Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

22 Juillet 2024 - 11:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] |

| |

| Filed by a Party other than the Registrant [ ] |

| |

| Check the appropriate box: |

| |

| [ ] |

|

Preliminary Proxy Statement |

| [ ] |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] |

|

Definitive Proxy Statement |

| [X] |

|

Definitive Additional Materials |

| [ ] |

|

Soliciting Material Pursuant to §240.14a-12 |

| |

Neuberger Berman Municipal Fund Inc.

|

|

| |

(Name of Registrant as Specified In Its Charter) |

|

| |

|

|

| |

|

|

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| [X] |

|

No fee required. |

| [ ] |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

|

|

| |

|

1) |

|

Title of each class of securities to which transaction applies: |

| |

|

|

|

|

| |

|

2) |

|

Aggregate number of securities to which transaction applies: |

| |

|

|

|

|

| |

|

3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined): |

| |

|

|

|

|

| |

|

4) |

|

Proposed maximum aggregate value of transaction: |

| |

|

|

|

|

| |

|

5) |

|

Total fee paid: |

| |

|

|

|

|

| |

|

|

| [ ] |

|

Fee paid previously with preliminary materials. |

| |

|

|

| [ ] |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

|

|

| |

|

1) |

|

Amount Previously Paid: |

| |

|

|

|

|

| |

|

2) |

|

Form, Schedule or Registration Statement No.: |

| |

|

|

|

|

| |

|

3) |

|

Filing Party: |

| |

|

|

|

|

| |

|

4) |

|

Date Filed: |

| |

|

|

|

|

Neuberger Berman Next Generation Connectivity Fund Inc. (NBXG)Neuberger Berman

Municipal Fund Inc. (NBH) Presentation to Institutional Shareholder Services (ISS) July 2024

Table of Contents Introduction and Overview of Neuberger Berman Neuberger Berman

Closed-End Fund Oversight Why SABA’s Nominee is the Wrong choice NBXG: Performance Review & Discussion NBH: Performance Review & Discussion

Is Change Warranted? No. The Funds’ Incumbent Director Nominees are the Right

Choice Incumbent Director nominees are independent and experienced in overseeing CEFs Neuberger Berman Closed-End Funds (NB CEFs) are designed and managed to help investors achieve their long-term investment goals The NB CEFs provide

exposure to diverse asset classes and investment strategies NBH and NBXG provide investors with access to markets and strategies they may not otherwise be able to invest in on their own and, for NBH, provides institutional quality leverage

that is not available to retail investors Each Director provides specialized expertise and contributes to the overall perspective and performance of the Board Replacing existing Directors of either Fund could impair its Board’s balance of

skills The three incumbent Board nominees are experienced and knowledgeable, independent of management, and have a history of acting in the best interests of all stockholders Saba Capital Master Fund Limited Ltd., a hedge fund managed by Saba

Capital Management, L.P. (together “Saba”), has an extensive history of destructive actions that have harmed CEF stockholders and caused increases in CEF expenses Saba’s tactics with other CEFs have been in its own interests, and not in the

best interests of all stockholders Saba’s nominee has few relevant skills to provide oversight, would add no incremental assistance to the Boards, and already serves on the boards of funds in multiple different complexes, raising questions

about capacity, among other things The nominee is an employee of Saba, which creates an irreconcilable conflict of interest with other stockholders Incumbent Director nominees have served as fiduciaries for all stockholders The Funds’ Boards

and management teams create value for all stockholders Rigorous and Independent Board oversight ensures all stockholders are protected Inherent Conflicts between Saba’s self-serving interests and those of other stockholders Saba’s nominee is

unqualified and conflicted Long history of overseeing closed-end funds (CEFs) and other types of investment companies prudently and in the best interest of all fund investors

Overview of Neuberger Berman

Neuberger Berman Overview Investing for clients for over 80 years As of June 30,

2024. Figures may not sum up due to rounding. 1. Includes the firm's current and former employees, directors and, in certain instances, their permitted transferees 2. Retention of MD and SVP investment professionals since becoming an

independent company in 2009. 3. Awarded by UN-supported Principles for Responsible Investment (PRI). The PRI 2020 Leader's Group is awarded to only 20 of ~2,100 PRI investment manager signatories. 4. Based on the average scores of reporting

investment management signatories globally with AUM greater than $50bn. 5. For illustrative and discussion purposes only. PRI grades are based on information reported directly by PRI signatories, of which investment managers totalled 3,123 for

