false

0001009891

0001009891

2025-01-31

2025-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

January 31, 2025

AIR INDUSTRIES GROUP

(Exact Name of Registrant as Specified in its Charter)

| Nevada |

|

001-35927 |

|

80-0948413 |

| State of Incorporation |

|

Commission File Number |

|

IRS Employer I.D. Number |

1460 Fifth Avenue, Bay Shore, New York 11706

(Address of Principal Executive Offices)

Registrant’s telephone number: (631) 968-5000

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

AIRI |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry Into a Definitive Material Agreement.

On January 31, 2025, we, Air Industries Group,

entered into the Eighth Amendment to Loan and Security Agreement with Webster Bank (“Eighth Amendment”). In the Eighth Amendment

Webster Bank relaxed the financial covenants in the agreement, permitted the repayment of our subordinated debt, and expanded our Term

Loan by approximately $1.6 million. These funds will be used for the purchase of new state of the art machinery, costing approximately

$1.9 million. This investment in production equipment will support the recently announced $33 million contract and will greatly increase

throughput. A copy of the Eighth Amendment is annexed to this Report as Exhibit 10.1 and reference is made thereto for the complete terms

and conditions of the Eighth Amendment.

Item 7.01 Regulation FD Disclosure.

On February 3, 2025 Air Industries Group issued

a press release announcing that it had reached an agreement with Webster Bank, its primary lender, to amend the Company’s Credit

Facility. A copy of the press release is annexed as Exhibit 99.1 to this Report.

The information contained in Item 7.01 in this

Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed as “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of such Section, nor shall it be deemed incorporated

by reference in any filing by us under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation

language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: February 3, 2025

| |

AIR INDUSTRIES GROUP |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

|

Scott Glassman

|

| |

|

Chief Financial Officer |

2

Exhibit 10.1

Execution version

EIGHTH

AMENDMENT TO

LOAN

AND SECURITY AGREEMENT

This

eighth Amendment TO LOAN AND SECURITY AGREEMENT (the “Amendment”), is dated January 30, 2025, and is made by

and among (a) AIR INDUSTRIES MACHINING, CORP., a New York corporation (“AIM”), NASSAU TOOL WORKS, INC., a New York

corporation (“NTW”), THE STERLING ENGINEERING CORPORATION, a Connecticut corporation (“Engineering”,

and together with AIM and NTW, individually a “Borrower”, and collectively the “Borrowers”), (b)

AIR INDUSTRIES GROUP, a Nevada corporation (together with its successors and permitted assigns, “Parent”), and AIR

REALTY GROUP, LLC, a Connecticut limited liability company (“Realty”, and together with Parent, the “Guarantor”)

and WEBSTER BANK, NATIONAL ASSOCIATION, a national banking association (successor by merger to Sterling National Bank), (together with

its successors and permitted assigns, the “Lender”).

Recitals

Pursuant to that certain Loan

and Security Agreement, dated as of December 31, 2019, as amended (the “Loan Agreement”) by and among Borrowers, Guarantor,

the other Credit Parties thereto, and Lender, Lender has agreed to make certain financial accommodations available to Borrowers from time

to time pursuant to the terms and conditions thereof (capitalized terms used herein and not otherwise defined herein shall have the meanings

assigned to such terms in the Loan Agreement, as amended hereby).

The Credit Parties have requested

that Lender agree to make certain amendments to the Loan Agreement.

NOW, THEREFORE, in consideration

of the premises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the parties hereto, intending to be legally bound hereby, agree as follows:

1. Amendments

to Loan Agreement. As of the effective date of this Amendment, the Loan Agreement is amended as follows:

(a) Section

1.1. Section 1.1 of the Loan Agreement is hereby amended by the addition, in alphabetical order, or the amendment and restatement,

as applicable, of each of the following definitions, to read in their entirety as follows:

“ATM Proceeds”

means the cash proceeds received by Parent from the issuance of common stock through an At-The Market offering described in the Form S-3

Registration statement filed by Parent with the United States Securities and Exchange Commission on or about December 13, 2024.

“Eighth Amendment

Effective Date” means January 30, 2025.

