Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 Août 2023 - 6:02PM

Edgar (US Regulatory)

Schedule of investments

Delaware Investments® National Municipal Income Fund

June 30, 2023 (Unaudited)

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds — 162.96%

|

| Education Revenue Bonds — 21.18%

|

Arizona Industrial Development

Authority Revenue

|

|

|

|

(Leman Academy Of Excellence of Projects)

Series A 4.50% 7/1/54

|

| 1,115,000

| $ 1,009,766

|

Board of Governors of the

Colorado State University System Enterprise Revenue

|

|

|

|

| Series A 5.00% 3/1/43

|

| 5,000,000

|

5,743,800

|

Brooklyn Park, Minnesota Charter

School Lease Revenue

|

|

|

|

| (Prairie Seeds Academy Project)

|

|

|

|

| Series A 5.00% 3/1/34

|

| 925,000

|

874,449

|

| Series A 5.00% 3/1/39

|

| 170,000

|

154,975

|

Chicago, Illinois Board of

Education Dedicated Capital Improvement Tax Revenue

|

|

|

|

| 5.00% 4/1/45

|

| 585,000

|

605,469

|

Chicago, Illinois Board of

Education Revenue

|

|

|

|

| ICE 5.75% 4/1/48 (BAM)

|

| 4,000,000

|

4,423,680

|

Colorado Educational & Cultural

Facilities Authority Revenue

|

|

|

|

(Charter School - Aspen Ridge School Project)

Series A 144A 5.25% 7/1/46 #

|

| 500,000

|

478,770

|

(Charter School - Community Leadership Academy Second Campus Project)

7.45% 8/1/48

|

| 500,000

|

500,940

|

(Charter School - Peak to Peak Charter School Project)

5.00% 8/15/34

|

| 1,000,000

|

1,015,850

|

(Charter School - Science Technology Engineering and Math (STEM) School Project)

5.125% 11/1/49

|

| 765,000

|

746,418

|

(Charter School - Skyview Academy Project)

144A 5.50% 7/1/49 #

|

| 750,000

|

749,993

|

(Charter School - University Lab School Building)

144A 5.00% 12/15/45 #

|

| 500,000

|

505,000

|

(Vail Mountain School Project)

4.00% 5/1/46

|

| 25,000

|

21,468

|

|

|

|

| Value (US $)

|

| Municipal Bonds (continued)

|

| Education Revenue Bonds (continued)

|

| District of Columbia Revenue

|

|

|

|

(Two Rivers Public Charter School Inc. Issue)

5.00% 6/1/50

|

| 760,000

| $ 698,531

|

Huntingdon County General

Authority Revenue

|

|

|

|

(AICUP Financing Program - Juniata College Project)

Series T 5.00% 10/1/51

|

| 2,500,000

|

2,462,175

|

Idaho Housing & Finance

Association Non-Profit Facilities Revenue

|

|

|

|

(Sage International School of Boise Project)

Series A 4.00% 5/1/50

|

| 1,055,000

|

977,278

|

Minnesota Higher Education

Facilities Authority Revenue

|

|

|

|

(St. John's University)

4.00% 3/1/36

|

| 410,000

|

397,889

|

Otsego, Montana Charter School

Lease Revenue

|

|

|

|

(Kaleidoscope Charter School)

Series A 5.00% 9/1/34

|

| 230,000

|

219,749

|

South Carolina, Clemson

University Higher Education Revenue

|

|

|

|

(Byrnes Hall Project)

Series A 4.00% 5/1/49

|

| 2,500,000

|

2,407,575

|

St. Cloud, Minnesota Charter

School Lease Revenue

|

|

|

|

(Stride Academy Project)

Series A 5.00% 4/1/46

|

| 375,000

|

277,294

|

St. Paul, Minnesota Housing &

Redevelopment Authority Charter School Lease Revenue

|

|

|

|

(Great River School Project)

Series A 144A 5.50% 7/1/38 #

|

| 240,000

|

241,702

|

(Twin Cities Academy Project)

