false

0001389545

0001389545

2025-03-04

2025-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: March 4, 2025

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-33678

|

68-0454536

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

(510) 899-8800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange On Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

NBY

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On March 4, 2025, NovaBay Pharmaceuticals, Inc. (the “Company”) entered into an engagement letter agreement (the “Engagement Agreement”) by and between the Company and Lucid Capital Markets, LLC (“Lucid”), that engages Lucid to provide financial advisory services to the Company in connection with exploring a potential business combination of the Company (a “Potential Transaction”). The Company engaged Lucid to explore a Potential Transaction in order to make available other strategic options and transactions to the Company and its stockholders in the event that (i) the Company did not receive stockholder approval for the liquidation and dissolution of the Company under Delaware law (the “Liquidation and Dissolution”) pursuant to a Plan of Liquidation and Dissolution of the Company at a new special meeting of stockholders to be called for this purpose (the “New Special Meeting”) or (ii) if after stockholder approval is received, the Board of Directors ultimately determines not to proceed with the Liquidation and Dissolution. Such Potential Transactions and strategic alternatives may include mergers, reverse mergers, strategic partnerships, and licensing and sub-licensing transactions.

Additional information regarding the Liquidation and Dissolution and the New Special Meeting is included in the preliminary proxy statement on Schedule 14A for the New Special Meeting filed by the Company with the Securities and Exchange Commission (the “SEC”) on February 18, 2025 (the “Preliminary Proxy Statement”).

While the Company continues to believe that the Liquidation and Dissolution is currently the best opportunity for the Company to maximize the remaining value of the Company and our stockholders, there are risks and uncertainties as to whether stockholders will approve the Liquidation and Dissolution at the New Special Meeting, including taking into consideration that the Company was not able to obtain stockholder approval for the Liquidation and Dissolution at its previously held special meeting of stockholders convened on November 22, 2024, and subsequently adjourned and finally reconvened on January 30, 2025. Therefore, the Board of Directors determined that the Company should pursue other potential strategic alternatives available to the Company and its stockholders and entered into the Engagement Agreement to provide support to the Company as it identifies, and evaluates such strategic alternatives, including a Potential Transaction.

The terms of the Engagement Agreement provide that such agreement continue until the earlier of: (i) the completion of a Potential Transaction, (ii) nine (9) months from March 4, 2025, or (iii) upon written notice of termination by either the Company or Lucid at any time. The Engagement Agreement also provides for the Company to pay Lucid for its advisory services, including: (i) a one-time fee of $100,000 that was due to Lucid on the date the Engagement Agreement was signed; (ii) specified monthly fees of up to a maximum of $250,000 payable to Lucid upon the termination of the Engagement Agreement (other than in the case of a material breach by Lucid) if a Potential Transaction is not consummated; (iii) an $800,000 transaction fee in the event the Company successfully completes a Potential Transaction; (iv) a fairness opinion fee in the amount of $300,000, due and payable to Lucid upon Lucid rendering a fairness opinion to the Company’s Board of Directors; and (v) a right of first refusal for Lucid to participate as a co-placement agent in any concurrent private placement equity financing by the Company contemplated along with a Potential Transaction, provided that Lucid secures investors for such private placement and the Company and Lucid are able to enter into a separate engagement agreement for Lucid to serve as co-placement agent.

The Engagement Agreement also contains representations, warranties, indemnification provisions and confidentiality provisions that are customary for an agreement of this nature.

The foregoing description of the terms of the Engagement Agreement do not purport to be complete and are subject to, and are qualified in their entirety by, reference to the Engagement Agreement, which is filed herewith as Exhibit 10.1, and is incorporated by reference.

Item 8.01 Other Events.

On March 7, 2025, the Company issued a press release relating to the New Special Meeting and the Company’s ongoing evaluation of alternative strategic options as further set forth in Item 1.01 of this Current Report on Form 8-K. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K, which is incorporated by reference.

Additional Information and Where to Find It

The Company intends to file a definitive proxy statement on Schedule 14A with the SEC with respect to the special meeting of Company stockholders to be held in connection with the Liquidation and Dissolution. Promptly after filing the definitive proxy statement with the SEC, the Company will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the New Special Meeting to consider the Liquidation and Dissolution. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS, INCLUDING IN CONNECTION WITH THE LIQUIDATION AND DISSOLUTION, THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE LIQUIDATION AND DISSOLUTION. Stockholders may obtain, free of charge, the Preliminary Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by the Company with the SEC in connection with the Liquidation and Dissolution at the SEC’s website (http://www.sec.gov) or at the Company’s investor relations website https://novabay.com/investors/) or by writing to NovaBay Pharmaceuticals, Inc., Investor Relations, 2000 Powell Street, Suite 1150, Emeryville, CA 94608. The Company’s website address is provided as an inactive textual reference only. The information provided on, or accessible through, the Company’s website is not part of this Current Report on Form 8-K, and, therefore, is not incorporated herein by reference.

