Verde AgriTech Ltd (TSX: “NPK”)

(“

Verde” or the “

Company”) is

pleased to announce its financial results for the first quarter

ended March 31, 2023 (“

Q1 2023”).

Q1 2023 Financials

- Sales of Verde's multinutrient potassium products, BAKS® and K

Forte® sold internationally as Super Greensand® (the

“Product”) by volume were 108,000 tonnes, compared

to 112,000 tonnes in Q1 2022 and 16,558 tonnes in Q1 2021.

- Revenue in Q1 2023 was $11.1 million, compared to $11.3 million

in Q1 2022 and $0.8 million in Q1 2021.

- Cash and other receivables held by the Company in Q1 2023 were

$34.3 million, compared to $22.3 million in Q1 2022 and $4.8

million in Q1 2021.

- EBITDA before non-cash events in Q1 2023 was $2.0 million,

compared to $3.7 million in Q1 2022 and a $0.8 million loss in Q1

2021.

- Total non-current assets in Q1 2023 were $68.3 million,

compared to $30.1 million in Q1 2022 and $21.4 million in Q1

2021.

- Net loss in Q1 2023 was $0.1 million, compared to a $3.0

million profit in Q1 2022 and a $1.0 million loss in Q1 2021.

- In Q1 2023, 8,559 million tonnes of chloride have been

prevented from being applied into soils by farmers who used the

Product in lieu of potassium chloride (“KCl”) fertilizers.1 A total

of 121,201 tonnes of chloride has been prevented from being applied

into soils by Verde’s customers since the Company started

production.2

“In Q1 2022, our sales grew by an impressive 574%, and our

revenue increased by an astonishing 1,260% compared to Q1 2021.

Achieving virtually the same volume as last year in markets that

experience the strongest downturns of the last few years in the

fertilizer industry is a remarkable accomplishment. The price of

soybeans, which represents a major portion of Verde's sales, has

declined by 33% in the past 12 months, with a substantial 21% drop

in the last three months alone.3 Additionally, potash prices

have seen a significant decrease of 67% over the past year, with a

sharp decline of 22% in the last three months.4 Despite these

challenging market conditions, Verde's performance in Q1 2023,

delivering results comparable to those achieved in Q1 2022,

demonstrates the unwavering commitment and strategic approach of

our team, and underscores our ability to thrive in an exceptionally

difficult market landscape,” stated Cristiano Veloso, Founder,

President & CEO of Verde.

Selected Annual Financial Information

The table below summarizes Q1 2023 financial results compared to

Q1 2022:

