Total

-

Modifié le 09/2/2017 18:47

0

0

Grupo GuitarLumber

Messages postés: 1716 -

Membre depuis: 24/6/2003

- See more at: http://www.total.com/fr/actionnaires/investisseurs-institutionnels/agenda#sthash.S2RuEvQl.dpuf

https://www.youtube.com/watch?v=3AQGjLOJAcg

https://www.youtube.com/watch?v=3AQGjLOJAcg

|

|

Réponses

1041 Réponses

... ...

|

801 de 1041

-

11/5/2019 14:15

0

0

waldron

Messages postés: 9813 -

Membre depuis: 17/9/2002

Total : Bon timing long terme pour revenir à l'achat 10/05/2019 | 08:53

achat

En cours

|

Cours d'entrée : 47.11€ | Objectif : 49.25€ | Stop : 45€ | Potentiel : 4.54%

| Le repli de ces dernières semaines a ramené les cours du

titre Total vers l'importante zone support des 46.05 EUR. Il apparaît

opportun d'exploiter ces niveaux de prix en données hebdomadaires.

On pourra se positionner à l'achat pour viser les 49.25 €. |

Période : Points forts - La

zone actuelle constitue un bon point d'entrée pour les investisseurs

intéressés par le dossier dans une optique à moyen / long terme. En

effet, le titre évolue à proximité du support des 46.05 EUR en données

hebdomadaires. - La proximité du support moyen terme des 45.23 EUR offre un bon timing pour l'achat du titre.

- La société dégage des marges élevées et apparaît très fortement rentable.

- Fondamentalement,

avec un ratio "valeur d'entreprise sur chiffre d'affaires" de l'ordre

de 0.76 pour l'exercice en cours, la société apparaît faiblement

valorisée. - L'entreprise fait partie des plus attractives du marché en termes de valorisation basée sur les multiples de résultat.

- Les investisseurs qui recherchent du rendement pourront trouver dans cette action un intérêt majeur.

- Les analystes couvrant le dossier recommandent majoritairement l'achat ou la surpondération de l'action.

- L'objectif

de cours moyen des analystes suivant la valeur est relativement éloigné

et suppose un potentiel d'appréciation important.

Points faibles - Le

groupe fait partie des entreprises dont les perspectives de croissance

apparaissent les plus faibles d'après les estimations d'analystes. - Dans le passé, le groupe a souvent déçu les analystes en publiant des chiffres d'activité inférieurs à leurs attentes.

|

802 de 1041

-

22/5/2019 20:57

0

0

adrian j boris

Messages postés: 302 -

Membre depuis: 28/6/2018

Total : et Eni remportent quatre blocs en Côte d'Ivoire

share with twitter share with LinkedIn share with facebook share via e-mail

0

22/05/2019 | 19:21

TOTAL ET ENI REMPORTENT QUATRE BLOCS EN CÔTE D'IVOIRE

ABIDJAN (Reuters) - La Côte d'Ivoire a annoncé mercredi avoir attribué l'exploitation de quatre nouveaux blocs pétroliers et gaziers offshore à Total et à Eni, qui vont se répartir à parts égales ces gisements.

Premier producteur mondial de cacao, la Côte d'Ivoire veut développer son secteur pétrolier, longtemps négligé.

Les deux pétroliers vont investir au total 185 millions de dollars (163,3 millions d'euros) durant la phase d'exploration, 90 millions pour le groupe français et 95 millions pour son concurrent italien, a précisé Sidi Touré.

La compagnie nationale ivoirienne Petroci Holding détiendra 10% de chaque bloc, a-t-il ajouté.

(Loucoumane Coulibaly; Claude Chendjou pour le service français, édité par Catherine Mallebay-Vacqueur)

Valeurs citées dans l'art

|

803 de 1041

-

23/5/2019 07:53

0

0

waldron

Messages postés: 9813 -

Membre depuis: 17/9/2002

La pression vendeuse pourrait dominer les échanges futurs

|

|

|

Recevoir les alertes

|

|

Zonebourse par email et SMS

|

|

|

Analyse du 22/05/2019 | 11:35

Opinion : Négative sous les 50 EUR

Objectif de cours : 46.5 EUR

Stop de protection: 51.3 EUR

| EURONEXT PARIS

Pétrole et gaz - compagnies intégrées |

Total conserve une configuration graphique fragilisée et pourrait entamer un repli sous la résistance des 50 EUR.

Techniquement, la tendance est baissière à moyen terme et haussière à

court terme. Les indicateurs mettent en avant une situation de surachat

au cours des dernières séances. Cet élément peut révéler un potentiel de

reprise limité à proximité de la résistance des 50 EUR.

Un mouvement de consolidation devrait prochainement se mettre en place

et ramener la valeur sur les 46.5 EUR, première zone de soutien

importante.

On pourra donc passer vendeur par l'intermédiaire du turbo put infini

Citigroup 75HIC qui cote 1.64 EUR. Le ralliement des 46.5 EUR

permettrait de réaliser un gain de l'ordre de 33% pour ce produit

dérivé. Le seuil d'invalidation théorique fixé initialement vers 51.3

EUR limitera le risque à 25%.

Nous assurons le suivi des produits proposés et rédigeons une

nouvelle recommandation pour la sortie de la ligne (sauf en cas de

désactivation). A ce titre, les objectifs et seuils d’invalidation sont

indiqués à titre informatif et peuvent évoluer en fonction des

conditions de marché et de nos convictions.

| Mnemo | Type | Strike | Barrière | Echéance | | FP | PUT | 57.3375 | 55.75 |

-

|

| Cours | Obj. théorique | Risk théorique | | 1.64 | 33% | -25% |

>> Retrouvez toutes nos recommandations produits dérivés

|

804 de 1041

-

25/5/2019 14:29

0

0

La Forge

Messages postés: 1339 -

Membre depuis: 03/8/2000

PARIS (Agefi-Dow Jones)--Le groupe pétrolier français Total

cherche à vendre environ un tiers de sa participation dans le gisement

pétrolier de Kashagan, au Kazakhstsan, pour un montant pouvant aller

jusqu'à 4 milliards de dollars (environ 3,5 milliards d'euros), a

rapporté l'agence Reuters vendredi.

Total a discuté

avec une compagnie pétrolière nationale chinoise au cours des derniers

mois mais les deux entreprises ne sont pas parvenues à s'entendre sur le

prix, a indiqué l'agence, citant des sources proches du dossier.