Participants in the Solicitation

The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed Liquidation and Dissolution. A list of the names of the directors and executive officers of the Company and information regarding their interests in the Liquidation and Dissolution, including their respective ownership of the Company’s common stock and securities is contained in the Preliminary Proxy Statement and will be contained in the definitive proxy statement for the proposed Liquidation and Dissolution when available. In addition, information about the Company’s directors and executive officers and their ownership in the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and filed with the SEC on March 26, 2024, as amended on March 29, 2024 and as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing.

Cautionary Language Concerning Forward-Looking Statements

This Current Report on Form 8-K, including exhibits, contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These forward-looking statements are based upon the Company and its management’s current expectations, assumptions, estimates, projections and beliefs. Such statements include, but are not limited to, statements regarding the Liquidation and Dissolution, the Company’s financial condition, the Company’s evaluation of other strategic transactions and related matters such as the impact that the Liquidation and Dissolution may have on the Company. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in, or implied by, these forward-looking statements. Other risks relating to the Company’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this Current Report, are detailed in the Company’s latest Form 10-K, subsequent Forms 10-Q and/or Form 8-K filings with the SEC and the Preliminary Proxy Statement, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NovaBay Pharmaceuticals, Inc.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Justin M. Hall |

| |

|

Justin M. Hall

|

| |

|

Chief Executive Officer and General Counsel

|

Dated: March 7, 2025

Exhibit 10.1

Strictly Confidential

March 4, 2025

Justin Hall, ESQ

Chief Executive Officer

NovaBay Pharmaceuticals, Inc.

2000 Powell Street, Suite 1150

Emeryville, CA 94608

Dear Justin:

We are pleased to confirm our mutual understanding regarding the retention of Lucid Capital Markets, LLC (“Lucid”) by NovaBay Pharmaceuticals, Inc. its subsidiaries, affiliates, beneficiaries, successors and assigns (collectively, the “Company”), subject to the terms and conditions of this agreement (the “Agreement”).

|

1.

|

Purpose of Engagement. Lucid will provide its services to the Company as its financial advisor regarding a potential business combination with an unaffiliated third party (referred to as a “Transaction”). This Transaction could take various forms, including but not limited to mergers, consolidations, reorganizations, acquisitions, recapitalizations, stock swaps, or other arrangements through which the Company may be acquired by, acquire, or merge with another entity. It is important to note that a Transaction may consist of multiple distinct components (such as mergers, spin-offs, or securities issuance), yet all such components will result in the payment of a single Transaction Fee (defined below) as per the terms of this Agreement. In addition, (i) a financing transaction for the purpose of raising cash or (ii) a liquidation and dissolution of the Company, in each case, shall not constitute a Transaction nor result in any payment of a Transaction Fee or any other amount to Lucid under this Agreement.

|

Lucid and the Company mutually acknowledge that this Agreement does not constitute a firm commitment or assurance of any Transaction. Both parties recognize and agree that the ultimate decision to proceed with a Transaction rests solely and entirely with the Company, and it is within their sole discretion to consummate such a Transaction.

|

2.

|

Term. The duration of this Agreement will commence from the date hereof and will expire on the earlier of (i) the completion of the Transaction, (ii) a period of nine (9) months from the aforementioned date, or (iii) receipt by a party of written notice of termination of this Agreement from either party, which termination notice can be provided by either party at any time, regardless of whether it pertains to a breach of this Agreement by the other party (referred to as the “Term”). Irrespective of any termination or expiration of this Agreement, the provisions outlined in Paragraphs 4, 5, 6, and the attached Exhibit A, which is hereby incorporated, will remain effective beyond such termination or expiration.

|

|

3.

|

Services. Lucid will act as the Company’s financial advisor with respect to the services described below (the “Services”):

|

| |

a)

|

Assisting the Company in developing a strategy to effectuate a Transaction and identifying and introducing the Company to potential acquirers, including prospective equity or asset acquirers, merger partners, and other interested parties. Additionally, facilitating introductions to potential targets, which may involve companies the Company could acquire or other entities of interest. Furthermore, actively promoting the Transaction to these potential acquirers and/or targets in each case through a confidential process;

|

| |

b)

|

Supporting the Company in reviewing any memorandum or relevant information furnished by a target or its representatives. Assisting the Company in the preparation of any memorandum or relevant information to the extent the Company is contemplating a sale. Assessing Transaction proposals and offering guidance to the Company's management regarding valuation, Transaction structure, and terms. This includes aiding in the preparation of presentations to the Company's board of directors concerning the Transaction proposals and meeting with the Company’s board of directors, at the Company’s request, to discuss the proposed transaction, and its financial implications.

