Uber Stock Spikes On Its Inclusion in the S&P 500 Index

04 Décembre 2023 - 10:59AM

Finscreener.org

Uber (NYSE:UBER)

shares saw a 5% increase in extended trading on Friday following

the announcement that it will be joining the

S&P 500 Index,

taking the place of Sealed Air Corp

(NYSE:SEE). As stated in a recent press release, this

adjustment is scheduled to occur before trading opens on Monday,

December 18.

When a company is included in the

S&P 500, its stock price typically experiences a boost. This

is because portfolio managers who align with the index, updated

quarterly, are required to purchase its stocks. To be eligible for

inclusion, companies must meet specific criteria regarding their

valuation and profitability.

Uber boosts profitability in recent months

Since its debut on the New York

Stock Exchange in 2019, Uber has grappled with high operational

costs, particularly in its competitive ride-hailing segment.

Initially, the company focused on adjusted EBITDA (earnings before

interest, tax, depreciation, and amortization) as its key financial

metric.

A significant portion of Uber’s

adjusted EBITDA has been derived from its mobility services.

However, the company expedited the profitability of its delivery

segment, driven by the recession-wary investment climateU+02019s

reluctance toward funding loss-making enterprises.

Additionally, increasing

advertising revenue has also bolstered UberU+02019s financial

health.

In response to these challenges,

Uber undertook significant cost-cutting measures in 2020, including

eliminating over 3,500 jobs.

Subsequent efforts by its

executives have focused on refining the company’s cost structure,

such as optimizing delivery expenses. In its third quarter, Uber

reported a net income of $221 million, with revenues totaling $9.29

billion. Over the past four quarters, the company has accrued a

profit exceeding $1 billion.

Uber CEO Dara Khosrowshahi, in a

discussion with UBS analyst Lloyd Walmsley at a December 2021

investor meeting, emphasized the goal to develop Uber into a

company capable of sustaining impressive top-line growth and

progressively enhancing margins over time.

As per the S&P 500U+02019s

inclusion criteria, companies must demonstrate positive earnings in

the most recent quarter and cumulatively over the past four

quarters. Additionally, a minimum adjusted market capitalization of

$14.5 billion is required. Uber boasts a market capitalization of

approximately $118 billion, significantly higher than the

S&P 500U+02019s median company market cap of just over $31

billion.

Is Uber stock a good buy right now?

Uber, renowned for its

ride-sharing services, also runs the

popular food delivery platform Uber Eats and a commercial freight

service named Uber Freight.

In its latest third-quarter

report, ending September 30, Uber witnessed a 25% year-over-year

increase in its operations, completing 2.4 billion trips through

ride-hailing and food delivery services. The company reported a

substantial $35.2 billion in customer bookings across its varied

services, encompassing rides, food, and freight

deliveries.

However, Uber faces substantial

operational costs. The company earns a fraction of each trip its

drivers complete, converting $35.2 billion in bookings to $9.2

billion in revenue. After accounting for operational expenses, the

net income stood at a modest $221 million for the

quarter.

A significant portion of

UberU+02019s expenses is attributed to its vast network of 6.5

million drivers, to whom it paid $16 billion in the third quarter

alone, nearly half of its total bookings. Significantly reducing

this cost could drastically alter UberU+02019s financial dynamics,

allowing the company to retain a larger share of revenue from each

service booked by customers.

Can Uber be valued at $1 trillion?

Uber is projected to achieve a

revenue of $35.4 billion for the entire year of 2023. Given its

current market cap, UBER stock trades at a price-to-sales (P/S)

ratio of approximately 3.3.

The ratio is significantly lower

than its peak P/S ratio of 8.9. However, taking a midpoint between

these two figures, a long-term P/S ratio of around 5.8 seems

feasible.

To reach a market valuation of $1

trillion by 2033, Uber would need to ramp up its annual revenue to

an impressive $173 billion. This ambitious goal requires the

company to sustain an average annual revenue growth of 17.2% over

the next decade.

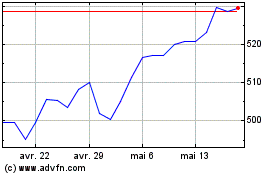

SPDR S&P 500 (AMEX:SPY)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

SPDR S&P 500 (AMEX:SPY)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024