Series A 5.30% 7/1/45

|

| 630,000

|

593,365

|

University of Texas System Board

of Regents Revenue

|

|

|

|

| Series B 5.00% 8/15/49

|

| 1,000,000

|

1,188,940

|

Washington Higher Education

Facilities Authority Revenue

|

|

|

|

(Gonzaga University Project)

4.00% 4/1/47

|

| 3,000,000

|

2,783,070

|

NQ- OV9 [0623] 0823

(3054904) 1

Schedule of investments

Delaware Investments® National Municipal Income Fund (Unaudited)

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Education Revenue Bonds (continued)

|

Westchester County, New York

Local Development Revenue

|

|

|

|

(Pace University)

Series A 5.00% 5/1/34

|

| 1,500,000

| $ 1,504,980

|

|

| 30,583,126

|

| Electric Revenue Bonds — 13.44%

|

American Municipal Power Ohio

Revenue

|

|

|

|

(Prairie State Energy Campus Project)

Series A 4.00% 2/15/36

|

| 2,500,000

|

2,525,550

|

Minnesota Municipal Power

Agency Electric Revenue

|

|

|

|

| 5.00% 10/1/47

|

| 1,210,000

|

1,249,361

|

Municipal Electric Authority of

Georgia Revenue

|

|

|

|

| (Plant Vogtle Units 3&4 Project M)

|

|

|

|

| Series A 4.00% 1/1/59

|

| 4,000,000

|

3,605,760

|

| Series A 5.00% 1/1/56 (BAM)

|

| 5,000,000

|

5,124,050

|

| Series A 5.00% 1/1/63 (BAM)

|

| 2,500,000

|

2,551,925

|

Salt River, Arizona Project

Agricultural Improvement & Power District Electric System Revenue

|

|

|

|

(Salt River Project)

Series A 5.00% 1/1/50

|

| 3,000,000

|

3,303,600

|

Southern Minnesota Municipal

Power Agency Supply Revenue

|

|

|

|

| Series A 5.00% 1/1/41

|

| 240,000

|

247,289

|

St. Paul, Minnesota Housing &

Redevelopment Authority District Energy Revenue

|

|

|

|

| Series B 4.00% 10/1/37

|

| 800,000

| 803,040

|

|

| 19,410,575

|

| Healthcare Revenue Bonds — 42.44%

|

Anoka, Minnesota Healthcare &

Housing Facilities Revenue

|

|

|

|

(The Homestead at Anoka Project)

5.375% 11/1/34

|

| 610,000

|

581,342

|

Apple Valley, Minnesota Senior

Living Revenue

|

|

|

|

(Minnesota Senior Living LLC Project)

Fourth Tier Series D 7.25% 1/1/52

|

| 1,035,000

|

673,609

|

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Healthcare Revenue Bonds (continued)

|

Apple Valley, Minnesota Senior

Living Revenue

|

|

|

|

(Senior Living LLC Project)

Fourth Tier Series D 7.00% 1/1/37

|

| 685,000

| $ 488,651

|

(Senior Living, LLC Project)

Second Tier Series B 5.00% 1/1/47

|

| 715,000

|

446,589

|

Arizona Industrial Development

Authority Revenue

|

|

|

|

| (Great Lakes Senior Living Communities LLC Project)

|

|

|

|

Fourth Tier Series D-2

144A 7.75% 1/1/54 #

|

| 50,000

|

26,531

|

Second Tier Series B

5.00% 1/1/49

|

| 70,000

|

36,843

|

Bethel, Minnesota Housing &

Health Care Facilities Revenue

|

|

|

|

(Benedictine Health System – St. Peter Communities Project)

Series A 5.50% 12/1/48

|

| 500,000

|

404,935

|

California Health Facilities

Financing Authority Revenue

|

|

|

|

(Kaiser Permanente)

Series A-2 5.00% 11/1/47

|

| 1,000,000

|

1,140,330

|

Colorado Health Facilities

Authority Revenue

|

|

|

|

(Aberdeen Ridge)

Series A 5.00% 5/15/49

|

| 500,000

|

382,175

|

| (AdventHealth Obligated Group)

|

|

|

|

| Series A 3.00% 11/15/51

|

| 2,000,000

|

1,476,780

|

| Series A 4.00% 11/15/50

|

| 500,000

|

476,445

|

(Adventist Health System/Sunbelt Obligated Group)

