false

0000887396

0000887396

2024-02-16

2024-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_________________

FORM

8-K

_________________

Current

Report

Pursuant

To Section 13 or 15 (d)

of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported):

FEBRUARY 16, 2024

_______________________________

EMPIRE

PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware |

001-16653 |

73-1238709 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

2200

S. Utica Place, Suite 150,

Tulsa Oklahoma

74114

(Address of Principal

Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (539) 444-8002

(Former name or former address,

if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock $.001 par value

|

EP

|

NYSE

American

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01 | Entry

into a Material Definitive Agreement. |

On February 16, 2024, Empire Petroleum

Corporation (the “Company”) issued that certain Promissory Note in the aggregate principal amount of $5,000,000 (the “Note”)

to Energy Evolution Master Fund, Ltd., a Cayman Islands exempted company (“Energy Evolution”). As of February 16, 2024,

Energy Evolution has advanced the Company $2,500,000 under the Note. From time to time after February 16, 2024 and for a period

of three months thereafter, upon at least ten business days prior written notice, Energy Evolution will advance up to another $2,500,000

to the Company, provided that no Event of Default (as defined in the Note) has occurred or is continuing. The proceeds of the Note will

be used by the Company to fund, in part, its ongoing oil and gas drilling program and for working capital purposes.

The Note matures on February 15, 2026 (the

“Maturity Date”) and accrues interest at the rate of 7% per annum. After the Maturity Date, any principal balance of the

Note remaining unpaid accrues interest at the rate of 9% per annum. At the option of Energy Evolution, interest payments will be paid

either in cash or in shares of common stock of the Company on each of the following dates (or if any such date is not a business day,

the next following business day) (each an “Interest Payment Date”), except upon the occurrence of an Event of Default, in

which case interest will accrue and be paid in cash on demand: (i) March 31, 2024; (ii) June 30, 2024; (iii) September 30,

2024; (iv) December 31, 2024; (v) March 31, 2025; (vi) June 30, 2025; (vii) September 30, 2025; (viii) December 31,

2025; and (ix) the Maturity Date. All or any portion of the outstanding principal amount of the Note may be converted into shares of

common stock of the Company at a conversion price of $6.25 per share (the “Conversion Price”), at the option of Energy Evolution,

at any time and from time to time. If the full principal amount of the Note is drawn and converted into shares of common stock of the

Company, 800,000 shares would be issued (without giving effect to any interest that may be converted). Accrued interest on the principal

amount converted will be due on the applicable date of conversion in cash or, at the option of Energy Evolution, by issuance of shares

of common stock of the Company in the manner set forth in the Note (where the date of conversion is the relevant Interest Payment Date”).

The Conversion Price is subject to customary adjustments. The Note may be prepaid at any time or from time to time without the consent

of Energy Evolution and without penalty or premium, provided that the Company provides Energy Evolution with at least five business days

prior written notice, each principal payment is made in cash and all accrued interest is paid in cash, or at the option of Energy Evolution,

by issuance of shares of common stock of the Company in the manner set forth in the Note (where the Interest Payment Date is the date

of prepayment).

For a description of any material relationship

between the Company and Energy Evolution, see the Company’s definitive proxy statement for its 2023 Annual Meeting of Stockholders

filed with the Securities and Exchange Commission (the “SEC”) on May 1, 2023, the Company’s Form 10-Q for the quarter

ended September 30, 2023 filed with the SEC on November 13, 2023 and the Company’s Current Report on Form 8-K filed with

the SEC on November 29, 2023.

The foregoing summary of the Note is qualified

in its entirety by reference to the full terms and conditions of the Note, a copy of which is filed as Exhibit 10 to this Current Report

on Form 8-K and is incorporated by reference into this Item 1.01.

| Item

2.03 | Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant. |

The information

set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

| Item

3.02 | Unregistered Sales of Equity Securities. |

The information set forth under Item 1.01 of this Current Report on Form

8-K is incorporated by reference into this Item 3.02. The issuance of the Note was not registered under the Securities Act of 1933, as

amended, in reliance upon the exemption from the registration requirements of that Act provided by Section 4(a)(2) thereof. Energy Evolution

is a sophisticated accredited investor with the experience and expertise to evaluate the merits and risks of an investment in securities

of the Company and the financial means to bear the risks of such an investment.