2023. Please see Principles for Responsible Investment (PRI) Scores and end of this material for information regarding PRI scores shown. 6. Among organizations with over 1,000 employees by Pensions & Investments. MD/SVP

RetentionRate2 Independent 100% Employee-Owned1 Global 39 Cities and 21 Portfolio Management Centers Stability Depth 750+ Investment Professionals Alignment 100% Deferred Cash Compensation Directly Linked To

Strategies Leadership THE NB DIFFERENCE Awarded to <1% of Investment Management Signatories3 96% Scale 2,800+ Employees NEUBERGER BERMAN: $481BN Equities $133bn Fixed Income $185bn Private Equity $97bn Private Credit $31bn

Real Assets $10bn $26bn Liquid & Specialty Alternatives Awarded 1st or 2nd Place in Each of the Last Ten Consecutive Years by Pension & Investments6 Culture ESG Scored above the median of large investment management peers

globally4 for our ESG integration efforts in every reported category5

Our Comprehensive Investment Offering Spans All Major Asset Classes Investing

$481bn for clients globally As of June 30, 2024. Figures may not sum up due to rounding. Global Investment Grade Global Non-Investment Grade Emerging Markets Debt Municipals Multi-Sector Currency Global U.S. EAFE / Japan Emerging

Markets - China PUBLIC MARKETS PRIVATE MARKETS EQUITIES FIXED INCOME HEDGE FUNDS & LIQUID ALTERNATIVES $133bn $97bn $185bn $31bn $21bn $5bn MULTI-ASSET STRATEGIES $341bn $140bn Commodities Diversified Real

Assets Global REITs U.S. REITs Private Real Estate – Almanac Real Estate Secondaries Real Estate Primaries & Co-Investments Infrastructure PUBLIC REAL ASSETS $3bn $7bn PRIVATE EQUITY PRIVATE CREDIT SPECIALTY

ALTERNATIVES PRIVATE REAL ASSETS GLOBAL RESEARCH CAPABILITIES ESG INTEGRATION DATA SCIENCE Multi-Manager Hedge Funds Long/Short Event Driven Global Macro Risk Premia Options Primaries Co-Investments Secondaries Specialty

Strategies Hedge Fund Co-Investments Insurance-Linked Strategies Crossover / Pre-IPO Private Debt Capital Solutions Special Situations Residential Loans Specialty Finance Private Placement European Private

Loans Quantitative Thematic Custom Direct Investing

Corporate Governance Guidelines There is a difference between operating companies

and investment companies 1. Neuberger Berman Governance and Proxy Voting Guidelines Neuberger Berman differentiates between operating companies and investment companies when assessing certain aspects of corporate governance “We recognize

that some of our investments, including but not limited to those listed outside major stock exchanges, mutual funds, exchange-traded funds, closed-end funds and special purpose acquisition companies, do not operate in markets where it would be

appropriate to apply the full breadth of our guidelines. In those instances we will vote based on our assessment of best practices that protect shareholder value” 1

Neuberger Berman Closed-End Fund Oversight

Corporate Governance Responsible for oversight and monitoring of the accounting

and financial reporting policies, processes, and practices. Supports financial statement audits During each Fund’s 2023 FY, its Audit Committee met seven times Responsible for assisting the Board in the oversight and monitoring of NB

CEFs NBH’s Closed-End Funds Committee met nine times during FY 2023. NBXG’s Closed-End Funds Committee met six times during FY 2023 Responsible for reviewing Fund principal contractual arrangements. Guides the process by which Independent

Directors consider whether to approve/renew such contracts During each Fund’s FY 2023, its Contract Review Committee met six times Responsible for the oversight of compliance matters, risk management and other regulatory matters During each

Fund’s 2023 FY, its Ethics and Compliance Committee met four times Responsible for acting in an emergency when a quorum of its Board is not available; the Committee has all the powers of the Board when the Board is not in session During each

