Melcor REIT (TSX: MR.UN) today announced results for the second

quarter ended June 30, 2023. Revenue was stable at $18.12

million in the quarter and $37.11 million year-to-date. Second

quarter same-asset NOI was up 4% to $11.02 million and was up 1%

year-to-date at $21.92 million. In-place occupancy currently sits

at 87% with committed occupancy at 89%.

Andrew Melton, CEO of Melcor REIT commented: "I'm

pleased to report another quarter of stable results for the REIT.

We continue to be encouraged with progress we are making on new and

renewed leasing, and have achieved a 92% retention rate to date in

2023. We believe our leasing efforts will show benefits in the

quarters to come.

The REIT is experiencing many of the same current

challenges of the real estate industry including escalating

financing costs, increasing inflation in operating and leasing

costs, occupancy and leasing challenges in office space, and

increasing capitalization rates impacting valuations and

financing.

During the quarter we listed our Saskatchewan

properties for sale as part of a strategic decision to focus on our

Alberta markets. The sale of these properties would serve to reduce

the REIT's operating loan providing additional liquidity for future

opportunities. We remain committed on achieving value for our

unitholders and believe these assets can be sold at a price that is

reflective of current market conditions."

HIGHLIGHTS:We continue to focus

efforts on leasing and completed 48,767 sf of new leasing and

418,132 sf in renewals and holdovers year-to-dater for a 92%

retention rate. Occupancy remains strong at 87% with commitment on

an additional 40,158 sf bringing committed occupancy up to 89%.

Weighted average base rents (WABR) improved 2% since year end

despite challenging market conditions. Our portfolio produced

stable results in the second quarter despite rising costs and

inflationary pressures in all our markets.

Retail properties continue to anchor our portfolio,

and have seen slight improvements in both occupancy and WABR

compared to last year. Retail represents 44% of our total GLA and

61% of net rental income in Q2-2023. Our office properties continue

to navigate downward pressure on rental rates and an increase in

supply in some of our key geographic areas, specifically our

Edmonton office properties which have seen an increase in new

development of office space in recent years.

We remain prudently focussed on identifying

opportunities to strategically acquire or dispose of assets, with

intentionality around pruning non-core assets. In Q1-2023, we sold

Kelowna Business Centre for $19.50 million. This was an

opportunistic sale that enabled the REIT to pay down our line of

credit while also achieving a good return on investment for

unitholders. In Q2-2023, we listed our five Saskatchewan properties

for sale. Under International Financial Reporting Standards (IFRS),

this required a balance sheet reclassification of the three retail

properties as assets held for sale and the exclusion of these

properties from our same-asset NOI calculations. These properties

have a combined 198,000 sf and were listed for sale due to their

geographic location as part of a strategic decision to focus on our

Alberta markets. The asset sales would generate net cash proceeds

which would be used to pay down the revolving credit facility.

In the quarter and year-to-date, rental revenue

remained steady, with net rental consistent over Q2-2022 and a

slight decrease of 2% year-to-date, due to the amortization of

tenant incentives recognized in the period. Comparative to Q2-2022,

NOI increased 3%, and is consistent year-to-date. Our same-asset

NOI calculations normalize out Kelowna Business Center, which was

sold in 2023, as well as assets held for sale, and is up 1%

year-to-date and 4% in the quarter. NOI variance is largely due to

the timing of operating expenses and increased utility costs

including gas/heat and power, offset by the recovery revenues

collected.

We adjusted our normalized capital expenditures

estimates at the end of 2022 to account for increases realized in

the past and projections for future spend required to properly

manage our assets to attract and retain tenants. This increase in

estimate resulted in a reduction in the quarter and year to date to

both adjusted funds from operations, which was down 6% in the

quarter and down 16% year-to-date, as well as adjusted cash from

operations which was down 7% in the quarter and 17% year to date.

These reductions had an inverse effect on our payout ratios, which

have gone up in both the quarter and year-to-date.

FINANCIAL HIGHLIGHTSFinancial

highlights of our performance are summarized below.