“Fixed Charge

Coverage Ratio” means, for a Person on any date of determination, the

ratio of (a) EBITDA less unfinanced Capital Expenditures to (b) (i) taxes paid in cash, plus (ii) to the extent Distributions have not

been reflected in net income, Distributions that are made by Parent (provided that Distributions by Parent are not permitted without Lender’s

prior written consent, which consent may be granted or withheld in Lender’s sole and absolute discretion), plus, (iii) Interest

Expense paid in cash, plus (iv) principal payments made or required to be made on any and all long term Debt (other than in respect of

the Revolving Loans prior to the Maturity Date and other than principal payments made from proceeds of ATM Proceeds during such period,

so long as such payment are Permitted Subordinated Indebtedness Payments), in each case determined for such Person and its Subsidiaries

on a consolidated basis in accordance with GAAP on a rolling twelve month basis, on such date of determination.

“Installment

Payment Date” means the first day of each calendar month, commencing on the date described in Section 4.3, and continuing on

the same day of each calendar month thereafter until the earlier of the Termination Date or the date on which the Term Loan or Term Loan

Cap Ex Advance, as applicable has been irrevocably paid in full.

“Permitted

Subordinated Indebtedness Payments” shall have the meaning set forth in that certain Subordination Agreement dated as of December

31, 2019, as amended by Amendment No. 1 to Subordination Agreement dated December 7, 2021 and by Amendment No. 2 to Subordination Agreement

dated as of the Eighth Amendment Effective Date, all by and among Lender and Taglich Brothers Inc., Michael N. Taglich, Michael N. Taglich

& Claudia Taglich JTWROS, and Robert F. Taglich as subordinated creditors.

“Term Cap

Ex Commitment” means $1,640,000.

“Term Cap

Ex Commitment Period” means the period from the Eighth Amendment Effective Date through January 31, 2025.

(b) Section

4.2(b). Section 4.2(b) of the Loan Agreement is hereby amended and restated in its entirety to read as follows:

(b) For

so long as the Term Loan and the Term Cap Ex Loan remain outstanding, if Excess Cash Flow for any Fiscal Year of Parent and its consolidated

subsidiaries is a positive number, beginning with the Fiscal Year ending December 31, 2020, Borrowers shall pay to Lender, for application

to the Term Loan and the Term Cap Ex Loan on a pro rata basis, an amount equal to the lesser of (i) twenty-five percent (25%) of

the Excess Cash Flow for such Fiscal Year and (ii) the outstanding principal balance of the Term Loan and the Term Cap Ex Loan. Such payment

shall be made to Lender and applied to the outstanding principal balance of the Term Loan and Term Cap Ex Loan, on or prior to April 15

of the Fiscal Year immediately following such Fiscal Year.

(c) Section

4.3. Section 4.3(a) and Section 4.3(b) of the Loan Agreement are hereby amended and restated in their entirety read as follows:

(a) The

principal of the Term Loan shall be payable to Lender in equal monthly installments on each Installment Payment Date occurring after the

Seventh Amendment Effective Date, each in an amount equal to $67,857.15 (plus interest payable pursuant to Section 4.1).

(b) The

principal of the Term Cap Ex Loan Advance shall be payable to Lender in equal monthly installments on each Installment Payment Date occurring

after the Eighth Amendment Effective Date, each in an amount equal to $19,523.81 (plus interest payable pursuant to Section 4.1).

(d) Section

9.3. Section 9.3(c) of the Loan Agreement is hereby amended and restated in its entirety as follows:

(c) on the Agreement

Date and thereafter, (i) for working capital in the ordinary course of Borrowers’ business, and (ii) with regard to proceeds of

the Term Cap Ex Loan, to finance Eligible Equipment (other than Term Loan Primary Collateral) purchased by (or otherwise being funded

through reimbursement to) Borrowers on or about the Eighth Amendment Effective Date, and (iii) with regard to proceeds of the Term Loan,

to finance or refinance Eligible Equipment (other than Term Cap Ex Loan Primary Collateral) on or prior to the Seventh Amendment Effective

Date.

(e) Section

9.14(a). Section 9.14(a) of the Loan Agreement is hereby amended and restated in its entirety as follows:

(a) The

Fixed Charge Coverage Ratio for Parent and its consolidated Subsidiaries for any Fiscal Quarter of Parent, determined as of the last day

of such Fiscal Quarter, shall not be less than (i) 1.05 to 1.00 for the Fiscal Quarter ending March 31, 2025, (ii) 1.05 to 1.00 for the

Fiscal Quarter ending June 30, 2025, and (iii) 1.25 to 1.00 for all other Fiscal Quarters.

