Pulse Seismic Inc. (TSX:PSD) (OTCQX:PLSDF) (“Pulse” or “the

Company”) is pleased to report its financial and operating results

for the year ended December 31, 2018. The audited consolidated

financial statements, accompanying notes and MD&A are being

filed on SEDAR (www.sedar.com) and will be available on Pulse’s

website at www.pulseseismic.com.

HIGHLIGHTS FOR THE YEAR ENDED DECEMBER

31,

2018

- Total revenue for the year ended

December 31, 2018 was $10.2 million compared to $43.5 million for

the year ended December 31, 2017. The third quarter of 2017

included Pulse’s largest-ever seismic data licensing agreement, for

$29.5 million;

- The Company incurred a net loss of

$1.7 million ($0.03 per share basic and diluted) for 2018 compared

to net earnings of $15.1 million ($0.27 per share basic and

diluted) for 2017;

- Cash EBITDA(a) was $5.0 million

($0.09 per share basic and diluted) for the year ended December 31,

2018, compared to $37.1 million ($0.67 per share basic and diluted)

for the year ended December 31, 2017;

- Shareholder free cash flow(a) was

$4.7 million ($0.09 per share basic and diluted) for the year ended

December 31, 2018, compared to $29.7 million ($0.54 per share basic

and diluted) for the year ended December 31, 2017;

- In 2018 Pulse purchased and

cancelled, through its normal course issuer bid, a total of 227,500

common shares at a total cost of approximately $673,000 (average

cost of $2.96 per common share including commissions); and

- At December 31, 2018, the Company had a cash balance of $23.0

million, compared to a cash balance of $27.4 million at December

31, 2017.

HIGHLIGHTS FOR THE THREE MONTHS ENDED

DECEMBER 31, 2018

- Total revenue for the three months

ended December 31, 2018 was $4.3 million compared to $5.4 million

for the three months ended December 31, 2017;

- Net earnings were $1.0 million

($0.02 per share basic and diluted) compared to net earnings of

$1.3 million or ($0.02 per share basic and diluted) in the fourth

quarter of 2017;

- Cash EBITDA was $3.2 million ($0.06

per share basic and diluted) compared to $3.8 million ($0.07 per

share basic and diluted) in the fourth quarter of 2017; and

- Shareholder free cash flow was $2.6

million ($0.05 per share basic and diluted) compared to $3.3

million ($0.06 per share per share basic and diluted) in the fourth

quarter of 2017.

Subsequent

to year end, on January 15, 2019 Pulse acquired 100 percent of the

shares of Seitel Canada Ltd. Purchase consideration included an

initial cash payment of $53.6 million at closing, plus potential

additional payments of up to $5 million, in aggregate, within two

years of closing. Pulse also assumed an estimated $4.2 million in

additional future liabilities. The $53.6 million cash payment

consisted of $20.6 million cash on hand and $33.0 million in

long-term debt. The acquisition more than doubled Pulse’s seismic

coverage, increasing Pulse’s revenue generating potential by adding

unique, complementary, high-quality data over areas that Pulse’s

library did not previously cover. Pulse now owns approximately

65,310 square kilometres of 3D and 829,207 kilometres of 2D seismic

data.

| |

|

|

|

| |

SELECTED FINANCIAL AND OPERATING INFORMATION |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Three months ended December 31, |

