UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024.

Commission File Number 001-31722

New Gold Inc.

Suite 3320 - 181 Bay Street

Toronto, Ontario M5J 2T3

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨

Form 40-F x

INCORPORATION BY REFERENCE

Exhibit 99.1 of this Form 6-K is incorporated by reference as an additional exhibit to the registrant’s Registration

Statement on Form F-10 (File No. 333-279369).

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

NEW GOLD INC. |

| |

|

|

| |

By: |

/s/ Sean Keating |

| Date: May 24, 2024 |

|

Sean Keating |

| |

|

Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

FORM 51-102F3

MATERIAL

CHANGE REPORT

| ITEM 1 |

Name and Address of Company |

| |

|

| |

New Gold Inc. (“New Gold” or the “Company”)

Suite 3320, 181 Bay Street

Toronto, Ontario M5J 2T3 |

| |

|

| ITEM 2 |

Date of Material Change |

| |

|

| |

May 13, 2024 |

| |

|

| ITEM 3 |

News Release |

| |

|

| |

A news release with respect to this material change was issued by the

Company on May 13, 2024 through GlobeNewswire and was subsequently filed on SEDAR+ at www.sedarplus.ca. |

| |

|

| ITEM 4 |

Summary of Material Change |

| |

|

| |

On May 13, 2024, New Gold and an affiliate of Ontario

Teachers’ Pension Plan Board (“Ontario Teachers’”) entered into a partial royalty repurchase and

amending agreement (the “Partial Royalty Repurchase and Amending Agreement”), pursuant to which New Gold and

the Ontario Teachers’ affiliate agreed, among other things, to reduce the royalty rate payable by New Gold pursuant to

the free cash flow royalty agreement dated March 31, 2020 in respect of the New Afton mine (the “Original Royalty

Agreement”) from 46.0% to 19.9% from and after May 31, 2024 and to make certain other amendments to the Original

Royalty Agreement, in consideration for a one-time cash payment by New Gold to the Ontario Teachers’ affiliate of US$255,000,000

(the “Partial Royalty Repurchase”).

Also on May 13, 2024, New Gold entered into an agreement

with a syndicate of underwriters led by CIBC Capital Markets (collectively, the “Underwriters”), pursuant to which

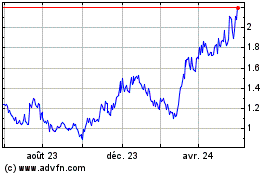

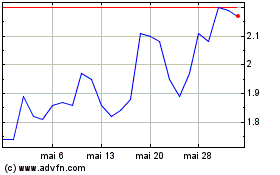

the Underwriters agreed to purchase, on a bought deal basis, 87,300,000 common shares of New Gold (“Common Shares”)

at a price of US$1.72 per Common Share (the “Offering Price”), for aggregate gross proceeds of approximately $150

million (the “Offering”). In addition, the Underwriters were granted an over-allotment option (the “Over-Allotment

Option”) to purchase, at the Offering Price, up to an additional 15% of the number of Common Shares issued pursuant to

the Offering to cover over-allotments, if any. The closing of the Offering occurred on May 17, 2024, resulting in net proceeds

to New Gold from the Offering, including the net proceeds from the exercise by the Underwriters of the Over-Allotment Option in full,

of US$172,679,400.

New Gold completed the royalty repurchase on May 22, 2024.

New Gold funded the repurchase with cash on hand, borrowings from its existing revolving credit facility and net proceeds from the

Offering. |

| ITEM

5 |

Full

Description of Material Change |

| |

|

| |

On May 13, 2024, New Gold and the Ontario Teachers’

affiliate entered into the Partial Royalty Repurchase and Amending Agreement, pursuant to which New Gold and the Ontario Teachers’

affiliate agreed to: (i) reduce the royalty rate payable by New Gold in respect of the New Afton mine pursuant to the Original

Royalty Agreement from 46.0% to 19.9% from and after May 31, 2024; (ii) terminate the option whereby the Ontario Teachers’

affiliate or, after May 30, 2024, a third party purchaser of the Ontario Teachers’ affiliate’s interest, could elect

to form a partnership with respect to the New Afton mine; (iii) terminate New Gold’s option to repurchase and cancel the

Original Royalty Agreement (which right would otherwise terminate on May 30, 2024); and (iv) make certain other related

or consequential amendments to the Original Royalty Agreement and terminate the strategic partnership agreement between New Gold

and a limited partnership controlled by Ontario Teachers’ dated February 24, 2020 (the “2020 Purchase Agreement”),

all in consideration for a one-time cash payment by New Gold to the Ontario Teachers’ affiliate of US$255,000,000.

Also on May 13, 2024, New Gold entered into an agreement

with a syndicate of underwriters led by CIBC Capital Markets (collectively, the “Underwriters”), pursuant to which

the Underwriters agreed to purchase, on a bought deal basis, 87,300,000 common shares of New Gold (“Common Shares”)

at a price of US$1.72 per Common Share (the “Offering Price”), for aggregate gross proceeds of approximately $150

million (the “Offering”). In addition, the Underwriters were granted an over-allotment option (the “Over-Allotment

Option”) to purchase, at the Offering Price, up to an additional 15% of the number of Common Shares issued pursuant to

the Offering to cover over-allotments, if any. The closing of the Offering occurred on May 17, 2024, resulting in net proceeds

to New Gold from the Offering, including the net proceeds from the exercise by the Underwriters of the Over-Allotment Option in full,

of US$172,679,400.

Upon satisfaction of the terms and conditions contained in the

Partial Royalty Repurchase and Amending Agreement, on May 22, 2024 the parties completed the Partial Royalty Repurchase and

entered into the amended and restated free cash flow royalty agreement (the “Amended and Restated Free Cash Flow Royalty

Agreement”).

The Amended and Restated Free Cash Flow Royalty Agreement is on

terms substantially similar to the terms of the Original Royalty Agreement, except as otherwise described below. In particular, the

royalty rate payable in respect of the New Afton mine will be reduced to 19.9% after May 31, 2024, and the option to convert

the royalty to a formal partnership has been removed. The right of first offer in favour of New Gold on any proposed sale by the

Ontario Teachers’ affiliate of its royalty interest has been replaced with a right of first refusal, whereby if the Ontario

Teachers’ affiliate receives a bona fide, binding offer to acquire all, but not less than all, of its royalty interest, New

Gold has a right, exercisable within 60 days, to repurchase the royalty for cancellation at a price equal to 103.0% of the amount

provided in the third party offer. Upon the exercise of such right of first refusal, New Gold must satisfy the purchase price in

cash, provided that if the third party offer includes non-cash consideration, New Gold may elect to satisfy the purchase price in

cash or non-cash consideration, including newly issued Common Shares of New Gold or non-cash consideration that is reasonably equivalent

to that contained in the third party offer, at New Gold’s discretion.

|

| |

New Gold is not subject

to any restrictions on transfer of the New Afton mine; provided that, if a change of control

(as defined in the indenture for New Gold’s outstanding 7.5% senior notes dated as

of June 24, 2020, the “Change of Control”) is announced on or prior

to December 31, 2030 that is subsequently completed, the Ontario Teachers’ affiliate

may elect, within 10 business days after announcement of the Change of Control, to sell its

royalty interest to New Gold or its successor-in-interest for fair market value (as determined

in accordance with the terms of the Amended and Restated Free Cash Flow Royalty Agreement)

within 30 days following the closing of the Change of Control transaction (subject to extension

if necessary to complete the fair market value determination). The purchase price may be

payable in cash or listed securities of New Gold’s successor-in-interest, at its election,

or a combination thereof, subject to a cap on the number of securities to be issued of 9.99%

of the class of listed securities issued. If the Ontario Teachers’ affiliate declines

to sell its royalty interest in connection with such Change of Control, the right will not

apply to any subsequent Change of Control.