Total détient une participation de 16,8% dans le permis Nord Caspienne

qui couvre le champ pétrolier géant de Kashagan. Les autres majors en

charge de l'exploitation du champ sont Eni, Royal Dutch Shell, Exxon

Mobil, et China National Petroleum.

Contacté par l'agence Agefi-Dow Jones, Total n'était pas disponible dans l'immédiat pour commenter ces informations.

Une vente de tout ou partie de la participation de Total dans le champ

de Kashagan permettrait au groupe de dégager des liquidités alors qu'il

convoite d'autres actifs. Total a annoncé début mai un accord avec

Occidental Petroleum en vue de reprendre les actifs africains de

l'américain Anadarko pour 8,8 milliards de dollars (7,9 milliards

d'euros) dans le cas où ce dernier serait racheté par Occidental.

-François Schott, Agefi-Dow Jones; +33 (0)1 41 27 47 92; fschott@agefi.fr ed: ECH

Agefi-Dow Jones The financial newswire

(END) Dow Jones Newswires

May 24, 2019 09:25 ET (13:25 GMT)

|

805 de 1041

-

30/5/2019 09:13

0

0

La Forge

Messages postés: 1339 -

Membre depuis: 03/8/2000

Total va distribuer un dividende de 2,56 E par action

Cercle Finance•29/05/2019 à 16:45

(CercleFinance.com) - Total annonce que son assemblée générale réunie

ce jour a adopté les résolutions agréées par le conseil

d'administration, dont la distribution d'un dividende de 2,56 euros par

action, en hausse de 3,2% par rapport à celui de l'année précédente.

Total et Shell se traitent environ 9,7 fois, au-dessus d'OMV (8,1 fois),

quand Repsol affiche un ratio de 7,5 fois seulement.

|

806 de 1041

-

16/6/2019 23:04

0

0

sarkasm

Messages postés: 1319 -

Membre depuis: 26/2/2009

Total: Positive Developments Showcasing The Growth Story Jun. 16, 2019 2:40 PM ET| 4 comments| About: TOTAL S.A. (TOT), Includes: BP, CEO, PBR, RDS.A, RDS.B

Power Hedge Macro, energy, alternative energy, contrarian Marketplace Energy Profits in Dividends (6,970 followers)

Summary Total is on track to deliver approximately 9% production growth this year. Over the past week, the company has started production at the enormous Culzean field in the North Sea. The

FID for the Mero 2 project in Brazil was just announced, so this will

also contribute to the company's forward growth starting next decade. These things should result in forward revenue growth for Total, barring a sharp downturn in oil prices. The

company's stock might be slightly overvalued at present levels, but it

does sport a much more attractive valuation than most of its peers do.

Looking for a community to discuss ideas with? Energy Profits in

Dividends features a chat room of like-minded investors sharing

investing ideas and strategies. Get started today »

The past week has seen quite a few positive developments for French oil and gas supermajor Total S.A. (TOT).

As might be expected, these developments broadly support the growth

thesis that I have discussed in some of my past articles on the company.

In particular, we see that the company is well-positioned to continue

to grow its production going forward. All else being equal, this should

have a positive effect on the company's financial performance. Let us

have a look at a few of these developments and how they are likely to

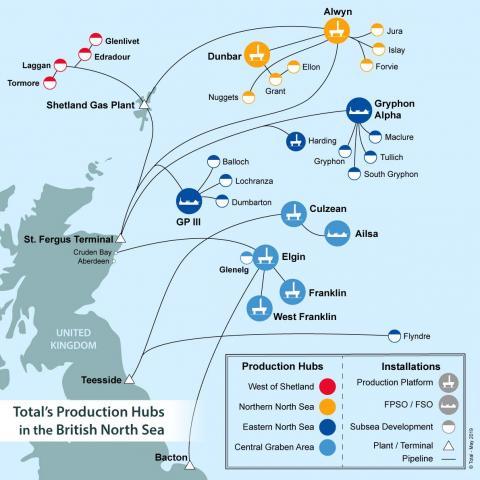

benefit the company over the coming years. Culzean Field In The North Sea The first positive development that we will be discussing here came about on Tuesday, June 11, 2019. On this date, the company stated

that it has begun producing from the massive Culzean natural gas field

in the U.K. portion of the North Sea. I first discussed the potential of

this massive field in a previous article on the company. As

just mentioned, the Culzean natural gas field is located in the U.K.

portion of the North Sea, approximately 230 km from Aberdeen. It is just

one of the fields that the company has in the region:

Source: Total S.A.

The Culzean field was first

discovered in 2008 by Maersk Oil, whose stake was transferred to Total

following an acquisition last year. The current owners are Total, with a

49.99% interest, BP (BP),

with a 32% interest, and JX Nippon, with an 18.01% stake. The field is

currently considered to be one of the largest natural gas fields in the

North Sea, containing an estimated 250 to 300 million barrels of oil

equivalent in place. This also provides the field with a very high level

of maximum production. The field is expected to produce about 100,000

barrels of oil equivalent per day at its peak, which would be

approximately 5% of the total natural gas output of the United Kingdom. Unlike

some of the other projects that we have seen in the North Sea recently,

Culzean was brought to first production ahead of schedule. In addition,

the project was completed at about $500 million under budget. The fact

that the project was under budget is something that is always nice to

see as it frees up money that the company can use for other purposes. The

development project was actually a fairly intensive one as it involved

the drilling of six wells and the construction of three bridge-linked

platforms along with a floating storage and offloading unit. This

project was originally expected to cost about $5 billion. Now

that the project is operational, roughly half of the gas produced by

the Culzean field will accrete to Total's production totals. This will

result in steady growth for the company as it gets ramped up over the

coming months. Assuming that we do not see a sharp decline in energy

prices, this should also have a positive impact on the company's

revenues. Mero Field In Brazil The

second major development that we saw this week also came on Tuesday,

June 11, 2019. This development was Brazilian energy giant Petrobras (PBR) announcing

its final investment decision to proceed with the development of the

Mero project located in the resource-rich Libra block in the pre-salt.

Total is a partner in this project with a 20% stake in it so it will

receive some of the benefits of its development. The Mero project is located

approximately 180 km from Rio de Janeiro in the pre-salt Libra block.

