UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment

Company Act file number: |

811-04611 |

| |

|

| Exact

name of registrant as specified in charter: |

abrdn

Asia-Pacific Income Fund, Inc. |

| |

|

| Address of principal executive

offices: |

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Name and address of agent for

service: |

Sharon Ferrari |

| |

abrdn Inc. |

| |

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Registrant’s

telephone number, including area code: |

1-800-522-5465 |

| |

|

| Date

of fiscal year end: |

October 31 |

| |

|

| Date

of reporting period: |

April 30, 2023 |

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to shareholders

pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith.

abrdn Asia-Pacific Income Fund, Inc. (FAX)

Semi-Annual Report

April 30, 2023

Managed Distribution Policy

(unaudited)

The Board of Directors of the abrdn

Asia-Pacific Income Fund, Inc. (the "Fund") has authorized a managed distribution policy ("MDP") of paying monthly distributions at an annual rate set once a year. The Fund's current monthly distribution is set at a

rate of $0.0275 per share. With each distribution, the Fund will issue a notice to shareholders and an accompanying press release which will provide detailed information regarding the amount and estimated composition

of the distribution and other information required by

the Fund's MDP exemptive order. The Fund's

Board of Directors may amend or terminate the MDP at any time without prior notice to shareholders; however, at this time, there are no reasonably foreseeable circumstances that might cause the termination of the MDP.

You should not draw any conclusions about the Fund's investment performance from the amount of distributions or from the terms of the Fund's MDP.

Distribution Disclosure

Classification (unaudited)

The Fund’s policy is to provide

investors with a stable distribution rate. Each monthly distribution will be paid out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital.

The Fund is subject to U.S.

corporate, tax and securities laws. Under U.S. tax rules, the amount applicable to the Fund and character of distributable income for each fiscal period depends on the actual exchange rates during the entire year

between the U.S. Dollar and the currencies in which Fund assets are denominated and on the aggregate gains and losses realized by the Fund during the entire year.

Therefore, the exact amount

of distributable income for each fiscal year can only be determined as of the end of the Fund’s fiscal year, October 31. Under Section 19 of the Investment Company Act of 1940, as amended (the “1940

Act”), the Fund is required to indicate

the sources of certain distributions to

shareholders. The estimated distribution composition may vary from month-to-month because it may be materially impacted by future income, expenses and realized gains and losses on securities and fluctuations in

the value of the currencies in which Fund assets are denominated.

Based on generally accepted

accounting principles, the Fund estimates the distributions for the fiscal year commenced November 1, 2022 through the distributions declared on June 9, 2023 consisted of 55% net investment income, and 45% tax return

of capital.

In January 2024, a Form

1099-DIV will be sent to shareholders, which will state the final amount and composition of distributions and provide information with respect to their appropriate tax treatment for the 2023 calendar year.

abrdn Asia-Pacific Income Fund, Inc.

Letter to Shareholders (unaudited)

Dear Shareholder,

We present the Semi-Annual

Report, which covers the activities of abrdn Asia-Pacific Income Fund, Inc. (the “Fund”), for the six-month period ended April 30, 2023. The Fund’s principal investment objective is to seek

current income. The Fund may also achieve incidental capital appreciation.

Total Investment Return1

For the six-month period

ended April 30, 2023, the total return to shareholders of the Fund based on the net asset value (“NAV”) and market price of the Fund, respectively, compared to the Fund’s benchmark is as follows:

| NAV2,3

| 17.69%

|

| Market Price2

| 21.09%

|

| Blended Benchmark4

| 12.43%

|

For more information about

Fund performance, please visit the Fund on the web at www.abrdnfax.com. Here, you can view quarterly commentary on the Fund's performance, monthly fact sheets, distribution and performance information, and other Fund

literature.

NAV, Market Price and

Premium(+)/Discount(-)

The below table represents

comparison from current six-month period end to prior fiscal year end of market price to NAV and associated Premium(+) and Discount(-).

|

|

|

|

| NAV

| Closing

Market

Price

| Premium(+)/

Discount(-)

|

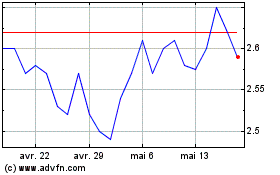

| 4/30/2023

| $3.16

| $2.72

| -13.92%

|

| 10/31/2022

| $2.85

| $2.37

| -16.84%

|

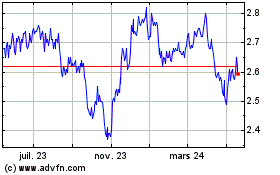

During the six-month period

ended April 30, 2023, the Fund’s NAV was within a range of $2.83 to $3.33 and the Fund’s market price traded within a range of $2.33 to $2.90. During the six-month period ended April 30, 2023, the

Fund’s shares traded within a range of a premium(+)/discount(-) of -11.73% to -18.21%.

Managed Distribution Policy

Distributions to common

shareholders for the six-month period ended April 30, 2023 totaled $0.165 per share. Based on the market price of $2.72 on April 30, 2023, the annualized distribution rate over the six-month period ended April 30,

2023 was 12.1%. Based on the NAV of $3.16 on April 30, 2023, the annualized distribution rate over the six-month period ended April 30, 2023 was 10.5%. Since all distributions are paid after deducting applicable

withholding taxes, the effective distribution rate may be higher for those U.S. investors who are able to claim a tax credit.

On May 9, 2023 and June 9,

2023, the Fund announced that it will pay on May 31, 2023 and June 30, 2023, respectively, a distribution of U.S. $0.0275 per share to all shareholders of record as of May 19, 2023 and June 23, 2023, respectively.

The Fund’s policy is to

provide investors with a stable monthly distribution out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital, which is a non-taxable return of capital. This policy

is subject to an annual review as well as regular review at the Board’s quarterly meetings, unless market conditions require an earlier evaluation.

The below chart indicates the

Fund's NAV and Market Price distribution rates over the prior three fiscal periods.

|

| Distribution

per share to

common

shareholders

| Market

Price

| Market

Price 12-

month

distribution

rate

| NAV

| NAV 12-

month

distribution

rate

|

| 10/31/2022

| $0.33

| $2.37

| 13.9%

| $2.85

| 11.6%

|

| 10/31/2021

| $0.33

| $4.22

| 7.8%

| $4.38

| 7.5%

|

| 10/31/2020

| $0.33

| $3.80

| 8.7%

| $4.65

| 7.1%

|

Portfolio Allocation

As of April 30, 2023, the

Fund held 75.5% of its total investments in Asian debt securities, 7.4% in Australian debt securities, 7.5% in Latin America debt securities, 2.0% in European debt securities, 0.6% in U.S. debt securities, 2.2% in

African debt securities and 4.8% in cash.

{foots1}

| 1

| Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be

lower or higher than the performance quoted. Net asset value return data includes investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of

all distributions.

|

{foots1}

| 2

| Assuming the reinvestment of dividends and distributions.

|

{foots1}

| 3

| The Fund’s total return is based on the reported NAV for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments.

|

{foots1}

| 4

| Blended Benchmark as defined in Total Investment Return section on Page 6.

|

| abrdn Asia-Pacific Income Fund, Inc.

| 1

|

Letter to Shareholders (unaudited) (continued)

The Fund's currency exposure as of April 30,

2023 was 45.6% in U.S. Dollar, 5.2% in the Australian Dollar, 41.2% in various Asian currencies, 7.5% in various Latin America currencies and 0.5% in various European currencies.

Credit Quality

As of April 30, 2023, 17.6%

of the Fund’s total investments were invested in securities where either the issue or the issuer was rated A or better by S&P Global Ratings (“S&P”)*, Moody’s Investors Services, Inc. (“Moody’s”)** or Fitch Ratings, Inc. (“Fitch”)***

Fund’s Leverage

The table below summarizes

certain key terms of the Fund’s current leverage:

| Amount ($ in millions)

| Maturity

|

| Revolving Credit Facility

| $65

| August 2, 2023

|

10-Year Series A Mandatory

Redeemable Preferred Shares

| $50

| June 25, 2023

|

15-Year Series C Senior Secured

Notes

| $50

| February 8, 2032

|

15-Year Series D Senior Secured

Notes

| $100

| August 10, 2032

|

15-Year Series E Senior Secured

Notes

| $100

| June 19, 2034

|

As at April 30, 2023, the

Series A Mandatory Redeemable Preferred Shares (“MRPS”), with a liquidation value of $50 million, are rated A by Fitch and the combined $250 million 10-year and 15-Year Series C, D and E Senior Secured

Notes are rated A by Fitch.

A more detailed description of

the Fund’s leverage can be found in the Notes to Financial Statements.

Unclaimed Share Accounts

Please be advised that

abandoned or unclaimed property laws for certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed

property, and Fund shares could be considered “unclaimed property” due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to

a shareholder is returned to the Fund’s transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Fund’s

transfer agent will follow the applicable state’s statutory

requirements to contact you, but if

unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will have to contact the state to recover your property, which may involve time and expense. For more

information on unclaimed property and how to maintain an active account, please contact your financial adviser or the Fund’s transfer agent.

