Revival Gold

Inc. (TSXV: RVG,

OTCQX: RVLGF) (“Revival Gold” or

the “Company”) is pleased to announce the successful completion of

its previously announced brokered private placement for gross

proceeds of $7,167,464 (the “Offering”). The Offering was co-led by

Paradigm Capital Inc. and BMO Capital Markets, on behalf of a

syndicate of agents, which included Beacon Securities Limited (the

“Agents”).

The Offering was completed in connection with

the proposed acquisition by the Company of all the issued and

outstanding shares of Ensign Minerals Inc. (“Ensign”) pursuant to a

three-cornered amalgamation (the “Transaction”) between the

Company, Ensign, and Revival Gold Amalgamation Corp. (“Revival

Subco”), a wholly owned subsidiary of the Company. Shareholders of

Ensign overwhelmingly approved the Transaction at a meeting of

shareholders held on May 1, 2024. Closing of the Transaction is

expected to occur within the next couple of weeks and is subject to

the satisfaction of certain terms and conditions. Please see the

Company’s press release dated April 10, 2024, for further

information on the Transaction. The Transaction remains subject to

the satisfaction of certain conditions and the approval of the TSX

Venture Exchange (the “TSXV”)

Under the Offering, 22,398,325 subscription

receipts of Revival Subco (the “Subscription Receipts”) were sold

by Revival Subco at a price of $0.32 per Subscription Receipt (the

“Issue Price”). Each Subscription Receipt represents the right of a

holder to receive, upon satisfaction or waiver of the Escrow

Release Conditions (as defined below), without payment of

additional consideration, one common share of Revival Subco (a

“Revival Subco Share”) and one-half of one Revival Subco common

share purchase warrant (each whole such warrant, a “Revival Subco

Warrant”), in accordance with the terms and conditions of a

subscription receipt agreement entered into among the Company,

Revival Subco and Marrelli Trust Company Limited (the “Subscription

Receipt Agent”) dated May 2, 2024 (the “Subscription Receipt

Agreement”). Pursuant to the terms of the Transaction, the Offering

and the Subscription Receipt Agreement, each Revival Subco Share

issued under the Offering will be exchanged for one common share of

the Company (a “Revival Share”), and each Revival Subco Warrant

will be exchanged for one Revival Share purchase warrant (a

"Revival Warrant"). Each Revival Warrant will be exercisable by the

holder thereof for one Revival Share (each, a “Revival Warrant

Share”) at an exercise price of C$0.45 per Revival Warrant Share

for a period of thirty-six (36) months following the satisfaction

or waiver of the Escrow Release Conditions, subject to adjustments

in certain events.

The net proceeds of the Offering are expected to

be used by the Company, following completion of the Transaction, to

complete a Preliminary Economic Assessment on Ensign’s Mercur

Project, advance permitting preparations on the Company’s

Beartrack-Arnett Project (“Beartrack-Arnett”), continue exploration

for high-grade material at Beartrack-Arnett, and for working

capital and general corporate purposes.

As consideration for their services, the Agents

are entitled to receive: (i) a cash commission of $430,047; and

(ii) 1,343,900 non-transferable compensation warrants (the

“Compensation Warrants”). Each Compensation Warrant entitles the

holder to purchase one Revival Subco Share at the Issue Price for a

period of twenty-four (24) months from the satisfaction of the

Escrow Release Conditions. 50% of the Agent’s aggregate cash

commission and corporate finance fee, and the Compensation

Warrants, were paid and issued, respectively, to the Agents upon

closing of the Offering, with the remainder to be paid to the

Agents upon satisfaction or waiver of the Escrow Release

Conditions.

The net proceeds from the sale of the

Subscription Receipts (the “Escrowed Funds”), net of 50% of the

aggregate cash commission and the Agent’s expenses have been

deposited in escrow and will be held by the Subscription Receipt

Agent pending the satisfaction or waiver of the Escrow Release

Conditions.

The escrow release conditions for the Offering

(the “Escrow Release Conditions”) are as follows:

- Written

confirmation from Revival Gold and Revival Subco of the completion

or irrevocable waiver or satisfaction of all conditions precedent

to the Transaction (except such conditions that can only be

satisfied at the effective time of the Transaction);

- The receipt of

all required regulatory, and shareholder approvals, as applicable,

for the Transaction and the Offering, including the conditional

approval of the listing of the Revival Shares to be issued in

connection with the Offering on the TSXV;

- Written

confirmation to the Agents from each of the Company and Ensign that

all conditions of the Transaction have been satisfied or waived,

other than release of the Escrowed Funds, and that the Transaction

shall be completed forthwith upon release of the Escrowed

Funds;