Years ended December 31, |

|

| |

(thousands of dollars

except per share data, |

2018 |

2017 |

2018 |

|

2017 |

|

| |

numbers of shares and

kilometres of seismic data) |

|

|

|

| |

|

|

|

|

|

|

| |

Revenue –

Data library sales |

4,313 |

5,449 |

10,188 |

|

43,525 |

|

| |

|

|

|

|

|

|

| |

Amortization of seismic

data library |

1,811 |

1,958 |

7,337 |

|

15,870 |

|

| |

Net earnings

(loss) |

1.024 |

1,311 |

(1,730 |

) |

15,087 |

|

| |

Per share

basic and diluted |

0.02 |

0.02 |

(0.03 |

) |

0.27 |

|

| |

Cash provided by

operating activities |

2,457 |

2,080 |

(3,250 |

) |

38,755 |

|

| |

Per share

basic and diluted |

0.05 |

0.04 |

(0.06 |

) |

0.70 |

|

| |

Cash EBITDA(a) |

3,209 |

3,791 |

5,037 |

|

37,070 |

|

| |

Per share

basic and diluted (a) |

0.06 |

0.07 |

0.09 |

|

0.67 |

|

| |

Shareholder free cash

flow (a) |

2,616 |

3,301 |

4,671 |

|

29,729 |

|

| |

Per share

basic and diluted (a) |

0.05 |

0.06 |

0.09 |

|

0.54 |

|

| |

Capital

expenditures |

|

|

|

|

|

| |

Seismic

data purchases, digitization and related costs |

- |

1,450 |

62 |

|

1,575 |

|

| |

Property and equipment |

9 |

8 |

18 |

|

48 |

|

| |

Total capital

expenditures |

9 |

1,458 |

80 |

|

1,623 |

|

| |

|

|

|

|

|

|

| |

Special dividend

paid |

- |

10,915 |

- |

|

10,915 |

|

| |

|

|

|

|

|

|

| |

Weighted average shares

outstanding |

|

|

|

|

|

| |

basic and

diluted |

53,793,317 |

54,404,433 |

53,838,106 |

|

55,135,035 |

|

| |

Shares outstanding at

period-end |

|

|

53,793,317 |

|

54,020,817 |

|

| |

Seismic

library |

|

|

|

|

|

| |

2D in

kilometres |

|

|

450,000 |

|

447,000 |

|

| |

3D in

square kilometres |

|

|

28,956 |

|

28,956 |

|

| |

|

|

|

|

|

|

| |

FINANCIAL POSITION AND RATIO |

|

|

|

|

| |

|

|

|

December 31, |

|

December 31, |

|

| |

(thousands of dollars except ratio) |

|

|

2018 |

|

2017 |

|

| |

Working capital |

|

|

25,804 |

|

22,486 |

|

| |

Working capital

ratio |

|

|

15:1 |

|

3:1 |

|

| |

Cash and cash

equivalents |

|

|

23,016 |

|

27,422 |

|

| |

Total assets |

|

|

38,847 |

|

51,693 |

|

| |

Shareholders’ equity |

|

|

35,238 |

|

37,810 |

|

| |

|

|

|

|

|

|

| |

|

|

| |

(a) The Company’s continuous disclosure

documents provide discussion and analysis of “cash EBITDA”, “cash

EBITDA per share”, “shareholder free cash flow” and “shareholder

free cash flow per share”. These financial measures do not have

standard definitions prescribed by IFRS and, therefore, may not be

comparable to similar measures disclosed by other companies. The

Company has included these non-GAAP financial measures because

management, investors, analysts and others use them as measures of

the Company’s financial performance. The Company’s definition of

cash EBITDA is cash available for interest payments, cash taxes,

repayment of debt, purchase of its shares, discretionary capital

expenditures and the payment of dividends, and is calculated as

earnings (loss) from operations before interest, taxes,

depreciation and amortization less participation survey revenue,

plus any non-cash and non-recurring expenses. Cash EBITDA excludes

participation survey revenue as these funds are directly

used to fund specific participation surveys and this revenue is not

available for discretionary capital expenditures. The Company

believes cash EBITDA assists investors in comparing Pulse’s results

on a consistent basis without regard to participation survey

revenue and non-cash items, such as depreciation and amortization,

which can vary significantly depending on accounting methods or

non-operating factors such as historical cost. Cash EBITDA per

share is defined as cash EBITDA divided by the weighted average

number of shares outstanding for the period. Shareholder free cash

flow further refines the calculation of capital available to invest

in growing the Company’s 2D and 3D seismic data library, to repay

debt, to purchase its common shares and to pay dividends by

deducting non-discretionary expenditures from cash EBITDA.

Non-discretionary expenditures are defined as debt financing costs

(net of deferred financing expenses amortized in the current

period) and current tax provisions. Shareholder free cash flow per

share is defined as shareholder free cash flow divided by the

weighted average number of shares outstanding for the period.

These non-GAAP financial measures are defined,

calculated and reconciled to the nearest GAAP financial measures in

the Management's Discussion and Analysis.

OUTLOOK

As a result of the January 15, 2019 acquisition, Pulse has more

than doubled the size of its primary asset and its

revenue-generating potential. While there are an estimated $4.2

million in additional future liabilities associated with the

purchase of the shares of Seitel Canada Ltd., Pulse considered

these costs to be part of the negotiated purchase price. Those

costs aside, the low cost structure of the business model

facilitates significant synergies on future sales. Additionally,

the financing structure for this acquisition positions the Company

to comfortably meet its new level of obligations which includes

interest expense, deferred payments to the vendor based on sales of

the newly acquired data, and a very low level of debt principal

payments for three years post acquisition.

The Company intends to pay down debt, continue to manage costs

conservatively and to continue to be stringent in assessing

potential new opportunities. Pulse also has unused borrowing

capacity on the credit facility of up to a further $22 million if

needed. Pulse’s management team is pleased with the Company’s

financial position and go-forward cost structure, and confident in

its ability to handle its indebtedness in the current economic

environment.