Open Market Repurchase Program

The Fund’s Board

approved an open market repurchase and discount management policy, which allows the Fund to purchase, in the open market, its outstanding common shares, with the amount and timing of any repurchase determined at the

discretion of the Fund’s investment adviser. If shares are repurchased, the Fund reports the number of shares repurchased on its website monthly. During the six-month period ended April 30, 2023, the Fund did

not repurchase any shares through this program.

On a quarterly basis, the

Fund’s Board will receive information on any transactions made pursuant to this policy during the prior quarter and if shares are repurchased management will post the number of shares repurchased on the

Fund’s website on a monthly basis. Under the terms of the Program, the Fund is permitted to repurchase up to 10% of its outstanding shares of common stock in the open market during any 12 month period.

Portfolio Holdings Disclosure

The Fund’s complete

schedule of portfolio holdings for the second and fourth quarters of each fiscal year are included in the Fund’s semi-annual and annual reports to shareholders. The Fund files its complete schedule of portfolio

holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. These reports are available on the

SEC’s website at http://www.sec.gov. The Fund makes the information available to shareholders upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465.

Proxy Voting

A description of the policies

and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month

period ended

{foots1}

| *

| S&P’s ratings are expressed as letter grades that range from ‘AAA’ to ‘D’ to communicate the agency’s opinion of relative level of credit risk. Ratings from

‘AA’ to ‘CCC’ may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. The investment grade category is a rating from

‘AAA’ to ‘BBB-’.

|

{foots1}

| **

| Moody’s is an independent, unaffiliated research company that rates fixed income securities. Moody’s assigns ratings on the basis of risk and the borrower’s ability to make interest

payments. Typically, securities are assigned a rating from ‘Aaa’ to ‘C’, with ‘Aaa’ being the highest quality and ‘C’ the lowest quality.

|

{foots1}

| ***

| Fitch is an international credit rating agency. Fitch ratings range from AAA (reliable and stable) to D (high risk).

|

| 2

| abrdn Asia-Pacific Income Fund, Inc.

|

Letter to Shareholders (unaudited) (concluded)

June 30 is available by August 31 of the

relevant year: (1) upon request without charge by calling Investor Relations toll-free at 1-800-522-5465; and (2) on the SEC’s website at http://www.sec.gov.

Investor Relations Information

As part of abrdn’s

commitment to shareholders, we invite you to visit the Fund on the web at www.abrdnfax.com. Here, you can view monthly fact sheets, quarterly commentary, distribution and performance information, and other Fund

literature.

Enroll in abrdn’s email

services and be among the first to receive the latest closed-end fund news, announcements, videos, and other information. In addition, you can receive electronic versions of important Fund documents, including annual

reports, semi-annual reports, prospectuses and proxy statements. Sign up today at https://www.abrdn.com/en-us/cefinvestorcenter/contact-us/preferences

Contact Us:

| •

| Visit: https://www.abrdn.com/en-us/cefinvestorcenter

|

| •

| Email: Investor.Relations@abrdn.com; or

|

| •

| Call: 1-800-522-5465 (toll free in the U.S.).

|

Yours sincerely,

/s/ Christian Pittard

Christian Pittard

President

{foots1}

All amounts are U.S. Dollars

unless otherwise stated.

| abrdn Asia-Pacific Income Fund, Inc.

| 3

|

Loan Facilities and the Use of Leverage

(unaudited)

Loan Facilities and the Use of Leverage

The amounts borrowed under

the Revolving Credit Facility, the Notes and the Series A MRPS (each as defined below) may be invested to seek to return higher rates than the rates pursuant to which interests or dividends are paid under such forms

of leverage. However, the cost of leverage could exceed the income earned by the Fund on the proceeds of such leverage. To the extent that the Fund is unable to invest the proceeds from the use of leverage in assets

which pay interest at a rate which exceeds the rate paid on the leverage, the yield on the Fund’s common stock will decrease. In addition, in the event of a general market decline in the value of assets in which

the Fund invests, the effect of that decline will be magnified in the Fund because of the additional assets purchased with the proceeds of the leverage.

The Fund employed leverage

obtained via bank borrowing and other forms of leverage during the six-month period ended April 30, 2023. On August 3, 2022, the Fund executed an amendment and assignment of the $100,000,000 senior secured revolving

credit loan facility (the “Revolving Credit Facility”) with a syndicate of banks with The Bank of Nova Scotia, acting as administrative agent. As of April 30, 2023, the Fund’s outstanding balance on

the revolving credit facility was $65,000,000.

At April 30, 2023, the Fund

had $250,000,000 in aggregate principal amount of senior secured notes rated `A’ by Fitch Ratings outstanding ($50,000,000 in 3.87% Series C Senior Secured Notes due February 8, 2032, $100,000,000 in 3.70%

Series D Senior Secured Notes due August 10, 2032 and $100,000,000 in 3.73% Series E Senior Secured Notes due June 19, 2034) (collectively, the “Notes”).

At April 30, 2023, the Fund

had 2,000,000 shares of Series A MRPS, rated `A’ by Fitch ratings, outstanding with an aggregate liquidation preference of $50,000,000 ($25 per share).

The Fund’s leveraged

capital structure creates special risks not associated with unleveraged funds having similar investment objectives and policies. The funds borrowed pursuant to the Revolving Credit Facility and the Notes may

constitute a substantial lien and burden by reason of their prior claim against the income of the Fund and against the net assets of the Fund in liquidation. The Fund is limited in its ability to declare dividends or

other distributions under the terms of the various forms of leverage. In the event of an event of default under the Revolving Credit Facility, the lenders have the right to cause a liquidation of the collateral (i.e.,

sell portfolio securities and other assets of the Fund) and, if any such default is not cured, the lenders may be able to control the liquidation as well. In the event of an event of default under the Note Purchase

Agreement, the holders of the Notes have the right to cause a liquidation of the collateral (i.e., cause the sale of portfolio securities and other assets of the Fund). A liquidation of the Fund’s collateral

assets in an event of default, or a voluntary paydown of the Revolving Credit Facility, Series A MRPS or

the Notes in order to avoid an event of

default, would typically involve administrative expenses and sometimes penalties. Additionally, such liquidations often involve selling off of portions of the Fund’s assets at inopportune times which can result

in losses when markets are unfavorable.

Each of the Revolving Credit

Facility Agreement, the Note Purchase Agreement, and the Securities Purchase Agreement relating to the Series A MRPS includes usual and customary covenants for the applicable type of transaction. These covenants

impose on the Fund asset coverage requirements, Fund composition requirements and limits on certain investments, such as illiquid investments, which are more stringent than those imposed on the Fund by the 1940 Act.

The covenants or guidelines could impede the Fund’s investment manager, investment adviser, or sub-adviser from fully managing the Fund’s portfolio in accordance with the Fund’s investment objective

and policies. Furthermore, non-compliance with such covenants or the occurrence of other events could lead to the cancellation of any and/or all of the forms of leverage. As of April 30, 2023, the Fund was in

compliance with all covenants under the agreements relating to the various forms of leverage. Under the Fund's loan facilities, the Fund is charged interest on amounts borrowed at a variable rate, which may be based

on a reference rate such as the London Interbank Offered Rate (“LIBOR”), European Interbank Offer Rate (“EURIBOR”), Sterling Overnight Interbank Average Rate (“SONIA”) or Secured

Overnight Financing Rate (“SOFR”) plus a spread. Additionally, the Fund may invest in certain debt securities, derivatives or other financial instruments that utilize one of these rates as a

“benchmark” or “reference rate” for various interest rate calculations. In July 2017, the United Kingdom Financial Conduct Authority (“FCA”), which regulates the LIBOR

administrator, announced that the FCA will no longer persuade or compel banks to submit rates for the calculation of LIBOR after 2021. However, for US dollar LIBOR, it now appears that the relevant date may be

deferred to June 30, 2023 for the most common tenors (overnight and one, three, six and 12 months). See LIBOR Risk for additional details.