This is a block that some long-time readers may recognize as it is a

very resource-rich block that I have discussed multiple times in my past

writings. The block is jointly controlled by Petrobras, with a 40%

stake, Total, with a 20% stake, Royal Dutch Shell (RDS.A) (NYSE:RDS.B), with a 20% stake, CNOOC (CEO), with a 10%, and CNPC, with a 10% stake. All of these companies will ultimately benefit from this development. The

first phase of the Mero project started operation back in November

2017. This second phase is meant to increase the production output of

the field. It will accomplish this both by ordinary production additions

and via a second FPSO unit that will be capable of processing

approximately 180,000 barrels of liquids per day. This is significantly

more than the 50,000 barrels per day that the other FPSO at the site is

capable of handling. However, the second unit will not, by itself,

maximize the production of the field. At peak production, the Mero field

is expected to be producing approximately 600,000 barrels of oil per

day. As of yet, no estimated date has been provided for when the field

is expected to be producing at this level, but it will certainly be at

least a few years out. The Mero 2 FPSO alone is not expected to start

operating until 2022 and there will clearly be a great deal of work to

do after that to reach this 600,000 barrel per day level. In the first quarter of 2019,

Total had an average hydrocarbons production of 2.946 million barrels

of oil equivalents per day. The company's 20% stake of this 600,000

barrels of oil equivalents per day is 120,000 boe/day, which would be a

4% increase over first-quarter levels. Admittedly, this seems rather

modest, but when we combine it with the other projects that Total is

bringing online over the next few years, we see that Total has some

strong forward growth potential. Total's Growth Prospects As

I discussed in an earlier article (linked above), Total has strong

growth prospects this year. The company has several projects scheduled

to come online this year, including Kaombo Sul in Angola, Iara 1 in

Brazil, and the enormous Johan Sverdrup field in Norway. Of course, we

also have the Culzean field in the United Kingdom that was already

discussed. Altogether, these projects should be able to grow the

company's production by about 9% in 2019 alone. This would come on the

back of the 9% production growth that the company delivered in 2018.

Barring a steep decline in energy prices, this 2019 production growth

should have a beneficial impact on Total's revenues and cash flows. Valuation All

this growth is well and good, but as is always the case, we do not want

to pay too much for it. This is because overpaying for any asset is a

surefire way to ensure sub-optimal returns from that asset. In the case

of a large energy company like Total, one valuation metric that we can

use to value it is the price-to-earnings growth ratio. This is a way of

adjusting the more familiar price-to-earnings ratio to take a company's

forward earnings growth into account. As a general rule, a

price-to-earnings growth ratio over 1.0 could be an indication that a

stock is undervalued relative to its forward growth prospects and vice

versa. According to Zacks Investment Research,

Total is expected to grow its earnings per share at a 9.34% rate over

the next three to five years. At the current stock price, this gives

Total a price-to-earnings growth ratio of 1.05. Thus, this would appear

to indicate that the stock is slightly overvalued at its present level

and potential investors may want to wait for a dip in the price before

buying in. With that said though, this is a better valuation than most

of Total's peers have so it might still be worth dipping a toe in. Conclusion In

conclusion, we saw several positive developments for Total's growth

story play out this week. The company managed to grow its production by

9% last year and is on track to deliver that same performance this year,

which should have a positive impact on the company's earnings. With

that said though, Total might still be slightly overvalued at the

present level, but it does certainly have a more attractive valuation

than its peers do so it might still be worth taking a chance on. Those

investors that prefer to be cautious, though, may want to buy on any

dips.

At

Energy Profits in Dividends, we seek to generate a 7%+ income yield by

investing in a portfolio of energy stocks while minimizing our risk of

principal loss. By subscribing, you will get access to our best ideas

earlier than they are released to the general public (and many of them

are not released at all) as well as far more in-depth research than we

make available to everybody. We are currently offering a two-week free

trial for the service, so check us out!

|

807 de 1041

-

17/6/2019 10:55

0

0

The Grumpy Old Men

Messages postés: 1134 -

Membre depuis: 02/1/2007

https://www.saftbatteries.com/fr/communiqu%C3%A9s-...

|

808 de 1041

-

28/6/2019 11:31

0

0

The Grumpy Old Men

Messages postés: 1134 -

Membre depuis: 02/1/2007

Le titre devrait consolider

|

|

|

Recevoir les alertes

|

|

Zonebourse par email et SMS

|

|

|

Analyse du 28/06/2019 | 09:26

Opinion : Négative sous les 49.75 EUR

Objectif de cours : 46.7 EUR

Stop de protection: 50.2 EUR

|

|

Le

titre Total a rebondi ces dernières semaines dans le sillage des cours

pétroliers. La valeur est ainsi revenue au contact de la zone de

résistance des 49.75 EUR, niveau qui pourrait susciter quelques

dégagements.

Sous ce niveau, nous anticipons l'amorce d'une correction technique avec les 46.7 EUR comme principal objectif baissier.

Nous profitons donc de la zone de cours actuelle pour passer vendeurs

par l'intermédiaire du turbo put illimité Commerzbank N556Z qui cote

0.58 EUR. Le ralliement des 46.7 EUR permettrait de réaliser un gain de

l'ordre de 38% pour ce produit dérivé. Le seuil d'invalidation théorique

fixé initialement vers 50.2 EUR limitera le risque à 22%.

Nous assurons le suivi des produits proposés et rédigeons une

nouvelle recommandation pour la sortie de la ligne (sauf en cas de

désactivation). A ce titre, les objectifs et seuils d’invalidation sont

indiqués à titre informatif et peuvent évoluer en fonction des

conditions de marché et de nos convictions.

| Mnemo | Type | Strike | Barrière | Echéance | | N556Z | PUT | 54.613 | 53.5 |

-

|

| Cours | Obj. théorique | Risk théorique | | 0.58 | 38% | -22% |

>> Retrouvez toutes nos recommandations produits dérivés

|

809 de 1041

-

03/7/2019 08:52

0

0

La Forge

Messages postés: 1339 -

Membre depuis: 03/8/2000

3/07/2019 | 08:48

PARIS (Agefi-Dow Jones)--Le groupe pétrolier Total a annoncé jeudi le

démarrage de sa bioraffinerie de La Mède, située dans les

Bouches-du-Rhône, avec la production des premiers litres de

biocarburants.

Ce projet lancé en 2015 a bénéficié d'un investissement de 275

millions d'euros. Il consistait en la reconversion d'une raffinerie

d'hydrocarbures en une plateforme de nouvelles énergies.

La bioraffinerie nouvellement créée a une capacité de production de

500.000 tonnes de HVO, un biocarburant de qualité premium. Elle produira

du biodiesel ainsi que du biojet pour l'aviation.

Par ailleurs, elle "a été spécifiquement conçue pour pouvoir traiter

tout type d'huiles", a indiqué le groupe dans un communiqué.

