Paramount Gold Nevada Corp. (NYSE American: PZG) (“Paramount” or

the “Company”) has issued an S-K 1300 Technical Report Summary

(“TRS” or the “Study”) for its 100% owned Sleeper Gold-Silver

Project (the “Project”) improving upon the total resources and

associated confidence in the resources previously reported.

Paramount’s President and COO Glen Van Treek

stated that, “Our team is thrilled with the progress we have made

advancing the Sleeper project since the complete database

verification process commenced. We are very optimistic this new

resource estimate will support a robust Initial Assessment of

project economics as recommended by our consultants, MDA of Reno,

Nevada, a division of RESPEC.”

CEO Rachel Goldman noted that, “The database

verification process has captured the value of tens of millions of

dollars of historical work done on the Sleeper Project. Sleeper is

a significant asset which we think is not reflected in our current

valuation and the future potential of our Company. This resource

restatement is a major step forward towards realizing Sleeper’s

value for our shareholders.”

The digitizing and validation of the Sleeper

database included over 4,200 drill holes completed since the

original AMAX gold discovery hole in the 1980’s, a span of over 40

years. The database review included a revision of gold and silver

values against original assay certificates, drill hole logs, sample

sheets and verification of over 300,000 samples containing gold and

silver assays. Additionally, the team re-assayed over 3,000 samples

of old pulps and split core from drilling conducted in the 80’s and

90’s, bringing the overall database to current industry

standards.

The new resource model based on the verified

database increased total gold resources from 2.4 million ounces to

3.1 million ounces and improved the confidence level by upgrading

60% or 1.9 million ounces of total gold resources to the measured

and indicated categories from inferred resources in the TRS filed

in September of 2022.

Mineral Resources

|

Category |

Tonnes(000’s) |

Au(g/T) |

Au(000’s oz) |

Ag(g/T) |

Ag(000’s oz) |

|

Measured |

4,902 |

0.537 |

85 |

3.61 |

570 |

|

Indicated |

158,337 |

0.356 |

1,812 |

4.06 |

20,661 |

|

Inferred |

119,909 |

0.315 |

1,214 |

2.45 |

9,454 |

Notes:

- The estimate of mineral resources

was done by RESPEC in metric tonnes.

- Mineral Resources comprised all

model blocks at a 0.14 g Au/t cut-off for Oxide and Mixed, 0.17 g

Au/t for Sulfide within an optimized pit and 0.14 g Au/t for

dumps.

- The average grades of the Mineral

Resources are comprised of the weighted average of Oxide, Mixed,

Sulfide, and dumps mineral resources. Alluvium mineralized

materials are not included in the mineral resources.

- Mineral Resources within the

optimized pit are block-diluted tabulations. Dumps mineral

resources are undiluted tabulations.

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources potentially

amenable to open pit mining methods are reported using a gold price

of US$1,800/oz, a silver price ofUS$22/oz, a throughput rate of

30,000 tonnes/day, assumed metallurgical recoveries of 84.6% for Au

and 52.3% for Ag, mining costs of US$2.40/tonne mined, heap leach

processing costs of US$3.08/tonne processed, floatation with

bio-oxidation processing costs of US$8.52/tonne processed, general

and administrative costs of $0.46/tonne processed. Gold and silver

commodity prices were selected based on analysis of the three-year

running average at the end of July 2023.

- The effective date of the estimate

is June 30, 2023.

- Rounding may result in apparent

discrepancies between tonnes, grade, and contained metal

content.

Source: (As Filed) S-K 1300 Technical Report Summary

Initial Assessment

RESPEC recommends the completion of a TRS

Initial Assessment to test the preliminary project economics and if

positive, recommends additional metallurgical testing and a

7,600-meter infill drill program to provide additional information

related to geotechnical data, hydrology, improvements to resource

reliability and confidence. RESPECs detailed recommendations,

outlined in the Study, provide a clear path forward through to the

completion of a Pre-Feasibility Study.

S-K 1300 is a Securities Exchange Commission

("SEC") requirement that requires registrants with material mining

operations including those in the exploration and development stage

to provide certain disclosures about its mining activities in its

SEC filings.

Qualified Person DisclosureThe mineral resource

estimate was completed and reviewed by a Qualified Person at

RESPEC, and metallurgical inputs were given by a Qualified Person

at Woods Process, who are independent of Paramount Gold Nevada

Corp.

All the above-named Companies have reviewed and

approved this news release.

To stay informed of future press releases, subscribe to our

E-Alerts Program and to learn more about our projects visit the

projects section of our website.

About Paramount Gold Nevada

Corp.Paramount Gold Nevada Corp. is a U.S. based precious

metals exploration and development company. Paramount’s strategy is

to create shareholder value through exploring and developing its

mineral properties and to realize this value for its shareholders

in three ways: by selling its assets to established producers;

entering joint ventures with producers for construction and

operation; or constructing and operating mines for its own

account.