Interest Rate Swaps

As of April 30, 2023, the

Fund held interest rate swap agreements with an aggregate notional amount of $65million, which represented 100% of the Fund’s Revolving Credit Facility balance outstanding. Under the terms of the agreements

currently in effect, the Fund

| 4

| abrdn Asia-Pacific Income Fund, Inc.

|

Loan Facilities and the Use of Leverage

(unaudited) (concluded)

receives a floating rate of interest and pays

fixed rates of interest for the terms and based upon the notional amounts set forth below:

Remaining

Term as of

April 30, 2023

| Receive/(Pay)

Floating

Rate

| Amount

(in $ millions)

| Fixed Rate

Payable (%)

|

| 82 months

| Receive

| $20,000.0

| 3.46%

|

| 106 months

| Receive

| $20,000.0

| 3.40%

|

| 118 months

| Receive

| $25,000.0

| 3.38%

|

A significant risk associated with interest

rate swaps is the risk that the counterparty may default or file for bankruptcy, in which case the Fund would bear the risk of loss of the amount expected to be received under the swap agreements. There can be no

assurance that the Fund will have an interest rate swap in place at any given time nor can there be any assurance that, if an interest rate swap is in place, it will be successful in hedging the Fund’s interest

rate risk with respect to the loan facility.

| abrdn Asia-Pacific Income Fund, Inc.

| 5

|

Total Investment Return (unaudited)

The following table summarizes

the average annual Fund performance compared to the Fund’s primary benchmark, blended benchmark, for the six-month, 1-year, 3-year, 5-year and 10-year periods ended April 30, 2023.

|

| 6 Months

| 1 Year

| 3 Years

| 5 Years

| 10 Years

|

| Net Asset Value (NAV)

| 17.69%

| -2.70%

| -0.82%

| -0.48%

| -0.37%

|

| Market Price

| 21.09%

| -4.78%

| 0.55%

| -1.24%

| -1.76%

|

| Blended Benchmark*

| 12.43%

| 8.19%

| -0.50%

| 2.77%

| 3.38%

|

| Bloomberg Asian-Pacific Aggregate Index1

| 8.99%

| -3.64%

| -4.21%

| -1.61%

| -1.02%

|

| *

| The blended benchmark is summarized in the table below:

|

|

| Weight

|

| Bloomberg AusBond Composite Index2

| 10.0%

|

| Markit iBoxx Asian Local Bond Index3

| 40.0%

|

| J.P. Morgan Asian Credit Diversified Index4

| 35.0%

|

| J.P. Morgan EMBI Global Diversified Index5

| 15.0%

|

Performance of a $10,000

Investment (as of April 30, 2023)

This graph shows the change in

value of a hypothetical investment of $10,000 in the Fund for the period indicated.

The Fund changed its investment

strategies effective June 24, 2020, following shareholder approval of the changes. Performance information for periods prior to June 24, 2020 does not reflect the current investment strategy. Please see Note 1 in the

Notes to Financial Statements for details.

{foots1}

| 1

| The Bloomberg Asian-Pacific Aggregate Index contains fixed-rate, investment-grade securities denominated in Australian dollar, Chinese yuan, Hong Kong dollar, Indonesian rupiah, Japanese yen, Malaysian

ringgit, New Zealand dollar, Singapore dollar, South Korean won and Thai baht. The index is composed primarily of local currency sovereign debt, but also includes government-related, corporate and securitized bonds.

|

{foots1}

| 2

| The Bloomberg AusBond Composite Bond Index includes investment grade fixed interest bonds of all maturities issued in the Australian debt market under Australian law.

|

{foots1}

| 3

| The Markit iBoxx Asia Local Bond Index (“iBoxx ALBI”) is designed to reflect the performance of local currency bonds from 11 Asian local currency bond markets.

|

{foots1}

| 4

| The J.P. Morgan Asian Credit Diversified Index is a variant of the JP Morgan Asia Credit Index ("JACI") that focuses on reducing concentration risk of the JACI index to any particular market. The

JACI is a broad-based securities market index which consists of liquid US dollar-denominated debt securities issued out of the Asia ex-Japan region.

|

{foots1}

| 5

| The J.P. Morgan EMBI Global Diversified Index is a comprehensive global local emerging markets index comprising liquid, fixed rate, domestic currency government bonds.

|

| 6

| abrdn Asia-Pacific Income Fund, Inc.

|

Total Investment Return (unaudited) (concluded)

abrdn Inc. has entered into

an agreement with the Fund to limit investor relations services fees, without which performance would be lower. This agreement aligns with the term of the advisory agreement and may not be terminated prior to the end

of the current term of the advisory agreement. See Note 3 in the Notes to Financial Statements.

Returns represent past

performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program

sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment

return at market value is based on changes in the market price at which the Fund’s shares traded on the NYSE American during the period and assumes reinvestment of dividends and distributions, if any, at market

prices pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV as of the financial reporting period end date of

April 30, 2023. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market

price and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received

from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent

month-end is available at www.abrdnfax.com or by calling 800-522-5465.

The annualized net operating

expense ratio based on the six-month period ended April 30, 2023 was 3.32%.The annualized net operating expenses excluding interest expense and distributions to Series A Mandatory Redeemable Preferred Shares based on

the six-month period ended April 30, 2023 was 1.35%.

| abrdn Asia-Pacific Income Fund, Inc.

| 7

|

Portfolio Composition (as a percentage of net assets) (unaudited)

As of April 30, 2023

Quality of Investments(1)

As at April 30, 2023, 17.6%

of the Fund’s investments were invested in securities where either the issue or the issuer was rated “A” or better by S&P, Moody’s or Fitch or, if unrated, was judged to be of equivalent

quality by abrdn Asia Limited (the “Investment Manager”). The following table shows the ratings of securities held by the Fund as at April 30, 2023, compared with October 31, 2022 and April 30, 2022:

| Date

| AAA/Aaa

%

| AA/Aa

%

| A

%

| BBB/Baa

%

| BB/Ba*

%

| B*

%

| CCC/CC/C*

%

| NR**

%

|

| April 30, 2023

| 3.6

| 6.0

| 8.0

| 56.3

| 12.7

| 5.7

| 2.9

| 4.8

|

| October 31, 2022

| 2.4

| 3.9

| 7.3

| 32.1

| 12.3

| 6.2

| 2.1

| 34.3

|

| April 30, 2022

| 4.4

| 4.6

| 5.8

| 28.0

| 11.6

| 8.1

| 1.8

| 36.3

|

| *

| Below investment grade

|

| **

| Not Rated

|

| (1)

| For financial reporting purposes, credit quality ratings shown above reflect the lowest rating assigned by either S&P, Moody’s or Fitch if ratings differ. These rating agencies are

independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or

lower. Investments designated NR are not rated by these rating agencies. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. The Investment Manager

evaluates the credit quality of unrated investments based upon, but not limited to, credit ratings for similar investments.

|

Geographic Composition

The table below shows the

geographical composition of the Fund’s total investments as at April 30, 2023, compared with October 31, 2022 and April 30, 2022:

| Date

| Asia

(including NZ)

%

| Latin America

%

| Australia

%

| Europe

%

| Other, < 5

%

|

| April 30, 2023

| 75.5

| 7.5

| 7.4

| 2.0

| 7.6

|

| October 31, 2022

| 76.2

| 6.4

| 7.3

| 5.2

| 4.9

|

| April 30, 2022

| 74.8

| 5.2

| 11.0

| 4.5

| 4.5

|

Currency Composition

The table below shows the

currency composition of the Fund’s total investments as of April 30, 2023, compared with October 31, 2022 and April 30, 2022:

| Date

| U.S. Dollar

%

| Asian Currencies

(including NZ Dollar)

%

| Latin American

Currencies

%

| Australian

Dollar

%

| Other, < 5

%

|

| April 30, 2023

| 45.6

| 41.2

| 7.5

| 5.2

| 0.5

|

| October 31, 2022

| 57.2

| 35.2

| 6.4

| 0.9

| 0.3

|

| April 30, 2022

| 37.8

| 47.7

| 5.2

| 9.0

| 0.3

|

| 8

| abrdn Asia-Pacific Income Fund, Inc.

|

Portfolio Composition (as a percentage of net assets) (unaudited) (concluded)

As of April 30, 2023

Maturity Composition

The average maturity of the

Fund’s total investments was 4.6 years at April 30, 2023, compared with 12.1 years at October 31, 2022, and 11.9 years at April 30, 2022. The following table shows the maturity composition of the Fund’s

investments as at April 30, 2023, compared with October 31, 2022 and April 30, 2022:

| Date

| Under 3 Years

%

| 3 to 5 Years

%

| 5 to 10 Years

%

| 10 Years & Over

%

|

| April 30, 2023

| 48.2

| 32.9

| 18.9

| -

|

| October 31, 2022

| 24.4

| 16.0

| 39.9

| 19.7

|

| April 30, 2022

| 28.0

| 15.9

| 36.3

| 19.8

|

Modified Duration

As of April 30, 2023, the

modified duration* of the Fund was 6.9 years. This calculation excludes the interest rate swaps that are used to manage the leverage of the Fund. Excluding swaps will increase portfolio duration.

| *

| Modified duration is a measure of the sensitivity of the price of a bond to the fluctuations in interest rates.

|

| abrdn Asia-Pacific Income Fund, Inc.

| 9

|

Summary of Key Rates (unaudited)

The following table summarizes

the movements of key interest rates and currencies from April 30, 2023 compared to October 31, 2022 and April 30, 2022.