Les biocarburants seront produits pour 60-70% à partir d'huiles

végétales 100% durables et pour 30-40% à partir de retraitement de

déchets.

Au total, "100% des huiles traitées à La Mède sont certifiées durables

selon les critères exigés par l'Union Européenne", a souligné Total.

-François Berthon, Agefi-Dow Jones; +33 (0)1 41 27 47 93; fberthon@agefi.fr ed: VLV

Agefi-Dow Jones The financial newswire

|

810 de 1041

-

04/7/2019 11:28

0

0

adrian j boris

Messages postés: 302 -

Membre depuis: 28/6/2018

Total lance la Phase 3 du développement du champ de Dunga au Kazakhstan

share with twitter share with LinkedIn share with facebook share via e-mail

0

04/07/2019 | 11:22

PARIS (Agefi-Dow Jones)--Le groupe pétrolier Total a annoncé jeudi avoir approuvé, avec ses partenaires, la Phase 3 du développement du champ de pétrole de Dunga, dans l'ouest du Kazakhstan.

PRINCIPAUX POINTS DU COMMUNIQUE:

-Ce projet nécessite un investissement de 300 millions de dollars et créera 400 emplois directs de plus dans la région, au plus fort du chantier de construction.

-La Phase 3 du champ de Dunga, opéré par Total, comprend le raccordement de puits supplémentaires aux infrastructures existantes et l'augmentation de la capacité de traitement de l'usine de 10% à 20.000 barils de pétrole par jour en 2022. Elle permettra la production de plus de 70 millions de barils de réserves supplémentaires.

-Le lancement de ce projet est rendu possible par l'approbation du Gouvernement de la République du Kazakhstan quant à l'extension de 15 ans de l'accord de partage de production (PSA) du champ de pétrole de Dunga signé en 1994 et dont l'expiration était prévue en 2024.

-Le champ pétrolier de Dunga est opéré par Total (60%), aux côtés de l'Oman Oil Company (20%) et de Partex (20%).

-Agefi-Dow Jones; +33 (0)1 41 27 48 11; djbourse.paris@agefi.fr ed: LBO

Agefi-Dow Jones The financial newswire

|

811 de 1041

-

08/7/2019 16:08

0

0

sarkasm

Messages postés: 1319 -

Membre depuis: 26/2/2009

PARIS (Agefi-Dow Jones)--Total Eren et EDF Renouvelables ont annoncé lundi dans un communiqué la signature de quatre contrats de vente d'électricité (Power Purchase Agreement ou PPA) en Inde, chacun d'une durée de 25 ans.

PRINCIPAUX POINTS DU COMMUNIQUE:

-Ces contrats concernent quatre projets de centrales solaires situés

dans le nord de l'Inde et totalisant une capacité de 716 MWc.

-Ces projets photovoltaïques ont été remportés par EDEN Renewables

India, entreprise codétenue à parité qui porte les activités solaires

photovoltaïques des deux partenaires en Inde.

-Agefi-Dow Jones; +33 (0)1 41 27 48 11; djbourse.paris@agefi.fr ed: LBO

(END) Dow Jones Newswires

July 08, 2019 04:18 ET (08:18 GMT)

|

812 de 1041

-

09/7/2019 16:38

0

0

waldron

Messages postés: 9813 -

Membre depuis: 17/9/2002

Total : début des livraisons de batteries Saft pour la CTA 09/07/2019 | 14:28

Saft,

filiale de batteries de Total, annonce avoir commencé à livrer ses

systèmes batteries au nouveau site de CRRC Sifang America dédié à la

fabrication des rames série 7000 commandées par la Chicago Transit

Authority (CTA).

Ces batteries, commandées en avril 2018 à

l'issue d'un appel d'offres, assureront l'alimentation de secours des

systèmes critiques (éclairage, chauffage, commande des portes et

systèmes de communication) des rames de nouvelle génération de la CTA.

Le

contrat, le plus important remporté à ce jour par la société en

Amérique du Nord, prévoit une commande initiale de coffres de batteries

destinés à 400 rames, assortie d'options pour 446 coffres

supplémentaires.

|

813 de 1041

-

10/7/2019 08:17

0

0

grupo

Messages postés: 1061 -

Membre depuis: 11/5/2004

TOTAL - Credit Suisse relève sa recommandation à “surperformer” contre

“neutre” et abaisse son objectif de cours à 58 euros contre 60 euros.

|

814 de 1041

-

10/7/2019 08:38

0

0

grupo

Messages postés: 1061 -

Membre depuis: 11/5/2004

Total cède pour 635 millions de dollars d'actifs non stratégiques au Royaume-Uni 10/07/2019 | 08:33

PARIS (Agefi-Dow Jones)--Le groupe pétrolier Total a annoncé mercredi

avoir signé un accord pour la cession de plusieurs actifs non

stratégiques situés au Royaume-Uni à Petrogas NEO, la branche

exploration-production du conglomérat omanais MB Holding, pour un

montant de 635 millions de dollars, soit environ 570 millions d'euros.

"Cette transaction est en ligne avec notre stratégie de gestion de

portefeuille qui vise à abaisser notre point mort en optimisant

l'allocation du capital et en cédant les actifs à coûts techniques

élevés. Notre objectif premier est de maintenir notre point mort

organique avant dividende sous 30 dollars le baril et nous montrer plus

sélectifs dans notre portefeuille nous permettra d'y parvenir" a déclaré

Arnaud Breuillac, le directeur général exploration-production de Total,

cité dans un communiqué.

L'opération reste soumise à l'approbation des autorités et devrait

être finalisée en décembre 2019, a ajouté le groupe pétrolier.

Les actifs à céder étaient précédemment détenus par Maersk Oil, une

société rachetée par Total en 2018 et qui lui a permis de devenir le

deuxième opérateur en mer du Nord.

-Dimitri Delmond, Agefi-Dow Jones; +33 (0)1 41 27 47 31; ddelmond@agefi.fr ed: LBO

Agefi-Dow Jones The financial newswire

|

815 de 1041

-

10/7/2019 16:13

0

0

adrian j boris

Messages postés: 302 -

Membre depuis: 28/6/2018

Total : petite hausse après une analyse positive

share with twitter share with LinkedIn share with facebook share via e-mail

0

10/07/2019 | 12:41

Dans un marché parisien en baisse symbolique de 0,1%, l'action Total grappillait 0,5%, vers 50 euros, après que Credit suisse a relevé à l'achat ('surperformance'), contre 'neutre' précédemment, son conseil sur le titre.