- The distribution

of the Revival Shares following the satisfaction of the Escrow

Release Conditions being exempt from applicable Canadian prospectus

and registration requirements of applicable securities laws and not

subject to any hold or restricted period;

- The Company,

Revival Subco and Ensign shall not be in breach or default of any

of its covenants or obligations under the Subscription Receipt

Agreement or the agency agreement dated May 2, 2024 entered into

among Revival, Revival Subco, Ensign and the Agents (the “Agency

Agreement”), except (in the case of the Agency Agreement only) for

those breaches or defaults that have been waived by the Agents and

all conditions set out in the Agency Agreement shall have been

fulfilled; and

- Revival Gold,

Revival Subco, Ensign, and the lead agent (on its own behalf and on

behalf of the Agents) having delivered a joint notice to the

Subscription Receipt Agent confirming that the conditions set forth

have been satisfied or waived (to the extent such waiver is

permitted).

In the event that the Escrow Release Conditions

are not satisfied on or before the date which is 75 days following

the closing of the Offering, or if prior to such time, the Company

advises the lead agent or announces to the public that it does not

intend to or will be unable to satisfy the Escrow Release

Conditions or that the Transaction has been terminated or

abandoned, the net escrowed proceeds under the Offering (plus any

interest accrued thereon) will be returned to the holders of the

Subscription Receipts on a pro-rata basis and the Subscription

Receipts will be cancelled without any further action on the part

of the holders. To the extent that the escrowed proceeds are not

sufficient to refund the aggregate issue price paid to the holders

of the Subscription Receipts, the Company will be responsible and

liable to contribute such amounts as are necessary to satisfy any

shortfall.

The Subscription Receipts are subject to a hold

period of four months and one day from the date of issuance. The

Revival Shares and Revival Warrants to be issued upon the

conversion of Subscription Receipts and closing of the Transaction

will not be subject to a hold period under applicable Canadian

securities laws.

Certain insiders of the Company, namely Hugh

Agro, Robert Chausse, Wayne Hubert, Michael Mansfield, Maura Lendon

and Tim Warman (together, the “Insiders”) subscribed to the

Offering for an aggregate of 1,402,950 Subscription Receipts. This

issuance of Subscription Receipts to the Insiders constitutes a

“related party transaction” as such term is defined under

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”). The Company is

relying on an exemption from the formal valuation and minority

shareholder approval requirements provided under MI 61-101 pursuant

to section 5.5(a) and section 5.7(1)(a) of MI 61-101, on the basis

that the participation in the Offering by Insiders does not exceed

25% of the fair market value of the Company’s market

capitalization. The Subscription Receipts issued to the Insiders,

and the Revival Shares and Revival Warrants issuable thereunder,

will be subject to a hold period of four months and one day in

accordance with the policies of the TSX Venture Exchange (the

“TSXV”). The Offering remains subject to certain conditions

including but not limited to the approval of the TSXV, satisfaction

of the Escrow Release Conditions, completion of the Transaction and

other conditions in the Subscription Receipt Agreement.

The Company also announces that it proposes to

issue Revival Shares as part of the payment to MPA Morrison Park

Advisors Inc. (“MPA”) in connection with their provision of

financial advisory services including delivery of a fairness

opinion to the Company’s Board of Directors in relation to the

Transaction and ancillary matters (the “Services”). The Company

entered into a financial advisory services agreement with MPA on

February 2, 2024 (the “MPA Agreement”) pursuant to which the

Company agreed to pay MPA a cash fee to perform the Services (the

“Fee”), payable upon the successful completion of the Transaction.

Pursuant to the MPA Agreement, Revival may elect to pay a portion

of the Fee, equal to $250,000, in Revival Shares. Accordingly, upon

completion of the Transaction, Revival expects to issue to MPA that

number of Revival Shares equal to $250,000 based on the closing

price of the Revival Shares on the TSXV on the trading day

immediately prior to the date the Transaction closes.

The securities offered pursuant to the Offering

have not been, nor will they be, registered under the U.S.

Securities Act and may not be offered or sold in the United States

or to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from the registration

requirements. This news release shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any

sale of the securities in any state in which such offer,

solicitation or sale would be unlawful. “United States” and “U.S.

person” are as defined in Regulation S under the U.S. Securities

Act.

About Revival Gold Inc.

Revival Gold is a growth-focused gold

exploration and development company. The Company is advancing the

Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing

gold mine in Idaho. The Project benefits from extensive existing

infrastructure and is the subject of a recent Preliminary

Feasibility Study for the potential restart of open pit heap leach

gold production operations.

Since reassembling the Beartrack-Arnett land

position in 2017, Revival Gold has made one of the largest new

discoveries of gold in the United States in the past decade. The

mineralized trend at Beartrack extends for over five kilometers and

is open on strike and at depth. Mineralization at Arnett is open in

all directions.