Fund’s FY 2023, each Fund’s Executive Committee met one time Audit Closed-End Funds Contract Review Ethics and Compliance Executive Responsible for seeking, identifying and recommending to the Board qualified candidates for election or

appointment to the Board During each Fund’s FY 2023, its Governance and Nominating Committee met two times Governance & Nominating The Board has established a thoughtful governance structure that utilizes committees for deeper director

engagement and oversight of critical areas of focus, including a dedicated Closed-end Funds Committee Responsible for overseeing and guiding the process by which its Board reviews Fund performance and interfacing with management personnel

responsible for investment risk management During each Fund’s 2023 FY, each Fund’s Investment Performance Committee met four times Investment Performance

Nominee Biographies Marc Gary Mr. Gary has legal and investment management

experience as executive vice president and general counsel of a major asset management firm.2 He also has experience as executive vice president and general counsel at a large corporation, and as national litigation practice chair at a large

law firm He has served as a member of the boards of various profit and not-for-profit organizations. He formerly served as the executive vice chancellor and COO of a religious seminary where he oversaw the seminary’s institutional

budget Martha C. Goss Ms. Goss has experience as chief operating and financial officer of an insurance holding company. She has experience as an investment professional, head of an investment unit and treasurer for a major insurance company,

experience as the Chief Financial Officer of two consulting firms, and experience as a lending officer and credit analyst at a major bank She has experience managing a personal investment vehicle. She has served as a member of the boards of

various profit and not-for-profit organizations, including five NYSE listed operating companies and a university Michael M. Knetter Dr. Knetter has organizational management experience as a dean of the Madison business school at University of

Wisconsin and as President and CEO of the University of Wisconsin Foundation. He also has responsibility for overseeing management of the university’s endowment He has academic experience as a professor of international economics He has

served as a member of the boards of various public companies and another mutual fund. He has served as a Fund Director for multiple years 2. Asset Management firm not affiliated with Neuberger Berman

Board Actions Taken in the Interest of Stockholders The incumbent Director

nominees each currently serve on the Boards of Directors for three other NB CEFs and a family of open-end funds, all part of the Neuberger Berman Fund Complex The Boards of NBH and NBXG, including the incumbent Director nominees, have

carefully considered numerous discount mitigation techniques and regularly monitor the Funds’ discount on both a relative and absolute basis, acting when appropriate The Directors have taken a variety of actions designed to enhance investor

value and make all NB CEFs more competitive in the secondary marketActions have included: Action Taken How does this action help reduce CEF discount? NBXG NBH Other Funds Distribution rate increases Increase cash distributions to

stockholders ✔ ✔ Managed / level-rate distribution plan Enhances CEF distribution stability ✔ ✔ ✔ Use of return of capital (ROC) to equitably benefit stockholders Preference is to use ROC to enhance distributions ✔ ✔ ✔ Approved

fund mergers Improves trading volume and liquidity, lower expenses ✔ ✔ Discount management program Board has approved Tender Offers and Measurement Programs ✔ ✔ Structured Fund with limited term providing 100% liquidity at NAV Ensures

opportunity for Liquidity at NAV ✔ Market Insights and fund commentaries Increase CEF visibility and support stockholders ✔ ✔ ✔ Diligence materials and updates for CEF research analysts Keeps funds in good standing on platforms and

increases visibility ✔ ✔ ✔ Quarterly Webinar for stockholders and financial advisors Increase CEF visibility and support stockholders ✔ ✔ Meetings with institutional investors and advisors Increase CEF visibility and support

stockholders and their advisers ✔ ✔ ✔ Demonstrated History of Acting in the Long-Term Interest of Stockholders

Highly Experienced Board Focused on Protecting Stockholder Interests Marc

Gary Martha C. Goss Michael M. Knetter Michael J. Cosgrove Ami G. Kaplan Deborah C. McLean George W. Morriss Tom D. Seip Franklyn E. Smith Joseph V. Amato Total Up for re-election NBH/NBXG NBH/NBXG NBH/NBXG Skills/

Expertise Independent/No Conflicts ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 9 Registered Closed-End Fund ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 10 Executive Leadership ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 9 Public Service or Academic Positions

✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 9 Other Investment Fund/Asset Management ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 10 Public Operating Company Board Experience ✔ ✔ ✔ ✔ 4 Consulting ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 8 Other Finance and

Accounting ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 10 Retail or Retirement Market ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ 10 Risk Management and Compliance ✔ ✔ ✔ ✔ ✔ ✔ 6 Total 8 10 9 8 9 8 10 8 9 7 The current Fund Board has an extensive

set of skills needed to effectively oversee the NB CEFs Admiral James G. Stavridis, the Board’s cybersecurity and global affairs expert, retired from his position as a Director effective June 30, 2024. In connection with its efforts to replace

this skillset, the Board has hired a consultant with a similar level of expertise to assist in its oversight obligations.

