Flagship Communities Real Estate Investment Trust (the

“

REIT” or “

Flagship”) (TSX:MHC.U)

announced today that it has waived conditions on the acquisition of

three high-quality manufactured housing communities

(“

MHCs”) from two separate vendor groups

comprising 957 lots for an aggregate purchase price of

approximately US$56.8 million (collectively, the

“

Acquisitions”). The Acquisitions are subject to

customary closing conditions and are expected to close in December

2021.

The purchase price of approximately US$56.8

million is expected to be funded primarily with the net proceeds

from the REIT’s US$40.4 million offering of trust units

(“Units”) (see “Equity Financing” below), with the

balance to be funded with cash on hand. The REIT's pro forma Debt

to Gross Book Value Ratio (see “Non-IFRS Financial Measures” below)

following the Acquisitions and the Offering is expected to be

approximately 40.0% (prior to any exercise of the over-allotment

option). The Acquisitions, together with the Offering, are expected

to be immediately accretive to the REIT’s adjusted funds from

operations ("AFFO") per Unit on a leverage neutral

basis.

“We are continuing to grow our geographic

footprint near existing communities, applying our successful

business model with new strategic acquisitions,” said Kurt Keeney,

President and Chief Executive Officer. “These acquisitions are in

line with our disciplined growth strategy and have significantly

enhanced our portfolio and presence in key markets. The

Acquisitions allow Flagship to continue to consolidate existing

markets, providing the REIT with above market growth opportunities

over time.”

Highlights of the

Acquisitions

- Increased Size and Scale: The Acquisitions add

three communities and 957 lots to our portfolio. Together with the

other acquisitions completed since the REIT’s initial public

offering (the “IPO”), the REIT’s pro forma portfolio totals 63

communities comprising 11,328 lots, representing an approximate 37%

increase in the number of lots.

- Further Consolidation of Existing Markets: The

Acquisitions are indicative of the REIT’s ability to continue

consolidating its operating footprint within existing markets. The

REIT intends to continue sourcing acquisitions in Arkansas and

Kentucky as well as other adjacent markets with a focus on

strategically expanding the REIT’s contiguous portfolio.

-

Operating Platform Synergies and Economies of

Scale: The REIT has successfully expanded its portfolio

and is well-positioned to further benefit from its scalable

management platform going forward. The REIT intends to continue its

growth by sourcing acquisitions in existing and adjacent markets

which are expected to generate significant economies of scale and

operational synergies.

-

Improved Leverage Profile: Following the

completion of the Acquisitions and the Offering, the REIT’s Debt to

Gross Book Value Ratio is expected to be approximately 40.0% (prior

to any exercise of the over-allotment option) compared to 49.6%

following completion of the IPO and 42.0% as at September 30,

2021.

-

Accretive to AFFO per Unit: The Acquisitions,

together with the Offering, are expected to be immediately

accretive to the REIT’s AFFO per unit on a leverage neutral

basis.

"These stable, high performing communities are

an excellent addition to our portfolio, and we are excited to have

sourced them off-market through our long-standing industry

relationships," commented Nathan Smith, Chief Investment Officer.

"Furthermore, we are strengthening our existing footprint in

Lexington and Little Rock, where Flagship already has a meaningful

and growing presence. These new properties are in great locations

in highly desirable areas within our target markets and provide the

REIT with operating economies of scale."

Overview of the

Acquisitions

-

Lexington, KY: The Lexington acquisition comprises

546 lots across approximately 71 acres and is within close

proximity to two post-secondary institutions (University of

Kentucky and Transylvania University), state parks, popular

eateries and major entertainment attractions including the Kentucky

Horse Park. The community is currently 92.6% occupied, with no

rental homes in the community. The community is approximately 10

minutes away from North Park Marketplace which features a Walmart

Supercenter, popular restaurants and numerous retailers. Local

attractions, such as the Explorium of Lexington, State Botanical

Garden of Kentucky and Waveland State Historic Site, are located

within ~8 miles of the community. The community sits near both

Interstate 64 and Highway 421 and is minutes away from downtown

Lexington. The acquisition is in the heart of the REIT’s prominent

Kentucky footprint, near other existing communities (Adams Pointe,

Cherry Hill Pointe and Bradbury Pointe).

-

Bryant, AR: The Bryant acquisition comprises 327

lots across approximately 97 acres and is located ~20 miles

southwest of downtown Little Rock, AR. The community is within

close proximity to the Bryant public school district,

necessity-based retailers including Walmart and Dollar Tree and two

hospitals (Saline Memorial Hospital and Arkansas Heart Hospital).

