Gold Royalty Corp. (“

Gold Royalty” or the

“

Company”) (NYSE American: GROY) is pleased to

announce that it has entered into an agreement with National Bank

Financial Inc. and BMO Capital Markets Corp., as joint

book-runners, on behalf of a syndicate of underwriters

(collectively, the “

Underwriters”), pursuant to

which the Underwriters have agreed to purchase, on a bought deal

basis, 17,442,000 units of the Company (the

“

Units”) at a price of US$1.72 per Unit (the

“

Offering Price”), for aggregate gross proceeds of

approximately US$30 million (the “

Offering”).

Each Unit will consist of one common share of

the Company (each a “Common Share”) and one common

share purchase warrant (each a “Warrant”). Each

Warrant will be exercisable to acquire one Common Share of the

Company for a period of thirty-six months at an exercise price of

US$2.25. Subject to receipt of the necessary approvals, the Common

Shares as well as the Common Shares issuable upon exercise of the

Warrants will be listed on the NYSE American. The Company has

agreed to use commercially reasonable efforts to list the Warrants

on the NYSE American following closing of the Offering.

The Company has granted the Underwriters an

over-allotment option, exercisable in whole or in part at any time

at the Offering Price up to 30 days after closing of the Offering,

to purchase up to an additional 15% of the number of Units issued

pursuant to the Offering, for additional gross proceeds to the

Company of up to approximately US$4.5 million, to acquire Units,

Common Shares and/or Warrants (or any combination

thereof).

The Company intends to use the net proceeds of

the Offering to fund a portion of the consideration for its

acquisition (the "Acquisition") of a copper stream

(the “Stream”) in respect of the Vares Silver

Project, operated by a subsidiary of Adriatic Metals plc and

located in Bosnia and Herzegovina pursuant to a purchase and sale

agreement (the “PSA”) between the Company and OMF

Fund III (Cr) Ltd., an entity managed by Orion Mine Finance

Management LP (“Orion”). Under the terms of the

PSA, Gold Royalty will pay US$50 million to acquire the Stream from

Orion at the closing of the Acquisition, comprised of US$45 million

payable in cash and US$5 million to be satisfied by the issuance of

2,906,977 Gold Royalty shares.

Closing of the Offering is expected to occur on

or about May 31, 2024 (the “Closing Date”),

subject to customary closing conditions, including the receipt of

all necessary approvals of the NYSE American in accordance with its

applicable listing requirements. The closing of the Offering is not

conditional upon the completion of the Acquisition. In the event

that the Acquisition is not completed, the Company may reallocate

the net proceeds from the Offering for general corporate purposes,

including to fund other acquisitions or repay outstanding

indebtedness.

The Offering will be made in each of the

provinces and territories of Canada, other than Quebec and Nunavut,

by way of a prospectus supplement to the Company’s Canadian short

form base shelf prospectus dated July 15, 2022. The Company has

also filed with the U.S. Securities and Exchange Commission

(the “SEC”) a registration statement on Form F-3

(File No. 333-265581), containing a shelf prospectus dated July 6,

2022, which was declared effective by the SEC on July 15, 2022. The

securities in the Offering are being offered only by means of a

prospectus, including a prospectus supplement, forming a part of

the registration statement. A preliminary prospectus supplement and

accompanying prospectus relating to, and describing the terms of,

the Offering has been filed with the SEC. The Offering may also be

made on a private placement basis in other international

jurisdictions in reliance on applicable private placement

exemptions. Before investing, prospective investors should read the

Canadian base shelf prospectus and the prospectus supplement

thereto, or the registration statement, including the U.S. base

prospectus therein, and the prospectus supplement thereto, as

applicable, including, in each case, the documents attached thereto

or incorporated by reference therein, for more complete information

about the Company and the Offering.

