TORONTO, Feb. 20, 2024 (GLOBE NEWSWIRE) --

Discovery Silver Corp. (TSX: DSV, OTCQX: DSVSF)

(“Discovery” or the “Company”) is pleased to announce results from

the Feasibility Study (“FS” or “the Study”) on its 100%-owned

Cordero silver project (“Cordero” or “the Project”) located in

Chihuahua State, Mexico. Highlights include (all figures are in

US$ unless otherwise noted):

-

Large-scale, long-life production: 19-year mine

life with average annual production of 37 Moz AgEq in Year 1 to

Year 12.

-

Low costs, high margins & low capital

intensity: average AISC of less than $12.50 over the first

eight years of the mine life placing Cordero in the bottom half of

the cost curve.

-

Low capital intensity: initial development capex

of $606 million resulting in an attractive after-tax NPV-to-capex

ratio of 2.0.

-

Attractive project economics: Base Case after-tax

NPV5% (“NPV”) of $1.2 billion and IRR of 22% with NPV expanding to

$2.2 billion in Year 4.

-

Tier 1 reserve base: Reserves of Ag - 302 Moz, Au

- 840 koz, Pb – 3.0 Blb and Zn – 5.2 Blb, positioning Cordero as

one of the largest undeveloped silver deposits globally.

-

Clear upside potential: 240Mt of Measured &

Indicated Resource sit outside the FS pit highlighting the

potential to materially extend the mine life at modestly higher

silver prices.

-

Substantial socio-economic contribution: an

initial investment of over $600 million, 2,500 jobs created during

construction, $4 billion of goods and services purchased and

estimated tax contributions of over $1.4 billion within

Mexico.

-

Industry-leading environmental standards:

third-party reviews of proposed environmental practices to ensure

adherence to both Mexican regulatory standards and Equator

Principles 4. The Study also incorporates investment in

infrastructure and technology to recycle wastewater from local

communities with discharged water representing the primary source

of water for mine operations.

Tony Makuch, CEO, states: “Our Feasibility

Study has delivered outstanding results that clearly establish

Cordero as one of the world’s leading development-stage projects.

Cordero is the largest undeveloped silver project globally based on

both reserves and annual production and has low unit costs in

support of high margins and substantial cash flow generation.

Cordero is also extremely capital efficient, with an initial NPV to

Capex ratio of 2.0x, with the NPV almost doubling to over $2

billion by year four following completion of the Phase 2 mill

expansion that is primarily funded by internal cash flow. With more

than 300 Moz of silver reserves, a mine life of close to 20 years

and significant extension potential, Cordero is uniquely positioned

to play a key role in closing market deficits in the silver space

and in supplying future consumption in high-growth areas including

the battery vehicle and solar power sectors.

“Importantly, Cordero will have a major

positive socio-economic impact locally in Parral, in the Chihuahua

region and at the national level. Cordero will create up to 2,500

jobs during the construction period, 1,000 direct jobs over the

mine life, will purchase in excess of $4 billion of goods and

services from local and regional suppliers, and will generate $1.4

billion of tax revenues at all levels of government. As part of our

proactive approach to water management, we also plan to invest in

infrastructure and technology that will support recycling of

wastewater produced from local communities for use as our primary

source of water for the Project. Our team in Mexico has already won

numerous awards for social responsibility, environmental protection

and workplace culture and we look forward to expanding on these

efforts as part of our commitment to the sustainable development of

Cordero and our adherence to the highest industry standards for

environmental protection, water management, social responsibility

and health and safety.”

The Company will be hosting a Conference Call to

present the FS results on Tuesday February 20, 2024, at 11:00am ET.

A presentation by management will be followed by Q&A. The

webcast can be accessed at the following link: Webcast Link

FEASIBILITY STUDY

SUMMARY

Project Economics

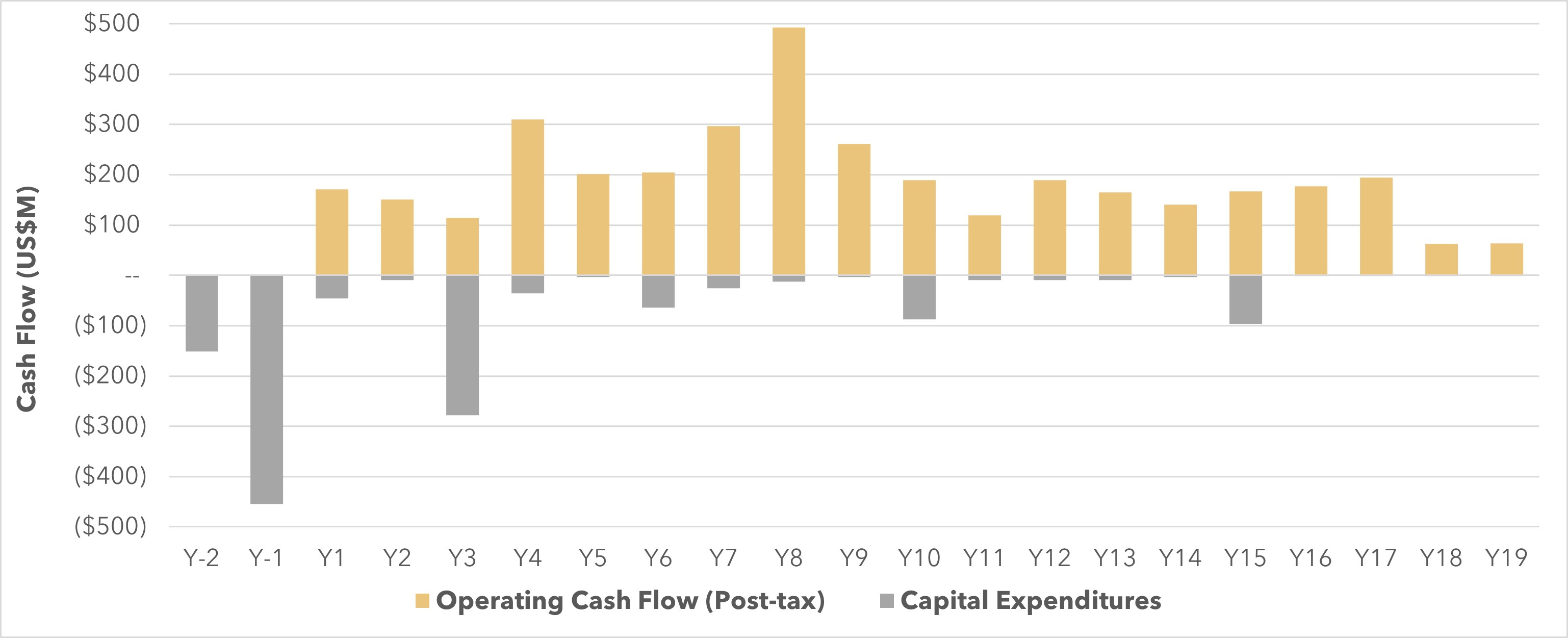

The economics for the FS were based on the

following metal prices: Ag - $22.00/oz, Au - $1,600/oz, Pb -

$1.00/lb and Zn - $1.20/lb. A 10% increase in metal prices results

in a 40% increase in the Project NPV to over $1.6 billion. The

payback is 5.2 years due to the expansion of the processing plant

from 26,000 tpd to 51,000 tpd in Year 3 at a capital cost of $291

million. This expansion will be funded from operating cash flow.

Completion of the expansion in Year 3 results in a peak Project NPV

of $2.2 billion in Year 4.

|

|

Units |

Base Case |

Base Case

Metal Prices

+10% |

Base Case

Metal Prices

-10% |

|

After-Tax NPV (5% discount rate) |

(US$ M) |

$1,177 |

$1,647 |

$707 |

|

Internal Rate of Return |

(%) |

22.0% |

27.2% |

16.1% |

|

Payback |

(yrs) |

5.2 |

4.3 |

6.5 |

Note – refer to Appendix C for a more

detailed sensitivity analysis.