Series A 5.00% 11/15/48

|

| 1,000,000

|

1,038,930

|

(American Baptist)

8.00% 8/1/43

|

| 1,660,000

|

1,672,699

|

(Bethesda Project)

Series A-1 5.00% 9/15/48

|

| 750,000

|

669,165

|

(Cappella of Grand Junction Project)

144A 5.00% 12/1/54 #

|

| 525,000

|

346,448

|

(CommonSpirit Health)

Series A-2 5.00% 8/1/44

|

| 290,000

|

299,532

|

(Covenant Living Communities and Services)

Series A 4.00% 12/1/40

|

| 750,000

|

645,608

|

2 NQ- OV9 [0623] 0823

(3054904)

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Healthcare Revenue Bonds (continued)

|

Colorado Health Facilities

Authority Revenue

|

|

|

|

(Covenant Retirement Communities, Inc.)

Series A 5.00% 12/1/35

|

| 1,000,000

| $ 1,007,300

|

(Sanford)

Series A 5.00% 11/1/44

|

| 1,465,000

|

1,505,888

|

(Sunny Vista Living Center Project)

Series A 144A 6.25% 12/1/50 #

|

| 505,000

|

340,976

|

Crookston, Minnesota Health Care

Facilities Revenue

|

|

|

|

(Riverview Health Project)

5.00% 5/1/51

|

| 1,390,000

|

1,055,385

|

Cuyahoga County, Ohio Hospital

Revenue

|

|

|

|

(The Metrohealth System)

5.50% 2/15/57

|

| 1,000,000

|

1,012,650

|

Deephaven, Minnesota Housing &

Healthcare Facility Revenue

|

|

|

|

| (St. Therese Senior Living Project)

|

|

|

|

| Series A 5.00% 4/1/38

|

| 280,000

|

244,378

|

| Series A 5.00% 4/1/40

|

| 270,000

|

231,485

|

Escambia County, Florida Health

Facilities Authority Revenue

|

|

|

|

(Baptist Healthcare Corporation Obligated Group)

Series A 4.00% 8/15/50

|

| 1,150,000

|

996,498

|

Hayward, Minnesota Health Care

Facilities Revenue

|

|

|

|

(American Baptist Homes Midwest Obligated Group)

5.75% 2/1/44

|

| 500,000

|

416,700

|

(St. John's Lutheran Home of Albert Lea Project)

Series A 5.375% 10/1/44 ‡

|

| 125,000

|

75,000

|

Henrico County, Virginia Economic

Development Authority Residential Care Facility Revenue

|

|

|

|

(Westminster Canterbury Richmond)

Series A 5.00% 10/1/52

|

| 1,200,000

|

1,216,200

|

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Healthcare Revenue Bonds (continued)

|

Hillsborough County, Florida

Industrial Development Authority Hospital Revenue

|

|

|

|

(Tampa General Hospital Project)

Series A 3.50% 8/1/55

|

| 6,875,000

| $ 5,190,900

|

Hospital Facility Authority Union

County, Oregon Revenue

|

|

|

|

(Grande Ronde Hospital Project)

5.00% 7/1/39

|

| 1,665,000

|

1,701,730

|

Idaho Health Facilities Authority

Revenue

|

|

|

|

(St. Luke's Health System Project)

Series A 3.00% 3/1/51

|

| 4,630,000

|

3,298,968

|

| Illinois Finance Authority Revenue

|

|

|

|

(NorthShore - Edward-Elmhurst Health Credit Group)

Series A 5.00% 8/15/51

|

| 4,355,000

|

4,585,554

|

Jacksonville, Alabama Public

Educational Building Authority Revenue

|

|

|

|

(Jsu Foundation Project)

Series A 5.25% 8/1/53 (AGM)

|

| 3,000,000

|

3,260,880

|

Maple Grove, Minnesota Health

Care Facilities Revenue

|

|

|

|

(Maple Grove Hospital Corporation)

4.00% 5/1/37

|

| 1,000,000

|

937,070

|

(North Memorial Health Care)

