Bluestone Resources Inc. ("Bluestone") (TSXV:BSR |

OTCQB:BBSRF) and

Aura Minerals Inc. ("Aura")

(TSX:ORA | B3:AURA33 |OTCQX:ORAAF), are pleased to

announce that they have entered into a definitive arrangement

agreement (the "Arrangement Agreement") pursuant to which Aura will

acquire all of the issued and outstanding common shares of

Bluestone (the "Bluestone Shares") by way of a plan of arrangement

under the Business Corporations Act (British Columbia) (the

"Arrangement" or “Transaction”).

Transaction Highlights

- Aura will be

acquiring a 100% interest in Bluestone’s Cerro Blanco gold project

(“Cerro Blanco”) and the adjacent Mita Geothermal project (“Mita

Geothermal”).

- Bluestone valued

at approximately C$ 0.50 per Bluestone Share, representing a 51%

premium to spot and a 40% premium to the volume weighted average

price (“VWAP) of the Bluestone Shares on the TSX Venture Exchange

(the “TSXV”) for the 25 day period ending October 24th, 2024, to be

paid in a combination of cash or Aura shares on closing and a

contingent value right (“CVR”), representing a total enterprise

value of up to US$74.3 million.i

- Pursuant to the

Transaction, for each Bluestone share held, Bluestone shareholders

will be able to elect to receive upfront consideration on closing

consisting of either: (i) a cash payment of C$0.287; or (ii) 0.0179

of an Aura common share, subject to proration; or a combination of

both. The upfront consideration will be subject to maximum

aggregate Aura shares issuable of 1,363,272 (representing 50% of

the upfront consideration).

- Bluestone

shareholders will also receive a CVR providing the holder thereof

with the potential to receive a cash payment of up to an aggregate

amount of C$0.2120, for each Bluestone share, payable in three

equal annual installments upon Cerro Blanco achieving commercial

production.

- The Transaction

was unanimously approved by Bluestone’s Board of Directors and by

Aura’s Board of Directors.

- The Transaction

will be subject to the approval by Bluestone securityholders at a

special meeting of Bluestone securityholders and subject to the

receipt of certain regulatory, court, TSXV and Toronto Stock

Exchange (“TSX”) approvals, and other closing conditions customary

in transactions of this nature.

Cerro Blanco is a near surface high grade gold

deposit, in Jutiapa, Guatemala. An N.I. 43-101 technical report on

the project was produced and filed in April 2022. The Mita

Geothermal project is an advanced-stage, renewable energy project

licensed to produce up to 50 megawatts of power. As previously

disclosed by Bluestone, on June 17, 2024, Bluestone received a

notice from the Guatemalan Ministry of Environment (“MARN”)

challenging the approval procedure that approved the surface mining

method for Cerro Blanco. Bluestone has the view that environmental

permit amendment met and exceeded the terms of reference provided

by the MARN, and it adhered to Guatemalan law. Aura intends, upon

closing of the transaction, to evaluate the alternatives for a

future potential development of Cerro Blanco.

Rodrigo Barbosa, CEO of Aura,

stated, “Cerro Blanco stands as a world-class deposit that

has encountered both social and institutional hurdles. We are

confident that, along the next few years, by integrating it with

Aura's 360 vision, we can refine our strategic approach to make

Cerro Blanco another flagship project that exemplifies the utmost

respect for social and environmental responsibilities while

delivering value to all stakeholders.”

Peter Hemstead, President, CEO, and

Board Chair of Bluestone Resources, added: “After a

fulsome Strategic Review Process, the acquisition by Aura provides

the best outcome for Bluestone shareholders and to further advance

the Cerro Blanco gold project and Mita geothermal project. The

Transaction presents shareholders with a choice to maintain

exposure to Cerro Blanco through a proven Latin America mine

developer and producer with a strong balance sheet or elect cash.

Aura is a well established Latin American producer with a track

record of development and has the financial capacity to advance and

unlock potential value from Cerro Blanco.”

Benefits to Bluestone

Shareholders

- Total

consideration premium of 40% to the 25-day VWAP of Bluestone Shares

on the TSXV as of October 24, 2024.