|

|

| Apr–23

| Oct–22

| Apr-22

|

| Australia

| 90 day Bank Bills

| 3.68%

| 3.09%

| 0.70%

|

|

| 10 yr bond

| 0.00%

| 3.14%

| 1.83%

|

|

| currency local per 1USD

| $1.51

| $1.56

| $1.41

|

| South Korea

| 90 day commercial paper

| 3.52%

| 3.96%

| 1.72%

|

|

| 10 yr bond

| 3.37%

| 4.23%

| 3.24%

|

|

| currency local per 1USD

| ₩1,338.40

| ₩1,424.45

| ₩1,256.00

|

| Thailand

| 3 months deposit rate

| 0.85%

| 0.55%

| 0.38%

|

|

| 10 yr bond

| 2.53%

| 3.19%

| 2.71%

|

|

| currency local per 1USD

| ฿34.15

| ฿38.06

| ฿34.25

|

| Philippines

| 90 day T-Bills

| 5.82%

| 3.75%

| 1.25%

|

|

| 10 yr bond

| 6.12%

| 7.46%

| 6.00%

|

|

| currency local per 1USD

| ₱55.39

| ₱57.95

| ₱52.21

|

| Malaysia

| 3-month T-Bills

| 2.85%

| 2.71%

| 1.80%

|

|

| 10 yr bond

| 3.73%

| 4.37%

| 4.38%

|

|

| currency local per 1USD

| RM4.46

| RM4.37

| RM4.35

|

| Singapore

| 3-month T-Bills

| 3.94%

| 4.05%

| 1.29%

|

|

| 10 yr bond

| 2.76%

| 3.43%

| 2.53%

|

|

| currency local per 1USD

| S$1.33

| S$1.42

| S$1.38

|

| India

| 3-month T-Bills

| 6.78%

| 6.42%

| 4.04%

|

|

| 10 yr bond

| 7.11%

| 7.45%

| 7.14%

|

|

| currency local per 1USD

| ₹81.84

| ₹82.78

| ₹76.44

|

| Indonesia

| 3 months deposit rate

| 3.94%

| 3.55%

| 3.26%

|

|

| 10 yr bond

| 6.51%

| 7.51%

| 6.97%

|

|

| currency local per 1USD

| Rp14,670.00

| Rp15,597.50

| Rp14,497.00

|

| China Onshore

| 3-month Bill Yield

| 2.00%

| 1.60%

| 1.84%

|

|

| 10 yr bond

| 2.78%

| 2.64%

| 2.84%

|

|

| currency local per 1USD

| ¥6.93

| ¥7.30

| ¥6.59

|

| Sri Lanka

| 3-month Generic Govt Yield

| 25.06%

| 31.84%

| 20.33%

|

|

| 10 yr bond

| 23.37%

| 27.68%

| 17.26%

|

|

| currency local per 1USD

| Rs320.86

| Rs365.50

| Rs351.32

|

| USD Denominated Bonds

| Indonesia (3 months)

| 4.44%

| 5.88%

| 4.01%

|

|

| Sri Lanka (3 Months)

| 34.68%

| 0.00%

| 24.45%

|

| 10

| abrdn Asia-Pacific Income Fund, Inc.

|

Portfolio of Investments (unaudited)

As of April 30, 2023

|

| Principal

Amount

| Value

|

| CORPORATE BONDS—69.8%

|

|

| AUSTRALIA—6.6%

|

|

|

| Australia & New Zealand Banking Group Ltd.

|

|

|

|

| (fixed rate to 06/15/2026, variable rate thereafter), 6.75%, 06/15/2026(a)(b)(c)

| $

| 6,000,000

| $ 5,789,269

|

| 5.91%, 08/12/2032(c)(d)

| AUD

| 900,000

| 602,551

|

| Commonwealth Bank of Australia

|

|

|

|

| FRN, 6.86%, 11/09/2032(a)(c)(d)

|

| 1,000,000

| 692,903

|

| 6.70%, 03/15/2038(c)(d)

|

| 2,500,000

| 1,722,916

|

| Emeco Pty. Ltd., 6.25%, 07/10/2026(d)

|

| 1,000,000

| 619,020

|

| Macquarie Bank Ltd., 3.62%, 06/03/2030(a)

| $

| 6,845,000

| 5,859,185

|

| Mineral Resources Ltd., 8.00%, 11/01/2027(a)(d)

|

| 6,850,000

| 6,975,937

|

| National Australia Bank Ltd.

|

|

|

|

| 3.50%, 06/09/2025

|

| 2,000,000

| 1,948,611

|

| 6.16%, 03/09/2033(c)(d)

| AUD

| 1,500,000

| 1,012,971

|

| Qantas Airways Ltd., 5.25%, 09/09/2030(a)(d)

|

| 2,270,000

| 1,451,717

|

| QBE Insurance Group Ltd., (fixed rate to 05/12/2025, variable rate thereafter), 5.88%, 05/12/2025(a)(b)(c)

| $

| 4,000,000

| 3,776,738

|

| Santos Finance Ltd., 4.13%, 09/14/2027(a)(d)

|

| 9,100,000

| 8,534,512

|

| Wesfarmers Ltd., 2.55%, 06/23/2031(a)(d)

| AUD

| 23,600,000

| 12,829,968

|

| Westpac Banking Corp., 4.11%, 04/15/2025

| SGD

| 250,000

| 186,208

|

| Total Australia

|

| 52,002,506

|

| BAHRAIN—0.3%

|

|

|

| Oil & Gas Holding Co. BSCC (The), 7.50%, 10/25/2027(a)

| $

| 2,500,000

| 2,557,650

|

| CHINA—13.2%

|

|

|

| Central China Real Estate Ltd.

|

|

|

|

| 7.25%, 04/24/2023(a)(d)

|

| 200,000

| 48,082

|

| 7.65%, 08/27/2023(a)(d)

|

| 1,110,000

| 245,344

|

| 7.90%, 11/07/2023(a)(d)

|

| 800,000

| 164,157

|

| 7.75%, 05/24/2024(a)(d)

|

| 3,500,000

| 703,842

|

| Central Huijin Investment Ltd. Series 2020-4, 3.02%, 03/13/2025

| CNY

| 30,000,000

| 4,349,222

|

| China Construction Bank Corp. Series 2021-1, 3.45%, 08/10/2031(d)

|

| 50,000,000

| 7,260,950

|

| China Evergrande Group, 8.75%, 06/28/2025(a)(d)(e)(f)

| $

| 12,500,000

| 818,750

|

| China Oil & Gas Group Ltd., 4.70%, 06/30/2026(a)(d)

|

| 3,595,000

| 3,021,597

|

| CIFI Holdings Group Co. Ltd., 5.95%, 10/20/2025(a)(d)(e)

|

| 1,300,000

| 192,526

|

| Country Garden Holdings Co. Ltd.

|

|

|

|

| 7.25%, 04/08/2026(a)(d)(f)

|

| 3,277,000

| 1,696,280

|

| 3.30%, 01/12/2031(a)(d)(f)

|

| 2,522,000

| 981,358

|

| ENN Clean Energy International Investment Ltd., 3.38%, 05/12/2026(a)(d)

|

| 4,526,000

| 4,044,186

|

|

| Principal

Amount

| Value

|

|

|

|

|

|

|

|

| Far East Horizon Ltd., 4.25%, 10/26/2026(a)

| $

| 3,670,000

| $ 3,143,987

|

| Gansu Provincial Highway Aviation Tourism Investment Group Co. Ltd., 3.25%, 11/03/2023(a)

|

| 3,600,000

| 3,510,000

|

| Geely Automobile Holdings Ltd.

|

|

|

|

| (fixed rate to 12/09/2024, variable rate thereafter), 4.00%, 12/09/2024(a)(b)(c)

|

| 3,000,000

| 2,839,445

|

| VRN, 4.00%, 12/09/2024(a)(b)(c)

|

| 2,500,000

| 2,366,204

|

| GLP China Holdings Ltd., 2.95%, 03/29/2026(a)

|

| 3,962,000

| 2,479,543

|

| Huarong Finance II Co. Ltd.

|

|

|

|

| 5.50%, 01/16/2025(a)

|

| 6,700,000

| 6,347,195

|

| 5.00%, 11/19/2025(a)

|

| 2,400,000

| 2,195,770

|

| Industrial & Commercial Bank of China Ltd.

|

|

|

|

| Series 2020-2, Series A, 4.15%, 11/16/2030(d)

| CNY

| 50,000,000

| 7,394,154

|

| Series 2020-1, Series A, 3.28%, 01/20/2032(d)

|

| 30,000,000

| 4,323,365

|

| Kaisa Group Holdings Ltd.

|

|

|

|

| 10.88%, 07/23/2023(a)(d)(e)(f)

| $

| 1,211,000

| 116,231

|

| 9.75%, 09/28/2023(a)(d)(e)(f)

|

| 700,000

| 67,186

|

| Lenovo Group Ltd., 6.54%, 07/27/2032(a)(d)

|

| 5,600,000

| 5,630,295

|

| Logan Group Co. Ltd.

