NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED STATES

Parex Resources Inc. ("Parex" or the "Company") (TSX:PXT), a company focused on

Colombian oil exploration and production, is pleased to announce financial and

operating results for the three months ("Second Quarter" or "Q2") ended June 30,

2014. All amounts herein are in United States dollars unless otherwise stated.

Q2 2014 Financial and Operational Highlights

-- Achieved a record quarterly oil production of 19,876 barrels per day

("bopd"), an increase of 8 percent over the three months ending March

31, 2014;

-- Generated funds flow from operations of $77.3 million ($0.70 per share

basic);

-- Realized an operating netback of $61.65 per bbl and a funds flow netback

of $45.93 per bbl;

-- The Company participated in drilling 13 gross (7.75 net) wells in

Colombia resulting in 4 oil wells, 2 disposal wells, 4 cased and

untested and 3 dry and abandoned (1);

-- Closed a strategic corporate acquisition in late June 2014 that

increased our working interest in blocks LLA-32 and LLA-34 and added in

excess of 4,000 bopd;

-- Issued an independent mid-year reserves report(2) with:

-- Proved plus probable ("2P") reserves growth of 80 percent in six

months, increasing from 32.0 million barrels of oil equivalent

("MMboe") (net company working interest) at December 31, 2013 to

57.6 MMboe (net company working interest) at June 30, 2014;

-- Gross undeveloped drilling locations increased to 47, 78 and 99

wells in the proved ("1P"), proved plus probable ("2P") and proved

plus probable plus possible ("3P") cases;

-- 2P reserve life index ("RLI") increases from 5.1 years to 6.7 years;

and

-- Increased 2014 annual production guidance to approximately 22,250 bopd

from the initial guidance of 17,500 - 18,500 bopd. We expect Q4 2014

exit rate production to exceed approximately 27,000 bopd. July 2014

production averaged 25,120 bopd.

-- Forecasted cash flows are expected to materially increase for the second

half of 2014. Applying the Q2 2014 after tax cash flow per barrel of

$46/bbl on forecast Q3 2014 production, results in expected quarterly

funds flow in excess of $100 million as compared to Q2 2014 funds flow

of approximately $77 million (assuming all other variables including

commodity prices stay constant). It is also expected that cash flow per

barrel in 2014 will incrementally increase as a result of the

utilization of Verano tax losses.

(1) Wells Drilled: Tigana Norte-1 (producing), Carmentea-1 (producing),

Begonia-1 (temporarily shut-in), Chacharo-1 (temporarily shut-in);

Disposal wells: Berbena-1, Carmentea-2; Untested (standing): Arlequin-1,

Calona-1; Kananaskis-2, Tigana Sur Oeste-1; Dry & Abandoned: Restrepo-1,

Terranova-1, Terranova-1ST.

(2) For additional information related to the mid-year 2014 reserve

evaluation, refer to the news release dated July 10, 2014, "Parex

Increases 2P Reserves by 80% to 58 MMboe, RLI to 6.7 Years and Forecast

2014 Exit Rate Production to Exceed 27,000 bopd".

Second Quarter Financial Summary

For Q2 2014, sales volumes excluding purchased oil averaged 18,502 bopd (net

working interest before royalty) and the average realized sales price in

Colombia was $104.53 per barrel ("/bbl"), generating an operating netback of

$61.65/bbl.

Operating plus transportation unit costs of $27.82/bbl were in-line with the

prior quarter costs of $27.74/bbl. Second quarter production expenses were

$11.41/bbl compared to $9.19/bbl in the Q2 2013 comparative period. The increase

in operating costs per barrel is primarily due to temporarily suspended

production at Adalia, Celtis, Celeus and Rumi fields and Kona field work-over

and recompletion costs. The increased operating costs per barrel were offset by

reduced transportation costs per barrel. Transportation costs on a per barrel

basis are expected to remain at the current level for the balance of the year.

Funds flow from operations in the Second Quarter of 2014 of $77.3 million ($0.70

per share basic) compared to $76.7 million ($0.70 per share basic) in the

previous quarter. The temporary increase in crude oil inventories of 121,875

barrels to 195,440 barrels resulted in funds flow being reduced by approximately

$5.7 million. We expect our crude oil inventory to progressively decline to the

end of September 30, 2014 to be in line with December 31, 2013 levels.