| Item

9.01 | Financial

Statements and Exhibits. |

| (d) | | Exhibits. |

| | | |

| The following exhibits are filed or furnished herewith. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

EMPIRE

PETROLEUM CORPORATION

|

|

| Date:

February 21, 2024 |

By: |

/s/ Michael

R. Morrisett |

|

| |

|

Michael

R. Morrisett

President

and Chief Executive Officer |

|

4

EXHIBIT

10

THIS

NOTE HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN

EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY,

MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE

EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE

STATE SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY

ACCEPTABLE TO THE COMPANY.

| $5,000,000 |

|

Original

Issue Date: February 16, 2024 |

Empire

Petroleum Corporation

PROMISSORY NOTE DUE February 15, 2026

THIS

NOTE of Empire Petroleum Corporation, a Delaware corporation (the “Company”), dated February 16, 2024 (the “Original

Issue Date”), is designated as Promissory Note due February 15, 2026, in the original aggregate principal amount of Five Million

Five Dollars ($5,000,000) (this “Note”).

FOR

VALUE RECEIVED, the Company promises to pay to the order of Energy Evolution Master Fund, Ltd., a Cayman Islands exempted company, or

its registered assigns (the “Investor”), the principal sum of Five Million Dollars ($5,000,000) or such lesser amount

that may be advanced by the Investor to the Company hereunder, plus any and all accrued but unpaid interest thereon, in cash on February

15, 2026 (subject to Section 11, the “Maturity Date”). This Note is subject to the following additional provisions:

1.

Advances. As of the Original Issue Date, the

Investor has advanced the Company an amount equal to Two Million Five Hundred Thousand Dollars ($2,500,000) under this Note. From time

to time from the date of the Original Issue Date and for a period of three (3) months thereafter, upon at least ten (10) Business Days

prior written notice, the Investor shall advance up to another Two Million Five Hundred Thousand Dollars ($2,500,000) under this Note,

provided that no Event of Default has occurred or is continuing.

2.

Interest. The outstanding principal amount of

this Note shall accrue interest at the rate of 7% per annum until the Maturity Date. After the Maturity Date and upon the occurrence

and during the continuation of any Event of Default, any principal balance of the Note remaining unpaid shall bear interest at the rate

of 9% per annum. Accrued interest shall be calculated on the basis of a 360-day year for the actual number of days elapsed and shall

accrue daily commencing on the Original Issue Date and be compounded monthly on the first (1st) day of each calendar month.

At the option of the Investor, interest payments shall be paid either in cash or in shares of Empire Common Stock (as defined below)

(“Interest Shares”) on each of the following dates (or if any such date is not a Business Day, the next following

Business Day) (each, an “Interest Payment Date”), except upon the occurrence (and during the continuance) of an Event

of Default, in which case interest will accrue and be paid in cash on demand:

(a)

March 31, 2024;

(b)

June 30, 2024;

(c)

September 30, 2024;

(d)

December 31, 2024;

(e)

March 31, 2025;

(f)

June 30, 2025;

(g)

September 30, 2025;

(h)

December 31, 2025; and

(i)

the Maturity Date.

No

later than five (5) Business Days prior to each Interest Payment Date, the Investor shall send written notice to the Company of whether

it is electing to have the upcoming interest payment paid in cash or Interest Shares. The failure to send any such election shall be

deemed an election to be paid in Interest Shares. The Company covenants that all Interest Shares issued and delivered to the Investor

hereunder shall, upon issuance in accordance with the terms hereof, be duly and validly authorized, issued and fully paid and nonassessable

3.

Interest Shares. If so elected by the Investor

for any Interest Payment Date, the number of Interest Shares to be issued to the Investor on such Interest Payment Date shall be calculated

as follows:

IS = AI

/ 5WVAP;

where

| IS | = number

of Interest Shares (rounded up to the next whole number if a fraction); |

| AI | = aggregate

amount of accrued and unpaid interest on the Interest Payment Date; and |

| 5VWAP | = average

Daily VWAP for the five (5) Trading Days preceding the Interest Payment Date. |

4.

Certain Defined Terms.

(a)

“Business Day” means any day other than a Saturday, a Sunday, or any day on which the Federal Reserve Bank of New

York is closed.

(b)

“Close of Business” means 5:00 p.m., New York City time.

