American Manganese Inc.: Chinese EMM Market Review Identifies Supply/Demand Window for New Western Production and Project Upd...

30 Novembre 2011 - 12:00PM

Marketwired

Larry W. Reaugh, President and Chief Executive Officer of American

Manganese Inc. (TSX VENTURE:AMY)(PINK SHEETS:AMYZF)(FRANKFURT:2AM)

("American Manganese" or the "Company") is pleased to announce the

Company has received the report titled: "A Study of Electrolytic

Manganese Metal (EMM) Industry and China's Dominating Effects to

the Global Market", prepared by JF Zhang Associates of Vancouver,

BC Canada.

Highlights of the Report Include:

-- China electrolytic manganese metal (EMM) production is to be

consolidated;

-- China to find balance of EMM production, protect environment and

depleting resources;

-- China leading in steel and EMM production;

-- EMM production costs are rising in China;

-- Necessity of EMM production in western countries;

Click here to view Report:

http://www.amydata.com/data/reports/China%20Impacts%20(EMM)%20v108.pdf

Mr. Reaugh states that, "The report confirms that Chinese EMM

production capacity will likely decline to between 1.3 and 1.5

million tonnes as a direct result of imposed industry

consolidation; while the demand for EMM metal could increase from

about 1.3 million tonnes today to over 2.6 million tonnes by 2015.

The increased demand appears to be driven by the rapidly growing

domestic use of high quality specialty steels and 200 Series

stainless steel products. The report also highlights that the era

of low cost Chinese production is over due to: Depleting resources

and declining head grades; rapidly rising labour and energy costs;

and increased capital intensity for new Chinese projects to meet

much higher regulatory compliance thresholds for increased energy

efficiency, safety and environmental protection."

Mr. Reaugh goes on to say: "The Artillery Peak Project is well

positioned with its large resource, and potentially much lower EMM

production cost, to capitalize on this emerging opportunity. The

Company is financially strong with $5 million in the bank, more

than enough to complete the ongoing pilot plant test,

pre-feasibility study and environmental and regulatory permitting

as well as begin the final feasibility report."

Pilot Plant and Pre-feasibility Update

The Company expects to receive an update shortly from Kemetco

regarding the results of the final three tests of the

nano-filtration, chilling unit, and electroplating and metal

production unit operations.

These results will be incorporated into the pre-feasibility

study being conducted by Wardrop Engineering (A Tetra Tech Company)

which is not expected until mid-February, 2012.

The current NI 43-101 compliant resource estimate of the

Artillery Peak Manganese deposit includes an Indicated resource of

about 220.9 million tonnes grading 2.84% Mn (13.83 billion lbs

contained Mn), and an Inferred resource of about 56.3 million

tonnes grading 2.84 % Mn (3.53 billion lbs contained Mn).

About JF ZHANG ASSOCIATES INC.

JF ZHANG ASSOCIATES INC. is a Vancouver-based research and

advisory firm with particular focus on energy, mining, and

agricultural business markets in China. Managed by a group of

highly qualified and experienced professionals with diversified

backgrounds and track records, it conducts research for their

clients and helps them resolve the most important strategic issues

faced in understanding China's markets. With its broad network,

on-the-ground and well-connected affiliates, and more than 50-years

accumulated transactional experiences in these sectors, we provide

investment insight to foreign clients regarding Chinese dominated

markets and help Chinese companies to access opportunities outside

of China.

For more information about JF ZHANG ASSOCIATES, please visit:

www.JFzhang.com.

About Manganese

China controls electrolytic manganese production (EMM) supplying

and producing 98.44% of the world's needs (3.0 billion pounds per

year).

There is no substitute for manganese in steel (total manganese

market greater than 31 billion pounds per year, fourth largest

traded metal).

Manganese is the most critical metal at risk to supply and

restriction in the United States as there is no US production.

EMM's greatest uses are the upgrading of specialty steel (47%), and

the manufacture of aluminum alloys (32%) and electronics (14%).

Electrolytic manganese dioxide (EMD) for the battery industry is

expected to be the fastest growing segment of the manganese

market.

China has a 20% export duty on EMM and the US has a 14% import

duty.

The current world price for Electrolytic Manganese Metal is

about $1.45/lb, while the US price is about $1.84/lb.

About American Manganese Inc:

American Manganese Inc. is a diversified specialty and critical

metal Company focusing on potentially becoming the lowest cost

producer of electrolytic manganese from its Arizona Manganese

Project. The Company is well financed to execute its contemplated

work programs.

This release has been reviewed by John W. Fisher, P. Eng., a

qualified person pursuant to National Instrument 43-101.

On behalf of Management

AMERICAN MANGANESE INC.

Larry W. Reaugh, President and Chief Executive Officer

This news release may contain certain "Forward-Looking

Statements" within the meaning of Section 21E of the United States

Securities Exchange Act of 1934, as amended. All statements, other

than statements of historical fact, included herein are

forward-looking statements that involve various risks and

uncertainties. There can be no assurance that such statements will

prove to be accurate, and actual results and future events could

differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ

materially from the Company's expectations are disclosed in the

Company's documents filed from time to time with the TSX-Venture

Exchange, the British Columbia Securities Commission and the US

Securities and Exchange Commission.

The TSX-Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

Contacts: American Manganese Inc. Larry W. Reaugh President and

Chief Executive Officer 604-531-9639 604-531-9634

(FAX)www.americanmanganeseinc.com

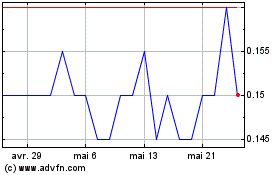

Recylico Battery Materials (TSXV:AMY)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Recylico Battery Materials (TSXV:AMY)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024