|

| |

c)

|

Assisting the Company’s management in negotiating the terms of a Transaction (as appropriate);

|

| |

d)

|

Coordinating due diligence (including assisting with a data room in a sale Transaction), documentation and Transaction closing; and

|

| |

e)

|

If a fairness opinion in connection with a Transaction is deemed necessary, Lucid will provide the fairness opinion, regardless of whether it is fair or not, to the Company's board of directors. This opinion will assess whether, as of the opinion date, the consideration proposed in the Transaction is financially fair to the Company's stockholders. The Fairness Opinion will be communicated and delivered in written form. In addition, Lucid shall prepare, at the request of the Company, detailed and customary disclosure that summarizes Lucid’s process, methodology and its findings as set forth in the Fairness Opinion (similar to other public company transactions) for inclusion in any registration statement, proxy statement or other documents filed with the Securities and Exchange Commission in connection with the Transaction.

|

The Fairness Opinion is intended solely for the use of the board of directors of the Company or any relevant committee thereof in their assessment of the Transaction. It is not to be disseminated, circulated, quoted, or referenced in any manner, either in its entirety or in part, for any other purposes, except under the following circumstances: (i) if it is to be included in full (along with the summary of the Fairness Opinion) in any registration statement, proxy statement, or other document filed with the Securities and Exchange Commission, which Lucid is aware is likely to occur with the Company being a public company; or (ii) if it is to be presented as evidence or referenced in any litigation concerning matters pertinent to the Transaction covered in the Fairness Opinion. In such case, the Company will notify Lucid in writing at least three (3) business days prior to its use in any litigation.

Lucid shall not be required under this Agreement to undertake duties not reasonably within the scope of the financial advisory or investment banking services contemplated by this Agreement.

|

4.

|

Nature of Engagement. In order to facilitate Lucid’s efforts to effect a Transaction, during the Term, the Company shall not authorize any other party to act as the Company’s financial advisor with respect to the Services in relation to a Transaction, or to prepare a Fairness Opinion

|

|

5.

|

Fees. In consideration for the services described above, Lucid shall be entitled to receive, and the Company agrees to pay Lucid, the following compensation:

|

| |

a.

|

Initial Fee. An upfront one-time retainer fee of $100,000 (the “Initial Fee”) payable by check or wire transfer on the date hereof.

|

| |

b.

|

Monthly Accrual Fee. Beginning on April 4th, the Company shall accrue an amount of $100,000 for each 30-day period (the "Monthly Accrual Fee"). A pro-rata amount of the Monthly Accrual Fee will be paid to Lucid by wire transfer upon termination of the Agreement by the Company or Lucid, assuming Lucid is not in material breach of the contract. This amount shall continue to accrue $100,000 each 30-day period for a maximum of $250,000. For the sake of clarity, if the Company consummates a Transaction, then the Company shall not pay Lucid the Monthly Accrual Fee. However, if the Company does not consummate a transaction, Lucid's fees would be capped at $350,000 (which amount includes the Initial Fee).

|

| |

c.

|

Transaction Fee. If the Company consummates a Transaction, the Company shall pay to Lucid a one-time transaction fee (the “Transaction Fee”), payable by wire transfer at the closing of the Transaction, equal to $900,000.

|

| |

d.

|

Fairness Opinion. The fee for rendering the Fairness Opinion shall be $300,000, which shall be paid when Lucid renders the Fairness Opinion.

|

| |

e.

|

Fee Obligation. Lucid shall be entitled to the fees set forth in this Paragraph 5 only with respect to any Transaction that is consummated during the Term, or within one year after the date of termination or expiration of this Agreement with an Introduced Party during the Term (the “Tail Period”). Lucid shall be owed a Transaction Fee only in respect of a completed Transaction during the Tail Period with companies that Lucid introduced to the Company during the Term and who entered into a non-disclosure agreement (an “Introduced Party”).

|

| |

f.

|

Concurrent Financing Transaction. If there is a concurrent private placement financing of equity of the Company contemplated alongside the Transaction (“Concurrent Financing”), Lucid shall have a right of first refusal to act as a co-placement agent with economics of no less than 25% of the total economics in such Concurrent Financing provided that Lucid is able to secure investors who invest 25% of the gross amount of such Concurrent Financing and the Company and Lucid are able to negotiate a separate engagement letter relating to serving as co-placement agent.