| All amounts in CAD

$’000 |

Q1 2023 |

Q1 2022 |

|

Tonnes sold ‘000 |

108 |

|

112 |

|

|

Average revenue per tonne sold $ |

103 |

|

101 |

|

|

Average production cost per tonne sold $ |

(25 |

) |

(24 |

) |

|

Average gross profit per tonne sold $ |

78 |

|

77 |

|

|

Average gross margin |

76 |

% |

77 |

% |

|

|

|

|

|

Revenue |

11,125 |

|

11,304 |

|

|

Production costs (1) |

(2,710 |

) |

(2,654 |

) |

| Gross

Profit |

8,415 |

|

8,650 |

|

| Gross

Margin |

76 |

% |

77 |

% |

|

Sales and marketing expenses |

(1,207 |

) |

(958 |

) |

|

Product delivery freight expenses |

(3,867 |

) |

(2,973 |

) |

|

General and administrative expenses |

(1,372 |

) |

(1,041 |

) |

| EBITDA

(2) |

1,969 |

|

3,678 |

|

|

Share Based, Equity and Bonus Payments (Non-Cash Event) (3) |

(28 |

) |

(64 |

) |

|

Depreciation and Amortisation (3) |

(911 |

) |

(26 |

) |

| Operating Profit after

non-cash events |

1,030 |

|

3,588 |

|

|

Interest Income/Expense (4) |

(1,042 |

) |

(185 |

) |

| Net (Loss) / Profit

before tax |

(12 |

) |

3,403 |

|

| Income tax (5) |

(96 |

) |

(370 |

) |

| Net

Profit |

(108 |

) |

3,033 |

|

(1) – C$864,000 of depreciation related to the investments made

in Plant 1, Plant 2 and access routes improvement in the last 12

months that are included in production costs in the financial

statements have been reclassified to a non-cash event in the

MD&A. (2) – Non GAAP measure(3) – Included in General and

Administrative expenses in financial statements (4) – Please see

Summary of Interest-Bearing Loans and Borrowings notes (5) – Please

see Income Tax notes in Q1 2023 Management’s Discussion and

AnalysisExternal Factors

Revenue and costs are affected by external factors including

changes in the exchange rates between the C$ and R$ along with

fluctuations in potassium chloride spot CFR Brazil.5 The table

below summarizes these changes:

| |

% Δ |

Q1 2023 |

Q1 2022 |

|

Canadian Dollar (C$) Average Exchange Rate |

-7 |

% |

R$3.84 |

R$4.12 |

|

Potassium Chloride CFR Brazil Lowest Price |

-39 |

% |

US$455 |

US$750 |

|

Potassium Chloride CFR Brazil Highest Price |

-57 |

% |

US$520 |

US$1,200 |

Q1 2023 compared with Q1

2022

EBITDA and EPS The Company had an EBITDA of

$1,969,000 in Q1 2023, compared to $3,678,000 in Q1 2022. This

decrease can be mainly attributed to two factors:

- Higher average freight cost: In Q1 2023, the average freight

cost per tonne of Product sold on a CIF (Cost, Insurance, and

Freight) basis increased from $44 to $53. This increase was driven

by a higher percentage of sales being made to the northern region

of Mato Grosso state, which is located farther away from Verde's

production facilities. As a result, the weighted average distance

of Product delivered increased by 12% in the quarter compared to

the previous year, with a $600,000 impact in Q1 2023.

- Reduction in potassium chloride (KCl) CFR Brazil price compared

to the previous year: The drop in KCl prices resulted in a 16%

decrease in revenue per tonne excluding freight expenses (FOB

price) in Brazilian Reais, from R$308 per tonne in Q1 2022 to R$259

per tonne in Q1 2023. As a result, this had a $435,000 impact on

the Company's quarterly results.

Basic loss per share was $0.002 for Q1 2023, compared to

earnings of $0.06 for Q1 2022.

Product Sales

Sales by volume decreased by 4% in Q1 2023, to 108,000 tonnes

sold, compared to 112,000 tonnes sold in Q1 2022, due to the

circumstances summarized below.

At the onset of the Ukrainian war in February 2022, concerns

arose regarding potential geopolitical sanctions against Russia and

their potential impact on the availability of potash fertilizers.

This led to a surge in customer orders during the first and second

quarters as they sought to stockpile fertilizers for the upcoming

crop season.

However, these concerns proved unfounded as the market actually

experienced an oversupply of potash due to increased availability.

Coupled with a 15% decrease in potash consumption in Brazil

throughout 2022, this resulted in a 23% increase in year-end potash

stock in Brazil, highlighting the lower overall demand for the

product during the year.6

As a consequence, potash prices have significantly declined,

witnessing a 67% decrease over the past year, with a sharp 22%

decline in the first three months of 2023.7 This has prompted

farmers to delay their agricultural input purchases as they

anticipate further price drops, thereby reducing the demand for

fertilizers in Q1 of 2023.

Furthermore, the price of soybeans, which represents the major

portion of Verde's sales, has declined by 33% over the past 12

months, with a significant drop of 21% in the last three

months.8

Despite the exceptional market circumstances witnessed in Q1

2021 and Q1 2022, Verde delivered in Q1 2023 results comparable to

those achieved in the previous year.

Revenue

Revenue from sales decreased by 2% in Q1 2023, to $11,125,000

from the sale of 108,000 tonnes of Product, at average $103 per

tonne sold; compared to $11,304,000 in Q1 2022 from the sale of

112,000 tonnes of Product, at average $101 per tonne sold.

The increase in average revenue per tonne was mainly due to the

higher percentage of CIF sales in the quarter, with 68% in Q1 2023,

compared to 60% in Q1 2022.