Second quarter:

- Revenue remained stable at $18.12

million (Q2-2022: $18.15 million)

- NOI was up 3% at $11.69 million

(Q2-2022: $11.39 million)

- FFO was up 1% to $6.17 million or

$0.21 per unit (Q2-2022: $6.11 million or $0.21 per unit)

- ACFO was down 7% at $4.20 million or

$0.14 per unit (Q2-2022: $4.51 million or $0.15 per unit) for a

quarterly payout ratio of 83% based on ACFO (Q2-2022: 77%)

Year-to-date:

- Revenue remained stable at $37.11

million (2022: $37.12 million)

- NOI remained stable at

$23.21 million (2022: $23.25 million)

- FFO was down 4% at $12.18 million

or $0.42 per unit (Q2-2022: $12.64 million or $0.43 per

unit)

- ACFO was down 17% at

$7.97 million or $0.27 per unit (Q2-2022: $9.57 million

or $0.33 per unit) for a year-to-date payout ratio of 88% based on

ACFO (2022: 73%)

As at June 30, 2023 we had $3.18 million in

cash and $8.60 million in undrawn liquidity under our revolving

credit facility. In the quarter, we paid out one mortgage using our

revolving credit facility for $4.00 million, and paid out $14.26

million of one of our Class C mortgages with $12.74 million in

proceeds from a new mortgage signed in the quarter at a rate of

4.62% over a five year term, with the remaining balance paid out

using our revolving credit facility.

Management believes FFO best reflects our true

operating performance and ACFO best reflects our cash flow and

therefore our ability to pay distributions. Net income in the

current and comparative period is significantly impacted by the

non-cash fair value adjustments described above and thus not a

meaningful metric to assess financial performance.

OPERATING HIGHLIGHTSWe are pleased

with the volume of new leasing activity across our portfolio.

Leasing in the quarter includes 466,899 sf of new and renewed

leases (including holdovers) and we have retained 92% of expiring

leases. Future leasing is promising, with commitments on an

additional 40,158 sf in new deals which would bring committed

occupancy up to 89%. Leasing efforts yielded a WABR increase of 2%

across the portfolio in Q2-2023, which will help offset rising

costs.

DISTRIBUTIONSOur monthly

distributions remained at $0.04 per unit, stable over year-end. The

quarterly payout ratio was 83% (88% year-to-date) based on ACFO and

57% (57% year-to-date) based on FFO.

SUBSEQUENT EVENTOn July 14, 2023

we declared a distribution of $0.04 per unit payable on August 15,

2023 to unitholders on record on July 31, 2023.

Non-standard KPI's:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000's) |

|

2023 |

|

|

2022 |

|

Δ% |

|

2023 |

|

|

2022 |

|

Δ% |

|

NOI1 |

|

11,689 |

|

|

11,391 |

|

3 |

|

|

23,211 |

|

|

23,246 |

|

— |

|

|

Same-asset NOI1 |

|

11,019 |

|

|

10,564 |

|

4 |

|

|

21,920 |

|

|

21,648 |

|

1 |

|

|

FFO1 |

|

6,173 |

|

|

6,108 |

|

1 |

|

|

12,181 |

|

|

12,638 |

|

(4 |

) |

|

AFFO1 |

|

4,081 |

|

|

4,352 |

|

(6 |

) |

|

7,740 |

|

|

9,263 |

|

(16 |

) |

|

ACFO1 |

|

4,198 |

|

|

4,506 |

|

(7 |

) |

|

7,974 |

|

|

9,571 |

|

(17 |

) |

|

Rental revenue |

|

18,123 |

|

|

18,154 |

|

— |

|

|

37,113 |

|

|

37,119 |

|

— |

|

|

Income before fair value adjustments1 |

|

3,245 |

|

|

3,267 |

|

(1 |

) |

|

6,260 |

|

|

6,961 |

|

(10 |

) |

|

Fair value adjustment on investment properties2 |

|

(7,830 |

) |

|

(5,540 |

) |

nm |

|

|

(9,416 |

) |

|

(9,202 |

) |

nm |

|

|

Cash flows from operations |

|

3,087 |

|

|

2,430 |

|

27 |

|

|

4,969 |

|

|

6,723 |

|

(26 |

) |

|

Distributions paid to unitholders |

|

1,555 |

|

|

1,556 |

|

— |

|

|

3,111 |

|

|

3,112 |

|

— |

|

|

Distributions paid3 |

$0.12 |

|

$0.12 |

|

— |

|

$0.24 |

|

$0.24 |

|

— |

|

- Non-GAAP financial

measure. Refer to the Non-GAAP and Non-Standard Measures section

for further information.

- The abbreviation nm is shorthand for

not meaningful and is used through this MD&A where

appropriate.

