Kelt Reports Financial and Operating Results for the Three Months

Ended March 31, 2014

CALGARY, ALBERTA--(Marketwired - May 13, 2014) - Kelt

Exploration Ltd. ("Kelt" or the "Company") (TSX:KEL) has released

its financial and operating results for the three months ended

March 31, 2014. The Company's financial results are summarized as

follows:

| (CA$ thousands, except as otherwise

indicated) |

|

Q1 2014 |

|

Q4 2013 |

|

|

Q1 2013 |

|

| Revenue, before royalties and financial

instruments |

|

47,793 |

|

18,543 |

|

|

3,865 |

|

| Funds from operations(1) |

|

26,084 |

|

9,396 |

|

|

2,179 |

|

|

|

Basic ($/ common share)(1) |

|

0.24 |

|

0.09 |

|

|

0.09 |

|

|

|

Diluted ($/ common share)(1) |

|

0.23 |

|

0.09 |

|

|

0.09 |

|

| Profit (loss) |

|

4,851 |

|

(1,838 |

) |

|

(140 |

) |

|

|

Basic ($/ common share) |

|

0.04 |

|

(0.02 |

) |

|

(0.01 |

) |

|

|

Diluted ($/ common share) |

|

0.04 |

|

(0.02 |

) |

|

(0.01 |

) |

| Total capital expenditures, net of dispositions(2) |

|

40,933 |

|

231,329 |

|

|

40,210 |

|

| Total assets |

|

666,257 |

|

485,201 |

|

|

141,834 |

|

| Bank debt |

|

- |

|

- |

|

|

- |

|

| Working capital surplus (deficiency) |

|

123,150 |

|

20,500 |

|

|

(24,471 |

) |

| Shareholders' equity |

|

539,410 |

|

392,872 |

|

|

98,138 |

|

| Weighted average common shares outstanding (000's) |

|

|

|

|

|

|

|

|

|

|

Basic |

|

110,991 |

|

99,244 |

|

|

25,359 |

|

|

|

Diluted |

|

112,788 |

|

100,242 |

|

|

25,359 |

|

| (1) Refer to advisory regarding non-GAAP measures. |

| (2) Total capital expenditures incurred during the first

quarter of 2013 include approximately $22.9 million of expenditures

incurred prior to completion of the Arrangement on February 26,

2013. |

FINANCIAL STATEMENTS

Kelt's unaudited condensed interim financial statements and

related notes for the quarter ended March 31, 2014 will be

available to the public on SEDAR at www.sedar.com and will also be

posted on the Company's website at www.keltexploration.com on May

13, 2014.

Kelt's operating results for the three months ended March 31,

2014 are summarized as follows:

|

|

Q1 2014 |

|

|

Q4 2013 |

|

|

Q1 2013 |

|

| Average daily production |

|

|

|

|

|

|

|

|

|

|

|

Oil (bbls/d) |

|

2,428 |

|

|

809 |

|

|

158 |

|

|

|

NGLs (bbls/d) |

|

654 |

|

|

487 |

|

|

82 |

|

|

|

Gas (mcf/d) |

|

42,367 |

|

|

26,660 |

|

|

6,456 |

|

|

|

Combined (BOE/d)(2) |

|

10,143 |

|

|

5,739 |

|

|

1,316 |

|

| Production per million common shares (BOE/d)(1) |

|

91 |

|

|

58 |

|

|

52 |

|

| Average realized prices, after financial

instruments |

|

|

|

|

|

|

|

|

|

|

|

Oil ($/bbl) |

|

89.62 |

|

|

81.35 |

|

|

87.84 |

|

|

|

NGLs ($/bbl) |

|

69.36 |

|

|

57.00 |

|

|

70.96 |

|

|

|

Gas ($/mcf) |

|

6.00 |

|

|

3.97 |

|

|

3.60 |

|

| Operating netbacks(1) ($/BOE) |

|

|

|

|

|

|

|

|

|

|

|

Oil and gas revenue |

|

52.36 |

|

|

35.12 |

|

|

32.64 |

|

|

|

Realized loss on financial instruments |

|

(1.37 |

) |

|

(0.38 |

) |

|

- |

|

|

|

Average realized price, after financial instruments |

|

50.99 |

|

|

34.74 |

|

|

32.64 |

|

|

|

Royalties |

|

(6.52 |

) |

|

(4.71 |

) |

|

(4.36 |

) |

|

|

Production and transportation expense |

|

(15.07 |

) |

|

(11.36 |

) |

|

(9.00 |

) |

|

|

Operating netback(1) |

|

29.40 |

|

|

18.67 |

|

|

19.28 |

|

| Undeveloped land |

|

|

|

|

|

|

|

|

|

|

|

Gross acres |

|

346,120 |

|

|

299,142 |

|

|

134,238 |

|

|

|

Net acres |

|

227,284 |

|

|

184,082 |

|

|

72,166 |

|

| (1) Refer to advisory regarding non-GAAP measures. |

| (2) Average daily production reported in the table above for

the first quarter of 2013 is calculated over the 90 day period

ended March 31, 2013. Production for the 33 day period following

commencement of active operations on February 27, 2013, averaged

3,588 BOE per day. |

MESSAGE TO SHAREHOLDERS

The Company is pleased to report its first quarter interim

results to shareholders for the three months ended March 31,

2014.

