Aura Minerals Inc. ("Aura Minerals" or the "Company") (TSX:ORA)

announces an update on the mine and plant expansion at its

wholly-owned Aranzazu copper project ("Aranzazu") in Zacatecas

State, Mexico. All amounts are presented in United States dollars

unless otherwise noted.

On July 18, 2012, the Company released the results of the

Preliminary Economic Assessment ("PEA") for Aranzazu, prepared by

AMC Mining Consultants (Canada) Ltd. ("AMC"). The PEA evaluated a

feed rate expansion at Aranzazu from the current 2,600 tonnes per

day ("tpd") to 4,000 tpd and 5,600 tpd, and recommended an

expansion to 4,000 tpd which it determined would result in a net

present value of $200 million to enable the Company to take the

project forward. The PEA also included an expected capital

requirement of $107 million for the expansion which included

installation and commissioning of an arsenic control facility using

partial roasting technology (the "roaster") as the selected

long-term solution to decrease arsenic levels to coincide with the

expansion.

The Company announces the following updates to the Aranzazu mine

and mill expansion:

-- Basic engineering (65% completed to date) now fixes the feed rate

expansion of 4,500 tpd and anticipates completion of the expansion by

the second quarter of 2015. The engineering is expected to be completed

in August 2013 and includes the design for an upgrade to the fresh water

system, a redesign of the coarse ore stockpile feeders and a high

capacity tailings thickener to improve water recovery;

-- The expanded operation, with roaster capability, expected to have a

remaining life of 16 years and estimated life-of-mine cash costs per

payable pound of copper of $1.15 to $1.25;

-- The Company expects the estimated capital requirement of $113 million

(including a contingency of $12 million) is expected to be funded by a

combination of internally generated cash flows and external financing

and which is allocated amongst the following phases;

-- $41 million for mine development, which enables access to higher

grade ores and the phasing out of the open pit activities during

2014, and increases production to approximately 25 million pounds

per year;

-- $33 million for the roaster, which is expected to result in

substantially reduced arsenic-related treatment and refining charges

and penalties; and

-- $39 million for plant expansion (additional mill, paste-fill plant

and thickeners) which is expected to increase production to an

expected 35 million pounds of copper per year;

-- The roaster was selected and the purchase contract awarded in February

2013 with an estimated 46 week delivery time. The roaster is expected to

be operational in the second quarter of 2014; and

-- The deposit continues to remain open at depth and on strike therefore

allowing potential for further future expansion.

Jim Bannantine, the Company's President and Chief Executive

Officer stated: "Since the publication of the Preliminary Economic

Assessment, Aura Minerals has made excellent progress on the

engineering and procurement for Aranzazu's roaster and plant

expansion and has advanced underground mine development and

expansion. Current priorities include procurement, installation and

commissioning of the roaster over the remainder of this year and

early next year and continued day by day development and expansion

of underground mining. Engineering and subsequent procurement for

the plant expansion are expected to allow for installation of

additional equipment late next year after the underground mine

expansion reaches capacity to feed the expanded plant and the

roaster is up and running.

The Company expects each of these project elements, individually

and as a group, are expected to result in substantial reductions to

the cash costs per payable pound of copper over the life of the

project and therefore contribute to realizing a value of the

Aranzazu asset greater than that stated in the PEA because of the

increase in capacity from 4,000 to 4,500 tpd."

Additional Project Commentary

Mineral Resource:

The measured, indicated and inferred mineral resources as of

September 30, 2011, and included in the PEA, have not been

updated.

Mining:

The underground mine has been designed to facilitate the

extraction of 4,500 tpd through the application of transverse long

hole open stoping, a low-cost bulk mining technique suitable for

the significant mineralized mining width and strong continuity of

Aranzazu resources. Paste backfill is integral to the project to

maximize both resource recovery and mining productivity. Modern

trackless mobile equipment will be used for the majority of mining

activities.