- Distributions have

been paid out at $0.04 per unit per month since August 2021.

Operational Highlights:

|

|

June 30, 2023 |

December 31, 2022 |

Δ% |

|

Number of properties |

|

38 |

|

|

39 |

|

(3 |

) |

|

GLA (sf) |

|

3,148,015 |

|

|

3,216,141 |

|

(2 |

) |

|

Occupancy (weighted by GLA) |

|

87.2 |

% |

|

88.1 |

% |

— |

|

|

Retention (weighted by GLA) |

|

92.2 |

% |

|

86.1 |

% |

11 |

|

|

Weighted average remaining lease term (years) |

|

4.08 |

|

|

4.25 |

|

(11 |

) |

|

Weighted average base rent (per sf) |

$16.80 |

|

$16.55 |

|

1 |

|

Per Unit Metrics:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

|

|

2023 |

|

|

2022 |

|

Δ% |

|

2023 |

|

|

2022 |

|

Δ% |

|

Per Unit Metrics |

|

|

|

|

|

|

|

Net income (loss) |

|

|

|

|

|

|

|

Basic |

$0.56 |

|

$1.39 |

|

|

$0.84 |

|

$0.89 |

|

|

|

Diluted |

($0.05 |

) |

$0.11 |

|

|

$0.04 |

|

$0.20 |

|

|

|

Weighted average number of units for net income (loss)

(000s):1 |

|

|

|

|

|

Basic |

|

12,963 |

|

|

12,963 |

|

— |

|

|

12,963 |

|

|

12,964 |

|

— |

|

|

Diluted |

|

29,088 |

|

|

29,088 |

|

— |

|

|

29,088 |

|

|

29,089 |

|

— |

|

|

FFO |

|

|

|

|

|

|

|

Basic2 |

$0.21 |

|

$0.21 |

|

|

$0.42 |

|

$0.43 |

|

|

|

Diluted2 |

$0.20 |

|

$0.20 |

|

|

$0.40 |

|

$0.42 |

|

|

|

Payout ratio2 |

|

57 |

% |

|

57 |

% |

|

|

57 |

% |

|

56 |

% |

|

|

AFFO |

|

|

|

|

|

|

|

Basic 2 |

$0.14 |

|

$0.15 |

|

|

$0.27 |

|

$0.32 |

|

|

|

Payout ratio2 |

|

86 |

% |

|

80 |

% |

|

|

90 |

% |

|

75 |

% |

|

|

ACFO |

|

|

|

|

|

|

|

Basic2 |

$0.14 |

|

$0.15 |

|

|

$0.27 |

|

$0.33 |

|

|

|

Payout ratio2 |

|

83 |

% |

|

77 |

% |

|

|

88 |

% |

|

73 |

% |

|

|

Weighted average number of units for FFO, AFFO and ACFO

(000s):3 |

|

|

|

|

|

Basic |

|

29,088 |

|

|

29,088 |

|

— |

|

|

29,088 |

|

|

29,089 |

|

— |

|

|

Diluted |

|

34,257 |

|

|

36,255 |

|

(6 |

) |

|

34,257 |

|

|

36,255 |

|

(6 |

) |

- For the purposes of

calculating per unit net income the basic weighted average number

of units includes Trust Units and the diluted weighted average

number of units includes Class B LP Units and convertible

debentures, to the extent that their impact is dilutive.

- Non-GAAP ratio. Refer to the Non-GAAP

and Non-Standard Measures section for further information.

- For the purposes of calculating per

unit FFO, AFFO and ACFO the basic weighted average number of units

includes Trust Units and Class B LP Units.

Balance Sheet Highlights:

|

|

June 30, 2023 |

December 31, 2022 |

Δ% |

|

Total assets ($000s) |

702,881 |

|

730,769 |

|

(4 |

) |

|

Equity at historical cost ($000s)1 |

288,196 |

|

288,196 |

|

— |

|

|

Indebtedness ($000s)2 |

420,362 |

|

440,688 |

|

(5 |

) |

|

Weighted average interest rate on debt |

4.16 |

% |

4.01 |

% |

4 |

|

|

Debt to GBV, excluding convertible debentures (maximum threshold -

60%)3 |

50 |

% |

51 |

% |

(2 |

) |

|

Debt to GBV (maximum threshold - 65%)3 |

56 |

% |

57 |

% |

(2 |

) |

|

Finance costs coverage ratio4 |

2.26 |

|

2.32 |

|

(3 |

) |

|

Debt service coverage ratio5 |

1.93 |

|

1.88 |

|

3 |

|

- Calculated as the sum of trust units

and Class B LP Units at their historical cost value. In accordance

with IFRS the Class B LP Units are presented as a financial

liability in the consolidated financial statements. Please refer to

page 11 for calculation of Equity at historical cost.

