UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

UNDER the

Securities Exchange Act of 1934

For the month of January, 2023

Commission File Number: 001-39766

ORLA MINING LTD.

(Translation of registrant's name into English)

Suite 202, 595 Howe Street

Vancouver, British Columbia,

V6C 2T5, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ORLA MINING LTD.. |

| |

|

| Date: January 16, 2023 |

|

/s/ Etienne Morin |

| |

Name: Etienne Morin

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

Exhibit 99.1

Orla Mining Achieves High End of Increased 2022

Production Guidance and Provides 2023 Guidance

Record Quarterly Gold Production

of 32,017 Ounces

VANCOUVER, BC, Jan. 16, 2023 /CNW/ - Orla Mining

Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") is pleased to provide an operational update for the fourth

quarter ended December 31, 2022. This news release also includes the Company's 2023 annual guidance which contains the outlook for production,

operating and capital costs, and exploration spending across the Company's portfolio.

(All amounts are in U.S. dollars unless otherwise

stated)

2022 Camino Rojo Oxide Mine Operational Update

The Camino Rojo Oxide Mine produced 32,017 ounces

of gold in the fourth quarter of 2022, for a total of 109,596 ounces of gold for the full year 2022, achieving the high end of the increased

production guidance range of 100,000 to 110,000 ounces. Orla's initial production guidance for 2022 was 90,000 to 100,000 ounces of gold

and was increased at the end of the third quarter to a range of 100,000 to 110,000 ounces of gold. Additional operational details for

the fourth quarter are found near the end of this news release. All-in Sustaining Costs ("AISC")1,2 guidance for

the year 2022 has been maintained at $600 to $700 per ounce of gold sold and financial results will be released in advance of the Fourth

Quarter and Year End 2022 Conference Call.

Orla ended the year with a cash position of $96.6

million at December 31, 2022, a net increase of $7.5 million during the fourth quarter. During the fourth quarter, the Company made the

third of four payments to Fresnillo plc ("Fresnillo"), for the amount of $15 million, related to the Layback Agreement (see

news release dated March 23, 2020), and also made the first quarterly principal repayment of $5.6 million on its credit facility.

2023 Guidance Summary

| Gold Production |

oz |

100,000 - 110,000 |

| All-in Sustaining Costs ("AISC")1,2 |

$/oz Au sold |

$750 - $850 |

| Capital Expenditures1,2 |

|

|

| Sustaining Capital Expenditures 1 |

$m |

$6 |

| Non-Sustaining Capital Expenditures 1 |

$m |

$4 |

| Exploration |

|

|

| Mexico |

$m |

$20 |

| USA (Nevada) |

$m |

$10 |

| Panama |

$m |

$3 |

| Total Exploration |

$m |

$33 |

| Site Admin & Permitting Expenses (Nevada/Panama) |

$m |

$11 |

| Corporate G&A |

$m |

$15 |

| 1. AISC, sustaining capital and non-sustaining capital are non-GAAP measures. See the "Non-GAAP Measures" section of this news release for additional information. |

| 2. Exchange rates used to forecast cost metrics include MXN/USD of 20.0 and CAD/USD of 1.28 |

"2022 was a defining year for Orla as we made

the successful transition from developer to producer," said Jason Simpson, President and Chief Executive Officer of Orla. "In

2023, cash generation from the high-margin Camino Rojo Mine will be invested into our prospective growth pipeline, the local communities,

paying taxes, and strengthening our balance sheet to the benefit of all our stakeholders."

Production and Cost Outlook

Gold production from the Camino Rojo Oxide Mine is

expected to be 100,000 to 110,000 ounces in 2023. The Company's cumulative gold production from 2022 and 2023 are expected to be in line

with the cumulative gold production from year 1 and 2 of the 2021 Camino Rojo Feasibility Study. Average daily mine production

at the Camino Rojo Oxide Mine is expected to be above 40,000 tonnes per day while average daily ore processing throughput is expected

to be above the design capacity of 18,000 tonnes per day.

Camino Rojo's operating costs are expected to total

approximately $65 million in 2023, including royalties and net of change in inventory, while sustaining capital expenditures1

are expected to total $6 million, which includes $2 million for the construction of an ore stockpile dome cover for dust mitigation, $2

million for several small operational improvement items, and $2 million for capitalized exploration on the Camino Rojo layback area. The

$4 million in non-sustaining capital1 relates to land acquisition at the Company's South Railroad project in Nevada.