En substance, les analystes s'attendent à ce que Total donne davantage de visibilité sur sa politique de retour de cash aux actionnaires lors de la journée stratégique qui sera organisée en septembre. La cible visée est de 58 euros.

|

816 de 1041

-

15/7/2019 13:47

0

0

maywillow

Messages postés: 1324 -

Membre depuis: 27/1/2002

Total : baisse de la marge de raffinage au 2e trimestre 15/07/2019 | 09:21

Total

indique que sa marge sur coûts variables, raffinage Europe (marge de

raffinage) a chuté à 27,6 dollars par tonne au deuxième trimestre 2019,

contre 33 dollars au trimestre précédent et 33,9 dollars un an

auparavant.

Pour rappel, cette marge est égale à la différence

entre les ventes de produits raffinés réalisées par le raffinage

européen de Total et les achats de pétrole brut avec les coûts variables

associés divisée par les quantités raffinées en tonnes.

Par

ailleurs, la compagnie énergétique précise que sur le trimestre écoulé,

le prix moyen du baril du Brent est ressorti à 68,9 dollars le baril

($/b), le prix moyen de ventes des liquides à 63,7 $/b, et celui du gaz à

3,82 $/Mbtu.

|

817 de 1041

-

25/7/2019 08:40

0

0

grupo

Messages postés: 1061 -

Membre depuis: 11/5/2004

PARIS (Agefi-Dow Jones)--Le spécialiste de l'énergie Total a confirmé jeudi ses objectifs de production pour 2019, après une hausse de 9% de cette dernière au cours d'un deuxième trimestre marqué par des marchés volatils et des perspectives toujours incertaines pour la croissance de la demande mondiale d'hydrocarbures.

"Les marchés

restent volatils avec un Brent qui s'est établi à 69 dollars le baril en

moyenne au deuxième trimestre, en hausse de 9% par rapport au trimestre

précédent mais avec des prix du gaz en retrait de 36% en Europe et 26%

en Asie", a expliqué le PDG du groupe, Patrick Pouyanné, cité dans un

communiqué.

Pour les trois mois clos le 30 juin, la

major pétrolière a dégagé un résultat net part du groupe de 2,89

milliards de dollars, comparé à un bénéfice de 3,72 milliards de dollars

sur la même période en 2018.

Le bénéfice net ajusté,

calculé au coût de remplacement, hors éléments non récurrents et hors

effet des variations de juste valeur, a reculé à 2,89 milliards de

dollars au deuxième trimestre, contre 3,55 milliards de dollars un an

plus tôt. "Cette baisse s'explique par la baisse du résultat

opérationnel net ajusté des secteurs et par l'augmentation du coût net

de la dette nette sur un an notamment du fait de la remontée des taux

d'intérêt en dollar", a expliqué Total dans un communiqué.

Selon un consensus réalisé par FactSet, les analystes tablaient en

moyenne sur un résultat net ajusté de 2,34 milliards de dollars. Le

résultat net ajusté, qui exclut certains éléments comme les stocks de

pétrole et des participations financières, est très suivi par les

opérateurs de marché.

Le résultat opérationnel ajusté

du groupe est ressorti à 3,59 milliards de dollars au deuxième

trimestre, contre 4,18 milliards de dollars un an plus tôt. Cette baisse

de 14% par rapport au deuxième trimestre 2018 est principalement due à

la baisse des prix du Brent et du gaz sur un an.

La

dette nette de Total s'établissait à 31,01 milliards de dollars à la fin

juin, contre 29,74 milliards de dollars fin mars et 23,77 milliards de

dollars fin juin 2018. Le ratio dette nette sur capital s'affichait

ainsi à 20,6% à la fin juin, contre 19,8% trois mois auparavant et 16,5%

fin juin 2018. Les taux d'endettement à fin mars et juin 2019 intègrent

l'impact de la nouvelle norme comptable IFRS 16, entrée en vigueur au

1er janvier, selon laquelle certains contrats locatifs sont désormais

comptabilisés dans la dette.

La production

d'hydrocarbures de Total a atteint 2,96 millions de barils équivalent

pétrole (BEP) par jour au deuxième trimestre, en hausse de 9% sur un an.

Pour l'ensemble de l'année, Total a confirmé

s'attendre à une croissance supérieure à 9% de sa production

d'hydrocarbures, "grâce à la montée en puissance de projets démarrés en

2018 et aux démarrages au premier semestre de Kaombo Sul en Angola et

Culzean en mer du Nord britannique ainsi que ceux à venir de Johan

Sverdrup en Norvège et Iara 1 au Brésil".

"Depuis le

début du troisième trimestre 2019, le Brent évolue au-dessus de 60

dollars le baril dans un contexte de reconduction des quotas de la

coalition OPEP+ et des incertitudes sur l'évolution de la production en

Libye, au Venezuela et en Iran. L'environnement reste volatil avec une

incertitude sur la croissance de la demande d'hydrocarbures liée aux

perspectives sur la croissance économique mondiale", a prévenu Total.

"Le groupe maintient sa discipline sur les dépenses en 2019 avec un

objectif d'investissements organiques autour de 14 milliards de dollars

et de coûts de production de 5,5 dollars par baril équivalent pétrole.

Le point mort cash organique avant dividende restera inférieur à 30

dollars le baril", a précisé Total. Au deuxième trimestre, ce point mort

organique a été inférieur à 25 dollars et celui après dividende

inférieur à 50 dollars le baril, a souligné l'énergéticien.

-Alice Doré, Agefi-Dow Jones; +33 (0)1 41 27 47 90; adore@agefi.fr ed: VLV

COMMUNIQUES FINANCIERS DE TOTAL:

https://www.total.com/fr/actionnaires

Agefi-Dow Jones The financial newswire

(END) Dow Jones Newswires

July 25, 2019 02:00 ET (06:00 GMT)

|

818 de 1041

-

Modifié le 02/8/2019 18:37

0

0

waldron

Messages postés: 9813 -

Membre depuis: 17/9/2002

https://seekingalpha.com/article/4280699-total-sol...