Production & Costs

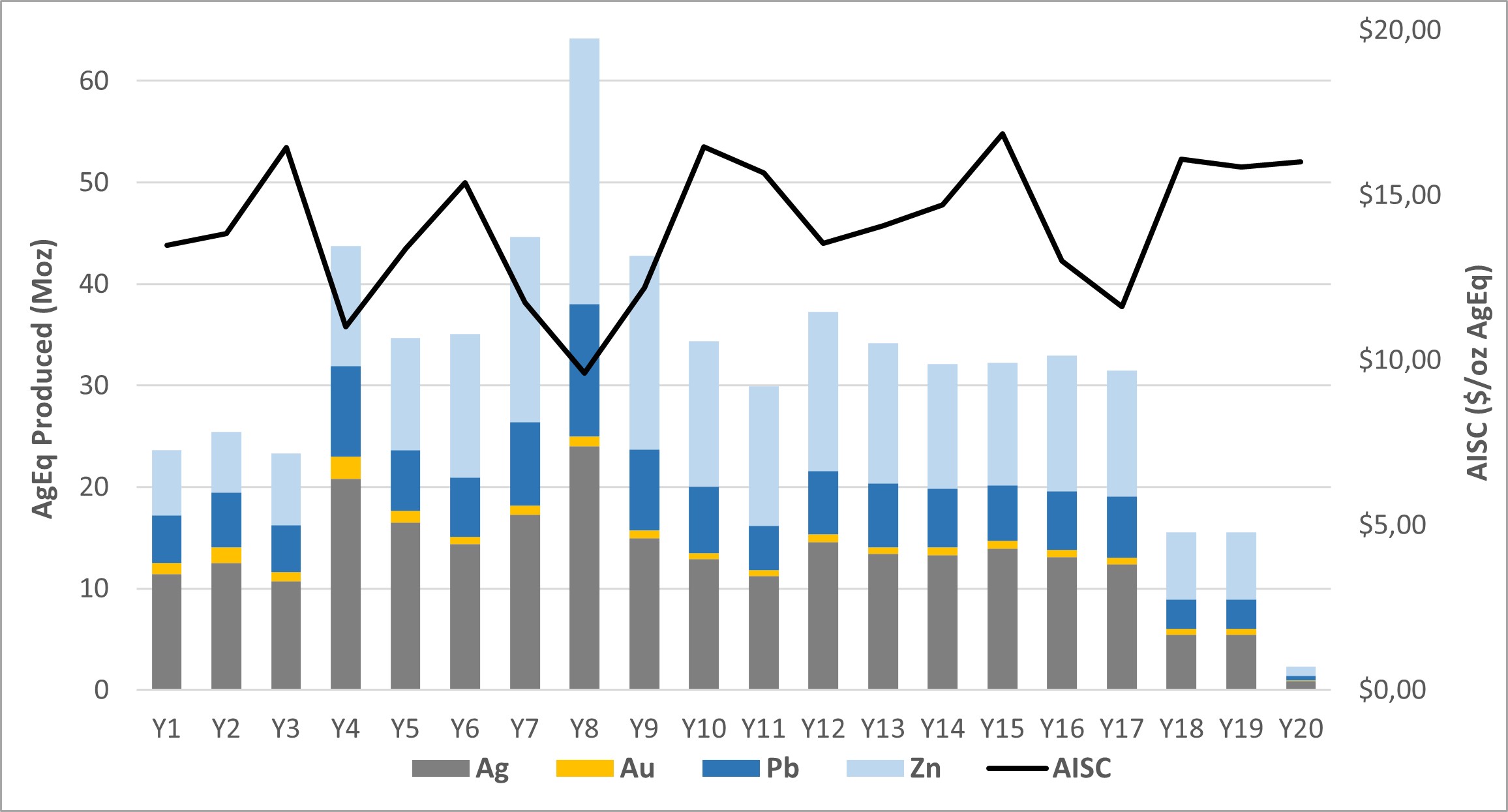

Annual production over the life-of-mine (“LOM”)

is expected to average 33 Moz AgEq. In Years 5 – Year 12 production

averages more than 40 Moz AgEq with peak production in Year 8 of 64

Moz AgEq. These production levels position Cordero as one of the

largest primary silver mines globally. All-In Sustaining Costs

(“AISC”) average less than $13.50/oz AgEq over the LOM. These costs

were effectively flat in comparison to the PFS due to cost

inflationary pressures being offset by improved silver payabilities

and reagent cost reductions.

|

|

Units |

Year 1 – 4

(Phase 1) |

Year 5 – 12

(Phase 2) |

Year 13 -19

(Phase 2) |

LOM |

|

AgEq Produced – Average/yr1 |

(Moz) |

29 |

40 |

28 |

33 |

|

AgEq Payable – Average/yr |

(Moz) |

26 |

35 |

24 |

29 |

|

AgEq Produced - Total |

(Moz) |

116 |

323 |

196 |

635 |

|

AgEq Payable - Total |

(Moz) |

102 |

279 |

169 |

550 |

|

All-In Sustaining Cost (AISC)2 |

(US$/AgEq oz) |

$13.22 |

$13.01 |

$14.36 |

$13.47 |

-

AgEq Produced is metal recovered in concentrate. AgEq Payable

is metal payable from concentrate and incorporates metal payment

terms outlined in the Concentrate Terms section below. AgEq is

calculated as Ag + (Au x 72.7) + (Pb x 45.5) + (Zn x 54.6); these

factors are based on metal prices of Ag - $22/oz, Au - $1,600/oz,

Pb - $1.00/lb and Zn - $1.20/lb.

-

AISC is a non-GAAP measure; refer to the Non-GAAP Measures

section of the release for further information on this measure. See

Technical Disclosure section for AISC calculation

methodology.

LOM Production

Note – Au/Pb/Zn production is shown on an

AgEq basis based on: Ag = $22/oz, Au = $1,600/oz, Pb = $1.00/lb and

Zn = $1.20/lb

Study Project Team

The FS was supported by a high-quality project

team consisting of the following groups:

-

Study lead: Ausenco Engineering Canada ULC (“Ausenco”)

-

Metallurgical testwork: Blue Coast Research under the supervision

of Libertas Metallurgy Ltd, Sacanus Holdings and Ausenco

-

Resource estimation: RedDot 3D Inc. in conjunction with RockRidge

Consulting and third-party review by Hardrock Consulting, LLC

-

Process & infrastructure design: Ausenco and M3 Mexicana S. de

R.L de C.V.

-

Mine planning & costing – AGP Mining Consultants Inc. with

third-party review by Hard Rock Consulting LLC

-

Tailings design, hydrogeology and geotechnical – WSP USA Inc.

-

Environmental: Ausenco, Investigacion Y Desarrollo De Acuiferos Y

Ambiente and CIMA Consultores Ambientales

Next Steps

The following work is planned for 2024 with the

objective of reaching a construction decision later this year or

early 2025.

-

Front-end Engineering Design (“FEED”): FEED

engineering work consists of early project planning and advancement

of engineering definition and will enable the Company to place

orders for long lead-time items and to award the EPC/EPCM contract

for the development of the Project.

-

Permitting: the Company formally submitted for

evaluation its Environmental Impact Assessment (“Manifestacion de

Impacto Ambiental” or “MIA”) in August 2023. The review process for

the MIA submission by Secretaría de Medio Ambiente y Recursos

Naturales (“SEMARNAT”) is ongoing. The other principal permit

required for construction and operation of Cordero is the Change of

Land Use (“Cambio de Uso de Suelo” or “CUS”). Formal submission of

the CUS is expected to be made by the third quarter of 2024.

-

Project financing: the Company plans to progress

all financing options for the Project through the course of 2024.

These options include equity, debt, offtake, joint ventures,

partnerships, lease financing on major equipment, streams,

royalties and other strategic alternatives.

-

Water management: a scoping study was completed

for the FS to upgrade local water treatment plants in the region

and for the construction of a water pipeline to site. Further

engineering work on the plant upgrade is expected to be completed

through the course of the year.

-

Key de-risking items: the Company also plans to

advance during the year the acquisition and leasing of surface

rights where appropriate and permitting for the land, power and

water required for the development and operation of

Cordero.

Further details on the Company’s 2024 work

program can be found in the news release dated January 24, 2024,

and filed under the Company’s profile on www.sedarplus.ca.

Resource Update

In conjunction with the FS, the Mineral Resource

Estimate for Cordero has been updated to incorporate an additional

33,400 m of drilling (total drilling of 310,900 m in 793 drill

holes). The Measured & Indicated Resource has grown by 70 Moz

AgEq to 1,202 Moz AgEq with the Inferred Resource being reduced by

12 Moz AgEq to 155 Moz AgEq as summarized below. The overall

expansion of the resource was largely driven by exploration success

at depth and in the northeast part of the deposit.

-

Measured & Indicated Resource of 1,202 Moz AgEq at an

average grade of 52 g/t AgEq (719 Mt grading 21 g/t Ag,

0.06 g/t Au, 0.31% Pb and 0.60% Zn)

-

Inferred Resource of 155 Moz AgEq at an average grade of 32

g/t AgEq (149 Mt grading 14 g/t Ag, 0.03 g/t Au, 0.18% Pb

and 0.35% Zn)

Mineral resources that are not mineral reserves

do not have demonstrated economic viability. Further details on the

Resource including all supporting technical disclosure are outlined

in Appendix A.

CAPITAL EXPENDITURES

Cordero is a very capital-efficient project due

to numerous underlying advantages:

-

Staged expansion of the process plant

-

Simple and conventional process design

-

Minimal earthworks due to gentle topography, the location of

bedrock near-surface and favourable geotechnical characteristics of

the bedrock

-

Minimal early mine development and pre-stripping resulting from the

deposit extending to surface

-

Close proximity to existing infrastructure including nearby highway

and adjacent powerline

-

Favourable mining jurisdiction with access to a highly skilled

local workforce and no need for a camp given the proximity of the

town of Parral approximately 40 km to the south

Initial Capital (to achieve

plant throughput of 9.6 Mt/a)

Initial capital to build Cordero Phase 1 is

estimated to total $606 million and will be incurred over a

two-year construction period. This capital estimate includes Phase

1 of the process plant with nameplate capacity of 9.6 Mt/a (~26,000

tpd), the construction of on-site infrastructure, a power

transmission line, the upgrade of the local water treatment plant

and water pipeline, all pre-stripping activities and construction

of the TSF starter dam that will provide 3 years of initial

tailings storage.

Contingency for the initial capital estimate

averages 12% and is applied to direct and indirect costs. Owners

costs represent 2.3% of direct costs. Indirect costs represent 16%

of direct costs. These proportions are in-line with typical

industry averages and are consistent with a cost base for a

greenfield project build in Mexico and commensurate with the level

of complexity of the project build.

Expansion Capital

(to expand plant to 19.2 Mt/a)

The processing facility will be expanded to a

nameplate capacity of 19.2 Mt/a (~51,000 tpd) at an estimated cost

of $291 million. Most of the costs associated with the expansion

will be incurred in Year 3. The expansion includes the addition of

parallel grinding and flotation circuits, additional on-site

infrastructure and a tailings dam lift that is concurrent with

plant expansion.

An expansion of the flotation circuit is planned

for Year 7 at a cost of $17 million to accommodate an increase in

zinc grades.

Sustaining Capital

Sustaining capital over the LOM totals $388

million (excluding closure costs net of salvage). This includes

$221 million to be spent on tailings management facility expansions

with the remainder to be spent on mine equipment, the process

plant, mobile equipment and replacements/refurbishments of

infrastructure assets. Sustaining capital for the process plant has

been classified as operating costs under the maintenance category.