5.00% 9/1/30

|

| 865,000

|

888,121

|

Maple Plain, Minnesota Senior

Housing & Health Care Revenue

|

|

|

|

(Haven Homes Project)

5.00% 7/1/54

|

| 1,500,000

|

1,209,930

|

Maricopa County, Arizona

Industrial Development Authority Hospital Revenue

|

|

|

|

(HonorHealth)

Series A 3.00% 9/1/51

|

| 1,000,000

|

716,870

|

Minneapolis Health Care System

Revenue

|

|

|

|

| (Fairview Health Services)

|

|

|

|

| Series A 5.00% 11/15/33

|

| 500,000

|

514,045

|

| Series A 5.00% 11/15/34

|

| 500,000

|

513,510

|

NQ- OV9 [0623] 0823

(3054904) 3

Schedule of investments

Delaware Investments® National Municipal Income Fund (Unaudited)

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Healthcare Revenue Bonds (continued)

|

Minneapolis Senior Housing &

Healthcare Revenue

|

|

|

|

| (Ecumen-Abiitan Mill City Project)

|

|

|

|

| 5.00% 11/1/35

|

| 220,000

| $ 201,190

|

| 5.25% 11/1/45

|

| 850,000

|

752,072

|

Missouri Health & Educational

Facilities Revenue

|

|

|

|

(Mercy Health)

4.00% 6/1/53 (BAM)

|

| 1,630,000

|

1,561,328

|

Montgomery County,

Pennsylvania Higher Education and Health Authority Revenue

|

|

|

|

| (Thomas Jefferson University)

|

|

|

|

| Series B 4.00% 5/1/56

|

| 1,000,000

|

868,410

|

| Series B 5.00% 5/1/57

|

| 3,515,000

|

3,615,775

|

New Hope, Texas Cultural

Education Facilities Revenue

|

|

|

|

| (Cardinal Bay Inc. - Village on the Park/Carriage Inn Project)

|

|

|

|

| Series A-1 5.00% 7/1/51

|

| 135,000

|

92,475

|

| Series B 4.75% 7/1/51

|

| 160,000

|

80,000

|

New York State Dormitory

Authority Revenue

|

|

|

|

(Montefiore Obligated Group)

Series A 3.00% 9/1/50

|

| 5,600,000

|

4,173,344

|

Puerto Rico Industrial Tourist

Educational Medical & Environmental Control Facilities Financing Authority Revenue

|

|

|

|

(Hospital Auxilio Mutuo Obligated Group Project)

5.00% 7/1/35

|

| 360,000

|

391,086

|

Rochester, Minnesota Health Care

& Housing Facility Revenue

|

|

|

|

(The Homestead at Rochester Project)

Series A 6.875% 12/1/48

|

| 1,220,000

|

1,214,803

|

Shakopee, Minnesota Health Care

Facilities Revenue

|

|

|

|

(St. Francis Regional Medical Center)

4.00% 9/1/31

|

| 205,000

|

205,232

|

St. Cloud, Minnesota Health Care

Revenue

|

|

|

|

| (Centracare Health System Project)

|

|

|

|

| 4.00% 5/1/49

|

| 1,585,000

|

1,453,001

|

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Healthcare Revenue Bonds (continued)

|

St. Cloud, Minnesota Health Care

Revenue

|

|

|

|

| (Centracare Health System Project)

|

| 5.00% 5/1/48

|

| 2,250,000

| $ 2,307,240

|

| Series A 5.00% 5/1/46

|

| 375,000

|

380,396

|

St. Paul, Minnesota Housing &

Redevelopment Authority Health Care Facilities Revenue

|

|

|

|

(HealthPartners Obligated Group Project)

Series A 5.00% 7/1/30

|

| 1,000,000

|

1,025,340

|

Union County, Oregon Hospital

Facility Authority Revenue

|

|

|

|

(Grande Ronde Hospital Project)

5.00% 7/1/47

|

| 500,000

|

494,895

|

Wisconsin Health & Educational

Facilities Authority Senior Living Revenue

|

|

|

|

(Covenant Communities, Inc. Project)

