expressions. In particular, the forward-looking statements

contained in this news release include statements referring to

future results, performance, achievements, prospects or

opportunities of BAM, Brookfield Asset Management or the Canadian,

U.S. or international markets.

Although BAM believes that such forward-looking

statements are based upon reasonable estimates, beliefs and

assumptions, actual results may differ materially from the

forward-looking statements. Factors that could cause actual results

to differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: (i) our

lack of independent means of generating revenue; (ii) our material

assets consisting solely of our interest in Brookfield Asset

Management; (iii) challenges relating to maintaining our

relationship with Brookfield Corporation and potential conflicts of

interest; (iv) BAM being a newly formed company; (v) our liability

for our asset management business; (vi) inflationary pressures;

(vii) the impact on growth in fee-bearing capital of poor product

development or marketing efforts; (viii) our ability to maintain

our global reputation; (ix) volatility in the trading price of our

class A limited voting shares; (x) being subjected to numerous

laws, rules and regulatory requirements, and the potential

ineffectiveness of our policies to prevent violations thereof; (xi)

meeting our financial obligations due to our cash flow from our

asset management business; (xii) foreign currency risk and exchange

rate fluctuations; (xiii) requirement of temporary investments and

backstop commitments to support our asset management business;

(xiv) rising interest rates; (xv) revenues impacted by a decline in

the size or pace of investments made by our managed assets; (xvi)

the variability of our earnings growth, which may affect our

dividend and the trading price of our class A limited voting

shares; (xvii) exposed risk due to increased amount and type

of investment products in our managed assets; (xviii) difficulty in

maintaining our culture or managing our human capital; (xix)

political instability or changes in government; (xx) unfavorable

economic conditions or changes in the industries in which we

operate; (xxi) catastrophic events, such as earthquakes,

hurricanes, or pandemics/epidemics; (xxii) deficiencies in public

company financial reporting and disclosures; (xxiii) ineffective

management of sustainability considerations, and inadequate or

ineffective health and safety programs; (xxiv) the failure of

our information and technology systems; (xxv) us and our managed

assets becoming involved in legal disputes; (xxvi) losses not

covered by insurance; (xxvii) inability to collect on amounts owing

to us; (xxviii) information barriers that may give rise to

conflicts and risks; (xxix) risks related to our renewable power

and transition, infrastructure, private equity, real estate, and

other alternatives, including credit strategies; (xxx) risks

relating to Canadian and United States taxation laws; and (xxxi)

other factors described from time to time in our documents filed

with the securities regulators in Canada and the United States.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive and other

factors could also adversely affect future results. Readers are

urged to consider these risks, as well as other uncertainties,

factors and assumptions carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on such

forward-looking statements, which are based only on information

available to us as of the date of this news release. Except as

required by law, BAM undertakes no obligation to publicly update or

revise any forward-looking statements, whether written or oral,

that may be as a result of new information, future events or

otherwise.

Past performance is not indicative nor a

guarantee of future results. There can be no assurance that

comparable results will be achieved in the future, that future

investments will be similar to historic investments discussed

herein, that targeted returns, growth objectives, diversification

or asset allocations will be met or that an investment strategy or

investment objectives will be achieved (because of economic

conditions, the availability of appropriate opportunities or

otherwise).

Target returns and growth objectives set forth

in this news release are for illustrative and informational

purposes only and have been presented based on various assumptions

made by BAM in relation to the investment strategies being pursued,

any of which may prove to be incorrect. There can be no assurance

that targeted returns or growth objectives will be achieved. Due to

various risks, uncertainties and changes (including changes in

economic, operational, political or other circumstances) beyond

BAM’s control, the actual performance of the business could differ

materially from the target returns and growth objectives set forth

herein. In addition, industry experts may disagree with the

assumptions used in presenting the target returns and growth

objectives. No assurance, representation or warranty is made by any

person that the target returns or growth objectives will be

achieved, and undue reliance should not be put on them.

Certain of the information contained herein is

based on or derived from information provided by independent

third-party sources. While BAM believes that such information is

accurate as of the date it was produced and that the sources from

which such information has been obtained are reliable, BAM makes no

representation or warranty, express or implied, with respect to the

accuracy, reasonableness or completeness of any of the information

or the assumptions on which such information is based, contained

herein, including but not limited to, information obtained from

third parties.

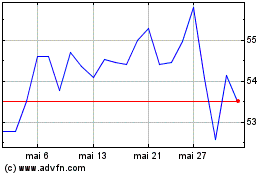

Brookfield Asset Managem... (TSX:BAM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Brookfield Asset Managem... (TSX:BAM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024