The community is currently 98.0% occupied, including 31 rental

homes. The community is located adjacent to Interstate 30,

providing excellent access to major transportation routes which

connect with major regional metropolitan areas and is also within

close proximity to recreational areas including state parks. The

Bryant acquisition is within a 20-minute drive to the REIT’s

existing community, Lakeside Estates, in Little Rock, AR.

- Bald Knob, AR: The

Bald Knob acquisition comprises 84 lots across approximately 29

acres and is within close proximity to Harding University, Bald

Knob High School and H L Lubker Elementary School. The community is

currently 56.0% occupied, including 8 rental homes with the

potential for abundant occupancy growth supported by significant

employment opportunities and strong demographic drivers. The

community sits near Highways 167 and 67, which conveniently connect

the community to Bald Knob sports complex and two nearby shopping

centers among other local retail destinations.

Summary of Recent Investment

Activity

Following the IPO in October 2020, the REIT has

completed or announced the acquisition of 18 communities, including

the Acquisitions, for an aggregate purchase price of approximately

US$172.5 million, increasing Flagship’s portfolio from 45

communities, comprising 8,255 lots to 63

communities, comprising 11,328 lots. The table

below provides a summary of completed and announced acquisitions as

of November 11, 2021.

|

|

Type |

Purchase Price (US$mm) |

# of Communities |

# of Lots |

|

Evansville, Paducah, Cincinnati |

MHCs |

$12.9 |

7 |

379 |

|

Shepherdsville, Bowling Green |

MHCs & Land |

$6.1 |

2 |

159 |

|

Little Rock |

MHC |

$5.3 |

1 |

167 |

|

Anderson |

MHC |

$13.9 |

1 |

175 |

|

St. Louis |

MHC |

$52.5 |

1 |

502 |

|

Evansville |

Land |

$0.3 |

n.a. |

n.a. |

|

Springfield |

MHC |

$16.3 |

1 |

231 |

|

Northern Kentucky, Central Ohio |

RV Resorts |

$8.4 |

2 |

467 |

|

Lexington |

MHC |

$36.0 |

1 |

546 |

|

Bryant |

MHC |

$20.4 |

1 |

327 |

|

Bald Knob |

MHC |

$0.4 |

1 |

84 |

| Total |

|

$172.5 |

18 |

3,037 |

Equity Financing

The REIT also announced today that it has

entered into an agreement with a syndicate of underwriters co-led

by BMO Capital Markets and Canaccord Genuity Corp. (together, the

“Lead Underwriters”) to sell, on a bought deal

basis, 2,100,000 Units at a price of US$19.25 per Unit

for gross proceeds of approximately US$40.4 million (the

“Offering”). The REIT has also granted the

Underwriters an over-allotment option to purchase up to an

additional 15% of the Offering on the same terms and conditions,

exercisable at any time, in whole or in part, up to 30 days after

the closing of the Offering. The Offering is expected to close on

or about November 18, 2021 and is subject to customary conditions,

including the approval of the Toronto Stock Exchange. The Offering

is not conditional upon closing of the Acquisitions.

The REIT intends to use the net proceeds from

the Offering to fund the purchase price of the Acquisitions and for

general business purposes. In the event the REIT is unable to

consummate any of the Acquisitions and the Offering is completed,

the REIT would use the net proceeds of the Offering to fund future

acquisitions and for general business purposes.

The Offering is being made pursuant to the

REIT’s base shelf prospectus dated May 7, 2021. The terms of the

Offering will be described in a prospectus supplement to be filed

with Canadian securities regulators.

The Units have not been, nor will they be,

registered under the United States Securities Act of 1933, as

amended, (the “1933 Act”) and may not be offered,

sold or delivered, directly or indirectly, in the United States,

except pursuant to an exemption from the registration requirements

of the 1933 Act. This press release does not constitute an offer to

sell or a solicitation of an offer to buy any Units in the United

States.

About Flagship Communities Real Estate

Investment Trust

Flagship Communities Real Estate Investment

Trust is a newly created, internally managed, unincorporated,

open-ended real estate investment trust established pursuant to a

declaration of trust under the laws of the Province of Ontario. The

REIT has been formed to own and operate a portfolio of

income-producing manufactured housing communities located in

Kentucky, Indiana, Ohio, Tennessee, Illinois, Arkansas, and

Missouri, including a fleet of manufactured homes for lease to

residents of such housing communities.