Kelt was incorporated on October 11, 2012 for the purpose of

participating in a Plan of Arrangement between ExxonMobil Canada

Ltd., ExxonMobil Celtic ULC and Celtic Exploration Ltd. and Kelt

(the "Arrangement"). The Arrangement was completed on February 26,

2013, at which time Kelt commenced active operations.

Kelt achieved record production levels in the first quarter of

2014. Average production for the three months ended March 31, 2014

was 10,143 BOE per day, up 77% from average production of 5,739 BOE

per day during the fourth quarter of 2013. Daily average production

in the first quarter of 2014 was 183% higher than the average

production of 3,588 BOE per day for the 33-day period ended March

31, 2013. On a production per share basis, the first quarter of

2014 was up 75% compared to the first quarter of 2013.

For the three months ended March 31, 2014, revenue was $47.8

million, funds from operations was $26.1 million ($0.23 per share,

diluted) and profit was $4.9 million ($0.04 per share, diluted). At

March 31, 2014, Kelt did not have any outstanding bank debt on its

$100.0 million demand loan facility. The working capital surplus

position, including cash and cash equivalents, at the end of the

first quarter was $123.2 million.

On March 25, 2014, the Company completed an equity financing

issuing 9.8 million common shares at a price of $11.60 per share

and 2.6 million common shares on a "CDE flow-through" basis at a

price of $12.75 per share, resulting in aggregate gross proceeds of

$147.0 million. Certain insiders participated in the equity

financing acquiring 1.1 million common shares for an aggregate

subscription price of $14.1 million. As at May 12, 2014, the

Company has 122.5 million common shares issued and outstanding.

Directors and officers of Kelt own (including shares that they

exercise control or direction over) 24.4 million common shares or

19.9% of the total shares outstanding.

During the three months ended March 31, 2014, Kelt drilled seven

gross (5.9 net) oil and gas wells, with a 100% success rate, and

one service well. The Company drilled two gross (0.9 net)

horizontal wells at Inga/Fireweed, British Columbia. These wells

were targeting condensate-rich natural gas in the Triassic Doig

formation. The Company drilled two gross (2.0 net) wells at Karr,

Alberta targeting the Triassic Montney oil formation. In addition,

Kelt drilled a 100% working interest water injection well at Karr,

which will reduce production expenses by eliminating water trucking

costs. At Pouce Coupe, Alberta, the Company drilled three gross

(3.0 net) wells in the Triassic Montney formation. Two wells that

were drilled in the natural gas leg have now been completed and the

third well drilled in the oil leg is expected to be completed in

the second quarter of 2014.

During the remainder of 2014 Kelt is well positioned financially

and expects that it will have sufficient financial flexibility to

carry out its operations during the year and to pursue new

opportunities as they arise. Management is excited about the

Company's prospects and looks forward to updating shareholders with

second quarter results in August 2014.

2014 GUIDANCE

Kelt remains optimistic about its future prospects. The Company

is opportunity driven and is confident that it can grow its

production base by building on its current inventory of development

projects and by adding new exploration prospects. Kelt will

endeavor to maintain a high quality product stream that on a

historical basis receives a superior price with reasonably low

production costs. In addition, the Company will focus its

exploration efforts in areas of multi-zone hydrocarbon potential,

primarily in west central Alberta and northeastern British

Columbia.

Kelt's Board of Directors has approved a 2014 capital

expenditure budget of $250.0 million, net of dispositions. In

aggregate, the Company expects to spend $198.0 million on drilling

and completing wells, $34.5 million on facilities, equipment and

pipelines, and $30.0 million on land and seismic. Proceeds from

dispositions, net of acquisitions, are expected to be $12.5

million.

Kelt expects production in 2014 to average approximately 11,000

BOE per day. Production is expected to be weighted 24% oil, 6%

NGLs, and 70% gas; however, operating income in 2014 is expected to

be derived 47% from oil production, 10% from NGLs production, and

43% from gas production.

The Company's average commodity price assumptions for 2014 are

US$92.00 (previously US$90.00) per barrel for WTI oil, US$4.60

(previously US$4.65) per MMBTU for NYMEX natural gas, $4.55

(previously $4.50) per GJ for AECO natural gas and a US/Canadian

dollar exchange rate of US$0.9174 (previously US$0.9200). These

prices compare to average calendar 2013 prices of US$97.98 per

barrel for WTI oil, US$3.68 per MMBTU for NYMEX natural gas, $2.97

per GJ for AECO natural gas and a US/Canadian dollar exchange rate

of US$0.971. Funds from operations for 2014 is forecasted to be

approximately $103.0 million (previously $102.0 million) or $0.85

per common share, diluted.