Total: A Solid Oil Supermajor With A Long-Term Strategy Aug. 2, 2019 10:51 AM ET| About: TOTAL S.A. (TOT)

Fun Trading Special situations, contrarian, long/short equity, value (12,703 followers)

Summary Total

revenues (excluding excise tax) came in at $51.24 billion, down 2.5%

from $52.54 billion generated in the year-ago quarter. Total

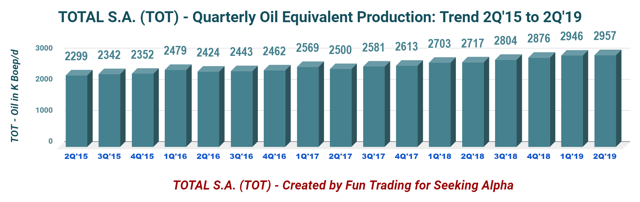

hydrocarbon production during the second quarter of 2019 averaged 2,957K

Boe/d, up from 2,717K Boe/d the same quarter last year. The

French-based Total S.A. is part of my selected "integrated" oil

supermajors and is the perfect candidate for a long-term investment.

Source: Steelguru/Wcom Investment Thesis The French-based Total S.A. (TOT) is part of my selected "integrated" oil supermajors and is the perfect candidate for a long-term investment. One

central component that the company shares with the big-oil group is

that it runs operations related to the integration of most aspects of

the value-oil chain. From upstream to downstream and chemicals, it has

all. Another characteristic that differentiates Total S.A. from most of its peers, besides Equinor (EQNR),

is that the North American region in terms of production is quite

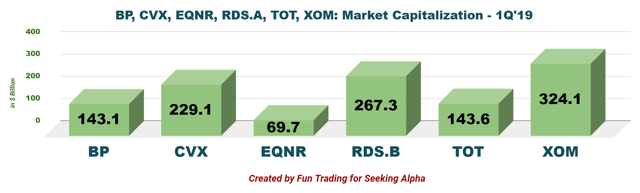

limited. However, Total's market capitalization is similar to BP Plc. (BP). Total belongs to the group "big oils" also called the "Dividend Aristocrats" - Exxon Mobil (XOM), Chevron (CVX), BP Plc, Equinor, and Royal Dutch Shell (RDS.A) (RDS.B).

The graph below is still showing the market capitalization for the six

oil majors in 1Q'19. I will change it when I get all the data for 2Q'19.

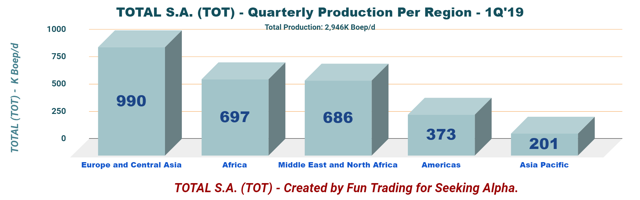

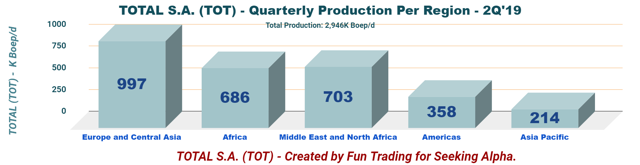

Total S.A. is very diversified and

active worldwide with one strong sector called Europe and Central Asia.

However, unlike Chevron or Exxon Mobil, its presence in the US is

limited to about 10%, and the chart below describes Total's

oil-equivalent production per region in 2Q'19 (upstream), with Americas

representing only 12.7% of the total output of the company:

Patrick de La Chevardiere, the CFO, said in the conference call: We

reported, I would say, as usual, solid second quarter result that

demonstrate the resilience of our portfolio and the benefit of our

best-in-class production growth despite an adverse environment in terms

of gas prices and refining margins.

The

investment thesis continues to be a long-term approach, and nothing has

changed since the last quarter. However, investing in the oil business

requires an adapted short-term trading solution representing about 30%

of your position. TOT is trading in tight correlation with oil and gas

prices and will move with the same applied volatility, and it is

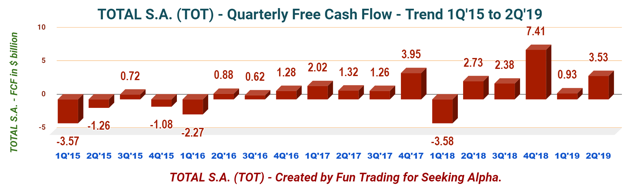

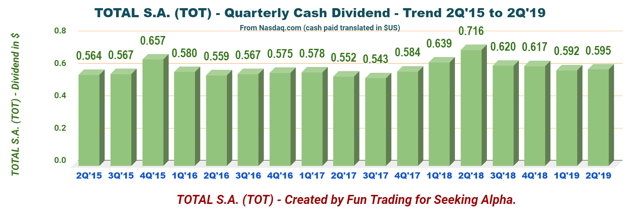

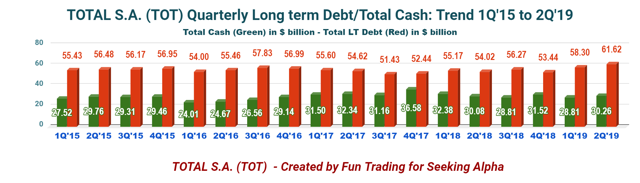

essential to take advantage of this situation. Balance Sheet and Production in 2Q 2019: The Raw Numbers | TOTAL S.A. | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 | | Total Revenues in $ Billion | 47.35 | 49.61 | 52.54 | 54.22 | 52.50 | 51.21 | 51.24 | | Total Revenues (minus excise tax) in $ Billion | 41.44 | 43.29 | 46.10 | 48.40 | 46.31 | 45.12 | 45.20 | | Net Income in $ Billion | 1.02 | 2.64 | 3.72 | 3.96 | 1.13 | 3.04 | 2.76 | | EBITDA $ Billion | 7.71 | 7.68 | 9.71 | 10.34 | 6.86 | 9.33 | 8.80 | | EPS diluted in $/share | 0.37 | 0.99 | 1.38 | 1.47 | 0.40 | 1.16 | 1.00 | | Cash from operating activities in $ Billion | 8.62 | 2.08 | 6.25 | 5.74 | 10.64 | 3.63 | 6.25 | | Capital Expenditures in $ Billion | 4.66 | 5.67 | 3.51 | 3.35 | 3.23 | 2.70 | 2.73 | | Free Cash Flow in $ Billion | 3.95 | -3.58 | 2.73 | 2.38 | 7.41 | 0.93 | 3.53 | | Total Cash $ Billion | 36.58 | 32.38 | 30.08 | 28.81 | 31.52 | 28.81 | 30.26 | | Long term Debt in $ Billion | 52.44 | 55.17 | 54.02 | 56.27 | 53.44 | 58.30 | 61.62 | | Dividend per share (Nasdaq.com) in $ | 0.584 | 0.639 | 0.716 | 0.620 | 0.617 | 0.592 | 0.595 (€0.66 per share) | | Shares outstanding (diluted) in Billion | 2.759 | 2.636 | 2.696 | 2.674 | 2.637 | 2.620 | 2.729 | | Oil Production | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 | | Oil Equivalent Production in K Boep/d | 2613 | 2703 | 2717 | 2804 | 2876 | 2946 | 2957 | | Americas Production in K Boep/d | 356 | 371 | 401 | 399 | 386 | 373 | 358 | | Global liquid price realized ($/Boe) | 43.3 | 47.3 | 54.3 | 55.4 | 46.9 | 45.4 | 47.7 (see note below) |

