Royal Dutch Shell

-

28/10/2015 10:53

0

0

Grupo GuitarLumber

Messages postés: 1724 -

Membre depuis: 24/6/2003

(CercleFinance.com) - Après avoir renoncé, le mois dernier, à un projet offshore au nord de l'Alaska, la major pétro-gazière Royal Dutch Shell continue de sabrer ses actifs d'Amérique du Nord. C'est cette fois le projet de Carmon Creek, situé dans l'Etat canadien de l'Alberta réputé pour ses sables bitumineux et dont le potentiel était chiffré à 80.000 barils/jour, qui passe à la trappe. Ce qui occasionnera une charge pour dépréciation de l'ordre de deux milliards de dollars sur les comptes du 3e trimestre, attendus le 29 octobre.

Le projet était sur la sellette depuis mars 2015. Hier, Shell a annoncé qu'après avoir passé en revue le projet d'un point de vue technique et avoir mis à jour ses hypothèses de coûts, il ne considérait plus, en l'état actuel des choses, que Carmon Creek pouvait figurer au sein de son portefeuille d'actifs.

Le directeur général, Ben van Beurden, a déclaré que cette décision s'était imposée au groupe en raison notamment de la faiblesse actuelle des cours du pétrole.

L'un de problèmes dénoncés le plus clairement : l'absence d'infrastructure permettant de transporter le brut qui aurait été extrait de ce projet vers les marchés pétroliers globaux.

Les travaux de développement du gisement seront gelés et jusqu'à ce qu'une décision soit prise, une maintenance minimale des infrastructures actuelles sera de rigueur.

De ce fait, les comptes du 3e trimestre seront grevés par une provision pour dépréciation de l'ordre de deux milliards de dollars (1,8 milliard d'euros environ).

|

|

Réponses

245 Réponses

...

|

61 de 245

-

01/4/2016 12:04

0

0

maywillow

Messages postés: 1331 -

Membre depuis: 27/1/2002

(CercleFinance.com) - Toujours à l'achat sur l'action Royal Dutch Shell (Xetra: A0ET6Q - actualité) , UBS (London: 0QNR.L - actualité) a relevé ce matin son objectif de cours de 1.800 à 1.950 pence (soit 24,60 euros). Les analystes saluent la refonte stratégique mise en place par la 'major' pétro-gazière anglo-néerlandaise, notamment le rachat de BG Group (EUREX: 1007667.EX - actualité) . Et ils jugent que le marché ne la prend pas suffisamment en compte.

A la Bourse de Londres, l'action Shell (London: RDSB.L - actualité) de classe A se tass ecependant de 0,8% à 1.670 pence, quand à Amsterdam elle plie de 1,4% à 21 euros.

'Dans

un secteur de l'énergie en plein bouleversement, Shell a entrepris de se réformer avec audace', indique une note de recherche. Selon UBS, l'acquisition de BG Group permet au groupe de concentrer son portefeuille sur des actifs de haute qualité, un bon point étant donné l'historique de Shell en termes opérationnels.

En outre, cette

opération devrait aussi être l'occasion de 'réinitialiser' le profil de l'action Shell en tant qu'investissement en mettant davantage l'accent sur la rentabilité et la génération de cash. Et finalement en réduisant le profil de risque du groupe dans un marché énergétique très volatil. UBS a notamment revu à la hausse ses prévisions de synergies entre Shell et BG Group.

Prochain catalyseur en vue : la journée investisseurs que Shell organisera le 7 juin prochain.

|

62 de 245

-

01/4/2016 15:18

0

0

maywillow

Messages postés: 1331 -

Membre depuis: 27/1/2002

(CercleFinance.com) - Le (Taiwan OTC: 8490.TWO - actualité) bureau d'études Nomura a confirmé ce matin son conseil d'achat sur l'action de la 'major' anglo-néerlandaise Royal Dutch Shell (Xetra: A0ET6Q - actualité) . Selon les analystes, l'action Shell (London: RDSB.L - actualité) offre le plus fort potentiel de hausse via des restructurations de son secteur. L'objectif de cours reste fixé à 1.750 pence (environ 23,7 euros).

A Londres ce midi, l'action Shell de classe A perd 1,3% à 1.662 pence, quand à Amsterdam elle cède 1,8% à 20,9 euros.

L'intégration de BG Group (EUREX: 1007667.EX - actualité)

, sujet sur lequel Shell devrait faire le point le 7 juin prochain dans le cadre de sa journée investisseurs, est la clé de voûte de l'argumentation de Nomura. Selon eux, l'éventuelle dégradation de la notation crédit du groupe de 'Aa1' à 'A+' par les agences Moody's et Standard & Poor's devrait inciter le directeur général, Ben van Beurden, à accélérer les cessions et les réductions d'investissements avant d'envisager de toucher au dividende.

Les analystes

rappellent que la major américaine Exxon, considérée comme la valeur la plus proche de Shell, a d'ailleurs réduit de 25% son budget d'investissement pour 2016. 'C'est cette stratégie que le patron opérationnel de Shell devrait suivre', pronostique une note de recherche.

|

63 de 245

-

03/4/2016 20:01

0

0

grupo

Messages postés: 1072 -

Membre depuis: 11/5/2004

Iran says Shell cleared all debts

An Iranian official said on Sunday that

the global energy giant Royal Dutch Shell has cleared all outstanding

payments from previous oil sales and other related deals.

The announcement was made by Ali-Asqar Hendi, the head of the Debts Settlement Committee of the Ministry of Petroleum of Iran.

Hendi had previously said that Shell owes Iran over $2 billion.

The company had in early March announced that it had paid €1.77 billion

(£1.4 billion) it owed the National Iranian Oil Company (NIOC),

settling debts after sanctions against the country were lifted in

January.

The outstanding debt to Iran was a result of Iranian oil deliveries

which Shell had been unable to pay for due to sanctions, Reuters

reported on 7 March.

The Anglo-Dutch company resumed talks with Tehran on the debt after

most Western sanctions were lifted in January. The payments were made

over the next few weeks after the removal of the sanctions in euros as

dollar transactions are still under US sanctions, Reuters added.

Analysts believe that the move will now allow Shell to access the

Iranian oil market. This is because the NIOC has been working to recover

its debt, as a precondition to start exporting oil to Shell.

Shell, along with its European peers, has already showed a keen

interest to return to the Iranian oil and gas projects. The Anglo-Dutch

oil giant alongside BP, Total, and Statoil, sent a delegation to Tehran

in November last year, to explore opportunities in the upstream sector

of the country.

The company was involved in the development of Iran’s Soroush and

Norouz oil fields in Persian Gulf waters. It was also planning to

develop a gas liquefaction project called Persian LNG in Iran’s South

Pars energy zone. However, it later cancelled its plans to that effect

as a result of the sanctions.

The sanctions - that were lifted in January - for multiple years

imposed tight limits on Iran’s financial transactions with the world.

They also prevented companies from investing in the country’s energy

projects among other restrictions.

|

64 de 245

-

05/4/2016 08:57

0

0

grupo

Messages postés: 1072 -

Membre depuis: 11/5/2004

3 Reasons Royal Dutch Shell's Stock Could Rise

April 04, 2016, 09:55:05 AM EDT

By Tyler Crowe, The Motley Fool, Motley Fool

Comment

Image Source: Royal Dutch Shell via flickr.com The past half decade has not been too kind to shares of

Royal Dutch Shell

. Even when oil was at $100 a barrel or more, troubles with

overspending led to shares going pretty much nowhere. Once the

oil price plunge hit a little less than two years ago, things

got even worse.