Average revenue per tonne excluding freight expenses (FOB price)

decreased by 10% in Q1 2023, to $67 compared to $75 in Q1 2022

mainly due to the decrease in Potassium Chloride CFR Brazil, from

US$750-US$1200 per tonne in Q1 2022 to US$455-US$520 per tonne in

Q1 20239. This reduction was partially offset by the 7%

appreciation of the Brazilian Real against the Canadian

Dollar. Production costsProduction costs include

all direct costs from mining, processing, and the addition of other

nutrients to the Product, such as Sulphur and Boron. It also

includes the logistics costs from the mine to the plant and related

salaries.

Verde’s production costs and sales price are based on the

following assumptions:

- Micronutrients added to BAKS® increase its production

cost, rendering K Forte® less expensive to produce.

- Production costs vary based on packaging type, with bulk

packaging being less expensive than Big Bags.

- Plant 1 produces K Forten® Bulk, K Forte® Big Bag, BAKS® Bulk,

and BAKS® Big Bag, while Plant 2 exclusively produces K Forte®

Bulk. Therefore, Plant 2's production costs are lower than Plant

1's costs, which produces two types of Products and offers two

types of packaging options each.

The table below shows a breakdown of full year 2023 Verde’s

production costs projection for BAKS® and K Forte®, and what

percentage of those costs is not controllable by management:

|

|

(+) |

(+) |

(=) |

|

| Cost per tonne of

product projected for 202310 (C$) |

Cash cost |

Assets depreciation |

Total cost expected for 202311 |

Non-controllable costs (% of total costs) |

|

K Forte® Bulk (Plant 1) |

20.2 |

3.8 |

24.0 |

61% |

| K Forte® Bulk (Plant 2) |

10.2 |

2.8 |

13.0 |

58% |

| K Forte® Big Bag (Plant

1) |

30.4 |

2.8 |

33.2 |

71% |

| BAKS® (2%S 0.2%B)12 Bulk

(Plant 1) |

42.1 |

3.8 |

45.9 |

81% |

| BAKS® (2%S 0.2%B) Big Bag

(Plant 1) |

51.3 |

3.8 |

55.0 |

85% |

Verde calculates its total production costs as a weighted

average of the production costs for BAKS® and K Forte®, taking into

account the production site and packaging type for each product.

Therefore, comparing the Company's production costs on a

quarter-over-quarter basis may not be meaningful due to the varying

proportions of the cost factors that impact each quarter.Production

costs increased by 2% in Q1 2023, to $2,710,000 compared to

$2,654,000 in Q1 2022. Average cost per tonne increased by 6% in Q1

2023, to $25 compared to $24 in Q1 2022.

Despite a 4% decrease in sales volume, from 112,000 tonnes in Q1

2022 to 108,000 tonnes in Q1 2023, Verde was able to reduce the

average production cost in Brazilian Reais. In Q1 2023, the average

production cost was R$96.47, compared to R$98.03 in Q1 2022. This

cost reduction can be attributed primarily to a shift in the sales

mix of packaging types, with a decrease in the percentage of Big

Bag sales from 39% in Q1 2022 to 24% in Q1 2023.

Sales Expenses

| CAD

$’000 |

Q1 2023 |

Q1 2022 |

|

Sales and marketing expenses |

(1,070 |

) |

(822 |

) |

|

Fees paid to independent sales agents |

(137 |

) |

(136 |

) |

|

Product delivery freight expenses |

(3,867 |

) |

(2,973 |

) |

|

Total |

(5,074 |

) |

(3,931 |

) |

Sales and marketing expenses

Sales and marketing expenses include employees’ salaries, car

rentals, travel within Brazil, hotel expenses, and the promotion of

the Product in marketing events.

This increase can be primarily attributed to the implementation

of a field sales team, which resulted in expenses related to car

rentals and travel. Additionally, the Company made additional

investments in media and third-party marketing agencies as part of

a strategic initiative to attract new customers.

Fees paid to independent sales agentsAs part of

Verde's marketing and sales strategy, the Company pays out

commissions to its independent sales agents. Fees paid to

independent sales agents increased by 1% in Q1 2023, to $137,000

compared to $136,000 in Q1 2022, in line with Q1 2023 sales.