- Calculated as the sum of total amount

drawn on revolving credit facility, mortgages payable, Class C LP

Units and convertible debentures, excluding unamortized discount

and transaction costs. Please refer to page 11 for calculation of

Indebtedness.

- Debt to GBV is a Non-GAAP ratio. Refer

to the Non-GAAP and Non-Standard Measures section for further

information.

- Non-GAAP financial ratio. Calculated

as the sum of FFO and finance costs; divided by finance costs,

excluding distributions on Class B LP Units and fair value

adjustment on derivative instruments. This metric is not calculated

for purposes of covenant compliance on any of our debt facilities.

Please refer to Non-GAAP and Non-Standard Measures section for

further information.

- Non-GAAP financial ratio. Calculated

as FFO; divided by sum of contractual principal repayments on

mortgages payable and distributions of Class C LP Units, excluding

amortization of fair value adjustment on Class C LP Units. This

metric is not calculated for purposes of covenant compliance on any

of our debt facilities. Please refer to Non-GAAP and Non-Standard

Measures section for further information.

MD&A and Financial

StatementsInformation included in this press release is a

summary of results. This press release should be read in

conjunction with the REIT's Q2-2023 quarterly report to

unitholders. The REIT’s consolidated financial statements and

management’s discussion and analysis for the three-months ended

June 30, 2023 can be found on the REIT’s website at

www.MelcorREIT.ca or on SEDAR (www.sedar.com).

Conference Call &

WebcastUnitholders and interested parties are invited to

join management on a conference call to be held July 28, 2023 at

11:00 AM ET (9:00 AM MT). Call 416-915-3239 in the Toronto area;

1-800-319-4610 toll free.

The call will also be webcast (listen only) at

https://www.gowebcasting.com/12635. A replay of the call will be

available at the same URL shortly after the call is concluded.

About Melcor REITMelcor REIT is an

unincorporated, open-ended real estate investment trust. Melcor

REIT owns, acquires, manages and leases quality retail, office and

industrial income-generating properties in western Canadian

markets. Its portfolio is currently made up of interests in 38

properties representing approximately 3.15 million square feet of

gross leasable area located across Alberta and in Regina,

Saskatchewan; and Kelowna, British Columbia. For more information,

please visit www.MelcorREIT.ca.

Non-GAAP and Non-standard

MeasuresNOI, FFO, AFFO and ACFO are key measures of

performance used by real estate operating companies; however, they

are not defined by International Financial Reporting Standards

(IFRS), do not have standard meanings and may not be comparable

with other industries or income trusts. These non-IFRS measures are

defined and discussed in the REIT’s MD&A for the quarter ended

June 30, 2023, which is available on SEDAR at

www.sedar.com.

Finance costs coverage ratio:

Finance costs coverage ratio is a non-GAAP ratio and is calculated

as FFO plus finance costs for the period divided by finance costs

expensed during the period excluding distributions on Class B LP

Units and fair value adjustment on derivative instruments.

Debt service coverage ratio: Debt

service coverage ratio is a non-GAAP ratio and is calculated as FFO

for the period divided by principal repayments on mortgages payable

and Class C LP Units made during the period.

Debt to Gross Book Value: Debt to

GBV is a non-GAAP ratio and is calculated as the sum of total

amount drawn on revolving credit facility, mortgages payable, Class

C LP Units, excluding unamortized fair value adjustment on Class C

LP Units, liability held for sale (as applicable) and convertible

debenture, excluding unamortized discount and transaction costs

divided by GBV. GBV is calculated as the total assets acquired in

the Initial Properties, subsequent asset purchases and development

costs less dispositions.

Income before fair value adjustment and

taxes: Income before fair value adjustment and income

taxes is a non-GAAP financial measure and is calculated as net

income excluding fair value adjustments for Class B LP Units,

investment properties and derivative instruments.