RDS.B

data by

YCharts

Like so many other companies, the prospects of Shell's stock

price is going to wax and wane with the price of oil. Beyond

that, though, there are a few things that management is doing

that could help boost its share price over the long term. Let's

look at three catalysts that could help Shell put its shares

back on track in the coming years.

Robust LNG demand

For the most part, integrated oil companies avoid being overly

concentrated to a single aspect of the oil and gas industry.

They all have similar percentages of upstream & downstream

assets, and the same for a balance between oil and gas

production. The theory is that by having a broad, balanced

portfolio of assets, it helps to smooth out some of the

volatility in the market.

That being said, Royal Dutch Shell is making a pretty

outsized bet on the globalization of natural gas through LNG

shipments. With BG Group into the fold now, Shell's LNG

footprint is larger than the next two integrated oil companies

combined

Image Source: Royal Dutch Shell investor presentation We have started to see a bit of a decline in LNG prices, and

that has led some companies to rethink some of their LNG

investments a few years down the road. Ultimately, though, LNG

is a strong business for integrated oil companies because it's

mostly conducted with long term supply contracts that aren't

influenced too much by the fluctuation of

natural gas prices

. If Shell can realize some strong demand across its LNG

portfolio, it would likely provide a strong source of free cash

flow that can be used to pay dividends and other shareholder

friendly initiatives.

Strong cost savings from BG Group integration

Royal Dutch Shell pretty has much no control of the price of

the commodities which it sells, so the only real thing that the

company can control is its costs and its capital allocation.

This issue has come to the forefront for oil and gas producers

as they try to handle the low price environment, but it's quite

pertinent for Shell because it has just recently completed the

$50 billion acquisition of BG Group.

According to Shell, it believes that it can realize pre-tax

cost savings of $3.5 billion by 2018. To meet that sort of

ambitious savings, it will involve lots of job cuts and

consolidating operations in places were the company has large

overlap like Brazil, Australia, Egypt, and North America.

Image Source: Royal Dutch Shell investor presentation So there are plenty of opportunities to be more selective

about capital spending and to reduce costs in overlapping

regions. The real challenge now, though, is to actually execute

on those cost cuts. Trying to reshape the corporate culture and

operating procedures can be a daunting task, and the size of BG

Group will make it that much more challenging in the first

several months. If management can indeed meet its stated goals for lower

operational expenses and more targeted capital spending, then

it should really help the company boost its returns on capital,

something Shell has struggled with in recent years. A boost in

returns could go a long way in earning Shell a higher valuation

multiple and send its share price higher.

Making good on shareholder return program

For a long term shareholder, this is probably the most

important catalyst for the company's stock in the coming years.

In 2017, when management believes the BG integration will be

mostly complete and

oil

prices

were be in a better place, the company intends on buying back

about $25 billion worth of the company's stock over a three

year period. The company is waiting until 2017 to start the

program because it can't cover today's capital spending and

dividend payments with cash from operations. Management

estimates that by 2017, all capital spending and dividend

payments will be covered with cash, and some remaining from

asset sales and excess cash flow can go into repurchases.

A large portion of that is to help recover the share

dilution that took place following the BG acquisition, but if

the combined companies were to lead to much higher overall

earnings, then removing that many shares should go a long way

in boosting per share profits. So much of this shareholder return program is predicated on

oil prices, though. The combined company and its estimated cost

cutting is expected to bring the company's production

break-even price from $70 per barrel to the low-to-mid $60

range. It's an improvement, but still quite a ways off from

today's oil prices. If we don't see a decent rebound in oil

prices between now and 2017, though, this major share

repurchase program may need to be put on the back burner.

What a Fool believes

I -- and no one, really -- can predict where Shell's stock will

go in the next couple of months. With so many factors

influencing oil prices, Shell's stock could go in any direction

that oil prices go in the short term. Longer term, though,

strong LNG demand, realizing the cost benefits from the BG

merger, and making good on its shareholder return program would

go a long way in boosting Shell's per share value. For

investors, the thing to watch out for in the near term is any

news or progress related to cost savings related to the Shell

merger, if that goes off well, then it should help to set up

that large buyback program.

The stupid-simple way to score a 22% dividend

There's nothing better than cold, hard cash. That's why the

savviest investors are using five simple dividend "tricks" to

unlock the mountains of cash stocks are delivering to

investors on a silver platter. to learn how you could score

your cut of the profits too!

The article

3 Reasons Royal Dutch Shell's Stock Could

Rise

originally appeared on Fool.com.

Tyler Crowe

has no position in any stocks mentioned.

You can follow

him at Fool.com

or on

Twitter

@TylerCroweFool

.

The Motley Fool has no position in any of the stocks

mentioned. Try any of our Foolish newsletter services

free for 30 days

. We Fools may not all hold the same opinions, but we all

believe that

considering a diverse range of insights

makes us better investors. The Motley Fool has a

disclosure policy

.Copyright © 1995 - 2016 The Motley Fool, LLC. All rights

reserved. The Motley Fool has a

disclosure policy

.

The views and opinions expressed

herein are the views and opinions of the author and do not necessarily

reflect those of Nasdaq, Inc.

Read more: http://www.fool.com/investing/general/2016/04/04/3-reasons-royal-dutch-shells-stock-could-rise.aspx#ixzz44vtBeTVx

|

65 de 245

-

05/4/2016 19:52

0

0

La Forge

Messages postés: 1346 -

Membre depuis: 03/8/2000

Dan Dicker / Oilprice.com

@oilandenergy

10:51 AM ET

Getty Images

A violent crossing of the demand and supply may cause a steep rise in oil prices

RECOMMENDED FOR YOU

Watch Taylor Swift Fall Off a Treadmill While Rapping to Drake

Promoted

Donald Trump Sells Another Condo at Trump Park Avenue

Recommended by

Today, I’m going to try and tackle the reasoning for my ‘wild’ predictions

for oil reaching triple digits by the end of 2017. While I am nearly

alone in these forecasts, they are not just pulled out of space, but

with deep regard for the fundamental supply/demand picture that everyone

mostly agrees upon, combined with what I think is a deeper insight into

the likely trajectory of oil company leverage, financing and the role

of financial oil derivatives. Despite the technical nature of this discussion, I think I can make a

strong case for $120 oil in 2018 using only two charts of my own making

– one charting global demand, which is more universally agreed upon,

and then an overlay of global production, which is more open to

prediction. Oilprice.com: Advantage U.S. In The Global Petroleum Showdown? First, demand: Almost all analysts including the EIA and IEA agree

that demand continues to grow at a steady pace throughout the rest of

the decade, and even a minor economic downturn will only slow the pace

of growth (green line), but not upend the upward trend line of demand.

Sorry to those environmentalists who pray for an end to carbon use

growth in the next decade – virtually no one currently believes it will

happen.