In 2023, Orla expects to make approximately $22 million

in debt repayments on its credit facility split evenly across quarters, and $23 million as a final payment relating to the Fresnillo Layback

Agreement to be paid in December 2023.

Income taxes accrued during 2022, including Mexican

Special Mining Duty, totalling approximately $35 million, will be paid in a lump sum in March 2023. Thereafter, Orla expects to pay

income tax instalments monthly, beginning in May 2023.

Approximately $11 million is expected to be spent

in 2023 related to site administration, permitting, and pre-engineering expenses for the Company's projects in the US and Panama.

| _________________________________________ |

| 1. |

Sustaining capital and non-sustaining capital are non-GAAP measures. See the "Non-GAAP Measures" section of this news release for additional information. |

Exploration Outlook

With the Camino Rojo Oxide Mine generating robust

cash flows, the Company is increasing investment in its large and prospective exploration portfolio. The total expected exploration spend

in 2023 is $35 million, with approximately $22 million to be spent at Camino Rojo in Mexico. Exploration at Camino Rojo will focus on confirmation

drilling of the oxide pit layback, resource and reserve conversion, additional Camino Rojo sulphide drilling to support development planning,

and drill testing of regional targets. The exploration program in Mexico will start in early 2023 and extend until year end. In Nevada,

USA, exploration activities at the South Railroad Project, located on the Carlin Trend, will focus on upgrading and increasing oxide resources

at satellite deposits and drill testing multiple exploration targets. Exploration activities in Nevada will be weighted to the second

half of 2023. In Panama, drilling at Cerro Quema will focus on regional exploration in the first quarter of 2023, to take advantage of

the dry season. Most of the exploration costs in 2023 will be expensed, as per Orla's accounting policy. Additional exploration details

related to 2022 results and 2023 plans on individual country exploration programs will be provided in the first quarter 2023.

2022 Camino Rojo Oxide Mine Operational Detail

| Mining and Processing Totals |

|

Q4 2022 |

FY 2022 |

| Ore Mined |

tonnes |

2,227,611 |

8,299,621 |

| Ore - processed |

tonnes |

1,777,118 |

6,579,070 |

| Low Grade Ore - stockpiled |

tonnes |

450,493 |

1,720,551 |

| Waste Mined |

tonnes |

1,556,189 |

5,535,125 |

| Total Mined |

tonnes |

3,783,801 |

13,834,747 |

| Strip Ratio |

w:o |

0.70 |

0.67 |

| Total Ore Mined Gold Grade |

g/t |

0.69 |

0.71 |

| Ore - processed |

g/t |

0.78 |

0.82 |

| Low Grade Ore - stockpiled |

g/t |

0.30 |

0.33 |

| |

|

|

|

| Ore Crushed |

tonnes |

1,744,711 |

6,485,707 |

| Ore Stacked |

tonnes |

1,802,376 |

6,882,063 |

| Stacked Ore Gold Grade |

g/t |

0.79 |

0.82 |

| Gold Produced |

oz |

32,017 |

109,596 |

| |

|

|

|

| Daily Stacked Throughput Rate – Average* |

tpd |

19,591 |

18,251 |

| Daily Stacked Throughput / Nameplate Capacity |

% |

108.84 % |

101.39 % |

| Total Crushed Ore Stockpile |

tonnes |

166,695 |

| Total Crushed Ore Stockpile Au Grade |

g/t |

0.86 |

| Total ROM Ore Stockpile** |

tonnes |

2,120,642 |

| Total ROM Ore Stockpile Grade |

g/t |

0.34 |

| *Average stacking rate calculation excludes truck-stacked overliner material (0 tonnes for Q4 2022 and 220,432 tonnes for FY 2022). |

| **ROM ore stockpile includes mined ore but yet crushed, and low-grade stockpiles. |

Fourth Quarter and Year End 2022 Conference Call

Orla will host a conference call on Friday, March

17, 2023, at 10:00 AM, Eastern Time, to provide a corporate update following the release of its financial and operating results for the

fourth quarter and year ended 2022:

Dial-In Numbers:

Conference ID: 5844017

Toll Free Dial-In: 1 (888) 550-5302

Toll Dial-In: 1

(646) 960-0685

Webcast:

https://orlamining.com/investors/presentations-and-events/

Qualified Persons Statement

The scientific and technical information in this news

release was reviewed and approved by Mr. J. Andrew Cormier, P. Eng., Chief Operating Officer of the Company, who is the Qualified Person

as defined under NI 43-101 standards.