In addition, if a Change of Control is completed within 20 months following

the completion of the Partial Royalty Repurchase, the Ontario Teachers’ affiliate will receive a one-time US$20,000,000 cash payment

from New Gold or its successor-in-interest, payable within 30 days following the completion of the Change of Control.

In recognition of the fact that the royalty interest is reduced to

19.9%, certain governance rights provided under the Original Royalty Agreement have been modified, including the elimination of a standing

advisory committee.

Pursuant to the Amended and Restated Free Cash Flow Royalty Agreement,

the 2020 Purchase Agreement has been terminated effective as of the closing of the Partial Royalty Repurchase, save for the indemnification

provisions thereunder, which shall remain outstanding in accordance with their terms.

|

| |

|

| ITEM

6 |

Reliance on subsection

7.1(2) of National Instrument 51-102 |

| |

|

| |

The report is not

being filed on a confidential basis. |

| |

|

| ITEM

7 |

Omitted Information |

| |

|

| |

No information has

been omitted. |

| |

|

| ITEM

8 |

Executive Officer |

| |

|

| |

Sean Keating, Vice President, General Counsel and Corporate Secretary

(416) 324-6000 |

| |

|

| ITEM

9 |

Date of Report |

| |

|

| |

May 23, 2024 |

Exhibit 99.2

THIS AMENDED AND RESTATED

FREE CASH FLOW ROYALTY AGREEMENT (this “Agreement”) dated as of May 22, 2024.

BETWEEN:

NEW

GOLD INC., a corporation existing under the laws of the Province of British Columbia

(the “Owner”)

- and -

BEAR

HOLDINGS LP, a limited partnership formed under the laws of the Province of Ontario by 3336050 NOVA SCOTIA LIMITED

as general partner for and on behalf of Bear Holdings LP

(the “Holder”)

RECITALS:

| A. | The Owner

is the owner and operator of the New Afton Mine (as hereinafter defined). |

| B. | The Owner

and the Holder entered into a purchase agreement dated February 24, 2020 (the “Purchase

Agreement”) pursuant to which, among other things, the Owner and the Holder entered

into a free cash flow royalty agreement dated March 31, 2020 (the “Original

Date”), providing for the grant by the Owner to the Holder of the FCF Royalty,

as defined herein, and setting out the Parties’ respective rights and obligations with

respect to the FCF Royalty (the “Original Agreement”). |

| C. | On May 13,

2024, the Parties entered into a Partial Royalty Repurchase and Amending Agreement (as hereinafter

defined), pursuant to which the Owner and the Holder agreed to reduce the rate of the FCF

Payments and terminate the Partnership Option, each as defined in the Original Agreement,

and make certain other related or consequential amendments to each of the Purchase Agreement

and the Original Agreement, in consideration for a one-time cash payment of $255 million

by the Owner to the Holder. |

| D. | On the

date hereof, the Parties wish to (i) terminate the Purchase Agreement, and (ii) amend

and restate the Original Agreement in its entirety as set out herein in consideration for

and pursuant to the terms of the Partial Royalty Repurchase and Amending Agreement. |

NOW, THEREFORE,

in consideration of the premises and mutual covenants and agreements herein contained and for other good and valuable consideration,

the receipt and adequacy of which are hereby acknowledged by each of the Parties hereto, the Parties mutually agree as follows:

| (a) | “Additional Capital Project”

means a proposed capital project on the Properties with a cost greater than $25 million which

is not set out in the LOM Plan. For greater certainty, an “Additional Capital Project”

will not include (i) any exploration costs or expenses related to a capital project

on the Properties and (ii) any additional costs and/or cost overruns associated with

capital projects currently set out in the LOM Plan. |

| (b) | “Affiliate”

means, with respect to any Person, any other Person who directly or indirectly Controls,

is Controlled by, or is under direct or indirect common Control with, such Person, and includes

any Person in like relation to an Affiliate. |

| (c) | “Agreed Capital Project”

has the meaning set out in Section 6(c). |

| (d) | “Agreement” means this

Amended and Restated Free Cash Flow Royalty Agreement and the schedules hereto, as the same

may be further amended or supplemented from time to time in accordance with the terms hereof. |

| (e) | “Approval Matter” has

the meaning set out in Section 6(a). |

| (f) | “Approval Matter Supporting Material”

has the meaning set out in Section 6(b). |

| (g) | “Approved Model” means

the model in respect of the New Afton Mine with the file name “Project Bear –

New Afton Financial Model (Phase II updated)” provided in section 2.1.3.2.1 of

the Data Room. |

| (h) | “Business Day” means

any day except Saturday, Sunday or any day on which major banks are generally not open for

business in the City of Kamloops, British Columbia or in the City of Toronto, Ontario. |

| (i) | “Change of Control Consideration”

has the meaning set out in Section 5(a). |

| (j) | “COC Exercise Notice”

has the meaning set out in Section 5(b). |

| (k) | “COC Sale Notice” has

the meaning set out in Section 5(b). |

| (l) | “COC Sale Price” has

the meaning set out in Section 5(a). |

| (m) | “COC Sale Right” has

the meaning set out in Section 5(a). |

| (n) | “Confidential Information”

has the meaning set out in Section 11(a). |

| (o) | “Concentrate Sales Process Hedges”

has the meaning set out in Section 9(b). |

| (p) | “Consideration Securities”

has the meaning set out in Section 5(a). |

| (q) | “Control” (including,

with correlative meanings, the terms “Controlling”, “Controlled by”

and “under common Control with”) as applied to any Person, means the possession,

directly or indirectly of the power to direct or cause the direction of the management and

policies of that Person, whether through the ownership of voting securities, by contract,

voting trust or otherwise. |

| (r) | “Credit Rating” means

the rating assigned by the relevant rating agency to the unsecured, senior, long term debt

or deposit obligations of the relevant entity (unsupported by third party credit enhancement). |

| (s) | “Data Room” means the

virtual data room set up by the Owner and the contents thereof as of 5:00 p.m. (Eastern

Time) on February 19, 2020, the index of documents of which is appended to the Disclosure

Letter. |

| (t) | “Disclosure Letter”

has the meaning set out in the Purchase Agreement. |

| (u) | “Expenditures” means

cash expenditures and all costs, obligations and liabilities incurred or properly accrued

(but not yet met) with respect to Operations including, without limitation, cash expenditures

and all costs, obligations and liabilities incurred or accrued: |

| (i) | costs and expenses in exploring for, developing,

mining, extracting, removing, and transporting to any processing site Minerals, such costs

and expenses shall include, without limitation, those incurred for labor, machinery operations,

fuel, explosives and other materials, developmental or ore delineation drilling; |

| (ii) | costs and expenses for milling, treating

or processing and transportation costs, all costs, charges and expenses for treatment in

the smelting and refining process (including handling, processing, deductions, tolling charges);

and sales and brokerage costs, and actual costs of transportation (including insurance, storage,

warehousing, port demurrage, delay and forwarding expenses) of Minerals or other products

from the New Afton Mine to the place of treatment and then to the place of sale, without

duplication; |

| (iii) | general and administrative costs and expenses

of the production of Minerals and operation of the New Afton Mine, including without limitation,

all royalties, production royalties, or other payments of any nature whatsoever payable to

third parties having an interest in the any of the Properties; |

| (iv) | costs and expenses incurred in connection

with the marketing of the Minerals and the delivery of Minerals to points of ultimate delivery

to customers, including without limitation, all shipping and delivery costs, agency fees,

and storage charges, without duplication; |

| (v) | in holding each Properties in full force

and effect (including land maintenance costs and any monies expended as required to comply

with applicable laws, such as the payment of annual maintenance fees, the completion and

submission of assessment work and filings required in connection with any assessment work

or annual maintenance fees), in curing title defects and in acquiring and maintaining surface

and other ancillary rights; |

| (vi) | in preparing for and in the application

for and acquisition of environmental and other permits necessary or desirable to commence

and complete exploration, development and operation activities (including in direct connection