These documents may be accessed for free on the

System for Electronic Document Analysis and Retrieval

(“SEDAR+”) at www.sedarplus.ca and on

the SEC’s Electronic Data Gathering, Analysis and Retrieval system

(“EDGAR”) at www.sec.gov. An electronic or

paper copy of the base shelf prospectus, the preliminary prospectus

supplement and the final prospectus supplement (when filed) as well

as any amendment to the documents may be obtained in Canada,

without charge, from National Bank Financial Inc. by phone at (416)

869-6534 or by email at NBF-Syndication@bnc.ca or from BMO Nesbitt

Burns Inc. by phone at 905-791-3151 Ext 4312 or by email at

torbramwarehouse@datagroup.ca and in the United States by

contacting National Bank of Canada Financial Inc. by phone at (416)

869-6534 or by email at NBF-Syndication@bnc.ca or BMO Capital

Markets Corp. by phone at 800-414-3627 or by email at

bmoprospectus@bmo.com, by providing the contact with an email

address or address, as applicable.

It is expected that delivery of the Units will

be made against payment therefor on or about the Closing Date,

which will be three business days following the date of the

prospectus supplement (this settlement cycle being referred to as

"T+3"). Under Rule 15c6-1 of the Securities Exchange Act of 1934,

as amended, trades in the secondary market are generally required

to settle in one business day (this settlement cycle being referred

to as “T+1”), unless the parties to any such trade expressly agree

otherwise. Accordingly, purchasers who wish to trade their Common

Shares, Warrants or Common Shares underlying the Warrants issuable

upon exercise thereof prior to the Closing Date will be required,

by virtue of the fact that the Units will not settle in T+1, to

specify an alternate settlement cycle at the time of any such trade

to prevent a failed settlement. Purchasers of Units who wish to

trade their Common Shares, Warrants or Common Shares underlying the

Warrants issuable upon exercise thereof prior to the Closing Date

should consult their own advisors. Furthermore, the Company has

agreed to use commercially reasonable efforts to list the Warrants

on the NYSE American. Listing will be subject to fulfilling all

listing requirements of the NYSE American. As a result, the

Warrants will not be immediately tradeable over the facilities of

the NYSE American on the Closing Date.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any province, state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such province, state or jurisdiction.

About Gold Royalty Corp.

Gold Royalty Corp. is a gold-focused royalty

company offering creative financing solutions to the metals and

mining industry. Its mission is to invest in high-quality,

sustainable, and responsible mining operations to build a

diversified portfolio of precious metals royalty and streaming

interests that generate superior long-term returns for our

shareholders. Gold Royalty's diversified portfolio currently

consists primarily of net smelter return royalties on gold

properties located in the Americas.

Gold Royalty Corp. Contact

Peter BehnckeDirector, Corporate Development

& Investor RelationsTelephone: (833) 396-3066Email:

info@goldroyalty.com

Forward-Looking Statements:

Certain of the information contained in this

news release constitutes "forward-looking information" and

"forward-looking statements" within the meaning of applicable

Canadian and U.S. securities laws (collectively, "forward-looking

statements"), including but not limited to statements regarding the

Company's acquisition of the Stream, the size and timing of the

Offering, the completion of the Offering, the satisfaction of

customary closing conditions related to the Offering, the use of

proceeds of the Offering, and the listing of the Common Shares and

Warrants on the NYSE American. Such statements can be generally

identified by the use of terms such as "may", "will", "expect",

"intend", "believe", "plans", "anticipate" or similar terms.

Forward-looking statements are based upon certain assumptions and

other important factors, including that the conditions to the

Offering and the Acquisition will be satisfied, and all requisite

regulatory approvals for the Offering will be obtained, in a timely

manner. Forward-looking statements are subject to a number of

risks, uncertainties and other factors which may cause the actual

results to be materially different from those expressed or implied

by such forward-looking statements including, among others, the

possibility that the Offering does not close when expected, or at

all, because conditions to closing are not satisfied on a timely

basis, or at all, the possibility that the Acquisition does not

close when expected, or at all, because conditions to closing are

not satisfied on a timely basis, or at all, and other factors set

forth in the Company's Annual Report on Form 20-F for the year

ended December 31, 2023, its registration statement, prospectuses

and prospectus supplements relating to the Offering and its other

publicly filed documents, available under its profiles at

www.sedarplus.ca and www.sec.gov. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements, prospectuses and prospectus supplement,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company does not

undertake to update any forward-looking statements, except in

accordance with applicable securities laws.

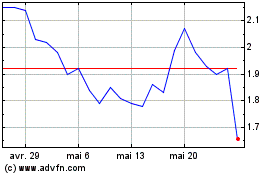

Gold Royalty (AMEX:GROY)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Gold Royalty (AMEX:GROY)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025