|

|

|

|

| 6.50%, 07/16/2023(a)(d)(e)(f)

|

| 7,800,000

| 1,400,590

|

| 5.25%, 10/19/2025(a)(d)(e)(f)

|

| 7,800,000

| 1,391,704

|

| Longfor Group Holdings Ltd., 3.95%, 09/16/2029(a)

|

| 5,400,000

| 4,034,977

|

| Meituan, 3.05%, 10/28/2030(a)(d)

|

| 3,300,000

| 2,614,198

|

| New Metro Global Ltd., 4.80%, 12/15/2024(a)(d)

|

| 1,416,000

| 1,051,762

|

| Shandong Iron & Steel Xinheng International Co. Ltd., 6.50%, 11/05/2023(a)

|

| 3,754,000

| 3,735,230

|

| Shandong Iron And Steel Xinheng International Co. Ltd., 4.80%, 07/28/2024(a)

|

| 2,040,000

| 1,968,600

|

| Shimao Group Holdings Ltd.

|

|

|

|

| 6.13%, 02/21/2024(a)(d)(e)(f)

|

| 4,400,000

| 538,706

|

| 5.60%, 07/15/2026(a)(d)(e)(f)

|

| 2,800,000

| 345,452

|

| Shui On Development Holding Ltd., 5.50%, 03/03/2025(a)(d)

|

| 2,000,000

| 1,741,000

|

| Sunac China Holdings Ltd.

|

|

|

|

| 5.95%, 04/26/2024(a)(d)(e)(f)

|

| 690,000

| 138,319

|

| 6.80%, 10/20/2024(a)(d)(e)(f)

|

| 5,714,000

| 1,145,440

|

| 7.00%, 07/09/2025(a)(d)(e)(f)

|

| 1,786,000

| 358,025

|

| Tencent Holdings Ltd., 2.39%, 06/03/2030(a)(d)

|

| 3,300,000

| 2,792,569

|

| Times China Holdings Ltd., 6.20%, 03/22/2026(a)(d)(e)(f)

|

| 7,100,000

| 865,675

|

| Vanke Real Estate Hong Kong Co. Ltd., 3.50%, 11/12/2029(a)

|

| 1,840,000

| 1,519,794

|

| Wanda Properties Global Co. Ltd., 11.00%, 01/20/2025(a)

|

| 2,700,000

| 1,634,155

|

| Weibo Corp., 3.38%, 07/08/2030(d)

|

| 6,000,000

| 4,828,020

|

| Xiaomi Best Time International Ltd., 2.88%, 07/14/2031(a)(d)

|

| 3,180,000

| 2,384,229

|

| abrdn Asia-Pacific Income Fund, Inc.

| 11

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2023

|

| Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| CHINA (continued)

|

|

|

| Yuzhou Group Holdings Co. Ltd., 8.30%, 05/27/2025(a)(d)(f)

| $

| 7,000,000

| $ 465,085

|

| Zhenro Properties Group Ltd.

|

|

|

|

| 7.88%, 04/14/2024(a)(d)(e)(f)

|

| 4,000,000

| 240,000

|

| 7.10%, 09/10/2024(a)(d)(e)(f)

|

| 1,000,000

| 60,000

|

| 6.63%, 01/07/2026(a)(d)(e)(f)

|

| 10,457,000

| 627,420

|

| Zhongsheng Group Holdings Ltd., 3.00%, 01/13/2026(a)(d)

|

| 4,156,000

| 3,828,230

|

| Total China

|

| 103,648,849

|

| GERMANY—0.8%

|

|

|

| Landwirtschaftliche Rentenbank, 4.75%, 04/08/2024(g)

| AUD

| 10,000,000

| 6,676,535

|

| HONG KONG—4.5%

|

|

|

| AIA Group Ltd., 5.63%, 10/25/2027(a)(d)

| $

| 5,000,000

| 5,215,987

|

| CAS Capital No. 1 Ltd., (fixed rate to 07/12/2026, variable rate thereafter), 4.00%, 07/12/2026(a)(b)(c)

|

| 7,000,000

| 5,636,400

|

| Hutchison Whampoa Finance CI Ltd., 7.50%, 08/01/2027(a)

|

| 15,500,000

| 17,239,847

|

| Hutchison Whampoa International 03/33 Ltd., 7.45%, 11/24/2033(a)

|

| 980,000

| 1,191,701

|

| Melco Resorts Finance Ltd., 5.75%, 07/21/2028(a)(d)

|

| 3,500,000

| 3,036,250

|

| Prudential Funding Asia PLC, 2.95%, 11/03/2033(a)(c)(d)

|

| 3,600,000

| 3,066,221

|

| Total Hong Kong

|

| 35,386,406

|

| INDIA—15.6%

|

|

|

| Axis Bank Ltd.

|

|

|

|

| Series 3, 7.60%, 10/20/2023

| INR

| 200,000,000

| 2,435,797

|

| Series 1, 8.85%, 12/05/2024

|

| 500,000,000

| 6,197,970

|

| Axis Bank Ltd./Gift City, (fixed rate to 09/08/2026, variable rate thereafter), 4.10%, 09/08/2026(a)(b)(c)

| $

| 10,900,000

| 9,246,988

|

| Bharti Airtel International Netherlands BV, 5.35%, 05/20/2024(a)

|

| 378,000

| 378,224

|

| CA Magnum Holdings, 5.38%, 10/31/2026(a)(d)

|

| 800,000

| 703,378

|

| GMR Hyderabad International Airport Ltd.

|

|

|

|

| 5.38%, 04/10/2024(a)

|

| 4,173,000

| 4,141,702

|

| 4.75%, 02/02/2026(a)

|

| 1,200,000

| 1,119,883

|

| Greenko Wind Projects Mauritius Ltd., 5.50%, 04/06/2025(a)(d)

|

| 8,206,000

| 7,790,836

|

| HDFC Bank Ltd.

|

|

|

|

| (fixed rate to 08/25/2026, variable rate thereafter), 3.70%, 08/25/2026(a)(b)(c)

|

| 7,304,000

| 6,292,396

|

| Series 1, 7.95%, 09/21/2026

| INR

| 750,000,000

| 9,258,498

|

| Housing Development Finance Corp. Ltd. Series Q003, 7.90%, 08/24/2026

|

| 100,000,000

| 1,220,761

|

|

| Principal

Amount

| Value

|

|

|

|

|

|

|

|

| ICICI Bank Ltd.

|

|

|

|

| 7.60%, 10/07/2023

| INR

| 100,000,000

| $ 1,217,953

|

| 9.15%, 08/06/2024

|

| 250,000,000

| 3,114,451

|

| India Green Power Holdings, 4.00%, 02/22/2027(a)(d)(h)

| $

| 7,072,000

| 6,153,123

|

| Indiabulls Housing Finance Ltd., 9.00%, 04/29/2026

| INR

| 100,000,000

| 1,156,947

|

| Indian Railway Finance Corp. Ltd. Series 129, 8.45%, 12/04/2028

|

| 50,000,000

| 641,943

|

| JSW Infrastructure Ltd., 4.95%, 01/21/2029(a)(d)

| $

| 3,420,000

| 2,960,971

|

| National Highways Authority of India Series 5, 7.70%, 09/13/2029

| INR

| 150,000,000

| 1,848,133

|

| NTPC Ltd.

|

|

|

|

| Series 60, 8.05%, 05/05/2026

|

| 50,000,000

| 620,997

|

| Series 61-B, 8.10%, 05/27/2026

|

| 250,000,000

| 3,109,680

|

| Periama Holdings LLC, 5.95%, 04/19/2026(a)

| $

| 3,280,000

| 3,155,688

|

| Power Finance Corp. Ltd.

|

|

|

|

| Series 125, 8.65%, 12/28/2024

| INR

| 400,000,000

| 4,961,508

|

| Series 130C, 8.39%, 04/19/2025

|

| 250,000,000

| 3,092,910

|

| 6.15%, 12/06/2028(a)

| $

| 7,112,000

| 7,357,221

|

| Power Grid Corp. of India Ltd.

|

|

|

|

| 8.13%, 04/25/2027

| INR

| 150,000,000

| 1,885,568

|

| Series LIII, 8.13%, 04/25/2028

|

| 500,000,000

| 6,238,580

|

| REC Ltd.

|

|

|

|

| Series 180A, 8.10%, 06/25/2024

|

| 150,000,000

| 1,846,126

|

| Series 123, 9.34%, 08/25/2024

|

| 150,000,000

| 1,869,289

|

| 5.63%, 04/11/2028(a)

| $

| 3,443,000

| 3,458,226

|

| Reliance Industries Ltd., 4.13%, 01/28/2025(a)

|

| 4,800,000

| 4,716,906

|

| Shriram Finance Ltd., 4.40%, 03/13/2024(a)

|

| 8,000,000

| 7,753,207

|

| State of Maharashtra India, 7.20%, 08/09/2027

| INR

| 300,000,000

| 3,598,544

|

| UPL Corp. Ltd., 4.63%, 06/16/2030(a)

| $

| 3,327,000

| 2,848,610

|

| Total India

|

| 122,393,014

|

| INDONESIA—4.8%

|

|

|

| Bank Mandiri Persero Tbk PT

|

|

|

|

| 4.75%, 05/13/2025(a)

|

| 2,198,000

| 2,174,285

|

| 5.50%, 04/04/2026(a)

|

| 2,216,000

| 2,242,748

|

| Bank Rakyat Indonesia Persero Tbk PT Series OB, 8.25%, 08/24/2024

| IDR

| 10,000,000,000

| 699,046

|

| Bank Tabungan Negara Persero Tbk PT, 4.20%, 01/23/2025(a)

| $

| 7,300,000

| 6,902,150

|

| Hutama Karya Persero PT, 3.75%, 05/11/2030(a)(d)(g)

|

| 3,766,000

| 3,505,943

|

| LLPL Capital Pte Ltd., 6.88%, 02/04/2039(a)(h)

|

| 5,065,988

| 4,531,577

|

| Medco Oak Tree Pte Ltd., 7.38%, 05/14/2026(a)(d)

|

| 4,565,000

| 4,382,996

|

| Pertamina Geothermal Energy PT, 5.15%, 04/27/2028(a)(d)

|

| 2,892,000

| 2,906,460

|

| 12

| abrdn Asia-Pacific Income Fund, Inc.