(c)

“Daily VWAP” means, for any Trading Day, the per share volume-weighted average price of the Empire Common Stock as

displayed under the heading “Bloomberg VWAP” on Bloomberg page “TELL <EQUITY> VAP” (or, if such page is

not available, its equivalent successor page) in respect of the period from the scheduled open of trading until the scheduled close of

trading of the primary trading session on such Trading Day (or, if such volume-weighted average price is unavailable, the market value

of one share of Empire Common Stock on such Trading Day, determined, using a volume-weighted average price method, by a nationally recognized

independent investment banking firm selected by the Company). The Daily VWAP will be determined without regard to after-hours trading

or any other trading outside of the regular trading session.

(d)

“Empire Common Stock” means the common stock, $0.001 par value per share, of the Company.

(e)

“Event of Default” means (a) any failure of the Company to make any payment of interest or principal hereunder in

cash or by issuance of Interest Shares or Underlying Shares (as applicable) within two (2) Business Days of the date when due or (b)

any other material breach of the terms hereof by the Company which failure remains uncured within five (5) Business Days of notice by

the Investor to the Company.

(f)

“Lien” means any mortgage, deed of trust, pledge, hypothecation, assignment for security, security interest, encumbrance,

levy, lien or charge of any kind, whether voluntarily incurred or arising by operation of law or otherwise, against any property, any

conditional sale or other title retention agreement, and any lease in the nature of a security interest.

(g)

“Market Disruption Event” means, with respect to any date, the occurrence or existence, during the one-half hour period

ending at the scheduled close of trading on such date on the principal U.S. national or regional securities exchange or other market

on which the Empire Common Stock is listed for trading or trades, of any material suspension or limitation imposed on trading (by reason

of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Empire Common Stock or in any options

contracts or futures contracts traded on such exchange or market relating to the Empire Common Stock.

(h)

“Trading Day” means any day on which (i) trading in the Empire Common Stock generally occurs on the principal U.S.

national or regional securities exchange on which the Empire Common Stock is then listed or, if the Empire Common Stock is not then listed

on a U.S. national or regional securities exchange, on the principal other market on which the Empire Common Stock is then traded; and

(ii) there is no Market Disruption Event. If the Empire Common Stock is not so listed or traded, then “Trading Day” means

a Business Day.

5.

Timing; Status of Interest Shares; Listing. The

Company will deliver the Interest Shares due to the Investor on or before the Close of Business on the second (2nd) Business

Day immediately after the Interest Payment Date on which such interest is due. Each Interest Share delivered upon payment of interest

will be a newly issued or treasury share and will be duly and validly issued, fully paid, non-assessable, free from preemptive rights

and free of any Lien or adverse claim (except to the extent of any Lien or adverse claim created by the action or inaction of the Investor).

If the Empire Common Stock is then listed on any securities exchange, or quoted on any inter-dealer quotation system, then the Company

will cause each Interest Share, when issued, to be admitted for listing on such exchange or quotation on such system. Any Interest Shares

will be restricted securities and issued in the form of book-entries with the Company’s transfer agent. The person in whose name

any Interest Shares are issuable will be deemed to become the holder of record of such Interest Shares as of the Close of Business on

the date such interest is due, conferring, as of such time, upon such person, without limitation, all voting and other rights appurtenant

to such Interest Shares. The Company will pay any documentary, stamp or similar issue or transfer tax or duty due on the issue of any

Interest Shares.

6.

Registration of the Note. The Company shall register

this Note upon records maintained by the Company for that purpose (the “Note Register”) in the name of the Investor.

The Company may deem and treat the registered Investor of this Note as the absolute owner hereof for the purpose of any payment of principal

hereof or interest hereon and for all other purposes, absent actual notice to the contrary from such record Investor.

7.

Registration of Transfers and Exchanges. The

Company shall register the transfer of any portion of this Note in the Note Register upon surrender of this Note to the Company at its

address for notice set forth herein. Upon any such registration or transfer, a new Note, in substantially the form of this Note (any

such new note, a “New Note”), evidencing the portion of this Note so transferred shall be issued to the transferee

and a New Note evidencing the remaining portion of this Note not so transferred, if any, shall be issued to the transferring Investor.

The acceptance of the New Note by the transferee thereof shall be deemed the acceptance by such transferee of all of the rights and obligations

of a holder of a Note. No service charge or other fee will be imposed in connection with any such registration of transfer or exchange.

The Company agrees that its prior consent is not required for the transfer of any portion of this Note.

8.