Product delivery freight expensesProduct

delivery freight expenses increased by 30% in Q1 2023, to

$3,867,000 compared to $2,973,000 in Q1 2022, as the Company has

significantly increased the volume sold as CIF (Cost Insurance and

Freight), up from 60% of total sales in Q1 2022 to 68% in Q1

2023.

Sales made to states that are situated at a greater distance

from Verde’s production facilities had a notable effect on the

logistics costs. In Q1 2023, the average freight cost per tonne of

Product sold on a CIF (Cost, Insurance, and Freight) basis

increased from $44 to $53, compared to the previous year. This

increase was driven by a higher percentage of sales being made to

the northern region of Mato Grosso state, which is located farther

away from Verde’s production facilities. As a result, the weighted

average distance of Product delivered increased by 12% in Q1 2023

compared to Q1 2022, with a $600,000 impact in the quarter.General

and Administrative Expenses

| CAD

$’000 |

Q1 2023 |

Q1 2022 |

|

General administrative expenses |

(920 |

) |

(410 |

) |

|

Legal, professional, consultancy and audit costs |

(317 |

) |

(411 |

) |

|

IT/Software expenses |

(112 |

) |

(204 |

) |

|

Taxes and licenses fees |

(23 |

) |

(16 |

) |

|

Total |

(1,372 |

) |

(1041 |

) |

General administrative expenses These costs

include general office expenses, rent, bank fees, insurance,

foreign exchange variances and remuneration of executive and

administrative staff in Brazil. General administrative expenses

increased by 125% in Q1 2023, to $920,000 compared to $410,000 in

Q1 2022. Prior to Q4 2022, administrative employees working at the

offices situated within Verde's production facilities were

accounted for as part of the personnel production costs. However,

in Q1 2022, an adjustment was implemented to ensure alignment with

accounting standards. This adjustment involved shifting the cost

centre for expenses associated with 33 employees who met that

criterion. As a result, a total of $222,000 was reallocated from

production costs to general administrative expenses in the

quarter.Furthermore, additional rental expenses were incurred in

Plant 2, which involved the rental of water trucks and metallic

structures to support operations.Additionally, the Company made the

decision to outsource cleaning and maintenance services for Plant

1, Plant 2, and Verde's administrative office in São Gotardo.

Previously, these services were handled by employees of the

Company. Legal, professional, consultancy and audit

costsLegal and professional fees include legal,

professional, consultancy fees along with accountancy, audit and

regulatory costs. Consultancy fees are consultants employed in

Brazil, such as accounting services, patent process, lawyer’s fees

and regulatory consultants. Expenses decreased by 23% in Q1 2023,

to $317,000 compared to $411,000 in Q1 2022. The decrease was

mainly due to 2022 costs relating to the re-domiciliation of the

Company to Singapore.

IT/Software expensesIT/Software expenses

include software licenses such as Microsoft Office, Customer

Relationship Management (CRM) software and enterprise resource

planning (ERP). Expenses decreased by 45% in Q1 2023, to $112,000

compared to $204,000 in Q1 2022. Q1 2022 was higher as the Company

was implementing the change in its accounts from ERP to SAP

Business One. This has now been concluded.Taxes and

licencesTaxes and licence expenses include general taxes,

product branding and licence costs. Expenses increased in Q1 2023,

to $23,000 compared to $16,000 in Q1 2022 and increase of $7,000.

Share Based, Equity and Bonus Payments (Non-Cash

Events) These costs represent the expense associated with

stock options granted to employees and directors along with equity

compensation and non-cash bonuses paid to key management.Share

Based, equity and bonus payments costs decreased by 56% in Q1 2023,

to $28,000 compared to $64,000 in Q1 2022. The decrease is a result

of a reduction on share based payments in the quarter.Liquidity and

Cash Flows For additional details see the consolidated statements

of cash flows for the quarters ended March 31, 2023 and March 31,

2022 in the quarterly financial statements.

| Cash received from /

(used for):CAD

$’000 |

3 months endedMar 31, 2023 |

3 months endedMar 31, 2022 |

|

Operating activities |

(450 |

) |

3,284 |

|

|

Investing activities |

(1,889 |

) |

(3,382 |

) |

|

Financing activities |

5,336 |

|

2,805 |

|

On March 31, 2023, the Company held cash of $4,289,000, a

decrease of $4,684,000 on the same period in 2022.