For the period from January 1, 2014 to June 30, 2014, funds flow from operations

was $154.1 million and capital expenditures were $156.5 million. The Company's

Q2 capital expenditures, before corporate acquisition costs, were $95.1 million

which included $78.2 million for drilling and completions and $9.5 million for

facilities primarily at the Akira field and on Block LLA-34. On June 25, 2014

the Company closed an acquisition of a private company for total net

consideration of $186.2 million, consisting of a cash payment, 14.7 million

Parex common shares and adjustments.

Working capital surplus at period end was $31.2 million, compared to a working

capital surplus of $36.9 million in the previous quarter. The Company's bank

debt increased to $56.0 million primarily due to closing the corporate

acquisition and seasonal increases in capital activities. The current credit

facility borrowing base of $125 million is being reviewed in association with

the reserves increase reflected in the June 30, 2014 reserve evaluation noted

above.

Three Months ended Three Months

June 30 ended March 31,

2014 2013 2014

----------------------------------------------------------------------------

Operational

Average daily production

Oil (bbl/d) 19,876 15,463 18,425

Average daily sales

Oil (bbl/d) 18,502 16,145 19,099

Oil Inventory - end of period

(barrels) 195,440 134,636 73,565

Operating netback ($/bbl)

Reference Price - Brent 109.70 102.56 108.17

Oil revenue 104.53 99.34 103.42

Royalties (15.06) (13.65) (14.48)

----------------------------------------------------------------------------

Net revenue 89.47 85.69 88.94

Production expense (11.41) (9.19) (9.66)

Transportation expense (16.41) (18.28) (18.08)

----------------------------------------------------------------------------

Operating netback 61.65 58.22 61.20

Financial ($000s except per share

amounts)(1)

Oil and natural gas revenue 182,996 147,585 179,794

Net income 11,408 7,632 9,663

Per share - basic 0.10 0.07 0.09

Adjusted Net income (2) 26,612 5,987 20,099

Per share - basic 0.24 0.06 0.18

Funds flow from operations 77,331 65,638 76,746

Per share - basic 0.70 0.61 0.70

Acquisitions 191,065 - -

Capital expenditure 95,101 77,921 61,405

Total assets 1,226,983 824,276 882,306

Working capital (deficit) surplus 31,189 8,630 36,957

Convertible debentures(3) 68,375 64,338 64,728

Long-term debt (4) 56,000 27,400 4,000

Outstanding shares (end of period)

(000s)

Basic 125,197 108,279 109,783

Weighted average basic 111,163 108,416 109,095

Diluted(5) 121,733 129,885 118,353

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1. The table above contains Non-GAAP measures. See "Non-GAAP Terms" for

further discussion.

2. Net income has been adjusted for the International Financial Reporting

Standards ("IFRS") accounting effects of changes in the derivative

financial liability related to the convertible debenture. Management

considers adjusted net income a better measure of the Company's

financial performance.

3. Face value of the convertible debenture is Cdn$85 million with a

conversion price of Cdn$10.15 per share.

4. Borrowing limit currently set at $125 million.

5. Diluted shares as stated include the effects of common shares and in-

the-money stock options outstanding at the period-end. The June 30, 2014

closing stock price was Cdn$12.55 per share.

Business Development: Expanding Drilling Inventory

1. LLA-10 Farm-in: Parex has signed a farm-in agreement for the Exploration

Area of Block LLA-10 in the Llanos Basin of Colombia. Pursuant to the

terms of the farm-in agreement, Parex will pay 89% of the dry-hole cost

of one exploration well to earn 44.5% working interest and operatorship.

The Block is approximately 189,500 gross acres and subject to an initial

base royalty of 11%. We expect to commence drilling operations in late

2014 subject to regulatory approval from the Colombian National

Hydrocarbons Agency ("ANH").

