Form 8-K - Current report

08 Août 2023 - 3:02PM

Edgar (US Regulatory)

0000061398

false

0000061398

2023-08-08

2023-08-08

0000061398

us-gaap:CommonStockMember

2023-08-08

2023-08-08

0000061398

tell:SeniorNotes8.25PercentDue2028Member

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

August 8, 2023 |

|

| |

|

|

Tellurian

Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-5507 |

|

06-0842255 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 1201

Louisiana Street, Suite

3100, Houston,

TX |

|

77002 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| Registrant’s telephone number, including

area code: |

(832)

962-4000 |

|

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol |

|

Name of each exchange on which registered |

| Common

stock, par value $0.01 per share |

|

TELL |

|

NYSE

American LLC |

| |

|

|

|

|

| 8.25%

Senior Notes due 2028 |

|

TELZ |

|

NYSE

American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry Into a Material Definitive Agreement. |

On August 8, 2023, Tellurian

Inc. (the “Company”) entered into a securities purchase agreement (the “SPA”) with an institutional

investor (the “Investor”) pursuant to which the Investor agreed to purchase, and the Company agreed to issue and sell

in a private placement to the Investor (the “Private Placement”), (i) $250,000,000 aggregate principal amount

of senior secured notes (the “Senior Notes”) pursuant to an indenture (the “Base Indenture”) between

the Company and Wilmington Trust, National Association, as trustee (the “Trustee”), and an eighth supplemental indenture

(the “Eighth Supplemental Indenture”) among the Company, the Trustee and the collateral agent named therein and (ii) $83,334,000

aggregate principal amount of senior secured convertible notes (the “Convertible Notes” and, together with the Senior

Notes, the “Notes”) pursuant to the Base Indenture between the Company and the Trustee, and a ninth supplemental indenture

(the “Ninth Supplemental Indenture” and, together with the Base Indenture and the Eighth Supplemental Indenture, the

“Indentures”), among the Company, the Trustee and the collateral agent named therein. The Private Placement is expected

to close in the near future, subject to the satisfaction of customary closing conditions.

The Company will use the net

proceeds from the sales of the Notes to partially redeem the $333.3 million aggregate principal amount of 6.00% Senior Secured Convertible

Notes due May 1, 2025 (the “Prior Convertible Notes”) pursuant to a redemption letter agreement between the Company

and the holder of the Prior Convertible Notes (the “Redemption Agreement”). Subject to the terms and conditions of

the Redemption Agreement, payment of the remaining aggregate principal amount of the Prior Convertible Notes will be forgiven, any obligations

arising under the Prior Convertible Notes (other than the requirement to pay accrued and unpaid interest on those notes through the date

of redemption) will be released, and the covenants under the purchase agreement relating to those notes will be terminated.

Securities Purchase Agreement

The SPA contains customary

representations, warranties and agreements by the Company, obligations of the parties, termination provisions and closing conditions.

Pursuant to the SPA, the Company has agreed to indemnify the Investor against certain liabilities. The representations, warranties and

covenants contained in the SPA were made only for purposes of such agreement and as of specific dates, were solely for the benefit of

the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties. The SPA also includes certain

covenants that, among other things, limit the Company’s ability to issue certain types of securities for specified periods of time.

Form of Indentures and Form of Notes

The Eighth and Ninth Supplemental

Indentures will be entered into among the Company, the Trustee and the collateral agent named therein. The Indentures will govern the

terms of the Notes, including with respect to the rights and duties of the Trustee (including in connection with an event of default under

the Notes (as described below)), replacement of the Trustee, discharge of the Indenture, cancellation of the Notes, and amendment and

modification of the Indentures or the Notes.

Key terms of the Notes and

the Indentures are as follows:

| Maturity: |

|

October 1, 2025 (the “Maturity Date”) |

| |

|

|

| Issue Price: |

|

Each Senior Note will be sold at an offering price of approximately $864 per $1,000 Senior Note, which represents an original issue discount of 11.00% for the Senior Notes.

Each Convertible Note will be sold at an offering price of $1,000 per $1,000 Convertible Note. |

| |

|

|

| Collateral: |

|

The Notes will be senior obligations of the Company secured

by a pledge of the equity interests in the Company’s subsidiary Tellurian Production Holdings LLC and mortgages of the material

real property oil and gas assets of Tellurian Production Holdings LLC and its subsidiaries (together, the “Collateral”).