The Company does not see indications of an industry rebound and

is therefore very cautious about the coming year. Not only are the

industry signals generally weak, the situation is so dominated by

shifting political and regulatory affairs – including looming

elections in Alberta and federally – that it would be imprudent to

attempt even broad predictions. Pulse is, accordingly, prepared for

additional quarters of weak traditional sales, and continues to

caution that visibility as to future traditional sales remains very

poor. An industry rebound will depend on some combination of export

pipeline approvals, LNG projects proceeding, political resolution

of seemingly intractable issues and more favourable government tax

and industry policies – all without another downturn in crude oil

prices.

Pulse has been structured to survive and even grow through all

phases of the industry cycle. It has clearly demonstrated that its

business is strong, that its model works, that its capabilities

meet its aspirations, and that its management team is capable and

prudent. The Company’s low cost structure and the immense coverage

of its seismic database make Pulse’s revenue, cash margin and

shareholder free cash flow highly levered to any uptick in industry

field activity and demand for seismic data.

Pulse’s sales are highly scalable without either capital

investment or higher operating costs, and a transaction-based sale

of any size could occur at any time (transaction-based sales are

innately unpredictable). These ongoing advantages are compounded by

the seismic data library’s larger size and greatly expanded

coverage. Now Canada’s largest pure-play seismic data library

provider, Pulse is able to weather additional short-term weakness,

while positioned for and confident of a longer-term recovery in

western Canada’s oil and natural gas sector.

CORPORATE PROFILE

Pulse is a market leader in the acquisition,

marketing and licensing of 2D and 3D seismic data to the western

Canadian energy sector. Pulse owns the largest licensable seismic

data library in Canada, currently consisting of approximately

65,310 square kilometres of 3D seismic and 829,207 kilometres of 2D

seismic. The library extensively covers the Western Canada

Sedimentary Basin where most of Canada’s oil and natural gas

exploration and development occur.

For further information, please contact:Neal

Coleman, President and CEOOrPamela Wicks,

Vice President Finance and CFOTel.: 403-237-5559Toll-free:

1-877-460-5559E-mail: info@pulseseismic.com.Please visit our

website at www.pulseseismic.com.

This document contains information that

constitutes “forward-looking information” or “forward-looking

statements” (collectively, “forward-looking information”) within

the meaning of applicable securities legislation.The Outlook

section contains forward-looking information which includes, among

other things, statements regarding:

- Pulse does not see indications of an industry rebound and is

therefore very cautious about the coming year;

- Pulse’s capital allocation strategy;

- Pulse’s dividend policy;

- Oil and natural gas prices;

- Oil and natural gas drilling activity and land sales

activity;

- Oil and natural gas company capital budgets;

- Future demand for seismic data;

- Future seismic data sales;

- Future demand for participation surveys;

- Pulse’s business and growth strategy; and

- Other expectations, beliefs, plans, goals, objectives,

assumptions, information and statements about possible future

events, conditions, results and performance.

Undue reliance should not be placed on

forward-looking information. Forward-looking information is based

on current expectations, estimates and projections that involve a

number of risks and uncertainties, which could cause actual results

to vary and in some instances to differ materially from those

anticipated in the forward-looking information. Pulse does not

publish specific financial goals or otherwise provide guidance, due

to the inherently poor visibility of seismic revenue.

The material risk factors include, without

limitation:

- Uncertainty of the timing of data sales from newly acquired

seismic data library which was partially funded with long-term

debt;

- Oil and natural gas prices;

- The demand for seismic data and participation surveys;

- The pricing of data library license sales;

- Relicensing (change-of-control) fees and partner copy

sales;

- Cybersecurity;

- The level of pre-funding of participation surveys, and the

Company’s ability to make subsequent data library sales from such

participation surveys;

- The Company’s ability to complete participation surveys on time

and within budget;

- Environmental, health and safety risks;

- Federal and provincial government laws and regulations,

including those pertaining to taxation, royalty rates,

environmental protection and safety;

- Competition;

- Dependence on qualified seismic field contractors;

- Dependence on key management, operations and marketing

personnel;

- The loss of seismic data;

- Protection of intellectual property rights;

- The introduction of new products; and

- Climate change.

The foregoing list is not exhaustive. Additional

information on these risks and other factors which could affect the

Company’s operations and financial results is included under “Risk

Factors” of the Company’s MD&A for the year ended December 31,

2018. Forward-looking information is based on the assumptions,

expectations, estimates and opinions of the Company’s management at

the time the information is presented.

PDF

available: http://resource.globenewswire.com/Resource/Download/76ce5b99-7fe1-4598-bfb4-236cb3b04e5d

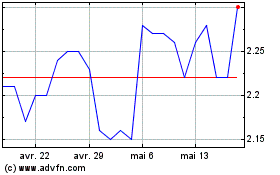

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Pulse Seismic (TSX:PSD)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025