Courtesy of Oilprice.comNow, let’s overlay the rudimentary global production line(s) on top,

put some likely dates on this chart and describe some of the possible

scenarios:  Courtesy of Oilprice.com Courtesy of Oilprice.comFirst, we notice that the blue line of production going back before

the oil crash is steeper than the demand line – hence the current gluts

we are experiencing and low barrel prices. Low prices have made

production growth begin to slacken, which I’ve indicated by easing the

slope of the light blue line. It’s clear that if nothing else happened

from here, we’d still see future production outstrip demand – hence some

analysts’ fear of never seeing triple digit oil prices, or at least a

much lower for much longer scenario. Oilprice.com: Saudi Arabia Tries to Slow Iran Oil Exports, Without Much Success But most analysts agree that the sharp drop in Capex budgets, not

just among shale producers, will have its effect on sharply lowering

production this year and putting growth in reverse, efficiencies and

well cost reductions notwithstanding. What’s critical to note is how the

media, and surprisingly most analysts, see global oil merely through

the prism of U.S. independent shale players. To me, this is the critical

grave mistake they make. Recent lease outcomes in the Gulf of Mexico,

problems in Brazil and the likely end of spending for all new Russian

oil projects are just a few of the other gargantuan gaps in global

production we’re likely to see after 2016. I’ve drawn two lines in black on production; one that most of the

analysts including the EIA are making in how they see this production

curve playing out, and mine – how I see it likely playing out. While the EIA and most other analysts agree that sharp capex drops

will begin to have their halting effects on oil production, they tend to

argue over when those production drops come and how steep they will be.

In all cases, they argue that any drop in production will be answered

by a rally in oil prices, to the degree that U.S. shale players again

‘turn on the spigots’ and reestablish the gluts that have kept us under

$50 a barrel for most of the last year. In this scenario, production

never – or at least exceedingly slowly – rebalances to match demand. I see it much differently.

I could argue that the shale players, even with their low well drilling

costs and backlog of ‘drilled but uncompleted wells’ (DUCs) cannot in

any way repeat their frantic production increases they achieved from

2012-2014 ever again. I believe this because of financing constraints

and the lack of quality acreage among other reasons – but I don’t have

to even “win” this predictive argument. Oilprice.com: Why We Could See An Oil Price Shock In 2016 Longer-term projects from virtually all other conventional and

non-conventional sources that have not been funded for the past two

years will see their results, in that there won’t be the oil from them

that was planned upon. Chevron estimated in 2013 that oil companies

would have to spend a minimum of $7-10 trillion dollars to 2030 to

merely keep up with demand growth and the natural decline of current

wells. And this was without factoring in the drop in exploration

spending that is occurring now and throughout the next two years. Severe

capex cuts from virtually every oil company and state-run producer over

the last two years has put this necessary spending budget way behind

schedule. You can see why I tend to have a much more radical view of the decline line in production beginning in late 2016

and lasting, in my view, at least until the middle of 2018, when

production again only begins to get the funding (and time) it needs to

try and “catch up”. Meanwhile, there will be, as I see it, a violent crossing of the

demand and supply lines in my graph – and an equally violent move in the

price of oil because of it. Finally, when this trajectory becomes obvious, the financial markets

will waste no time taking full advantage of it – with a massive influx

of speculative money, driving up prices even more quickly and steeply. I’ve seen that before – and am currently alone in believing how close we are in seeing it again. This article originally appeared on Oilprice.com

|

66 de 245

-

05/4/2016 20:18

0

0

La Forge

Messages postés: 1346 -

Membre depuis: 03/8/2000

How Risky Is Royal Dutch Shell's Stock?

Despite its massive size and vertically integrated

business model, there are still some risks that anyone invested in Royal

Dutch Shell should consider.

Image source: Royal Dutch Shell via Flickr. Investors looking for some form of stability over the long term have

turned to integrated oil and gas stocks. Their ability to throw off gobs

of cash and pay generous dividends over time has been a pretty

attractive proposal. One thing that makes investors in these companies

nervous is when the market for oil and gas tanks, or when one of these

companies makes a transformative acquisition. Royal Dutch Shell (NYSE:RDS-A) (NYSE:RDS-B) is in the middle of both right now. With Shell working through the BG merger while the energy market is

working through one of its toughest periods in recent history, some

might be curious as to how risky Shell's stock is today. Let's take a

quick look at the two biggest risks for shareholders today. An over-promise on the dividend?

Over the past

couple years, as oil prices have declined, dozens of companies across

the space have been forced to preserve cash by cutting dividends. The

one last bastion where dividends have remained consistent is with

integrated oil companies. Having assets across the entire value chain of

oil has helped to make up for the massive losses experienced on the

production side of the business. However, with oil prices this low, those Big Oil dividend payments

are becoming rather onerous. Dividend yields for almost all of these

companies are at multi-decade highs, and with dividend payments at Shell

and BP (NYSE:BP) pushing the 8% mark, there are questions about whether those payments can actually continue.

RDS.B Dividend Yield (TTM) data by YCharts. Shell's management has said on multiple occasions that its dividend

is a priority, but we've heard many other companies say that and

subsequently cut dividends. To help offset the more than $9 billion in

annual dividend payments, Shell has enacted a scrip dividend program via

which investors can take dividend payments in the form of newly issued

shares. This will help to offset some of the cash outlays for the

company, but that's typically only necessary when a company is

cash-strapped. Another thing to consider is that now, thanks to the BG

merger, Shell has a lot more shares that need to receive a dividend each

quarter. Shell's dividend payment isn't something that will completely break

the company. If the operating environment for oil and gas companies were

to deteriorate much further, then Shell has the option to cut the

dividend to preserve a lot of cash. From an investor's standpoint,

though, a dividend cut would mean two things: 1) We would likely see a

large price drop in the short term, and 2) those invested in Shell over

the long term will generate much lower total returns. That's something

the company can ill afford as its total returns over the past 20 years

have wildly underperformed its peers, and it hasn't even been able to

keep pace with the S&P 500.

RDS.B Total Return Price data by YCharts. Making a big bet on megaprojects...again

Typically,

integrated oil and gas companies are rather risk-averse. To mitigate

risk, they build balanced portfolios with production coming from a wide

variety of sources so they aren't tied too closely to a single market.

That is why it's a little surprising to see Shell make two pretty

concentrated bets on LNG and deepwater production. By acquiring BG

Group, Shell's LNG production will be more than double that of the

next-largest LNG producer, ExxonMobil (NYSE:XOM). Looking even further down the road, Shell has another large suite of

LNG projects under consideration that could expand Shell's lead in LNG

over the next decade.

Image source: Royal Dutch Shell investor presentation. Another realm in which Shell is doubling its efforts is in deepwater

projects, especially in Brazil, where BG Group has sizable investments

over the next few years.

Image source: Royal Dutch investor presentation. The reason these investment plans stick out is because they are very

much the same kind of investments that -- some say -- got big oil

companies in trouble over the past couple of years. These

multibillion-dollar projects with long lead times mean there's very

little wiggle room in capital spending budgets as oil prices wax and

wane. So, it's a little surprising to see Shell double-down on these

kinds of investments. Other companies, notably Chevron (NYSE:CVX)

and ExxonMobil, have shifted more toward other investments such as

shale, which have lower upfront capital obligations and shorter

investment cycles. In doing so, they can make their capital spending

budgets a little bit more responsive to current market conditions. This isn't to say Shell is wrong in making these kinds of

investments. LNG could be a very lucrative market for it, and global

demand for oil suggests that more deepwater production will be needed.