About Orla Mining Ltd.

Orla is operating the Camino Rojo Oxide Gold Mine,

a gold and silver open-pit and heap leach mine, located in Zacatecas State, Mexico. The property is 100% owned by Orla and covers over

160,000 hectares. The technical report for the 2021 Feasibility Study on the Camino Rojo oxide gold project entitled "Unconstrained

Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico"

dated January 11, 2021 (the "2021 Camino Rojo Feasibility Study"), is available on SEDAR and EDGAR under the Company's profile

at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of Cerro Quema located in Panama which includes a gold production

scenario and various exploration targets. Cerro Quema is a proposed open pit mine and gold heap leach operation. The technical report

for the Pre-Feasibility Study on the Cerro Quema oxide gold project entitled "Project Pre-Feasibility Updated NI 43-101 Technical

Report on the Cerro Quema Project, Province of Los Santos, Panama" dated January 18, 2022, is available on SEDAR and EDGAR

under the Company's profile at www.sedar.com and www.sec.gov, respectively. Orla also owns 100% of the South Railroad Project, a

feasibility-stage, open pit, heap leach project located on the Carlin trend in Nevada. The technical report for the 2022 Feasibility Study

entitled "South Railroad Project, Form 43-101F1 Technical Report Feasibility Study, Elko County, Nevada" dated March

23, 2022, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. The technical

reports are available on Orla's website at www.orlamining.com.

Non-GAAP Measures

The Company has included certain performance measures

in this news release which are not specified, defined, or determined under generally accepted accounting principles (in the Company's

case, International Financial Reporting Standards ("IFRS"")). These are common performance measures in the gold mining

industry, but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented

by other issuers. Accordingly, the Company uses such measures to provide additional information and you should not consider them in isolation

or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles ("GAAP").

In addition to the below, refer to the "Non-GAAP measures" section of the Company's Management's Discussion and Analysis for

the period ended September 30, 2022, for a more detailed discussion of these non-IFRS measures and their calculation.

All-in Sustaining Costs

The Company has provided an AISC performance measure

that reflects all the expenditures that are required to produce an ounce of gold from operations. While there is no standardized meaning

of the measure across the industry, the Company's definition conforms to the all-in sustaining cost definition as set out by the World

Gold Council in its guidance dated November 14, 2018. Orla believes that this measure is useful to external users in assessing operating

performance and the Company's ability to generate free cash flow from current operations.

Sustaining and Non-Sustaining Capital

The Company defines non-sustaining capital expenditures

are those expenditures which were (i) incurred to develop new operations, or (ii) incurred at existing operations which will materially

increase production or mine life. Sustaining capital expenditures are defined as all capital expenditures other than non-sustaining capital

expenditures. Sustaining capital is relevant to the AISC metric as it is needed to maintain the Company's current operations and provides

improved transparency related to our ability to finance these expenditures from current operations.

Forward-looking Statements

This news release contains certain "forward-looking

information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning

of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended,

the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission,

all as may be amended from time to time, including, without limitation, statements regarding: the Company's production and cost outlook,

including expected production, AISC, processing throughputs, operating costs, sustaining and non-sustaining capital expenditures, exploration

and development expenditures, corporate general and administrative expenses, debt repayments and income tax payments; and the Company's

exploration outlook, including planned exploration spend and the goals and timing of the Company's exploration programs. Forward-looking

statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects

to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements

are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements

were made, including without limitation, assumptions regarding the Company's ability to achieve the production, cost and development expectations

for its respective operations and projects; the price of gold, silver, and copper; the accuracy of mineral resource and mineral reserve

estimations; prices for energy inputs, labour, materials, supplies and services; that there will be no material adverse change affecting

the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political

and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current

levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances

that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in

such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results

to differ materially from those anticipated. These risks include, but are not limited to: uncertainty and variations in the estimation

of mineral resources and mineral reserves, including risks that the interpreted drill results may not accurately represent the actual

continuity of geology or grade of the deposit, bulk density measurements may not be representative, interpreted and modelled metallurgical