with the Properties, payment to charities, contributions, government programs, lobbying costs

pertaining thereto); |

| (vii) | in undertaking geophysical, geochemical

and geological or technical surveys, drilling, assaying and metallurgical testing, including

costs of assays, metallurgical testing and other tests and analyses to determine the quantity

and quality of Minerals, water and other materials or substances; |

| (viii) | in the preparation of work programmes

and the presentation and reporting of data including any program for the preparation of a

feasibility study or other evaluation of a Property; |

| (ix) | in connection with the protection of the

environment in relation to the Properties including environmental remediation, rehabilitation,

decommissioning and long-term care and monitoring, whether or not a mine reclamation trust

fund has been established; |

| (x) | in acquiring facilities, equipment or machinery,

or the use of any of the foregoing things, and for all parts, supplies and consumables; |

| (xi) | for salaries and wages, including actual

labour overhead expenses for employees assigned to exploration and development activities; |

| (xii) | travelling expenses and fringe benefits

(whether or not required by Law) of all Persons engaged in work with respect to and for the

benefit of the Operations including for their food, lodging and other reasonable needs; |

| (xiii) | payments to contractors or consultants

for work done, services rendered or materials supplied; |

| (xiv) | all Taxes levied against or in respect

of any Property, or activities on the Properties, and the costs of insurance premiums and

performance bonds or other security; |

| (xv) | in connection with any impact benefit or

other agreements between the Owner and Indigenous Groups; |

| (xvi) | in connection with any other agreements

between the Owner and any other Person; |

| (xvii) | any and all royalties payable on or in

respect of any Property; and |

| (xviii) | any Tax payable pursuant to a return

filed under the Mineral Tax Act [RSBC 1996] Chapter 291. |

| (v) | “FCF Payments” has

the meaning set out in Section 2. |

| (w) | “FCF Royalty” means

the free cash flow royalty granted to the Holder by the Owner pursuant to the Original Agreement,

as amended by this Agreement. |

| (x) | “FMV" means the monetary

consideration that a prudent and informed buyer would pay to a prudent and informed seller

in an open and unrestricted market, each acting at arm's length with the other and under

no compulsion to act; provided, however, that in determining the FMV of the FCF Royalty,

FMV shall not include a downward adjustment to reflect the liquidity of the FCF Royalty,

the effect of the transaction on the FCF Royalty or the fact that the FCF Royalty does not

form part of a controlling interest. |

| (y) | “Free Cash Flow” has

the meaning set out in Schedule “B”. |

| (z) | “Guaranteed FCF Amount”

means the lesser of (i) $60,000,000 and (ii) the amount expressed in United States

dollars that is the product of (x) the aggregate amount of “Free Cash Flow

(Post-Tax)” on Line 217 of tab “New Afton Model” in the Approved Model

shown as having been generated by the New Afton Mine during the Guaranteed FCF Period calculated

using the Approved Model (on the basis that any years of negative free cash flow from production

shall be deemed to be one dollar ($1.00) and excluding any and all federal or provincial

income taxes) and after adjustment to the Approved Model to reflect the actual realized commodity

prices (excluding the effect of any Trading Activities) and exchange rates during the Guaranteed

FCF Period multiplied by (y) 46.0% multiplied by (z) the Guaranteed FCF Percentage. |

| (aa) | “Guaranteed FCF Percentage”

means 55%. |

| (bb) | “Guaranteed FCF Period”

means the period commencing on April 1, 2020 and terminating on March 31, 2024. |

| (cc) | “Holder” has the meaning

set out in the recitals to this Agreement. |

| (dd) | “IFRS” means International

Financial Reporting Standards as issued by the International Accounting Standards Board and

as applicable to entities that are publicly accountable in Canada. |

| (ee) | “Indigenous Group”

means any band, band council, tribal council or other governing body, however organized,

that is established by aboriginal peoples of Canada within the meaning section 35(2) of

the Constitution Act, 1982, within their asserted traditional territory in British

Columbia. |

| (ff) | “LOM Plan” means the

Owner’s life of mine model in respect of the New Afton Mine provided in the Data Room. |

| (gg) | “Losses” means all

damages, claims, losses, liabilities, fines, penalties and expenses. |

| (hh) | “Mineral Rights” has

the meaning set out in Section 11(c). |

| (ii) | “Minerals” means all

marketable naturally occurring metallic and non-metallic minerals or mineral bearing material

in whatever form or state in or under the Properties which are owned by the Owner or to which

the Owner is entitled, including, without limitation, any precious metal or any base metal,

owned by the Owner or to which the Owner is entitled and that is mined, extracted, removed,

produced or otherwise recovered from the Properties (other than any rock, sand, gravel or

aggregate used in connection with the conduct of the Operations by the Owner), whether in

the form of ore, doré, concentrates, refined metals or any other beneficiated or derivative

products thereof and including any such minerals or mineral bearing materials or products

derived from any processing or reprocessing of any tailings, waste rock or other waste products

originally derived from the Properties (to the extent that the same are owned by the Owner

or to which the Owner is entitled). |

| (jj) | “New Afton Mine” means

the gold mine owned and operated by New Gold in Kamloops, British Columbia on the area comprised

by the Properties. |

| (kk) | “North Surface Land”

means PID 014-421-666, being that part of the North ½ of Section 35 which lies

to the North of Savona and Kamloops Wagon Road Township 19 Range 19 West of the 6th

Meridian Kamloops Division Yale District except Plan 27151. |

| (ll) | “Operations” means

the operations of the New Afton Mine. |

| (mm) | “Original Agreement”

has the meaning set out in the recitals to this Agreement. |

| (nn) | “Original Date” has

the meaning set out in the recitals to this Agreement. |

| (oo) | “Owner” has the meaning

set out in the recitals to this Agreement. |

| (pp) | “Owner Change of Control”

means a “Change of Control”, as defined in the indenture between the Owner, the

guarantors thereof and Computershare Trust Company, N.A. dated as of June 24, 2020,

in respect of the Owner or any publicly-traded successor thereof, as such indenture exists

on the date hereof. |

| (qq) | “Partial Royalty Repurchase

and Amending Agreement” means the partial royalty repurchase and amending agreement

dated May 13, 2024 between the Owner and the Holder. |

| (rr) | “Party” means any

of the Holder and the Owner and “Parties” means the Holder and the Owner

collectively. |

| (ss) | “Person” means any

individual, sole proprietorship, partnership, firm, entity, unincorporated association, unincorporated

syndicate, unincorporated organization, trust, body corporate, government authority and,

where the context requires, any of the foregoing when they are acting as trustee, executor,

administrator or other legal representative. |

| (tt) | “Prime” means at any

particular time, the rate of interest, expressed as a rate per annum, that the Bank of Nova

Scotia establishes as its prime rate of interest with respect to short term loans to its

most credit worthy customers. |

| (uu) | “Properties” means

the properties set out on Schedule ”A”. |

| (vv) | “Purchase Agreement”

has the meaning set out in the recitals to this Agreement. |

| (ww) | “Rate Adjustment Date”

means May 31, 2024. |

| (xx) | “Released Properties”

has the meaning set out in Section 13(b). |

| (yy) | “Relinquishment Event”

has the meaning set out in Section 13(b). |

| (zz) | “ROFR Acceptance Notice”

has the meaning set out in 4(b)(ii). |

| (aaa) | “ROFR Acceptance Period”

has the meaning set out in Section 4(b)(ii). |

| (bbb) | “ROFR Consideration”

has the meaning set out in Section 4(b)(ii). |

| (ccc) | “ROFR Offer” has

the meaning set out in Section 4(b)(i). |

| (ddd) | “Sale Interest” has

the meaning set out in Section 4(b). |

| (eee) | “Tax” has the meaning

set out in Section 3(c). |

| (fff) | “Third Party” has

the meaning set out in Section 4(b)(i). |

| (ggg) | “Third Party Offer”

has the meaning set out in Section 4(b)(i). |

| (hhh) | “Third Party Valuator”