Why SABA’s Nominee is the Wrong Choice

The Board and Neuberger Berman are focused on ALL our stockholders Saba has a

long history of exiting CEFs after capturing a quick profit for THEIR investors, and destroying value for other fund investors Utilizes required shareholder meetings to pressure boards to meet its demands intended to generate a short-term gain

from receiving NAV or close to NAV through tender offers or other liquidity events that do not permanently reduce trading discounts Exits funds quickly after pressuring their boards to implement short term “fixes,” leaving remaining

stockholders with shares in funds with reduced size, higher expenses, and in some cases challenged to continue to meet their objectives Fund Name Ticker Tender Expiration Date Saba ownership prior to announcement of tender offer Saba

Ownership Immediately After Tender Ownership at the next quarter end Current Ownership3 %Δ After Announcement %Δ Qtr end after Announcement %Δ to Current3 Templeton Global Income Fd (now

SABA) GIM 11/9/2023 30.7% 19.2% 15.6% 12.2% (37.4%) (49.3%) (60.1%) Delaware Investment National Municipal Income Fund VFL 12/13/2022 16.3% 0.0% 0.0% 1.9% (100.0%) (100.0%) (88.5%) Eaton Vance Senior Floating-Rate

Trust EFR 7/30/2021 9.5% 0.0% 0.0% 0.0% (99.9%) (100.0%) (100.0%) Eaton Vance Floating-Rate Income Trust EFT 7/30/2021 15.6% 0.0% 0.0% 0.0% (100.0%) (100.0%) (100.0%) Eaton Vance Senior Income Trust,

Inc. EVF 7/30/2021 21.2% 0.0% 0.0% 0.0% (100.0%) (100.0%) (100.0%) Voya Prime Rate Trust (now BRW – Saba managed) PPR 7/19/2021 24.6% 22.5% 22.46% 3.2% (8.6%) (8.6%) (87.1%) Voya Prime Rate Trust (now BRW – Saba managed)

PPR 1/4/2021 22.5% 15.0% 12.94% 3.2% (33.2%) (42.4%) (85.9%) Royce Global Value Trust, Inc. RGT 12/21/2020 13.7% 3.1% 1.0% 0.0% (77.4%) (92.8%) (100.0%) Neuberger Berman High Yield Strategies Fund

Inc. NHS 12/10/2020 24.9% 8.0% 0.0% 0.0% (67.9%) (100.0%) (100.0%) Western Asset High Income Fund II Inc. HIX 11/16/2020 8.9% 0.0% 0.0% 0.0% (100.0%) (100.0%) (100.0%) Western Asset High Income Opportunity Fund

Inc. HIO 11/16/2020 10.2% 6.1% 2.4% 0.0% (40.0%) (76.4%) (100.0%) Western Asset Global High Income Fund Inc. EHI 11/16/2020 20.4% 0.0% 0.0% 0.0% (100.0%) (100.0%) (100.0%) Invesco Dynamic Credit Opportunities

Fund VTA 12/5/2019 10.0% 7.6% 6.5% N/A4 (23.7%) (34.7%) N/A4 Invesco Senior Income Trust VVR 12/5/2019 12.1% 10.1% 9.3% 0.0% (16.7%) (23.3%) (100.0%) Invesco High Income Trust

II VLT 12/5/2019 14.5% 7.8% 4.1% 0.0% (46.1%) (71.7%) (100.0%) First Trust Strategic High Income Fund II FHY 9/28/2017 10.0% 5.0% 3.5% N/A4 (50.4%) (64.7%) N/A4 3. Disclosed in Annual Report for holdings of PPR, now Saba

Capital Income & Opportunities Fund, as of 4/30/24; Disclosed in DEF 14A filing for holdings of GIM, now Saba Capital Income & Opportunities Fund II, as of 5/1/24; All other funds based on Saba’s 13F disclosure holdings as of 3/31/24.