Source: Company filings and Morningstar Note: Global liquid price realized is based on $63.7 per barrel and $3.82 Mcf and 1,407.5 KBop/d and 1,549.5 K Boep/d ("ng"). Note

from the conference call about the dividend: "So first one is that we

make two dividend payments in the second quarter, and in the third

quarter non-payment will be done, and so we are clear the situation and

in the future from the Q4, we'll have one payment per quarter." Said

Jean Pierre Sbraire. Balance sheet and Production discussion 1 - Total Revenues were $51.24 billion (including excise tax) in 2Q'19

Total's revenues came in at $51.24 billion (including the excise taxes) or $45.202 billion net, down 2.5% from $52.54 billion generated in the year-ago quarter. Adjusted net income was $2.9 billion or $1.05 per share, an increase of 5% sequentially. Patrick de La Chevardiere said in the conference call: The

second quarter environment was marked by continued volatility. Brent

was at $60 per barrel in June, down from a high of $74 per barrel in

April. And in July, it has been regaining strength with support from

OPEC and geopolitical tensions.

Natural gas prices, notably, NBP

in Europe and spot LNG in Asia have fallen sharply in a move that we

attribute mainly to mild weather in the face of ample supply.

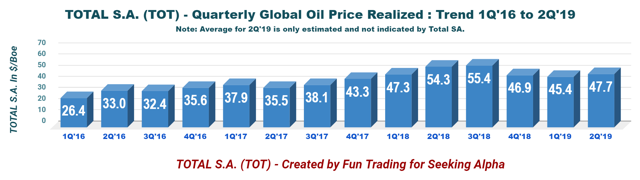

Average realized liquid price was $63.7 this quarter compared to $58.7 in 1Q'19. However, global hydrocarbon price achieved in 2Q'19 was estimated at $47.7

per Boe (could not find it this quarter in the filing and I have

determined it as explained in a note above), which is a 5% increase

sequentially but down 12.2% compared to 2Q'18 as we can see below:

Net income was $2.756 billion, down 25.9% from 2018 or $1.00 per share diluted. 2 - 2019 Guidance The

upstream production is expected to increase by 9% in 2019 compared to

2018. CapEx is expected in the range of $15-16 billion in 2019 and 2020.

However, organically, Total will spend $1.5 billion more than it did in

2018, from $12.5 billion to $14 billion. 3 - Free Cash Flow

Free cash flow yearly ("ttm") is $14.25 billion, and the company is paying about $8.2 billion in dividend annually. Furthermore,

TOT has indicated a share buyback program in February for $5 billion

and repurchased $0.4 billion worth of shares during second-quarter 2019. Free cash flow for 2Q'19 was $3.53 billion. TOT is passing the FCF test. Below is the dividend history paid according to Nasdaq.com.

Note: Total's dividend yield is now ~4.4% net. As

I said in my preceding article, Total is an American Deposit Receipt,

or ADR, and comes with foreign withholding taxes that will reduce the

dividend paid to an American investor. Total is not the only one in this

situation. An

American Depositary Receipt, or ADR, is a certificate issued by an

American bank that represents a certain number of shares of foreign

stock. From the individual investor's perspective, buying and selling

ADRs happens the exact same way we buy and sell regular stocks. -

Source: The Motley Fool.

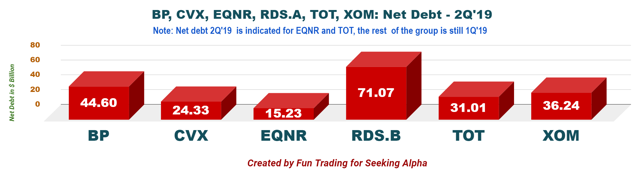

France's withholding rate on the dividend paid to U.S. ADR holders is 12.8%, which reduces the dividend yield paid. 4 - Net Debt is $31.01 billion according to the company as of the end of June.

Total cash as of June 30, 2019, was

about $30.259 billion compared with $30.084 billion the same quarter a

year ago. Net debt is now $31.01 billion with a net debt to EBITDA ("ttm") ratio of 0.88x, which is excellent. Net debt-to-capital ratio was 20.6% at the end of the second quarter of 2019, up from 19.8% in the 1Q'19. Net

debt comparison with Total's peers. The 2Q'19 net debt is valid only

for Equinor and Total. The four other supermajors have still 1Q'19 net

debt indicated in the chart below and will be actualized later.

5 - Oil Equivalent Production

Total hydrocarbon production during the second quarter of 2019 averaged 2,957K Boe/d, up from 2,717K Boe/d the same quarter last year (we can see a steady uptrend in the chart above). Production increased by 8.8%

from a year ago due to the acquisition of Maersk Oil and the ramp-up of

new projects (e.g., Yamal LNG, Moho Nord, or Fort Hills).

Reminder: On August 21, 2017, Total acquired Maersk Oil for $7.45 billion in a share and debt transaction. The deal closed on March 8, 2018. Also, the company acquired Engie's LNG assets in July 2018 for $1.5 billion. Liquids production averaged 1,407K Bop/d, or an increase of ~0.5%, from the year-ago period. Gas production during the quarter was 1,549K Boep/d, up ~17.6% year over year. Total sold mature fields in the UK North Sea for $0.6 billion this quarter. Patrick Pouyanné said in the conference call about the Anadarko acquisition: We

see these African assets of Anadarko are really a portfolio - a

world-class portfolio of assets in our African stronghold. And we have

accessed them at a very attractive price, more than 3 billion barrels of

resources for less than $60 per barrel; 100,000 barrel per day of

current production increasing to 160,000 barrel per day by early 2025.