|

|

6.

|

Reimbursement of Expenses. In addition to the fees outlined in Paragraph 5 above, the Company undertakes to promptly reimburse Lucid for all reasonable and documented out-of-pocket expenses incurred by Lucid upon request, including but not limited to reasonable and documented travel expenses and database fees. Lucid shall not be entitled to reimbursement of expenses in connection with this engagement if such expenses have exceeded $5,000 in total without obtaining the prior written consent of the Company, which will not be unreasonably withheld, conditioned, or delayed. The Company shall also reimburse Lucid for fees and reasonable disbursements of one legal counsel necessary in connection with performing the Services with such expenses not to exceed $20,000.

|

If the foregoing and the attached Exhibit A correctly set forth our agreement, please execute the enclosed copy of this letter in the space provided and return it to us.

| |

Very truly yours, |

|

| |

|

|

|

|

LUCID CAPITAL MARKETS, LLC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David Strupp

|

|

|

|

Name: David Strupp

|

|

|

|

Title: Managing Director

|

|

Confirmed and agreed to on March 4, 2025

NOVABAY PHARMACEUTICALS, INC.

| By: |

/s/ Justin Hall |

|

| Name: Justin Hall |

|

| Title: CEO |

|

Exhibit A

|

(A)

|

Representations of the Company. The Company hereby represents and warrants that any and all information supplied hereunder to Lucid in connection with any and all Services to be performed hereunder by Lucid for and on behalf of the Company shall be, to the best of the Company’s knowledge, true, complete and correct as of the date of such dissemination or as of the date such information was prepared (if the information clearly indicates it was prepared as of a date at least 90 days before the date disseminated) and/or dated and shall not fail to state a material fact necessary to make any of such information, in the light of the circumstances under which they were supplied, not misleading. The Company hereby acknowledges that the ability of Lucid to adequately provide services as described herein is dependent upon the dissemination of accurate, correct and complete information in connection with pursuing a potential Transaction. The Company further represents and warrants hereunder that this Agreement has been duly and validly authorized by all requisite corporate action; that the Company has the full right, power and capacity to execute, deliver and perform its obligations hereunder; and that this Agreement, upon execution and delivery of the same by the Company, will represent the valid and binding obligation of the Company enforceable in accordance with its terms, except as may be limited by any applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws and equitable principles related to or affecting creditors’ rights generally or the effect of general principles of equity. The representations and warranties set forth herein shall survive the termination of this Agreement.

|

|

(B)

|

Indemnification. The Company hereby agrees to indemnify and hold Lucid, its officers, directors, principals, employees, shareholders, affiliates, and members, and their successors and assigns, harmless from and against any and all loss, claim, damage, liability, deficiencies, actions, suits, proceedings, costs and legal expenses or expense whatsoever (including, but not limited to, reasonable legal fees and other expenses and reasonable disbursements incurred in connection with investigating, preparing to defend or defending any action, suit or proceeding, including any inquiry or investigation, commenced or threatened, or any claim whatsoever, or in appearing or preparing for appearance as witness in any proceeding, including any pretrial proceeding such as a deposition) (collectively the "Losses") arising out of, based upon, or in any way related or attributed to (i) any breach of a representation, warranty or covenant by the Company contained in this Agreement or (ii) any activities or services performed hereunder by Lucid, unless it is finally judicially determined in a court of competent jurisdiction that such Losses were the primary and direct result of the fraud, intentional misconduct or gross negligence of Lucid in performing the services hereunder.

|

If Lucid receives written notice of the commencement of any legal action, suit or proceeding with respect to which the Company is or may be obligated to provide indemnification pursuant to this Section (B), Lucid shall, within thirty (30) days of the receipt of such written notice, give the Company written notice thereof (a "Claim Notice"). Intentional failure to give such Claim Notice within such thirty (30) day period shall not constitute a waiver by Lucid of its right to indemnity hereunder with respect to such action, suit or proceeding, except and only to the extent such failure results in the forfeiture by the Company of substantial rights and defenses. Upon receipt by the Company of a Claim Notice from Lucid with respect to any claim for indemnification which is based upon a claim made by a third party ("Third Party Claim"), the Company may assume the defense of the Third Party Claim with counsel of its own choosing, as described below. Lucid shall cooperate in the defense of the Third Party Claim and shall furnish such records, information and testimony and attend all such conferences, discovery proceedings, hearings, trial and appeals as may be reasonably required in connection therewith. Lucid shall have the right to employ its own counsel in any such action, which shall be at the Company's expense if (i) the Company and Lucid shall have mutually agreed in writing to the retention of such counsel, (ii) the Company shall have failed in a reasonably timely manner to assume the defense and employ counsel or experts reasonably satisfactory to Lucid in such litigation or proceeding or (iii) the named parties to any such litigation or proceeding (including any impleaded parties) include the Company and Lucid and representation of the Company and Lucid by the same counsel or experts would, in the reasonable opinion of Lucid, be inappropriate due to actual or potential differing interests between the Company and Lucid. The Company shall not satisfy or settle any Third Party Claim for which indemnification has been sought and is available hereunder, without the prior written consent of Lucid, which consent shall not be delayed and which shall not be required if Lucid is granted a release in connection therewith. The indemnification provisions hereunder shall survive the termination of this Agreement.