Trade and other receivables increased by 70% in Q1 2023, to

$29,996,000 compared to $17,618,000 in Q1 2022. Trade and other

payables decreased by 6% in Q1 2023 to $9,494,000 compared to

$10,071,000 in Q1 2022.

Q1 2023 Results Conference Call

The Company will host a conference call on Wednesday, May 24,

2023, at 10:00 am Eastern Time, to discuss Q1 2023 results and

provide an update. Subscribe using the link below and receive the

conference details by email.

|

Date: |

Wednesday, May 24, 2023 |

|

Time: |

10:00 am Eastern Time |

|

Subscription link: |

https://bit.ly/Q1_2023_ResultsPresentation |

The questions can be submitted in advance through the following

link up to 48 hours before the conference call:

https://bit.ly/Q1_2023_ResultsPresentation_Questions.

The Company’s first quarter financial statements and related

notes for the period ended March 31, 2023 are available to the

public on SEDAR at www.sedar.com and the Company’s website at

www.investor.verde.ag/.

About Verde AgriTech

Verde is an agricultural technology Company that

produces potash fertilizers. Our purpose is to improve the health

of all people and the planet. Rooting our solutions in nature, we

make agriculture healthier, more productive, and profitable.

Verde is a fully integrated Company: it mines

and processes its main feedstock from its 100% owned mineral

properties, then sells and distributes the Product.

Verde’s focus on research and development has

resulted in one patent and eight patents pending. Among its

proprietary technologies are Cambridge Tech, 3D Alliance, MicroS

Technology, N Keeper, and Bio Revolution.13 Currently, the Company

is fully licensed to produce up to 2.8 million tonnes per year of

its multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®. In 2022, it became Brazil's

largest potash producer by capacity.14 Verde has a combined

measured and indicated mineral resource of 1.47 billion tonnes at

9.28% K2O and an inferred mineral resource of 1.85 billion tonnes

at 8.60% K2O (using a 7.5% K2O cut-off grade).15 This amounts to

295.70 million tonnes of potash in K2O. For context, in 2021

Brazil’s total consumption of potash in K2O was 6.57 million16.

Brazil ranks second in global potash demand and

is its single largest importer, currently depending on external

sources for over 97% of its potash needs. In 2022, potash accounted

for approximately 3% of all Brazilian imports by dollar

value.17

Corporate Presentation

For further information on the Company, please view

shareholders’ deck:

https://verde.docsend.com/view/hx6998vbxy6vy49x

Investors Newsletter

Subscribe to receive the Company’s updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

https://bit.ly/InvestorsNL-April2023

Cautionary Language and Forward-Looking Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

(i) the estimated

amount and grade of Mineral Resources and Mineral Reserves;

(ii) the PFS

representing a viable development option for the Project;

(iii) estimates of

the capital costs of constructing mine facilities and bringing a

mine into production, of sustaining capital and the duration of

financing payback periods;

(iv) the estimated

amount of future production, both produced and sold;

(v) timing of

disclosure for the PFS and recommendations from the Special

Committee;

(vi) the Company’s

competitive position in Brazil and demand for potash; and,

(vii) estimates of

operating costs and total costs, net cash flow, net present value

and economic returns from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

(i) the presence of

and continuity of resources and reserves at the Project at

estimated grades;

(ii) the geotechnical

and metallurgical characteristics of rock conforming to sampled

results; including the quantities of water and the quality of the

water that must be diverted or treated during mining

operations;

(iii) the capacities

and durability of various machinery and equipment;

(iv) the availability

of personnel, machinery and equipment at estimated prices and

within the estimated delivery times;

(v) currency exchange

rates;

(vi) Super Greensand®

and K Forte® sales prices, market size and exchange rate

assumed;

(vii) appropriate

discount rates applied to the cash flows in the economic

analysis;

(viii) tax rates and

royalty rates applicable to the proposed mining operation;