Sustaining capital for mining only includes down payments on

replacement equipment with the remaining lease costs classified as

mine operating costs.

|

DESCRIPTION (all in US$ millions) |

INITIAL

CAPITAL |

EXPANSION

CAPITAL |

SUSTAINING

LOM CAPEX |

TOTAL LOM

CAPEX |

|

CAPITAL EXPENDITURES |

|

|

|

|

|

Mining |

$117 |

$2 |

$110 |

$229 |

|

Onsite Infrastructure |

$44 |

$14 |

- |

$57 |

|

Processing Plant |

$210 |

$148 |

- |

$359 |

|

Tailings Facility (TSF) |

$28 |

$60 |

$221 |

$310 |

|

Offsite Infrastructure |

$57 |

- |

$16 |

$73 |

|

Indirects |

$73 |

$44 |

$11 |

$128 |

|

Owners Costs |

$11 |

$4 |

- |

$14 |

|

Contingency |

$65 |

$37 |

$31 |

$133 |

|

Closure costs / Salvage value |

- |

- |

$75 |

$75 |

|

Capital Expenditures - Subtotals |

$606 |

$309 |

$463 |

$1,377 |

OPERATIONS

Mining

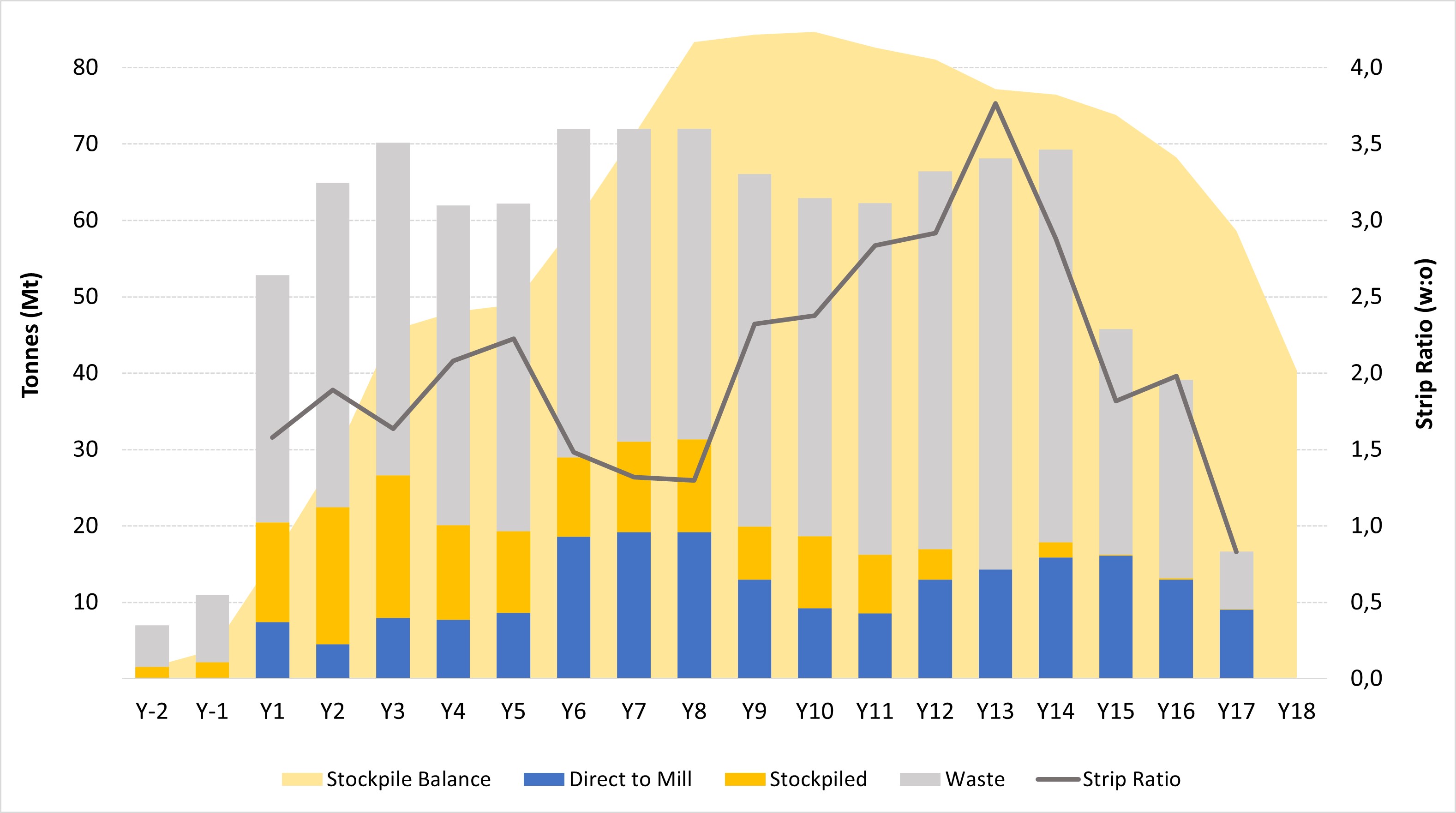

The mine plan incorporates accelerated stripping

as well as stockpiling of low-grade material to optimize the grade

profile over the LOM.

-

The mine plan is based on a detailed mine design that incorporates

mining dilution, ore loss, safety berms and haul roads.

-

Following a steady ramp up period, the mining rates over the life

of the mine are relatively consistent at approximately 70

Mt/a.

-

The ultimate pit contains 1,042 Mt in total consisting of 327 Mt of

ore, 696 Mt of waste and 19 Mt of stockpiled oxide material above

cut-off. The average strip ratio is 2.0:1 and is even over the

LOM.

-

Pit slope designs were based on eight geotechnical core holes and

logging of core from exploration core holes.

Processing

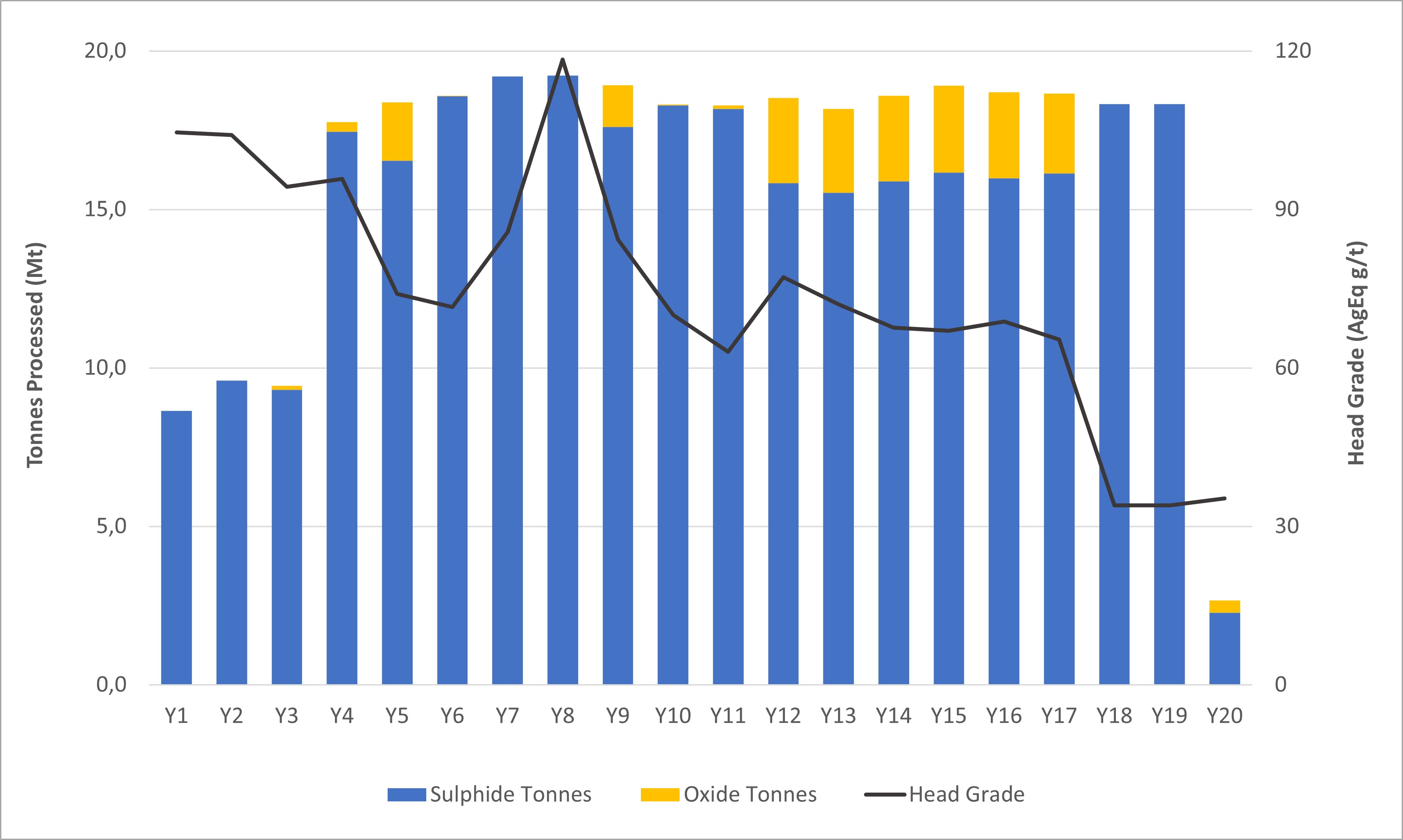

Processing was broken into two main phases to

optimize the capital efficiency of the project. Oxides and

sulphides are co-processed up to a maximum oxide tonnage proportion

of 15% of total mill feed.

-

Phase 1 throughput (Year 1 to Year 4): Year 1 is a ramp up year

with throughput at 80% of nameplate capacity of 9.6 Mt/a (~26,000

tpd). Year 4 is a transition year to Phase 2 throughput levels.

Oxides represent 1% of mill feed during Phase 1.

-

Phase 2 throughput (Year 5+): Nameplate capacity of 19.2 Mt/a

(51,000 tpd)

- Process design

-

Phase 1: primary crushing, grinding (SAG and ball milling to a

targeted grind size of 200 micron) and two-stage flotation to

produce Precious Metals and Zn concentrates.

-

Phase 2: addition of parallel grinding and flotation

circuits.