(f) Schedule

1.2. Schedule 1.2 of the Loan Agreement is hereby amended and restated by Schedule 1.2 attached to this Amendment.

2. No

Other Changes. Except as explicitly amended by this Amendment, all of the terms and conditions of the Loan Agreement shall remain

in full force and effect and shall apply to any Loan made thereunder.

3. Amendment

Fee. In consideration of Lender’s agreement to enter into this Amendment, Borrowers shall pay to Lender a non-refundable amendment

fee in an amount equal to $20,000 which amendment fee has been fully earned as of the effective date of this Amendment, and which shall

be payable at the execution and delivery of this Amendment.

4. Conditions

Precedent. This Amendment shall be effective on the date (such date, the “Eighth Amendment Effective Date”) that

each of the following conditions have been satisfied, in form and substance satisfactory to Lender:

(a) The

Lender shall have received a fully executed copy of this Amendment;

(b) The

Lender shall have received a Term Loan Cap Ex Note in the original principal amount of $1,640,000, payable to Lender and properly executed

by Borrowers;

(c) Evidence,

in form and substance acceptable to Lender, that the Eligible Equipment financed with proceeds of the Term Cap Ex Advance has been purchased

by a Borrower together with copies of all invoices relating to such Eligible Equipment.

(d) The

Lender shall have received a copy of the resolutions or equivalent action, in form and substance reasonably satisfactory to the Lender,

of the Board of Directors or equivalent authorizing body of each Borrower authorizing, as applicable, the execution, delivery of this

Amendment and the performance of this Amendment, certified by the Secretary, an Assistant Secretary or other authorized representatives

of each Borrower as of the Eighth Amendment Effective Date, which certificate shall state that the resolutions or other action hereby

certified have not been amended, modified (except as any later such resolution or other action may modify any earlier such resolution

or other action), revoked or rescinded and are in full force and effect; and

(e) The

Lender shall have received the amendment fee set forth in Section 3 above and Borrowers shall have paid or cause to be paid all fees and

expenses required to be paid in accordance with this Amendment.

5. Representations

and Warranties. Borrowers hereby represent and warrant to Lender as follows:

(a) Each

Borrower has all requisite power and authority to execute this Amendment and any other agreements or instruments required hereunder and

to perform all of its obligations hereunder, and this Amendment and all such other agreements and instruments have been duly executed

and delivered by each Borrower and constitute the legal, valid and binding obligation of Borrowers, enforceable in accordance with its

terms.

(b) The

execution, delivery and performance by each Borrower of this Amendment and any other agreements or instruments required hereunder have

been duly authorized by all necessary corporate action and do not (i) require any authorization, consent or approval by any governmental

department, commission, board, bureau, agency or instrumentality, domestic or foreign, (ii) violate any provision of any law, rule

or regulation or of any order, writ, injunction or decree presently in effect, having applicability to any Borrower, or the certificate

of formation, articles of incorporation, operating agreement, or by-laws of any Borrower, or (iii) result in a breach of or constitute

a default under any indenture or loan or credit agreement or any other agreement, lease or instrument to which any Borrower is a party

or by which it or its properties may be bound or affected.

(c) All

of the representations and warranties contained in the Loan Agreement are correct on and as of the date hereof as though made on and as

of such date, except to the extent that such representations and warranties relate solely to an earlier date.

(d) After

giving effect to this Amendment and the transactions contemplated hereby, no Default or Event of Default has occurred and is continuing.

6. References.

All references in the Loan Agreement to “this Agreement” shall be deemed to refer to the Loan Agreement as amended hereby;

and any and all references in the Loan Documents to the Loan Agreement shall be deemed to refer to the Loan Agreement as amended hereby.

7. No

Waiver. The execution of this Amendment and the acceptance of all other agreements and instruments related hereto shall not be deemed

to be a waiver of any Default or Event of Default under the Loan Agreement or a waiver of any breach, default or event of default under

any Loan Document or other document held by Lender, whether or not known to Lender and whether or not existing on the date of this Amendment.