4. No longer active CEF Saba quickly exited or greatly reduced its ownership in funds where a tender offer was the outcome:

Saba’s takeovers of BRW and SABA have hurt stockholders Saba used its controlling

interest in these funds to implement self-serving, riskier strategies that drastically changed those chosen by investors. Source: Financial Statements, Shareholder Reports Saba Capital Income & Opportunities Fund (BRW) BRW trades at a

wider persistent discount to NAV since Saba’s 2021 takeover Under Saba, BRW has significantly underperformed benchmark index:11/1/23 – 4/30/24: BRW +3.23% iBoxx USD Liquid High Yield Index: +8.74% Portfolio exposure now includes SPACs,

Crypto and up to 12% in a single hedge fund – not what stockholders who owned Voya Prime Rate CEF wanted nor anticipated Almost 25% of his holdings are in other hedge funds and crypto BRW expense ratio for 2024 SASR was 6.10% (annualized,

including waivers) vs 2.26% for full fiscal year 2021 ~31% CEFs – Not only adds to expenses due to acquired fund fees but presents a serious conflict of interest Paul Kazarian is on the PM team of the fund Saba Capital Income &

Opportunities Fund II (SABA) Saba shifting portfolio exposure to riskier assets Now has higher fees and expenses (SASR 4/2024 = 2.36% vs FY 2023 = 0.85%) ~18% CEFs – Not only adds to expenses due to acquired fund fees but presents a serious

conflict of interest Paul Kazarian is on the PM team of the fund Tender Offer Tender Offers Discount Widened Discount Widened Saba Takeover

SABA’s Nominee Lacks Independence and has Insufficient Expertise to Contribute to

the Boards SABA Nominee Marc Gary Martha C. Goss Michael M. Knetter Michael J. Cosgrove Ami G. Kaplan Deborah C. McLean George W. Morriss Tom D. Seip Franklyn E. Smith Joseph V. Amato Paul Kazarian Up for

re-election NBH/NBXG NBH/NBXG NBH/NBXG Skills/ Expertise Independent/No Conflicts ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ X Registered Closed-End Fund ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Executive Leadership ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ X Public

Service or Academic Positions ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ X Other Investment Fund/Asset Management ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ Public Operating Company Board Experience ✔ ✔ ✔ ✔ X Consulting ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ X Finance and

Accounting ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ X Retail or Retirement Market ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ ✔ X Risk Management and Compliance ✔ ✔ ✔ ✔ ✔ ✔ ✔ Total 8 10 9 8 9 8 10 8 9 7 3 Paul Kazarian is an employee of Saba

and is not qualified to properly support Neuberger Berman’s CEFs

Two Distinct Market Environments Since Inception Figure 1: Impact of Rate Hikes

Digested (05/26/2021 – 05/26/2022) – NAV Indexed to 100 Figure 2: Normalized Environment (05/27/2022 – Current) – NAV Indexed to 100 NBXG -30.5% BSTZ -30.1% BIGZ -41.7% NBXG +34.6% BSTZ +8.4% BIGZ -4.2% A seismic shift in the

valuation regime for growth equities soon after launch, followed by a more normalized period for stock-picking NBXG – Neuberger Berman Next Generation Connectivity Fund BIGZ – BlackRock Innovation & Growth Trust BSTZ – BlackRock Science

and Technology Trust II Source: Factset, Bloomberg. Data as of July 8, 2024. Returns represent NAV Total Returns.

NBXG’s Mandate-Driven Underweight to Mega Caps Has Been a Headwind Significant

exposure to and exceptional returns of Mag 7 driving index performance Source: Neuberger Berman, Bloomberg, FactSet as of June 30, 2024 Mag 7 Return Since Inception Avg Mag 7 Weight Since Inception

NBXG Private Program Return Profile Favorable relative performance of private

markets program vs small cap growth and comparable vintage peer Source: Company filings, Neuberger Berman estimates, FactSet. as of June 30, 2024 Small-Cap Growth Proxy Average MCap of ~$6bn

NBXG Dividend Adjusted NAV Is Back At Cost Basis Source: Factset, Bloomberg.