- Partnership with

an established multi‐mine producer and developer with last

twelve-month production of 270,000 gold equivalent ounce (“GEO”),

of which about 25% from copper production, and with a plan to

achieve 450,000 GEO with a common operating philosophy and record

of fiscal discipline, high ESG standards and a proven history of

shareholder value creation.

- Aura has

seamlessly integrated its operations in the local communities in

which it operates. Aura has developed and is operating mines in

Honduras, Mexico, and Brazil. It owns a significant operation 230

km from Cerro Blanco in Honduras, which provides a deep

understanding of the local environment, a crucial factor for the

successful development of the Cerro Blanco ore body.

- Bluestone

shareholders have the option to receive either (i) a cash payment

of C$0.287 for each Bluestone Share held; or (ii) 0.0179 of an Aura

common share for each Bluestone Share held, subject to pro-ration;

or a combination of both.

- The CVR

consideration provides additional exposure to the development of

Cerro Blanco in the form of future contingent cash payments subject

to Cerro Blanco achieving commercial production thresholds.

- Aura has the

financial capacity to finance the development of Cerro Blanco with

minimal or no future dilution. Its Latin American experience,

strong balance sheet, and robust free cash flow generation support

the company’s development and exploration initiatives while still

paying dividends.

- Meaningful

ongoing exposure to future value catalysts across the combined

asset portfolio, including Aura’s assets and Bluestone’s Cerro

Blanco gold project.

Benefits to Aura Shareholders

- Reinforces

Aura’s growth pipeline to go beyond 450,000 GEO in the next few

years, including a mix of gold and copper (in the last twelve

months, about 25% Aura’s revenues came from copper production),

with a new potential flagship asset in line with Aura’s strategy to

continue to build its business.

- Potential for a

significant increase in the Mineral Resources base of Aura.

- Potential

synergies as Cerro Blanco is approximately 230 km from the Minosa

operating mine in Honduras and Aura’s extensive Latin American

presence and knowledge.

- Aura to work in

partnership with local stakeholders to develop Cerro Blanco.

Transaction Details

The Transaction will be completed pursuant to a

court-approved plan of arrangement under the Business

Corporations Act (British Columbia). The Transaction will be

subject to the approval of: (i) at least 66-⅔% of the votes cast by

holders of Bluestone Shares; (ii) 66-⅔% of the votes cast by

holders of Bluestone Shares and options, voting together as a

single class; and (iii) “minority approval” in accordance with

Multilateral Instrument 61-101, at a special meeting of Bluestone

securityholders to be held to consider the Transaction (the

“Special Meeting”). In addition to Bluestone securityholder

approval, the Transaction is also subject to the receipt of certain

regulatory, court, TSXV and TSX approvals, and other closing

conditions customary in transactions of this nature.

The Arrangement Agreement includes customary

deal protections, including a non-solicitation covenant on the part

of Bluestone (subject to customary fiduciary out provisions) and a

right for Aura to match any competing offer that constitutes a

superior proposal. The Arrangement Agreement includes a termination

fee of US$2 million, payable by Bluestone under certain

circumstances.

All officers and directors of Bluestone, along

with Nemesia S.à.r.l. and CD Capital Natural Resources Fund III

LLP, owning in aggregate approximately 39% of the outstanding

Bluestone Shares, have entered into voting support agreements

pursuant to which they have agreed, among other things, to vote

their Bluestone Shares in favour of the Transaction.

Full details of the Transaction will be included

in the management information circular of Bluestone, expected to be

mailed to shareholders and filed on www.sedarplus.ca. Closing is

expected to occur in January 2025, subject to satisfaction of the

conditions to closing.

Board of Directors and Special Committee

Recommendations

The Arrangement Agreement has been unanimously

approved by the Board of Directors of Bluestone, following the

unanimous recommendation of a Special Committee of independent

directors of Bluestone (the “Special Committee”). Bluestone’s Board

of Directors unanimously recommend that the Bluestone

securityholders vote in favour of the Transaction.

GenCap Mining Advisory Ltd. has provided an

opinion to the Special Committee and Board of Directors of

Bluestone, stating that, as of the date of such opinion, and based

upon and subject to the assumptions, limitations and qualifications

stated in such opinion, the consideration to be paid under the

Transaction is fair, from a financial point of view to the

Bluestone shareholders.