8. Release.

Borrowers hereby absolutely and unconditionally release and forever discharge Lender, and any and all participants, parent corporations,

subsidiary corporations, affiliated corporations, insurers, indemnitors, successors and assigns thereof, together with all of the present

and former directors, officers, agents and employees of any of the foregoing, from any and all claims, demands or causes of action of

any kind, nature or description, whether arising in law or equity or upon contract or tort or under any state or federal law or otherwise,

any Borrower has had, now has or has made claim to have against any such person for or by reason of any act, omission, matter, cause or

thing whatsoever relating to any Loan Document arising from the beginning of time to and including the date of this Amendment, whether

such claims, demands and causes of action are matured or unmatured or known or unknown.

9. Costs

and Expenses. Borrowers hereby reaffirms their agreement under the Loan Agreement to pay or reimburse Lender on demand for all costs

and expenses incurred by Lender in connection with the Loan Documents, including without limitation all reasonable fees and disbursements

of legal counsel. Without limiting the generality of the foregoing, Borrowers specifically agree to pay all fees and disbursements of

counsel to Lender for the services performed by such counsel in connection with the preparation of this Amendment and the documents and

instruments incidental hereto. Borrowers hereby agree that Lender may, at any time or from time to time in its sole discretion and without

further authorization by Borrowers, make a loan to the Borrowers under the Loan Agreement, or apply the proceeds of any loan, for the

purpose of paying any such fees, disbursements, and costs and expenses.

10. Counterparts.

This Amendment may be executed by means of (a) an electronic signature that complies with the federal Electronic Signatures in Global

and National Commerce Act, state enactments of the Uniform Electronic Transactions Act, or any other relevant and applicable electronic

signatures law; (b) an original manual signature; or (c) a faxed, scanned, or photocopied manual signature. Each electronic signature

or faxed, scanned, or photocopied manual signature shall for all purposes have the same validity, legal effect, and admissibility in evidence

as an original manual signature. This Amendment may be executed in any number of counterparts, each of which shall be deemed to be an

original, but such counterparts shall, together, constitute only one instrument. Delivery of an executed counterpart of a signature page

of this Amendment will be as effective as delivery of a manually executed counterpart of the Agreement.

11. Headings.

Section Headings are for convenience of reference only, and are not part of, and are not to be taken into consideration in interpreting

this Amendment.

12. Governing

Law. The rights and obligations hereunder of each of the parties hereto shall be governed by and interpreted and determined in accordance

with the laws of the State of New York.

[Signature pages follow]

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed as of the date first written above.

| BORROWERS: |

AIR INDUSTRIES MACHINING, CORP. |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

Name |

Scott Glassman |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

NASSAU TOOL WORKS, INC. |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

Name |

Scott Glassman |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

THE STERLING ENGINEERING CORPORATION |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

Name |

Scott Glassman |

| |

Title: |

Chief Financial Officer |

| |

|

|

| GUARANTORS: |

AIR INDUSTRIES GROUP |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

Name |

Scott Glassman |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

AIR REALTY GROUP, LLC |

| |

|

|

| |

By: |

/s/ Scott Glassman |

| |

Name |

Scott Glassman |

| |

Title: |

Chief Financial Officer |

[Signature Page to Eighth Amendment to Loan and Security Agreement (Air Industries)]

| |

WEBSTER BANK, NATIONAL ASSOCIATION, |

| |

as Lender |

| |

|

|

| |

By: |

/s/ Gordon Massave |

| |

Name: |

Gordon Massave |

| |

Title: |

Managing Director |

[Signature Page to Eighth Amendment to Loan and Security Agreement (Air Industries)]

Schedule 1.2

Term Loan Primary Collateral

The Eligible Equipment of Borrowers described

in the Appraisal with an effective date of February 9, 2024, issue date March 1, 2024, prepared for Webster Business Credit, a division

of Webster Bank, N.A., by Tiger Valuation Services, LLC, so long as such items of Equipment shall, at all times, remain Eligible Equipment.

For the avoidance of doubt, Term Loan Primary Collateral shall not include any Term Cap Ex Loan Primary Collateral.