However, by making more concentrated bets on LNG and deepwater rather

than trying to balance its production portfolio with a more diverse

stream, Shell exposes itself to a bit more risk than some of its peers. What a Fool believes

In the grand scheme of

things, Royal Dutch Shell isn't what you would call a "risky" stock. As

the world's second largest publicly traded oil and gas company, it has

immense competitive advantages such as economics of scale and access to

cheap credit in a capital-intense industry. When you compare Shell

specifically to its peers, though, some aspects of its look slightly

riskier than the others. Shell's decision to make concentrated bets on

megaprojects (again) and the possibility of a dividend cut if market

conditions were to deteriorate any more could really hurt long-term

returns for investors. I can't fault investors who want to invest in Shell's stock because of the potential benefits, but there are better options in the integrated oil and gas space today that seem slightly less risky based on today's market. A secret billion-dollar stock opportunity

The

world's biggest tech company forgot to show you something, but a few

Wall Street analysts and the Fool didn't miss a beat: There's a small

company that's powering their brand-new gadgets and the coming

revolution in technology. And we think its stock price has nearly

unlimited room to run for early-in-the-know investors! To be one of

them, just click here.

Tyler Crowe owns shares of ExxonMobil. You can follow him at Fool.com or on Twitter @TylerCroweFool. The Motley Fool owns shares of and recommends ExxonMobil. The

Motley Fool recommends Chevron and Total (ADR). Try any of our Foolish

newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

|

67 de 245

-

08/4/2016 18:42

0

0

La Forge

Messages postés: 1346 -

Membre depuis: 03/8/2000

Royal Dutch Shell - More Reasons To Buy Apr. 8, 2016 11:10 AM ET|3 comments | About: Royal Dutch Shell plc (RDS.A), RDS.B

Alpha Investor ⊕Follow (1,521 followers) Long/short equity, value, special situations, growth Send Message Summary Royal

Dutch Shell’s downstream business was a tailwind last year due to

strong refining margins, but it has got off to a rough start this year.

However, refining crack spreads have started improving of

late due to an increase in demand for gasoline and heating oil, which

had taken a hit during the winter season.

Gasoline demand in 2016 has grown impressively after a

weak January and is tracking ahead of last year’s levels, which is good

news for Shell as crack spreads will improve.

Shell has improved the efficiency of its downstream

business by using advantaged feedstocks, which has enabled it to reduce

capacity and volumes but improve margins.

Shell’s refining business will improve due to the Norco

refinery in Louisiana since it produces high-value gasoline blendstock

and is closely integrated with a petrochemical plant nearby.

Last month, I had focused on why the upstream business of Royal Dutch Shell (NYSE:RDS.A) (NYSE:RDS.B)

is in for better times going forward on the back of a recovery in crude

oil prices. However, of late, the oil rally has started losing steam as

the Brent has dropped below

$40 a barrel once again. But, even if the upstream business of Shell

faces weakness due to low oil prices, its downstream business will act

as a tailwind due to low input costs. For instance, in the fourth quarter last year, earnings from Shell's downstream business stood at

$1.5 billion as compared to $1.6 billion in the year-ago quarter. In

comparison, earnings from the upstream business had dropped to $500

million from $1.7 billion in the year-ago period. This clearly indicates

that Shell is witnessing strength in the downstream business, and it is

likely that this momentum will continue this year despite a rough

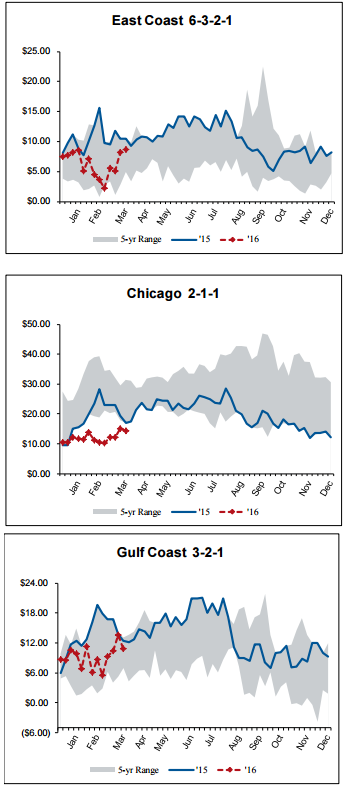

start. Let's see why. Improving crack spreads will be a tailwind So far this year, refining crack spreads have remained weak as compared to last year. For instance, the East Coast 6-3-2-1 refining crack spreads

have averaged $6.31 per barrel in the first quarter of 2016 as compared

to $10.44 a barrel in the year-ago period. Similarly, the Gulf Coast

refining spreads are down to $9.22 a barrel as against $13.62 a barrel

in the year-ago quarter. This weakness in the refining crack

spreads so far this year is a result of low demand for gasoline and

heating oils, as the usage of these refining products has dropped due to

the winter season in the U.S. as this has kept cars off the roads. For

instance, according to the latest data, demand for gasoline in U.S. in

the month of January dropped

0.6% on a year-over-year basis, marking the first decline in 14 months.

As a result, the oversupply in the market increased and led to a drop

in refining crack spreads. According to Phil Flynn of Price Futures Group: "The

historic late January blizzard that buried much of the U.S. Northeast

under mountains of snow hurt demand, Flynn said. "People in New York

City couldn't find their car, so this was probably a one-off," Flynn

said."

But, the good thing is that refining crack

spreads have started picking up pace of late and are now close to 2015

levels. This is shown in the charts given below:

Source: Howard Weil Thus,

as evident from the charts above, refining margins across all regions

in the U.S. have now improved. This is not surprising as gasoline prices

and demand usually pick up pace in the spring and summer seasons as

more cars get on the road. For instance, last year, gasoline consumption

by motorists in America stood at 9.16 million bpd, and this year,

demand is already tracking ahead of last year's rate at 9.4 million bpd. Now,

looking ahead, this positive trend in gasoline consumption will

continue as sales of motor vehicles in the U.S. are expected to rise

once again this year. For instance, after hitting sales

of around 17.5 million units in 2015, which was the highest in 15

years, auto sales in the U.S. are expected to rise once again in the

coming two years. For instance, according to IHS, the U.S. auto market

will grow to 18 million units in the next couple of years, which will lead to higher consumption of gasoline. Therefore,

the weakness in the gasoline market should be short-lived due to higher

demand, and allow Shell to gradually improve its downstream performance

going forward. More importantly, Shell is well-placed to make the most

of an increase in gasoline demand and refining crack spreads going

forward as the company has streamlined its refining segment to achieve

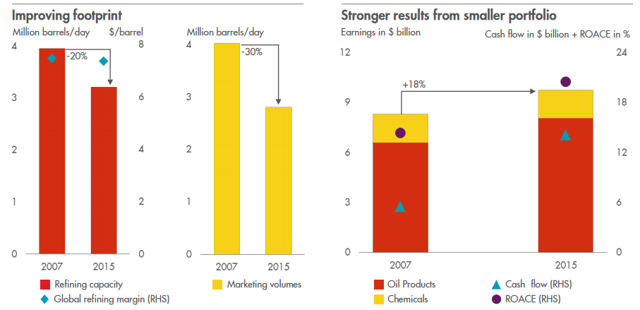

higher margins. Shell's efficient downstream business will be a tailwind Shell

has managed to improve the efficiency of its downstream business by

deploying higher grade feedstock and improving supply. As a result, the

company has been able to generate stronger returns from a more

streamlined portfolio, improving its earnings, cash flow, and returns

over the years. Additionally, despite lowering its marketing volumes by

30% and refining capacity by 20%, the company has managed to retain its

margins in the refining business. This is shown in the chart below:

Source: Royal Dutch Shell Going forward, Shell's feedstock footprint is anticipated to improve further after the break-up of

its joint venture with Saudi Aramco last month. As a result of the end

of this relationship, Shell will now be able to increase gasoline

production from the Norco refinery in Louisiana since it produces

high-value gasoline blendstock. Additionally, the Norco refinery is

closely integrated with a petrochemical plant of Shell that's located

nearby, giving shell integration benefits and lower costs. Conclusion Thus,

an improvement in the gasoline market will gradually lift crack spreads

going forward, and this will be a tailwind for Royal Dutch Shell's

downstream business. Moreover, since Shell has focused on improving the

efficiency of its downstream operations, it will be able to improve its

earnings and returns as the crack spreads improve. So, apart from a

potential improvement in the upstream business, strength in the

downstream is another reason why investors should be positive about

Royal Dutch Shell. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this

article myself, and it expresses my own opinions. I am not receiving

compensation for it (other than from Seeking Alpha). I have no business

relationship with any company whose stock is mentioned in this article.

|

68 de 245

-

08/4/2016 23:10

0

0

La Forge

Messages postés: 1346 -

Membre depuis: 03/8/2000

Well, this is a bit of a disappointment. We have

oil flying (up nearly 7 percent!), we have a weak dollar, we have China

quiet all week, and we have a dovish Fed that traders believe have put some kind of floor under the market. And this is all we get? The Dow Industrials

up 40 points in a lackluster, average-volume session? In the past

months, if oil would be up 7 percent and the dollar would be weak, we

would have been up 200-250 points. What's wrong? You can argue oil may be

decoupling from the markets. Maybe. But the usual suspects that would

benefit from a weak dollar are all up: energy, materials, industrials.

In fact, there's more than four stocks advancing for every one

declining. So, why the crummy point action?

Pisani: Here's what's next for stocks Pisani: Here's what's next for stocks

I think the problem is that the "V" rally is over. Remember, we dropped big in

January and February on fears of a recession. We rallied back when it

became clear that: 1) a recession is highly unlikely, and 2) the Fed is

so dovish that they are putting a "floor" under the markets. So, a good part of the rally was

predicated on a dovish Fed, which we now have. A more dovish Fed is now

priced in to the market. As for oil, if you believe $26 is

the bottom — and as time goes by it is increasingly looking like that is

the case — it is getting harder to get an equity reaction. The main

worry was, where's the bottom? The problem is not finding a

bottom, it's how much upside there is to the market. Investors are not

enthusiastic about buying at these levels because they're not at all

sold on paying up with stocks near historic highs and no appreciable

global growth outside the U.S.

<p>Pisani: Energy is dominating</p>

<p>CNBC's Bob Pisani looks ahead at the

markets as the energy sector is up over 1.5 percent after a surge in oil

prices.</p>

What about earnings? We all know that earnings

are down four consecutive quarters. Intuitively, this sounds like it is

not good news, and I certainly agree. But all weak earnings does is put a ceiling on stocks. And there is a ceiling: the markets topped out a year ago. Right? So, we have a floor to the market, and we have a ceiling. What's this all mean? Trading range. I said the market

was a "solid hold" two weeks ago, and nothing I have seen since then has

made me change my mind.

Here's how earnings declines affect stock markets Here's how earnings declines affect stock markets

What would change this dynamic? If we could inch

our way to a new high — 2,130 was the old historic high, way back in May

2015 — it would be a breakout from the range and might force some

marginal money back in. What could go wrong? We got an inkling this week: if investors come to believe that central bankers are toothless tigers. Haruhiko Kuroda, governor of the Bank of Japan, implied more quantitative easing was coming this week, and the yen rallied. Not good. Confidence eroding. There's still confidence in ECB President Mario Draghi and Fed Chair Janet Yellen,

as worry, but the cat is out of the bag, and worry about the limits of

central bank intervention can now be added as a risk factor.  Bob PisaniCNBC "On-Air Stocks" Editor

|

69 de 245

-

09/4/2016 21:02

0

0

Grupo GuitarLumber

Messages postés: 1724 -

Membre depuis: 24/6/2003

Moody's abaisse la note de Total

Soyez le premier à réagir !

Publié le 09/04/2016 à 20h46

L'agence de notation

Moody's met la pression sur le groupe pétrolier français Total, et

ajuste son approche des dossiers Royal Dutch Shell et BP au regard de

cours du pétrole attendus à 38 $ le baril en 2017...

Crédit photo © Reuters (Boursier.com) — Dans une revue des sociétés pétrolières, Moody's

Investors Service a abaissé la note de crédit long terme non garantie de

Total

de 'Aa1' à 'Aa3'. En outre, la note junior subordonnée du groupe

pétrolier est ramenée de 'Aa3' à 'A2'. La note court terme P-1 est

confirmée. Ces perspectives de notations sont toutes à 'stable'. Moody's

a par ailleurs procédé à des ajustements de notation sur BP et Shell. PUBLICITÉ inRead invented by Teads Sanctionné à cause de la faiblesse des prix pétroliers Pour

l'agence de notation, il s'agit de refléter par cette approche "la

pression continue sur le flux de trésorerie d'exploitation et de

traduire la faiblesse durable des prix du pétrole". Moody's explique

encore :: "La dégradation des notes de Total reflète principalement

notre anticipation d'un maintien prolongé de bas prix du pétrole en 2016

et 2017. Ils continueront à peser sur le cash-flow opérationnel et les

critères de crédit de Total". Désendettement difficile Moody's

ajoute que Total a réduit ses coûts opérationnels et d'investissement,

mais peine à se désendetter à court terme. La compagnie désinvestit pour

compenser le free cash flow négatif des deux prochaines années, ce qui

permet à Moody's de maintenir une perspective de notation à 'stable'.

Moody's est susceptible de revoir sa notation à moyen terme, quand les

prix du pétrole remonteront et si Total reprend le paiement du dividende

en espèce. L'agence de notation anticipe néanmoins de la part du groupe

pétrolier français des cash flows modérément négatifs dans les 3

prochaines années. Ajustements des notes de Shell et BP Moody's

-qui table sur un cours du baril à 33 dollars en 2016, 38 $ en 2017 et

43 $ en 2018- a par ailleurs dégradé de 'Aa1' à 'Aa2' la notation crédit

de Royal Dutch Shell. Cette nouvelle appréciation s'accompagne d'une

perspective crédit 'negative'. En d'autres termes, Moody's maintient la

pression sur le groupe en agitant la perspective d'une future

dégradation. Moody's a enfin confirmé à 'A2' la notation long terme de

BP. Celle-ci est assortie d'une perspective 'positive'.

|

70 de 245

-

12/4/2016 10:41

0

0

La Forge

Messages postés: 1346 -

Membre depuis: 03/8/2000

Shell (RDSA.LN) envisagera d'investir dans des

opportunités en Iran, a indiqué mardi son directeur général Ben Van

Beurden. "Nous savons que l'industrie pétrolière et gazière en Iran a

été un peu privée d'innovations technologiques de tout premier ordre.