An extensive underground development program that attains a

minimum of 700 meters per month of advance is being executed to

develop and maintain access to adequate resources to sustain 4,500

tpd of production. Underground project infrastructure include

ventilation shafts and fans, a centralized pumping station, a

modern maintenance facility, electrical substations, fueling

facility and other ancillary installations.

Material handling from the underground workings to the

concentrator is accomplished by a modern fleet of haulage trucks

via an extensive ramp system connected to two existing surface

portals. Primary crushing will continue to be performed on

surface.

The Company expects the planned underground infrastructure and

mining method support a potential increase in production to 4,500

tpd and the incremental investment in fixed plant and mobile

equipment has been included in the capital expenditure schedule

above. It is expected that the economy of scale realized by the

expansion of the mine and processing plant will yield a decrease in

the cash cost per payable pound of copper produced of between $0.75

and $1.00 per pound of payable copper.

Processing:

The expansion of the processing plant to 4,500 tpd capacity will

include an additional 13' x 18' primary ball mill and two 130 m3

and eight 5 m3 tank flotation cells. This will provide not only

sufficient additional rougher flotation capacity but also allow for

the total reconfiguration of the cleaner circuit to further

optimize final concentrate quality. Additional crushing capacity

will be achieved by more fully utilizing the available runtime of

the existing equipment so the expansion to 4,500 tpd is capital

efficient. The installation of the additional equipment can also be

carried out with minimal disruption to current production.

A new tailings thickener and the paste backfill plant is also

expected to improve the recovery of water from tailings. The

existing tailings storage facility offers short-term capacity,

while the majority of the tailings from the expanded production

scenario will be stored in a new facility to be developed to the

east of the current operation. It is anticipated that 40% of

tailings will be delivered to the underground mine as paste

backfill.

Roaster:

Arsenic reduction in the copper concentrate will be achieved

using partial roasting technology. The roaster was selected and the

contract awarded to Technip on February 26, 2013 with an expected

46 week delivery period. Pilot tests conducted using high arsenic

content concentrate from Aranzazu showed a decrease of arsenic

content by 85%. The expected arsenic content in the treated

concentrate once the roaster has been commissioned is 0.3% and the

roaster package includes a performance guarantee of a maximum of

0.5%. It is expected that the roaster will decrease arsenic related

charges and penalties by up to $1.00 per payable pound of copper

produced. The roaster has been presented to SEMARNAT, the Mexican

Environmental Authority, and SEMARNAT has authorized the roaster as

a modification to the existing operating license.

About the Aranzazu Mine

The Aranzazu mine is located within the Municipality of

Concepcion del Oro in the north eastern region of the State of

Zacatecas, Mexico, and covers approximately 11,380 hectares,

including the historical, past producing El Cobre area. The

property can be accessed by paved highway from both the city of

Zacatecas located 250 kilometres to the southwest and from the city

of Saltillo located 112 kilometres to the northeast. Both Zacatecas

and Saltillo are serviced by daily domestic and international

flights.

National Instrument 43-101 Compliance

Unless otherwise indicated, Aura Minerals has prepared the

technical information in this press release ("Technical

Information") based on information contained in the PEA technical

report titled "Preliminary Economic Assessment of the Expansion of

the Aranzazu Mine, Zacatecas, Mexico" dated August 31, 2012 and the

Company's news release dated July 18, 2012 (collectively the

"Disclosure Documents") available under the Company's profile on

SEDAR at www.sedar.com. Each Disclosure Document was prepared by or

under the supervision of a qualified person (a "Qualified Person")

as defined in National Instrument 43-101 Standards of Disclosure

for Mineral Projects. Readers are encouraged to review the full

text of the Disclosure Documents which qualifies the Technical

Information. The Disclosure Documents are each intended to be read

as a whole, and sections should not be read or relied upon out of

context. The Technical Information is subject to the assumptions

and qualifications contained in the Disclosure Documents.