Second Tier Series B-5

5.00% 7/1/53

|

| 1,000,000

| 748,580

|

|

| 61,291,817

|

| Housing Revenue Bonds — 1.76%

|

New York City Housing

Development Revenue

|

|

|

|

| (Sustainable Development)

|

|

|

|

| Series A 4.85% 11/1/53

|

| 500,000

|

503,570

|

| Series A 5.00% 5/1/63

|

| 2,000,000

| 2,040,480

|

|

| 2,544,050

|

| Industrial Development Revenue/Pollution ControlRevenue Bonds — 41.69%

|

Arizona Industrial Development

Authority Revenue

|

|

|

|

(Legacy Cares, Inc. Project)

Series A 144A 7.75% 7/1/50 #, ‡

|

| 725,000

|

398,750

|

Buckeye, Ohio

Tobacco Settlement Financing Authority Revenue

|

|

|

|

(Senior)

Series B-2 5.00% 6/1/55

|

| 4,615,000

|

4,328,639

|

4 NQ- OV9 [0623] 0823

(3054904)

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Industrial Development Revenue/Pollution ControlRevenue Bonds (continued)

|

City & County of San Francisco,

California Special Tax District No. 2020-1 Revenue

|

|

|

|

(Mission Rock Facilities and Services - Federally Taxable)

Series B 144A 5.25% 9/1/49 #

|

| 550,000

| $ 394,163

|

Fountain, Colorado Urban

Renewal Authority Tax Increment Revenue

|

|

|

|

(South Academy Highlands Project)

Series A 5.50% 11/1/44

|

| 655,000

|

627,208

|

GDB Debt Recovery Authority of

Puerto Rico Revenue

|

|

|

|

(Taxable)

7.50% 8/20/40

|

| 8,162,101

|

6,754,138

|

Golden State, California Tobacco

Securitization Settlement Asset-Backed Revenue

|

|

|

|

| Series A-1 5.00% 6/1/51

|

| 1,500,000

|

1,563,645

|

(Capital Appreciation)

Subordinate Series B-2

1.473% 6/1/66 ^

|

| 40,820,000

|

4,455,095

|

Inland, California Empire Tobacco

Securitization Revenue

|

|

|

|

| (Capital Appreciation Turbo Asset-Backed)

|

|

|

|

| Series E 144A 0.63% 6/1/57 #, ^

|

| 3,900,000

|

272,883

|

| Series F 144A 0.778% 6/1/57 #, ^

|

| 2,500,000

|

142,500

|

Lincoln Park Metropolitan District

Douglas County, Colorado Revenue

|

|

|

|

(Improvement)

5.00% 12/1/46 (AGM)

|

| 500,000

|

521,875

|

Miami-Dade County, Florida

Revenue

|

|

|

|

(Capital Appreciation)

3.505% 10/1/37 (BAM) ^

|

| 3,000,000

|

1,694,460

|

New York State Dormitory

Authority Personal Income Tax Revenue

|

|

|

|

(General Purpose)

Series E 3.00% 3/15/50

|

| 2,500,000

|

1,946,000

|

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Industrial Development Revenue/Pollution ControlRevenue Bonds (continued)

|

New York State Thruway Authority

State Personal Income Tax Revenue

|

|

|

|

(Climate Bond Certified - Green Bonds)

Series C 5.00% 3/15/55

|

| 4,000,000

| $ 4,346,680

|

Public Authority for Colorado

Energy Natural Gas Revenue

|

|

|

|

| 6.25% 11/15/28

|

| 865,000

|

928,353

|

| 6.50% 11/15/38

|

| 2,250,000

|

2,718,090

|

Public Finance Authority,

Wisconsin Revenue

|

|

|

|

(American Dream @ Meadowlands Project)

144A 7.00% 12/1/50 #

|

| 380,000

|

346,191

|

(Grand Hyatt San Antonio Hotel Acquisition Project)