Prepayment. The outstanding principal amount

of this Note may be prepaid at any time or from time to time, in each case together with all accrued and unpaid interest on the amount

prepaid through the date of prepayment (the “Pre-Payment Date”), without the consent of the Investor and without penalty

or premium, provided, however, that (i) Borrower must provide the Investor at least five (5) Business Days’ prior written notice

of any Pre-Payment Date, (ii) each principal prepayment shall be made in cash, and (iii) all accrued and unpaid interest thereon shall

be payable in cash, or at the option of the Investor, by issuance of Interest Shares in the manner set forth in Section 3 (where

the Interest Payment Date is the Pre-Payment Date).

9.

Optional Conversion of Principal.

(a)

All or any portion of the outstanding principal amount of this Note shall be convertible into shares of Common Stock at a price of Six

and 25/100 Dollars ($6.25) per share (the “Conversion Price”), at the option of the Investor, at any time and from

time to time. For the avoidance of doubt, any remaining unconverted principal amount remains payable in cash. The Investor may effect

conversions under this Section 9, by delivering to the Company a written notice in the form attached hereto as Exhibit A (each,

a “Conversion Notice”) together with a schedule in the form attached hereto as Schedule 1 (each, a “Conversion

Schedule”). With respect to each conversion hereunder, the date the applicable Conversion Notice together with the applicable

Conversion Schedule is delivered to the Company in accordance with this Section 9(a) is referred to herein as a “Conversion

Date.”

(b)

The number of shares issuable upon any conversion of principal hereunder (the “Underlying Shares”) shall equal the

outstanding principal amount of this Note to be converted divided by the Conversion Price. All accrued and unpaid interest on the principal

amount converted shall be due and payable on the applicable Conversion Date in cash or, at the option of the Investor, by issuance of

Interest Shares in the manner set out in Section 3 (where the Conversion Date is the relevant Interest Payment Date).

(c)

The Company shall, by the third Trading Day following a Conversion Date, issue or cause to be issued and delivered to or upon the written

order of the Investor and in such name or names as the Investor may designate a certificate for the Underlying Shares issuable upon such

conversion. Such certificate shall be issued with a restrictive legend if applicable. The Investor, or any person so designated by the

Investor to receive Underlying Shares, shall be deemed to have become holder of record of such Underlying Shares as of the applicable

Conversion Date.

(d)

The Investor shall not be required to deliver the original Note to the Company in order to effect a conversion hereunder. Execution and

delivery of the Conversion Notice shall have the same effect as cancellation of the Note and issuance of a New Note representing the

remaining outstanding principal amount.

(e)

Issuance of certificates for Underlying Shares upon conversion of (or otherwise in respect of) this Note shall be made without charge

to the Investor for any issue or transfer tax, withholding tax, transfer agent fee or other incidental tax or expense in respect of the

issuance of such certificate, all of which taxes and expenses shall be paid by the Company; provided, however, that the Company shall

not be required to pay any tax which may be payable in respect of any transfer involved in the registration of any certificates for Underlying

Shares or this Note in a name other than that of the Investor. The Investor shall be responsible for all other tax liability that may

arise as a result of holding or transferring this Note or receiving Underlying Shares in respect hereof.

(f)

The Company covenants that it will at all times reserve and keep available out of the aggregate of its authorized but unissued and otherwise

unreserved Common Stock, solely for the purpose of enabling it to issue Underlying Shares as required hereunder, the number of Underlying

Shares which are then issuable and deliverable upon the conversion of (and otherwise in respect of) the aggregate then-outstanding principal

amount of this Note (taking into account any applicable adjustments of Section 10). The Company covenants that all Underlying Shares

so issuable and deliverable shall, upon issuance in accordance with the terms hereof, be duly and validly authorized, issued and fully

paid and nonassessable.

10.

Certain Adjustments. The Conversion Price is

subject to adjustment from time to time as set forth in this Section 10. Paragraph (a) of this Section 10 shall in no way apply to any

rights offering or distribution of rights related to the Company’s Common Stock in the calendar year 2024.