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2023

|

| Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| INDONESIA (continued)

|

|

|

| Perusahaan Perseroan Persero PT Perusahaan Listrik Negara

|

|

|

|

| Series OB, 8.25%, 07/05/2023

| IDR

| 12,000,000,000

| $ 820,960

|

| 6.15%, 05/21/2048(a)

| $

| 3,129,000

| 3,051,036

|

| Tower Bersama Infrastructure Tbk PT, 2.75%, 01/20/2026(a)(d)

|

| 7,181,000

| 6,657,365

|

| Total Indonesia

|

| 37,874,566

|

| KAZAKHSTAN—0.8%

|

|

|

| Development Bank of Kazakhstan JSC, 10.95%, 05/06/2026(a)

| KZT

| 3,265,000,000

| 5,955,553

|

| KUWAIT—0.9%

|

|

|

| MEGlobal Canada ULC, 5.00%, 05/18/2025(a)

| $

| 6,759,000

| 6,708,308

|

| MACAO—2.1%

|

|

|

| MGM China Holdings Ltd., 5.88%, 05/15/2026(a)(d)

|

| 3,500,000

| 3,361,155

|

| Sands China Ltd., 5.63%, 08/08/2025(d)

|

| 4,900,000

| 4,799,782

|

| Studio City Finance Ltd., 5.00%, 01/15/2029(a)(d)

|

| 3,500,000

| 2,739,100

|

| Wynn Macau Ltd., 5.50%, 10/01/2027(a)(d)

|

| 6,000,000

| 5,347,500

|

| Total Macao

|

| 16,247,537

|

| MALAYSIA—1.9%

|

|

|

| DRB-Hicom Bhd IMTN, 5.10%, 12/12/2029

| MYR

| 5,000,000

| 1,099,547

|

| Malayan Banking Bhd IMTN, 4.08%, 09/25/2024(b)(c)(f)

|

| 5,000,000

| 1,120,188

|

| Pengerang LNG Two Sdn Bhd

|

|

|

|

| IMTN, 2.86%, 10/20/2028

|

| 5,000,000

| 1,046,889

|

| IMTN, 2.92%, 10/19/2029

|

| 5,000,000

| 1,035,602

|

| Petroleum Sarawak Exploration & Production Sdn Bhd IMTN, 4.10%, 03/19/2031

|

| 10,000,000

| 2,193,400

|

| Press Metal Aluminium Holdings Bhd IMTN, 4.00%, 08/15/2025

|

| 5,000,000

| 1,117,554

|

| Tenaga Nasional Bhd, 7.50%, 01/15/2096(a)

| $

| 2,700,000

| 2,875,500

|

| TNB Global Ventures Capital Bhd, 3.24%, 10/19/2026(a)

|

| 4,300,000

| 4,049,912

|

| Total Malaysia

|

| 14,538,592

|

| MEXICO—0.5%

|

|

|

| Petroleos Mexicanos, 7.19%, 09/12/2024(a)

| MXN

| 72,500,000

| 3,704,710

|

| PHILIPPINES—4.2%

|

|

|

| AC Energy Finance International Ltd., 5.10%, 11/25/2025(a)(b)

| $

| 6,800,000

| 5,185,000

|

| Globe Telecom, Inc., (fixed rate to 08/02/2026, variable rate thereafter), 4.20%, 08/02/2026(a)(b)(c)

|

| 4,097,000

| 3,787,676

|

| ICTSI Treasury BV, 5.88%, 09/17/2025(a)

|

| 7,000,000

| 6,958,000

|

|

| Principal

Amount

| Value

|

|

|

|

|

|

|

|

| Manila Water Co., Inc., 4.38%, 07/30/2030(a)(d)

| $

| 11,000,000

| $ 9,735,000

|

| Royal Capital BV, (fixed rate to 05/05/2024, variable rate thereafter), 4.88%,

05/05/2024(a)(b)(c)

|

| 7,000,000

| 6,842,500

|

| Total Philippines

|

| 32,508,176

|

| REPUBLIC OF KOREA—4.9%

|

|

|

| Busan Bank Co. Ltd., 3.63%, 07/25/2026(a)

|

| 11,400,000

| 10,422,979

|

| Hanwha Totalenergies Petrochemical Co. Ltd., 3.88%, 01/23/2024(a)

|

| 3,300,000

| 3,259,575

|

| Kookmin Bank, 2.50%, 11/04/2030(a)

|

| 2,000,000

| 1,650,599

|

| Kyobo Life Insurance Co. Ltd., (fixed rate to 06/15/2027, variable rate thereafter), 5.90%, 06/15/2052(a)(c)(d)

|

| 2,155,000

| 2,076,863

|

| Shinhan Bank Co. Ltd., 4.50%, 03/26/2028(a)

|

| 5,900,000

| 5,643,851

|

| SK Hynix, Inc.

|

|

|

|

| 2.38%, 01/19/2031(a)

|

| 2,071,000

| 1,557,115

|

| REGS, 2.38%, 01/19/2031(a)

|

| 7,000,000

| 5,263,062

|

| 6.50%, 01/17/2033(a)

|

| 5,400,000

| 5,356,810

|

| Tongyang Life Insurance Co. Ltd., (fixed rate to 09/22/2025, variable rate thereafter),

5.25%, 09/22/2025(a)(b)(c)

|

| 3,650,000

| 3,166,375

|

| Total Republic of Korea

|

| 38,397,229

|

| SAUDI ARABIA—0.4%

|

|

|

| Saudi Electricity Global Sukuk Co. 3, 5.50%, 04/08/2044(a)

|

| 2,976,000

| 3,041,532

|

| SINGAPORE—1.8%

|

|

|

| DBS Group Holdings Ltd.

|

|

|

|

| (fixed rate to 02/27/2025, variable rate thereafter), 3.30%, 02/27/2025(a)(b)(c)

|

| 3,600,000

| 3,387,901

|

| (fixed rate to 12/11/2023, variable rate thereafter), 4.52%, 12/11/2028(a)(c)(d)

|

| 2,400,000

| 2,386,296

|

| GLP Pte Ltd., (fixed rate to 05/17/2026, variable rate thereafter), 4.50%, 05/17/2026(a)(b)(c)

|

| 4,538,000

| 1,817,469

|

| Vena Energy Capital Pte Ltd., 3.13%, 02/26/2025(a)

|

| 7,000,000

| 6,599,755

|

| Total Singapore

|

| 14,191,421

|

| THAILAND—1.7%

|

|

|

| Bangkok Bank PCL

|

|

|

|

| 9.03%, 03/15/2029(a)

|

| 1,200,000

| 1,365,408

|

| (fixed rate to 09/25/2029, variable rate thereafter), 3.73%, 09/25/2034(a)(c)(d)

|

| 6,900,000

| 5,920,200

|

| GC Treasury Center Co. Ltd., 4.40%, 03/30/2032(a)(d)

|

| 4,209,000

| 3,862,499

|

| PTTEP Treasury Center Co. Ltd., 3.90%, 12/06/2059(a)

|

| 3,342,000

| 2,445,305

|

| Total Thailand

|

| 13,593,412

|

| abrdn Asia-Pacific Income Fund, Inc.

| 13

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2023

|

| Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| UNITED ARAB EMIRATES—2.0%

|

|

|

| DP World Ltd., 6.85%, 07/02/2037(a)

| $

| 2,700,000

| $ 3,014,566

|

| Galaxy Pipeline Assets Bidco Ltd., 2.63%, 03/31/2036(a)(h)

|

| 7,237,000

| 5,963,280

|

| MAF Global Securities Ltd., (fixed rate to 03/20/2026, variable rate thereafter), 6.38%,

