Glacier Media Inc. (TSX: GVC) (“Glacier” or the “Company”) reported

revenue and earnings for the period ended June 30, 2023.

SUMMARY RESULTS

|

(thousands of dollars) |

|

Three months ended June 30, |

|

Six months ended June 30, |

|

except share and per share amounts |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

37,322 |

|

|

$ |

43,135 |

|

|

$ |

76,540 |

|

|

$ |

85,367 |

|

|

EBITDA |

|

$ |

(3,237 |

) |

|

$ |

636 |

|

|

$ |

(5,478 |

) |

|

$ |

2,876 |

|

|

EBITDA margin |

|

|

(8.7 |

%) |

|

|

1.5 |

% |

|

|

(7.2 |

%) |

|

|

3.4 |

% |

|

EBITDA per share |

|

$ |

(0.02 |

) |

|

$ |

0.00 |

|

|

$ |

(0.04 |

) |

|

$ |

0.02 |

|

|

Capital expenditures |

|

$ |

1,142 |

|

|

$ |

1,040 |

|

|

$ |

2,219 |

|

|

$ |

2,132 |

|

|

Net (loss) income attributable to common shareholder |

|

$ |

(8,186 |

) |

|

$ |

(2,386 |

) |

|

$ |

(13,403 |

) |

|

$ |

(3,052 |

) |

|

Net (loss) income attributable to common shareholder per share |

|

$ |

(0.06 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.02 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, net |

|

|

131,900,782 |

|

|

|

132,601,956 |

|

|

|

132,195,531 |

|

|

|

132,678,333 |

|

|

|

|

|

|

|

|

|

|

|

(1) EBITDA is considered a non-GAAP

measure. Refer to “EBITDA Reconciliation” below for a

reconciliation of the Company’s net (loss) income attributable to

common shareholders as reported under IFRS to EBITDA.2023

OPERATING PERFORMANCE AND OUTLOOK

Operating Performance

Consolidated revenue for the three months ended

June 30, 2023, was $37.3 million, down $5.8 million or 13.5% from

the same period in the prior year. Consolidated EBITDA for the

period was a loss of $3.2 million, down $3.9 million from positive

EBITDA of $0.6 million for the same period in the prior year.

During Q1 2023, the Company completed two separate transactions

that resulted in three operations being accounted for as joint

ventures, compared to previously included in the consolidated

results. The Company completed the sale of its printing assets into

two new joint venture operations. Certain print community media

operations were treated as joint ventures from January 1, 2023, as

the result of changes made in the structure of the underlying

shareholders agreements with the previous minority shareholders,

and it was determined that Company no longer has the ability to

exercise control and therefore can no longer treat these entities

as subsidiaries. These transactions had the effect of reducing

reported revenue and EBITDA as compared to the same period in the

prior year and increasing equity earnings in the current period as

compared to the same period in the prior year.

Organic revenue declines in print media were

driven by lower demand for print media products; however, digital

media revenues continue to grow. The environmental and property

information operations, which are reliant on the commercial and

residential real estate industry, had lower revenues resulting from

higher interest rates, which is temporarily decreasing demand for

real estate related products. The agricultural information

operations also had declines in print related revenue but noted

increased revenue in digital products and events. The agricultural

information operations continue to be impacted by the industry

consolidation and the declining demand for print products. The

mining information operations continue to operate in a challenged

industry, especially with respect to junior miners, which is

resulting in lower advertising revenue.

EBITDA for the period decreased as the result of

lower revenues in the operations as discussed above. Additionally,

rising costs related to inflation, (e.g. increased employee costs,

newsprint, and printing costs) compounded the effects of reduced

revenue.

Outlook

Despite the challenging environment, the Company

continues to focus on a combination of generating long-term revenue

gains in its growth businesses and cost management in its legacy

businesses. Operational investments in key strategic development

areas continue to be scaled back until the economic outlook becomes

more certain. The Company is monitoring economic conditions and

will respond accordingly.

The Company is taking action to reduce print

operations where print products are no longer economically

feasible. This transition has already been completed in a number of

markets resulting in the closure of the related print publications.

The targeted closure of print operations will continue to occur and

allow the Company to focus on the transformation to digital

products.

Higher interest rates continue to impact

results. Softness in the residential and commercial real estate

markets continued to negatively affected operations during the

second quarter, though Q2 saw a marked improvement over Q1. Higher

rates also continue to impact the junior mining market and their

ability to raise capital, impacting advertising revenues at The

Northern Miner Group. It is expected that industry specific

softness will continue into the latter half of 2023 with overall

economic uncertainty, inflation, and the impact of higher interest

rates. Although uncertain, it is anticipated that the pressures

from increased interest rates will begin to ease toward the end of

2023.

Long-term, the digital media, data, and

information businesses offer growth potential for the future. The

underlying fundamentals of these products have demonstrated their

value in the face of the challenging market conditions.

Even with the challenging economic environment,

some of the Company’s operations continue to perform well. The

Company is optimistic that many of its operations can and will

continue to perform well in the long-term and will continue to

generate strong cash flows and enhance shareholder value. The

respective brands, market positions and value to customers have

remained strong. The Company continues to focus on the long-term

growth of its data and information and digital media operations.

The targeted closure of print publications which are no longer

economically feasible will help the transition to digital and

support the long-term growth therein. Strategic investment spending

in the core areas of focus has resulted in lower operating profits

in the short term, with the goal of improved and more robust

product offerings over time. This investment spending has become

more targeted to strictly necessary spending and will continue to

be scaled back until economic recovery is more certain. The Company

has implemented and will continue to proactively implement cost

cutting measures that will take effect throughout 2023.