The Company further agrees, upon demand by Lucid, to promptly reimburse Lucid for, or pay, any Loss as to which Lucid has been indemnified herein with such reimbursement to be made currently as any Loss is incurred by Lucid. Notwithstanding the provisions of the aforementioned indemnification, any such reimbursement or payment by the Company of fees, expenses, or disbursements incurred by Lucid shall be repaid by Lucid in the event of any proceeding in which a final judgment (after all appeals or the expiration of time to appeal) is entered in a court of competent jurisdiction against Lucid based solely upon its gross negligence or intentional misconduct in the performance of its duties hereunder, and provided further, that the Company shall not be required to make reimbursement or payment for any settlement effected without the Company’s prior written consent (which consent shall not be unreasonably withheld or delayed).

If for any reason the foregoing indemnification is unavailable or is insufficient to hold Lucid harmless (other than as provided above), the Company agrees to contribute the amount paid or payable by Lucid in such proportion as to reflect not only the relative benefits received by the Company, as the case may be, on the one hand, and Lucid, on the other hand, but also the relative fault of the Company and Lucid as well as any relevant equitable considerations. In no event shall Lucid contribute in excess of the fees actually received by it pursuant to the terms of this Agreement.

For purposes of this Agreement, each officer, director, shareholder, member, and employee or affiliate of Lucid and each person, if any, who controls Lucid (or any affiliate) within the meaning of either Section 15 of the Securities Act of 1933, as amended, or Section 20 of the Securities Exchange Act of 1934, as amended, shall have the same rights as Lucid with respect to matters of indemnification by the Company hereunder.

|

(C)

|

Confidentiality. As to the non-public business, financial and other propriety information, documents, statements, reports, projections, plans, data and other items, whether or not prepared or generated in connection with a Transaction or written or oral, that has been or will be disclosed to Lucid or its Representatives (as defined below) and any additional information and data requested by Lucid or its Representatives that shall be reasonably available and necessary in connection with a Transaction (the “Information”), Lucid agrees that during the Term, or such earlier time, if any, if Lucid is informed that the Information, in error, becomes part of the public domain due to Lucid’s actions, it will:

|

| |

(i)

|

treat all Information as confidential and preserve its confidentiality on its behalf and on behalf of its Representatives;

|

| |

(ii)

|

only use the Information for performing the Services in a Transaction and no other reason or purpose;

|

| |

(iii)

|

not duplicate or use any Information, except for use in evaluating the Transaction;

|

| |

(iv)

|

not disclose the Information, except to its affiliates’ respective officers, directors, employees, representatives, auditors and professional advisors who need to know such information in connection with Lucid performing the Services (“Representative”), with such disclosure to be under circumstances that will preserve its confidentiality and for which Lucid shall be responsible; and

|

| |

(v)

|

inform any Representative who shall be given such Information of the terms hereof.

|

Any Information provided to Lucid with respect to the Transaction shall not be deemed to be confidential if (1) as evidenced by written records, it was in Lucid’s lawful possession at the time of disclosure; (2) at the time of disclosure, it is in the public domain; (3) after disclosure, it becomes, through no act or omission on the part of Lucid or any Representative, in the public domain; (4) is independently developed by Lucid without use of, or reference to, the Information; or (5) it was lawfully and independently obtained by Lucid from a third party who, to the knowledge of Lucid, was not under obligation of confidentiality to the Company or any of its affiliates either by law or under an express or implied agreement. In addition, Lucid is permitted to produce the Information pursuant to a court order, legal process, government action or request from the Securities and Exchange Commission, Financial Industry Regulatory Authority, NYSE American LLC or other regulator, provided that Lucid must: (1) notify the Company as promptly as practicable after being informed of the requirement to produce any Information; (2) provide the Company a reasonable opportunity to review and comment on such requirement to produce any Information; and (3) use its reasonable best efforts to obtain reasonable assurance that any Information disclosed will be accorded confidential treatment.