C'est ce que des entreprises comme la nôtre peuvent apporter", a-t-il

déclaré, en marge d'une conférence sur le gaz naturel liquéfié en

Australie. "Mais nous savons aussi que les responsables iraniens avec

lesquels nous devrons traiter sont de formidables négociateurs." Il a

ajouté que le groupe ne savait pas encore quels termes et conditions

l'Iran pourrait offrir, et que si Shell étudiera les occasions dans ce

pays, elles devront se mesurer aux autres opportunités du groupe.

-Robb Stewart, Dow Jones Newswires (Version française Céline Fabre) ed: VLV

(END) Dow Jones Newswires

April 12, 2016 03:56 ET (07:56 GMT)

|

71 de 245

-

12/4/2016 12:42

0

0

La Forge

Messages postés: 1346 -

Membre depuis: 03/8/2000

Shell 'A' (NYSE:RDSA)

Graphique Intraday de l'Action Aujourd'hui : Mardi 12 Avril 2016

Shell (RDSA.LN) envisagera d'investir dans des opportunités en Iran, a

indiqué mardi son directeur général Ben Van Beurden. "Nous savons que

l'industrie pétrolière et gazière en Iran a été un peu privée

d'innovations technologiques de tout premier ordre. C'est ce que des

entreprises comme la nôtre peuvent apporter", a-t-il déclaré, en marge

d'une conférence sur le gaz naturel liquéfié en Australie. "Mais nous

savons aussi que les responsables iraniens avec lesquels nous devrons

traiter sont de formidables négociateurs." Il a ajouté que le groupe ne

savait pas encore quels termes et conditions l'Iran pourrait offrir, et

que si Shell étudiera les occasions dans ce pays, elles devront se

mesurer aux autres opportunités du groupe.

-Robb Stewart, Dow Jones Newswires (Version française Céline Fabre) ed: VLV

(END) Dow Jones Newswires

April 12, 2016 03:56 ET (07:56 GMT)

|

72 de 245

-

12/4/2016 23:15

0

0

sarkasm

Messages postés: 1325 -

Membre depuis: 26/2/2009

Les cours pétroliers ont fini mardi au plus haut de l'année,

poursuivant leur rebond à la faveur de rumeurs sur un nouvel accord

entre Ryad et Moscou pour stabiliser leur offre, en pleine spéculations

sur l'issue d'une réunion dimanche entre pays producteurs.

Le cours du baril de référence (WTI) pour livraison en mai a gagné

1,81 dollar à 42,17 dollars sur le New York Mercantile Exchange (Nymex),

soit un niveau où il n'avait plus terminé depuis novembre.

Les cours, qui avaient déjà fortement monté depuis une semaine, ont

accéléré mardi après que l'agence de presse russe Interfax "a annoncé

que la Russie et l'Arabie saoudite étaient parvenus à un consensus sur

un plafonnement de leur production", a rapporté dans une note Tim Evans,

de Citi.

Ces rumeurs viennent alimenter les

spéculations des investisseurs à l'approche d'une réunion entre pays

producteurs dimanche à Doha, au Qatar, à laquelle participeront l'Arabie

saoudite, membre dominant de l'Organisation des pays exportateurs de

pétrole (Opep), et la Russie, qui ne fait pas partie du cartel. Le but

affiché est de trouver un accord susceptible de limiter l'actuelle

surabondance d'or noir.

"Il faut quand même noter que

(l'Arabie et la Russie) étaient déjà parvenues à un accord,- conditionné

à la participation d'autres producteurs -, lors d'une réunion le 16

février à Ryad", a relativisé M. Evans, pour qui le consensus évoqué

mardi appartient donc "aux archives" plutôt qu'à l'actualité.

L'accord de février, également accepté par le Qatar et le Venezuela,

avait déjà permis aux cours de massivement rebondir après être tombés au

plus bas depuis 2003. Mais les marchés avaient peu à peu commencé à

s'interroger, non seulement sur son extension à d'autres participants

mais aussi sur l'éventualité d'une baisse concertée de l'offre, au-delà

d'un simple gel.

Désormais, la confiance semble revenir

et "les investisseurs se projettent sur la réunion de Doha", a reconnu

Mike Lynch, de Strategic Energy & Economic Research. "Le sentiment

général, c'est que l'on a atteint un plancher... Mais je crains

franchement que ce soit exagéré et que l'on soit allés trop vite."

Ce sentiment était partagé par de nombreux observateurs, qui mettent

déjà en garde sur un brusque repli du marché au cas où la réunion de

Doha déboucherait sur une issue décevante, même si la prudence des

commentaires contraste avec l'ampleur du rebond des cours.

jdy/jld/elc

(END) Dow Jones Newswires

April 12, 2016 16:19 ET (20:19 GMT)

|

73 de 245

-

15/4/2016 17:35

0

0

waldron

Messages postés: 9905 -

Membre depuis: 17/9/2002

04/05/16 | 08:00 Q1 2016 Publication de résultats

|

74 de 245

-

18/4/2016 00:02

0

0

maywillow

Messages postés: 1331 -

Membre depuis: 27/1/2002

Pas d'accord à Doha sur le pétrole

Actualités des marchés

- Toute l'info

- Séance en direct

- A ne pas manquer demain

- Opinions

- Calendrier

- Dossiers

REUTERS |

Le 17/04/16 à 22:50

Les tensions entre l'Arabie saoudite et l'Iran persistent. Ryad exige

que la république islamique s'associe au gel de la production. Pour

Téhéran, stabiliser la production effacerait les bénéfices attendus de

la levée des sanctions. L'échec à Doha devrait tirer les cours du brut

vers le bas.

Les tensions Iran-Arabie menacent un accord sur le pétrole | Crédits photo : Sophie James / Shutterstock.com

par Rania El Gamal et Reem Shamseddine DOHA, 17 avril (Reuters) - Les discussions de Doha entre pays producteurs de pétrole membres de l'Opep ou extérieurs au cartel se sont achevées ce dimanche sans accord sur un "gel" de la production, l'Arabie saoudite ayant exigé que l'Iran se joigne au mouvement. PUBLICITÉinRead invented by Teads Même si les concertations vont se poursuivre, l'issue de cette réunion entre ministres du Pétrole

va raviver les inquiétudes des acteurs du secteur, qui redoutent que

les pays producteurs ne relancent la course aux parts de marché, ce qui

risquerait de porter un coup d'arrêt à la remontée du prix du baril. L'Arabie saoudite notamment a menacé d'accroître sa production si aucun n'accord n'était trouvé. Dix-huit pays, dont la Russie

qui ne fait pas partie de l'Organisation des pays exportateurs de

pétrole (Opep), étaient représentés à Doha pour finaliser un accord dans

les tuyaux depuis février et qui aurait stabilisé la production

jusqu'en octobre prochain à ses niveaux de janvier. Mais Ryad,

chef de file de l'Opep, a insisté pour que tous les pays membres de

l'Opep soient partie prenante à ce gel concerté de la production, y

compris l'Iran. Or, la République islamique, absente dimanche à Doha, se

refuse à stabiliser sa production au moment où la levée des sanctions

occidentales liées à son programme nucléaire peut lui permettre de

reprendre pied sur le marché mondial de la production de brut. "Si

l'Iran gèle sa production pétrolière au niveau de février, cela

signifiera qu'il ne peut pas bénéficier de la levée des sanctions", a

expliqué le ministre iranien du Pétrole, Bijan Zanganeh. SOUS LES 40 DOLLARS ? Au

