Contango ORE, Inc. (“Contango” or the “Company”) (NYSE American:

CTGO) is pleased to announce the results on gold production from

the First Batch of Manh Choh ore processed at the Fort Knox mill

located near Fairbanks, Alaska and operated by Kinross Alaska.

Processing of ore from the First Batch started on July 3rd and

continued through August 2nd.

Results for the First Batch of Manh Choh Ore

Processed1

Fort Knox processed approximately 210,000 tons (190,500 tonnes)

of Manh Choh ore with an average grade of approximately 0.276

ounce/ton (9.46 grams/tonne (“g/t”)), with an average recovery of

95%. Recoveries were slightly better than the 90% estimated in the

Manh Choh Technical Report Summary2 (the “TRS”), which is in part

due to oxidized ores tending to have higher recoveries than sulfide

ores. Attributable to the Peak Gold JV, approximately 55,000 ounces

of gold and 11,000 ounces of silver contained in doré bars were

poured at Fort Knox and sent to a third-party refinery for further

refining.

For Contango’s 30% share of the gold and silver production,

8,900 ounces of gold were delivered into its hedges at an average

price of $2,025/ounce and 5,800 ounces of gold were sold at an

average spot price of approximately $2,440. The blended weighted

average of hedged and spot gold price realized was $2,188 per ounce

of gold sold. In addition, 3,218 ounces of silver were sold at an

average spot price of $27.58. Furthermore, there is still

approximately 6,000 ounces of gold in Recoverable Inventory at Fort

Knox (30% to the account of Contango equal to approximately 1,500

ounces of gold plus a small amount of silver). To date, the

Company’s share of gold and silver sales totaled $32.2 million. The

ounces of gold and silver in Recoverable Inventory will be sold and

reported with Batch #2.

Rick Van Nieuwenhuyse, CEO and President for Contango said: “The

start of Q3 has been a transformative time for Contango - starting

with Manh Choh’s first gold pour on July 8th and continuing with

the first batch of production into early August. In addition, we

closed the acquisition of HighGold and its Johnson Tract property,

which increased the Company’s estimated mineral resources by

threefold. At Manh Choh, the Peak Gold JV completed the first batch

of ore processed through Fort Knox, producing approximately 55,000

ounces of gold and 11,000 ounces of silver. Contango sold its

portion of gold and silver for proceeds of $32.2 million. I would

like to acknowledge and thank Kinross, and in particular both the

Manh Choh and Fort Knox teams, for achieving this important

milestone. Mining and transportation of ore mined at Manh Choh

continues to be delivered to the stockpile at Fort Knox and at this

stage we believe All-In-Sustaining-Costs (“AISC”) remain in line

with the feasibility study (TRS). In late October 2024, the Company

expects to receive the Peak JV financial results for the quarter

ended September 30, 2024, which we will report and discuss in our

earnings for the quarter when we announce in the first half of

November.

Having exceeded Contango’s internal production expectations from

the first batch, we can now look forward to two more batches

planned in the Fall for the remainder of 2024. Our guidance for

Contango’s 30% share of production from Manh Choh is to produce a

total of 30,000 to 40,000 ounces of gold in 2024. Assuming we can

meet these production targets and the price of gold remains at

current levels, the Company expects to be in a strong cash position

by the end of the year after funding working capital and delivering

into our hedges. We then look forward to executing on our ‘Hybrid

Royalty’ model focusing on our Lucky Shot and Johnson Tract

properties, which we believe can both be developed efficiently by

using our DSO (Direct Shipping Ore) approach.”

The Process of Producing Gold at Fort Knox

Manh Choh ore is batch processed at the Fort Knox mill roughly

once a quarter. Each batch will take approximately one month to

complete. Ore stored on the Manh Choh stockpile starts by being

transferred to the run of mine (ROM) feed stockpile located next to

the Fort Knox mill. The first processing step involves the ore

being conveyed to the large gyratory crusher, then on to the SAG

mill (semi-autogenous grinding mill), and from there to a dedicated

ball mill where material is ground to approximately 80% passing 75

microns size particles. From the ball mill, the ground ore material

enters a thickener and then moves to a series of leach tanks where

cyanide leaches the gold out of the finely ground rock material and

then passes onto a series of Carbon in Pulp (CIP) extraction tanks,

where activated charcoal carbon absorbs the gold in the CIP leach

solution. From the CIP tanks the carbon is screened off and

separated, and then sent to the desorption facility where the gold

is stripped off the carbon and put back into solution using caustic

soda. The now highly concentrated gold in solution is sent for

electrolysis where electrical current is used to plate the gold

onto steel wool and then on to the furnace for the final step of

pouring a doré bar containing mostly gold, silver and a few minor

metals such as copper. The doré bars are then sent to a third-party

refinery to produce 4-Nines or 99.99% gold and silver bars, which

are then sold on market.