NBXG cumulative total return since inception has outpaced peers

NBXG Discount Narrowing Since 2022 And Remains Favorable Amongst Peers Closing

the NAV discount more than similar vintage peers Source: FactSet. Data as of June 30, 2024. Current Premium/Discount NBXG = -11.8% BSTZ = -12.8% BIGZ = -14.5%

NBXG Review & Discussion – Distributions Fund has maintained consistent

distributions, per stated objectives in mandate Since inception, NBXG has declared 37 consecutive monthly distributions of 10 cents per share (for a total of $3.70) Emphasis has been on delivering consistent monthly cash flows to

stockholders The Fund continues to employ an option writing strategy intended to generate current gains from options premiums, and to enhance the fund’s risk adjusted return potential

NBXG Review & Discussion – Fees & Expenses Portfolio Avg. Net Assets

($Mil) Mgmt Fees (%) Other Nonmgmt Expenses (%) Investment-Related Expenses/ Taxes (%) Total Expenses (%) NB Next Gen Connectivity 982.8 1.250 0.070 0.000 1.320 Peer Group Average 999.8 1.187 0.079 0.000 1.266 NBXG fees are

in line with peer average SOURCE – NB Funds 15c Report / Broadridge

NBH: Review & Discussion – Nav/Premium Discount NBH Daily Valuation since

Change in Investment Guidelines NBH’s IPO was in September 2002 Fund’s initial investment strategy was to invest in a portfolio of intermediate maturity bonds (maximum maturity of 15 years) NBH maintained this investment strategy until

August 2018, when NB recommended, and the Fund’s Board approved removing any maturity limitations and increased the maximum percentage allowed in below investment grade bonds to 30% Post this change, the PM team had far greater flexibility to

invest where they saw opportunities At that time, yields available in the municipal market were so low that even having expanded maturity/duration flexibility proved ineffective as existing portfolio holdings possessed a book yield higher than

bonds available at the longest parts of the municipal curve Average Prem/Disc(8/28/2018-7/12/2024) NBH -5.14% Peers -6.17%

NBH: Review & Discussion – Nav/Premium Discount Impact of short-term funding

costs on valuation Most Municipal CEFs use leverage to enhance distributions to common stockholders. There is a strong correlation between the level of distributions and a CEF’s valuation. When investors doubt a CEF’s distribution

sustainability, valuations can decline and discounts widen. The Fed’s Zero Interest Rate Policy (ZIRP) kept short-term rates, including the SIFMA Municipal Swap Index, at historically low levels. This drove Municipal CEF valuations to high

levels, with many trading at premiums above NAV, including NBH As the Fed indicated a shift from easy monetary policy, markets and investors reacted even before formal changes. With actual monetary tightening and rising short-term rates,

investors moved away from leveraged CEFs, putting pressure on valuations. This trend started to reverse in late 2023/early 2024 as signs of Fed easing emerged and markets began repricing rate-sensitive investments Average

Prem/Disc(8/28/2018-7/12/2024) NBH -5.14% Peers -6.17%

NBH: Review & Discussion – Total Shareholder Return NBH NAV performance, has

improved as market environment has provided opportunity to fully use broader investment guidelines Through 6/30 YTD 1 Year Trailing 18 Months Trailing 2 Years Neuberger Berman Municipal Fund (NBH) 0.98 4.29 5.51 2.97 Benchmark 1:

Bloomberg Municipal 10 Yr 8-12 TR USD -1.57 1.92 2.73 2.97 Mstar Peer Group Median 0.19 4.64 5.97 3.66 NBH performance has been positively impacted by: The ability to prudently use greater exposure to credit opportunities Potential

to position the portfolio across the entire yield curve

NBH: Review & Discussion – Distributions On Monday, July 15th, NBH announced

a 43.5% increase in its monthly distribution rate The new monthly distribution rate of $0.05417 per share represents an annualized distribution per share of $0.65 and results in a distribution rate of approximately 5.91% of the Fund’s market

price and 5.38% of its net asset value, as of July 12, 2024 Neuberger Berman and the Fund’s Board continue to be focused on delivering value to stockholders The distribution rate increase is an effort to enhance the Fund’s competitiveness in

the secondary market and increase demand for the Fund’s common stock in the secondary market, which may result in a narrowing in the discount between the market price of the Fund’s common stock and its net asset value per share The Fund’s