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s) |

2023 |

|

2022 |

|

Δ% |

2023 |

|

2022 |

|

Δ% |

|

Net income for the period |

7,198 |

|

18,059 |

|

|

10,854 |

|

11,521 |

|

|

|

Fair value adjustment on Class B LP Units |

(10,643 |

) |

(16,770 |

) |

|

(13,546 |

) |

(9,675 |

) |

|

|

Fair value adjustment on investment properties |

7,830 |

|

5,540 |

|

|

9,416 |

|

9,202 |

|

|

|

Fair value adjustment on derivative instruments |

(1,140 |

) |

(3,562 |

) |

|

(464 |

) |

(4,087 |

) |

|

|

Income before fair value adjustment and taxes |

3,245 |

|

3,267 |

|

(1 |

) |

6,260 |

|

6,961 |

|

(10 |

) |

Fair value of investment

properties: Fair value of investment properties in the

Property Profile and Regional Analysis sections of the MD&A is

a supplementary financial measure and is calculated as the sum of

the balance sheet balances for investment properties and other

assets (TIs and SLR).

NOI Reconciliation:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s) |

2023 |

|

2022 |

|

Δ% |

2023 |

|

2022 |

|

Δ% |

|

Net income for the period |

7,198 |

|

18,059 |

|

|

10,854 |

|

11,521 |

|

|

| Net

finance costs |

5,492 |

|

2,985 |

|

|

13,012 |

|

8,934 |

|

|

| Fair

value adjustment on Class B LP Units |

(10,643 |

) |

(16,770 |

) |

|

(13,546 |

) |

(9,675 |

) |

|

| Fair

value adjustment on investment properties |

7,830 |

|

5,540 |

|

|

9,416 |

|

9,202 |

|

|

| General

and administrative expenses |

736 |

|

810 |

|

|

1,515 |

|

1,598 |

|

|

|

Amortization of tenant incentives |

993 |

|

906 |

|

|

2,051 |

|

1,807 |

|

|

|

Straight-line rent adjustment |

83 |

|

(139 |

) |

|

(91 |

) |

(141 |

) |

|

|

NOI |

11,689 |

|

11,391 |

|

3 |

23,211 |

|

23,246 |

|

— |

Same-asset Reconciliation:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s) |

2023 |

|

2022 |

|

Δ% |

2023 |

|

2022 |

|

Δ% |

|

Same-asset NOI |

11,019 |

|

10,564 |

|

4 |

21,920 |

|

21,648 |

|

1 |

|

|

Disposals |

670 |

|

827 |

|

|

1,291 |

|

1,598 |

|

|

|

NOI1 |

11,689 |

|

11,391 |

|

3 |

23,211 |

|

23,246 |

|

— |

|

|

Amortization of tenant incentives |

(993 |

) |

(906 |

) |

|

(2,051 |

) |

(1,807 |

) |

|

|

SLR adjustment |

(83 |

) |

139 |

|

|

91 |

|

141 |

|

|

|

Net rental income |

10,613 |

|

10,624 |

|

— |

21,251 |

|

21,580 |

|

(2 |

) |

FFO & AFFO Reconciliation:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s, except per unit amounts) |