2. Colombia Bid Round 2014: Parex was advised by the ANH that it was deemed

to be the successful bidder for one conventional block and one

unconventional block in the Ronda Colombia 2014. The Company is awaiting

final confirmation from the ANH on the block awards. A summary of the

new block details are:

----------------------------------------------------------------------------

Company Total Initial Phase 1 Work

Gross Working Royalty (Base + Program

Block Basin Acres Interest X Factor) (US $ MM)

----------------------------------------------------------------------------

VIM-1 Lower Magdalena 223,651 100% 8%+17% $23 MM

----------------------------------------------------------------------------

VMM-9 Middle Magdalena 152,314 100% 8%+ 1% $89 MM

----------------------------------------------------------------------------

To view a regional map of Parex' current Colombian land holdings, click on the link:

http://parexresources.com/wp-content/uploads/2014/07/PXT-Land1.pdf

Operational Update

For the reminder of the year, Parex expects to have 2-3 operated drilling rigs

and 1 non-operated drilling rig in service.

Akira (Operated, Cabrestero Block, WI 100%): A drilling rig is currently moving

from the Las Maracas field to Akira to drill Akira-9 and Akira-10.

Arlequin (Operated, Cebucan Block, WI 100%): The Arlequin-1 exploration well

reached its planned total depth at 15,300 feet and was cased. We are currently

conducting testing operations.

Block LLA-32 (Operated, WI 70%): The Carmentea-1 well is producing from the

Mirador Formation at a facility restricted average gross rate of approximately

1,800 bopd. Kananaskis-3 is producing from the Mirador Formation and

Kananaskis-4 is drilling. The Calona-1 well was drilled in Q2 2014 and is

expected to be on production once water disposal facilities are in place.

Block LLA-40 (Operated, WI 50%): Four wells were drilled on the block to fulfill

the initial phase exploration commitments. Two wells were successful and two

wells will be converted to water disposal for the successful wells. Production

from the block is expected to commence during 2014.

Katmandu Norte (Operated, Cerrero Block, WI 65%): The Katmandu Norte-1

exploration well reached its planned total depth at 13,530 feet and was cased.

During Q3 2014 we plan to test Katmandu Norte-1 and drill a second appraisal

well.

Tigana (Non-Operated, Block LLA-34, WI 55%): Tigana Sur Oeste-1 successfully

delineated the Tigana structure along trend approximately 2.4 kilometers from

Tigana Sur-1, and this result was included in the GLJ Report for June 30, 2014.

Parex and its partner expect to drill additional Tigana field appraisal wells

during 2014 and after constructing additional drilling pads in early 2015, we

expect to continue appraising the pool in the north and south directions

followed by a multi-year development plan.

Tua (Non-Operated, Block LLA-34, WI 55%): Tua-7 and Tua-8 have been approved by

partners as the next delineation wells to be drilled in the Tua field during Q3

2014.

Q2 Conference Call Information

Parex will host a conference call to discuss these results on Wednesday, August

6, 2014 beginning at 9:30 am MT. To participate in the call, dial

1-866-696-5910, pass code: 7243427:

The live audio will be carried at: http://bell.media-server.com/m/p/jv32u6sr

This news release does not constitute an offer to sell securities, nor is it a

solicitation of an offer to buy securities, in any jurisdiction.

Non-GAAP Terms

This report contains financial terms that are not considered measures under GAAP

such as funds flow used in, or from operations, working capital, operating

netback per barrel and adjusted net income, but do not have any standardized

meaning under IFRS and may not be comparable to similar measures presented by

other companies. Management uses these non-GAAP measures for its own performance

measurement and to provide shareholders and investors with additional

measurements of the Company's efficiency and its ability to fund a portion of

its future capital expenditures.

Funds flow from operations is a non-GAAP term that includes all cash generated

from operating activities and is calculated before changes in non-cash working

capital. Management uses funds from (used in) operations to analyze operating

performance and monitor financial leverage, and considers funds from (used in)

operations to be a key measure as it demonstrates the Company's ability to

generate cash necessary to fund future capital investments. Funds flow from

operations is reconciled with net (loss) income in the consolidated statements

of cash flows.