Board has determined that—like many other CEFs—it is in the best interests of the Fund and its current stockholders to pay a higher distribution rate, even if that distribution represents a combination of net investment income, capital gains

and return of capital The distribution increase results in NBH’s NAV yield moving from the 33rd out of 40 municipal CEFs to 14th out of 40 (based on Morningstar data as of 6/28/24) Increase in Distribution provides a more Competitive NAV

yield – helping support Investor Demand and Adding to Stockholder Monthly Cash Flows

NBH: Review & Discussion – Fees & Expenses Portfolio Avg. Net Assets

($Mil) Mgmt Fees (%) Other Nonmgmt Expenses (%) Investment-Related Expenses/ Taxes (%) Total Expenses (%) Neuberger Municipal 373.4 0.550 0.168 1.628 2.346 Peer Group Average 422.4 0.613 0.120 1.239 1.972 NBH has lower

management fees vs peers, investment related expenses are higher due to differing leverage structure SOURCE – NB Funds 15c Report / Broadridge NBH management and other non-investment-related expenses are competitive and lower than Peer Group

average NBH Total Expenses (TER) is driven higher by investment-related expenses (cost of leverage) NBH leverage costs are higher than many Peer CEFs as NBH employs one form of Leverage – Variable Municipal Term Preferred stock (VMTPs) Other

CEFs use other forms of leverage – mostly, Tender Option Bonds The use of TOBs varies, but sometimes represent a substantial level (50% or more of total leverage employed) TOBs are a much less costly form of leverage relative to VMTPs Due to

the smaller size of NB Muni CEFs (historically, NB had three municipal CEFs (National, NY and Cal) and the lower total asset size of these CEFs prohibited the use of TOBs One of the rationales for the merger of the NY & CAL CEFs into NBH

in 2023, was to combine assets into a single portfolio where size would now support greater flexibility in terms of leverage structure

Is Change Warranted? No. The Funds’ Incumbent Director Nominees are the Right

Choice Incumbent Director nominees are independent and experienced in overseeing CEFs NB CEFs are designed and managed to help investors achieve their long-term investment goals The NB CEFs provide exposure to diverse asset classes and

investment strategies NBH and NBXG provide investors with access to markets and strategies they may not otherwise be able to invest in on their own and, for NBH, provides institutional quality leverage that is not available to retail

investors Each Director provides specialized expertise and contributes to the overall perspective and performance of the Board Replacing existing Directors of either Fund could impair its Board’s balance of skills The three incumbent Board

nominees are experienced and knowledgeable, independent of management, and have a history of acting in the best interests of all stockholders Saba has an extensive history of destructive actions that have harmed CEF stockholders and caused

increases in CEF expenses Saba’s tactics with other CEFs have been in its own interests, and not in the best interests of all stockholders Saba’s nominee has few relevant skills to provide oversight, would add no incremental assistance to the

Boards, and already serves on the boards of funds in multiple different complexes, raising questions about capacity, among other things The nominee is an employee of Saba, which creates an irreconcilable conflict of interest with other

stockholders Incumbent Director nominees have served as fiduciaries for all stockholders The Funds’ Boards and management teams create value for all stockholders Rigorous and Independent Board oversight ensures all stockholders are

protected Inherent Conflicts between Saba’s self-serving interests and those of other stockholders Saba’s nominee is unqualified and conflicted Long history of overseeing CEFs and other types of investment companies prudently and in the best

interest of all fund investors

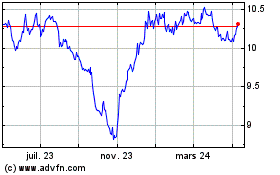

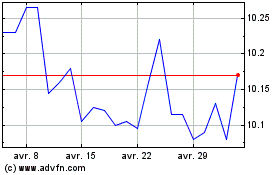

Neuberger Berman Municipal (AMEX:NBH)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Neuberger Berman Municipal (AMEX:NBH)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024