Head grades

The mine plan focuses on feeding higher grades

to the mill earlier in the mine life:

-

Year 1 – 4: processing of higher-grade sulphide

material predominantly from the Pozo de Plata zone

-

Year 5 – 16: processing of higher-grade sulphides

from the NE Extension and the South Corridor

-

Year 17 – 19: processing of mostly lower-grade

stockpiled material

TONNES PROCESSED / HEAD GRADES

|

UNIT

|

PHASE 1 |

PHASE 2 |

LOM

|

|

Year 1 – 4 |

Year 5 – 12 |

Year 13 – 19 |

|

Oxide tonnes processed |

(Mt) |

0 |

6 |

14 |

20 |

|

Sulphide tonnes processed |

(Mt) |

45 |

143 |

119 |

307 |

|

Tonnes processed |

(Mt) |

45 |

149 |

132 |

327 |

|

Head Grades |

|

|

|

|

|

|

Ag |

(g/t) |

42 |

30 |

23 |

29 |

|

Au |

(g/t) |

0.19 |

0.07 |

0.06 |

0.08 |

|

Pb |

(%) |

0.57 |

0.44 |

0.32 |

0.41 |

|

Zn |

(%) |

0.67 |

0.86 |

0.58 |

0.72 |

|

AgEq |

(g/t) |

99 |

81 |

58 |

74 |

Recoveries

Metal recoveries to the two concentrates are

based on the three rounds of detailed metallurgical testwork

completed by the Company and are summarized below:

METALLURGICAL RECOVERIES

(weighted

average)

|

PHASE 1 |

PHASE 2 |

LOM

|

|

Year 1 – 4 |

Year 5 – 12 |

Year 13 – 19 |

|

Ag |

91% |

87% |

81% |

87% |

|

Au |

28% |

28% |

28% |

28% |

|

Pb |

91% |

88% |

81% |

86% |

|

Zn |

84% |

86% |

84% |

85% |

Tailings Storage Facility (TSF)

-

The TSF was designed adhering to design criteria to minimize risk

for its lifecycle in accordance with the Global Industry Standard

on Tailings Management (“GISTM”).

-

The design is based on deposition of high-density thickened

tailings into a tailings storage facility that utilizes the

‘downstream expansion’ embankment construction method.

-

The TSF is located directly east of the open pit. The design

incorporates a total of five dam stages over the LOM (starter dam

and four downstream expansions).

-

Total capacity of the TSF is greater than the estimated volume

requirement of 327 Mt generated by the FS mine plan and additional

downstream expansion can be incorporated to store additional

tailings if required.

OPERATING COSTS

Operating costs are summarized in the table

below.

|

PARAMETER |

UNITS |

FS COST |

|

OPERATING COSTS |

|

|

|

Mining |

$/t mined |

2.35 |

|

Mining |

$/t milled |

7.35 |

|

Processing – Milling (Phase 1) |

$/t milled |

6.56 |

|

Processing – Milling (Phase 2) |

$/t milled |

6.24 |

|

Site G&A (Phase 1) |

$/t milled |

0.97 |

|

Site G&A (Phase 2) |

$/t milled |

0.54 |

Mining

-

Mining is assumed to be owner-operated with lease financing.

Estimated mining costs were built from first principles. The cost

of diesel was assumed to be $1.15/L compared to $1.10/L in the

PFS.

-

The lease financing structure assumes a 25% initial deposit, a term

of five years and an annual lease financing cost of 10.2%.

Processing

-

Processing costs for the crushing/milling/flotation/concentrate

dewatering, and G&A costs were developed from first

principles.

-

Processing costs benefit from a conventional grinding and flotation

concentrator process design, low power unit costs, a targeted

coarse grind size of 200 micron, relatively low cost of labor, and

economies of scale.

G&A

-

G&A costs estimates are based on a small management camp and

administration offices at site. The majority of the work force will

be Mexican nationals commuting daily from the town of Parral.

Parral is 34 km south of Cordero and has a population of

approximately 120,000. It is the regional government centre in the

southern part of Chihuahua State and has a well-established service

industry that supports numerous local mining operations.

CONCENTRATE TERMS

Metal Payable

-

Cordero is expected to produce clean, highly saleable concentrates

with minimal penalty elements.

-

Industry standard payables and deductions were applied to the

Precious Metals (PM) and Zn concentrates as per the table below. A

metallurgical balance summary is included in the Appendices.

-

Approximately 89% of recovered silver reports to the PM concentrate

where higher silver payabilities are received.

|

|

Ag |

Au |

Pb |

Zn |

|

Precious Metals Concentrate |

|

|

|

|

|

Average concentrate grade LOM |

3,062 |

2.05 |

50% |

- |

|

Payable metal |

95% |

95% |

95% |

- |

|

Minimum deduction |

50 g/t |

1 g/t |

3 units |

- |

|

Zn Concentrate |

|

|

|

|

|

Average concentrate grade LOM |

231 g/t |

0.62 g/t |

- |

50% |

|

Payable metal |

70% |

70% |

- |

85% |

|

Deduction |

93 g/t |

1 g/t |

- |

8 units |

Treatment/Refining Charges

- Treatment and

refining charges are based on a review of spot and recent benchmark

pricing and are summarized as follows:

|

PARAMETER |

UNITS |

FS COST |

SPOT |

5-YEAR

BENCHMARK

AVERAGE |

|

TREATMENT/REFINING CHARGES |

|

|

|

|

|

Treatment charge – PM concentrate |

$/dmt |

$120 |

~$25 |

~$130 |

|

Treatment charge – Zn concentrate |

$/dmt |

$200 |

~$90 |

~$240 |

|

Ag refining charge – PM concentrate |

$/oz |

$1.00 |

~$1.00 |

~$1.10 |

Concentrate Transportation

-

Transportation costs assume trucking of the concentrate to the

international ports at Guaymas and Manzanillo, and then shipping

via ocean freight to Asia.

-

Estimated transportation costs (trucking, port handling and ocean

freight) are $176/wet metric tonne (“wmt”) for the PM concentrate

and $135/wmt for Zn concentrate.

2024 FS vs 2023 PFS

Summary

The main changes in the FS in comparison to the

PFS include:

- An additional

33,400 m of reserve definition and expansion drilling that extended

the mine life to 19 years and increased the confidence level of

declared reserves with 71% of silver reserves in the Proven

category versus 58% in the PFS.

- Incorporating

the positive results from the FS metallurgical testwork program

that increased silver recoveries into the precious metals

concentrate by 6% (where higher payabilities are received) whilst

reducing reagent consumption.

- An additional

2,700 m of geotech drilling in 34 drill holes, 44 test pits and 24

seismic lines resulting in increased confidence of pit slope

assumptions and earthworks programs.

- Increase in

initial capital expenditures of $151 million to $606 million as

summarized in further detail below.

- Modest

deterioration in IRR and payback due to the higher initial capital

expenditures.

|

PARAMETER |

UNITS |

2023 PFS |

2024 FS |

|

SUMMARY |

|

|

|

|

After-Tax NPV (5% discount rate) |

(US$ M) |

$1,153 |

$1,177 |

|

Internal Rate of Return |

(%) |

28.0% |

22.0% |

|

Mine Life |

(yrs) |

18 |

19 |

|

Initial Capital |

(US$ M) |

$455 |

$606 |

|

LOM Capital |

(US$ M) |

$1,003 |

$1,377 |

|

Payback |

(yrs) |

4.2 |

5.2 |

|

|

|

|

|

|

OPERATIONS |

|

|

|

|

Tonnes Processed (LOM – Total) |

(Mt) |

302 |

327 |

|

Strip ratio (LOM) |

(w:o) |

2.1 |

2.0 |

|

|

|

|

|

|

PRODUCTION & COSTS |

|

|

|

|

AgEq Produced (LOM – Annual Average) |

(Moz) |

33 |

33 |

|

AgEq Produced (LOM – Total) |

(Moz) |

591 |

635 |

|

All-In Sustaining Cost (Y1 – Y12) |

(US$/AgEq oz) |

$12.82 |

$13.07 |

|

All-In Sustaining Cost (LOM) |

(US$/AgEq oz) |

$13.62 |

$13.47 |

Project Economics are based on Ag =

$22.00/oz, Au = $1,600/oz, Pb = $1.00/lb, Zn = $1.20/lb. See

Technical Disclosure section for AgEq and AISC calculation

methodology.

Initial Capital Changes

Total initial capital expenditures increased by

$151 million as summarized in the table below. The primary drivers

behind this increase were:

-

Mining – increase in pre-strip material and additional equipment

and infrastructure

-

Process plant – selection of preferred equipment vendors, additions

to the process plant design to add redundancy for operations and

cost inflation

-

Offsite infrastructure – addition of the upgrade to the Camargo

substation and addition of the water treatment plant upgrade plus

water pipeline to site

|

DESCRIPTION (all in US$ millions) |

2023 PFS |

2024 FS |

Difference |

|

INITIAL CAPITAL EXPENDITURES |

|

|

|

|

Mining |

$60 |

$117 |

$57 |

|

Onsite Infrastructure |

$31 |

$44 |

$13 |

|

Processing Plant |

$156 |

$210 |

$54 |

|

Tailings Facility (TSF) |

$45 |

$28 |

($17) |

|

Offsite Infrastructure |

$20 |

$57 |

$37 |

|

Indirects |

$61 |

$73 |

$12 |

|

Owners Costs |

$13 |

$11 |

($2) |

|

Contingency |

$61 |

$65 |

$4 |

|

Total Initial Capital Expenditures |

$455 |

$606 |

$151 |

TECHNICAL DISCLOSURE:

-

The FS project team was led by Ausenco Engineering Canada ULC

(“Ausenco”), with support from AGP Mining Consultants Inc. (“AGP”),

WSP USA Inc. (“WSP”) and RedDot3D Inc (“RedDot”).

-

Mineral resources that are not mineral reserves do not have

demonstrated economic viability.

-

A full technical report will be prepared in accordance with NI

43-101 and will be filed on SEDAR within 45 days of this press

release.

-

AgEq produced and AgEq payable are calculated as Ag + (Au x 72.7) +

(Pb x 45.5) + (Zn x 54.6); these factors are based on metal prices

of Ag - $22/oz, Au - $1,600/oz, Pb - $1.00/lb and Zn -

$1.20/lb.

-

All-in Sustaining cost (AISC) is calculated as: [Operating costs

(mining, processing and G&A) + Royalties + Concentrate

Transportation + Treatment & Refining Charges + Concentrate

Penalties + Sustaining Capital (excluding $37M of capex for the

initial purchase of mining fleet in Year 1)] / Payable AgEq

ounces

APPENDIX:

An appendix with the following supporting

information can be found at the end of the release.