Lucid further agrees that, upon the Company’s written request, Lucid shall promptly return or destroy, and cause all of its Representatives to promptly return or destroy, all Information to the Company within three business days after request by the Company; provided, that (1) Lucid may retain, in a secure location, a copy of such documents and records for purposes of defending any legal proceeding or complying with the requirements of any law, rule, or regulation to which Lucid is subject; and (2) in the event that a Transaction is consummated, Lucid may retain any other documents it deems reasonably necessary to permit it to establish a due diligence defense to any potential legal proceeding; provided that Lucid shall maintain the confidentiality of such retained Information pursuant to this Agreement. Upon the Company’s request, Lucid agrees to certify that it has completed such destruction or return. Notwithstanding the return or destruction of any Information, Lucid will continue to hold in confidence, and shall cause its Representatives to continue to hold in confidence, all Information during the term of this Agreement.

Notwithstanding anything to the contrary, limited material supplied by Lucis to a regulator in connection with a firm examination or informational request not believed to be related to the Company or the transaction (for example, as part of an in-person or virtual cycle examination inspecting many different records, will not be subject to the three requirements listed immediately above requirements, nor will limited routine filings Lucid may be required to make with regulators concerning basic information concerning its securities dealings or confidential regulatory filings it may be required to make (if ever) under FINRA Rule 5123 or its anti-money-laundering or Patriot Act related obligations.

|

(D)

|

Independent Contractor. It is expressly understood and agreed that Lucid shall, at all times, act as and shall at all times be an independent contractor with respect to the Company and not as an employee or agent of the Company, and nothing contained in this Agreement shall be construed to create a joint venture, partnership, association or other affiliation, or like relationship, between the parties. It is specifically agreed that the relationship is and shall remain that of independent parties to a contractual relationship and that Lucid shall have no right to bind the Company in any manner. In no event shall either party be liable for the debts or obligations of the other except as otherwise specifically provided in this Agreement.

|

|

(E)

|

Amendment. No modification, waiver, amendment, discharge or change of this Agreement shall be valid unless the same is evidenced by a written instrument signed by both parties.

|

|

(F)

|

Notices. All notices, demands or other communications given hereunder shall be in writing and shall be deemed to have been duly given when delivered in person or transmitted by electronic communication (e.g., email), or on the third calendar day after being mailed by United States registered or certified mail, return receipt requested, postage prepaid, to the addresses herein above first mentioned or to such other address as any party hereto shall designate to the other for such purpose in the manner hereinafter set forth.

|

|

(G)

|

Entire Agreement. This Agreement contains all of the understandings and agreements of the parties with respect to the subject matter discussed herein. All other agreements between the parties hereto shall remain in full force and effect in accordance with their terms.

|

|

(H)

|

Severability. The invalidity, illegality or unenforceability of any provision or provisions of this Agreement will not affect any other provision of this Agreement, which will remain in full force and effect, nor will the invalidity, illegality or unenforceability of a portion of any provision of this Agreement affect the balance of such provision. In the event that any one or more of the provisions contained in this Agreement or any portion thereof shall for any reason be held to be invalid, illegal or unenforceable in any respect, this Agreement shall be reformed, construed and enforced as if such invalid, illegal or unenforceable provision had never been contained herein.

|

|

(I)

|

Construction; Venue. This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without giving effect such state’s rules concerning conflicts of law. Any lawsuits with respect to, in connection with or arising out of this agreement shall be brought in a court for the Southern District of New York and the parties hereto consent to the jurisdiction and venue of such court for the Southern District as the sole and exclusive forum, unless such court is unavailable, for the resolution of claims by the parties arising under or relating to this agreement. The parties hereto further agree that proper service of process on a party may be made on any agent designated by such party located in the State of New York. EACH OF LUCID AND THE COMPANY HEREBY WAIVE ALL RIGHT TO TRIAL BY JURY IN ANY PROCEEDING, SUIT OR CLAIM (WHETHER BASED UPON CONTRACT, TORT OR OTHERWISE) ARISING OUT OF OR IN ANY WAY RELATING TO THIS AGREEMENT.

|

|

(J)

|

Binding Nature. The terms and provisions of this Agreement shall be binding upon and inure to the benefit of the parties, and their respective successors and assigns.

|

|

(K)

|

Counterparts. This Agreement may be executed in any number of counterparts, including electronic signatures in PDF, which shall be deemed as original signatures. All executed counterparts shall constitute one Agreement, notwithstanding that all signatories are not signatories to the original or the same counterpart.