Non-IFRS Financial Measures

The REIT uses certain non-IFRS financial

measures, including certain real estate industry metrics such as

FFO, FFO Per Unit, AFFO, AFFO Per Unit and Same Community, to

measure, compare and explain the operating results, financial

performance and financial condition of the REIT. The REIT also uses

AFFO in assessing its distribution paying capacity and NOI is a key

input in determining the value of the REIT’s properties. These

measures are commonly used by entities in the real estate industry

as useful metrics for measuring performance. However, they do not

have any standardized meaning prescribed by IFRS and are not

necessarily comparable to similar measures presented by other

publicly traded entities. These measures should be considered as

supplemental in nature and not as a substitute for related

financial information prepared in accordance with IFRS.

FFO is defined as IFRS consolidated net income

adjusted for items such as distributions on redeemable or

exchangeable units recorded as finance cost under IFRS (including

distributions on the Class B Units, unrealized fair value

adjustments to investment properties, loss on extinguishment of

acquired mortgages payable, gain on disposition of investment

properties and depreciation. The REIT’s method of calculating FFO

is substantially in accordance with the recommendations of the Real

Property Association of Canada ("REALPAC").

AFFO is defined as FFO adjusted for items such

as maintenance capital expenditures, and certain non-cash items

such as amortization of intangible assets, premiums and discounts

on debt and investments. The REIT’s method of calculating AFFO is

substantially in accordance with REALPAC’s recommendations.

NOI is defined as total revenue from properties

(i.e., rental revenue and other property income) less direct

property operating expenses in accordance with IFRS.

Same Community results are the results of the

MHCs owned throughout the applicable period and such measure is

used by management to evaluate period-over-period performance of

investment properties. These results remove the impact of

dispositions or acquisitions of investment properties.

Please refer to the REIT’s Management Discussion

and Analysis for the period ended September 30, 2021 for further

detail on non-IFRS financial measures, including reconciliations of

these measures to standardized IFRS measures.

Forward-Looking Statements

This press release contains statements that

include forward-looking information within the meaning of Canadian

securities laws. These forward-looking statements reflect the

current expectations of the REIT regarding future events, including

statements concerning the Acquisitions, including the closing and

timing thereof, as well as the expected impact of the Acquisitions

on the REIT and potential for further acquisitions and the location

thereof. In some cases, forward-looking statements can be

identified by terms such as "may", "will", "could", "occur",

"expect", "anticipate", "believe", "intend", "estimate", "target",

"project", "predict", "forecast", "continue", or the negative

thereof or other similar expressions concerning matters that are

not historical facts. Material factors and assumptions used by

management of the REIT to develop the forward-looking information

include, but are not limited to that the closing conditions to the

Acquisitions are met or waived in a timely manner and that the

anticipated impacts of the Acquisition are realized. While

management considers these assumptions to be reasonable based on

currently available information, they may prove to be

incorrect.

Although management believes the expectations

reflected in such forward-looking statements are reasonable and

represent the REIT’s internal expectations and beliefs at this

time, such statements involve known and unknown risks and

uncertainties and may not prove to be accurate and certain

objectives and strategic goals may not be achieved. A variety of

factors, many of which are beyond the REIT’s control, could cause

actual results in future periods to differ materially from current

expectations of events or results expressed or implied by such

forward-looking statements, such as the risks identified in the

REIT’s annual information form available under the REIT’s profile

at www.sedar.com, including under the heading "Risk Factors"

therein. Readers are cautioned against placing undue reliance on

forward-looking statements. Except as required by applicable

Canadian securities laws, the REIT undertakes no obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise, after

the date on which the statements are made.

For further information, please contact:

Eddie Carlisle, Chief Financial OfficerFlagship Communities Real

Estate Investment TrustTel: +1 (859) 568-3390

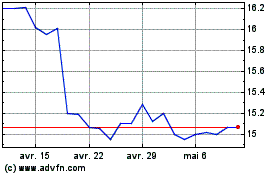

Flagship Communities Rea... (TSX:MHC.U)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

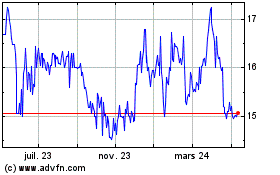

Flagship Communities Rea... (TSX:MHC.U)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024