Appendix A - Mineral Resource Estimate

Appendix B – Mineral Reserve Estimate

Appendix C – After-Tax NPV/IRR/Payback

Sensitivities

Appendix D - LOM Mine Plan Summary

Appendix E - LOM Process Throughput Summary

Appendix F – After-Tax Free Cash Flow

Appendix G - Simplified Process Flowsheets

Appendix H – Metallurgical Balance Summary

Appendix I - Site Layout

Appendix J - LOM Production & Cash Flow

Schedule

About Discovery

Discovery’s flagship project is its 100%-owned

Cordero silver project, one of the world’s largest silver deposits.

The FS summarized in today’s release demonstrates that Cordero has

the potential to be developed into a highly capital efficient mine

that offers the rare combination of large-scale production, low

costs and a long mine life. Cordero is located close to

infrastructure in a prolific mining belt in Chihuahua State,

Mexico.

On Behalf of the Board of Directors,

Tony Makuch, P.Eng

President & CEO

For further information contact:

Forbes Gemmell, CFA

VP Corporate Development

Phone: 416-613-9410

Email: forbes.gemmell@discoverysilver.com

Website: www.discoverysilver.com

Qualified

Person

The FS for the Company’s Cordero Silver project

as summarized in this release was completed by Ausenco with support

from AGP and WSP. The Mineral Reserve estimate as outlined, as

further set out in Appendix B, in this press release was

completed under the supervision of Willie Hamilton, P.Eng. of AGP,

who is an independent “Qualified Person” as defined under NI

43-101 and who has reviewed and approved the mineral reserve

estimate disclosure in this press release. The Mineral Resource

estimate, as further set out in Appendix A, as outlined in

this press release was completed under the supervision of R. Mohan

Srivastava, P.Geo., who is an independent “Qualified Person”

as defined under NI 43-101 and who has reviewed and approved the

mineral resource estimate disclosure in this press release. A full

technical report supporting the FS will be prepared in accordance

with NI 43-101 and will be filed on SEDAR within 45 days of this

press release. The remaining scientific and technical content of

this press release was reviewed and approved by Gernot Wober,

P.Geo, VP Exploration of the Company and a “Qualified Person” as

such term is defined in NI 43-101 and Pierre Rocque, P.Eng., an

Independent Consultant to the Company, and an independent

“Qualified Person” as such term is defined by 43-101.

NON-GAAP MEASURES:

The Company has included certain non-GAAP

performance measures as detailed below. In the mining industry,

these are common performance measures but may not be comparable to

similar measures presented by other issuers and the non-GAAP

measures do not have any standardized meaning. Accordingly, it is

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS.

CASH COSTS PER OUNCE

The Company calculated total cash costs per

ounce by dividing the sum of operating costs, royalty costs,

production taxes, refining and shipping costs, by payable

silver-equivalent ounces. While there is no standardized meaning of

the measure across the industry, the Company believes that this

measure is useful to external users in assessing operating

performance.

ALL-IN SUSTAINING COSTS

("AISC")

The Company has provided an AISC performance

measure that reflects all the expenditures that are required to

produce an ounce of payable metal. While there is no standardized

meaning of the measure across the industry, the Company’s

definition conforms to the all-in sustaining cost definition as set

out by the World Gold Council in its guidance dated June 27, 2013.

Subsequent amendments to the guidance have not materially affected

the figures presented.

FREE CASH FLOW

Free Cash Flow is a non-GAAP performance measure

that is calculated as cash flows from operations net of cash flows

invested in mineral property, plant and equipment and exploration

and evaluation assets. The Company believes that this measure is

useful to the external users in assessing the Company’s ability to

generate cash flows from its mineral projects.

FORWARD-LOOKING STATEMENTS:

Neither TSX Exchange nor its Regulation Services Provider

(as that term is defined in policies of the TSX Exchange) accepts

responsibility for the adequacy or accuracy of this

release.

This news release is not for distribution to United States

newswire services or for dissemination in the United

States.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of any of the securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful, including any of the

securities in the United States of America. The securities have not

been and will not be registered under the United States Securities

Act of 1933, as amended (the “1933 Act”) or any state securities

laws and may not be offered or sold within the United States or to,

or for account or benefit of, U.S. Persons (as defined in

Regulation S under the 1933 Act) unless registered under the 1933

Act and applicable state securities laws, or an exemption from such

registration requirements is available.

Cautionary Note Regarding Forward-Looking

Statements

This news release may include forward-looking

statements that are subject to inherent risks and uncertainties.

All statements within this news release, other than statements of

historical fact, are to be considered forward looking. Although

Discovery believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results or developments may differ materially from those described

in forward-looking statements. Statements include but are not

limited to the feasibility of the Project and its attractive

economics and significant exploration upside; construction decision

and development of the Project, timing and results of the

feasibility study and the anticipated capital and operating costs,

sustaining costs, net present value, internal rate of return, the

method of mining the Project, payback period, process capacity,

average annual metal production, average process recoveries,

concession renewal, permitting of the Project, anticipated mining

and processing methods, feasibility study production schedule and

metal production profile, anticipated construction period,

anticipated mine life, expected recoveries and grades, anticipated

production rates, infrastructure, social and environmental impact

studies, the completion of key de-risking items, including the

timing of receipt permits, availability of water and power,

availability of labour, job creation and other local economic

benefits, tax rates and commodity prices that would support

development of the Project, and other statements that express

management's expectations or estimates of future performance,

operational, geological or financial results Information concerning

mineral resource/reserve estimates and the economic analysis

thereof contained in the results of the feasibility study are also

forward-looking statements in that they reflect a prediction of the

mineralization that would be encountered, and the results of

mining, if a mineral deposit were developed and mined.

Forward-looking statements are statements that are not historical

facts which address events, results, outcomes or developments that

the Company expects to occur. Forward-looking statements are based

on the beliefs, estimates and opinions of the Company’s management

on the date the statements are made and they involve a number of

risks and uncertainties.

Factors that could cause actual results to

differ materially from those described in forward-looking

statements include fluctuations in market prices, including metal

prices, continued availability of capital and financing, and

general economic, market or business conditions, the actual results

of current and future exploration activities; changes to current

estimates of mineral reserves and mineral resources; conclusions of

economic and geological evaluations; changes in project parameters

as plans continue to be refined; the speculative nature of mineral

exploration and development; risks in obtaining and maintaining

necessary licenses, permits and authorizations for the Company’s

development stage and operating assets; operations may be exposed

to new diseases, epidemics and pandemics, including any ongoing or

future effects of COVID-19 (and any related ongoing or future

regulatory or government responses) and its impact on the broader

market and the trading price of the Company’s shares; provincial

and federal orders or mandates (including with respect to mining

operations generally or auxiliary businesses or services required

for operations) in Mexico, all of which may affect many aspects of

the Company's operations including the ability to transport

personnel to and from site, contractor and supply availability and

the ability to sell or deliver mined silver; changes in national

and local government legislation, controls or regulations; failure

to comply with environmental and health and safety laws and

regulations; labour and contractor availability (and being able to

secure the same on favourable terms); disruptions in the

maintenance or provision of required infrastructure and information

technology systems; fluctuations in the price of gold or certain

other commodities such as, diesel fuel, natural gas, and

electricity; operating or technical difficulties in connection with

mining or development activities, including geotechnical challenges

and changes to production estimates (which assume accuracy of

projected ore grade, mining rates, recovery timing and recovery

rate estimates and may be impacted by unscheduled maintenance);

changes in foreign exchange rates (particularly the Canadian

dollar, U.S. dollar and Mexican peso); the impact of inflation;

geopolitical conflicts; employee and community relations; the

impact of litigation and administrative proceedings (including but

not limited to mining reform laws in Mexico) and any interim or

final court, arbitral and/or administrative decisions; disruptions

affecting operations; availability of and increased costs

associated with mining inputs and labour; delays in construction

decisions and any development of the Project; changes with respect

to the intended method of mining and processing ore from the

Project; inherent risks and hazards associated with mining and

mineral processing including environmental hazards, industrial

accidents, unusual or unexpected formations, pressures and

cave-ins; the risk that the Company’s mines may not perform as

planned; uncertainty with the Company's ability to secure

additional capital to execute its business plans; contests over

title to properties; expropriation or nationalization of property;

political or economic developments in Canada and Mexico and other

jurisdictions in which the Company may carry on business in the

future; increased costs and risks related to the potential impact

of climate change; the costs and timing of exploration,

construction and development of new deposits; risk of loss due to

sabotage, protests and other civil disturbances; the impact of

global liquidity and credit availability and the values of assets

and liabilities based on projected future cash flows; risks arising

from holding derivative instruments; and business opportunities

that may be pursued by the Company.There can be no assurances that

such statements will prove accurate and, therefore, readers are

advised to rely on their own evaluation of such uncertainties.

Discovery does not assume any obligation to update any

forward-looking statements except as required under applicable

laws. The risks and uncertainties that may affect forward-looking

statements, or the material factors or assumptions used to develop

such forward-looking information, are described under the heading

"Risks Factors" in the Company’s Annual Information Form dated

March 30, 2023, which is available under the Company’s issuer

profile on SEDAR+ at www.sedarplus.ca.