means an accounting firm or mining valuation firm, in each case, that: (i) is independent

of the Parties; (ii) has experience in mining valuations; and (iii) is mutually

agreed by the Parties, each acting reasonably. |

| (iii) | “Transfer” means,

with respect to this Agreement, any sale, exchange, transfer, assignment, gift, alienation

or other transaction, whether voluntary, involuntary or by operation of law, by all or, in

the case of the Owner, a portion of the legal or beneficial ownership of, or any security

interest or other interest in, this Agreement passes from the Holder or the Owner, as applicable,

to another Person, whether or not for value, and “to Transfer”, “Transferred”

and similar expressions shall have corresponding meanings. |

| (jjj) | “Trading Activities”

has the meaning set out in Section 9(a). |

| (kkk) | “Unapproved Additional Capital

Project” has the meaning set out in Section 6(c). |

| 2. | Grant of Free Cash Flow Royalty |

Subject to the terms of this

Agreement, effective as of the Original Date, the Owner hereby grants and agrees to pay to the Holder the FCF Royalty, being the right

to receive Free Cash Flow payments calculated in accordance with Schedule “B” (the “FCF Payments”)

calculated annually (or for the period from April 1, 2020 to December 31, 2020 for the first calendar year) at the following

rates and in the following manner:

(a) at

the rate of 46.0% of Free Cash Flow during the period commencing on April 1, 2020 and terminating at the end of the day on the Rate

Adjustment Date;

(b) the

FCF Payments from and after the Rate Adjustment Date shall be calculated at the rate of 19.9% of Free Cash Flow; and

(c) if,

in any calendar year during which the Owner is implementing an Agreed Capital Project(s) the Free Cash Flow for such calendar year

is less than zero ($0), the Holder’s proportionate share of such loss up to the value of the total capital expenditure of such

Agreed Capital Project(s), being 46.0% or 19.9% (as applicable), shall be set off against either (i) any future FCF Payments paid

to the Holder, including without limitation the Guaranteed FCF Amount, or (ii) any amounts payable by the Owner to the Holder hereunder

if applicable, including the ROFR Consideration or any payment to be made pursuant to Section 5 (as applicable).

| 3. | Time and Manner of FCF Payments |

(a) The

FCF Payments shall be calculated on a calendar year basis (except in the first year when they will be calculated for the period from

April 1, 2020 to December 31, 2020) and shall become due and payable sixty (60) days following the last day of such calendar

year. FCF Payments shall be made by wire transfer of immediately available funds to such account as the Holder may designate to the Owner

in writing not less than ten business days prior to the dates upon which such payments are to be made, and shall be accompanied by a

settlement sheet showing in reasonable detail the proceeds of sale, costs and other deductions in accordance with the methodology provided

in Schedule “B”, together with any other pertinent information in sufficient detail to explain the calculation of the FCF

Payments.

(b) All

FCF Payments shall be considered final and in full satisfaction of all obligations of the Owner with respect thereto, unless the Holder

gives the Owner written notice describing and setting forth a specific objection to the calculation thereof within sixty (60) days after

receipt by the Holder of the annual statement provided for in Section 3(a). If the Holder objects to a particular annual statement

as herein provided, the Holder shall, for a period of thirty (30) days after the Owner’s receipt of notice of such objection, have

the right, upon reasonable notice and at a reasonable time, to have the Owner’s accounts and records relating to the calculation

of the FCF Payments in question audited by a third party accountant acceptable to each of the Holder and the Owner. If such audit determines

that there has been a deficiency or an excess in the payment made to the Holder, such deficiency or excess shall be resolved by adjusting

the next annual FCF Payment due hereunder. The Holder shall pay all costs of such audit, unless a deficiency of five percent (5%) or

more of the amount due is determined to exist. The Owner shall pay the reasonable costs of such audit if a deficiency of five percent

(5%) or more of the amount due is determined to exist, together with interest on the amount of such deficiency at the rate of Prime plus

two percentage points calculated from the date that such deficient amount was due and payable. The Owner’s books and records shall

be kept in accordance with IFRS. Failure on the part of the Holder to deliver written notice of an objection to the calculation in such

60-day period shall establish the correctness of such FCF Payments and preclude the Holder from any objections with respect thereto or

making any claims for adjustment thereon, absent manifest error.

(c) All

FCF Payments, including interest and penalties, if any, will be made subject to withholding or deduction in respect of the FCF Payments

for, or on account of, any present or future taxes, duties, assessments or governmental charges of whatever nature (collectively, “Tax”)

imposed or levied by or on behalf of any government having power and jurisdiction to tax and for which the Owner is obligated in law

to withhold or deduct and remit to such taxing authority having such power and jurisdiction.

(d) Within

ninety (90) days of March 31, 2024 (or such other date as is mutually agreed by the Owner and the Holder in writing), the Owner

shall deliver to the Holder a statement setting out the aggregate amount of FCF Payments paid or payable to the Holder relating the period

from the date hereof to March 31, 2024 and a draft calculation of the Guaranteed FCF Amount based on the Approved Model (together

with any other pertinent information in sufficient detail to explain the Owner’s calculation of the Guaranteed FCF Amount).

(e) The

Owner’s calculation of the Guaranteed FCF Amount shall be considered final and in full satisfaction of all obligations of the Owner

with respect thereto, unless the Holder gives the Owner written notice describing and setting forth a specific objection to the calculation

thereof within thirty (30) days after receipt by the Holder of the draft calculation of the Guaranteed FCF Amount referred to above.

If the Holder objects to the draft calculation of the Guaranteed FCF Amount, the Holder shall, for a period of thirty (30) days after

the Owner’s receipt of notice of such objection, have the right, upon reasonable notice and at a reasonable time, to have the Owner’s

accounts and records relating to the calculation of the Guaranteed FCF Amount audited by a Third Party Valuator who, acting as experts

and not arbitrators, shall make any required adjustments to the calculation of the Guaranteed FCF Amount to reflect their determination

of the Guaranteed FCF Amount. The Parties hereto agree that all adjustments shall be made without regard to materiality. The Third Party

Valuator shall only decide the specific items under dispute by the Owner and the Holder and its decision for any disputed portions of

the calculation of the Guaranteed FCF Amount. The Owner and the Holder shall each bear their own fees and expenses in preparing or reviewing,

as the case may be, the draft calculation of the Guaranteed FCF Amount. The fees and expenses of the Third Party Valuator shall be paid

by the Holder unless a deficiency of five percent (5%) or more of the amount due is determined to exist. The Owner shall pay the reasonable

costs of the Third Party Valuator if a deficiency of five percent (5%) or more of the amount due is determined to exist. The Third Party

Valuator shall make a determination as soon as practicable within fifteen (15) days (or such other time as the Owner and the Holder shall

agree in writing) after their engagement, and its determination of the Guaranteed FCF Amount shall be conclusive and binding upon the

Parties hereto and will not be subject to appeal, absent manifest error. The final, binding and conclusive calculation of the Guaranteed

FCF Amount based upon the agreement or deemed agreement of the Owner and the Holder or the written determination delivered by the Third

Party Valuator, in either case in accordance with this Section 3(e), shall be deemed to be the Guaranteed FCF Amount for purposes

of this Agreement.

(f) If

the aggregate amount of FCF Payments paid or payable by the Owner to the Holder on or before March 31, 2024 is less than the Guaranteed

FCF Amount, the Owner shall pay to the Holder, contemporaneously with the delivery of such statement, by wire transfer to the account

designated by the Holder in writing to the Owner in respect of FCF Payments, the amount of any such shortfall within ten (10) days

of the date of the final determination referred to in Section 3(e) above.

| 4. | Transfers; Right of First Refusal |

(a) The

Holder shall not Transfer, directly or indirectly, the whole or any part of its interest in this Agreement, except as provided in this

Section 4 or as otherwise required or permitted by this Agreement. Any non-complying purported Transfer shall be of no effect. A

change of Control of the Holder shall be deemed to be a “Transfer” by the Holder prohibited pursuant to this Section 4(a) and

such deemed Transfer shall be subject to the restrictions on Transfers set forth in the Agreement, including those set forth in this

Section 4.

