Almaden Minerals Ltd. (“Almaden” or

“the

Company”; TSX: AMM; NYSE American: AAU) is pleased to

report on two recent court decisions, both relating to the

submission (the “Submission”) issued by Mexico’s Ministry of the

Economy (“Economia”) to the second district court in Puebla State

(the “District Court”) in February 2023.

As reported on February 22, April 13, and

September 14, 2023, Economia made the Submission to the District

Court seeking to deny the two mineral title applications which were

first made by Almaden in 2002 and 2008. The Submission claims that

the applications contain technical faults, despite Economia’s

previous statements to the contrary and its acceptance of the

mineral title applications and grant of the mineral titles in 2003

and 2009. By alleging technical faults in the mineral title

applications, Economia appears to be arbitrarily seeking to deny

the grant of the mineral titles and avoid the indigenous

consultation ordered by the February 2022 decision of Mexico’s

Supreme Court (“SCJN”). Such consultation would be welcomed by both

the Company and surrounding community members.

The two court decisions reported today are

summarized below:

- The Federal

Appeals court (“TCC”) dismisses all of the appeals filed by the

Parties, including those of the Company and supporting community

members, and rules the Submission is compliant with the 2022

decision of the SCJN, since the SCJN decision did not formally

prevent Economia from reviewing the technical aspects of the

mineral title applications;

- The TCC ruling

also does not address the validity of the Submission and therefore

safeguards the Company’s right to challenge the substance and

legality of the Submission through the Mexican Federal

Administrative Court (“TFJA”);

- As follow-up to

the press release of September 14, 2023, the TFJA has now granted a

definitive injunction in relation to the Submission, which prevents

Economia from releasing the mineral rights covered by Almaden’s

mineral title applications to third parties while the trial

continues, anticipated to last 18 months.

By way of background, the two mineral titles

previously owned by Almaden which covered the Ixtaca project were

the subject of a lawsuit against the Mexican government (President,

Congress, Ministry of Economy, Directorate of Mines, Mining

Registry Office) asserting that the Mexican mining law is

unconstitutional. In April 2019, the District Court issued a

decision that Mexico’s mining law is unconstitutional because it

fails to include provisions requiring consultation of indigenous

communities before granting mineral titles. This decision was

appealed by Mexican authorities and the Company, as an affected

third party, with the appeals being heard by the SCJN.

In early 2022, the SCJN ruled that the Mexican

mineral title law is constitutional, but that Economia should have

provided for a consultation procedure with relevant indigenous

communities prior to issuing the mineral titles. The SCJN ordered

Economia to declare Almaden’s mineral titles ineffective and to

then conduct indigenous consultation prior to re-issuing them.

The SCJN decision provided guidance to Mexican

authorities regarding the procedures required to be followed by

those authorities in the follow-up to its decision and performance

of indigenous consultation. The decision also clarified that unless

there is a significant impact on the rights of an indigenous

community caused by the granting of the mineral title, such as

relocation or something similar, title issuance is not dependent

upon the consent of any indigenous community. The District Court

was responsible for ensuring that the SCJN decision was properly

implemented.

As noted above, on February 22, 2023, Economia

made the Submission to the District Court seeking to deny the two

mineral title applications, and on April 13, 2023, Almaden reported

that the District Court ruled that the Submission formally complied

with the SCJN decision. However, the District Court ruling appeared

to rely heavily on Economia’s Submission regarding the Company’s

2002 and 2008 title applications, and in its decision the District

Court did not provide arguments to address the Company’s challenge

of the Submission. Almaden and local community members filed

separate appeals of this decision to the TCC. In parallel, Almaden

initiated a case in the TFJA to contest the substance and legality

of the Submission (see press release of September 14, 2023).

In the court decisions announced today, the TCC

has denied all Parties’ appeals of the District Court decision and

ruled that the Submission formally complies with the SCJN decision,

since in the exercise of its jurisdictional freedom Economia could

determine the inadmissibility of the mineral title applications as

the SCJN decision did not limit Economia’s jurisdiction when

reviewing technical aspects of the mineral title applications.

Also, the TCC confirmed that the subject matter

of the appeal was limited to verifying Economia’s compliance with

the SCJN decision, rather than analysing the substance or legality

of the Submission itself. Almaden has been advised that as a

consequence, the TCC safeguarded the Company’s rights to pursue a

separate legal process to examine the substance and legality of the

Submission. This TCC ruling is final.

In addition, the TFJA has now granted a

definitive injunction to Almaden’s Mexican subsidiary, Minera

Gorrion (“MG”), which prevents Economia from releasing the mineral

rights covered by the Company’s mineral title applications while

the administrative trial regarding the substance and legality of

the Submission continues. Economia has five days from the time of

its notification of this decision to appeal this ruling. Almaden

has been advised that so long as the TFJA trial continues, its

mineral title applications from 2002 and 2008 remain in place thus

preserving the Company’s preferential rights to the mineral title.

The TFJA process is expected to take approximately 18 months.

