Moneta Gold Inc. (

TSX:ME) (OTCQX:MEAUF)

(XETRA:MOP) (“Moneta” or the

“Company”) is pleased to announce the Company’s

participation in the OTC Metals & Mining Virtual Conference for

1x1 meetings as well as a general presentation that will be

broadcast live on Tuesday October 18, 2022 at 2:00 pm ET.

Moneta invites individual and institutional

investors, as well as advisors and analysts, to attend real-time,

interactive presentations on VirtualInvestorConferences.com.

DATE: October 18th, 2022

TIME: 2:00 pm EST

LINK: https://bit.ly/3q1Z3Ka

This will be a live, interactive online event

where investors are invited to ask the company questions in

real-time. If attendees are not able to join the event live on the

day of the conference, an archived webcast will also be made

available after the event.

Learn more about the event at

www.virtualinvestorconferences.com.

Moneta is also available for 1x1 meetings: October 19th &

20th, 2022.

Recent Company Highlights

On September 7, 2022, Moneta released the

Preliminary Economic Assessment (“PEA”) results for its 100% owned

Tower Gold project in Timmins, Ontario, Canada’s most prolific gold

producing camp. The PEA demonstrates the potential to develop a

low-cost 19,200 tonnes per day (“tpd”), or 7.0 million tonne per

annum (“tpa”), combined open pit and underground mining operation

with strong economics and the opportunity for significant benefit

to the Indigenous Nations, local stakeholders, and shareholders.

Highlights included:

- Robust economics

with an after-tax Net Present Value (“NPV5%”) of C$1,066 million,

Internal Rate of Return (“IRR”) of 31.7%, and pay-back of 2.6 years

at US$1,600/oz gold and FX of US$0.78/C$

- Low capital

intensity project achieved by a sequenced development strategy,

with underground development starting in year 1

- Mine life of 24

years, with average annual gold production of 192,666 ounces (“oz”)

for total LOM of 4,581,000 oz, and average annual gold production

of 261,014 oz in years 1 to 11, with peak production of 368,622

oz

- LOM cash cost of

US$910/oz and all-in sustaining cost (“AISC”) of US$1,073/oz, with

cash cost of US$811/oz and AISC of US$1,004/oz for years 1 to

11

- Several

opportunities to improve PEA including, expansion of underground

resources and throughput, mill expansion (notably after year 11),

and site layout optimization

The Company has started pre-feasibility work,

including environmental base-line studies, community engagement,

geotechnical and hydrological studies, as well as additional

metallurgical recovery test-work, and will continue resource

upgrade and infill drilling over the next year.

About Moneta Gold

Moneta is a Canadian-based gold exploration

company focused on advancing its 100% wholly owned Tower Gold

project, located in the Timmins region of Northeastern Ontario,

Canada’s most prolific gold producing camp. A September 2022,

Preliminary Economic Assessment study outlined a combined open pit

and underground mining and a 7.0 million tonne per annum

conventional leach/CIL operation over a 24-year mine life, with 4.6

Moz of recovered gold, generating an after-tax NPV5% of $1,066M,

IRR of 31.7%, and a 2.6-year payback at a gold price US$1,600/oz.

Tower Gold hosts an estimated gold mineral resource of 4.5 Moz

indicated and 8.3 Moz inferred. Moneta is committed to creating

shareholder value through the strategic allocation of capital and a

focus on the current resource upgrade drilling program, while

conducting all business activities in an environmentally and

socially responsible manner.

About Virtual Investor Conferences®

Virtual Investor Conferences (VIC) is the

leading proprietary investor conference series that provides an

interactive forum for publicly traded companies to seamlessly

present directly to investors.

Providing a real-time investor engagement

solution, VIC is specifically designed to offer companies more

efficient investor access. Replicating the components of an on-site

investor conference, VIC offers companies enhanced capabilities to

connect with investors, schedule targeted one-on-one meetings and

enhance their presentations with dynamic video content.

Accelerating the next level of investor engagement, Virtual

Investor Conferences delivers leading investor communications to a

global network of retail and institutional investors.

It is recommended that investors pre-register

and run the online system check to expedite participation and

receive event updates.

FOR FURTHER INFORMATION, PLEASE

CONTACT:Gary V. O’Connor, CEO 416-357-3319

Linda Armstrong, Investor Relations647-456-9223

Virtual Investor ConferencesJohn M. ViglottiSVP

Corporate Services, Investor AccessOTC Markets Group (212)

220-2221johnv@otcmarkets.com

The Company’s public documents may be accessed at www.sedar.com.

For further information on the Company, please visit our website at

www.monetagold.com or email us at info@monetagold.com.

This news release includes certain

forward-looking information and forward-looking statements,

collectively “forward-looking statements” within the meaning of

applicable securities legislation. Forward-looking statements are

frequently identified by such words as “may”, “will”, “plan”,

“expect”, “anticipate”, “estimate”, “intend” and similar words

referring to future events and results. Forward-looking statements

include but are not limited to information with respect to the

closing of the Offering, the use of proceeds, the timing of the

renunciation and tax treatment of the Flow Through Shares as well

as future performance of the business, its operations and financial

performance and condition such as the Corporation’s drilling

program . Forward-looking statements are subject to inherent risks

and uncertainties including without limitation the impact of

COVID-19 related disruptions in relation to the Corporation's

business operations including upon its employees, suppliers,

facilities and other stakeholders; uncertainties and risk that have

arisen and may arise in relation to travel, and other financial

market and social impacts from COVID-19 and responses to COVID 19

and the ability of the Corporation to finance and carry out its

anticipated goals and objectives. International conflicts and other

geopolitical risks, including war, military action, terrorism,

trade and financial sanctions, which have historically led to, and

may in the future lead to, uncertainty or volatility in global

commodity and financial markets and supply chains; the impact of

Russia’s invasion of Ukraine and the widespread international

condemnation has had a significant destabilizing effect on world

commodity prices, supply chains, inflation risk, and global

economies more broadly, may adversely affect the Corporation's

business, financial condition, and results of operations.

Forward-looking statements are based on the

current opinions and expectations of management. All

forward-looking information is inherently uncertain and subject to

a variety of assumptions, risks and uncertainties, including the

speculative nature of mineral exploration and development,

fluctuating commodity prices, competitive risks and the

availability of financing, as described in more detail in our

recent securities filings available at www.sedar.com. Actual events

or results may differ materially from those projected in the

forward-looking statements and we caution against placing undue

reliance thereon. We assume no obligation to revise or update these

forward-looking statements.

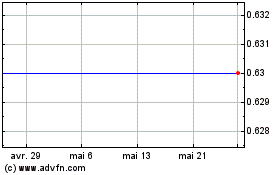

Moneta Gold (TSX:ME)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Moneta Gold (TSX:ME)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024