The Company is working to reach the point where

increases in the revenue, profit and cash flow from its data,

analytics and intelligence products and digital media products

exceeds the decline of its print advertising related profit and

cash flow.

Financial Position. As at June

30, 2023, the Company had a cash balance of $13.8 million and $7.3

million of non-recourse mortgages and loans (the majority of which

relates to farm show land in Saskatchewan and Ontario).

The Company has net $5.4 million of deferred

purchase price obligations to be paid over the next two years. This

amount is net of contributions from minority partners.

For further information please contact Mr. Orest

Smysnuik, Chief Financial Officer, at 604-708-3264.

ABOUT THE COMPANY

Glacier Media Inc. is an information &

marketing solutions company pursuing growth in sectors where the

provision of essential information and related services provides

high customer utility and value. The Company’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements that relate to, among other things, the Company’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations, and estimates. These forward-looking statements

include, among other things, statements relating to our

expectations as to investment spending and in targeted key

strategic areas and the scaling back of such spending; the expected

effects of cost cutting measures and targeted closure of print

publications; the expected industry specific softness in 2023; our

expectations as to timing of easing of interest rate increases; and

our expectation that the Company can generate future profits

operating at lower levels of revenue from its digital media, data

and information operations, and pressures from increased interest

rates will ease toward the end of 2023. These forward-looking

statements are based on certain assumptions, including continued

economic growth and recovery and the realization of cost savings in

a timely manner and in the expected amounts, which are subject to

risks, uncertainties and other factors which may cause results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements, and undue

reliance should not be placed on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve the intended results from our

strategic initiatives, the failure to reduce debt and the other

risk factors listed in our Annual Information Form under the

heading “Risk Factors” and in our MD&A under the heading

“Business Environment and Risks”, many of which are out of our

control. These other risk factors include, but are not limited to

that future cash flow from operations and the availability under

existing banking arrangements are believed to be adequate to

support financial liabilities and that the Company expects to be

successful in its objection with CRA, the ability of the Company to

sell advertising and subscriptions related to its publications,

foreign exchange rate fluctuations, the seasonal and cyclical

nature of the agricultural and energy sectors, discontinuation of

government grants, general market conditions in both Canada and the

United States, changes in the prices of purchased supplies

including newsprint, the effects of competition in the Company’s

markets, dependence on key personnel, integration of newly acquired

businesses, technological changes, tax risk, financing risk, debt

service risk and cybersecurity risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

NON-IFRS FINANCIAL MEASURES

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”), EBITDA margin and EBITDA per share,

are not generally accepted measures of financial performance under

IFRS. Management utilizes EBITDA as a financial performance measure

to assess profitability and return on equity in its decision

making. In addition, the Company, its lenders and its investors use

EBITDA to measure performance and value for various purposes.

Investors are cautioned; however, that EBITDA should not be

construed as an alternative to net income (loss) attributable to

common shareholders determined in accordance with IFRS as an

indicator of the Company’s performance.

The Company’s method of calculating these

financial performance measures may differ from other companies and,

accordingly, they may not be comparable to measures used by other

companies. A quantitative reconciliation of these non-IFRS measures

is included in the section entitled EBITDA Reconciliation.

EBITDA RECONCILIATION

|

(thousands of dollars) |

|

Three months ended June 30, |

|

Six months ended June 30, |

|

except share and per share amounts |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common shareholders |

|

$ |

(8,186 |

) |

|

$ |

(2,386 |

) |

|

$ |

(13,403 |

) |

|

$ |

(3,052 |

) |

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

Non-controlling interests |

|

$ |

363 |

|

|

$ |

879 |

|

|

$ |

(3,274 |

) |

|

$ |

1,756 |

|

|

Net interest expense, debt and lease liability |

|

$ |

380 |

|

|

$ |

412 |

|

|

$ |

675 |

|

|

$ |

823 |

|

|

Depreciation and amortization |

|

$ |

2,857 |

|

|

$ |

3,175 |

|

|

$ |

5,829 |

|

|

$ |

6,220 |

|

|

Loss on disposal |

|

$ |

187 |

|

|

$ |

- |

|

|

$ |

6,169 |

|

|

$ |

- |

|

|

Restructuring and other expenses (net) |

|

$ |

2,455 |

|

|

$ |

148 |

|

|

$ |

2,760 |

|

|

$ |

(340 |

) |

|

Share of earnings from joint ventures and associates |

|

$ |

631 |

|

|

$ |

(456 |

) |

|

$ |

533 |

|

|

$ |

(825 |

) |

|

Income tax recovery |

|

$ |

(1,924 |

) |

|

$ |

(1,136 |

) |

|

$ |

(4,767 |

) |

|

$ |

(1,706 |

) |

|

EBITDA (1) |

|

$ |

(3,237 |

) |

|

$ |

636 |

|

|

$ |

(5,478 |

) |

|

$ |

2,876 |

|

|

Notes: |

|

|

|

|

|

|

|

|

|

(1) Refer to "Non-IFRS Measures" section of MD&A for discussion

of non-IFRS measures used in this table. |

|

|

|

|

|

|

|

|

|

|

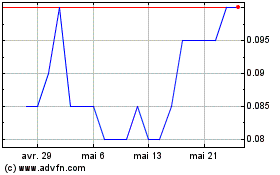

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024