Duane Poliquin, Chair of Almaden, stated, “While

we await a decision regarding the substance and legality of the

Submission, the injunction will prevent the Government of Mexico

from declaring “freedom of land” in the area covered by Almaden’s

mineral title applications. However, we are acutely aware of the

damage already caused to our stakeholders over the past several

years by this ongoing arbitrary treatment and we are considering

additional legal remedy to address the loss of rights in

Mexico.”

About Almaden

Almaden Minerals Ltd. discovered the Ixtaca

deposit in Puebla State, Mexico, in 2010. Almaden’s interest in the

Ixtaca project is subject to a 2.0% NSR royalty held by Almadex

Minerals Ltd. The Ixtaca deposit hosts a proven and probable

reserve containing 1.38 million ounces of gold and 85.1 million

ounces of silver (73.1 million tonnes grading 0.59 g/t Au and 36.3

g/t Ag). A report titled “Ixtaca Gold-Silver Project, Puebla State,

Mexico NI 43-101 Technical Report on the Feasibility Study”, which

was prepared in accordance with NI 43-101, is available under the

Company’s profile on SEDAR and on the Company’s website.

On Behalf of the Board of Directors,

“J. Duane

Poliquin” J. Duane

PoliquinChairAlmaden Minerals Ltd.

Safe Harbor Statement

Certain of the statements and information in

this news release constitute “forward-looking statements” within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and “forward-looking information” within the

meaning of applicable Canadian provincial securities laws. All

statements, other than statements of historical fact, are

forward-looking statements or information. Forward-looking

statements or information in this news release relate to, among

other things, the timing and nature of any future rulings of the

TFSA.

These forward-looking statements and information

reflect the Company’s current views with respect to future events

and are necessarily based upon a number of assumptions that, while

considered reasonable by the Company, are inherently subject to

significant legal, regulatory, business, operational and economic

uncertainties and contingencies, and such uncertainty generally

increases with longer-term forecasts and outlook. These assumptions

include: stability and predictability in Mexico’s consultation

process with indigenous communities and judicial decisions thereon;

stability and predictability in Mexico’s mineral tenure, mining,

environmental and agrarian laws and regulations, as well as their

application and judicial decisions thereon; continued respect for

the rule of law in Mexico; prices for gold, silver and base metals

remaining as estimated; currency exchange rates remaining as

estimated; availability of funds; capital, decommissioning and

reclamation estimates; mineral reserve and resource estimates;

prices for energy inputs, labour, materials, supplies and services

(including transportation); no labour-related disruptions; all

necessary permits, licenses and regulatory approvals being received

in a timely manner; the ability to secure and maintain title and

ownership to properties and the surface rights necessary for

operations; community support in the Ixtaca Project; and the

ability to comply with environmental, health and safety laws. The

foregoing list of assumptions is not exhaustive.

The Company cautions the reader that

forward-looking statements and information involve known and

unknown risks, uncertainties and other factors that may cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements or

information contained in this news release. Such risks and other

factors include, among others, risks related to: Mexico’s

consultation process with indigenous communities and potential

litigation in respect thereof; political risk in Mexico; crime and

violence in Mexico; corruption; environmental risks, including

environmental matters under Mexican laws and regulations; impact of

environmental impact assessment requirements on the Company’s

planned exploration and development activities on the Ixtaca

Project; certainty of mineral title and the outcome of litigation;

community relations; governmental regulations and the ability to

obtain necessary licences and permits; risks related to mineral

properties being subject to prior unregistered agreements,

transfers or claims and other defects in title; changes in mining,

environmental or agrarian laws and regulations and changes in the

application of standards pursuant to existing laws and regulations

which may increase costs of doing business and restrict operations;

as well as those factors discussed the section entitled "Risk

Factors" in Almaden's Annual Information Form and Almaden's latest

Form 20-F on file with the United States Securities and Exchange

Commission in Washington, D.C. Although the Company has attempted

to identify important factors that could affect the Company and may

cause actual actions, events or results to differ materially from

those described in forward-looking statements or information, there

may be other factors that cause actions, events or results not to

be as anticipated, estimated or intended. There can be no assurance

that our forward-looking statements or information will prove to be

accurate. Accordingly, readers should not place undue reliance on

forward-looking statements or information. Except as required by

law, the Company does not assume any obligation to release publicly

any revisions to on forward-looking statements or information

contained in this news release to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events.

Contact Information:

Almaden Minerals Ltd.Tel. 604.689.7644Email:

info@almadenminerals.comhttp://www.almadenminerals.com/

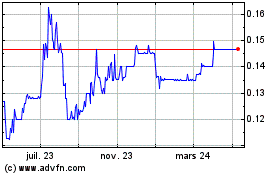

Almaden Minerals (AMEX:AAU)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

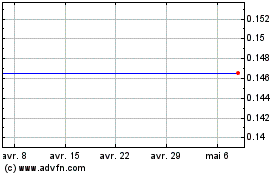

Almaden Minerals (AMEX:AAU)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024