(a)

Stock Dividends and Splits. If the Company, at any time while this Note is outstanding: (i) pays a stock dividend on its Common

Stock or otherwise makes a distribution on any class of capital stock that is payable in shares of Common Stock, (ii) subdivides outstanding

shares of Common Stock into a larger number of shares, or (iii) combines outstanding shares of Common Stock into a smaller number of

shares, then in each such case the Conversion Price shall be multiplied by a fraction of which the numerator shall be the number of shares

of Common Stock outstanding immediately before such event and of which the denominator shall be the number of shares of Common Stock

outstanding immediately after such event. Any adjustment made pursuant to clause (i) of this paragraph shall become effective immediately

after the record date for the determination of shareholders entitled to receive such dividend or distribution, and any adjustment pursuant

to clause (ii) or (iii) of this paragraph shall become effective immediately after the effective date of such subdivision or combination.

(b)

Pro Rata Distributions. If the Company, at any time while this Note is outstanding, distributes to all holders of Common Stock

(i) evidences of its indebtedness, (ii) any security (other than a distribution of Common Stock covered by the preceding paragraph),

(iii) rights or warrants to subscribe for or purchase any security, or (iv) any other asset (in each case, “Distributed Property”),

then, at the request of the Investor delivered before the 90th day after the record date fixed for determination of shareholders entitled

to receive such distribution, the Company will deliver to the Investor, within five Trading Days after such request (or, if later, on

the effective date of such distribution), the Distributed Property that the Investor would have been entitled to receive in respect of

the Underlying Shares for which this Note could have been converted immediately prior to such record date. If such Distributed Property

is not delivered to the Investor pursuant to the preceding sentence, then upon any conversion of this Note that occurs after such record

date, the Investor shall be entitled to receive, in addition to the Underlying Shares otherwise issuable upon such conversion, the Distributed

Property that the Investor would have been entitled to receive in respect of such number of Underlying Shares had the Investor been the

record holder of such Underlying Shares immediately prior to such record date. Notwithstanding the foregoing, this Section 10(b) shall

not apply to any distribution of rights or securities in respect of adoption by the Company of a shareholder rights plan, which events

shall be covered by Section 10(a).

(c)

Fundamental Transactions. If, at any time while this Note is outstanding, (i) the Company effects any merger or consolidation

of the Company with or into another person, (ii) the Company effects any sale of all or substantially all of its assets in one or a series

of related transactions, (iii) any tender offer or exchange offer (whether by the Company or another person) is completed pursuant to

which holders of Common Stock tender or exchange their shares for other securities, cash or property, or (iv) the Company effects any

reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into

or exchanged for other securities, cash or property (other than as a result of a subdivision or combination of shares of Common Stock

covered by Section 10(a) above) (in any such case, a “Fundamental Transaction”), then upon any subsequent conversion

of this Note, the Investor shall have the right to receive, for each Underlying Share that would have been issuable upon such conversion

absent such Fundamental Transaction, the same kind and amount of securities, cash or property as it would have been entitled to receive

upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the holder of

one share of Common Stock (the “Alternate Consideration”). For purposes of any such conversion, the Company shall

apportion the Conversion Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different

components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to

be received in a Fundamental Transaction, then the Investor shall be given the same choice as to the Alternate Consideration it receives

upon any conversion of this Note following such Fundamental Transaction.

(d)

Reclassifications; Share Exchanges. In case of any reclassification of the Common Stock, or any compulsory share exchange pursuant

to which the Common Stock is converted into other securities, cash or property (other than compulsory share exchanges which constitute

Change of Control transactions), the Investor shall have the right thereafter to convert such shares only into the shares of stock and

other securities, cash and property receivable upon or deemed to be held by holders of Common Stock following such reclassification or

share exchange, and the Investor shall be entitled upon such event to receive such amount of securities, cash or property as a holder

of the number of shares of Common Stock of the Company into which such shares of the Note could have been converted immediately prior

to such reclassification or share exchange would have been entitled. This provision shall similarly apply to successive reclassifications

or share exchanges.

(e)

Calculations. All calculations under this Section 10 shall be made to the nearest cent or the nearest 1/100th of a share, as applicable.

The number of shares of Common Stock outstanding at any given time shall not include shares owned or held by or for the account of the

Company, and the disposition of any such shares shall be considered an issue or sale of Common Stock.

(f)

Notice of Adjustments. Upon the occurrence of each adjustment pursuant to this Section 10 (other than excluded transactions under

clause (i) of paragraph (a)), the Company at its expense will promptly compute such adjustment in accordance with the terms hereof and

prepare a certificate describing in reasonable detail such adjustment and the transactions giving rise thereto, including all facts upon

which such adjustment is based. Upon written request, the Company will promptly deliver a copy of each such certificate to the Investor.