The Collateral will be removed as a secured obligation under the Convertible Notes if the Senior Notes are no longer outstanding. |

| |

|

|

| Coupon: |

|

The Senior Notes will bear interest at 10.00% per annum,

paid quarterly in cash, plus approximately 1.1 million shares of common stock of the Company per

quarter (the “Senior Notes Share Coupon”).

The Convertible Notes will bear interest at 6.00% per

annum, paid quarterly in cash, plus approximately 1.9 million shares of common stock of the Company

per quarter (the “Convertible Notes Share Coupon,” and together with the Senior

Notes Share Coupon, the “Share Coupons”).

To the extent that the average daily volume-weighted average price of the common stock of the Company during a quarter is less than $1.35, the Company will pay the holders of the Notes an amount equal to that difference multiplied by the number of shares underlying the Share Coupons for that quarter. |

| |

|

|

| Share Coupon Make Whole: |

|

Upon any retirement, redemption, or conversion of the Senior Notes or Convertible Notes, the Company will pay a full make-whole payment for any and all unpaid Share Coupons through the Maturity Date for the Note being retired. |

| |

|

|

| Conversion Price: |

|

The conversion rate for the Convertible Notes will be 512.8205 shares of common stock of the Company per $1,000 principal amount of Convertible Notes (equivalent to a conversion price of approximately $1.95 per share of common stock) (the “Conversion Price”), subject to adjustment in certain circumstances. |

| Investor Redemption: |

|

On or after October 1, 2024, the holders of the Notes may redeem up to the entire principal amount

of the Notes for a cash purchase price equal to principal amount of the Notes being redeemed, plus accrued and unpaid interest, if

the Company’s liquidity falls below a specified threshold. |

| |

|

|

| Other Redemptions at the Option of Holders: |

|

Holders of the Senior Notes or the Convertible Notes may force the Company to redeem the applicable

Notes for cash upon (i) a fundamental change or (ii) an event of default, at a price specified in the Indentures. |

| |

|

|

| Forced Conversion: |

|

The Company will force the holders of the Convertible Notes to convert all of the Convertible Notes if the trading price of its common stock closes above 300% of the Conversion Price for 20 consecutive trading days and certain other conditions are satisfied. |

| |

|

|

| Covenants: |

|

The Indentures will provide that the Company will be subject to certain affirmative and negative covenants. |

| |

|

|

| Optional Redemption: |

|

The Company may provide written notice to each holder

of the Senior Notes calling all of such holder’s Notes for a cash purchase price equal to 100%

of the principal amount being redeemed, plus accrued and unpaid interest (the “Optional

Redemption”).

The Company may not redeem the Convertible Notes. |

| |

|

|

| Events of Default: |

|

The Indentures include customary events of default. |

The maximum number of

shares of common stock that the Company may issue in connection with the Notes, including shares payable as interest on the Notes

and shares issuable upon conversion of the Convertible Notes, is 68,414,528 (this compares to a maximum number of shares of

87,351,503 in connection with the initial issuance of the Prior Convertible Notes).

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 2.03.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth

in Item 1.01 is incorporated herein by reference to this Item 3.02.

The Investor has represented that it is an “accredited investor,”

as such term is defined in Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

The Company relied on the private placement exemption from the registration requirements of the Securities Act set forth in Section 4(a)(2)

thereof and Rule 506(b) of Regulation D thereunder for purposes of the transactions contemplated by the SPA.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TELLURIAN INC. |

| |

|

|

| Date: August 8, 2023 |

By: |

/s/ Simon G. Oxley |

| |

Name: |

Simon G. Oxley |

| |

Title: |

Executive Vice President and Chief Financial Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=tell_SeniorNotes8.25PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

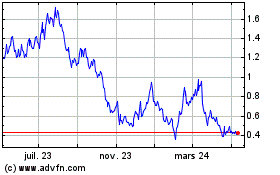

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

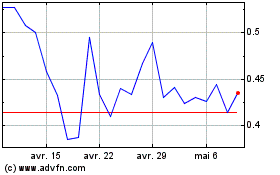

Tellurian (AMEX:TELL)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025