Advisors and Counsel

GenCap Mining Advisory Ltd. is acting as

financial advisor to the Special Committee. Blake, Cassels &

Graydon LLP is acting as Canadian legal advisor to Bluestone and

Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as U.S.

legal advisor to Bluestone. Stikeman Elliott LLP is acting as legal

advisor to the Special Committee.

Gowling WLG (Canada) LLP is acting as Canadian

legal advisor to Aura and Dorsey & Whitney LLP is acting as

U.S. legal advisor to Aura.

About Aura Minerals Inc.

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360 Mining. Aura is a mid-tier gold and copper production company

focused on operating and developing gold and base metal projects in

the Americas. The Company has 4 operating mines including the

Aranzazu copper-gold-silver mine in Mexico, the Apoena (EPP) and

Almas gold mines in Brazil, and the Minosa (San Andres) gold mine

in Honduras. The Company’s development projects include Borborema,

currently in construction and Matupá both in Brazil. Aura has

unmatched exploration potential owning over 630,000 hectares of

mineral rights and is currently advancing multiple near-mine and

regional targets along with the Aura Carajas copper project in the

prolific Carajás region of Brazil.

About Bluestone Resources Inc.

Bluestone Resources is a Canadian-based precious

metals exploration and development company focused on opportunities

in Guatemala. The Company’s flagship asset is the Cerro Blanco gold

project, a near surface mine development project located in

Southern Guatemala in the department of Jutiapa. The Company trades

under the symbol “BSR” on the TSX Venture Exchange and “BBSRF” on

the OTCQB.

Forward-Looking Statements

This news release contains certain

“forward-looking information” and “forward-looking statements”, as

such terms are defined under applicable securities laws

(collectively, “forward-looking statements”). Forward-looking

statements can be identified by the use of words and phrases such

as “plans”, “expects” ,“is expected”, “budget”, “scheduled,”

“estimates”, “forecasts”, “intends”, “anticipates” or “believes” or

variations (including negative variations) of such words and

phrases, or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements herein include, but are not limited to,

the expected benefits of the Arrangement, statements with respect

to the consummation and timing of the Transaction; approval by

Bluestone’s shareholders; the satisfaction of the conditions

precedent of the Transaction; timing, receipt and anticipated

effects of court, regulatory and other consents and approvals and

the strengths, characteristics and potential of the Transaction.

These forward-looking statements are based on current expectations

and are subject to known and unknown risks, uncertainties and other

factors, many of which are beyond Aura’s ability to predict or

control and could cause actual results to differ materially from

those contained in the forward-looking statements. Specific

reference is made to Aura’s most recent Annual Information Form on

file with certain Canadian provincial securities regulatory

authorities for a discussion of some of the factors underlying

forward-looking statements, which include, without limitation,

volatility in the prices of gold, copper and certain other

commodities, changes in debt and equity markets, the uncertainties

involved in interpreting geological data, increases in costs,

environmental compliance and changes in environmental legislation

and regulation, interest rate and exchange rate fluctuations,

general economic conditions and other risks involved in the mineral

exploration and development industry. Readers are cautioned that

the foregoing list of factors is not exhaustive of the factors that

may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking

statements.

i Estimated net debt on transaction close of US$20 million.

For more information, please contact:

For further information about Aura Minerals Inc., please contact:

Investor Relations

ri@auraminerals.com

www.auraminerals.com

For further information about Bluestone Resources Inc., please contact:

Peter Hemstead, President, CEO, and Chair of the Board

Phone: +1 604 689 7842

info@bluestoneresources.ca

www.bluestoneresources.ca

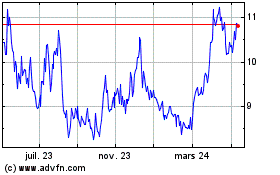

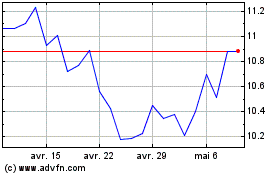

Aura Minerals (TSX:ORA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Aura Minerals (TSX:ORA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024