Series A 5.00% 2/1/62

|

| 1,475,000

|

1,450,176

|

Puerto Rico Sales Tax Financing

Revenue

|

|

|

|

| (Restructured)

|

|

|

|

| Series A-1 4.04% 7/1/51 ^

|

| 66,455,000

|

14,048,587

|

| Series A-1 4.75% 7/1/53

|

| 8,500,000

|

8,120,730

|

| Series A-1 5.00% 7/1/58

|

| 2,510,000

|

2,453,174

|

Shoals, Indiana Exempt Facilities

Revenue

|

|

|

|

(National Gypsum Project)

7.25% 11/1/43 (AMT)

|

| 25,000

|

25,165

|

South San Francisco Community

Facilities District No. 2021-01 Revenue

|

|

|

|

(Public Facilities & Services)

4.00% 9/1/44

|

| 1,000,000

|

907,140

|

Thornton, Colorado Development

Authority Revenue

|

|

|

|

| (East 144th Avenue & I-25 Project)

|

|

|

|

| Series B 5.00% 12/1/35

|

| 265,000

|

269,309

|

| Series B 5.00% 12/1/36

|

| 440,000

|

447,093

|

Tobacco Securitization Authority of

Southern California Revenue

|

|

|

|

| (San Diego County)

|

|

|

|

Capital Appreciation Second Subordinate Series C

1.105% 6/1/46 ^

|

| 3,235,000

|

588,349

|

NQ- OV9 [0623] 0823

(3054904) 5

Schedule of investments

Delaware Investments® National Municipal Income Fund (Unaudited)

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Industrial Development Revenue/Pollution ControlRevenue Bonds (continued)

|

Tobacco Securitization Authority of

Southern California Revenue

|

|

|

|

| (San Diego County)

|

Capital Appreciation Third Subordinate Series D

1.183% 6/1/46 ^

|

| 3,015,000

| $ 454,451

|

|

| 60,202,844

|

| Lease Revenue Bonds — 14.16%

|

Colorado State Department of

Transportation Certificates of Participation Revenue

|

|

|

|

| 5.00% 6/15/34

|

| 340,000

|

354,756

|

| 5.00% 6/15/36

|

| 545,000

|

565,557

|

Denver, Colorado Health &

Hospital Authority Revenue

|

|

|

|

(550 Acoma, Inc.)

4.00% 12/1/38

|

| 500,000

|

453,920

|

Idaho Housing & Finance

Association Grant & Revenue

|

|

|

|

| Series A 4.00% 7/15/39

|

| 1,000,000

|

990,270

|

| Illinois Finance Authority Revenue

|

|

|

|

(Provident Group–Sccil Properties Llc – University Of Illinois Urbana-Champaign Project)

Series A 5.25% 10/1/53

|

| 500,000

|

549,850

|

(Provident Group–Sccil Properties LLC – University Of Illinois Urbana-Champaign Project)

5.00% 10/1/48

|

| 1,000,000

|

1,076,550

|

Irvine Facilities Financing

Authority Revenue

|

|

|

|

(Gateway Preserve Land Acquisition Project)

4.25% 5/1/53

|

| 5,000,000

|

4,933,150

|

Metropolitan Pier &

Exposition Authority, Illinois Revenue

|

|

|

|

| (McCormick Place Expansion Project)

|

|

|

|

| Series A 4.65% 12/15/52 (AGM) ^

|

| 4,625,000

|

1,103,571

|

| Series B 4.545% 12/15/54 (BAM) ^

|

| 5,000,000

|

1,077,850

|

|

|

|

| Value (US $)

|

| Municipal Bonds (continued)

|

| Lease Revenue Bonds (continued)

|

New Jersey Transportation Trust

Fund Authority Revenue

|

|

|

|

| Series AA 4.00% 6/15/50 (BAM)

|

| 2,210,000

| $ 2,155,060

|

New York Liberty Development

Revenue

|

|

|

|

(4 World Trade Center - Green Bonds)

Series A 2.875% 11/15/46 (BAM)

|

| 7,000,000

|

5,237,050

|

Virginia Commonwealth

Transportation Board Revenue

|

|

|

|

(U.S. Route 58 Corridor Development Program)