(b) If,

at any time, the Holder receives a bona fide binding offer in writing from any other Person dealing at arm’s length with

the Holder (the “Third Party”) to acquire all, but not less than all, of the Holder’s interest in this Agreement,

whether directly or indirectly, (the “Sale Interest”) that the Holder wishes to accept (a “Third Party Offer”),

then the Holder shall first offer the Sale Interest to the Owner in the manner set forth below:

| (i) | the Holder shall deliver a copy of the Third

Party Offer to the Owner accompanied by a written offer to sell the Sale Interest to the

Owner on the terms and subject to the conditions set out in the Third Party Offer, provided

that the purchase price payable by the Owner shall be equal to 103% of the purchase price

contained in the Third Party Offer (the “ROFR Offer”) and, if any non-cash

consideration is offered as payment of all or any part of the purchase price in the Third

Party Offer, the Holder shall concurrently deliver to the Owner a good faith calculation

of the value of such non-cash consideration together with all supporting documentation; |

| (ii) | the Owner shall thereafter have 60 days

following its receipt of the ROFR Offer and any other information required by Section 4(e)(i) (the

“ROFR Acceptance Period”) to accept the ROFR Offer by notice in writing

delivered to the Holder (the “ROFR Acceptance Notice”), in which event

the ROFR Offer shall become a binding agreement by the Holder to sell, and by the Owner to

purchase, as principal, the Sale Interest on the terms and subject to the conditions contained

in the ROFR Offer; and |

| (iii) | if the ROFR Offer includes non-cash consideration

and the Owner, acting reasonably, does not agree with the value ascribed by the Third Party

thereto in the ROFR Offer, the Owner shall, within 20 days of receipt of the ROFR Offer,

notify the Holder and the Parties shall negotiate in good faith to determine a mutually agreeable

value for the non-cash consideration. If the Parties are unable to agree on an amount within

five days of such notification, the non-cash consideration value shall be determined in accordance

with Section 3(e) applied mutatis mutandis. The ROFR Acceptance Period shall

be extended to the date that is five Business Days from the date on which the non-cash consideration

value is settled or agreed, if such date is after the end of the original ROFR Acceptance

Period. |

(c) The

purchase price payable by the Owner pursuant to the ROFR Offer shall be in cash; provided that if any non-cash consideration is offered

as payment of all or any part of the purchase price in the Third Party Offer then the Owner may, at its election, pay up to the same

proportion of the purchase price in (i) if the Owner has a class of shares listed on a stock exchange or market at such time, newly

issued common shares of the Owner (valued based on the five day volume-weighted average trading price of such shares on the date of the

ROFR Acceptance Notice on the exchange having the greatest volume of trading over such period) and/or (ii) non-cash consideration

that is reasonably structurally equivalent to the form of non-cash consideration in the Third Party Offer.

(d) Any

sale of the Sale Interest by the Holder to the Owner pursuant to Section 4(b) shall be completed within 30 days following the

expiry of the ROFR Acceptance Period. Concurrently upon completion of the sale pursuant to Section 4(b), the FCF Royalty shall be

cancelled by the Owner (and not otherwise Transferred to any other Person by the Owner).

(e) If

the Owner does not deliver a ROFR Acceptance Notice to the Holder within the ROFR Acceptance Period, the rights of the Owner to purchase

the Sale Interest shall terminate and the Holder may sell the Sale Interest to the Third Party provided that:

| (i) | the sale is completed within 90 days of

the expiry of the ROFR Acceptance Period (other than in circumstances where the Holder requires

regulatory approval(s) in order to complete the sale, in which case, the Holder will

have an additional 90 days in which to complete the sale); and |

| (ii) | such sale is completed on the terms contained

in the Third Party Offer. |

(f) If

the Holder does not complete the sale of the Sale Interest to the Third Party within the timeframe provided by Section 4(e)(i),

the obligations set out in this Section 4 shall again apply with respect to any such sale.

(g) If

the Holder completes a sale to a Third Party pursuant to this Section 4, the Holder and the Third Party shall provide a certificate

to the Owner that the sale of the Sale Interest has been completed, in all respects, in accordance with Section 4, as applicable.

For a period of 30 days following receipt of such certificate, the Owner shall be permitted on written request to the Holder and the

Third Party to be provided with reasonable access to the closing documentation relating to such third-party sale.

(h) If

the Holder is contemplating a Transfer pursuant to this Section 4, the Holder may, at the Holder’s risk, grant access to the

Mine to any Third Party who has made an offer or proposal to the Holder that is, or is reasonably expected to become, a Third Party Offer

and who agrees to comply with customary confidentiality obligations in favour of each Party provided that the Holder first provides to

the Owner (i) a copy of any such offer or proposal and (ii) reasonable advance notice in writing. Access to such Third Party

shall occur during reasonable working hours for the purposes of due diligence in respect of the Properties. The Holder must ensure that

such Third Party causes minimal inconvenience to or interference with the Owner or contractors or subcontractors of the Owner in the

conduct of Operations and strictly complies with all safety regulations or instructions promulgated or given by or on behalf of the Owner.

The Owner shall cooperate with the Holder in connection with such diligence activities and shall cause its personnel to be available

during such reasonable working hours for informational sessions with such Third Party.

| 5. | Owner Change of Control |

(a) If,

on or prior to December 31, 2030, an Owner Change of Control is publicly announced which is subsequently completed, the Holder shall,

in accordance with Section 5(b), have the right to sell, and the Owner (or its successor) shall be obligated to repurchase all,

but not less than all, of the Holder’s interest in this Agreement (the “COC Sale Right”) at a purchase price

equal to the midpoint of the FMV of the FCF Royalty as determined by the two Third Party Valuators referred to in Section 5(c) (the

“COC Sale Price”).

(b) The

Holder shall have 10 Business Days from the date of first public announcement of an Owner Change of Control to notify the Owner of its

intent to exercise the COC Sale Right (a “COC Exercise Notice”) in which event the Holder shall be deemed to have

irrevocably agreed to sell, and the Owner shall be bound to purchase, all, but not less than all, of the Holder’s interest in this

Agreement at the COC Sale Price on the date that is later of (i) 30 days following completion of the Change of Control and (ii) 30

days after the date of determination of the COC Sale Price. If the Holder does not deliver a COC Exercise Notice to the Owner within

such 30-day period, then the Holder shall be deemed to have irrevocably waived its right to exercise the COC Sale Right and the

Owner shall have no obligation to repurchase the Holder’s interest in this Agreement pursuant to this Section 5 in connection

with any Owner Change of Control.

(c) If

the Holder delivers a COC Exercise Notice, the Parties shall promptly and no later than 14 days following receipt of such COC Exercise

Notice, engage two Third Party Valuators who shall each be instructed to independently determine, within 20 days following their respective

engagement, the FMV of the FCF Royalty as at the date the third party entered into the definitive written agreement with the Owner to

consummate the Owner Change of Control.

(d) The

Owner may satisfy the COC Sale Price in cash, by the issuance of listed securities of the Person that, immediately following completion

of the Owner Change of Control, Controls the Owner or is the successor-in-interest of the Owner by amalgamation or otherwise (“Consideration

Securities”), or a combination of cash and Consideration Securities; provided that the number of Consideration Securities that

may be issued in satisfaction of the COC Sale Price shall not exceed 9.99% of the class of Consideration Securities outstanding immediately

following the issuance of such securities to the Holder. The number of Consideration Securities issued shall be calculated by dividing

(i) the dollar value of that portion of the COC Sale Price to be paid by the issuance of Consideration Securities by (ii) the

five-day volume-weighted average trading price of the Consideration Securities on the Business Day immediately prior to payment of the

COC Sale Price (expressed in United States dollars, if applicable, using the Bank of Canada foreign exchange rate then in effect on such

Business Day) on the exchange having the greatest volume of trading over such period.