domains may not be representative, and metallurgical recoveries may not be representative; the Company's reliance on Camino Rojo and risks

associated with its start-up phase; financing risks and access to additional capital; risks related to natural disasters, terrorist acts,

health crises and other disruptions and dislocations, including by the COVID-19 pandemic; risks related to the Company's indebtedness;

success of exploration, development, and operation activities; foreign country and political risks, including risks relating to foreign

operations and expropriation or nationalization of mining operations; concession risks; permitting risks; environmental and other regulatory

requirements; delays in or failures to enter into a subsequent agreement with Fresnillo Plc with respect to accessing certain additional

portions of the mineral resource at Camino Rojo and to obtain the necessary regulatory approvals related thereto; the mineral resource

estimations for Camino Rojo being only estimates and relying on certain assumptions; the Layback Agreement with Fresnillo Plc remaining

subject to the transfer of surface rights; delays in or failure to get access from surface rights owners; risks related to guidance estimates

and uncertainties inherent in the preparation of feasibility and pre-feasibility studies, including but not limited to, assumptions underlying

the production estimates not being realized, changes to the cost of production, variations in quantity of mineralized material, grade

or recovery rates, geotechnical or hydrogeological considerations during mining differing from what has been assumed, failure of plant,

equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to exchange,

interest or tax rates, cost of labour, supplies, fuel and equipment rising, changes in project parameters, delays, and costs inherent

to consulting and accommodating rights of local communities; uncertainty in estimates of production, capital, and operating costs and

potential production and cost overruns; the fluctuating price of gold, silver, and copper; global financial conditions; uninsured risks;

competition from other companies and individuals; uncertainties related to title to mineral properties; conflicts of interest; risks related

to compliance with anti-corruption laws; volatility in the market price of the Company's securities; assessments by taxation authorities

in multiple jurisdictions; foreign currency fluctuations; the Company's limited operating history; risks related to the Company's history

of negative operating cash flow; litigation risks; intervention by non-governmental organizations; outside contractor risks; risks related

to historical data; unknown labilities in connection with acquisitions; the Company's ability to identify, complete, and successfully

integrate acquisitions; dividend risks; risks related to the Company's foreign subsidiaries; risks related to the Company's accounting

policies and internal controls; the Company's ability to satisfy the requirements of the Sarbanes-Oxley Act of 2002; enforcement of civil

liabilities; the Company's status as a passive foreign investment company for U.S. federal income tax purposes; information and cyber

security; gold industry concentration; shareholder activism; risks associated with executing the Company's objectives and strategies,

as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual

information form dated March 18, 2022, which are available on www.sedar.com and www.sec.gov. Except as required by the securities disclosure

laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's

beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

This news release has been prepared in accordance

with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current

standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral

reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated

mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents

incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian National

Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy

and Petroleum (the "CIM") — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council,

as amended (the "CIM Definition Standards").

For United States reporting purposes, the United

States Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization

Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the

Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements

and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace

the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required

to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer

that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Corporation is not required

to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101

and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference

herein may not be comparable to similar information disclosed by United States companies subject to the United States federal securities

laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization

Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred

mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral

reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101.

While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral

resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into

a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these

terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves.

Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred

mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further,

"inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically.

Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher

category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not

form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar"

to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly,

there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable

mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources"

under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC

Modernization Rules or under the prior standards of SEC Industry Guide 7.

SOURCE Orla Mining Ltd.

View original content: http://www.newswire.ca/en/releases/archive/January2023/16/c6968.html

%CIK: 0001680056

For further information: Jason Simpson, President & Chief Executive

Officer; Andrew Bradbury, Vice President, Investor Relations & Corporate Development; www.orlamining.com; info@orlamining.com

CO: Orla Mining Ltd.

CNW 06:00e 16-JAN-23

This regulatory filing also includes additional resources:

ex991.pdf

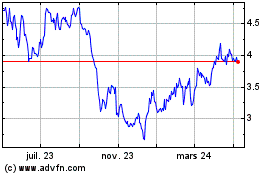

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

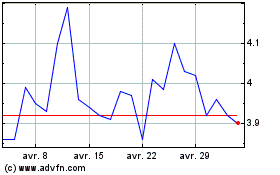

Orla Mining (AMEX:ORLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024