03/20/2026(a)(b)(c)

|

| 6,500,000

| 6,342,765

|

| Total United Arab Emirates

|

| 15,320,611

|

| UNITED KINGDOM—1.6%

|

|

|

| Standard Chartered PLC

|

|

|

|

| 4.05%, 04/12/2026(a)

|

| 5,000,000

| 4,854,720

|

| 6.30%, 01/09/2029(a)(c)(d)

|

| 7,276,000

| 7,458,225

|

| Total United Kingdom

|

| 12,312,945

|

| UNITED STATES—0.7%

|

|

|

| Hyundai Capital America, 6.38%, 04/08/2030(a)(d)

|

| 5,100,000

| 5,365,031

|

| VIETNAM—0.5%

|

|

|

| Mong Duong Finance Holdings BV, 5.13%, 05/07/2029(a)(d)(h)

|

| 4,310,000

| 3,730,908

|

| Total Corporate Bonds

|

| 546,155,491

|

| GOVERNMENT BONDS—67.8%

|

|

| ANGOLA—1.4%

|

|

|

| Angolan Government International Bond, 9.50%, 11/12/2025(a)

|

| 11,000,000

| 10,849,520

|

| AUSTRALIA—4.1%

|

|

|

| Australia Government Bond Series 154, 2.75%, 11/21/2029(a)

| AUD

| 2,300,000

| 1,483,355

|

| New South Wales Treasury Corp.

|

|

|

|

| Series 26, 4.00%, 05/20/2026(a)

|

| 7,500,000

| 5,046,665

|

| 3.00%, 02/20/2030(a)

|

| 13,500,000

| 8,556,572

|

| Queensland Treasury Corp.

|

|

|

|

| Series 23, 4.25%, 07/21/2023(a)

|

| 22,000,000

| 14,575,662

|

| 3.50%, 08/21/2030(a)

|

| 300,000

| 195,940

|

| Treasury Corp. of Victoria, 2.25%, 11/20/2040

|

| 5,000,000

| 2,310,705

|

| Total Australia

|

| 32,168,899

|

| BRAZIL—3.7%

|

|

|

| Brazil Notas do Tesouro Nacional Series NTNF, 10.00%, 01/01/2029

| BRL

| 128,000,000

| 23,534,719

|

| Brazil Notas do Tesouro Nacional Serie F Series NTNF, 10.00%, 01/01/2033

|

| 30,000,000

| 5,459,551

|

| Total Brazil

|

| 28,994,270

|

| COLOMBIA—0.8%

|

|

|

| Colombian TES Series B,Series B, 10.00%, 07/24/2024

| COP

| 28,000,000,000

| 5,895,160

|

| DOMINICAN REPUBLIC—0.2%

|

|

|

| Dominican Republic International Bond, 13.63%, 02/03/2033(a)(d)

| DOP

| 64,000,000

| 1,360,440

|

|

| Principal

Amount

| Value

|

|

|

|

| HONG KONG—0.4%

|

|

|

| Airport Authority, 4.88%, 01/12/2033(a)(d)

| $

| 1,350,000

| $ 1,397,750

|

| Hong Kong Government International Bond, 5.25%, 01/11/2053(a)

|

| 1,660,000

| 1,863,785

|

| Total Hong Kong

|

| 3,261,535

|

| INDIA—7.4%

|

|

|

| India Government Bond

|

|

|

|

| 5.22%, 06/15/2025

| INR

| 533,000,000

| 6,294,968

|

| 6.79%, 05/15/2027

|

| 325,000,000

| 3,939,246

|

| 7.17%, 01/08/2028

|

| 550,000,000

| 6,741,030

|

| 7.26%, 01/14/2029

|

| 1,340,000,000

| 16,457,258

|

| 9.20%, 09/30/2030

|

| 9,590,000

| 130,259

|

| 6.19%, 09/16/2034

|

| 500,000,000

| 5,600,013

|

| 7.40%, 09/19/2062

|

| 1,500,000,000

| 18,415,248

|

| Total India

|

| 57,578,022

|

| INDONESIA—19.1%

|

|

|

| Indonesia Government International Bond

|

|

|

|

| 8.50%, 10/12/2035(a)

| $

| 9,880,000

| 13,026,549

|

| 7.75%, 01/17/2038(a)

|

| 6,000,000

| 7,618,567

|

| 5.35%, 02/11/2049

|

| 2,670,000

| 2,734,377

|

| Indonesia Treasury Bond

|

|

|

|

| Series FR64, 6.13%, 05/15/2028

| IDR

| 271,570,000,000

| 18,383,641

|

| Series FR71, 9.00%, 03/15/2029

|

| 200,000,000,000

| 15,309,884

|

| Series FR78, 8.25%, 05/15/2029

|

| 240,000,000,000

| 17,820,859

|

| Series FR82, 7.00%, 09/15/2030

|

| 65,000,000,000

| 4,547,342

|

| Series FR87, 6.50%, 02/15/2031

|

| 21,000,000,000

| 1,429,446

|

| Series FR73, 8.75%, 05/15/2031

|

| 300,000,000,000

| 23,034,969

|

| Series FR54, 9.50%, 07/15/2031

|

| 16,000,000,000

| 1,282,083

|

| Series FR96, 7.00%, 02/15/2033

|

| 255,606,000,000

| 17,976,402

|

| Series FR72, 8.25%, 05/15/2036

|

| 150,000,000,000

| 11,399,898

|

| Series FR79, 8.38%, 04/15/2039

|

| 98,500,000,000

| 7,600,883

|

| Series FR83, 7.50%, 04/15/2040

|

| 44,000,000,000

| 3,151,624

|

| Perusahaan Penerbit SBSN Indonesia III, 4.15%, 03/29/2027(a)

| $

| 3,770,000

| 3,751,150

|

| Total Indonesia

|

| 149,067,674

|

| IRAQ—0.3%

|

|

|

| Iraq International Bond, 5.80%, 01/15/2028(a)(d)(h)

|

| 2,093,750

| 1,952,841

|

| JORDAN—1.2%

|

|

|

| Jordan Government International Bond, 7.75%, 01/15/2028(a)

|

| 9,502,000

| 9,670,185

|

| 14

| abrdn Asia-Pacific Income Fund, Inc.

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2023

|

| Principal

Amount

| Value

|

| GOVERNMENT BONDS (continued)

|

|

| MALAYSIA—6.8%

|

|

|

| Malaysia Government Bond

|

|

|

|

| Series 0114, 4.18%, 07/15/2024

| MYR

| 10,900,000

| $ 2,473,829

|

| Series 0119, 3.91%, 07/15/2026

|

| 34,000,000

| 7,749,911

|

| Series 0417, 3.90%, 11/16/2027

|

| 48,300,000

| 11,004,004

|

| Series 0513, 3.73%, 06/15/2028

|

| 17,500,000

| 3,955,587

|

| Series 0220, 2.63%, 04/15/2031

|

| 46,000,000

| 9,469,268

|

| Series 0519, 3.76%, 05/22/2040

|

| 9,793,000

| 2,103,093

|

| Series 0222, 4.70%, 10/15/2042

|

| 16,500,000

| 4,021,221

|

| Series 0518, 4.92%, 07/06/2048

|

| 30,500,000

| 7,602,154

|

| Series 0120, 4.07%, 06/15/2050

|

| 14,800,000

| 3,195,941

|

| Malaysia Government Investment Issue Series 0121, 3.45%, 07/15/2036

|

| 8,200,000

| 1,735,405

|

| Total Malaysia

|

| 53,310,413

|

| MALDIVES—0.2%

|

|

|

| Maldives Sukuk Issuance Ltd., 9.88%, 04/08/2026(a)

| $

| 2,200,000

| 1,783,565

|

| MEXICO—3.6%

|

|

|

| Mexican Bonos

|

|

|

|

| Series M 20, 10.00%, 12/05/2024

| MXN

| 50,000,000

| 2,747,907

|

| Series M 20, 8.50%, 05/31/2029

|

| 469,000,000

| 25,669,204

|

| Total Mexico

|

| 28,417,111

|

| MONGOLIA—0.9%

|

|

|

| Development Bank of Mongolia LLC, 7.25%, 10/23/2023(a)

| $

| 7,200,000

| 7,062,534

|

| NIGERIA—1.4%

|

|

|

| Nigeria Government International Bond, 8.75%, 01/21/2031(a)

|

| 14,100,000

| 11,174,250

|

| PAKISTAN—2.0%

|

|

|

| Pakistan Global Sukuk Programme Co. Ltd. (The), 7.95%, 01/31/2029(a)

|

| 6,245,000

| 2,672,060

|

| Pakistan Government International Bond

|

|

|

|

| 8.25%, 04/15/2024(a)

|

| 7,495,000

| 3,737,307

|

| 8.25%, 09/30/2025(a)

|

| 5,209,000

| 2,133,815

|

| 6.88%, 12/05/2027(a)

|

| 18,129,000

| 6,360,016

|

| 7.38%, 04/08/2031(a)