APPENDIX A – MINERAL RESOURCE

ESTIMATE

Material

|

Class

|

Tonnes

|

Grade |

Contained Metal |

|

Ag |

Au |

Pb |

Zn |

AgEq |

Ag |

Au |

Pb |

Zn |

AgEq |

|

(Mt) |

(g/t) |

(g/t) |

(%) |

(%) |

(g/t) |

(Moz) |

(koz) |

(Mlb) |

(Mlb) |

(Moz) |

Oxide

|

Measured |

29 |

29 |

0.07 |

0.23 |

0.27 |

49 |

27 |

67 |

148 |

171 |

45 |

|

Indicated |

37 |

24 |

0.06 |

0.25 |

0.29 |

44 |

28 |

74 |

207 |

241 |

53 |

|

M&I |

66 |

26 |

0.07 |

0.24 |

0.28 |

46 |

55 |

142 |

355 |

412 |

99 |

|

Inferred |

32 |

19 |

0.03 |

0.26 |

0.33 |

42 |

20 |

35 |

188 |

234 |

43 |

Sulphide

|

Measured |

324 |

24 |

0.07 |

0.34 |

0.63 |

57 |

247 |

745 |

2,413 |

4,473 |

598 |

|

Indicated |

329 |

18 |

0.04 |

0.28 |

0.58 |

48 |

190 |

416 |

2,045 |

4,215 |

506 |

|

M&I |

653 |

21 |

0.06 |

0.31 |

0.60 |

53 |

437 |

1,161 |

4,458 |

8,687 |

1,104 |

|

Inferred |

116 |

12 |

0.02 |

0.16 |

0.35 |

30 |

45 |

86 |

418 |

906 |

111 |

TOTAL

|

Measured |

353 |

24 |

0.07 |

0.33 |

0.60 |

57 |

274 |

812 |

2,561 |

4,644 |

643 |

|

Indicated |

366 |

19 |

0.04 |

0.28 |

0.55 |

47 |

218 |

490 |

2,252 |

4,456 |

559 |

|

M&I |

719 |

21 |

0.06 |

0.30 |

0.57 |

52 |

493 |

1,303 |

4,813 |

9,099 |

1,202 |

|

Inferred |

149 |

14 |

0.03 |

0.18 |

0.35 |

32 |

65 |

121 |

606 |

1,140 |

155 |

Supporting Technical Disclosure for Resource

-

Mineral Resource Estimates are inclusive of Mineral

Reserves.

-

The previous Cordero mineral resource estimate (MRE) was

completed in January 2023 for Cordero by RedDot. The current

mineral resource estimate was calculated for Discovery Silver by

RedDot, who is acting as this report’s QP for mineral

resources.

-

Mineral resources that are not mineral reserves do not have

demonstrated economic viability.

- The Resource

is an in-pit resource containing a total of 868 Mt of

Mineral Resource and 1,639 Mt of waste (below NSR$7.25 cut off) for

total tonnes of 2,507,Mt). The pit is constrained by a pit

optimisation based on the following parameters:

-

Commodity prices: Ag - $24.00/oz, Au - $1,800/oz, Pb -

$1.10/lb, Zn - $1.20/lb.

-

Metallurgical recoveries: Ag – 87%, Au – 18%, Pb – 89%

and Zn – 88%. AgEq for sulphide mineralization and Ag – 59%, Au –

18%, Pb - 37% and Zn - 85% for oxide mineralization.

-

Operating costs:

-

Base mining costs of $1.59/t for ore and $1.59/t for waste were

developed by AGP Mining Consultants Inc.

-

Processing costs of $5.22/t for mill/flotation and G&A

costs of $0.86/t were developed by Ausenco Engineering Canada

ULC.

-

Average pit slope assumption of

450

-

Sulphide and Oxide mineral resources are reported at a $7.25/t

NSR cut-off based on the approximate estimated processing and

G&A cost for mineralization. NSR is defined as the net revenue

from metal sales (taking into account metallurgical recoveries and

payabilities) less treatment costs and refining charges.

-

Individual metals are reported at 100% of in-situ

grade.

- AgEq for sulphide mineral

resources is calculated as Ag + (Au x 15.52) + (Pb x 32.15) + (Zn x

34.68); these factors are based on commodity prices of Ag -

$24.00/oz, Au - $1,800/oz, Pb - $1.10/lb, Zn - $1.20/lb and assumed

recoveries of Ag – 87%, Au – 18%, Pb – 89% and Zn – 88%. AgEq for

oxide mineral resources is calculated as Ag + (Au x 22.88) + (Pb x

19.71) + (Zn x 49.39); these factors are based on commodity prices

of Ag - $24.00/oz, Au - $1,800/oz, Pb - $1.10/lb and Zn - $1.20/lb

and assumed recoveries of Ag – 59%, Au – 18%, Pb - 37% and Zn -

85%.

-

There are no known factors or issues that materially affect the

mineral resource and mineral reserve estimates other than normal

risks faced by mining projects in Mexico in terms of legal,

environmental, permitting, taxation, socio-economic, and political

factors. Additional risk factors are listed in the "Cautionary Note

Regarding Forward-Looking Statements" section in this news

release

-

The effective date of the Resource is August 31, 2023, and is

based on drilling through end of March 2023. A full technical

report will be prepared in accordance with NI 43-101 and will be

filed on SEDAR within 45 days of this press release.

APPENDIX B – MINERAL RESERVE

ESTIMATE

Material

|

Class

|

Tonnes

|

Grade |

Contained Metal |

|

Ag |

Au |

Pb |

Zn |

Ag |

Au |

Pb |

Zn |

|

(Mt) |

(g/t) |

(g/t) |

(%) |

(%) |

(Moz) |

(Moz) |

(Blb) |

(Blb) |

Oxide

|

Proven |

10 |

46 |

0.08 |

0.35 |

0.38 |

15 |

0.03 |

0.08 |

0.09 |

|

Probable |

10 |

40 |

0.09 |

0.40 |

0.42 |

13 |

0.03 |

0.09 |

0.09 |

|

Total P&P |

20 |

43 |

0.08 |

0.37 |

0.40 |

28 |

0.05 |

0.17 |

0.18 |

Sulphide

|

Proven |

212 |

29 |

0.09 |

0.42 |

0.74 |

199 |

0.61 |

1.96 |

3.48 |

|

Probable |

95 |

24 |

0.06 |

0.40 |

0.73 |

74 |

0.18 |

0.83 |

1.53 |

|

Total P&P |

307 |

28 |

0.08 |

0.41 |

0.74 |

274 |

0.78 |

2.79 |

5.00 |

TOTAL

|

Proven |

223 |

30 |

0.09 |

0.42 |

0.73 |

214 |

0.64 |

2.04 |

3.57 |

|

Probable |

104 |

26 |

0.06 |

0.40 |

0.70 |

87 |

0.20 |

0.91 |

1.62 |

|

Total P&P |

327 |

29 |

0.08 |

0.41 |

0.72 |

302 |

0.84 |

2.96 |

5.18 |

Supporting Technical Disclosure for Reserves

-

This mineral reserve estimate has an effective date of February

16, 2024, and is based on the mineral resource estimate, for

Discovery Silver by RedDot that has an effective date of August 31,

2023.

-

The Mineral Reserve estimate was completed under the

supervision of Willie Hamilton, P.Eng. of AGP, who is a Qualified

Person as defined under NI 43-101.

-

Mineral Reserves are stated within the final pit designs based

on a US$20.00/oz silver price, US$1,600/oz gold price, US$0.95/lb

lead price and US$1.20/lb zinc price.

- An

NSR cut-off of US$10.00/t was used to estimate reserves. The

life-of-mine mining cost averaged US$2.35/t mined.

Processing, G&A and closure costs were US$7.28/t ore. The

metallurgical recoveries were varied according to head grade and

concentrate grades. Lead concentrate recoveries for sulphide

material were approximately 87.5%, 73.9% and 12.6% for lead, silver

and gold respectively. Zinc concentrate recoveries for sulphide

material were approximately 95.0%, 14.3% and 9.5% for zinc, silver

and gold respectively. Oxide recoveries to zinc concentrates

were 85%, 9% and 8% for zinc, silver, and gold respectively.

Oxide recoveries to lead concentrates were 37%, 50% and 10% for

lead, silver, and gold respectively.

APPENDIX C: AFTER-TAX NPV / IRR /

PAYBACK SENSITIVITIES

Sensitivity of the Project’s NPV, IRR and payback at different

Ag and Zn price assumptions is outlined in the table below. For

these sensitivities the Au and Pb prices have been fixed at

$1,600/oz and $1.00/lb respectively. The Base Case scenario for the

FS is highlighted in grey below and assumes Ag - $22.00/oz, Au -

$1,600/oz, Pb - $1.00/lb and Zn - $1.20/lb.

|

|

Ag ($/oz) |

|

$18.00 |

$20.00 |

$22.00 |

$25.00 |

$30.00 |

|

|

NPV

(5%) |

IRR |

Payback |

NPV

(5%) |

IRR |

Payback |

NPV

(5%) |

IRR |

Payback |

NPV

(5%) |

IRR |

Payback |

NPV

(5%) |

IRR |

Payback |

|

(US$M) |

(%) |

(yrs) |

(US$M) |

(%) |

(yrs) |

(US$M) |

(%) |

(yrs) |

(US$M) |

(%) |

(yrs) |

(US$M) |

(%) |

(yrs) |

Zn

($/lb)