|

|

(L)

|

Attorneys’ Fees and Court Costs. If any party to this Agreement brings an action, directly or indirectly based upon this Agreement or the matters contemplated hereby against the other party, the prevailing party shall be entitled to recover, in addition to any other appropriate amounts, its reasonable costs and expenses in connection with such proceeding, including, but not limited to, reasonable attorneys’ fees and related expenses and court costs.

|

|

(M)

|

Computer Virus. During the course of this engagement, Lucid may exchange electronic versions of documents and emails with you using commercially available software. Unfortunately, the technology community is occasionally victimized by the creation and dissemination of so-called viruses, or similar destructive electronic programs. Lucid takes the issues raised by these viruses seriously and has invested in document and email scanning software that identifies and rejects files containing known viruses. Lucid also updates its system with the software vendor’s most current releases at regular intervals.

|

By utilizing this virus scanning software, Lucid’s system may occasionally reject a communication you send. Lucid in turn may send you something that is rejected by your system. This infrequent occurrence is to be expected as part of the ordinary course of business.

Because the virus protection industry is generally one or two steps behind new viruses, Lucid cannot guarantee that its communications and documents will always be virus free. Occasionally, a virus will escape and go undetected as it is passed from system to system. Although Lucid believes its virus protection measures are excellent, it can make no warranty that its documents will be virus free at all times.

Please inform Lucid immediately in the event a virus enters your company’s system via any electronic means originating from Lucid. Through cooperative efforts, disruption to communications can be minimized.

|

(N)

|

Information Disclosure. Subject to the confidentiality obligations contained in this Agreement, Lucid may disclose any information when it is believed necessary for the conduct of its business, or where disclosure is required by law. For example, information may be disclosed for audit or research purposes, or to law enforcement and regulatory agencies to do such things as prevent fraud. Information may also be disclosed to affiliates as well as to others that are outside Lucid. Lucid may make other disclosures of information as permitted by law.

|

|

(O)

|

Legal Services. While certain principals of Lucid are attorneys, Lucid is not, in any manner, providing legal services or legal advice to the Company. Furthermore, the Company agrees and acknowledges that Lucid is not an advisor as to tax, accounting or regulatory matters in any jurisdiction.

|

|

(P)

|

Securities Trading and Other Activities. Lucid is a full service securities firm engaged, directly or indirectly, in various activities, including securities trading, investment management, financing and brokerage activities, in each case from which conflicting interests or duties may arise. Lucid shall conduct its activities with appropriate information barriers in place to protect the confidentiality of the information disclosed by the Company to Lucid or its representatives in connection with this Agreement. In addition, the Company agrees and acknowledges that in the ordinary course of Lucid’s activities, Lucid and its affiliates may actively trade the debt or equity securities (or related derivative securities) of the Company and other companies which may be the subject of the engagement contemplated by this Agreement for its own account and for the accounts of its customers and may at any time hold long and short positions in such securities in each case in compliance with applicable laws and provided disclosures required by applicable law, if any, are made related thereto. Lucid will disclose to the Company any representation of a counterparty that makes a proposal for any potential Transaction, and Lucid will not serve as a financial advisor to any party other than the Company in a Transaction without the Company’s prior written consent.

|

|

(Q)

|

No Fiduciary Duties. The Company represents that it is a sophisticated business enterprise that has retained Lucid for the limited purposes set forth in this Agreement, and the parties acknowledge and agree that their respective rights and obligations are contractual in nature. Each party disclaims any intention to impose fiduciary obligations on the other by virtue of the engagement contemplated by this Agreement.

|

|

(R)

|

Regulatory Requirements. If necessary, the Company agrees to provide Lucid with information and supporting documentation to enable Lucid to comply with the requirements under Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 ("USA Patriot Act") (Public Law 107-56), the Financial Crimes Enforcement Network, and other regulations.

|

|

(S)

|

Marketing. Lucid shall have the ability, at its option and expense and after the announcement by the Company of the Transaction, to publicize (i.e., use of the Company logo in its marketing materials) its role in providing the Company with the services noted herein.

|

Exhibit 99.1

NovaBay Pharmaceuticals to Hold Special Meeting of Stockholders

Stockholders as of the March 18, 2025 record date will be entitled to vote

Company engages financial advisor to explore strategic options should stockholders fail to approve the dissolution proposal

EMERYVILLE, Calif. (March 7, 2025) – NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) (“NovaBay” or the “Company”) announces it will hold a virtual Special Meeting on April 16, 2025, at which stockholders will vote on a proposal for the liquidation and dissolution of the Company under Delaware law, pursuant to the Plan of Complete Liquidation and Dissolution of the Company (the “Dissolution”). The Special Meeting was announced in a preliminary proxy statement on Schedule 14A filed with the Securities and Exchange Commission (“SEC”) on February 18, 2025 (the “Preliminary Proxy Statement”). Holders of NovaBay’s common stock as of the record date, March 18, 2025, will be entitled to vote at the Special Meeting.