4.00% 5/15/47

|

| 2,000,000

| 1,956,540

|

|

| 20,454,124

|

| Local General Obligation Bonds — 5.79%

|

Beacon Point, Colorado

Metropolitan District

|

|

|

|

| 5.00% 12/1/30 (AGM)

|

| 600,000

|

621,096

|

Cass Lake-Bena, Minnesota

Independent School District No. 115

|

|

|

|

(Minnesota School District Credit Enhancement Program)

Series A 4.00% 2/1/39

|

| 930,000

|

935,031

|

Chicago Board of Education Tax

General Obligation

|

|

|

|

(Dedicated Revenues)

Series D 5.00% 12/1/46

|

| 3,000,000

|

2,951,070

|

Chicago, Illinois Board of

Education Dedicated Capital Improvement

|

|

|

|

| 5.00% 4/1/46

|

| 905,000

|

911,724

|

Jefferson County, Colorado

School District No. R-1

|

|

|

|

| 5.25% 12/15/24

|

| 750,000

|

772,853

|

| New York City, New York

|

|

|

|

| Fiscal 2023 Subordinate Series B-1 5.25% 10/1/47

|

| 1,500,000

|

1,687,440

|

| Philadelphia, Pennsylvania

|

|

|

|

(Tax-Exempt)

Series A 4.00% 5/1/42

|

| 500,000

| 488,995

|

|

| 8,368,209

|

6 NQ- OV9 [0623] 0823

(3054904)

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Pre-Refunded Bonds — 1.00%

|

Colorado Educational & Cultural

Facilities Authority

|

|

|

|

(Charter School - Atlas Preparatory School Project)

144A 5.25% 4/1/45-25 #, §

|

| 700,000

| $ 723,359

|

St. Paul, Minnesota Housing &

Redevelopment Authority Hospital Facility

|

|

|

|

| (Healtheast Care System Project)

|

|

|

|

| Series A 5.00% 11/15/29-25 §

|

| 395,000

|

411,081

|

| Series A 5.00% 11/15/30-25 §

|

| 290,000

| 301,806

|

|

| 1,436,246

|

| State General Obligation Bonds — 6.05%

|

| California State

|

|

|

|

| (Various Purpose)

|

|

|

|

| 3.00% 3/1/46

|

| 2,000,000

|

1,638,700

|

| 4.00% 10/1/50

|

| 5,000,000

|

5,027,100

|

| Commonwealth of Puerto Rico

|

|

|

|

| (Restructured)

|

|

|

|

| Series A-1 4.00% 7/1/37

|

| 99,821

|

89,861

|

| Series A-1 4.00% 7/1/46

|

| 2,340,000

| 1,985,396

|

|

| 8,741,057

|

| Transportation Revenue Bonds — 7.75%

|

Colorado High Performance

Transportation Enterprise Revenue

|

|

|

|

(C-470 Express Lanes)

5.00% 12/31/56

|

| 1,000,000

|

996,760

|

Denver, Colorado City & County

Airport System Subordinate Revenue

|

|

|

|

| Series A 5.00% 12/1/48 (AMT)

|

| 1,000,000

|

1,030,620

|

Illinois State Toll Highway

Authority Revenue

|

|

|

|

(Senior)

Series A 5.00% 1/1/42

|

| 2,700,000

|

2,967,813

|

| Port Authority of Guam Revenue

|

|

|

|

(Governmental)

Series A 5.00% 7/1/48

|

| 1,050,000

|

1,071,473

|

Puerto Rico Highway &

Transportation Authority Revenue

|

|

|

|

(Restructured)

Series A 5.00% 7/1/62

|

| 1,250,000

|

1,218,750

|

|

|

| Principal

amount°

| Value (US $)

|

| Municipal Bonds (continued)

|

| Transportation Revenue Bonds (continued)

|

South Jersey, New Jersey

Transportation Authority Revenue

|

|

|

|

| Series A 5.00% 11/1/45 (BAM)

|

| 2,455,000

| $ 2,625,156

|

St. Paul, Minneapolis Metropolitan

Airports Commission Revenue

|

|

|

|

(Senior)