[Signature Page to Eighth Amendment to Loan and Security Agreement (Air Industries)]

Exhibit

99.1

February

3, 2025 07:00 AM Eastern Standard Time

Air

Industries Group Secures Expansion of

Term

Loan from Webster Bank

BAY

SHORE, N.Y. -- (BUSINESS WIRE) -- Air Industries Group (“Air Industries”) (NYSE American: AIRI), a leading manufacturer

of precision components and assemblies for large aerospace and defense prime contractors, today announced that its primary lender, Webster

Bank has amended the terms of its Credit Facility. Relaxing the required Covenants, permitting the repayment of Subordinated Debt, and

expanding the Company’s Term Loan by approximately $1.6 million. These funds will be used for the purchase of new state of the

art machinery, costing approximately $1.9 million. This investment in production equipment will support the recently announced $33 million

contract and will greatly increase throughput.

Lou

Melluzzo, Chief Executive Officer of Air Industries Group, commented: “Webster Bank has been our primary lender and a vital

partner to Air Industries for five years. This increase in our equipment term loan facilitates the purchase of two new state of the art

machines to expand the production of components for the CH-53K heavy lift helicopter. These new machines will duplicate an existing production

cell, doubling the production capacity for these products.

“Our

loan facility with Webster matures at the end of this year. Negotiations for an extension of the facility will begin in the second quarter,

after the filing of our Form 10-K. Webster Bank has been a phenomenal partner to work with, and we have a high degree of confidence that

we will be successful in extending the loan facility.”

ABOUT

AIR INDUSTRIES GROUP

Air

Industries Group is a leading manufacturer of precision components and assemblies for large aerospace and defense prime contractors.

Its products include landing gears, flight controls, engine mounts and components for aircraft jet engines, ground turbines and other

complex machines. Whether it is a small individual component or complete assembly, its high quality and extremely reliable products are

used in mission critical operations that are essential for the safety of military personnel and civilians.

FORWARD

LOOKING STATEMENTS

Certain

matters discussed in this press release are ‘forward-looking statements’ intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995. In particular, the Company’s statements regarding trends in

the marketplace, future revenues, earnings and Adjusted EBITDA, the ability to realize firm backlog and projected backlog, cost cutting

measures, potential future results and acquisitions, are examples of such forward-looking statements. The forward-looking statements

are subject to numerous risks and uncertainties, including, but not limited to, the timing of projects due to variability in size, scope

and duration, the inherent discrepancy in actual results from estimates, projections and forecasts made by management, regulatory delays,

changes in government funding and budgets, and other factors, including general economic conditions, not within the Company’s control.

The factors discussed herein and expressed from time to time in the Company’s filings with the Securities and Exchange Commission

could cause actual results and developments to be materially different from those expressed in or implied by such statements. The forward-looking

statements are made only as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstances.

NON-GAAP

FINANCIAL MEASURES

The

Company uses Adjusted EBITDA, a Non-GAAP financial measure as defined by the SEC, as a supplemental profitability measure because management

finds it useful to understand and evaluate results, excluding the impact of non-cash depreciation and amortization charges, stock based

compensation expenses, and nonrecurring expenses and outlays, prior to consideration of the impact of other potential sources and uses

of cash, such as working capital items. This calculation may differ in method of calculation from similarly titled measures used by other

companies and may be different than the EBITDA calculation used by our lenders for purposes of determining compliance with our financial

covenants. This Non-GAAP measure may have limitations when understanding performance as it excludes the financial impact of transactions

such as interest expense necessary to conduct the Company’s business and therefore are not intended to be an alternative to financial

measure prepared in accordance with GAAP. The Company has not quantitatively reconciled its forward looking Adjusted EBITDA target to

the most directly comparable GAAP measure because items such as amortization of stock-based compensation and interest expense, which

are specific items that impact these measures, have not yet occurred, are out of the Company’s control, or cannot be predicted.

For example, quantification of stock-based compensation is not possible as it requires inputs such as future grants and stock prices

which are not currently ascertainable.

Anyone

wishing to contact us or send a message can also do so by visiting: www.airindustriesgroup.com/contact-us/

Contacts

Air

Industries Group

Chief

Financial Officer

631-328-7039

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

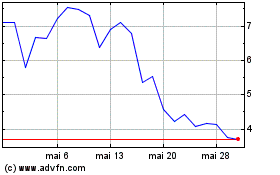

Air Industries (AMEX:AIRI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Air Industries (AMEX:AIRI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025