|

$1.05 |

602 |

14.7 |

6.9 |

784 |

17.2 |

6.3 |

965 |

19.7 |

5.8 |

1,237 |

23.1 |

4.8 |

1,690 |

28.5 |

4.1 |

|

$1.10 |

673 |

15.6 |

6.7 |

854 |

18.1 |

6.2 |

1,036 |

20.4 |

5.6 |

1,308 |

23.8 |

4.8 |

1,761 |

29.2 |

4.0 |

|

$1.20 |

814 |

17.4 |

6.4 |

996 |

19.7 |

5.9 |

1,177 |

22.0 |

5.2 |

1,449 |

25.2 |

4.6 |

1,902 |

30.5 |

3.9 |

|

$1.30 |

955 |

18.9 |

6.1 |

1,137 |

21.2 |

5.5 |

1,318 |

23.4 |

4.9 |

1,590 |

26.6 |

4.4 |

2,043 |

31.7 |

3.8 |

|

$1.45 |

1,167 |

21.2 |

5.7 |

1,348 |

23.4 |

5.1 |

1,530 |

25.5 |

4.7 |

1,802 |

28.6 |

4.2 |

2,254 |

33.5 |

3.7 |

APPENDIX D - LOM MINE PLAN SUMMARY

APPENDIX E - LOM PROCESS THROUGHPUT

SUMMARY

APPENDIX F – AFTER-TAX FREE CASH

FLOW

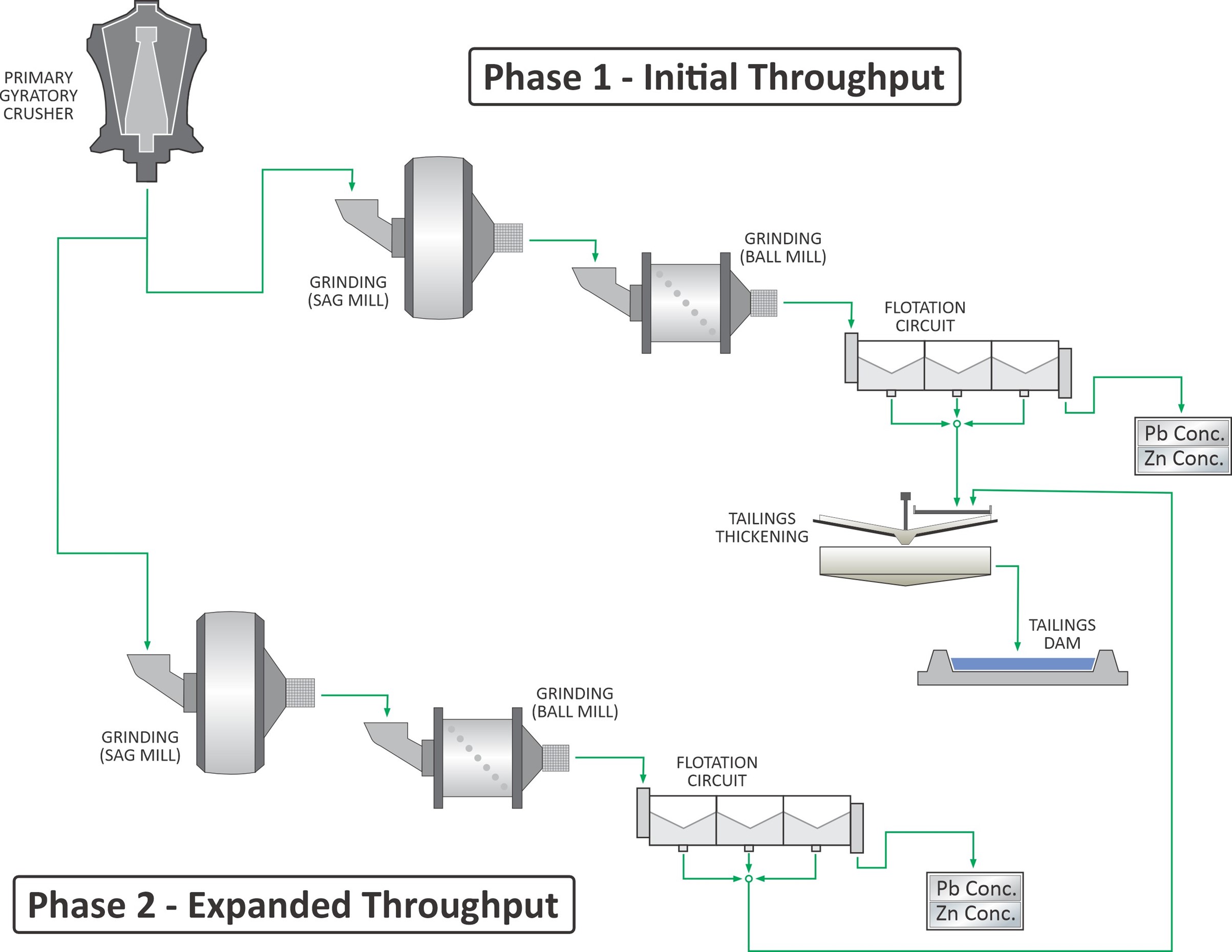

APPENDIX G - SIMPLIFIED PROCESS

FLOWSHEETS

PHASE 1 – 26,000 tpd nameplate

capacity / PHASE 2 – 51,000 tpd nameplate

capacity

APPENDIX H – METALLURGICAL BALANCE

SUMMARY

|

UNITS

|

PHASE 1 |

PHASE 2 |

LOM |

|

Years 1 - 4 |

Years 5 - 12 |

Years 13 - 19 |

|

Ag |

Au |

Pb |

Zn |

Ag |

Au |

Pb |

Zn |

Ag |

Au |

Pb |

Zn |

Ag |

Au |

Pb |

Zn |

|

MET BALANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average head grade |

g/t or % |

42 |

0.19 |

0.57 |

0.67 |

30 |

0.07 |

0.44 |

0.86 |

23 |

0.06 |

0.32 |

0.57 |

29 |

0.08 |

0.41 |

0.72 |

|

Recovered to Pb Con |

% |

83 |

18 |

91 |

5 |

77 |

18 |

88 |

4 |

70 |

18 |

84 |

4 |

77 |

18 |

86 |

5 |

|

Recovered to Zn Con |

% |

8 |

10 |

nm |

85 |

10 |

10 |

nm |

86 |

11 |

10 |

nm |

85 |

10 |

10 |

nm |

85 |

|

Tailings |

% |

9 |

72 |

nm |

10 |

13 |

72 |

nm |

10 |

19 |

72 |

nm |

11 |

13 |

72 |

nm |

10 |

|

Total |

% |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONCENTRATE GRADES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pb Concentrate |

g/t or % |

3,750 |

3.86 |

57 |

- |

3,096 |

1.60 |

52 |

- |

2,548 |

1.82 |

44 |

- |

3,062 |

2.05 |

50 |

- |

|

Zn Concentrate |

g/t or % |

302 |

1.61 |

- |

50 |

198 |

0.43 |

- |

51 |

273 |

0.59 |

- |

50 |

231 |

0.62 |

- |

50 |

nm – Pb recovery into the Zn concentrate was not modelled

for the purposes of this Study

APPENDIX I - SITE

LAYOUT:

APPENDIX J – PRODUCTION & CASH FLOW

SCHEDULE:

|

|

Units |

Total/Avg |

Y-2 |

Y-1 |

Y1 |

Y2 |

Y3 |

Y4 |

Y5 |

Y6 |

Y7 |

Y8 |

Y9 |

Y10 |

Y11 |

Y12 |

Y13 |

Y14 |

Y15 |

Y16 |

Y17 |

Y18 |

Y19 |

Y20 |

|

MINING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mineralized Material Mined* |

mt |

347 |

2 |

2 |

20 |

22 |

27 |

20 |

19 |

29 |

31 |

31 |

20 |

19 |

16 |

17 |

14 |

18 |

16 |

13 |

9 |

-- |

-- |

-- |

|

Waste Mined |

mt |

696 |

5 |

9 |

32 |

42 |

44 |

42 |

43 |

43 |

41 |

41 |

46 |

44 |

46 |

49 |

54 |

51 |

30 |

26 |

8 |

-- |

-- |

-- |

|

Total Material Mined |

mt |

1,043 |

7 |

11 |

53 |

65 |

70 |

62 |

62 |

72 |

72 |

72 |

66 |

63 |

62 |

66 |

68 |

69 |

46 |

39 |

17 |

-- |

-- |

-- |

|

Mining Rate |

ktpd

|

150 |

19 |

30 |

145 |

178 |

192 |

170 |

170 |

197 |

197 |

197 |

181 |

172 |

171 |

182 |

187 |

190 |

125 |

107 |

46 |

-- |

-- |

-- |

|

Strip Ratio |

w:o |

2.01 |

3.5 |

4.1 |

1.6 |

1.9 |

1.6 |

2.1 |

2.2 |

1.5 |

1.3 |

1.3 |

2.3 |

2.4 |

2.8 |

2.9 |

3.8 |

2.9 |

1.8 |

2.0 |

0.8 |

-- |

-- |

-- |

|

|

*Mineralized material mined includes 20Mt of above cutoff

oxides that are not processed. For ore processed (ie: reserves),

see "Processing" section below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROCESSING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oxides – Mill Feed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ore Tonnes |

mt |

20 |

-- |

-- |

-- |

-- |

0.1 |

0.3 |

1.9 |

0.0 |

-- |

-- |

1.3 |

0.0 |

0.1 |

2.7 |

2.6 |

2.7 |

2.7 |

2.7 |

2.5 |

-- |

-- |

0.4 |

|

Ore Grades: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ag |

g/t |

43.0 |

-- |

-- |

-- |

-- |

50.8 |

64.7 |

46.0 |

46.0 |

-- |

-- |

44.5 |

32.1 |

48.1 |

42.4 |

42.6 |

42.6 |

42.6 |

42.6 |

42.6 |

-- |

-- |

22.8 |

|

Au |

g/t |

0.08 |

-- |

-- |

-- |

-- |

0.09 |

0.06 |

0.09 |

0.09 |

-- |

-- |

0.09 |

0.16 |

0.03 |

0.08 |

0.08 |

0.08 |

0.08 |

0.08 |

0.08 |

-- |

-- |

0.07 |

|

Pb |

% |

0.37% |

-- |

-- |

-- |

-- |

0.68% |

0.63% |

0.34% |

0.34% |

-- |

-- |

0.60% |

0.44% |

0.19% |

0.36% |

0.36% |

0.36% |

0.36% |

0.36% |

0.36% |

-- |

-- |

0.20% |

|

Zn |

% |

0.40% |

-- |

-- |

-- |

-- |

0.93% |

0.53% |

0.34% |

0.34% |

-- |

-- |

0.68% |

0.73% |

0.41% |

0.39% |

0.38% |

0.38% |

0.38% |

0.38% |

0.38% |

-- |

-- |

0.24% |

|

AgEq |

g/t |

76 |

-- |

-- |

-- |

-- |

113 |

109 |

76 |

75 |

-- |

-- |

95 |

85 |

72 |

74 |

74 |

74 |

74 |

74 |

74 |

-- |

-- |

43 |

|

Sulphides – Mill Feed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ore Tonnes |