(g)

Notice of Corporate Events. If the Company (i) declares a dividend or any other distribution of cash, securities or other property

in respect of its Common Stock, including without limitation any granting of rights or warrants to subscribe for or purchase any capital

stock of the Company or any subsidiary of Parent (other than excluded transactions under clause (i) of paragraph (a)), (ii) authorizes

and publicly approves, or enters into any agreement contemplating or solicits shareholder approval for any Fundamental Transaction or

(iii) publicly authorizes the voluntary dissolution, liquidation or winding up of the affairs of the Company, then the Company shall

deliver to the Investor a notice describing the material terms and conditions of such transaction, at least 20 calendar days prior to

the applicable record or effective date on which a person would need to hold Common Stock in order to participate in or vote with respect

to such transaction, and the Company will take all steps reasonably necessary in order to insure that the Investor is given the practical

opportunity to convert this Note into Common Stock under Section 9 hereof prior to such time so as to participate in or vote with

respect to such transaction; provided, however, that the failure to deliver such notice or any defect therein shall not affect the validity

of the corporate action required to be described in such notice.

(h)

Fractional Shares. The Company shall not be required to issue or cause to be issued fractional Underlying Shares on conversion

of this Note. If any fraction of an Underlying Share would, except for the provisions of this Section, be issuable upon conversion of

this Note or payment of interest hereon, the number of Underlying Shares to be issued will be rounded up to the nearest whole share.

11.

Event of Default;

Acceleration. Upon the occurrence of an Event of Default, the Maturity Date shall be deemed also to have occurred and the

outstanding principal amount of this Note and all accrued and unpaid interest thereon shall immediately be due and payable to the

Investor. The Company waives presentment, demand, notice of dishonor, protest, and notice of nonpayment and protest of this

Note.

12.

Notices. Any

and all notices or other communications or deliveries hereunder shall be in writing and shall be deemed given and effective on the

earliest of (i) the date of transmission, if such notice or communication is delivered via e-mail specified in this Section prior to

6:30 p.m. (New York City time) on Trading Day, (ii) the next Trading Day after the date of transmission, if such notice or

communication is delivered via e-mail specified in this Section on a day that is not a Trading Day or later than 6:30 p.m. (New York

City time) on any Trading Day, (iii) the Trading Day following the date of mailing, if sent by nationally recognized overnight

courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given. The addresses for such

communications shall be: (i) if to the Company, Empire Petroleum Corporation, 2200 S. Utica Place, Suite 150, Tulsa Oklahoma 74114,

Attention: Chief Executive Officer and President, E-mail: mike@empirepetrocorp.com; and (ii) if to the Investor, to the address or

e-mail appearing on the shareholder records of the Company or such other address or e-mail as the Investor may provide to the

Company in accordance with this Section.

13.

Miscellaneous.

(a)

This Note shall be binding on and inure to the benefit of the parties hereto and their respective successors and assigns. The Company

may not assign any of its rights or obligations hereunder to any other person without the prior written consent of the Investor, which

may be given or withheld in its sole discretion.

(b)

Nothing in this Note shall be construed to give to any person or corporation other than the Company and the Investor any legal or equitable

right, remedy, or cause under this Note.

(c)

All questions concerning the construction, validity, enforcement, and interpretation of this Note shall be governed by and construed

and enforced in accordance with the laws of the State of Delaware. Each party hereto hereby irrevocably waives, to the fullest extent

permitted by applicable law, any and all right to trial by jury in any action, claim, suit, investigation or proceeding (including, without

limitation, an investigation or partial proceeding, such as a deposition), whether commenced or threatened (“Proceeding”).

The prevailing party in a Proceeding shall be reimbursed by the other party for its reasonable attorneys’ fees and other costs

and expenses incurred with the investigation, preparation, and prosecution of such Proceeding.

(d)

The headings herein are for convenience only, do not constitute a part of this Note and shall not be deemed to limit or affect any of

the provisions hereof.

(e)

In case any one or more of the provisions of this Note shall be deemed by a court of competent jurisdiction to be invalid or unenforceable

in any respect, the validity and enforceability of the remaining terms and provisions of this Note shall not in any way be affected or

impaired thereby and the parties will attempt in good faith to agree upon a valid and enforceable provision which shall be a commercially

reasonable substitute therefor, and upon so agreeing, shall incorporate such substitute provision in this Note.

