Current Report Filing (8-k)

01 Septembre 2022 - 11:03PM

Edgar (US Regulatory)

false 0000842717 0000842717 2022-08-29 2022-08-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 29, 2022

BLUE RIDGE BANKSHARES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Virginia |

|

001-39165 |

|

54-1470908 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 1807 Seminole Trail Charlottesville, Virginia |

|

22901 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (540) 743-6521

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, no par value |

|

BRBS |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On August 29, 2022, Blue Ridge Bank, National Association (the “Bank”), the wholly-owned bank subsidiary of Blue Ridge Bankshares, Inc., entered into a formal written agreement (the “Agreement”) with the Office of the Comptroller of the Currency (the “OCC”), the Bank’s primary federal banking regulator. The Agreement became effective August 29, 2022 and will remain effective until it is amended by the Bank and the OCC, or the OCC modifies, waives or terminates the Agreement.

Under the terms of the Agreement, the Bank is required to take the following actions within the time frames specified in the Agreement:

| |

• |

|

create a compliance committee composed of at least three of the Bank’s directors to monitor compliance with the Agreement and make quarterly progress reports to the Bank’s board of directors regarding actions the Bank has taken to comply with the Agreement and the results and status of such actions; |

| |

• |

|

adopt, implement and adhere to a written program to effectively assess and manage the risks posed by the Bank’s third-party fintech relationships; |

| |

• |

|

obtain an OCC non-objection prior to onboarding or signing a contract with a new third-party fintech partner, or offering new products or services or conducting new activities with or through existing third-party fintech partners; |

| |

• |

|

adopt, implement and adhere to an effective written Bank Secrecy Act (“BSA”) risk assessment program to ensure BSA compliance risk assessments provide a comprehensive and accurate assessment of the Bank’s BSA compliance risk across all products, services, customers, entities, and geographies, including all activities provided by or through the Bank’s third-party fintech partners; |

| |

• |

|

adopt a revised independent BSA audit program that includes an expanded scope and risk-based review of activities conducted through the Bank’s third-party fintech partners; |

| |

• |

|

ensure that the Bank’s BSA department is appropriately staffed with personnel that have requisite expertise, training, skills and authority; |

| |

• |

|

adopt, implement and adhere to revised and expanded risk-based policies, procedures, and processes (including specific requirements for the Bank’s fintech businesses) to obtain and analyze appropriate customer due diligence, enhanced due diligence, and beneficial ownership information for bank customers at the time of account opening and on an ongoing basis, and to effectively use this information to monitor and investigate suspicious or unusual activity; |

| |

• |

|

develop, implement and adhere to an enhanced written risk-based program to ensure the timely identification, analysis, and suspicious activity monitoring and reporting for all lines of business, including activities provided by and through the Bank’s third-party fintech relationship accounts and sub-accounts; |

| |

• |

|

submit to the OCC an action plan to conduct a review and provide a written report of the Bank’s suspicious activity monitoring, including with respect to high risk customer activity involving the Bank’s third-party fintech partners, and thereafter conduct such review and provide the written report to the OCC; and |

2

| |

• |

|

implement and adhere to an acceptable written program to effectively assess and manage the Bank’s information technology activities, including those activities conducted through and by the Bank’s third-party fintech partners. |

The Bank continues to cooperate with the OCC, and to work to bring the Bank’s fintech policies, procedures and operations into conformity with OCC directives. The Bank’s board of directors and management are committed to fully addressing the provisions of the Agreement within the required timeframes, and believe the Bank has made progress in addressing the requirements to date.

The foregoing summary description of the Agreement is not complete and is qualified in its entirety by reference to the Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

BLUE RIDGE BANKSHARES, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: September 1, 2022 |

|

|

|

By: |

|

/s/ Judy C. Gavant |

|

|

|

|

|

|

Judy C. Gavant |

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer |

4

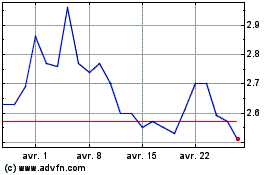

Blue Ridge Bancshares (AMEX:BRBS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Blue Ridge Bancshares (AMEX:BRBS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024