mt |

307 |

-- |

-- |

9 |

10 |

9 |

17 |

17 |

19 |

19 |

19 |

18 |

18 |

18 |

16 |

16 |

16 |

16 |

16 |

16 |

18 |

18 |

2 |

|

Mill Head Grade: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ag |

g/t |

27.7 |

-- |

-- |

44.8 |

44.3 |

38.9 |

39.9 |

31.7 |

28.1 |

31.4 |

41.7 |

27.0 |

25.2 |

23.1 |

27.0 |

24.8 |

24.3 |

25.4 |

23.6 |

22.1 |

12.6 |

12.6 |

12.6 |

|

Au |

g/t |

0.08 |

-- |

-- |

0.19 |

0.25 |

0.15 |

0.19 |

0.10 |

0.06 |

0.07 |

0.08 |

0.06 |

0.05 |

0.05 |

0.06 |

0.05 |

0.06 |

0.06 |

0.06 |

0.05 |

0.05 |

0.05 |

0.05 |

|

Pb |

% |

0.41% |

-- |

-- |

0.59% |

0.61% |

0.54% |

0.56% |

0.39% |

0.36% |

0.48% |

0.73% |

0.48% |

0.40% |

0.28% |

0.42% |

0.43% |

0.38% |

0.36% |

0.38% |

0.40% |

0.16% |

0.16% |

0.16% |

|

Zn |

% |

0.74% |

-- |

-- |

0.73% |

0.61% |

0.73% |

0.65% |

0.61% |

0.75% |

0.92% |

1.29% |

0.99% |

0.77% |

0.74% |

0.89% |

0.80% |

0.69% |

0.66% |

0.75% |

0.69% |

0.35% |

0.35% |

0.35% |

|

AgEq |

g/t |

74 |

-- |

-- |

105 |

104 |

94 |

96 |

74 |

71 |

86 |

118 |

83 |

70 |

63 |

78 |

72 |

67 |

66 |

68 |

64 |

34 |

34 |

34 |

|

TOTAL ORE - Mill Feed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ore Tonnes |

mt |

327 |

-- |

-- |

9 |

10 |

9 |

18 |

18 |

19 |

19 |

19 |

19 |

18 |

18 |

19 |

18 |

19 |

19 |

19 |

19 |

18 |

18 |

3 |

|

Mill Head Grade: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ag |

g/t |

29 |

-- |

-- |

45 |

44 |

39 |

40 |

33 |

28 |

31 |

42 |

28 |

25 |

23 |

29 |

27 |

27 |

28 |

26 |

25 |

13 |

13 |

14 |

|

Au |

g/t |

0.08 |

-- |

-- |

0.19 |

0.25 |

0.15 |

0.19 |

0.10 |

0.06 |

0.07 |

0.08 |

0.06 |

0.05 |

0.05 |

0.06 |

0.05 |

0.06 |

0.06 |

0.06 |

0.05 |

0.05 |

0.05 |

0.05 |

|

Pb |

% |

0.41% |

-- |

-- |

0.59% |

0.61% |

0.55% |

0.56% |

0.38% |

0.36% |

0.48% |

0.73% |

0.49% |

0.40% |

0.28% |

0.41% |

0.42% |

0.38% |

0.36% |

0.38% |

0.39% |

0.16% |

0.16% |

0.16% |

|

Zn |

% |

0.72% |

-- |

-- |

0.73% |

0.61% |

0.73% |

0.65% |

0.59% |

0.01 |

0.92% |

1.29% |

0.97% |

0.01 |

0.74% |

0.82% |

0.74% |

0.65% |

0.62% |

0.70% |

0.65% |

0.35% |

0.35% |

0.33% |

|

AgEq |

g/t |

74 |

-- |

-- |

105 |

104 |

94 |

96 |

74 |

71 |

86 |

118 |

84 |

70 |

63 |

77 |

72 |

68 |

67 |

69 |

65 |

34 |

34 |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lead/Silver Conc. – Recovery: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ag |

% |

77% |

-- |

-- |

83% |

84% |

82% |

82% |

74% |

75% |

80% |

86% |

78% |

77% |

71% |

73% |

73% |

72% |

71% |

72% |

72% |

58% |

58% |

58% |

|

Au |

% |

18% |

-- |

-- |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

18% |

|

Pb |

% |

86% |

-- |

-- |

92% |

92% |

90% |

90% |

84% |

88% |

90% |

93% |

86% |

89% |

85% |

83% |

83% |

81% |

81% |

81% |

83% |

77% |

77% |

70% |

|

Zinc Conc. – Recovery: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ag |

% |

10% |

-- |

-- |

8% |

8% |

9% |

8% |

10% |

10% |

9% |

7% |

9% |

10% |

12% |

10% |

10% |

11% |

11% |

11% |

10% |

15% |

15% |

14% |

|

Au |

% |

10% |

-- |

-- |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

|

Zn |

% |

85% |

-- |

-- |

85% |

84% |

85% |

84% |

84% |

85% |

86% |

87% |

86% |

85% |

85% |

86% |

85% |

85% |

84% |

85% |

85% |

78% |

78% |

79% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRODUCTION PROFILE |

Units |

Total/Avg |

Y-2 |

Y-1 |

Y1 |

Y2 |

Y3 |

Y4 |

Y5 |

Y6 |

Y7 |

Y8 |

Y9 |

Y10 |

Y11 |

Y12 |

Y13 |

Y14 |

Y15 |

Y16 |

Y17 |

Y18 |

Y19 |

Y20 |

|

METAL PRODUCED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ag – Ag/Pb Concentrate |

moz |

229 |

-- |

-- |

10 |

11 |

10 |

19 |

14 |

13 |

16 |

22 |

13 |

11 |

10 |

13 |

12 |

12 |

12 |

11 |

11 |

4 |

4 |

1 |

|

Au – Ag/Pb Concentrate |

koz |

153 |

-- |

-- |

10 |

14 |

8 |

20 |

10 |

7 |

8 |

9 |

7 |

5 |

5 |

7 |

6 |

7 |

7 |

7 |

6 |

5 |

5 |

1 |

|

Pb – Ag/Pb Concentrate |

mlbs |

2,581 |

-- |

-- |

104 |

118 |

102 |

197 |

131 |

128 |

182 |

286 |

175 |

143 |

96 |

137 |

139 |

126 |

121 |

126 |

133 |

63 |

63 |

9 |

|

AgEq – Ag/Pb Concentrate |

moz |

358 |

-- |

-- |

16 |

18 |

15 |

29 |

21 |

19 |

24 |

36 |

22 |

18 |

14 |

20 |

18 |

18 |

18 |

18 |

17 |

8 |

8 |

1 |

|

Ag – Zn Concentrate |

moz |

30 |

-- |

-- |

1 |

1 |

1 |

2 |

2 |

2 |

2 |

2 |

2 |

1 |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

1 |

1 |

0 |

|

Au – Zn Concentrate |

koz |

80 |

-- |

-- |

5 |

7 |

4 |

10 |

5 |

3 |

4 |

5 |

4 |

3 |

3 |

4 |

3 |

4 |

4 |

4 |

3 |

3 |

3 |

0 |

|

Zn – Zn Concentrate |

mlbs |

4,437 |

-- |

-- |

118 |

110 |

130 |

217 |

203 |

259 |

335 |

480 |

351 |

264 |

252 |

287 |

253 |

226 |

221 |

245 |

228 |

122 |

122 |

17 |

|

AgEq – Zn Concentrate |

moz |

277 |

-- |

-- |

8 |

8 |

8 |

15 |

13 |

16 |

20 |

28 |

21 |

16 |

16 |

18 |

16 |

14 |

14 |

15 |

14 |

8 |

8 |

1 |

|

Ag – Total |

moz |

259 |

-- |

-- |

11 |

13 |

11 |

21 |

17 |

14 |

17 |

24 |

15 |

13 |

11 |

15 |

13 |

13 |

14 |

13 |

12 |

5 |

5 |

1 |

|

Au – Total |

koz |

233 |

-- |

-- |

15 |

21 |

12 |

30 |

16 |

10 |

12 |

13 |

10 |

8 |

8 |

10 |

9 |

11 |

11 |

10 |

9 |

8 |

8 |

1 |

|

Pb – Total |

mlbs |

2,581 |

-- |

-- |

104 |

118 |

102 |

197 |

131 |

128 |

182 |

286 |

175 |

143 |

96 |

137 |

139 |

126 |

121 |

126 |

133 |

63 |

63 |

9 |

|

Zn – Total |

mlbs |

4,437 |

-- |

-- |

118 |

110 |

130 |

217 |

203 |

259 |

335 |

480 |

351 |

264 |

252 |

287 |

253 |

226 |

221 |

245 |

228 |

122 |

122 |

17 |

|

AgEq – Total Metal Produced |

moz |

635 |

-- |

-- |

24 |

25 |

23 |

44 |

35 |

35 |

45 |

64 |

43 |

34 |

30 |

37 |

34 |

32 |

32 |

33 |

33 |

16 |

16 |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

METAL PAYABLE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ag – Ag/Pb Concentrate |

moz |

218 |

-- |

-- |

10 |

11 |

9 |

18 |

14 |

12 |

15 |

21 |

13 |

11 |

9 |

12 |

11 |

11 |

11 |

11 |

10 |

4 |

4 |

1 |

|

Au – Ag/Pb Concentrate |

koz |

78 |

-- |

-- |

7 |

11 |

6 |

15 |

6 |

3 |

3 |

2 |

2 |

1 |

2 |

3 |

2 |

3 |

3 |

3 |

2 |

3 |

3 |

0 |

|

Pb – Ag/Pb Concentrate |

mlbs |

2,427 |

-- |

-- |

98 |

112 |

97 |

187 |

122 |

120 |

172 |

272 |

165 |

135 |

90 |

129 |

130 |

118 |

113 |

118 |

125 |

58 |

58 |

9 |

|

AgEq – Ag/Pb Concentrate |

moz |

334 |

-- |

-- |

15 |

17 |

14 |

27 |

20 |

18 |

23 |

34 |

20 |

17 |

13 |

18 |

17 |

17 |

17 |

16 |

16 |

7 |

7 |

1 |

|

Ag – Zn Concentrate |

moz |

12 |

-- |

-- |

0 |

1 |

0 |

1 |

1 |

1 |

1 |

0 |

0 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

0 |

|

Au – Zn Concentrate |

koz |

7 |

-- |

-- |

1 |

3 |

0 |

3 |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

|

Zn – Zn Concentrate |

mlbs |

3,733 |

-- |

-- |

99 |

92 |

109 |

182 |

170 |

218 |

282 |

406 |

296 |

222 |

212 |

242 |

213 |

190 |