“Given our past voting challenges, we cannot be assured of obtaining stockholder approval for the Dissolution proposal at our upcoming Special Meeting. To that end, we have engaged a financial advisor to explore additional strategic options,” said Justin Hall, NovaBay CEO. “While we go through the process of holding another Special Meeting, we are also considering other strategic alternatives – such as mergers, reverse mergers, strategic partnerships, and licensing and sub-licensing transactions – to ensure we have multiple paths forward regardless of the outcome at the Special Meeting in April.”

Approval of the Dissolution proposal authorizes the Company to liquidate and dissolve in accordance with the Plan of Dissolution at the discretion of the Board of Directors. Approval of the proposal requires the affirmative vote of a majority of the outstanding shares of NovaBay’s common stock. At the previous special meeting of stockholders originally convened on November 16, 2024, as subsequently adjourned and finally reconvened on January 30, 2025, approximately 49% of all outstanding shares of common stock voted in favor of the Dissolution proposal; however, this proposal did not quite exceed the 50% threshold of favorable votes of all outstanding shares of common stock required for its approval.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These forward-looking statements are based upon the Company and its management’s current expectations, assumptions, estimates, projections and beliefs. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in, or implied by, these forward-looking statements. Other risks relating to NovaBay’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in the Company’s latest Form 10-K, subsequent Forms 10-Q and/or Form 8-K filings with the SEC and the Preliminary Proxy Statement filed with the SEC on February 18, 2025, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Additional Information and Where to Find It

On February 18, 2025, NovaBay filed the Preliminary Proxy Statement with the SEC with respect to the Special Meeting to be held in connection with the potential Dissolution of the Company, and thereafter plans to file a definitive proxy statement as soon as reasonably possible. Promptly after filing the definitive proxy statement with the SEC, NovaBay will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the Special Meeting to consider the potential Dissolution. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT NOVABAY HAS FILED OR WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the Preliminary Proxy Statement and definitive version of the proxy statement, the supplements thereto, and any other relevant documents filed by NovaBay with the SEC in connection with the remaining proposal providing for the potential Dissolution at the SEC’s website (http://www.sec.gov) or at the Company’s investor relations website (https://novabay.com/investors/), or by writing to NovaBay Pharmaceuticals, Inc., Investor Relations, 2000 Powell Street, Suite 1150, Emeryville, CA 94608. The information provided on, or accessible through, our website is not part of this communication, and therefore is not incorporated herein by reference.

Participants in the Solicitation

NovaBay and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from NovaBay’s stockholders in connection with the Dissolution. A list of the names of the directors and executive officers of the Company and information regarding their interests in the potential Dissolution, including their respective ownership of the Company’s common stock and other securities is contained in the Preliminary Proxy Statement. In addition, information about the Company’s directors and executive officers and their ownership in the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and filed with the SEC on March 26, 2024, as amended on March 29, 2024 and as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the participants in the proxy solicitation and a description of their interests will be contained in the definitive proxy statement for NovaBay’s special meeting of stockholders and other relevant materials to be filed with the SEC with respect to the Dissolution when they become available. These documents can be obtained free of charge from the sources indicated above.

NovaBay Contact

Justin Hall

Chief Executive Officer and General Counsel

510-899-8800

jhall@novabay.com

Investor Contact

Alliance Advisors IR

Jody Cain

310-691-7100

jcain@allianceadvisors.com

# # #

v3.25.0.1

Document And Entity Information

|

Mar. 04, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NovaBay Pharmaceuticals, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 04, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33678

|

| Entity, Tax Identification Number |

68-0454536

|

| Entity, Address, Address Line One |

2000 Powell Street

|

| Entity, Address, Address Line Two |

Suite 1150

|

| Entity, Address, City or Town |

Emeryville

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94608

|

| City Area Code |

510

|

| Local Phone Number |

899-8800

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NBY

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001389545

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

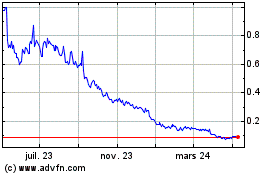

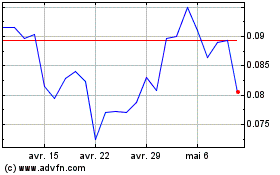

NovaBay Pharmaceuticals (AMEX:NBY)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

NovaBay Pharmaceuticals (AMEX:NBY)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025