Kelt estimates that the Company's bank indebtedness, net of

working capital, will be approximately $3.0 million (previously

$3.9 million) at December 31, 2014. On May 6, 2014, the Company

established a new $100.0 million committed term credit facility

with a syndicate of financial institutions. Additional information

is available under the heading of Subsequent events.

Changes in forecasted commodity prices and variances in

production estimates can have a significant impact on estimated

funds from operations and profit. Please refer to the cautionary

statement on forward-looking statements and information set out

below.

The information set out herein under the heading "2014 Guidance"

is "financial outlook" within the meaning of applicable securities

laws. The purpose of this financial outlook is to provide readers

with disclosure regarding Kelt's reasonable expectations as to the

anticipated results of its proposed business activities for 2014.

Readers are cautioned that this financial outlook may not be

appropriate for other purposes.

ADVISORY REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements and

forward-looking information within the meaning of applicable

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "objective", "ongoing",

"may", "will", "project", "should", "believe", "plans", "intends"

and similar expressions are intended to identify forward-looking

information or statements. In particular, this press release

contains forward-looking statements concerning the Company's

expected future financial position and operating results.

Although Kelt believes that the expectations and assumptions on

which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because Kelt cannot give any assurance that they will

prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. These include, but are not limited to, the risks

associated with the oil and gas industry in general (e.g.,

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses; failure to obtain

necessary regulatory approvals for planned operations; health,

safety and environmental risks; uncertainties resulting from

potential delays or changes in plans with respect to exploration or

development projects or capital expenditures; volatility of

commodity prices, currency exchange rate fluctuations; imprecision

of reserve estimates; and competition from other explorers) as well

as general economic conditions, stock market volatility; and the

ability to access sufficient capital. We caution that the foregoing

list of risks and uncertainties is not exhaustive.

In addition, the reader is cautioned that historical results are

not necessarily indicative of future performance. The

forward-looking statements contained herein are made as of the date

hereof and the Company does not intend, and does not assume any

obligation, to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise

unless expressly required by applicable securities laws.

Certain information set out herein may be considered as

"financial outlook" within the meaning of applicable securities

laws. The purpose of this financial outlook is to provide readers

with disclosure regarding Kelt's reasonable expectations as to the

anticipated results of its proposed business activities for the

periods indicated. Readers are cautioned that the financial outlook

may not be appropriate for other purposes.

NON-GAAP MEASURES

This document contains certain financial measures, as described

below, which do not have standardized meanings prescribed by GAAP.

As these measures are commonly used in the oil and gas industry,

the Company believes that their inclusion is useful to investors.

The reader is cautioned that these amounts may not be directly

comparable to measures for other companies where similar

terminology is used.

"Operating income" is calculated by deducting royalties,

production expenses and transportation expenses from oil and gas

revenue, after realized gains or losses on financial instruments.

The Company refers to operating income expressed per unit of

production as an "Operating netback". "Funds from operations" is

calculated by adding back settlement of decommissioning obligations

and change in non-cash operating working capital to cash provided

by operating activities. Funds from operations per common share is

calculated on a consistent basis with profit (loss) per common

share, using basic and diluted weighted average common shares as

determined in accordance with GAAP. Funds from operations and

operating income or netbacks are used by Kelt as key measures of

performance and are not intended to represent operating profits nor

should they be viewed as an alternative to cash provided by

operating activities, profit or other measures of financial

performance calculated in accordance with GAAP.

"Production per common share" is calculated by dividing total

production by the basic weighted average number of common shares

outstanding, as determined in accordance with GAAP.

MEASUREMENTS AND ABBREVIATIONS

All dollar amounts are referenced in thousands of Canadian

dollars, except when noted otherwise. Where amounts are expressed

on a barrel of oil equivalent ("BOE") basis, natural gas volumes

have been converted to oil equivalence at six thousand cubic feet

per barrel and sulphur volumes have been converted to oil

equivalence at 0.6 long tons per barrel. The term BOE may be

misleading, particularly if used in isolation. A BOE conversion

ratio of six thousand cubic feet per barrel is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

References to oil in this discussion include crude oil and field

condensate. References to natural gas liquids ("NGLs") include,

pentane, butane, propane, and ethane. References to gas in this

discussion include natural gas and sulphur.

|

bbls |

barrels |

|

mcf |

thousand cubic feet |

|

MMBTU |

million British Thermal Units |

|

AECO-C |

Alberta Energy Company "C" Meter Station of the Nova Pipeline

System |

|

WTI |

West

Texas Intermediate |

|

NYMEX |

New

York Mercantile Exchange |

Kelt Exploration Ltd.David J. WilsonPresident and Chief

Executive Officer(403) 201-5340Kelt Exploration Ltd.Sadiq H.

LalaniVice President, Finance and Chief Financial Officer(403)

215-5310www.keltexploration.com

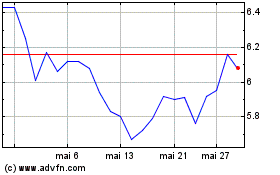

Kelt Exploration (TSX:KEL)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Kelt Exploration (TSX:KEL)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024