terme de cinq heures de discussion tendue, notamment entre l'Arabie

saoudite et la Russie, sur la formulation d'une éventuelle déclaration

finale, délégués et ministres ont annoncé qu'aucun accord n'avait été

trouvé. "Nous avons conclu que nous avions tous besoin de temps

pour de nouvelles consultations", a déclaré le ministre qatari de

l'Energie Mohamed al Sada. Plusieurs sources au sein de l'Opep ont

précisé que si l'Iran acceptait de s'associer au gel de la production

lors de la prochaine réunion du cartel, prévue le 2 juin, les

discussions avec les autres pays producteurs pourraient reprendre. Le ministre russe du Pétrole, Alexander Novak,

a regretté les exigences "déraisonnables" de l'Arabie saoudite et s'est

dit déçu de l'issue de la réunion de Doha. Alors, dit-il, qu'il était

arrivé au Qatar

avec le sentiment qu'il s'agissait de parvenir à un accord, et non de

débattre, il s'est dit surpris par ces nouvelles exigences formulées

dimanche matin. L'échec de la réunion de Doha pourrait mettre un terme à la récente remontée des cours pétroliers. "Avec

l'absence d'accord aujourd'hui, la confiance des marchés dans la

capacité de l'Opep à parvenir à un accord équilibrant la production va

probablement baisser et cela va certainement avoir un effet baissier

sur les marchés pétroliers, où les cours se sont en partie redressés

sur l'anticipation d'un accord. Sans accord, les probabilités d'assister

à un rééquilibrage des marchés sont désormais repoussées à la mi-2017",

a résumé Abhishek Deshpande, spécialiste du pétrole chez Natixis. L'espoir d'une limitation concertée de l'offre mondiale avait permis au baril de Brent

de rebondir à près de 45 dollars, en progression de 60% par rapport aux

plus bas touchés en janvier autour de 27 dollars, après la chute qui

lui avait fait perdre plus de 75% depuis le pic à 115 dollars de la

mi-2014. Anticipant une réaction impulsive des marchés, Amrita

Sen, experte chez Energy Aspects, estime que le baril pourrait retomber

sous le seuil des 40 dollars ce lundi. "Même si l'absence d'un

accord de gel n'a pas de conséquence négative sur les équilibres --

puisque l'Iran est véritablement le seuil pays susceptible d'accroître

sa production de manière substantielle --, elle va avoir un immense

impact négatif sur le sentiment (des marchés), surtout au vu du battage

médiatique qu'il y a eu autour de cet accord", explique-t-elle.

(Bertrand Boucey, Eric Faye, Marc Angrand et Henri-Pierre André pour le

service français)

En savoir plus sur http://investir.lesechos.fr/marches/actualites/les...

|

75 de 245

-

27/4/2016 18:24

0

0

grupo

Messages postés: 1072 -

Membre depuis: 11/5/2004

Royal Dutch Shell Filing of Annual Financial Report 27/04/2016 3:10pm UK Regulatory (RNS & others)

TIDMRDSA TIDMRDSB

Filing of Annual Financial Report

· · · · · · · · · · · · · ·· ·· ·· ··

A copy of the annual financial report for:

* Shell International Finance BV

has been submitted to the National Storage Mechanism and available for

inspection at :

http://www.morningstar.co.uk/uk/NSM

The accounts can also be viewed on the Shell website at:

http://www.shell.com/investors/financial-reporting/

shell-international-finance-bv-reports.html

Enquiries

Shell Media Relations

International, UK, European Press: +44 (0)207 934 5550

Shell Investor Relations

Europe: + 31 70 377 3996

United States: +1 713 241 1042

END

(END) Dow Jones Newswires

April 27, 2016 11:10 ET (15:10 GMT)

|

76 de 245

-

28/4/2016 22:30

0

0

La Forge

Messages postés: 1346 -

Membre depuis: 03/8/2000

Les cours du pétrole ont confirmé jeudi leur bonne disposition en

finissant comme la veille au plus haut de l'année, malgré l'absence

d'actualités notables sur le marché de l'or noir.

Le

cours du baril de référence (WTI) pour livraison en juin a gagné 70

cents à 46,03 dollars sur le New York Mercantile Exchange (Nymex),

terminant pour la troisième séance de suite à un niveau de clôture sans

précédent depuis novembre.

A Londres, le prix du baril

de Brent de la mer du Nord pour livraison en juin a monté de 96 cents à

48,14 dollars sur l'Intercontinental Exchange (ICE), lui aussi au plus

haut depuis novembre.

"Les investisseurs se détournent

de la surabondance actuelle et passent à l'achat sur des considérations

techniques", notamment le passage de cours jugés symboliques, a résumé

Bart Melek, de TD Securities. "On vise probablement les 50 dollars pour

le Brent".

L'actualité de jeudi n'a guère donné

d'éléments susceptibles de justifier cette nouvelle hausse qui s'inscrit

dans la foulée d'un rebond de quelque 75% depuis la mi-février. Les

cours étaient alors tombés au plus bas depuis 2003, face à la pléthore

d'or noir dans le monde.

"C'est dur de comprendre pourquoi les cours du pétrole sont si hauts!", a reconnu James Williams, de WTRG Economics.

Les observateurs en étaient donc réduits à remonter aux nouvelles de

la veille, en premier lieu les chiffres hebdomadaires sur l'offre

américaine.

"Même si les chiffres sur les réserves

étaient décevants", puisqu'elles ont monté à un niveau historiquement

élevé, "la production américaine continue à décliner", a remarqué M.

Melek.

Le recul persistant de la production américaine,

qui s'installe désormais sous les neuf millions de barils par jour

(bj), est devenu la principale lueur d'espoir de résorption de la

surabondance mondiale, après l'échec de négociations entre d'autres pays

producteurs à la mi-avril.

Autre facteur de soutien

depuis le début de la semaine, le dollar s'affaiblit, ce qui rend plus

intéressants les cours pétroliers, libellés en monnaie américaine.

Même si la Réserve fédérale a contribué mercredi à cet affaiblissement

en s'abstenant comme prévu de relever ses taux, c'est surtout "le yen

japonais (qui) fait de son mieux pour supporter les cours en montant

comme un fou face à l'inertie de la Banque du Japon (Boj)", a remarqué

dans une note Matt Smith, de ClipperData.

Le dollar

chutait de quelque 3% face à la devise japonaise après la décision de

politique monétaire de la BoJ, qui, en renonçant à accélérer une

politique déjà très interventionniste, a déçu les fortes attentes des

marchés mais a éclairci les perspectives du yen.

(END) Dow Jones Newswires

April 28, 2016 15:13 ET (19:13 GMT)

|

77 de 245

-

02/5/2016 22:09

0

0

Ariane

Messages postés: 1320 -

Membre depuis: 29/9/2002

Royal Dutch Shell plc 1Q 2016 -- Forecast 02/05/2016 2:28pm Dow Jones News

Shell B (LSE:RDSB)

Intraday Stock Chart Today : Monday 2 May 2016

FRANKFURT--The following is a summary of analysts' forecasts for Royal

Dutch Shell plc (RDSA) first-quarter results, based on a poll of six

analysts conducted by Dow Jones Newswires. Figures in million dollars,

EPS and dividend in dollar, target price in pence, production in

thousand barrel of oil per day (kboe/d), according to IFRS). Earnings

figures are scheduled to be released May 4.