Conclusion and Technical Analysis Total

S.A. is one of the top oil supermajors for numerous reasons. However,

US investors are often focusing on US oil supermajors and tend to ignore

foreign companies such as Total S.A., despite being the fourth-largest

oil and gas company in the world based on its market capitalization and

offering strong protection to any oil downturn due to its substantial

refineries segment. Furthermore, its dividend yield net is about ~5% supported by a robust business model and a low tax rate in France. As

an oil supermajor, Total is a fully integrated company operating in

four traditional segments: upstream, downstream (mostly refining),

marketing and gas and renewables and power. Production upstream has been

growing steadily since 2Q'17 or up 18.3% in two years, which is a great

achievement. On May 5, 2019, Total acquired the assets of Anadarko Petroleum (APC)

in Algeria, Ghana, Mozambique, and South Africa for $8.8 billion. The

sale of these assets was a prerequisite for the takeover of Anadarko by

Occidental Petroleum (OXY) to complete the deal. Patrick Pouyanné; the CEO, said in the conference call: The

Anadarko assets will contribute to replenishing our resource base and

clarify the outlook for the coming years. And the way forward is no

clear to us until 2025 at least. And it will be the theme of our

September strategy presentation.

Moreover, the transaction, which

is cash additive and cash accretive in dollars per barrel will allow us

to continue to actively manage the portfolio. Let me be clear, it's not

a matter of volume growth for us, but it's a matter of value creation

for all our shareholders. This is why we will sell at least $5 billion

of non-core assets over the 2019/2020 period to continue high-grading

the asset base, which is consistent with our fundamental goal of keeping

our discipline and balancing profitable growth and balance sheet

strength with improving shareholder returns.

Technical Analysis

TOT experienced a decisive negative breakout of its symmetrical wedge pattern recently due to bearish sentiment

in oil prices fueled by the recent decision to cut interest rate by 25

basis points which bolstered the $US and President Trump threat (another

tweet) to hike tariffs on over 300 billions of Chinese imports. The

escalation of the trade war creates a whole new mess for the oil

market. Higher tariffs will hit demand in China and potentially slow

down both economies - and have knock on effects for the global economy.

All of that is hugely negative for crude oil. The problem is that the

oil market was facing a looming supply surplus anyways, with demand

badly trailing supply growth.

Technically,

the first support should be around $48-50, which is a double bottom.

However, the situation can worsen if President Trump escalates this

trade war where the only possible scenario is a lose-lose one. In this

case, the next support is about $44. However, it is not likely. The immediate upside should

be $52, which was the old support of the precedent pattern, which is now

the resistance. I recommend adding around $49.50 and accumulate on any

weakness. Conversely, it is prudent to sell at $52. Future oil prices

are paramount, and any trading/investing strategy should be based on a

robust analysis of oil prices. Author's note: If

you find value in this article and would like to encourage such

continued efforts, please click the "Like" button below as a vote of

support. Thanks!

|

819 de 1041

-

04/8/2019 14:30

0

0

maywillow

Messages postés: 1324 -

Membre depuis: 27/1/2002

Sortie du turbo put sur Total (+53.4%)

|

|

|

Recevoir les alertes

|

|

Zonebourse par email et SMS

|

|

Analyse du 02/08/2019 | 09:02

|

Nous soldons le turbo put illimité Commerzbank N556Z portant sur le titre Total à 0.89 EUR.

Ce produit dérivé a été conseillé à 0.58 EUR, soit un gain de 53.4%.

| Mnemo | Type | Strike | Barrière | Echéance | | N556Z | PUT | 54.4 | 53.14 |

-

|

| Cours entrée | Cours de sortie | Performance | | 0.58 | 0.89 | 53.40% |

Voir la recommandation associée

|

820 de 1041

-

05/8/2019 09:40

0

0

The Grumpy Old Men

Messages postés: 1134 -

Membre depuis: 02/1/2007

PARIS (Agefi-Dow Jones)--La major pétrolière Total a annoncé lundi la signature d'un accord en vue de céder une participation de 30% dans la Société des Transports Pétroliers par Pipelines, ou Trapil, à Pisto SAS, un opérateur logistique et de stockage pétrolier, pour un montant de 260 millions d'euros.

"La vente de parts de cet actif

d'infrastructures s'inscrit dans le cadre de la stratégie de gestion

active du portefeuille de Total", a déclaré Jean-Pierre Sbraire, le

directeur financier de Total, rappelant que le groupe "n'a pas vocation à

détenir des actifs d'infrastructures mais à détenir des contrats

d'usage de telles infrastructures lorsqu'ils sont nécessaires à la

gestion de nos actifs industriels".

"Cette cession

contribuera à la réalisation de l'objectif de cession de 5 milliards de

dollars sur 2019-2020", a ajouté le dirigeant.

Suite à

cette transaction, soumise à l'approbation des autorités françaises

compétentes, Total restera actionnaire minoritaire de Trapil avec une

participation de 5,55%, a précisé le groupe dans un communiqué.

-François Berthon, Agefi-Dow Jones; +33 (0)1 41 27 47 93; fberthon@agefi.fr ed: VLV

Agefi-Dow Jones The financial newswire

(END) Dow Jones Newswires

August 05, 2019 02:56 ET (06:56 GMT)

|

|

1041 Réponses

... ...

|

|

Messages à suivre: (1041)

Dernier Message: 16/Juil/2022 05h35

|

|

Hot Features

Hot Features

Total : Bon timing long terme pour revenir à l'achat

http://www.zonebourse.com/TOTAL-4717/actualite-bourse/Bon-timing-long-terme-pour-revenir-a-l-achat-28573375/" target="popup">

10/05/2019 | 08:53

achat

En coursCours d'entrée : 47.11€ | Objectif : 49.25€ | Stop : 45€ | Potentiel : 4.54%

titre Total vers l'importante zone support des 46.05 EUR. Il apparaît

opportun d'exploiter ces niveaux de prix en données hebdomadaires.

On pourra se positionner à l'achat pour viser les 49.25 €.

Période :

Points forts

zone actuelle constitue un bon point d'entrée pour les investisseurs

intéressés par le dossier dans une optique à moyen / long terme. En

effet, le titre évolue à proximité du support des 46.05 EUR en données

hebdomadaires.

avec un ratio "valeur d'entreprise sur chiffre d'affaires" de l'ordre

de 0.76 pour l'exercice en cours, la société apparaît faiblement

valorisée.

de cours moyen des analystes suivant la valeur est relativement éloigné

et suppose un potentiel d'appréciation important.

Points faibles

groupe fait partie des entreprises dont les perspectives de croissance

apparaissent les plus faibles d'après les estimations d'analystes.