Advisory on Forward Looking Statements

Certain information regarding Parex set forth in this document contains

forward-looking statements that involve substantial known and unknown risks and

uncertainties. The use of any of the words "plan", "expect", "prospective",

"project", "intend", "believe", "should", "anticipate", "estimate" or other

similar words, or statements that certain events or conditions "may" or "will"

occur are intended to identify forward-looking statements. Such statements

represent Parex's internal projections, estimates or beliefs concerning, among

other things, future growth, results of operations, production, future capital

and other expenditures (including the amount, nature and sources of funding

thereof), competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These statements

are only predictions and actual events or results may differ materially.

Although the Company's management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee future

results, levels of activity, performance or achievement since such expectations

are inherently subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could cause Parex'

actual results to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this document include,

but are not limited to, statements with respect to the performance

characteristics of the Company's oil properties; supply and demand for oil;

financial and business prospects and financial outlook; results of drilling and

testing, results of operations; drilling plans; activities to be undertaken in

various areas; capital plans in Colombia and exit rate production; plans to

acquire and process 3-D seismic; timing of drilling and completion; and planned

capital expenditures and the timing thereof. In addition, statements relating to

"reserves" or "resources" are by their nature forward-looking statements, as

they involve the implied assessment, based on certain estimates and assumptions

that the resources and reserves described can be profitably produced in the

future. The recovery and reserve estimates of Parex' reserves provided herein

are estimates only and there is no guarantee that the estimated reserves will be

recovered.

These forward-looking statements are subject to numerous risks and

uncertainties, including but not limited to, the impact of general economic

conditions in Canada, Colombia and Trinidad & Tobago; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are interpreted and

enforced, in Canada, Colombia and Trinidad & Tobago; competition; lack of

availability of qualified personnel; the results of exploration and development

drilling and related activities; obtaining required approvals of regulatory

authorities, in Canada, Colombia and Trinidad & Tobago; risks associated with

negotiating with foreign governments as well as country risk associated with

conducting international activities; volatility in market prices for oil;

fluctuations in foreign exchange or interest rates; environmental risks; changes

in income tax laws or changes in tax laws and incentive programs relating to the

oil industry; ability to access sufficient capital from internal and external

sources; the risks that any estimate of potential net oil pay is not based upon

an estimate prepared or audited by an independent reserves evaluator; that there

is no certainty that any portion of the hydrocarbon resources will be

discovered, or if discovered that it will be commercially viable to produce any

portion thereof; and other factors, many of which are beyond the control of the

Company. Readers are cautioned that the foregoing list of factors is not

exhaustive. Additional information on these and other factors that could effect

Parex's operations and financial results are included in reports on file with

Canadian securities regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com).

Although the forward-looking statements contained in this document are based

upon assumptions which Management believes to be reasonable, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking statements contained

in this document, Parex has made assumptions regarding: current commodity prices

and royalty regimes; availability of skilled labour; timing and amount of

capital expenditures; future exchange rates; the price of oil; the impact of

increasing competition; conditions in general economic and financial markets;

availability of drilling and related equipment; effects of regulation by

governmental agencies; receipt of all required approvals for the Acquisition;

royalty rates, future operating costs, and other matters. Management has

included the above summary of assumptions and risks related to forward-looking

information provided in this document in order to provide shareholders with a

more complete perspective on Parex's current and future operations and such

information may not be appropriate for other purposes. Parex's actual results,

performance or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do, what benefits Parex will derive.

These forward-looking statements are made as of the date of this document and

Parex disclaims any intent or obligation to update publicly any forward-looking

statements, whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities laws.

Neither the TSX nor its Regulation Services Provider (as that term is defined in

the policies of the TSX) accepts responsibility for the adequacy or accuracy of

this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Parex Resources Inc.

Michael Kruchten

Vice-President Corporate Planning and Investor Relations

(403) 517-1733

Investor.relations@parexresources.com

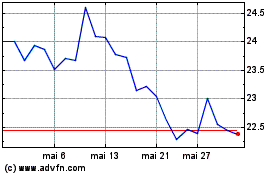

Parex Resources (TSX:PXT)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Parex Resources (TSX:PXT)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024