Paramount holds a 100% interest in four gold

projects: Grassy Mountain; Frost; Sleeper and Bald Peak.

The Grassy Mountain Gold Project consists of

approximately 8,200 acres located on private and BLM land in

Malheur County, Oregon. The Grassy Mountain Gold Project contains a

gold-silver deposit (100% located on private land) for which

results of a positive Feasibility Study have been released and key

permitting milestones accomplished.

Frost is comprised of 84 unpatented lode claims

covering approximately 1,730 acres located 12 miles southwest of

the Company’s proposed high-grade, underground Grassy Mountain gold

mine in Malheur County, Oregon (“Grassy”).

The Sleeper Gold Project is located in Northern

Nevada, the world’s premier mining jurisdiction. The Sleeper Gold

Project, which includes the former producing Sleeper mine, totals

2,474 unpatented mining claims (approximately 44,917 acres).

The drill ready, Bald Peak Project in Nevada,

consists of approximately 2,260 acres.

Cautionary Note to U.S. Investors

Paramount is subject to the reporting

requirements of the Securities Exchange Act of 1934 and this filing

and other U.S. reporting requirements are governed by Subpart 1300

of Regulation S-K promulgated by the SEC. Additionally, Paramount

is subject to certain reporting requirements under applicable

Canadian securities laws with respect to our material mineral

properties under National Instrument 43-101 Standards of Disclosure

for Mineral Projects (NI 43-101). We caution investors that certain

terms used under Canadian reporting requirements and definitions of

NI 43-101 to describe mineralization may not be classified as a

“reserve” unless the determination has been made that the

mineralization could be economically and legally produced or

extracted at the time the reserve determination is made. Therefore,

investors are cautioned not to assume that all or any part of the

mineralized material contained at any of our material projects will

ever be converted to Subpart 1300 of Regulation S-K compliant

reserves.

Safe Harbor for Forward-Looking Statements

This release and related documents may include

"forward-looking statements" and “forward-looking information”

(collectively, “forward-looking statements”) pursuant to applicable

United States and Canadian securities laws. Paramount’s future

expectations, beliefs, goals, plans or prospects constitute

forward-looking statements within the meaning of the United States

Private Securities Litigation Reform Act of 1995 and other

applicable securities laws. Words such as "believes," "plans,"

"anticipates," "expects," "estimates" and similar expressions are

intended to identify forward-looking statements, although these

words may not be present in all forward-looking statements.

Forward-looking statements included in this news release include,

without limitation, statements with respect to the use of proceeds

from the Offerings. Forward-looking statements are based on the

reasonable assumptions, estimates, analyses and opinions of

management made in light of its experience and its perception of

trends, current conditions and expected developments, as well as

other factors that management believes to be relevant and

reasonable in the circumstances at the date that such statements

are made, but which may prove to be incorrect. Management believes

that the assumptions and expectations reflected in such

forward-looking statements are reasonable. Assumptions have been

made regarding, among other things: the conclusions made in the

feasibility study for the Grassy Mountain Gold Project (the “FS”);

the quantity and grade of resources included in resource estimates;

the accuracy and achievability of projections included in the FS;

Paramount’s ability to carry on exploration and development

activities, including construction; the timely receipt of required

approvals and permits; the price of silver, gold and other metals;

prices for key mining supplies, including labor costs and

consumables, remaining consistent with current expectations; work

meeting expectations and being consistent with estimates and plant,

equipment and processes operating as anticipated. There are a

number of important factors that could cause actual results or

events to differ materially from those indicated by such

forward-looking statements, including, but not limited to:

uncertainties involving interpretation of drilling results;

environmental matters; the ability to obtain required permitting;

equipment breakdown or disruptions; additional financing

requirements; the completion of a definitive feasibility study for

the Grassy Mountain Gold Project; discrepancies between actual and

estimated mineral reserves and mineral resources, between actual

and estimated development and operating costs and between estimated

and actual production; the global epidemics, pandemics, or other

public health crises, including the novel coronavirus (COVID-19)

global health pandemic, and the spread of other viruses or

pathogens and the other factors described in Paramount’s

disclosures as filed with the SEC and the Ontario, British Columbia

and Alberta Securities Commissions.

Except as required by applicable law, Paramount

disclaims any intention or obligation to update any forward-looking

statements as a result of developments occurring after the date of

this document.

Paramount Gold Nevada Corp. Rachel

Goldman, Chief Executive OfficerChristos

Theodossiou, Director of Corporate

Communications844-488-2233Twitter:

@ParamountNV

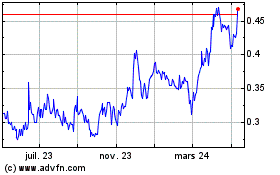

Paramount Gold and Silver (AMEX:PZG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Paramount Gold and Silver (AMEX:PZG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024