|

| 2,355,000

| 794,624

|

| Total Pakistan

|

| 15,697,822

|

| PHILIPPINES—4.1%

|

|

|

| Philippine Government Bond

|

|

|

|

| Series 1069, 6.75%, 09/15/2032

| PHP

| 481,500,000

| 9,097,946

|

| Series 25-6, 9.25%, 11/05/2034

|

| 435,710,000

| 9,816,724

|

| Philippine Government International Bond

|

|

|

|

| 4.20%, 03/29/2047

| $

| 2,570,000

| 2,248,869

|

| 5.50%, 01/17/2048

|

| 5,200,000

| 5,439,922

|

| Philippines Government Bonds Series 25-7, 8.00%, 09/30/2035

| PHP

| 260,310,000

| 5,415,043

|

| Total Philippines

|

| 32,018,504

|

|

| Principal

Amount

| Value

|

|

|

|

| REPUBLIC OF KOREA—5.1%

|

|

|

| Export-Import Bank of Korea, 5.13%, 01/11/2033

| $

| 1,684,000

| $ 1,782,889

|

| Industrial Bank of Korea, 5.13%, 10/25/2024(a)

|

| 2,500,000

| 2,510,222

|

| Korea Electric Power Corp., 5.13%, 04/23/2034(a)

|

| 5,200,000

| 5,364,268

|

| Korea Treasury Bond

|

|

|

|

| Series 2709, 3.13%, 09/10/2027

| KRW

| 14,500,000,000

| 10,743,675

|

| Series 5203, 2.50%, 03/10/2052

|

| 31,500,000,000

| 19,653,710

|

| Total Republic of Korea

|

| 40,054,764

|

| SINGAPORE—2.3%

|

|

|

| Singapore Government Bond

|

|

|

|

| 3.00%, 09/01/2024

| SGD

| 11,800,000

| 8,801,694

|

| 2.38%, 06/01/2025

|

| 12,600,000

| 9,308,429

|

| Total Singapore

|

| 18,110,123

|

| UKRAINE—0.8%

|

|

|

| Ukraine Government Bond, 15.84%, 02/26/2025(f)

| UAH

| 210,000,000

| 4,142,654

|

| Ukraine Government International Bond, 7.38%, 09/25/2034(a)(e)(f)(h)

| $

| 10,600,000

| 1,696,000

|

| Total Ukraine

|

| 5,838,654

|

| URUGUAY—2.0%

|

|

|

| Uruguay Government International Bond, 8.25%, 05/21/2031

| UYU

| 674,024,434

| 15,603,141

|

| Total Government Bonds

|

| 529,869,427

|

| SHORT-TERM INVESTMENT—5.1%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 4.76%(i)

|

| 39,473,909

| 39,473,909

|

| Total Short-Term Investment

|

| 39,473,909

|

Total Investments

(Cost $1,284,741,212)(j)—142.7%

|

| 1,115,498,827

|

| Long Term Debt Securities

| (315,000,000)

|

| Mandatory Redeemable Preferred Stock at Liquidation Value

| (50,000,000)

|

| Other Assets in Excess of Liabilities—4.0%

|

| 31,449,667

|

| Net Assets—100.0%

|

| $781,948,494

|

| (a)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (b)

| Perpetual maturity. Maturity date presented represents the next call date.

|

| (c)

| Variable or Floating Rate security. Rate disclosed is as of April 30, 2023.

|

| (d)

| The maturity date presented for these instruments represents the next call/put date.

|

| (e)

| Security is in default.

|

| (f)

| Illiquid security.

|

| (g)

| Denotes the security is government guaranteed.

|

| (h)

| Sinkable security.

|

| (i)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of April 30, 2023.

|

| (j)

| See accompanying Notes to Financial Statements for tax unrealized appreciation/(depreciation) of securities.

|

| abrdn Asia-Pacific Income Fund, Inc.

| 15

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2023

| BRL

| Brazilian Real

|

| CNH

| Chinese Yuan Renminbi Offshore

|

| CNY

| Chinese Yuan Renminbi

|

| COP

| Colombian Peso

|

| DOP

| Dominican Republic Peso

|

| FRN

| Floating Rate Note

|

| IDR

| Indonesian Rupiah

|

| INR

| Indian Rupee

|

| KRW

| South Korean Won

|

| KZT

| Kazakhstan Tenge

|

| MXN

| Mexican Peso

|

| MYR

| Malaysian Ringgit

|

| PHP

| Philippine Peso

|

| PLC

| Public Limited Company

|

| SGD

| Singapore Dollar

|

| THB

| Thai Baht

|

| UAH

| Ukraine Hryvna

|

| USD

| U.S. Dollar

|

| UYU

| Uruguayan Peso

|

| VRN

| Variable Rate Note

|

| At April 30, 2023, the Fund held the following futures contracts:

|

| Futures Contracts

| Number of

Contracts

Long/(Short)

| Expiration

Date

| Notional

Amount

| Market

Value

| Unrealized

Appreciation/

(Depreciation)

|

| Long Contract Positions

|

|

|

|

|

|

| Korea Treasury Bond - 10 year

| 404

| 6/20/2023

| $34,371,996

| $34,329,737

| $(42,259)

|

| United States Treasury Bond

| 265

| 6/21/2023

| 35,658,739

| 37,472,656

| 1,813,917

|

| United States Treasury Note 6%—5 year

| 283

| 6/30/2023

| 30,347,744

| 31,057,039

| 709,295

|

|

|

|

|

|

| $2,480,953

|

| Short Contract Positions

|

|

|

|

|

|

| United States Treasury Note 6%—10 year

| (417)

| 6/21/2023

| $(2,800,837)

| $(3,225,687)

| $(424,850)

|

| United States Treasury Note 6%—5 year

| (283)

| 6/30/2023

| (30,346,521)

| (31,057,039)

| (710,518)

|

|

|

|

|

|

| $(1,135,368)

|

|

|

|

|

|

| $1,345,585

|

| At April 30, 2023, the Fund held the following forward foreign currency contracts:

|

Purchase Contracts

Settlement Date*

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| Chinese Yuan Renminbi Offshore/United States Dollar

|

|

|

|

|

|

| 07/12/2023

| UBS AG

| CNH

| 344,887,172

| USD

| 50,414,804

| $50,066,124

| $(348,680)

|

| Philippine Peso/United States Dollar

|

|

|

|

|

|

| 05/02/2023

| Citibank N.A.

| PHP

| 154,740,378

| USD

| 2,785,857

| 2,793,903

| 8,046

|

| 05/02/2023

| Citibank N.A.

| PHP

| 51,580,126

| USD

| 941,346

| 931,301

| (10,045)

|

| 07/25/2023

| Citibank N.A.

| PHP

| 180,095,126

| USD

| 3,215,929

| 3,251,826

| 35,897

|

| Singapore Dollar/United States Dollar

|

|

|

|

|

|

| 05/19/2023

| Citibank N.A.

| SGD

| 44,367,832

| USD

| 33,245,949

| 33,267,901

| 21,952

|

| South Korean Won/United States Dollar

|

|

|

|

|

|

| 06/15/2023

| Citibank N.A.

| KRW

| 16,212,275,845

| USD

| 12,346,160

| 12,152,688

| (193,472)

|

| 06/15/2023

| Royal Bank of Canada

| KRW

| 3,548,799,000

| USD

| 2,664,329

| 2,660,172

| (4,157)

|

| Thai Baht/United States Dollar

|

|

|

|

|

|

| 05/30/2023

| UBS AG

| THB

| 1,076,894,529

| USD

| 30,882,238

| 31,621,080

| 738,842

|

|

| $136,744,995

| $248,383

|

Sale Contracts

Settlement Date*

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| United States Dollar/Chinese Renminbi

|

|

|

|

|

|

| 07/12/2023

| State Street Bank & Trust Co.

| USD

| 6,413,753

| CNY

| 43,959,000

| $6,386,832

| $26,921

|

| United States Dollar/Indian Rupee

|

|

|

|

|

|

| 06/01/2023

| HSBC Bank PLC

| USD

| 4,270,573

| INR

| 350,816,000

| 4,287,096

| (16,523)

|

| 06/01/2023

| UBS AG

| USD

| 1,930,713

| INR

| 160,405,611

| 1,960,213

| (29,500)

|

| 16

| abrdn Asia-Pacific Income Fund, Inc.

|

Portfolio of Investments (unaudited) (concluded)

As of April 30, 2023

Sale Contracts

Settlement Date*

| Counterparty

| Currency

Purchased

| Amount

Purchased

| Currency

Sold

| Amount

Sold

| Fair Value

| Unrealized

Appreciation/

(Depreciation)

|

| United States Dollar/Indonesian Rupiah

|

|

|

|

|

|

| 06/26/2023

| Citibank N.A.

| USD

| 4,195,343

| IDR

| 62,720,369,732

| $4,274,416

| $(79,073)

|

| 06/26/2023

| HSBC Bank PLC

| USD

| 7,162,698

| IDR

| 105,177,354,000

| 7,167,874

| (5,176)

|

| United States Dollar/Malaysian Ringgit

|

|

|

|

|

|

| 06/16/2023

| BNP Paribas S.A.

| USD

| 8,404,669

| MYR