(f)

No provision of this Note may be waived or amended except in a written instrument signed, in the case of an amendment, by the Company

and the Investor or, in the case of a waiver, by the party against whom enforcement of any such waiver is sought. No waiver of any default

with respect to any provision, condition or requirement of this Note shall be deemed to be a continuing waiver in the future or a waiver

of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of either

party to exercise any right hereunder in any manner impair the exercise of any such right.

(g)

To the extent it may lawfully do so, the Company hereby agrees not to insist upon or plead or in any manner whatsoever claim, and will

resist any and all efforts to be compelled to take, the benefit or advantage of, usury laws wherever enacted, now or at any time hereafter

in force, in connection with any claim, action or Proceeding that may be brought by any Investor in order to enforce any right or remedy

under this Note. Notwithstanding any provision to the contrary contained in this Note, it is expressly agreed and provided that the total

liability of the Company under this Note for payments in the nature of interest shall not exceed the maximum lawful rate authorized under

applicable law (the “Maximum Rate”), and, without limiting the foregoing, in no event shall any rate of interest or

default interest, or both of them, when aggregated with any other sums in the nature of interest that the Company may be obligated to

pay under this Note exceed such Maximum Rate. It is agreed that if the maximum contract rate of interest allowed by law and applicable

to this Note is increased or decreased by statute or any official governmental action subsequent to the date hereof, the new maximum

contract rate of interest allowed by law will be the Maximum Rate of interest applicable to this Note from the effective date forward,

unless such application is precluded by applicable law. If under any circumstances whatsoever, interest in excess of the Maximum Rate

is paid by the Company to any Investor with respect to indebtedness evidenced by this Note, such excess shall be applied by such Investor

to the unpaid principal balance of any such indebtedness or be refunded to the Company, the manner of handling such excess to be at such

Investor’s election.

[Signature

on Next Page]

IN

WITNESS WHEREOF, the Company has caused this Note to be duly executed by a duly authorized officer as of the date first above indicated.

| |

Empire Petroleum Corporation |

|

| |

|

|

| |

By: /s/ Michael Morrisett |

|

| |

Name: Michael Morrisett |

|

| |

Title: President and CEO |

|

EXHIBIT

A

Empire

Petroleum Corporation

Promissory

Note due February 15, 2026 (the “Note”)

CONVERSION

NOTICE

(To

be Executed by the Investor

in

order to convert the Note)

The

undersigned hereby elects to convert the principal amount of the Note indicated below into shares of Common Stock of Empire Petroleum

Corporation as of the Conversion Date under the Note. If shares are to be issued in the name of a Person other than the undersigned,

the undersigned will pay all transfer taxes payable with respect thereto and is delivering herewith such certificates and opinions as

reasonably requested by the Company in accordance therewith. No fee will be charged to the Investor for any conversion, except for such

transfer taxes, if any. All terms used in this notice shall have the meanings set forth in the Note.

| Conversion

calculations: |

|

| |

Conversion

Date

|

| |

|

| |

|

| |

Principal

amount of Note owned prior to conversion |

| |

|

| |

|

| |

Principal

amount of Note to be Converted |

| |

|

| |

|

| |

Principal

amount of Note remaining after Conversion |

| |

|

| |

|

| |

Number

of shares of Common Stock to be Issued |

| |

|

| |

|

| |

Name

of Investor |

| |

|

| |

|

| |

|

| |

|

| |

By: _______________________________________________________________________________ |

| |

Name: |

| |

Title: |

Schedule

1

Empire

Petroleum Corporation

Promissory

Note due February 15, 2026

CONVERSION

SCHEDULE

(to

be attached to each Conversion Notice)

This

Conversion Schedule reflects conversions made under the Note through the Conversion Date specified in the Conversion Notice to which

this schedule is attached.

Conversion

Date |

Principal

Amount

of Conversion |

Aggregate

Principal Amount Remaining After Conversion Date |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

12

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

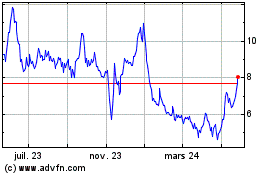

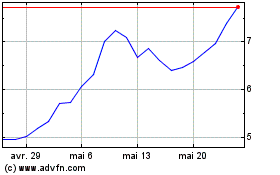

Empire Petroleum (AMEX:EP)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Empire Petroleum (AMEX:EP)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024