===

CSS CCS

Earnings EPS Production

1st Quarter adjusted(a) adj.(a) (kboe/d)

AVERAGE 849 0.12 3,531

Prev. Year 3,246 0.52 3,166

+/- in % -74 -76 +12

Prev. Quarter 1,825 0.29 3,039

+/- in % -53 -57 +16

MEDIAN 949 0.13 3,495

Maximum 1,330 0.18 4,007

Minimum 200 0.07 3,027

Amount(b) 6 6 6

Canaccord 200 0.08 4,007

Deutsche Bank 1,017 0.14 3,194

Jefferies 1,330 0.18 3,469

Morgan Stanley 1,188 0.15 3,521

Santander 880 0.12 3,969

Target price Rating

Canaccord 1,550 Hold

Deutsche Bank 2,035 Buy

Jefferies 2,404 Buy

Santander 1,953 Buy

Morgan Stanley -- Overweight

===

Year-earlier figures are as reported by the company.

(a) Clean cost of supplies.

(b) Including anonymous estimates from one more analyst.

DJG/mus

(END) Dow Jones Newswires

May 02, 2016 10:13 ET (14:13 GMT)

|

78 de 245

-

03/5/2016 17:17

0

0

Grupo GuitarLumber

Messages postés: 1724 -

Membre depuis: 24/6/2003

Shell B (LSE:RDSB)

Graphique Intraday de l'Action Aujourd'hui : Mardi 3 Mai 2016

Le géant pétrolier et gazier anglo-néerlandais Royal Dutch Shell

(RDSA.LN) devrait annoncer mercredi un bénéfice ajusté, qui exclut les

éléments exceptionnels, de 1,5 milliard de dollars au titre du premier

trimestre, en baisse de 52% par rapport aux 3,2 milliards de dollars

enregistrés un an auparavant, d'après les prévisions de deux analystes

sondés par Thomson Reuters. Il s'agit des premiers résultats que Shell

publiera depuis son acquisition de BG Group cette année, pour 50

milliards de dollars environ. L'intégration de son rival de moindre

envergure permettra à Shell d'être davantage présent dans le secteur en

plein essor du gaz naturel liquéfié et les actifs en eaux profondes au

large du Brésil. Les investisseurs s'intéresseront plus particulièrement

aux indications relatives aux synergies promises.

|

79 de 245

-

04/5/2016 10:37

0

0

The Grumpy Old Men

Messages postés: 1149 -

Membre depuis: 02/1/2007

Shell 'A' (NYSE:RDSA)

Graphique Intraday de l'Action Aujourd'hui : Mercredi 4 Mai 2016

Royal Dutch Shell (RDSA.LN) a annoncé mercredi qu'il continuait de

réduire ses coûts et ses investissements, alors que le géant pétrolier

anglo-néerlandais intègre la récente acquisition de BG Group, d'un

montant d'environ 50 milliards de dollars, dans un contexte de chute

historique des cours du pétrole.

Lors de la publication

de ses premiers résultats trimestriels depuis l'acquisition en début

d'année de BG, Shell a fait état d'un fort recul de son bénéfice mais le

groupe a souligné que la baisse des coûts lui avait permis de compenser

l'impact de l'affaiblissement des cours du pétrole et du gaz ainsi que

l'augmentation des charges d'exploitation liées à BG.

Shell a déclaré qu'il prévoyait d'investir 30 milliards de dollars cette

année dans l'exploration et le développement de projets pétroliers et

gaziers, soit 3 milliards de dollars de moins que sa précédente

prévision.

L'intégration de BG a contribué à la hausse

de 16% des volumes de production du groupe au premier trimestre, à 3,7

millions de barils d'équivalent pétrole par jour.

Le

bénéfice trimestriel hors coûts de remplacement des stocks s'est établi à

800 millions de dollars, une chute de 83% par rapport au résultat du

premier trimestre 2015. Le bénéfice ajusté, qui exclut les éléments

exceptionnels comme les plus-values de cessions, s'est replié à 1,6

milliard de dollars, contre 3,7 milliards de dollars, mais il a

néanmoins dépassé les attentes des analystes.

A 9h33, le titre cédait 0,3%, à 1.756 pence.

-Sarah Kent, Dow Jones Newswires

(Version française Aurélie Henri) ed: VLV - ECH

(END) Dow Jones Newswires

May 04, 2016 03:39 ET (07:39 GMT)

|

80 de 245

-

04/5/2016 13:43

0

0

Ariane

Messages postés: 1320 -

Membre depuis: 29/9/2002

Shell : bénéfice net divisé par dix au 1er trimestre. 04/05/2016 | 11:21 Royal Dutch Shell cède

1% à Amsterdam après la publication d'un bénéfice net part du groupe

divisé par dix à 484 millions de dollars au premier trimestre 2016, par

rapport à la même période l'année dernière.

A coûts

d'approvisionnement constant (CCS) et hors éléments exceptionnels, la

compagnie pétro-gazière anglo-néerlandaise a vu son bénéfice net chuter

de 58% à 1,55 milliard de dollars, soit 22 cents par action.

Cette

chute en comparaison annuelle traduit essentiellement un creusement de

la perte des activités amont (exploration et production), à -1,44

milliard, liée au déclin des cours alors que la production s'est accrue à

2,828 millions de barils équivalent pétrole par jour.

Shell

indique toutefois avoir bénéficié dans cette branche d'une réduction de

ses dépenses opérationnelles, les mesures prises pour réduire ses coûts

ayant compensé l'augmentation de dépenses liée à la consolidation de BG

Group.

La contribution des activités aval (raffinage et

commercialisation) a quant à elle baissé d'un quart à deux milliards de

dollars, à cause de conditions de raffinage plus difficiles dans le

secteur et malgré une performance sous-jacente plus forte en

commercialisation.

|

|

245 Réponses

...

|

|

Messages à suivre: (245)

Dernier Message: 05/Mai/2022 07h24

|

|

Hot Features

Hot Features

(CercleFinance.com) - Toujours à l'achat sur l'action Royal Dutch Shell (Xetra: A0ET6Q - actualité) , UBS (London: 0QNR.L - actualité)

a relevé ce matin son objectif de cours de 1.800 à 1.950 pence (soit

24,60 euros). Les analystes saluent la refonte stratégique mise en place

par la 'major' pétro-gazière anglo-néerlandaise, notamment le rachat de

BG Group (EUREX: 1007667.EX - actualité) . Et ils jugent que le marché ne la prend pas suffisamment en compte.

A la Bourse de Londres, l'action Shell (London: RDSB.L - actualité) de classe A se tass ecependant de 0,8% à 1.670 pence, quand à Amsterdam elle plie de 1,4% à 21 euros.

'Dans

un secteur de l'énergie en plein bouleversement, Shell a entrepris de

se réformer avec audace', indique une note de recherche. Selon UBS,

l'acquisition de BG Group permet au groupe de concentrer son

portefeuille sur des actifs de haute qualité, un bon point étant donné

l'historique de Shell en termes opérationnels.

En outre, cette

opération devrait aussi être l'occasion de 'réinitialiser' le profil de

l'action Shell en tant qu'investissement en mettant davantage l'accent

sur la rentabilité et la génération de cash. Et finalement en réduisant

le profil de risque du groupe dans un marché énergétique très volatil.

UBS a notamment revu à la hausse ses prévisions de synergies entre Shell

et BG Group.

Prochain catalyseur en vue : la journée investisseurs que Shell organisera le 7 juin prochain.