(e) If

at any time prior to January 22, 2026 an Owner Change of Control is completed, regardless of whether the Holder exercises the COC

Sale Right in respect of such Change of Control, the Owner (or its successor) shall pay the Holder a cash payment of $20 million

by wire transfer of immediately available funds to an account(s) specified in writing by the Holder within 30 days following completion

of the Owner Change of Control. For certainty, the foregoing shall only apply in respect of the first Owner Change of Control that occurs

after the Closing (as defined in the Partial Royalty Repurchase and Amending Agreement).

(a) Notwithstanding

any other provision of this Agreement to the contrary, until the New Afton Mine ceases commercial production, the following matters (each

such matter, an “Approval Matter”) shall require the approval of the Holder:

| (i) | the granting of any royalty, product streaming

agreement or other third-party burden on account of the production or sale of Minerals other

than existing royalties and royalties imposed by law, and other than payments of any nature

made to any Indigenous Group; |

| (ii) | any borrowings in respect of the New Afton

Mine that would result in the incurrence of new “Interest Costs” for purposes

of the calculation of Free Cash Flow pursuant to Schedule “B” hereof; and |

| (iii) | any Additional Capital Project. |

(b) With

respect to any Approval Matter, the Owner shall present a detailed description and supporting material (the “Approval Matter

Supporting Material”) of such Approval Matter to the Holder, which, in the case of an Additional Capital Project, shall include

a detailed description and financial model. Thereafter, the Holder shall consider the Approval Matter Supporting Material and shall provide

a decision in writing with respect to the Approval Matter within 45 days of receiving such material in respect of any such Approval Matter.

If the Holder does not provide a decision in writing with respect to the Approval Matter within the timeframe provided in this Section 6(b),

the Approval Matter shall be deemed to be approved.

(c) If

the Holder approves of an Additional Capital Project in writing, or is deemed to have approved of an Additional Capital Project, such

Additional Capital Project shall thereafter be deemed to be an “Agreed Capital Project” with its revenue and

costs included in the FCF Payment calculation for the applicable period(s) in accordance with Schedule “B”. In the event

that the Holder does not approve an Additional Capital Project in accordance with Section 6(b), the Owner shall be free to implement

such Additional Capital Project which is not an Agreed Capital Project (each, an “Unapproved Additional Capital Project”)

in its discretion, and the revenue and costs of any such Unapproved Additional Capital Project will not be included in the FCF Payment

calculation for the applicable period(s) in accordance with Schedule “B”.

(a) This

Agreement shall continue from the Original Date in perpetuity unless: (i) the Owner delivers a ROFR Acceptance Notice; or (ii) the

Holder exercises the COC Sale Right, and, in either case, such transaction is completed in accordance with Section 4(d) or

Section 5(b), as applicable, in which case this Agreement shall be cancelled on completion of such transaction.

(b) If

any right, power or interest of either Party under this Agreement would violate the rule against perpetuities, then such right,

power or interest will terminate at the expiration of twenty (20) years after the death of the last survivor of all the lineal descendants

of Her Majesty, Queen Elizabeth II of England, living on the date of the Original Agreement.

The Owner shall have the

right to commingle any ores, Minerals from the Properties with ores, minerals and mineral products produced from other properties, provided

that such commingling is accomplished after such Minerals have been weighed or measured and sampled in accordance with sound mining and

metallurgical practices (detailed records of which shall be kept by Owner) and further provided that the Owner and the Holder shall agree

(each acting reasonably and in good faith) upon a weighing/measurement/sampling protocol prior to any commingling occurring. Any FCF

Payment due hereunder shall be determined by equitable allocation between Minerals from the Properties and ores, minerals and mineral

products from other properties in accordance with sound accounting and metallurgical practice. As provided in Section 17(b), the

Holder will have the right to access the Properties as contemplated therein.

(a) The

Holder acknowledges that the Owner shall have the right to market and to sell to third parties the Minerals, and any other minerals and

mineral products produced from the Properties in any manner. The Holder further acknowledges that the Owner may from time to time undertake

forward sale and/or purchase contracts, spot-deferred contracts, and option and/or other price hedging and price protection arrangements

and mechanisms and speculative purchases and sales of forward, futures and option contracts, both on and off commodity exchanges (collectively,

“Trading Activities”) in connection with precious metals derived completely from Minerals products produced from the

Properties. Except for Concentrate Sales Process Hedges, such Trading Activities and the profits and losses generated thereby, shall

not, in any manner, be taken into account in the calculation of FCF Payments due the Holder, whether in connection with the determination

of price, the date of sale, or the date any FCF Payments is due.

(b) Where,

in the ordinary course of business and in respect of metals derived completely from Minerals produced from the Properties, a gold or

copper swap contract relating to the quantity of a single concentrate shipment and for a period of no more than one year is entered into

by the Owner for the purpose of reducing exposure to gold and copper prices in the period between provisional and final assays in the

sale of a concentrate shipment (“Concentrate Sales Process Hedges”), the gains or losses from such Concentrate Sales

Process Hedges will be included in Treatment and Refining Charges (as such term is defined in Schedule “B”) in the FCF Payments

calculation.

| 10. | Representations and Warranties of

the Owner |

(a) The

Owner hereby represents and warrants to the Holder as follows:

| (i) | it is duly incorporated, organized, validly

existing and in good standing under the laws of its governing jurisdiction; |

| (ii) | it has all necessary corporate power and

authority to enter into and perform its obligations under this Agreement and to own the Properties

and to carry on its business as conducted and as proposed to be conducted in respect of in

the Properties; |

| (iii) | neither the execution nor delivery of

this Agreement nor the consummation of the transactions contemplated herein nor the compliance

with the terms, conditions and provisions of this Agreement will conflict with or result

in a breach of any terms, conditions or provisions of the charter documents or by-laws of

the Owner, any law, rule or regulation having the force of law, any contractual restrictions

that are binding upon the Owner, or any writ, judgment, injunction, determination or award

that is binding upon the Owner; |

| (iv) | this Agreement has been duly executed and

delivered by the Owner and constitutes a valid and legally binding obligation of the Owner;

and |

| (v) | the Owner possesses or will possess all

material licences, approvals and consents of all governments and regulatory authorities that

are required to properly conduct its mining business on the Properties. |

(b) All

representations, warranties, covenants and agreements of the Owner set forth in this Agreement shall survive the creation of the FCF

Royalty and shall continue in full force and effect for the benefit of the Holder for the duration of the term of the FCF Royalty.

| 11. | Confidentiality; Area of Interest |

(a) All

information, data, reports, records, analyses, economic and technical studies and test results relating to the Properties and the activities

of the Owner or any other party thereon and the terms and conditions of this Agreement (all of which will hereinafter be referred to

as “Confidential Information”) will be treated by the Holder as confidential and will not be disclosed to any person

not a party to this Agreement, except in the following circumstances:

| (i) | the Holder may disclose Confidential Information

to its auditors, legal counsel, institutional lenders, brokers, underwriters and investment

bankers, provided that such non-party users are first advised of the confidential nature

of the Confidential Information, undertake to maintain the confidentiality thereof and are

strictly limited in their use of the Confidential Information to those purposes necessary

for such non-party users to perform the services for which they were retained by the Holder; |

| (ii) | the Holder may disclose Confidential Information

to prospective purchasers of the Holder's right to receive the FCF Royalty, provided that

each such prospective purchaser first agrees in writing to hold such information confidential

in accordance with this Section 11(a) and to use it exclusively for the purpose

of evaluating its interest in purchasing such FCF Royalty right; |

| (iii) | the Holder may disclose Confidential Information

where that disclosure is necessary to comply with any requirements under applicable law,

rules or regulations, and the Owner agrees to promptly provide to the Holder all such

information as the Holder, acting reasonably, determines is necessary or desirable to fulfill

the Holder's disclosure obligations and requirements under applicable laws, provided that

prior to making any such disclosure the Holder shall give the Owner five (5) business

days’ prior written notice and the opportunity to comment on such disclosure; or |

| (iv) | with the prior written approval of the

Owner. |

The Holder shall ensure that

its, and its affiliates’, employees, directors, officers and agents and those persons listed in Section 11(a)(i) and

Section 11(a)(ii) are made aware of this Section 11 and comply with the provisions of this Section 11. The Holder

shall be liable to the Owner for any improper use or disclosure of such terms or information by such persons.