|

2023 |

|

|

2022 |

|

Δ% |

|

2023 |

|

|

2022 |

|

Δ% |

|

Net income for the period |

|

7,198 |

|

|

18,059 |

|

|

|

10,854 |

|

|

11,521 |

|

|

|

Add / (deduct) |

|

|

|

|

|

|

|

Fair value adjustment on investment properties |

|

7,830 |

|

|

5,540 |

|

|

|

9,416 |

|

|

9,202 |

|

|

|

Fair value adjustment on Class B LP Units |

|

(10,643 |

) |

|

(16,770 |

) |

|

|

(13,546 |

) |

|

(9,675 |

) |

|

|

Amortization of tenant incentives |

|

993 |

|

|

906 |

|

|

|

2,051 |

|

|

1,807 |

|

|

|

Distributions on Class B LP Units |

|

1,935 |

|

|

1,935 |

|

|

|

3,870 |

|

|

3,870 |

|

|

|

Fair value adjustment on derivative instruments |

|

(1,140 |

) |

|

(3,562 |

) |

|

|

(464 |

) |

|

(4,087 |

) |

|

|

FFO1 |

|

6,173 |

|

|

6,108 |

|

1 |

|

|

12,181 |

|

|

12,638 |

|

(4 |

) |

|

Deduct |

|

|

|

|

|

|

|

Straight-line rent adjustments |

|

83 |

|

|

(139 |

) |

|

|

(91 |

) |

|

(141 |

) |

|

|

Normalized capital expenditures |

|

(750 |

) |

|

(588 |

) |

|

|

(1,500 |

) |

|

(1,176 |

) |

|

|

Normalized tenant incentives and leasing commissions |

|

(1,425 |

) |

|

(1,029 |

) |

|

|

(2,850 |

) |

|

(2,058 |

) |

|

|

AFFO |

|

4,081 |

|

|

4,352 |

|

(6 |

) |

|

7,740 |

|

|

9,263 |

|

(16 |

) |

|

FFO/Unit |

$ |

0.21 |

|

$ |

0.21 |

|

|

$ |

0.42 |

|

$ |

0.43 |

|

|

|

AFFO/Unit |

$ |

0.14 |

|

$ |

0.15 |

|

|

$ |

0.27 |

|

$ |

0.32 |

|

|

|

Weighted average number of units (000s):1 |

|

29,088 |

|

|

29,088 |

|

— |

|

|

29,088 |

|

|

29,089 |

|

— |

|

- For the purposes of

calculating per unit FFO and AFFO, the basic weighted average

number of units includes Trust Units and Class B LP Units.

ACFO Reconciliation:

|

|

Three months ended June 30 |

|

Six months ended June 30 |

|

|

($000s, except per unit amounts) |

|

2023 |

|

|

2022 |

|

Δ% |

|

2023 |

|

|

2022 |

|

Δ% |

|

Cash flows from operations |

|

3,087 |

|

|

2,430 |

|

27 |

|

|

4,969 |

|

|

6,723 |

|

(26 |

) |

|

Distributions on Class B LP Units |

|

1,935 |

|

|

1,935 |

|

|

|

3,870 |

|

|

3,870 |

|

|

|

Actual payment of tenant incentives and direct leasing costs |

|

1,046 |

|

|

2,188 |

|

|

|

3,001 |

|

|

3,921 |

|

|

|

Changes in operating assets and liabilities |

|

601 |

|

|

(139 |

) |

|

|

1,133 |

|

|

(1,067 |

) |

|

|

Amortization of deferred financing fees |

|

(296 |

) |

|

(291 |

) |

|

|

(649 |

) |

|

(642 |

) |

|

|

Normalized capital expenditures |

|

(750 |

) |

|

(588 |

) |

|

|

(1,500 |

) |

|

(1,176 |

) |

|

|

Normalized tenant incentives and leasing commissions |

|

(1,425 |

) |

|

(1,029 |

) |

|

|

(2,850 |

) |

|

(2,058 |

) |

|

|

ACFO |

|

4,198 |

|

|

4,506 |

|

(7 |

) |

|

7,974 |

|

|

9,571 |

|

(17 |

) |

|

|

|

|

|

|

|

|

|

ACFO/Unit |

$ |

0.14 |

|

$ |

0.15 |

|

|

$ |

0.27 |

|

$ |

0.33 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of units (000s)1 |

|

29,088 |

|

|

29,088 |

|

— |

|

|

29,088 |

|

|

29,089 |

|

— |

|

- The

diluted weighted average number of units includes Trust Units,

Class B LP Units and convertible debentures.

Forward-looking Statements:This

press release may contain forward-looking information within the

meaning of applicable securities legislation, which reflects the

REIT's current expectations regarding future events.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond the REIT's control, that could cause actual results and

events to differ materially from those that are disclosed in or

implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to, general and local

economic and business conditions; the financial condition of

tenants; the REIT’s ability to refinance maturing debt; leasing

risks, including those associated with the ability to lease vacant

space; and interest rate fluctuations. The REIT’s objectives and

forward-looking statements are based on certain assumptions,

including that the general economy remains stable, interest rates

remain stable, conditions within the real estate market remain

consistent, competition for acquisitions remains consistent with

the current climate and that the capital markets continue to

provide ready access to equity and/or debt. All forward-looking

information in this press release speaks as of the date of this

press release. The REIT does not undertake to update any such

forward-looking information whether as a result of new information,

future events or otherwise. Additional information about these

assumptions and risks and uncertainties is contained in the REIT’s

filings with securities regulators.

Contact Information:

Tel: 1.855.673.6931 Em: ir@melcorREIT.ca

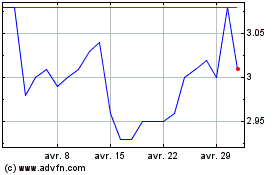

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024