Series C 5.00% 1/1/46

|

| 1,245,000

| 1,284,790

|

|

| 11,195,362

|

| Water & Sewer Revenue Bonds — 7.70%

|

Guam Waterworks Authority Water

& Wastewater System Revenue Refunding

|

|

|

|

| 5.00% 7/1/37

|

| 3,000,000

|

3,069,090

|

Portland, Oregon Sewer System

Revenue

|

|

|

|

| (Second Lien)

|

|

|

|

| Series A 5.00% 12/1/42

|

| 2,195,000

|

2,470,999

|

| Series A 5.00% 12/1/47

|

| 5,000,000

| 5,572,550

|

|

| 11,112,639

|

Total Municipal Bonds

(cost $240,287,024)

| 235,340,049

|

|

|

|

|

|

|

| Short-Term Investments — 3.18%

|

| Variable Rate Demand Notes — 3.18%¤

|

Los Angeles Department of Water

& Power Revenue

|

|

|

|

Subordinate Series A-2 2.60% 7/1/45

(SPA - Barclays Bank)

|

| 3,000,000

|

3,000,000

|

Subordinate

Series B-3 2.60% 7/1/34

(SPA - Barclays Bank)

|

| 500,000

|

500,000

|

Minneapolis, Minnesota Health

Care System Revenue

|

|

|

|

(Fairview Health Services) Series C 3.65% 11/15/48

(LOC – Wells Fargo Bank N.A.)

|

| 200,000

|

200,000

|

University of North Carolina

Hospitals at Chapel Hill

|

|

|

|

Series A 3.60% 2/15/31

(SPA - TD Bank N.A.)

|

| 900,000

| 900,000

|

Total Short-Term Investments

(cost $4,600,000)

| 4,600,000

|

|

|

|

|

Total Value of Securities—166.14%

(cost $244,887,024)

| $239,940,049

|

NQ- OV9 [0623] 0823

(3054904) 7

Schedule of investments

Delaware Investments® National Municipal Income Fund (Unaudited)

|

|

|

| Value (US $)

|

|

|

| Liquidation Value of Preferred – (68.55%)

|

|

| (99,000,000)

|

| Receivables and Other Assets Net of Liabilities—2.41%

|

|

| $ 3,480,038

|

| Net Assets Applicable to 12,278,003 Shares Outstanding—100.00%

|

|

| $144,420,087

|

| °

| Principal amount shown is stated in USD unless noted that the security is denominated in another currency.

|

| #

| Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At June 30, 2023, the aggregate value of Rule 144A securities was $4,967,266, which

represents 3.44% of the Fund's net assets.

|

| ‡

| Non-income producing security. Security is currently in default.

|

| ^

| Zero-coupon security. The rate shown is the effective yield at the time of purchase.

|

| §

| Pre-refunded bonds. Municipal bonds that are generally backed or secured by US Treasury bonds. For pre-refunded bonds, the stated maturity is followed by the year

in which the bond will be pre-refunded.

|

| ¤

| Tax-exempt obligations that contain a floating or variable interest rate adjustment formula and an unconditional right of demand to receive payment of the unpaid

principal balance plus accrued interest upon a short notice period (generally up to 30 days) prior to specified dates either from the issuer or by drawing on a bank letter of credit, a guarantee, or insurance issued

with respect to such instrument. Each rate shown is as of June 30, 2023.

|

| Summary of abbreviations:

|

| AGM – Insured by Assured Guaranty Municipal Corporation

|

| AICUP – Association of Independent Colleges & Universities of Pennsylvania

|

| AMT – Subject to Alternative Minimum Tax

|

| BAM – Insured by Build America Mutual Assurance

|

| ICE – Intercontinental Exchange, Inc.

|

| LLC – Limited Liability Corporation

|

| LOC – Letter of Credit

|

| N.A. – National Association

|

| SPA – Stand-by Purchase Agreement

|

| USD – US Dollar

|

8 NQ- OV9 [0623] 0823

(3054904)

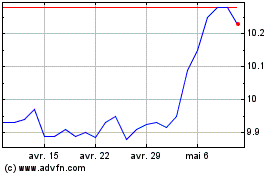

abrdn National Municipal... (AMEX:VFL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

abrdn National Municipal... (AMEX:VFL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024