Any Confidential Information

that becomes a part of the public domain by no act or omission in breach of this Section 11(a) will cease to be Confidential

Information for the purposes of this Section 11(a).

(b) The

Holder acknowledges that Confidential Information may include material non-public information and that applicable securities laws impose

restrictions on trading securities when in possession of such information.

(c) During

the term of this Agreement, the Holder agrees that it will not acquire or agree to acquire any interest in any mineral rights (including

without limitation any exploration or prospecting permit, mineral lease, mining lease, surface lease or similar tenure) (collectively,

“Mineral Rights”) located within five (5) kilometres of the outermost external boundaries of the Properties,

and the Holder further agrees that neither the Holder nor any of its Affiliates acting on its behalf or at its direction, will acquire

or agree to acquire any interest in an entity that, either directly or through Affiliates, derives more than 20% of its value from the

ownership of Mineral Rights located within five (5) kilometers of the outermost external boundaries of the Properties.

All tailings relating to

the Minerals shall be subject to the FCF Payments if such tailings are processed by or behalf of the Owner in the future and result in

the production of Minerals. If commingling of the tailings occurs, the amount of such tailings subject to the FCF Payments shall be based

upon the estimated weight of such tailings multiplied by the estimated grade of such tailings in accordance with sound accounting and

metallurgical practice.

| 13. | Maintenance of Properties |

(a) The

Owner shall do or cause to be done all things and make all payments necessary or appropriate to maintain the right, title and interest

of the Owner in the Properties and to maintain the Properties in good standing, provided that the Owner shall in its sole discretion

be: (i) entitled to abandon or surrender or allow to lapse or expire any part or parts of the Properties if the Owner determines,

acting reasonably, that such part or parts are not economically viable or otherwise have insufficient value to warrant continued maintenance;

and (ii) permitted to Transfer the Properties as permitted under this Agreement. For greater certainty, a Relinquishment Event (as

defined below) does not constitute a Transfer and is not subject to Article 4.

(b) Notwithstanding

Section 13(a), if the Owner or an Affiliate of the Owner wishes to abandon surrender, allow to lapse or expire (the “Relinquishment

Event”) all or any portion of the Properties (the “Released Properties”), then the Owner shall provide the

Holder with a minimum of 30 days’ prior written notice of such intended Relinquishment Event. Upon receipt of the said notice,

the Holder shall have a period of 10 days within which to advise the Owner in writing that it desires to acquire the Released Properties,

by quitclaim deed or equivalent legal instrument, for consideration equal to $10.00. If the Holder shall forward such written notice

to the Owner within the said 10-day period, the Owner shall thereafter do all such acts and things or shall cause all such acts and things

to be done, at the Holder’s own sole cost and expense, to assign or convey, as appropriate, the Released Properties to the Holder

for the said $10.00 and to have the Released Properties recorded or registered into the name of the Holder (at the sole cost of the Holder).

If the Holder does not forward the said written notice to the Owner within the said 10-day period, then the Owner or the Affiliate of

the Owner shall have the right to complete the Relinquishment Event with respect to the applicable Released Properties. If a Relinquishment

Event is completed and thereafter, the Owner or any Affiliate of the Owner subsequently reacquires a direct or indirect beneficial interest

in the Released Properties then such Released Properties will once again be subject to the obligation to pay the FCF Royalty pursuant

to this Agreement with respect thereto.

Subject to Section 5,

the Owner shall be entitled to Transfer the Properties and its rights and obligations under this Agreement, provided the following conditions

are satisfied, and upon such conditions being satisfied in respect of any Transfer only the Owner shall be released from all obligations

under this Agreement:

(a) any

purchaser, transferee, lessee or assignee of the Properties or this Agreement (other than a mortgagee, charge, lessee, assignee or encumbrancer)

agrees in writing in favour of the Holder to be bound by the terms of this Agreement;

(b) any

purchaser, transferee or assignee of this Agreement (other than a mortgagee, charge, lessee, assignee or encumbrancer) has simultaneously

acquired the Owner’s right, title and interest in and to the Properties; and

(c) any

mortgagee, chargee, lessee, assignee or encumbrancer of the Properties or this Agreement agrees in advance in writing in favour of the

Holder to be bound by and subject to the terms of this Agreement in the event it takes possession of or forecloses on all or part of

the Properties and undertakes to obtain an agreement in writing in favour of the Holder from any subsequent purchaser, lessee, assignee

or transferee of such mortgagee, chargeholder, lessee or encumbrancer that such subsequent purchaser, lessee, assignee or transferee

will be bound by the terms of this Agreement including, without limitation, this Section 14.

(a) All

decisions concerning methods, the extent, times, procedures and techniques of any exploration, development, mining, milling, processing,

extraction treatment, if any, and the materials to be introduced into the Properties or produced therefrom, and all decisions concerning

the sale or other disposition of Minerals (including, without limitation, decisions as to buyers, times of sale, whether to store or

stockpile Minerals for a reasonable length of time without selling the same) shall be made by the Owner, in its sole discretion, provided

that if the Owner determines to stockpile Minerals it shall first take commercially reasonable steps to secure such Minerals from loss,

theft, tampering and contamination.

(b) The

Owner shall not be responsible for nor obliged to make any FCF Payments which account for the value of any Minerals lost in any mining

or processing of the Minerals.

| 16. | Books; Records; Inspections |

The Owner shall keep true,

complete and accurate books and records of all of its operations and activities with respect to the Properties, including the mining

of Minerals therefrom and the mining, treatment, processing, refining and transportation of Minerals, prepared in accordance with IFRS,

consistently applied. Subject to complying with the confidentiality provisions in Section 11(a) of this Agreement, the Holder

and/or its authorized representatives shall be entitled, upon delivery of thirty (30) business days advance notice, and during the normal

business hours of the Owner, to perform audits or other reviews and examinations of the Owner’s books and records relevant to the

calculation and payment of the FCF Payments pursuant to this Agreement no more than once per calendar year to confirm compliance with

the terms of this Agreement. All expenses of any audit or other examination permitted hereunder shall be paid by the Holder, unless the

results of such audit or other examination permitted hereunder disclose a deficiency in respect of any FCF Payments paid to the Holder

hereunder in respect of the period being audited or examined in an amount greater than five percent (5%) of the amount of the FCF Payments

properly payable with respect to such period, in which event all expenses of such audit or other examination shall be paid by the Owner.

| 17. | Information and Inspection Rights |

(a) The

Holder shall be entitled to convene a meeting with members of the Owner’s senior management team up to two times per calendar year

(or such additional number as the Owner may otherwise agree) for the purpose of keeping the Holder advised of material matters in respect

of the Operations and to allow the Holder to make suggestions regarding the Operations, which the Owner will consider in good faith;

provided, however, that if the Owner wishes to undertake an Additional Capital Project, the Holder shall be entitled to promptly have

convened an additional meeting with members of the Owner’s senior management team in connection with its evaluation of such Additional

Capital Project, such meeting to occur no later than 10 days after receipt by the Holder of Approval Matter Supporting Material in respect

of such Additional Capital Project in accordance with Section 6(b).