The PEA was prepared under the direction of AMC by independent

industry professionals, all Qualified Persons under NI 43-101. The

Qualified Person for Aura Minerals is Bruce Butcher, P. Eng., Vice

President, Technical Services, who has reviewed and approved this

press release. The updates in this press release do not materially

change the overall results or conclusions of the PEA.

The PEA is preliminary in nature. It includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorized as mineral reserves. There is no certainty that

the PEA will be realized. Mineral resources that are not mineral

reserves do not have demonstrated economic viability.

Cautionary Note

This news release contains certain "forward-looking information"

and "forward-looking statements", as defined in applicable

securities laws (collectively, "forward-looking statements"). All

statements other than statements of historical fact are

forward-looking statements. Forward-looking statements relate to

future events or future performance and reflect the Company's

current estimates, predictions, expectations or beliefs regarding

future events and include, without limitation, statements with

respect to: the planned Aranzazu mine and mill expansion, including

the cost, timing and results thereof; projected mine performance

and economics; project internal cash flows; external financing; the

amount of mineral reserves and mineral resources; the amount of

future production over any period; the amount of waste tonnes

mined; the amount of mining and haulage costs; cash costs;

operating costs; strip ratios and mining rates; expected grades and

ounces of metals and minerals; expected processing recoveries;

expected time frames; prices of metals and minerals; mine life; and

gold hedge programs. Often, but not always, forward-looking

statements may be identified by the use of words such as "expects",

"anticipates", "plans", "projects", "estimates", "assumes",

"intends", "strategy", "goals", "objectives" or variations thereof

or stating that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved, or the

negative of any of these terms and similar expressions.

Forward-looking statements are necessarily based upon a number

of estimates and assumptions that, while considered reasonable by

the Company, are inherently subject to significant business,

economic and competitive uncertainties and contingencies.

Forward-looking statements in this news release are based upon,

without limitation, the following estimates and assumptions: the

availability of financing on acceptable terms; the presence of and

continuity of metals at the Company's Mines at modeled grades; the

capacities of various machinery and equipment; the results or

performance of the proposed expansion of Aranzazu, the availability

of personnel, machinery and equipment at estimated prices; exchange

rates; metals and minerals sales prices; appropriate discount

rates; tax rates and royalty rates applicable to the mining

operations; cash costs; anticipated mining losses and dilution;

metals recovery rates, reasonable contingency requirements; and

receipt of regulatory approvals on acceptable terms.

Known and unknown risks, uncertainties and other factors, many

of which are beyond the Company's ability to predict or control

could cause actual results to differ materially from those

contained in the forward-looking statements. Specific reference is

made to the PEA and the most recent Annual Information Form on file

with certain Canadian provincial securities regulatory authorities

for a discussion of some of the factors underlying forward-looking

statements, which include, without limitation, gold and copper or

certain other commodity price volatility, changes in debt and

equity markets, the uncertainties involved in interpreting

geological data, increases in costs, environmental compliance and

changes in environmental legislation and regulation, interest rate

and exchange rate fluctuations, general economic conditions and

other risks involved in the mineral exploration and development

industry. Readers are cautioned that the foregoing list of factors

is not exhaustive of the factors that may affect the

forward-looking statements.

All forward-looking statements herein are qualified by this

cautionary statement. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company undertakes no

obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

Contacts: Aura Minerals Inc. Alex Penha Vice President,

Corporate Development (416) 509-0583 or (416) 649-1033 (416)

649-1044 (FAX)info@auraminerals.com www.auraminerals.com

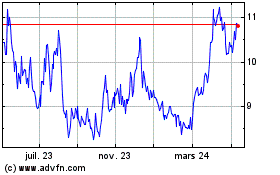

Aura Minerals (TSX:ORA)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

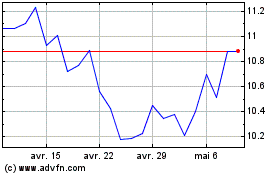

Aura Minerals (TSX:ORA)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025