Schneider Electric Expects Higher Raw Material Prices as Tariffs Bite

19 Septembre 2018 - 9:55AM

Dow Jones News

By Nina Trentmann

French industrial group Schneider Electric SE (SU.FR) is

forecasting higher raw material prices following newly introduced

import tariffs in the U.S. and China.

"There is going to be an impact," Alain Dedieu, senior vice

president for the company's industry business, said on Wednesday in

Tianjin, China, alongside the World Economic Forum's Annual Meeting

of the New Champions. "We might see a slowdown in global

growth."

Though not directly impacted by U.S. or Chinese tariffs,

Schneider could be indirectly hit by higher input costs and an

overall decline in economic sentiment. The company provides

automation solutions, hardware, software and services.

China and the U.S. each represent around 15% of global revenue

at Schneider.

"Every disruption in the global market is causing hiccups," said

Mr. Dedieu.

The escalation of trade tensions earlier this week when both the

U.S. and China levied new tariffs on each other's goods creates new

volatility and uncertainty for multinational companies like

Schneider, said Mr. Dedieu.

"One of the core skills for managers now is to manage volatility

on a month-to-month base," he said. "This cannot go on."

Write to Nina Trentmann at Nina.Trentmann@wsj.com,

@Nina_Trentmann

(END) Dow Jones Newswires

September 19, 2018 03:40 ET (07:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

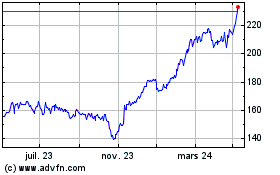

Schneider Electric (EU:SU)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

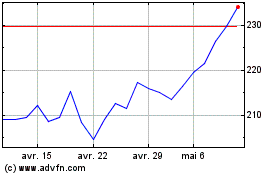

Schneider Electric (EU:SU)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024