Additional disclosure including the Company’s

financial statements, technical reports, news releases and other

information can be obtained at www.revival-gold.com or on SEDAR+ at

www.sedarplus.ca.

For further information, please contact:

Hugh Agro, President or CEO or Lisa Ross, CFOTelephone: (416)

366-4100 or Email: info@revival-gold.com.

Ensign Minerals Inc.

Ensign is a private company existing under the

Business Corporations Act (British Columbia) and focused on

exploring for precious metals within the Mercur District, Utah,

USA. Ensign controls approximately 6,255 hectares in the district

where the known mineralization occurs on primarily privately held

patented claims. Ensign’s property holdings include Mercur, West

Mercur, South Mercur and North Mercur.

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This press release includes certain

"forward-looking information" within the meaning of Canadian

securities legislation and “forward-looking statements” within the

meaning of U.S. securities legislation (collectively

“forward-looking statements”). Forward-looking statements are not

comprised of historical facts. Forward-looking statements include

estimates and statements that describe the Company’s future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although these statements are based on information currently

available to the Company, the Company provides no assurance that

actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

statements could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking statements.

Forward-looking statements in this document

include, but are not limited to, risk factors relating to the

timely receipt of all regulatory and third party approvals for the

Offering or the Transaction, including that of the TSX Venture

Exchange, that the Transaction may not close within the timeframe

anticipated or at all or may not close on the terms and conditions

currently anticipated by the Company for a number of reasons

including, without limitation, as a result of the occurrence of a

material adverse change, disaster, change of law or other failure

to satisfy the conditions to closing of the Transaction or failure

to satisfy the Escrow Release Conditions, the inability of the

Company to apply the use of proceeds from the Offering as

anticipated, the Company’s objectives, goals and future

plans, and statements of intent, the implications of exploration

results, mineral resource/reserve estimates and the economic

analysis thereof, exploration and mine development plans, timing of

the commencement of operations, estimates of market conditions, and

statements regarding the results of the pre-feasibility study,

including the anticipated capital and operating costs, sustaining

costs, net present value, internal rate of return, payback period,

process capacity, average annual metal production, average process

recoveries, concession renewal, permitting of the project,

anticipated mining and processing methods, proposed pre-feasibility

study production schedule and metal production profile, anticipated

construction period, anticipated mine life, expected recoveries and

grades, anticipated production rates, infrastructure, social and

environmental impact studies, availability of labour, tax rates and

commodity prices that would support development of the Project.

Factors that could cause actual results to differ materially from

such forward-looking statements include, but are not limited to

failure to identify mineral resources, failure to convert estimated

mineral resources to reserves, the inability to maintain the

modelling and assumptions upon which the interpretation of results

are based after further testing, the inability to complete a

feasibility study which recommends a production decision, the

preliminary nature of metallurgical test results, delays in

obtaining or failures to obtain required governmental,

environmental or other project approvals, changes in regulatory

requirements, political and social risks, uncertainties relating to

the availability and costs of financing needed in the future,

uncertainties or challenges related to mineral title in the

Company’s projects, changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity and in particular gold

prices, delays in the development of projects, capital, operating

and reclamation costs varying significantly from estimates, the

continued availability of capital, accidents and labour disputes,

and the other risks involved in the mineral exploration and

development industry, an inability to raise additional funding, the

manner the Company uses its cash or the proceeds of an offering of

the Company’s securities, an inability to predict and counteract

the effects of COVID-19 on the business of the Company, including

but not limited to the effects of COVID-19 on the price of

commodities, capital market conditions, restriction on labour and

international travel and supply chains, future climatic conditions,

the discovery of new, large, low-cost mineral deposits, the general

level of global economic activity, disasters or environmental or

climatic events which affect the infrastructure on which the

project is dependent, and those risks set out in the Company’s

public documents filed on SEDAR+. Although the Company believes

that the assumptions and factors used in preparing the

forward-looking statements in this news release are reasonable,

undue reliance should not be placed on such information, which only

applies as of the date of this news release, and no assurance can

be given that such events will occur in the disclosed time frames

or at all. Specific reference is made to the most recent Annual

Information Form filed on SEDAR+ for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this presentation. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

other than as required by law.

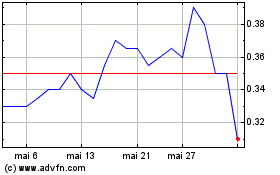

Revival Gold (TSXV:RVG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

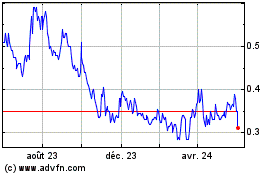

Revival Gold (TSXV:RVG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024