(ix) the availability

of acceptable financing under assumed structure and costs;

(x) anticipated

mining losses and dilution;

(xi) reasonable

contingency requirements;

(xii) success in

realizing proposed operations;

(xiii) receipt of

permits and other regulatory approvals on acceptable terms; and

(xiv) the fulfilment

of environmental assessment commitments and arrangements with local

communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Founder,

Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.investor.verde.ag | www.supergreensand.com |

www.verde.ag

1 Verde’s Product is a salinity and chloride-free replacement

for KCl fertilizers. Potassium chloride is composed of

approximately 46% of chloride, which can have biocidal effects when

excessively applied to soils. According to Heide Hermary (Effects

of some synthetic fertilizers on the soil ecosystem, 2007),

applying 1 pound of potassium chloride to the soil is equivalent to

applying 1 gallon of Clorox bleach, with regard to killing soil

microorganisms. Soil microorganisms play a crucial role in

agriculture by capturing and storing carbon in the soil, making a

significant contribution to the global fight against climate

change.

2 1 tonne of Product (10% K2O) has 0.1 tonnes of K2O, which is

equivalent to 0.17 tonnes of potassium chloride (60% K2O),

containing 0.08 tonnes of chloride.

3 Soybeans (Paranaguá) price went from US$40.36 in April 2022 to

US$26.93 in April 2023, and from US$34.21 in February 2023 to

US$26.93 in April 2023. Source: Economic Research Center of the

ESALQ/University of São Paulo. Available at:

https://www.cepea.esalq.usp.br/br/indicador/soja.aspx

4 Potassium Chloride CFR Brazil price went from US$1200 in April

2022 to US$400 in April 2023, and from US$515 in February 2023 to

US$400 in April 2023. Source: Acerto Limited Report.

5 Source: Acerto Limited Report.

6 Source: Brazilian Fertilizer Mixers Association (from

"Associação Misturadores de Adubo do Brasil", in Portuguese).

7 Potassium Chloride CFR Brazil price went from US$1200 in April

2022 to US$400 in April 2023, and from US$515 in February 2023 to

US$400 in April 2023. Source: Acerto Limited Report.

8 Soybeans (Paranaguá) price went from US$40.36 in April 2022 to

US$26.93 in April 2023, and from US$34.21 in February 2023 to

US$26.93 in April 2023. Source: Economic Research Center of the

ESALQ/University of São Paulo. Available at:

https://www.cepea.esalq.usp.br/br/indicador/soja.aspx

9 Source: Acerto Limited Report.

10 The costs were estimated based on the

following assumptions: Costs in line with Verde’s 2023 budget.

Sales volume of 1.0Mt per year. Crude Oil WTI (NYM U$/bbl) =

US$80.00. Diesel price = U$$1.26. Currency exchange rate: US$1.00 =

R$5.25; C$1.00 = R$4.20. Total cost per tonne includes all costs

directly related to production and feedstock extraction in addition

to assets depreciation.

11 Total cost per tonne includes labor mining,

mining, crushing, processing, maintenance of support facilities,

product transportation from mine pits to production plants,

laboratory expenses, G&A, and environmental compensation

expenses.

12 BAKS® can be customized according to the

crop’s needs, so it can have several compositions. The 2%S 0.2%B

composition is responsible for most of Verde’s sales.

13 Learn more about our technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r9

14 See the release at:

https://investor.verde.ag/verde-starts-ramp-up-of-plant-2s-second-stage-to-reach-production-of-2-4mtpy/

15 As per the National Instrument 43-101 Standards of Disclosure

for Mineral Projects within Canada (“NI 43 -101”), filed on SEDAR

in 2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

16 Source: Brazilian Fertilizer Mixers Association (from

"Associação Misturadores de Adubo do Brasil", in Portuguese).

17 Source: Brazilian Comex Stat, available at:

http://comexstat.mdic.gov.br/en/geral

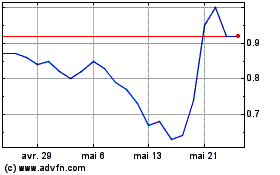

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Verde Agritech (TSX:NPK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024