INVESTOR WEBINAR

Contango will be hosting a webinar on Tuesday, August 20th,

2024, at 1:00 pm Alaska time (5:00pm EST) to provide an update on

Manh Choh. Please use this link to register for the event: Link:

https://events.6ix.com/preview/manh-choh-update. We look forward to

seeing you there!

ABOUT CONTANGO

Contango is a NYSE American listed company that engages in

exploration for gold and associated minerals in Alaska. Contango

holds a 30% interest in the Peak Gold JV, which leases

approximately 675,000 acres of land for exploration and development

on the Manh Choh project, with the remaining 70% owned by KG Mining

(Alaska), Inc., an indirect subsidiary of Kinross, operator of the

Peak Gold JV. The Company also has a lease on the Johnson Tract

project from the underlying owner, CIRI Native Corporation, a lease

on Lucky Shot project from the underlying owner, Alaska Hardrock

Inc. and, through its subsidiary, 100% ownership of approximately

8,600 acres of peripheral State of Alaska mining claims. In

addition, Contango also owns a 100% interest in an additional

approximately 145,000 acres of State of Alaska mining claims

through its wholly owned subsidiary, which gives Contango the

exclusive right to explore and develop minerals on these lands.

Additional information can be found on our web page at

www.contangoore.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding

Contango that are intended to be covered by the safe harbor for

“forward-looking statements” provided by the Private Securities

Litigation Reform Act of 1995, based on Contango’s current

expectations and includes statements regarding future results of

operations, quality and nature of the asset base, the assumptions

upon which estimates are based and other expectations, beliefs,

plans, objectives, assumptions, strategies or statements about

future events or performance (often, but not always, using words

such as “expects”, “projects”, “anticipates”, “plans”, “estimates”,

“potential”, “possible”, “probable”, or “intends”, or stating that

certain actions, events or results “may”, “will”, “should”, or

“could” be taken, occur or be achieved). Forward-looking statements

are based on current expectations, estimates and projections that

involve a number of risks and uncertainties, which could cause

actual results to differ materially from those, reflected in the

statements. These risks include, but are not limited to: the risks

of the exploration and the mining industry (for example,

operational risks in exploring for and developing mineral reserves;

risks and uncertainties involving geology; the speculative nature

of the mining industry; the uncertainty of estimates and

projections relating to future production, costs and expenses; the

volatility of natural resources prices, including prices of gold

and associated minerals; the existence and extent of commercially

exploitable minerals in properties acquired by Contango or the Peak

Gold JV; ability to realize the anticipated benefits of the Peak

Gold JV; potential delays or changes in plans with respect to

exploration or development projects or capital expenditures; the

interpretation of exploration results and the estimation of mineral

resources; the loss of key employees or consultants; health, safety

and environmental risks and risks related to weather and other

natural disasters); uncertainties as to the availability and cost

of financing; Contango’s inability to retain or maintain its

relative ownership interest in the Peak Gold JV; inability to

realize expected value from acquisitions; inability of our

management team to execute its plans to meet its goals; the extent

of disruptions caused by an outbreak of disease, such as the

COVID-19 pandemic; and the possibility that government policies may

change, political developments may occur or governmental approvals

may be delayed or withheld, including as a result of presidential

and congressional elections in the U.S. or the inability to obtain

mining permits. Additional information on these and other factors

which could affect Contango’s exploration program or financial

results are included in Contango’s other reports on file with the

U.S. Securities and Exchange Commission. Investors are cautioned

that any forward-looking statements are not guarantees of future

performance and actual results or developments may differ

materially from the projections in the forward-looking statements.

Forward-looking statements are based on the estimates and opinions

of management at the time the statements are made. Contango does

not assume any obligation to update forward-looking statements

should circumstances or management’s estimates or opinions

change.

1 Amounts and grade at Fort Knox are

reported in short tons and ounces. All results reported in this

release include a metric equivalent in parenthesis.

2 See press release announcing TRS:

https://www.contangoore.com/press-release/contango-ore-announces-completion-of-s-k-1300-technical-report-summary-for-its-manh-choh-project-in-alaska.

To view a copy of the TRS, see:

https://cdn.prod.website-files.com/5fc5d36fd44fd675102e4420/6470afdaf94d2ac9f93d93e0_SIMS%20Contango%20Manh%20Choh%20Project%20S-K%201300%20TRS%20FINAL%2020230524%20(1)-compressed.pdf.

The information contained in, or otherwise accessible through, the

links are not part of, and are not incorporated by reference into

this investor presentation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819334833/en/

Contango ORE, Inc. Rick Van Nieuwenhuyse (907) 888-4273

www.contangoore.com

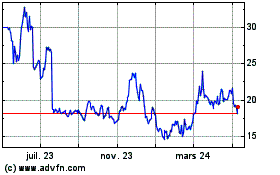

Contango Ore (AMEX:CTGO)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

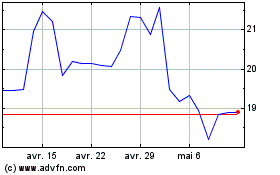

Contango Ore (AMEX:CTGO)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025