(b) The

Holder may, at the risk of the Holder, have access to the Properties up to two times per calendar year (and such other time(s) as

the Owner may agree) for the purposes of inspecting the Operations. The Holder must ensure that its representatives or consultant, as

the case may be, cause minimal inconvenience to or interference with the Operations and comply strictly with any safety regulations or

instructions promulgated or given by or on behalf of the Owner.

(c) Subject

to the Owner’s obligations and restrictions under applicable securities laws, the Owner shall provide the Holder with:

| (i) | reasonable access to the Owner’s scientific

and technical data (including life of mine plans and related models, work plans and programs,

permitting information, environmental studies and feasibility studies) for the Operations

and results of Operations; |

| (ii) | quarterly reports of management of the

Owner including a discussion of all material developments in respect of the Operations at

the New Afton Mine in the previous quarter; |

| (iii) | other written reports (including technical

reports) on the status of the Owner’s work programs with respect to the Operations

as and when such reports are prepared; and |

| (iv) | all reports of the New Afton Mine Independent

Tailings Review Board. |

(d) For

certainty, the Holder shall treat all information provided to it pursuant to this Section 17 (whether disclosed in writing, orally,

visually, electronically or by any other means) as Confidential Information in accordance with Section 11.

(a) The

Owner does hereby agree to defend, indemnify, reimburse and hold harmless the Holder, its Affiliates, and their respective officers,

directors, employees, agents and their successors and assigns (collectively, “Holder Indemnified Parties”), and each

of them, from and against any and all Losses that the Holder Indemnified Parties may sustain, suffer or incur as a result of:

| (i) | any Operations conducted on or in respect

of the Properties by or on behalf of the Owner that result from or relate to Losses, in any

way arising from or connected with any non-compliance by the Owner with any present or future

environmental laws; and |

| (ii) | any failure by the Owner to timely and

fully perform all abandonment, restoration, remediation and reclamation required by all governmental

authorities pertaining or related to the Operations or activities by or on behalf of the

Owner on or with respect to the Properties. |

(b) The

Parties acknowledge that the Holder is acting as agent and trustee for and on behalf of each other Holder Indemnified Party with respect

to any rights pursuant to Section 18(a) but the Owner and the Holder agree that they may amend, terminate, revise or replace

this Agreement at any time and in any manner whatsoever, notwithstanding any such rights granted pursuant hereto to any such Holder Indemnified

Party, without notice to, consent of, or any other obligation whatsoever to, such Holder Indemnified Party.

Any matter in this Agreement

in dispute between the Parties which has not been resolved by the Parties within thirty (30) days of the delivery of notice by either

Party of such dispute shall be referred to binding arbitration. Such referral to binding arbitration shall be to a qualified single arbitrator

pursuant to the Arbitrations Act, 1991 (Ontario), which Act shall govern such arbitration proceeding in accordance with its terms

except to the extent modified by the rules for arbitration set out in Schedule ”C”. The determination of such arbitrator

shall be final and binding upon the Parties hereto and the costs of such arbitration shall be as determined by the arbitrator. The Parties

covenant that they shall conduct all aspects of such arbitration having regard at all times to expediting the final resolution of such

arbitration.

(a) Interest

in Land; Registration of Interest

| (i) | The Parties intend that, subject to the

provisions of Section 13(b), the FCF Royalty on the Properties will be a covenant running

with the Properties, will be enforceable as an in rem interest in land which shall

run with the Properties (provided that such interest shall be satisfied only by the payment

to the Holder of the FCF Payments). Any conveyance by the Owner of the Properties shall include

a provision requiring the transferee to pay the FCF Royalty on the Properties. Subject to

compliance with Section 14, upon a conveyance by the Owner of the Properties and this

Agreement, the Owner shall automatically be released from, and shall have no obligations

to the Holder in respect of, any obligations hereunder that accrue following the date of

such transfer. |

| (ii) | It is the express intention of the Parties

that to the fullest extent permissible at law, the FCF Royalty on the Properties shall be

registerable or otherwise recordable in all public places where interests in a royalty are

recordable, and accordingly, the Holder will have the right from time to time after the date

hereof, at its own cost and expense, to make any additional registrations or records of notice

of this Agreement and the FCF Royalty, any other documents relating to or contemplated by

the foregoing and any caution or other title document, against title to the Properties or

elsewhere, and the Owner will cooperate with all such registrations and recordings and provide

its written consent or signature to any documents and do such other things from time to time

as are necessary or desirable to effect all such registrations or recordings or otherwise

to protect the interests of the Holder in the FCF Royalty as contemplated hereunder. |

(b) No

Partnership, etc.

This Agreement is not intended

to, and will not be deemed to, create (expressly or by implication) any partnership relation between the Parties including, without limitation,

a joint venture, mining partnership, commercial partnership or other partnership relationship between the Owner and the Holder, and in

this regard the Parties acknowledge and agree that the Holder is neither an owner nor operator of the New Afton Mine. The obligations

and liabilities of the Parties will be several and not joint and neither of the Parties will have or purport to have any authority to

act for or to assume any obligations or responsibility on behalf of another Party. Nothing herein contained will be deemed to constitute

a Party the partner, agent, joint venturer or legal representative of another Party, nor shall anything in this Agreement be construed

to create, expressly or by implication, a fiduciary relationship between the Parties.

(c) Further

Assurances

Each Party shall with reasonable

diligence execute all such further instruments and documents and do all such further actions as may be reasonably necessary or desirable

to effectuate the documents and transactions contemplated in this Agreement, in each case at the cost and expense of the Party requesting

such further document or action, unless expressly indicated otherwise.

(d) Binding

Effect

All covenants, conditions,

and terms of this Agreement shall bind and enure to the benefit of the Parties hereto and their respective successors (including any

successor by reason of amalgamation of any Party) and permitted assigns.

(e) Governing

Law

This Agreement shall be governed

by and construed under the laws of the Province of Ontario and the federal laws of Canada applicable therein.

(f) Time

of Essence

Time is of the essence in

this Agreement.

(g) Waiver

The failure of a Party to

insist on the strict performance of any provision of this Agreement or to exercise any right, power or remedy upon a breach hereof shall

not constitute a waiver of any provision of this Agreement or limit the Party’s right thereafter to enforce any provision or exercise

any right.

(h) Amendment

No amendment, supplement,

modification or waiver of this Agreement shall be binding unless executed in writing by all Parties and, unless otherwise specified,

no consent or approval by any Party, shall be binding unless executed in writing by the Party to be bound thereby.

(i) Severability

If any provision of this

Agreement is wholly or partially invalid, this Agreement shall be interpreted as if the invalid provision had not been a part hereof

so that the invalidity shall not affect the validity of the remainder of the agreement which shall be construed as if the agreement had

been executed without the invalid portion. It is hereby declared to be the intention of the Parties that this Agreement would have been

executed without reference to any portion which may, for any reason, hereafter be declared or held invalid.

(j) Accounting

Principles

All calculations hereunder

shall be made in accordance with IFRS.

(k) Currency

All dollar amounts or references

to $ herein are in United States dollars.

(l) Assignment

to Affiliates

Notwithstanding the provisions

of Section 4, a Party may at any time Transfer all or any part of its interest in this Agreement (and the corresponding rights contained

in the Purchase Agreement) to an Affiliate provided such Affiliate shall agree in advance in writing with the other Party to be bound

by any obligations of such Party to be performed hereunder and further provided that such Party shall remain liable for the due performance

of any of its obligations hereunder.

(m) Notices

Any notice, direction, certificate,

consent, determination or other communication required or permitted to be given or made under this Agreement shall be in writing and

shall be effectively given and made if (a) delivered personally, or (b) sent by e-mail, in each case to the applicable address

set out below:

New Gold Inc.

181 Bay Street,

Suite 3320

Toronto, ON M5J 2T3

Attention: General

Counsel

Email: [Redacted]

with a copy (which shall not constitute

notice) to:

Davies Ward Phillips & Vineberg

LLP

155 Wellington Street West, Floor 37

Toronto, Ontario

M5V 3J7

Email: [Redacted]